444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK artificial organs and bionic implants market represents a revolutionary segment of the healthcare technology industry, encompassing advanced medical devices designed to replace or enhance human biological functions. This rapidly evolving market includes artificial hearts, cochlear implants, prosthetic limbs, neural implants, and various organ replacement technologies that are transforming patient care across the United Kingdom.

Market dynamics indicate substantial growth driven by an aging population, increasing prevalence of chronic diseases, and remarkable technological advancements in biomedical engineering. The market encompasses both temporary and permanent solutions, ranging from life-sustaining artificial organs to quality-of-life enhancing bionic implants that restore sensory and motor functions.

Technological innovation continues to drive market expansion, with developments in materials science, miniaturization, and biocompatibility leading to more sophisticated and reliable devices. The integration of artificial intelligence, machine learning, and advanced sensors has created next-generation implants that can adapt to patient needs and provide unprecedented functionality. Growth rates in certain segments are reaching 12-15% annually, reflecting the increasing acceptance and clinical success of these technologies.

Healthcare infrastructure in the UK, supported by the National Health Service (NHS) and private healthcare providers, has created a robust foundation for market development. The combination of world-class research institutions, innovative medical device companies, and comprehensive healthcare coverage has positioned the UK as a leading market for artificial organs and bionic implants in Europe.

The UK artificial organs and bionic implants market refers to the comprehensive ecosystem of medical devices, technologies, and services designed to replace, restore, or enhance human biological functions through artificial means. This market encompasses devices that can substitute for failing organs, restore lost sensory capabilities, or augment human physical and cognitive abilities.

Artificial organs include mechanical or bioengineered devices that perform the functions of natural organs, such as artificial hearts, kidneys, lungs, and liver support systems. These devices serve as either temporary bridges to transplantation or permanent replacements when donor organs are unavailable or unsuitable.

Bionic implants represent advanced prosthetic and enhancement devices that integrate with the human nervous system to restore or augment natural capabilities. These include cochlear implants for hearing restoration, retinal implants for vision recovery, neural implants for brain-computer interfaces, and sophisticated prosthetic limbs controlled by neural signals.

Market scope extends beyond the devices themselves to include surgical procedures, maintenance services, rehabilitation programs, and ongoing patient support systems that ensure successful integration and long-term functionality of these life-changing technologies.

Strategic analysis reveals that the UK artificial organs and bionic implants market is experiencing unprecedented growth, driven by technological breakthroughs, demographic shifts, and evolving healthcare needs. The market demonstrates strong momentum across multiple segments, with particular strength in neural implants, cardiac devices, and advanced prosthetics.

Key growth drivers include the aging population requiring organ replacement therapies, increasing prevalence of cardiovascular diseases, rising incidence of hearing and vision impairments, and growing acceptance of elective enhancement procedures. Adoption rates for certain bionic implants have increased by 25-30% over the past three years, indicating strong market acceptance.

Technological advancement remains the primary catalyst for market expansion, with innovations in biocompatible materials, wireless connectivity, and artificial intelligence creating more effective and user-friendly devices. The integration of Internet of Things (IoT) capabilities and remote monitoring systems has enhanced patient outcomes and reduced healthcare costs.

Competitive landscape features a mix of established medical device manufacturers, innovative startups, and research institutions collaborating to develop next-generation solutions. Strategic partnerships between technology companies and healthcare providers are accelerating product development and market penetration.

Future prospects indicate continued robust growth, with emerging technologies such as 3D bioprinting, nanotechnology, and advanced biomaterials expected to create new market opportunities and expand treatment possibilities for patients across the UK.

Market intelligence reveals several critical insights that define the current state and future trajectory of the UK artificial organs and bionic implants market:

Market segmentation analysis indicates that cardiac devices and neural implants represent the largest growth segments, while emerging categories such as bioengineered organs and smart prosthetics show the highest growth potential for future market expansion.

