444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK anti-caking market represents a vital segment within the broader food additives and industrial chemicals industry, experiencing robust growth driven by increasing demand across multiple sectors. Anti-caking agents serve as essential additives that prevent the formation of lumps and clumps in powdered and granulated materials, ensuring optimal flowability and product quality. The market encompasses various chemical compounds including silicon dioxide, calcium phosphate, magnesium carbonate, and sodium aluminosilicate, each serving specific applications across food processing, pharmaceuticals, cosmetics, and industrial manufacturing.

Market dynamics indicate strong expansion potential, with the sector projected to grow at a 6.2% CAGR over the forecast period. This growth trajectory reflects increasing consumer awareness regarding food quality, rising demand for processed foods, and expanding applications in non-food industries. The UK market benefits from its strategic position as a major food processing hub in Europe, coupled with stringent quality standards that drive demand for high-performance anti-caking solutions.

Regional distribution shows concentrated activity in England’s industrial corridors, with approximately 68% market share attributed to food and beverage applications. Scotland and Wales contribute significantly to pharmaceutical and industrial applications, while Northern Ireland focuses primarily on agricultural and feed additive segments. The market landscape reflects the UK’s diverse industrial base and sophisticated supply chain infrastructure.

The UK anti-caking market refers to the commercial ecosystem encompassing the production, distribution, and consumption of chemical additives designed to prevent agglomeration and maintain free-flowing properties in powdered and granulated materials across various industries within the United Kingdom.

Anti-caking agents function through multiple mechanisms including moisture absorption, surface coating, and crystal modification to maintain product integrity and usability. These compounds are classified as food additives under European regulations, with specific E-numbers assigned for food-grade applications. The market includes both synthetic and natural anti-caking solutions, catering to diverse consumer preferences and regulatory requirements.

Industrial applications extend beyond food processing to include pharmaceuticals, cosmetics, detergents, fertilizers, and construction materials. Each sector demands specific performance characteristics, driving innovation in formulation chemistry and application technology. The market serves as a critical enabler for various downstream industries, ensuring product quality and operational efficiency throughout supply chains.

Market performance demonstrates consistent growth momentum, supported by expanding food processing activities and increasing industrial applications. The UK market benefits from established manufacturing capabilities, robust regulatory frameworks, and strong export potential to European and global markets. Key growth drivers include rising demand for convenience foods, pharmaceutical industry expansion, and increasing adoption of specialty chemicals in industrial processes.

Competitive dynamics feature a mix of multinational corporations and specialized chemical manufacturers, creating a balanced market structure. Leading players focus on product innovation, regulatory compliance, and sustainable manufacturing practices to maintain market position. The sector demonstrates 72% adoption rate of advanced manufacturing technologies, enhancing production efficiency and product quality.

Future prospects remain positive, driven by emerging applications in nutraceuticals, organic food products, and advanced materials. Market participants are investing in research and development to create next-generation anti-caking solutions that meet evolving consumer demands and regulatory requirements. The integration of digital technologies and sustainable practices positions the market for continued expansion.

Strategic insights reveal several critical factors shaping market development and competitive positioning within the UK anti-caking sector:

Primary growth drivers propelling the UK anti-caking market include expanding food processing industry, increasing consumer demand for convenience foods, and rising pharmaceutical manufacturing activities. The food sector represents the largest application segment, with processed foods requiring anti-caking agents to maintain quality during storage and distribution. Consumer preferences for ready-to-eat meals, instant beverages, and packaged snacks drive consistent demand for effective anti-caking solutions.

Industrial expansion across multiple sectors creates additional demand drivers. The pharmaceutical industry requires high-purity anti-caking agents for tablet manufacturing and powder formulations. Cosmetics and personal care products utilize these additives to maintain product texture and application properties. The construction industry employs anti-caking agents in cement and concrete additives to improve workability and performance.

Regulatory support through clear guidelines and approval processes encourages market development. The UK’s alignment with international food safety standards facilitates trade and market access. Additionally, increasing awareness of product quality and shelf-life extension drives adoption across various applications. Technological advancements in manufacturing processes enable production of more effective and cost-efficient anti-caking solutions, supporting market expansion.

Key constraints affecting market growth include stringent regulatory requirements, raw material price volatility, and increasing consumer preference for additive-free products. Regulatory compliance demands significant investment in testing, documentation, and quality assurance systems, potentially limiting market entry for smaller players. The approval process for new anti-caking agents can be lengthy and expensive, delaying product launches and market expansion.

