444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK automotive LED lighting market represents a rapidly evolving segment within the broader automotive components industry, driven by technological advancement and regulatory changes. LED technology has fundamentally transformed vehicle lighting systems, offering superior energy efficiency, enhanced durability, and improved design flexibility compared to traditional halogen and xenon alternatives. The market encompasses various lighting applications including headlights, taillights, daytime running lights, interior illumination, and specialty automotive lighting solutions.

Market dynamics indicate substantial growth momentum, with the sector experiencing a compound annual growth rate of 8.2% over recent years. This expansion reflects increasing consumer demand for premium lighting solutions, stringent safety regulations, and the automotive industry’s broader shift toward electrification. LED adoption rates have reached approximately 72% penetration in new vehicle production across the UK market, demonstrating the technology’s mainstream acceptance.

Regulatory frameworks continue to shape market development, with UK automotive standards emphasizing improved visibility, energy efficiency, and environmental sustainability. The transition from traditional lighting technologies has accelerated significantly, particularly in premium and luxury vehicle segments where LED lighting systems have become standard equipment rather than optional features.

The UK automotive LED lighting market refers to the comprehensive ecosystem of light-emitting diode technology applications specifically designed for motor vehicles within the United Kingdom automotive sector. This market encompasses the design, manufacturing, distribution, and installation of LED lighting systems across various vehicle categories including passenger cars, commercial vehicles, motorcycles, and specialty automotive applications.

LED technology in automotive applications represents a significant advancement over conventional lighting solutions, utilizing semiconductor devices that emit light when electrical current passes through them. These systems offer numerous advantages including reduced power consumption, extended operational lifespan, faster response times, and enhanced design flexibility that enables innovative lighting configurations and styling options.

Market scope includes both original equipment manufacturer installations and aftermarket retrofit solutions, covering interior and exterior lighting applications. The technology spans from basic replacement bulbs to sophisticated adaptive lighting systems that adjust automatically based on driving conditions, weather, and traffic situations.

Strategic analysis reveals the UK automotive LED lighting market as a dynamic and rapidly expanding sector characterized by technological innovation and increasing consumer adoption. The market benefits from strong regulatory support, growing environmental consciousness, and the automotive industry’s ongoing electrification trend, which naturally aligns with energy-efficient lighting solutions.

Key growth drivers include mandatory daytime running light regulations, increasing safety awareness, and consumer preference for premium lighting aesthetics. The market demonstrates particular strength in the luxury and electric vehicle segments, where LED lighting systems contribute to both functional performance and brand differentiation. Adoption rates continue accelerating, with approximately 85% of new premium vehicles now featuring comprehensive LED lighting packages.

Competitive landscape features a mix of established automotive suppliers, specialized lighting manufacturers, and emerging technology companies. Innovation focuses on adaptive lighting systems, smart connectivity features, and integration with advanced driver assistance systems, positioning LED technology as a critical component of future automotive design.

Market intelligence reveals several critical insights shaping the UK automotive LED lighting landscape:

Primary growth catalysts propelling the UK automotive LED lighting market encompass regulatory, technological, and consumer-driven factors that collectively create a favorable environment for sustained expansion.

Regulatory mandates serve as fundamental market drivers, with UK automotive safety standards requiring enhanced visibility and energy efficiency. The implementation of mandatory daytime running lights has significantly boosted LED adoption, as these systems provide optimal performance for continuous operation requirements. Environmental regulations further support market growth by encouraging energy-efficient technologies that reduce vehicle power consumption and emissions.

Technological advancement continues driving market evolution through improved LED performance, reduced manufacturing costs, and enhanced functionality. Modern LED lighting systems offer superior brightness, color accuracy, and design flexibility compared to traditional alternatives. The integration of smart features including adaptive beam patterns, automatic dimming, and connectivity with vehicle systems creates additional value propositions for consumers and manufacturers.

Consumer preferences increasingly favor premium lighting solutions that enhance vehicle aesthetics, safety, and functionality. Market research demonstrates growing awareness of LED benefits including longer lifespan, reduced maintenance requirements, and improved visibility. The association of LED lighting with luxury and technological sophistication drives adoption across expanding vehicle segments.

