444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK automotive engine oils market represents a critical component of the nation’s automotive aftermarket industry, serving millions of vehicles across passenger cars, commercial vehicles, and motorcycles. This dynamic market encompasses a comprehensive range of lubricant products designed to protect, enhance, and optimize engine performance while meeting increasingly stringent environmental regulations and fuel efficiency standards.

Market dynamics in the UK are shaped by several key factors including the transition toward electric vehicles, evolving emission standards, and changing consumer preferences for high-performance synthetic oils. The market demonstrates remarkable resilience with consistent growth driven by 6.2% annual expansion in premium synthetic oil segments, reflecting consumers’ increasing awareness of engine protection benefits.

Regional distribution shows concentrated demand in major metropolitan areas including London, Manchester, Birmingham, and Glasgow, where vehicle density and commercial fleet operations drive substantial lubricant consumption. The market serves approximately 32.7 million registered vehicles across the UK, creating sustained demand for quality engine oil products.

Technology advancement continues reshaping the landscape as manufacturers develop advanced formulations to meet Euro 6 emission standards while providing extended drain intervals and improved fuel economy. The integration of low-viscosity oils and synthetic blend technologies represents significant growth opportunities for market participants.

The UK automotive engine oils market refers to the comprehensive ecosystem of lubricant products, distribution channels, and service providers that supply engine oils for automotive applications throughout the United Kingdom. This market encompasses conventional, synthetic blend, and full synthetic motor oils designed to lubricate, protect, and enhance the performance of internal combustion engines across various vehicle categories.

Market scope includes passenger car motor oils, heavy-duty diesel engine oils, motorcycle oils, and specialty lubricants for racing and high-performance applications. The market serves diverse customer segments from individual consumers performing DIY maintenance to professional service centers, fleet operators, and industrial applications requiring specialized lubrication solutions.

Value chain participants include international oil companies, independent lubricant manufacturers, distributors, retailers, and service providers who collectively ensure product availability and technical support across the UK market. The market operates through multiple distribution channels including automotive retailers, quick-lube services, dealership networks, and online platforms.

Strategic positioning within the UK automotive engine oils market reveals a mature yet evolving landscape characterized by premium product migration, environmental compliance requirements, and technological innovation. The market benefits from stable vehicle parc growth and increasing consumer awareness regarding engine protection and fuel efficiency benefits.

Key market drivers include stringent emission regulations, extended service intervals, and growing demand for high-performance synthetic formulations. Premium segment growth accelerates at 8.4% annually as consumers recognize long-term value propositions of advanced synthetic oils despite higher upfront costs.

Competitive dynamics feature established international brands competing alongside regional specialists and private label offerings. Market leaders leverage brand recognition, technical expertise, and comprehensive distribution networks to maintain market share while emerging players focus on niche segments and value propositions.

Future trajectory indicates continued evolution toward environmentally sustainable formulations, extended drain intervals, and specialized products for hybrid and alternative fuel vehicles. The market adapts to changing automotive landscape while maintaining core growth fundamentals.

Market segmentation analysis reveals distinct patterns across product categories, with synthetic oils commanding 42% market share and demonstrating strongest growth momentum. Consumer preferences increasingly favor premium formulations offering superior protection and performance characteristics.

Regulatory compliance serves as a primary market driver, with Euro 6 emission standards requiring advanced low-SAPS formulations that protect aftertreatment systems while maintaining engine performance. These regulations create mandatory upgrade cycles for both commercial and passenger vehicle applications.

Vehicle technology evolution drives demand for specialized lubricants as modern engines feature smaller displacements, turbocharging, direct injection, and variable valve timing systems requiring enhanced protection. Turbocharged engine adoption increases at 15.3% annually, creating demand for high-temperature stability oils.

Fuel economy pressures motivate consumers and fleet operators to select low-viscosity oils that reduce internal friction and improve miles per gallon performance. Government fuel efficiency targets and rising fuel costs amplify this trend across all vehicle segments.

Extended service intervals offered by synthetic oils appeal to time-conscious consumers and cost-focused fleet operators seeking reduced maintenance frequency without compromising engine protection. Premium oils enabling 10,000-mile service intervals gain significant market traction.