Primary market drivers propelling the UK artificial organs and bionic implants market forward include multiple interconnected factors that create sustained demand and growth opportunities across various segments.

Aging population dynamics represent the most significant driver, as the UK experiences demographic shifts that increase the prevalence of age-related organ failure, sensory impairments, and mobility limitations. The growing number of elderly citizens requiring medical intervention creates consistent demand for artificial organs and bionic solutions.

Chronic disease prevalence continues to rise, with cardiovascular diseases, diabetes, and kidney disorders affecting millions of UK residents. These conditions often progress to organ failure, creating substantial demand for artificial hearts, dialysis alternatives, and other life-sustaining technologies.

Technological advancement serves as a crucial driver, with breakthrough innovations in materials science, bioengineering, and digital health creating more effective and accessible solutions. The development of biocompatible materials, miniaturized electronics, and wireless connectivity has revolutionized device capabilities and patient experiences.

Healthcare system support through NHS coverage and private insurance acceptance has made these technologies more accessible to patients across different socioeconomic backgrounds. Government initiatives promoting medical innovation and research funding have accelerated development and adoption.

Quality of life expectations among patients and healthcare providers drive demand for solutions that not only sustain life but enhance functionality and independence. Modern bionic implants offer capabilities that can exceed natural human performance in certain applications.

Research and development investment from both public and private sectors continues to fuel innovation, with UK universities and medical device companies leading global research efforts in artificial organ development and bionic enhancement technologies.

Market challenges facing the UK artificial organs and bionic implants sector include several significant restraints that impact growth potential and market penetration across various segments.

High development costs represent a primary constraint, as the research, development, and regulatory approval processes for artificial organs and bionic implants require substantial financial investment. These costs often translate to higher device prices, potentially limiting accessibility for some patient populations.

Regulatory complexity creates challenges for manufacturers seeking approval for innovative devices. While the UK has streamlined some processes, the rigorous safety and efficacy requirements necessary for implantable devices can extend development timelines and increase costs.

Technical limitations persist in certain areas, particularly regarding long-term biocompatibility, device longevity, and integration with human biological systems. Some artificial organs and implants require regular maintenance or replacement, creating ongoing patient burden and healthcare costs.

Surgical complexity and the need for specialized medical expertise limit the number of healthcare facilities capable of performing implantation procedures. This geographic concentration can create access barriers for patients in certain regions.

Patient acceptance barriers include psychological factors, cultural considerations, and concerns about device reliability or potential complications. Some patients remain hesitant to adopt artificial solutions, preferring traditional treatment approaches.

Insurance and reimbursement challenges can limit patient access, particularly for newer or experimental technologies that may not yet have established coverage policies. The high cost of some devices may exceed standard reimbursement levels.

Cybersecurity concerns have emerged as connected devices become more prevalent, with patients and healthcare providers expressing concerns about data privacy and device security vulnerabilities.

Emerging opportunities in the UK artificial organs and bionic implants market present significant potential for growth, innovation, and improved patient outcomes across multiple therapeutic areas and technological applications.

Regenerative medicine integration offers substantial opportunities as researchers develop hybrid solutions combining artificial devices with biological tissue engineering. These approaches could create more natural and longer-lasting solutions for organ replacement and functional restoration.

Artificial intelligence enhancement presents opportunities to develop smarter, more adaptive devices that can learn from patient behavior and optimize performance automatically. AI-powered implants could provide personalized therapy and predictive maintenance capabilities.

Minimally invasive procedures represent a growing opportunity as technological advances enable less invasive implantation techniques. These approaches could reduce surgical risks, recovery times, and healthcare costs while expanding the eligible patient population.

Pediatric applications offer significant growth potential as researchers develop specialized devices for children and adolescents. Growing implants and age-appropriate technologies could address unique pediatric needs and improve long-term outcomes.

Enhancement applications beyond medical necessity present opportunities in elective procedures for performance augmentation, sensory enhancement, and cognitive improvement. This emerging segment could expand the market beyond traditional medical applications.