Raw material challenges impact production costs and supply chain stability. Price fluctuations in key ingredients such as silicon compounds and calcium-based materials affect profit margins and pricing strategies. Supply chain disruptions, particularly for imported raw materials, can create operational challenges and inventory management issues. Environmental concerns regarding certain synthetic anti-caking agents drive demand for alternative solutions, requiring additional research and development investment.

Market saturation in traditional applications limits growth potential, requiring companies to explore new market segments and applications. Competition from alternative technologies and natural solutions creates pricing pressure and margin compression. Additionally, economic uncertainties and changing trade relationships post-Brexit may impact import/export dynamics and market accessibility for international players.

Emerging opportunities within the UK anti-caking market span multiple dimensions, offering significant growth potential for innovative companies and strategic investors. The organic and natural food segment presents substantial opportunities, with 43% growth rate in demand for natural anti-caking solutions. Consumers increasingly seek clean-label products, driving development of plant-based and mineral-derived alternatives to synthetic additives.

Pharmaceutical expansion creates lucrative opportunities as the UK strengthens its position as a global pharmaceutical manufacturing hub. Advanced drug delivery systems, nutraceuticals, and personalized medicine applications require specialized anti-caking solutions with precise performance characteristics. The aging population and increasing healthcare awareness support long-term growth in pharmaceutical applications.

Export markets offer significant expansion potential, particularly in developing regions with growing food processing industries. The UK’s reputation for quality and regulatory compliance provides competitive advantages in international markets. Technology partnerships with equipment manufacturers and food processors can create integrated solutions and value-added services, enhancing market position and customer relationships.

Market dynamics reflect complex interactions between supply-side factors, demand patterns, and competitive forces shaping the UK anti-caking sector. Supply chain optimization initiatives have improved efficiency by 28% across major manufacturers, reducing costs and enhancing market competitiveness. Vertical integration strategies enable better quality control and cost management, while strategic partnerships facilitate market access and technology sharing.

Demand patterns show increasing sophistication, with customers seeking customized solutions for specific applications. Food processors require anti-caking agents that maintain functionality under various storage conditions while meeting clean-label requirements. Industrial users demand consistent performance and technical support to optimize their manufacturing processes. This evolution drives product innovation and service enhancement across the market.

Competitive forces include price competition, product differentiation, and service quality. Companies invest in research and development to create unique formulations and application methods. Digital transformation initiatives improve customer engagement and operational efficiency. MarkWide Research analysis indicates that companies adopting integrated digital strategies achieve 15% higher customer retention rates compared to traditional approaches.

Comprehensive research methodology employed for analyzing the UK anti-caking market combines primary and secondary research approaches to ensure accuracy and reliability of market insights. Primary research includes structured interviews with industry executives, technical experts, and key stakeholders across the value chain. Survey methodologies capture quantitative data on market trends, consumption patterns, and growth projections from representative samples of market participants.

Secondary research encompasses analysis of industry reports, regulatory filings, patent databases, and trade publications to gather comprehensive market intelligence. Financial analysis of public companies provides insights into market performance, investment trends, and competitive positioning. Regulatory database analysis ensures understanding of compliance requirements and their impact on market dynamics.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure accuracy and consistency. Market modeling techniques incorporate historical trends, current market conditions, and future projections to develop reliable forecasts. The methodology ensures comprehensive coverage of market segments, applications, and geographic regions within the UK market scope.

England dominates the UK anti-caking market with approximately 75% market share, driven by concentrated food processing activities in the Midlands and North regions. Major manufacturing centers in Manchester, Birmingham, and Leeds host significant production facilities for both domestic consumption and export markets. The region benefits from excellent transportation infrastructure, skilled workforce, and proximity to major European markets.

Scotland contributes substantially to pharmaceutical and specialty chemical applications, leveraging its strong life sciences sector and research capabilities. Edinburgh and Glasgow serve as key hubs for pharmaceutical manufacturing, while Aberdeen’s chemical industry supports industrial applications. Scottish companies focus on high-value, specialized anti-caking solutions for niche markets.

Wales and Northern Ireland represent emerging growth regions with increasing industrial activity and food processing investments. Wales benefits from government incentives for manufacturing development, while Northern Ireland’s agricultural sector drives demand for feed additive applications. Both regions show 12% annual growth in anti-caking agent consumption, reflecting expanding industrial bases and strategic development initiatives.