Professional service growth expands as consumers increasingly rely on quick-lube centers and professional technicians for maintenance services, creating opportunities for premium product recommendations and brand partnerships with service providers.

Electric vehicle transition poses long-term challenges as EV adoption reduces internal combustion engine oil demand. Government commitments to ban new petrol and diesel vehicle sales by 2030 create uncertainty regarding future market size and growth potential.

Price sensitivity among cost-conscious consumers limits premium product adoption, particularly during economic downturns when maintenance budgets face pressure. Conventional oils maintain appeal despite performance limitations due to lower acquisition costs.

Extended drain intervals paradoxically constrain market growth by reducing oil change frequency, even as they drive premium product adoption. Longer service intervals decrease overall volume consumption despite higher per-unit values.

DIY market decline affects traditional retail channels as younger consumers increasingly prefer professional service options, potentially reducing impulse purchases and brand visibility in automotive retail environments.

Supply chain complexities create challenges for smaller market participants competing against integrated oil companies with established refining and distribution capabilities. Raw material cost volatility impacts margins and pricing strategies across the market.

Hybrid vehicle growth creates opportunities for specialized lubricants addressing unique requirements of hybrid powertrains, including extended idle periods, frequent start-stop cycles, and thermal management challenges. Hybrid vehicle registrations increase 23.7% annually, representing emerging market segments.

Commercial fleet optimization offers substantial growth potential as logistics companies seek lubricants that maximize fuel economy, extend service intervals, and reduce total cost of ownership. Fleet management programs create opportunities for bulk supply contracts and technical partnerships.

Premium motorcycle segment expansion driven by leisure riding growth and high-performance motorcycle popularity creates demand for specialized oils meeting unique requirements of motorcycle engines, transmissions, and wet clutch systems.

Digital marketplace development enables direct-to-consumer sales, subscription services, and personalized product recommendations based on vehicle specifications and driving patterns. Online platforms reduce distribution costs while improving customer convenience.

Sustainability positioning allows manufacturers to differentiate through bio-based formulations, recycled content, and environmentally responsible packaging solutions appealing to environmentally conscious consumers and corporate sustainability programs.

Competitive intensity remains high as established international brands compete with regional specialists and private label offerings across multiple price points and performance categories. Market leaders invest heavily in research and development to maintain technological advantages and brand differentiation.

Innovation cycles accelerate as manufacturers develop advanced additive packages, base oil technologies, and specialized formulations addressing evolving engine requirements. R&D investment increases 12.8% annually among leading market participants seeking competitive advantages.

Distribution evolution reflects changing consumer preferences and retail landscape dynamics, with traditional automotive retailers competing against online platforms, quick-lube chains, and integrated service providers offering comprehensive maintenance solutions.

Pricing dynamics balance raw material costs, competitive pressures, and value proposition communication. Premium products command higher margins while conventional oils compete primarily on price points and availability.

Customer education becomes increasingly important as product complexity grows and consumers seek guidance regarding optimal oil selection for specific vehicle applications and driving conditions. Technical support and educational content influence purchase decisions.

Primary research encompasses comprehensive interviews with industry stakeholders including lubricant manufacturers, distributors, retailers, service providers, and end-users across diverse market segments. This approach ensures balanced perspectives on market trends, challenges, and opportunities.

Secondary analysis incorporates industry reports, regulatory documents, trade association data, and company financial statements to validate primary findings and establish quantitative market parameters. Government statistics and automotive industry data provide foundational market sizing information.

Market modeling utilizes statistical techniques to project future trends based on historical performance, regulatory changes, and technological developments. Scenario analysis addresses various potential outcomes regarding electric vehicle adoption and market evolution.

Expert validation involves consultation with industry experts, technical specialists, and market analysts to ensure research accuracy and relevance. MarkWide Research methodology emphasizes data triangulation and multiple source verification for reliable market insights.

Continuous monitoring tracks market developments, regulatory changes, and competitive activities to maintain current market intelligence and identify emerging trends affecting market dynamics and growth prospects.

England dominates market consumption with 68% regional share, driven by high vehicle density in metropolitan areas, extensive commercial fleet operations, and concentrated automotive service infrastructure. London and surrounding areas represent the largest single market concentration.