Market challenges present obstacles to accelerated growth within the UK automotive LED lighting sector, requiring strategic approaches from industry participants to address effectively.

Initial cost considerations remain a primary restraint, particularly for budget-conscious consumers and fleet operators. While LED technology offers long-term cost benefits through reduced energy consumption and maintenance requirements, the higher upfront investment compared to traditional lighting can limit adoption in price-sensitive market segments. Manufacturing complexity associated with advanced LED systems also contributes to elevated production costs.

Technical challenges include heat management requirements, electronic component integration, and compatibility with existing vehicle electrical systems. LED lighting systems require sophisticated thermal management solutions to maintain optimal performance and longevity, adding complexity to vehicle design and manufacturing processes. Integration with legacy vehicle platforms can present compatibility challenges that require custom engineering solutions.

Market fragmentation creates challenges for standardization and economies of scale. The diverse range of vehicle models, lighting applications, and performance requirements results in numerous product variants that can limit manufacturing efficiencies and increase development costs for suppliers.

Strategic opportunities within the UK automotive LED lighting market present significant potential for growth and innovation across multiple dimensions of the industry ecosystem.

Electric vehicle expansion represents a transformative opportunity, as EV manufacturers prioritize energy-efficient components to maximize battery range and performance. LED lighting systems align perfectly with electrification strategies, offering reduced power consumption and design flexibility that supports aerodynamic vehicle styling. The growing EV market creates substantial demand for advanced lighting solutions that complement sustainable transportation initiatives.

Aftermarket modernization presents considerable opportunities as vehicle owners seek to upgrade older vehicles with contemporary lighting technology. The large installed base of vehicles with traditional lighting systems creates a substantial retrofit market, particularly for commercial fleets seeking operational efficiency improvements and enhanced safety features.

Smart connectivity integration opens new possibilities for value-added services and functionality. LED lighting systems can incorporate communication capabilities, vehicle-to-infrastructure connectivity, and integration with autonomous driving systems. These advanced features create opportunities for premium pricing and differentiation in competitive markets.

Market forces shaping the UK automotive LED lighting landscape reflect complex interactions between technological innovation, regulatory evolution, and changing consumer expectations that collectively drive industry transformation.

Supply chain dynamics continue evolving as manufacturers seek to optimize production efficiency and reduce costs. Vertical integration strategies enable greater control over quality and innovation while horizontal partnerships facilitate access to specialized technologies and markets. MarkWide Research analysis indicates that supply chain optimization has contributed to approximately 28% improvement in manufacturing efficiency over recent years.

Competitive pressures drive continuous innovation and cost reduction efforts across the industry. Market participants invest heavily in research and development to maintain technological leadership and respond to evolving customer requirements. The emergence of new entrants, particularly from technology sectors, introduces fresh perspectives and accelerates innovation cycles.

Economic factors influence market development through their impact on vehicle sales, consumer spending patterns, and industrial investment. Economic stability supports sustained market growth while uncertainty can affect long-term planning and capital allocation decisions. LED lighting adoption demonstrates resilience during economic fluctuations due to its association with safety and efficiency benefits.

Analytical framework employed for comprehensive market assessment combines quantitative data analysis with qualitative insights to provide robust understanding of UK automotive LED lighting market dynamics and trends.

Primary research encompasses extensive stakeholder engagement including automotive manufacturers, LED lighting suppliers, distributors, and end-users across various market segments. Structured interviews and surveys capture current market conditions, future expectations, and strategic priorities that shape industry development. Industry experts provide specialized insights into technological trends, regulatory impacts, and competitive dynamics.

Secondary research incorporates comprehensive analysis of industry publications, regulatory documents, company reports, and market databases to establish baseline market understanding and validate primary research findings. Historical data analysis enables trend identification and pattern recognition that inform future market projections.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, statistical analysis, and expert review. Market modeling techniques project future scenarios based on identified trends and driving factors, providing strategic insights for industry participants and stakeholders.

Geographic distribution within the UK automotive LED lighting market reveals distinct regional characteristics influenced by automotive manufacturing concentration, consumer preferences, and economic factors.

