444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK car loan market represents a dynamic and essential component of the British automotive financing ecosystem, facilitating vehicle ownership across diverse consumer segments. This comprehensive market encompasses various lending products including personal contract purchase agreements, hire purchase arrangements, and traditional auto loans that enable consumers to acquire both new and used vehicles. Market dynamics indicate robust growth patterns driven by evolving consumer preferences, technological advancements in lending platforms, and shifting economic conditions that influence borrowing behaviors.

Consumer demand for flexible financing solutions continues to reshape the competitive landscape, with traditional banks, specialist automotive finance companies, and emerging fintech platforms competing for market share. The sector demonstrates resilience through economic fluctuations, supported by the essential nature of vehicle ownership for employment, education, and daily life requirements across the United Kingdom. Digital transformation initiatives have revolutionized application processes, credit assessment methodologies, and customer service delivery, creating more accessible and efficient lending experiences.

Regulatory frameworks established by the Financial Conduct Authority provide consumer protection while ensuring market stability and fair lending practices. The market exhibits strong growth potential with approximately 8.2% annual growth in loan originations, reflecting increased consumer confidence and expanding credit availability across various demographic segments.

The UK car loan market refers to the comprehensive ecosystem of financial products and services designed to facilitate vehicle purchases through various lending mechanisms, enabling consumers to spread the cost of car ownership over predetermined periods with structured repayment terms.

This market encompasses multiple financing structures including secured loans where the vehicle serves as collateral, unsecured personal loans for automotive purchases, dealer-arranged financing through manufacturer partnerships, and specialized products like balloon payment loans that offer lower monthly payments with larger final settlements. Financial institutions operating within this space range from high street banks and building societies to specialist automotive finance companies and peer-to-peer lending platforms.

Consumer accessibility remains a primary focus, with lenders developing products that accommodate varying credit profiles, income levels, and purchase preferences. The market facilitates both new and used vehicle acquisitions, supporting the broader automotive industry while providing essential mobility solutions for millions of UK consumers who require financing to achieve vehicle ownership goals.

The UK car loan market demonstrates exceptional resilience and growth potential, characterized by increasing digitalization, enhanced consumer protection measures, and expanding product diversity that caters to evolving customer needs. Market participants benefit from strong regulatory frameworks that promote fair lending while encouraging innovation in product development and service delivery mechanisms.

Key growth drivers include rising vehicle prices that necessitate financing solutions, changing consumer attitudes toward debt and ownership models, and technological advancements that streamline application and approval processes. The market shows particular strength in the used car financing segment, which accounts for approximately 72% of total loan volumes, reflecting consumer preferences for value-oriented vehicle purchases.

Competitive dynamics favor institutions that successfully integrate digital capabilities with personalized customer service, creating seamless experiences from initial inquiry through loan completion. MarkWide Research analysis indicates that lenders focusing on flexible terms, competitive rates, and transparent pricing structures achieve superior customer acquisition and retention rates.

Future prospects remain positive despite economic uncertainties, with the market positioned to benefit from recovering consumer confidence, stable employment levels, and continued innovation in automotive financing products that address diverse customer requirements across the United Kingdom.

Strategic analysis reveals several critical insights that define the current UK car loan market landscape and influence future development trajectories:

Economic recovery following recent challenges has strengthened consumer confidence and employment stability, creating favorable conditions for automotive financing growth. Rising vehicle prices across both new and used car segments necessitate financing solutions, as cash purchases become less feasible for average consumers seeking reliable transportation options.

Technological advancement in lending platforms enables faster application processing, more accurate credit assessments, and improved customer experiences that attract borrowers seeking convenient financing solutions. Digital-first approaches reduce operational costs for lenders while providing 24/7 accessibility that meets modern consumer expectations for immediate service availability.