Scotland contributes significant market volume through diverse applications including passenger vehicles, commercial fleets, and specialized industrial equipment. The region demonstrates strong preference for premium synthetic oils driven by harsh operating conditions and extended service requirements.

Wales and Northern Ireland represent smaller but stable market segments with distinct characteristics including rural driving patterns, agricultural vehicle applications, and seasonal demand variations. These regions show growing adoption of online purchasing channels.

Regional distribution networks vary significantly, with England benefiting from dense retail coverage while Scotland, Wales, and Northern Ireland rely more heavily on regional distributors and independent service providers for market access.

Economic factors influence regional consumption patterns, with affluent areas demonstrating higher premium product adoption rates while price-sensitive regions maintain stronger conventional oil demand despite performance limitations.

Market leadership features established international oil companies leveraging global scale, technical expertise, and comprehensive distribution networks to maintain competitive advantages across multiple product categories and customer segments.

Competitive strategies emphasize brand differentiation, technical innovation, distribution expansion, and customer service excellence. Leading companies invest in research and development, marketing programs, and strategic partnerships to maintain market position.

By Product Type:

By Vehicle Type:

By Distribution Channel:

Passenger Car Segment demonstrates steady growth with increasing preference for synthetic oils driven by consumer awareness of engine protection benefits and fuel economy improvements. Synthetic adoption reaches 47% penetration in passenger car applications, reflecting premium migration trends.

Commercial Vehicle Applications prioritize total cost of ownership optimization through extended drain intervals, fuel economy improvements, and reduced maintenance downtime. Fleet operators increasingly specify premium oils despite higher upfront costs to achieve operational savings.

Motorcycle Category shows robust growth driven by leisure riding popularity and high-performance motorcycle sales. Specialized formulations addressing wet clutch systems, gear protection, and high-temperature stability command premium pricing and strong brand loyalty.

High Mileage Segment expands as UK vehicle fleet ages and consumers seek cost-effective solutions for maintaining older vehicles. These specialized formulations address seal degradation, oil consumption, and performance restoration in high-mileage engines.

Racing and Performance applications represent niche but profitable segments demanding maximum protection under extreme conditions. Motorsports heritage and performance credentials influence mainstream consumer perceptions and brand positioning strategies.

Manufacturers benefit from stable demand fundamentals, premium product migration opportunities, and technological innovation potential. Advanced formulation capabilities enable differentiation and margin optimization while regulatory compliance creates barriers to entry for smaller competitors.

Distributors gain from diverse product portfolios, multiple channel opportunities, and value-added services including technical support and inventory management. Strong relationships with both suppliers and customers create competitive advantages and revenue stability.

Retailers enjoy consistent customer traffic, repeat purchase patterns, and opportunities for cross-selling complementary automotive products. Oil change services generate regular customer interactions supporting broader automotive service offerings.

Service providers benefit from recurring revenue streams, customer loyalty development, and opportunities for premium product recommendations. Professional installation services add value while building long-term customer relationships.

End consumers receive enhanced engine protection, improved fuel economy, and extended service intervals through advanced oil formulations. Professional guidance and warranty protection provide additional value beyond basic lubrication functions.

Fleet operators achieve total cost of ownership optimization through reduced maintenance frequency, improved fuel efficiency, and enhanced equipment reliability. Bulk purchasing programs and technical support services provide additional operational benefits.

Strengths:

Weaknesses:

Opportunities:

Threats:

Synthetic Oil Mainstream Adoption accelerates as consumers recognize long-term value propositions including extended service intervals, improved fuel economy, and superior engine protection. Price premiums decrease as production volumes increase and consumer acceptance grows.

Low-Viscosity Formulations gain prominence driven by fuel economy regulations and manufacturer specifications requiring 0W-20 and 0W-16 grades. These advanced oils provide improved cold-start protection while reducing internal friction and fuel consumption.

Sustainability Integration becomes increasingly important as manufacturers develop bio-based formulations, recycled content options, and environmentally responsible packaging solutions. Sustainable product adoption grows 18.5% annually among environmentally conscious consumers.

Digital Customer Engagement transforms marketing and sales approaches through online platforms, mobile applications, and personalized product recommendations. Data analytics enable targeted marketing and improved customer service delivery.