Remote monitoring capabilities create opportunities for comprehensive patient management systems that can track device performance, predict maintenance needs, and provide real-time health monitoring through connected implants.

International expansion opportunities exist as UK companies leverage their technological expertise and regulatory experience to enter emerging markets with growing healthcare infrastructure and increasing demand for advanced medical technologies.

Market dynamics in the UK artificial organs and bionic implants sector reflect complex interactions between technological innovation, healthcare policy, patient needs, and economic factors that shape market evolution and competitive positioning.

Innovation cycles drive market dynamics through continuous technological advancement, with new materials, manufacturing techniques, and digital capabilities creating regular market disruption. The rapid pace of innovation requires companies to maintain substantial R&D investments to remain competitive.

Healthcare policy evolution significantly impacts market dynamics through changes in NHS funding priorities, reimbursement policies, and regulatory frameworks. Policy shifts can create new opportunities or challenges for market participants and affect patient access to technologies.

Competitive intensity continues to increase as established medical device companies compete with innovative startups and technology firms entering the healthcare space. This competition drives innovation while potentially pressuring profit margins and market share distribution.

Supply chain considerations affect market dynamics through the availability of specialized materials, manufacturing capabilities, and skilled workforce requirements. Global supply chain disruptions can impact production schedules and cost structures.

Patient advocacy influence shapes market dynamics through organized efforts to improve access, funding, and treatment options. Patient groups play increasingly important roles in policy development and technology adoption decisions.

Technology convergence creates dynamic interactions between artificial organs, bionic implants, digital health platforms, and pharmaceutical therapies. These convergences create new treatment paradigms and market opportunities while requiring new collaborative approaches.

Economic factors including healthcare spending levels, insurance coverage policies, and economic conditions affect market dynamics through their impact on patient access, healthcare provider investment decisions, and research funding availability.

Comprehensive research methodology employed in analyzing the UK artificial organs and bionic implants market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with healthcare professionals, medical device manufacturers, regulatory experts, and patient advocacy groups to gather firsthand insights into market trends, challenges, and opportunities. These interviews provide qualitative depth and context to quantitative market data.

Secondary research analysis encompasses review of clinical studies, regulatory filings, company reports, academic publications, and industry databases to establish comprehensive market understanding. This research provides historical context and validates primary research findings.

Market segmentation analysis employs detailed categorization by device type, application area, end-user segment, and geographic region to identify specific growth patterns and opportunities within the broader market landscape.

Competitive intelligence gathering includes analysis of company strategies, product portfolios, patent filings, partnership agreements, and market positioning to understand competitive dynamics and future market direction.

Regulatory environment assessment involves detailed review of approval processes, safety requirements, reimbursement policies, and emerging regulatory trends that impact market development and product commercialization.

Technology trend analysis incorporates evaluation of emerging technologies, research developments, and innovation pipelines to identify future market opportunities and potential disruptions.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure data accuracy and reliability. MarkWide Research employs rigorous quality control measures throughout the research process to maintain analytical integrity.

Geographic distribution of the UK artificial organs and bionic implants market reveals distinct regional patterns influenced by healthcare infrastructure, population demographics, research capabilities, and economic factors across England, Scotland, Wales, and Northern Ireland.

England dominates the market with approximately 75% market share, driven by the concentration of major medical centers, research institutions, and healthcare infrastructure in London and other major metropolitan areas. The region benefits from substantial NHS investment and private healthcare presence.

London and Southeast England represent the largest market segment, hosting leading medical device companies, world-renowned hospitals, and cutting-edge research facilities. This region serves as the primary hub for innovation, clinical trials, and technology commercialization.

Scotland accounts for approximately 12% of market activity, with strong research capabilities centered around Edinburgh and Glasgow. Scottish universities and medical centers contribute significantly to artificial organ research and bionic implant development.