Changing mobility patterns influenced by remote work arrangements and lifestyle modifications drive demand for different vehicle types and financing structures. Environmental consciousness encourages electric and hybrid vehicle purchases, often requiring specialized financing products that accommodate higher purchase prices and government incentive programs.

Competitive market dynamics benefit consumers through improved product offerings, more favorable terms, and enhanced service quality as lenders differentiate themselves in an increasingly crowded marketplace. Regulatory support for fair lending practices builds consumer trust while encouraging market participation across diverse demographic segments.

Economic uncertainty and inflation concerns create cautious consumer attitudes toward major purchases and debt commitments, potentially limiting loan demand during periods of financial instability. Rising interest rates increase borrowing costs, making automotive financing less attractive for price-sensitive consumers and potentially reducing overall market volumes.

Stringent regulatory requirements while protecting consumers, impose compliance costs and operational complexities that particularly challenge smaller lenders and new market entrants. Credit risk management becomes increasingly complex as lenders balance accessibility with prudent lending standards, especially during economic downturns when default rates may increase.

Vehicle depreciation concerns affect consumer willingness to finance purchases, particularly for new cars that experience rapid value decline in initial ownership years. Alternative mobility solutions including car sharing, subscription services, and improved public transportation may reduce traditional vehicle ownership demand in urban areas.

Supply chain disruptions in the automotive industry create vehicle availability issues and price volatility that complicate financing decisions for both consumers and lenders. Changing consumer preferences toward sustainable transportation options may require significant product development investments from traditional automotive finance providers.

Electric vehicle financing presents substantial growth opportunities as government incentives and environmental awareness drive adoption of sustainable transportation solutions. Specialized lending products for EVs can capture this expanding market segment while supporting national decarbonization objectives through accessible financing options.

Fintech integration offers opportunities for traditional lenders to enhance their digital capabilities, improve customer experiences, and reduce operational costs through innovative technology partnerships. Open banking initiatives enable more sophisticated credit assessment methodologies that can expand lending to previously underserved consumer segments.

Commercial vehicle financing shows strong potential as businesses invest in fleet modernization, delivery capabilities, and sustainable transportation solutions. Flexible subscription models and usage-based financing products can attract consumers seeking alternatives to traditional ownership structures.

Partnership opportunities with automotive manufacturers, dealers, and technology companies can create integrated financing solutions that enhance customer convenience while expanding market reach. Data analytics capabilities enable personalized product offerings and risk management improvements that support profitable growth strategies.

Supply and demand equilibrium in the UK car loan market reflects complex interactions between consumer financing needs, lender capacity, regulatory requirements, and broader economic conditions. Demand patterns show seasonal variations with peak activity during registration plate changes and promotional periods, requiring lenders to manage capacity and pricing strategies accordingly.

Competitive intensity drives continuous innovation in product features, application processes, and customer service delivery as market participants seek differentiation advantages. Price competition benefits consumers through lower rates and fees, while challenging lenders to maintain profitability through operational efficiency and risk management excellence.

Regulatory evolution shapes market dynamics through consumer protection enhancements, lending standard requirements, and compliance obligations that influence product development and operational procedures. Technology adoption accelerates market transformation, enabling new business models and service delivery approaches that reshape competitive landscapes.

Economic cycles significantly impact market dynamics, with growth periods supporting expansion while downturns require defensive strategies and enhanced risk management. Consumer behavior changes driven by generational preferences, lifestyle modifications, and environmental consciousness create opportunities for adaptive lenders while challenging traditional approaches.

Comprehensive market analysis employs multiple research methodologies to ensure accurate, reliable, and actionable insights into UK car loan market dynamics. Primary research includes structured interviews with industry executives, consumer surveys, and focus groups that provide firsthand perspectives on market trends, challenges, and opportunities.

Secondary research incorporates analysis of regulatory filings, industry reports, financial statements, and market data from authoritative sources to establish quantitative foundations for market assessments. Data triangulation techniques validate findings across multiple sources, ensuring research accuracy and reliability for strategic decision-making purposes.