Service Partnership Expansion creates integrated offerings combining premium lubricants with professional installation, maintenance reminders, and technical support services. These partnerships enhance customer value while building loyalty and retention.

Specialized Applications Growth includes formulations for hybrid vehicles, high-performance engines, and extreme operating conditions. Niche segments command premium pricing while demonstrating technological capabilities and brand expertise.

Regulatory Evolution continues with implementation of Euro 6d emission standards requiring advanced low-SAPS formulations protecting diesel particulate filters and selective catalytic reduction systems. Compliance drives product reformulation and market differentiation opportunities.

Manufacturing Innovation includes development of Group III+ and Group IV base oils providing enhanced performance characteristics while meeting environmental requirements. Advanced additive packages enable extended drain intervals and improved fuel economy benefits.

Distribution Transformation reflects changing consumer preferences with expansion of online sales channels, subscription services, and direct-to-consumer delivery options. Traditional retail adapts through enhanced service offerings and digital integration.

Partnership Strategies involve collaborations between lubricant manufacturers and automotive OEMs, service chains, and fleet operators creating integrated solutions and market access opportunities. Strategic alliances enhance competitive positioning and customer reach.

Sustainability Initiatives encompass development of bio-based formulations, recycling programs, and carbon footprint reduction efforts. Environmental responsibility becomes increasingly important for brand positioning and customer preference.

Technology Integration includes IoT-enabled monitoring systems, predictive maintenance applications, and data analytics platforms providing insights into oil performance and optimization opportunities for fleet and commercial applications.

Premium Positioning Strategy should emphasize total cost of ownership benefits rather than upfront price comparisons. MWR analysis indicates consumers respond positively to value proposition messaging highlighting fuel savings, extended service intervals, and engine protection benefits.

Digital Channel Development requires investment in e-commerce capabilities, customer education content, and personalized product recommendation systems. Online platforms offer opportunities for direct customer relationships and margin optimization.

Sustainability Leadership creates competitive differentiation through bio-based formulations, recycled content integration, and environmental responsibility messaging. Early movers in sustainable lubricants gain market positioning advantages.

Service Integration Partnerships with quick-lube centers, dealerships, and independent service providers enhance market access while providing customer education and product recommendation opportunities. Professional endorsements influence consumer purchase decisions.

Innovation Investment in advanced formulations addressing hybrid vehicle requirements, extreme temperature performance, and extended drain capabilities maintains technological leadership and enables premium pricing strategies.

Market Education Programs addressing synthetic oil benefits, proper product selection, and maintenance best practices support premium migration while building brand credibility and customer loyalty among diverse consumer segments.

Market evolution toward premium synthetic formulations continues with projected growth of 9.2% annually in full synthetic segments over the next five years. Consumer education and total cost of ownership awareness drive this premium migration trend despite higher upfront costs.

Electric vehicle impact remains limited in the near term as ICE vehicles continue dominating the UK fleet through 2030. However, long-term planning must address gradual demand reduction as EV adoption accelerates beyond current government targets.

Regulatory compliance drives continued product innovation with anticipated Euro 7 standards requiring even more advanced formulations. Early preparation for future regulations creates competitive advantages and market positioning opportunities.

Digital transformation accelerates with online sales channels, subscription services, and data-driven customer engagement becoming standard market practices. Traditional distribution adapts through digital integration and enhanced service offerings.

Sustainability requirements increase as environmental consciousness grows among consumers and corporate customers. Bio-based formulations and circular economy principles become important differentiators in competitive market positioning.

MarkWide Research projects continued market resilience despite evolving automotive landscape, with premium product migration and service integration offsetting volume pressures from extended drain intervals and gradual EV adoption.

The UK automotive engine oils market demonstrates remarkable adaptability and growth potential despite facing long-term structural changes from electric vehicle adoption and evolving automotive technologies. Market fundamentals remain strong with stable vehicle parc, increasing premium product adoption, and continuous innovation in formulation technologies addressing regulatory requirements and consumer preferences.

Strategic opportunities abound for market participants willing to invest in premium positioning, digital transformation, and sustainability initiatives. The transition toward synthetic oils, specialized applications, and integrated service offerings creates value creation potential while traditional volume-based approaches face increasing pressure from extended drain intervals and market maturity.