Northern England demonstrates growing market presence through major medical centers in Manchester, Leeds, and Newcastle. The region benefits from strong engineering capabilities and increasing healthcare investment in advanced medical technologies.

Wales represents roughly 5% of market share, with Cardiff serving as the primary center for artificial organ and bionic implant activities. The region shows growing adoption rates and increasing investment in healthcare technology infrastructure.

Northern Ireland accounts for approximately 3% of market activity, with Belfast as the main hub for advanced medical device adoption. The region demonstrates increasing integration with broader UK market trends and technology adoption patterns.

Regional disparities in access and adoption rates reflect differences in healthcare infrastructure, specialist availability, and patient demographics. Efforts to improve regional equity in access to advanced medical technologies continue to shape market development patterns.

Competitive environment in the UK artificial organs and bionic implants market features a diverse ecosystem of established medical device manufacturers, innovative technology companies, research institutions, and emerging startups competing across various market segments.

Market positioning strategies vary among competitors, with some focusing on technological innovation, others emphasizing clinical outcomes, and many pursuing comprehensive patient support programs. Strategic partnerships with NHS trusts and private healthcare providers play crucial roles in market access and growth.

Innovation competition drives continuous product development, with companies investing heavily in R&D to develop next-generation devices with improved functionality, biocompatibility, and patient outcomes. Patent portfolios and intellectual property protection represent key competitive advantages.

Emerging competitors include technology startups and research spin-offs developing breakthrough technologies in areas such as bioengineered organs, smart prosthetics, and neural interface systems. These companies often collaborate with established players for commercialization and market access.

Market segmentation of the UK artificial organs and bionic implants market reveals distinct categories based on device type, application area, technology platform, and end-user characteristics that define specific market dynamics and growth opportunities.

By Device Type:

By Application Area:

By Technology Platform:

By End User:

Detailed category analysis reveals specific market dynamics, growth patterns, and opportunities within each major segment of the UK artificial organs and bionic implants market.

Artificial Hearts and Cardiac Devices represent the largest market category, driven by high prevalence of cardiovascular disease and advanced technology development. These devices demonstrate strong clinical outcomes and growing acceptance among patients and healthcare providers. Innovation focuses on miniaturization, improved biocompatibility, and wireless monitoring capabilities.

Cochlear and Hearing Implants show consistent growth with 8-10% annual expansion, supported by aging population demographics and improved device performance. Technology advancement in sound processing and wireless connectivity enhances patient experiences and outcomes.

Neural Implants and Brain Interfaces represent the fastest-growing category with emerging applications in treating depression, epilepsy, and neurological disorders. Research developments in brain-computer interfaces create new possibilities for paralysis treatment and cognitive enhancement.

Advanced Prosthetics demonstrate significant innovation with bionic limbs offering natural movement control through neural signals. These devices increasingly incorporate AI and machine learning to adapt to user preferences and improve functionality over time.

Retinal Implants show promising growth potential as technology advances enable better vision restoration outcomes. Clinical trials demonstrate improving success rates and expanding eligibility criteria for patients with various forms of blindness.

Bioengineered Organs represent an emerging category with substantial future potential as tissue engineering and 3D bioprinting technologies mature. These solutions could address organ shortage challenges while providing more natural replacement options.

Smart Implants with IoT connectivity and remote monitoring capabilities create new service opportunities and improved patient management systems. These devices enable predictive maintenance and real-time health monitoring.

Comprehensive benefits from the UK artificial organs and bionic implants market extend across multiple stakeholder groups, creating value for patients, healthcare providers, manufacturers, and the broader healthcare system.

Patient Benefits:

Healthcare Provider Benefits:

Manufacturer Benefits:

Healthcare System Benefits:

Strategic assessment of the UK artificial organs and bionic implants market through comprehensive SWOT analysis reveals key internal capabilities and external factors affecting market development and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the UK artificial organs and bionic implants market reflect technological advancement, changing patient expectations, and evolving healthcare delivery models that influence market development and competitive strategies.