England dominates market activity with approximately 78% market share, driven by major automotive manufacturing centers in the Midlands and North. The concentration of vehicle production facilities, supplier networks, and research institutions creates a robust ecosystem supporting LED lighting innovation and adoption. London and Southeast regions contribute significantly through luxury vehicle markets and early technology adoption patterns.

Scotland represents approximately 12% of market activity, with growth driven by commercial vehicle applications and fleet modernization initiatives. The region’s focus on sustainable transportation solutions aligns well with LED lighting benefits, supporting steady market expansion. Manufacturing capabilities in electronics and precision engineering provide foundation for LED lighting component production.

Wales and Northern Ireland collectively account for the remaining 10% market share, with growth opportunities in commercial applications and aftermarket services. Regional development initiatives supporting automotive industry growth create favorable conditions for LED lighting market expansion.

Market competition within the UK automotive LED lighting sector features diverse participants ranging from global automotive suppliers to specialized lighting manufacturers, creating a dynamic competitive environment.

Competitive strategies emphasize technological innovation, strategic partnerships, and market expansion through both organic growth and acquisitions. Companies invest significantly in research and development to maintain technological leadership and respond to evolving customer requirements.

Market segmentation analysis reveals distinct categories within the UK automotive LED lighting market, each characterized by specific requirements, growth patterns, and competitive dynamics.

By Application:

By Vehicle Type:

Detailed analysis of market categories reveals specific trends, opportunities, and challenges within distinct segments of the UK automotive LED lighting market.

Premium Vehicle Segment demonstrates the highest LED adoption rates, with approximately 92% penetration in luxury vehicle categories. This segment drives innovation through demand for advanced features including adaptive lighting, dynamic turn signals, and integrated design elements. Consumer willingness to pay premium prices for enhanced functionality and aesthetics supports continued technological advancement and market expansion.

Commercial Vehicle Applications focus primarily on operational efficiency and safety benefits rather than aesthetic considerations. Fleet operators increasingly recognize LED lighting advantages including reduced maintenance costs, improved visibility, and enhanced driver safety. Total cost of ownership calculations favor LED adoption despite higher initial investment requirements.

Aftermarket Segment presents significant growth opportunities as vehicle owners seek to modernize older vehicles with contemporary lighting technology. This category benefits from declining LED costs and increasing availability of retrofit solutions designed for popular vehicle models. Installation services and technical support become critical success factors in aftermarket applications.

Strategic advantages available to industry participants and stakeholders within the UK automotive LED lighting market encompass operational, financial, and competitive benefits that support sustainable business growth.

Manufacturers benefit from LED technology through reduced warranty claims, enhanced product differentiation, and alignment with sustainability initiatives. LED lighting systems offer superior reliability and longevity compared to traditional alternatives, reducing after-sales service requirements and improving customer satisfaction. The technology’s design flexibility enables innovative styling and functionality that supports premium positioning and brand differentiation.

Vehicle owners gain significant advantages including reduced energy consumption, lower maintenance costs, and improved safety performance. LED lighting typically consumes 50-80% less energy than halogen alternatives while providing superior illumination quality and faster response times. The extended lifespan of LED systems reduces replacement frequency and associated maintenance costs.

Fleet operators particularly benefit from LED adoption through operational cost reductions and improved safety records. Commercial applications demonstrate clear return on investment through reduced fuel consumption, lower maintenance expenses, and enhanced driver visibility that contributes to accident prevention and insurance cost reductions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends within the UK automotive LED lighting market reflect broader technological and social developments that shape future market evolution and competitive dynamics.

Adaptive Lighting Systems represent a significant trend toward intelligent lighting that automatically adjusts to driving conditions, weather, and traffic situations. These systems utilize sensors and algorithms to optimize beam patterns, intensity, and direction for maximum safety and efficiency. Market adoption of adaptive lighting features has increased by approximately 45% annually in premium vehicle segments.

Connected Lighting emerges as vehicles become increasingly integrated with digital ecosystems and smart infrastructure. LED lighting systems can communicate with other vehicle systems, traffic management infrastructure, and mobile devices to provide enhanced functionality and user experiences. This trend aligns with broader automotive digitalization initiatives and autonomous driving development.