Future success requires balanced approaches addressing immediate market opportunities while preparing for long-term industry evolution. Companies that combine technological innovation, customer education, and strategic partnerships will maintain competitive advantages as the market continues evolving toward higher performance, environmentally responsible, and digitally integrated solutions serving the diverse needs of UK automotive consumers and commercial operators.

What is Automotive Engine Oils?

Automotive engine oils are lubricants specifically formulated for use in internal combustion engines. They help reduce friction, prevent wear, and protect engine components from corrosion and deposits.

What are the key players in the UK Automotive Engine Oils Market?

Key players in the UK Automotive Engine Oils Market include Castrol, Mobil, and Shell, which are known for their extensive range of engine oils catering to various vehicle types and performance requirements, among others.

What are the main drivers of the UK Automotive Engine Oils Market?

The main drivers of the UK Automotive Engine Oils Market include the increasing vehicle production, rising consumer awareness about engine maintenance, and advancements in oil formulations that enhance engine performance and fuel efficiency.

What challenges does the UK Automotive Engine Oils Market face?

The UK Automotive Engine Oils Market faces challenges such as stringent environmental regulations, the growing popularity of electric vehicles, and the need for continuous innovation in oil formulations to meet changing consumer demands.

What opportunities exist in the UK Automotive Engine Oils Market?

Opportunities in the UK Automotive Engine Oils Market include the development of synthetic and bio-based oils, increasing demand for high-performance lubricants, and the potential for expansion in the electric vehicle segment with specialized lubricants.

What trends are shaping the UK Automotive Engine Oils Market?

Trends shaping the UK Automotive Engine Oils Market include the shift towards environmentally friendly products, the rise of smart lubricants with enhanced properties, and the growing focus on sustainability in oil production and usage.

UK Automotive Engine Oils Market

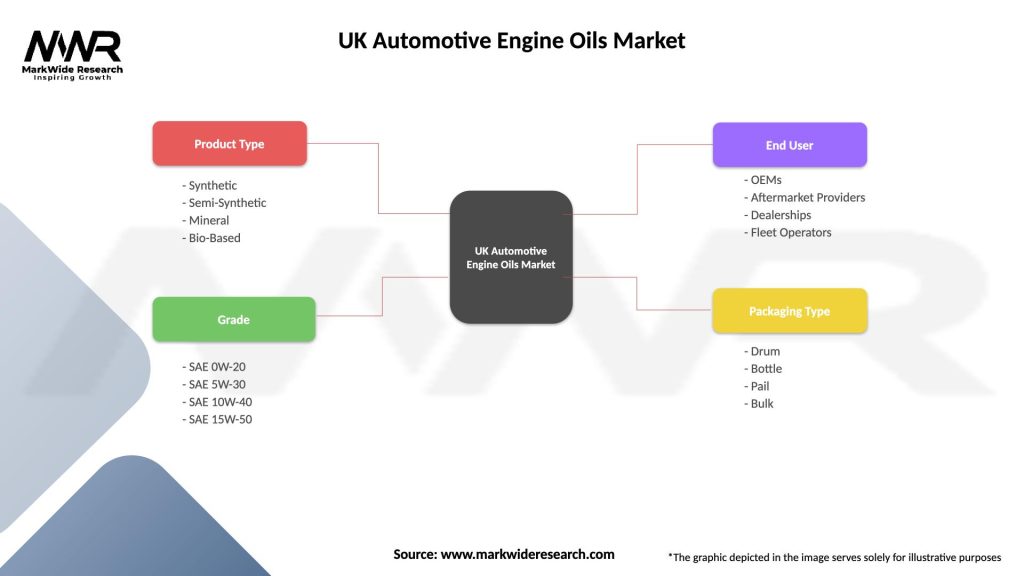

| Segmentation Details | Description |

|---|---|

| Product Type | Synthetic, Semi-Synthetic, Mineral, Bio-Based |

| Grade | SAE 0W-20, SAE 5W-30, SAE 10W-40, SAE 15W-50 |

| End User | OEMs, Aftermarket Providers, Dealerships, Fleet Operators |

| Packaging Type | Drum, Bottle, Pail, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Automotive Engine Oils Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at