Artificial Intelligence Integration represents a transformative trend as AI capabilities are embedded in implantable devices to provide adaptive functionality, predictive maintenance, and personalized therapy optimization. These smart systems can learn from patient behavior and automatically adjust performance parameters.

Miniaturization and Biocompatibility continue as key trends, with devices becoming smaller, more efficient, and better integrated with human biological systems. Advanced materials and manufacturing techniques enable less invasive procedures and improved patient comfort.

Wireless Connectivity and IoT integration creates connected health ecosystems where implants communicate with external monitoring systems, healthcare providers, and patient management platforms. This connectivity enables remote monitoring and proactive healthcare management.

Personalization and Customization trends focus on developing patient-specific solutions using 3D printing, genetic profiling, and individual anatomical modeling. These approaches improve device fit, function, and long-term outcomes.

Hybrid Biological-Artificial Solutions combine engineered tissues with artificial components to create more natural and potentially longer-lasting implants. This trend bridges traditional artificial devices with regenerative medicine approaches.

Enhanced User Interfaces improve patient interaction with bionic devices through intuitive control systems, mobile applications, and augmented reality interfaces that simplify device management and optimization.

Preventive and Predictive Capabilities enable devices to anticipate problems, prevent complications, and optimize performance before issues arise. These capabilities reduce maintenance requirements and improve patient outcomes.

Sustainability and Lifecycle Management trends focus on environmentally responsible device design, recyclable materials, and comprehensive end-of-life management programs for implantable devices.

Recent industry developments in the UK artificial organs and bionic implants market demonstrate accelerating innovation, strategic partnerships, and regulatory advancement that shape market evolution and competitive dynamics.

Breakthrough Technology Launches include next-generation artificial hearts with improved durability, advanced cochlear implants with enhanced sound processing, and bionic prosthetics with natural movement control. These innovations demonstrate significant performance improvements over previous generations.

Strategic Partnerships between medical device manufacturers, technology companies, and healthcare providers create comprehensive solutions and accelerate market adoption. Notable collaborations focus on AI integration, remote monitoring systems, and patient support programs.

Regulatory Approvals for innovative devices have accelerated through streamlined approval processes, enabling faster market access for breakthrough technologies. Recent approvals include advanced neural implants and bioengineered organ support systems.

Clinical Trial Successes demonstrate improving outcomes for various artificial organs and bionic implants, with success rates reaching 90% or higher for many device categories. These results support expanded clinical adoption and patient acceptance.

Investment and Funding activities show increased venture capital and government investment in UK-based artificial organ and bionic implant companies. This funding supports R&D activities and commercialization efforts.

Research Breakthroughs from UK universities and research institutions contribute to global advancement in bioengineering, materials science, and neural interface technologies. These developments often lead to commercial applications and patent filings.

Manufacturing Expansion includes new production facilities and capabilities in the UK, reducing dependence on international suppliers and supporting domestic market growth. These investments create jobs and enhance supply chain resilience.

Patient Access Programs expand availability of advanced devices through NHS coverage expansion, charitable programs, and innovative financing models that improve access across different patient populations.

Strategic recommendations for stakeholders in the UK artificial organs and bionic implants market focus on capitalizing on growth opportunities while addressing key challenges and market dynamics.

For Manufacturers: Focus on developing AI-enabled devices with enhanced connectivity and remote monitoring capabilities. Invest in biocompatible materials research and miniaturization technologies to improve patient outcomes and reduce surgical complexity. Establish strong partnerships with NHS trusts and private healthcare providers to ensure market access and clinical validation.

For Healthcare Providers: Develop specialized centers of excellence for artificial organ and bionic implant procedures to improve patient outcomes and operational efficiency. Invest in staff training and infrastructure to support advanced device implantation and maintenance. Implement comprehensive patient support programs to ensure successful device integration and long-term success.