Sustainable Manufacturing gains importance as environmental consciousness influences purchasing decisions and regulatory requirements. LED lighting manufacturers increasingly focus on sustainable production processes, recyclable materials, and reduced environmental impact throughout product lifecycles. Circular economy principles drive innovation in product design and end-of-life management.

Recent developments within the UK automotive LED lighting industry demonstrate continued innovation and market evolution driven by technological advancement and changing market requirements.

Technology partnerships between automotive manufacturers and LED specialists accelerate innovation and market introduction of advanced lighting solutions. Collaborative development programs focus on next-generation technologies including OLED integration, laser lighting, and smart connectivity features. These partnerships enable faster time-to-market and shared development costs for complex lighting systems.

Manufacturing investments in UK-based production facilities support market growth and supply chain resilience. Several major suppliers have announced expansion plans for LED lighting component manufacturing, driven by growing demand and desire to serve European markets from local facilities. MWR analysis indicates that domestic manufacturing capacity has increased by approximately 38% over two years.

Regulatory updates continue shaping market development through enhanced safety standards and environmental requirements. Recent changes to UK automotive lighting regulations emphasize improved visibility, reduced glare, and energy efficiency, creating opportunities for advanced LED technologies that meet or exceed these requirements.

Strategic recommendations for market participants focus on positioning for sustained growth and competitive advantage within the evolving UK automotive LED lighting landscape.

Innovation investment should prioritize adaptive lighting technologies, smart connectivity features, and integration with autonomous driving systems. Companies that develop comprehensive technology platforms rather than individual products will be better positioned for long-term success. Research and development spending should focus on emerging applications and next-generation lighting technologies.

Market expansion strategies should emphasize aftermarket opportunities and commercial vehicle applications where LED adoption rates remain below passenger car levels. Developing cost-effective retrofit solutions and comprehensive service support can capture significant market share in these growing segments. Partnership approaches with installation services and fleet management companies can accelerate market penetration.

Supply chain optimization becomes critical as market volumes increase and cost pressures intensify. Vertical integration in key components and strategic supplier relationships can improve margins and ensure technology access. Manufacturing efficiency improvements through automation and process optimization will be essential for competitive positioning.

Market projections for the UK automotive LED lighting sector indicate continued robust growth driven by technological advancement, regulatory support, and expanding application areas across the automotive industry.

Technology evolution will focus on intelligent lighting systems that integrate with vehicle safety systems, autonomous driving capabilities, and smart infrastructure. MarkWide Research projections suggest that adaptive lighting penetration will reach approximately 65% of new vehicles within five years, driven by safety benefits and regulatory encouragement.

Market expansion will be supported by continued electric vehicle growth, aftermarket modernization, and commercial vehicle adoption. The alignment between LED efficiency benefits and electrification strategies creates natural synergies that support sustained market development. Growth rates are expected to maintain strong momentum with projected annual expansion of 7.5-9.2% over the forecast period.

Competitive dynamics will intensify as market opportunities attract new entrants and existing participants expand their capabilities. Success will depend on technological innovation, cost competitiveness, and ability to serve diverse market segments with appropriate solutions. Industry consolidation may accelerate as companies seek scale advantages and comprehensive technology portfolios.

The UK automotive LED lighting market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, regulatory support, and changing consumer preferences. The market has demonstrated remarkable resilience and adaptability, successfully transitioning from niche premium applications to mainstream adoption across diverse vehicle segments.

Key success factors for market participants include continuous innovation investment, strategic partnerships, and focus on emerging applications including electric vehicles and smart connectivity features. The market’s evolution toward intelligent lighting systems and integration with autonomous driving technologies creates significant opportunities for companies that can develop comprehensive technology solutions rather than individual products.

Future market development will be shaped by the continued convergence of automotive electrification, digitalization, and sustainability trends that naturally align with LED technology benefits. Companies that position themselves at the intersection of these trends while maintaining cost competitiveness and operational excellence will be best positioned for sustained success in this growing and evolving market landscape.

What is Automotive LED Lighting?