Statistical modeling applications analyze historical trends, identify patterns, and project future market developments based on economic indicators, demographic changes, and industry dynamics. Expert consultation with automotive finance specialists, regulatory authorities, and technology providers enriches analysis with professional insights and industry knowledge.

Market segmentation analysis examines consumer demographics, product categories, regional variations, and competitive positioning to provide granular understanding of market structure and opportunities. Continuous monitoring processes track market developments, regulatory changes, and emerging trends to maintain current and relevant research findings.

London and Southeast England dominate the UK car loan market, accounting for approximately 38% of total lending volumes due to higher population density, elevated income levels, and greater vehicle financing needs in urban environments. Market characteristics in this region include preference for premium vehicles, shorter loan terms, and higher average loan amounts reflecting regional economic prosperity.

Northern England represents a significant market segment with strong demand for practical, value-oriented vehicle financing solutions that support employment and family transportation needs. Regional preferences favor used vehicle financing, extended repayment terms, and competitive interest rates that accommodate diverse income levels and economic conditions.

Scotland and Wales demonstrate unique market dynamics influenced by rural transportation requirements, seasonal employment patterns, and regional economic development initiatives. Lending patterns show increased demand for versatile vehicles and flexible financing terms that accommodate varied geographic and economic circumstances.

Midlands region benefits from strong automotive industry presence and manufacturing employment that supports robust car loan demand across both personal and commercial vehicle segments. Market growth in this area shows approximately 6.8% annual increase in loan originations, reflecting regional economic stability and consumer confidence levels.

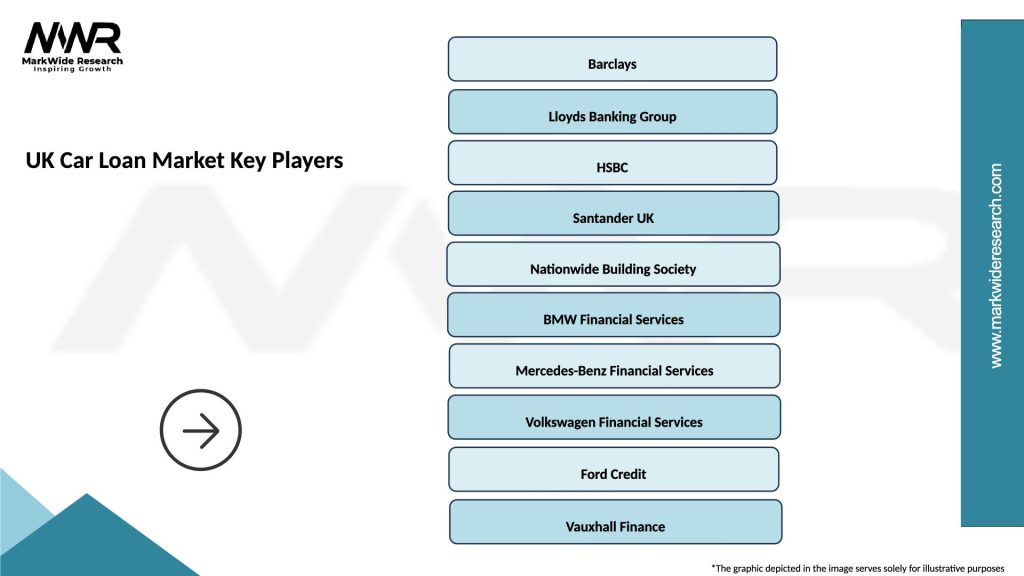

Market leadership in the UK car loan sector is distributed among several key player categories, each bringing distinct competitive advantages and market positioning strategies:

Competitive differentiation strategies focus on digital innovation, customer service excellence, flexible product features, and strategic partnerships that enhance market reach and customer acquisition capabilities.