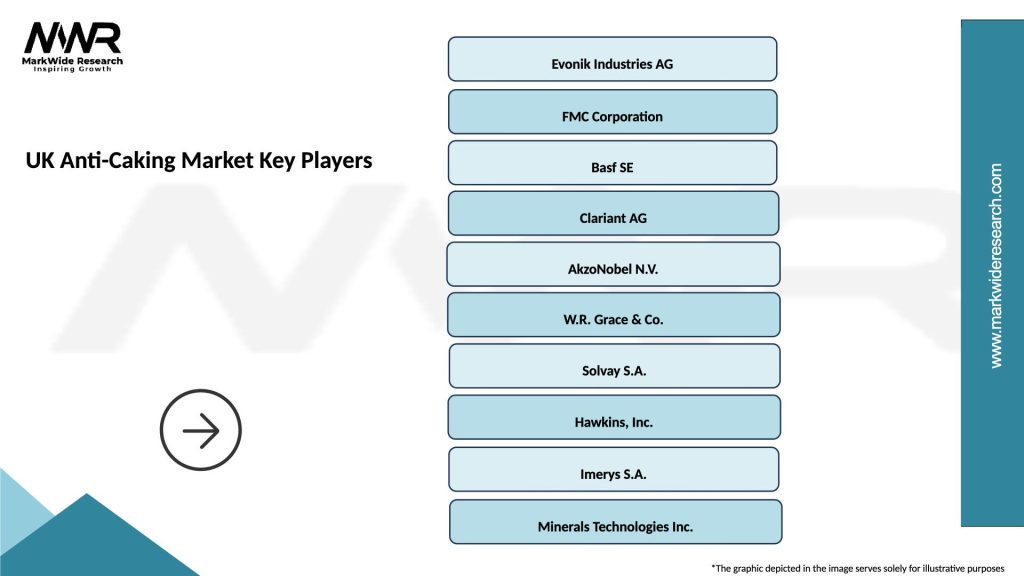

Market leadership is distributed among several key players, each bringing unique strengths and market positioning strategies to the UK anti-caking sector:

Competitive strategies emphasize product innovation, customer service excellence, and sustainable manufacturing practices. Companies invest in research and development to create next-generation formulations while maintaining cost competitiveness and regulatory compliance.

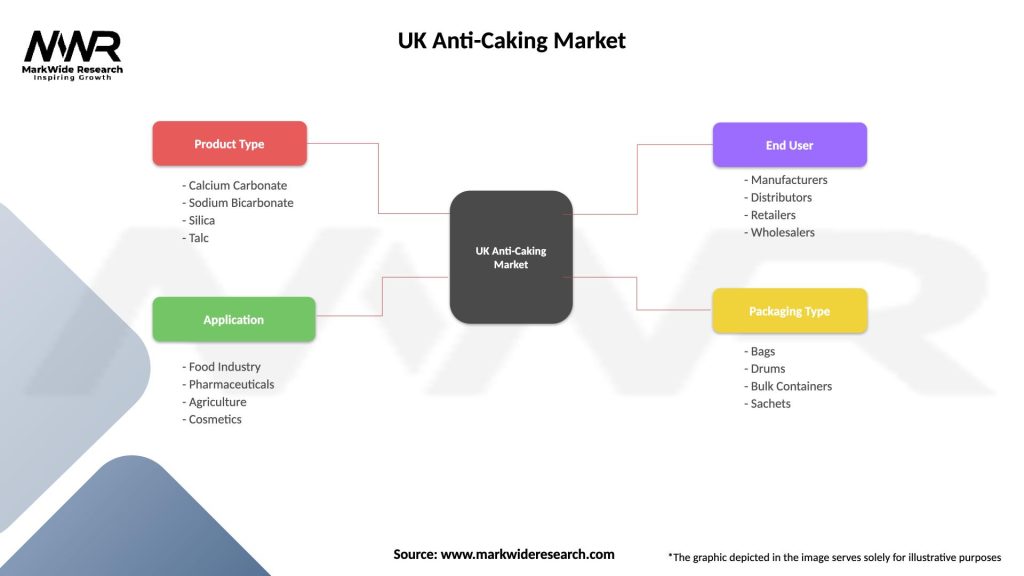

Market segmentation reveals diverse application areas and product categories within the UK anti-caking market, each with distinct characteristics and growth patterns:

By Product Type:

By Application:

Food and beverage applications represent the cornerstone of the UK anti-caking market, driven by extensive processed food manufacturing and evolving consumer preferences. This category demonstrates steady 5.8% annual growth, supported by increasing demand for convenience foods, instant beverages, and specialty food ingredients. Key applications include salt, sugar, spices, powdered beverages, and baking mixes, each requiring specific anti-caking performance characteristics.