Automotive LED lighting refers to the use of light-emitting diodes in vehicles for various applications, including headlights, taillights, and interior lighting. This technology is known for its energy efficiency, longevity, and brightness compared to traditional lighting solutions.

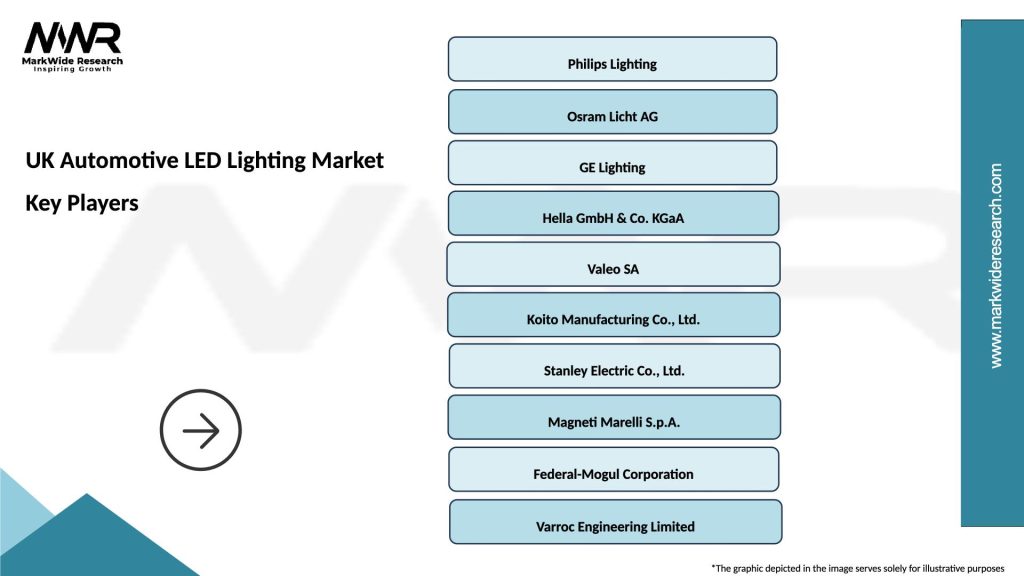

What are the key players in the UK Automotive LED Lighting Market?

Key players in the UK Automotive LED Lighting Market include Osram, Philips, and Valeo, which are known for their innovative lighting solutions and extensive product ranges. These companies focus on enhancing vehicle safety and aesthetics through advanced LED technologies, among others.

What are the main drivers of growth in the UK Automotive LED Lighting Market?

The main drivers of growth in the UK Automotive LED Lighting Market include the increasing demand for energy-efficient lighting solutions, advancements in automotive technology, and the rising consumer preference for stylish and customizable vehicle lighting. Additionally, regulatory standards promoting safety are also contributing to market expansion.

What challenges does the UK Automotive LED Lighting Market face?

The UK Automotive LED Lighting Market faces challenges such as high initial costs of LED technology and competition from traditional lighting systems. Additionally, the rapid pace of technological advancements can lead to obsolescence and increased pressure on manufacturers to innovate continuously.

What opportunities exist in the UK Automotive LED Lighting Market?

Opportunities in the UK Automotive LED Lighting Market include the growing trend of electric vehicles, which often utilize advanced lighting systems, and the potential for smart lighting solutions that integrate with vehicle technology. Furthermore, the increasing focus on sustainability presents avenues for eco-friendly lighting innovations.

What trends are shaping the UK Automotive LED Lighting Market?

Trends shaping the UK Automotive LED Lighting Market include the adoption of adaptive lighting systems that enhance visibility and safety, as well as the integration of LED technology with smart vehicle systems. Additionally, there is a growing emphasis on design flexibility and customization in automotive lighting solutions.

UK Automotive LED Lighting Market

| Segmentation Details | Description |

|---|---|

| Product Type | Headlights, Taillights, Fog Lights, Interior Lights |

| Technology | Halogen, Xenon, OLED, Laser |

| End User | OEMs, Aftermarket Providers, Vehicle Assemblers, Tier-1 Suppliers |

| Application | Passenger Vehicles, Commercial Vehicles, Motorcycles, Buses |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Automotive LED Lighting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at