By Product Type:

By Vehicle Type:

By Customer Segment:

Used Vehicle Financing dominates market volumes with approximately 74% of total loan originations, driven by affordability considerations, improved vehicle quality, and consumer preference for value-oriented purchases. Market dynamics in this category emphasize competitive rates, flexible terms, and comprehensive vehicle inspection processes that protect both lenders and borrowers.

Electric Vehicle Financing represents the fastest-growing segment with over 45% annual growth in loan applications, supported by government incentives, environmental awareness, and expanding charging infrastructure. Specialized products in this category often feature extended terms, competitive rates, and additional services that support EV ownership transition.

Premium Vehicle Financing attracts affluent consumers seeking luxury and performance vehicles through sophisticated lending products that emphasize service quality, flexible terms, and exclusive benefits. Market characteristics include higher average loan amounts, shorter repayment periods, and enhanced customer service experiences.

Commercial Vehicle Financing serves business customers requiring fleet solutions, delivery vehicles, and specialized transportation equipment through tailored lending products that accommodate business cash flow patterns and operational requirements. Growth trends show increasing demand for sustainable commercial vehicles and flexible financing structures.

For Consumers:

For Lenders:

For Automotive Industry:

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Customer Experience transformation continues reshaping the automotive financing landscape, with lenders investing heavily in mobile applications, artificial intelligence, and automated decision-making systems that provide instant loan approvals and seamless customer journeys. Consumer expectations for immediate service delivery drive continuous platform improvements and integration enhancements.

Sustainable Finance Integration reflects growing environmental consciousness through specialized lending products for electric and hybrid vehicles, often featuring preferential rates and terms that support national decarbonization goals. Green financing initiatives attract environmentally conscious consumers while positioning lenders as sustainability leaders.

Flexible Ownership Models emerge as alternatives to traditional purchase financing, including subscription services, usage-based payments, and balloon payment structures that provide lower monthly costs with varied end-of-term options. Consumer preferences for flexibility drive product innovation and market differentiation strategies.

Data-Driven Risk Assessment utilizes advanced analytics, open banking data, and machine learning algorithms to improve credit decision accuracy while expanding lending access to previously underserved consumer segments. MWR analysis indicates that lenders employing sophisticated data models achieve 15% better risk-adjusted returns compared to traditional assessment methods.

Regulatory Enhancement through Financial Conduct Authority initiatives strengthens consumer protection while promoting fair lending practices across the automotive finance sector. Recent developments include enhanced affordability assessments, improved disclosure requirements, and strengthened complaint handling procedures that build market confidence.

Technology Partnership Expansion sees traditional lenders collaborating with fintech companies to enhance digital capabilities, improve customer experiences, and reduce operational costs through innovative platform solutions. Strategic alliances enable rapid technology adoption while maintaining regulatory compliance and risk management standards.

Product Innovation Acceleration introduces new financing structures including subscription models, usage-based payments, and integrated insurance products that provide comprehensive vehicle ownership solutions. Market differentiation strategies focus on unique value propositions that address evolving consumer preferences and lifestyle requirements.

Sustainability Initiative Integration incorporates environmental considerations into lending decisions, product development, and operational practices that support national climate objectives while attracting environmentally conscious consumers. Green finance products demonstrate strong growth potential with increasing consumer adoption rates.

Digital Transformation Acceleration should remain a priority for automotive finance providers seeking competitive advantages through enhanced customer experiences, operational efficiency, and market differentiation. Investment focus should emphasize mobile-first platforms, artificial intelligence integration, and automated decision-making systems that meet evolving consumer expectations.

Product Portfolio Diversification can capture emerging market opportunities through specialized lending solutions for electric vehicles, commercial fleets, and alternative ownership models that address changing consumer preferences. Innovation strategies should balance market demand with risk management requirements and regulatory compliance obligations.

Partnership Strategy Development with automotive manufacturers, technology companies, and fintech providers can expand market reach, enhance service capabilities, and create integrated customer solutions. Strategic alliances should focus on mutual value creation while maintaining competitive positioning and operational independence.