For Investors: Consider opportunities in emerging categories such as bioengineered organs, neural interfaces, and smart implant technologies. Focus on companies with strong intellectual property portfolios, clinical validation, and clear regulatory pathways. MarkWide Research analysis suggests particular promise in AI-enabled devices and personalized medicine applications.

For Policymakers: Support continued investment in research and development through funding programs and tax incentives. Streamline regulatory processes while maintaining safety standards to accelerate innovation adoption. Develop comprehensive reimbursement policies that ensure patient access to life-changing technologies.

For Patients and Advocacy Groups: Engage actively in technology development processes to ensure patient needs and preferences are incorporated into device design. Support policy initiatives that improve access and coverage for artificial organs and bionic implants. Participate in clinical trials and research studies to advance technology development.

For Research Institutions: Focus on interdisciplinary collaboration combining engineering, medicine, and computer science expertise. Develop strong industry partnerships to accelerate technology transfer and commercialization. Pursue breakthrough research in areas such as bioengineered organs and neural interface technologies.

Future market prospects for the UK artificial organs and bionic implants market indicate continued robust growth driven by technological advancement, demographic trends, and evolving healthcare needs over the next decade.

Technology evolution will continue to drive market expansion through breakthrough innovations in AI, materials science, and bioengineering. Next-generation devices will offer improved functionality, biocompatibility, and integration with human biological systems. Growth projections suggest the market will expand at 12-15% annually over the next five years.

Demographic drivers will create sustained demand as the UK’s aging population requires increasing numbers of organ replacements and functional restoration devices. The prevalence of chronic diseases requiring artificial organ support is expected to continue rising, supporting long-term market growth.

Emerging applications in enhancement and augmentation will expand market opportunities beyond traditional medical necessity. Elective procedures for performance improvement and capability enhancement could create new market segments and revenue streams.

Regulatory environment evolution will likely support faster innovation adoption through streamlined approval processes and adaptive regulatory frameworks. Post-market surveillance and real-world evidence collection will become increasingly important for ongoing device approval and optimization.

Healthcare integration will deepen as artificial organs and bionic implants become standard treatment options supported by comprehensive care pathways, patient support programs, and outcome measurement systems.

International expansion opportunities will grow as UK companies leverage domestic market success to enter global markets with advanced technologies and proven clinical outcomes. Export potential could significantly contribute to market growth and economic impact.

Research and development will continue to accelerate through increased investment, international collaboration, and breakthrough discoveries in related fields such as regenerative medicine, nanotechnology, and quantum computing applications.

The UK artificial organs and bionic implants market represents a dynamic and rapidly evolving sector that combines cutting-edge technology with life-changing medical applications. Market analysis reveals strong growth momentum driven by demographic trends, technological advancement, and increasing healthcare needs across multiple patient populations.

Key market drivers including an aging population, rising chronic disease prevalence, and breakthrough innovations in AI and materials science create sustained demand for artificial organs and bionic implants. The market benefits from strong research capabilities, comprehensive healthcare infrastructure, and supportive regulatory environment that facilitate innovation and adoption.

Technological trends toward AI integration, wireless connectivity, and personalized medicine are transforming device capabilities and patient experiences. These advances enable more effective treatments, improved outcomes, and enhanced quality of life for patients requiring artificial organ support or functional restoration.

Market opportunities span multiple segments from life-sustaining artificial organs to enhancement-focused bionic implants. Emerging applications in pediatric care, regenerative medicine integration, and elective enhancement procedures create additional growth potential beyond traditional medical applications.

Competitive landscape features established medical device manufacturers alongside innovative startups and research institutions, creating a dynamic environment that drives continuous innovation and improvement. Strategic partnerships and collaborative approaches are essential for success in this complex and rapidly evolving market.

What is Artificial Organs & Bionic Implants?

Artificial organs and bionic implants are medical devices designed to replace or enhance biological functions in the human body. They include products like artificial hearts, bionic limbs, and retinal implants, which aim to improve the quality of life for patients with organ failure or disabilities.

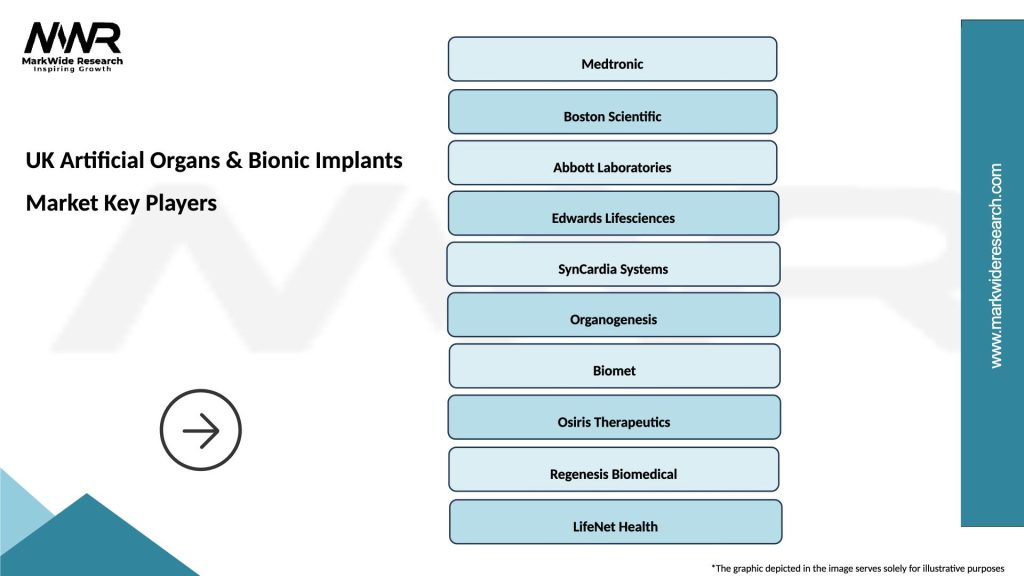

What are the key players in the UK Artificial Organs & Bionic Implants Market?

Key players in the UK Artificial Organs & Bionic Implants Market include companies such as Medtronic, Abbott Laboratories, and Boston Scientific, which are known for their innovative medical devices and technologies. These companies focus on developing advanced solutions for organ replacement and enhancement, among others.

What are the growth factors driving the UK Artificial Organs & Bionic Implants Market?

The UK Artificial Organs & Bionic Implants Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in medical technology, and a growing aging population. These elements contribute to a higher demand for effective treatment options and improved patient outcomes.

What challenges does the UK Artificial Organs & Bionic Implants Market face?

Challenges in the UK Artificial Organs & Bionic Implants Market include high development costs, regulatory hurdles, and the need for extensive clinical trials. Additionally, patient acceptance and the risk of complications can hinder market growth.

What opportunities exist in the UK Artificial Organs & Bionic Implants Market?

Opportunities in the UK Artificial Organs & Bionic Implants Market include the potential for technological innovations, such as bioengineered organs and smart implants. There is also a growing interest in personalized medicine, which could lead to tailored solutions for patients.

What trends are shaping the UK Artificial Organs & Bionic Implants Market?

Trends in the UK Artificial Organs & Bionic Implants Market include the integration of artificial intelligence in device design and the development of minimally invasive surgical techniques. These trends aim to enhance the functionality and safety of implants, improving patient experiences.

UK Artificial Organs & Bionic Implants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Heart Valves, Pacemakers, Prosthetic Limbs, Cochlear Implants |

| Technology | Biomaterials, 3D Printing, Robotics, Nanotechnology |

| End User | Hospitals, Rehabilitation Centers, Research Institutions, Home Care |

| Application | Cardiology, Orthopedics, Neurology, Urology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Artificial Organs & Bionic Implants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at