Risk Management Enhancement through advanced analytics, stress testing, and scenario planning can improve portfolio performance while supporting responsible lending growth. MarkWide Research recommends implementing comprehensive risk frameworks that balance accessibility with prudent lending standards across all customer segments.

Market growth prospects remain positive despite economic uncertainties, with the UK car loan sector positioned to benefit from recovering consumer confidence, stable employment levels, and continued innovation in automotive financing products. Long-term trends favor lenders that successfully integrate digital capabilities with personalized service delivery and flexible product offerings.

Electric vehicle financing will likely become a dominant growth driver as government incentives, environmental awareness, and charging infrastructure expansion accelerate EV adoption across consumer segments. Specialized lending products for sustainable transportation solutions present significant opportunities for market expansion and differentiation.

Technology integration will continue reshaping competitive dynamics through artificial intelligence, machine learning, and data analytics applications that improve risk assessment, customer experience, and operational efficiency. Digital-native lenders may gain market share through superior technology platforms and customer-centric service models.

Regulatory evolution will likely emphasize consumer protection, responsible lending, and market stability while encouraging innovation and competition. Future projections indicate sustained market growth with estimated 7.5% annual expansion over the next five years, driven by demographic changes, urbanization trends, and evolving mobility preferences across the United Kingdom.

The UK car loan market demonstrates remarkable resilience and growth potential, characterized by digital transformation, regulatory stability, and evolving consumer preferences that create opportunities for innovative financial service providers. Market dynamics favor institutions that successfully balance technological advancement with personalized customer service, competitive pricing, and responsible lending practices.

Future success in this sector will depend on adaptability to changing consumer needs, effective risk management, and strategic positioning to capture emerging opportunities in electric vehicle financing, digital lending platforms, and alternative ownership models. Industry participants that invest in technology, maintain regulatory compliance, and develop comprehensive product portfolios are well-positioned for sustained growth and market leadership in the evolving UK automotive finance landscape.

What is a Car Loan?

A car loan is a type of financing that allows individuals to borrow money to purchase a vehicle, which they then repay over time with interest. In the UK, car loans can be secured against the vehicle or unsecured, depending on the lender’s terms.

What are the key players in the UK Car Loan Market?

Key players in the UK car loan market include major banks like Lloyds Banking Group and Barclays, as well as specialized lenders such as Zuto and Carfinance247. These companies offer various financing options tailored to different consumer needs, among others.

What are the growth factors driving the UK Car Loan Market?

The UK car loan market is driven by factors such as increasing consumer demand for vehicles, competitive interest rates, and the rise of online lending platforms. Additionally, the growing trend of personal leasing is influencing financing options.

What challenges does the UK Car Loan Market face?

Challenges in the UK car loan market include rising interest rates, economic uncertainty affecting consumer confidence, and stricter lending regulations. These factors can impact loan approval rates and overall market growth.

What opportunities exist in the UK Car Loan Market?

Opportunities in the UK car loan market include the increasing popularity of electric vehicles, which may lead to new financing products, and the potential for partnerships between lenders and automotive manufacturers. Additionally, advancements in technology can enhance the customer experience.

What trends are shaping the UK Car Loan Market?

Trends in the UK car loan market include a shift towards digital applications and approvals, the rise of flexible payment options, and an increasing focus on sustainability in vehicle financing. These trends reflect changing consumer preferences and technological advancements.

UK Car Loan Market

| Segmentation Details | Description |

|---|---|

| Product Type | New Cars, Used Cars, Electric Vehicles, Hybrid Vehicles |

| Customer Type | Individual Buyers, Fleet Operators, Dealerships, Corporates |

| Loan Type | Secured Loans, Unsecured Loans, Personal Loans, PCP |

| Interest Rate Type | Fixed Rate, Variable Rate, Tracker Rate, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Car Loan Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at