Pharmaceutical applications showcase the highest growth potential within the market, reflecting the UK’s position as a major pharmaceutical manufacturing hub. This segment demands ultra-high purity anti-caking agents with comprehensive documentation and regulatory compliance. Applications include tablet manufacturing, powder formulations, and active pharmaceutical ingredient processing. The segment benefits from increasing pharmaceutical exports and domestic healthcare demand.

Industrial applications encompass diverse sectors including construction, agriculture, and chemical manufacturing. Detergent manufacturing represents a significant sub-segment, utilizing anti-caking agents to maintain powder flowability and prevent agglomeration during storage and transportation. Fertilizer applications support the agricultural sector, while construction materials benefit from improved workability and performance characteristics. MWR analysis indicates this category will experience 7.2% growth driven by infrastructure development and industrial expansion.

Manufacturers benefit from the UK anti-caking market through multiple value creation opportunities and competitive advantages. Access to advanced manufacturing technologies and skilled workforce enables production of high-quality products meeting international standards. The regulatory environment provides clear guidelines and approval processes, facilitating product development and market entry. Strategic location advantages support both domestic market service and export opportunities to European and global markets.

End-users gain significant operational benefits through improved product quality, extended shelf life, and enhanced manufacturing efficiency. Anti-caking agents prevent costly production disruptions caused by material handling issues and equipment blockages. Food processors achieve consistent product quality and consumer satisfaction, while pharmaceutical manufacturers ensure precise dosing and formulation integrity. Industrial users benefit from improved process efficiency and reduced maintenance requirements.

Supply chain stakeholders including distributors, logistics providers, and equipment manufacturers benefit from market growth and technological advancement. Distributors expand their product portfolios and service capabilities, while logistics providers develop specialized handling and storage solutions. Equipment manufacturers create integrated solutions combining anti-caking agents with processing equipment, enhancing customer value and market differentiation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean-label movement represents the most significant trend reshaping the UK anti-caking market, with consumers increasingly demanding natural and recognizable ingredients. This trend drives development of plant-based and mineral-derived alternatives to synthetic anti-caking agents. Manufacturers invest in research to create effective natural solutions that maintain performance while meeting clean-label requirements. The trend shows 35% annual growth in demand for natural anti-caking agents across food applications.

Sustainability initiatives influence product development and manufacturing processes throughout the industry. Companies adopt environmentally friendly production methods, reduce packaging waste, and develop biodegradable formulations. Life cycle assessment becomes standard practice for evaluating environmental impact and guiding product development decisions. Circular economy principles drive innovation in raw material sourcing and waste reduction strategies.

Digital transformation accelerates across the industry, with companies implementing advanced analytics, IoT sensors, and automated systems to optimize production and customer service. Digital platforms enable real-time monitoring of product performance and customer satisfaction. E-commerce channels expand market reach and improve customer accessibility. MarkWide Research data indicates that digitally enabled companies achieve 22% higher operational efficiency compared to traditional approaches.

Recent developments within the UK anti-caking market reflect ongoing innovation, strategic partnerships, and market expansion initiatives. Major manufacturers have announced significant investments in production capacity expansion and technology upgrades to meet growing demand. New product launches focus on natural and organic formulations, addressing consumer preferences for clean-label products. Strategic acquisitions and partnerships reshape the competitive landscape and enhance market capabilities.

Regulatory developments include updated guidelines for food additive approval and safety assessment procedures. The UK’s post-Brexit regulatory framework maintains alignment with international standards while providing flexibility for domestic market requirements. New sustainability regulations encourage development of environmentally friendly products and manufacturing processes. Industry associations collaborate with regulatory bodies to ensure smooth implementation of new requirements.

Technology advancements encompass improved manufacturing processes, enhanced product formulations, and innovative application methods. Nanotechnology applications create more effective anti-caking solutions with reduced usage levels. Advanced coating technologies improve product stability and performance characteristics. Digital quality control systems ensure consistent product quality and regulatory compliance throughout production processes.

Strategic recommendations for market participants focus on innovation, diversification, and operational excellence to capitalize on growth opportunities. Companies should invest in research and development to create next-generation anti-caking solutions meeting evolving market demands. Natural and organic product development represents a critical growth area requiring dedicated resources and expertise. Partnerships with food processors and pharmaceutical manufacturers can create integrated solutions and long-term customer relationships.

Market expansion strategies should emphasize export opportunities in developing regions with growing food processing industries. Companies should leverage the UK’s quality reputation and regulatory compliance expertise to access international markets. Digital marketing and e-commerce platforms can expand market reach and improve customer engagement. Strategic acquisitions of complementary technologies or market access capabilities can accelerate growth and competitive positioning.

Operational improvements should focus on supply chain optimization, cost reduction, and sustainability enhancement. Vertical integration strategies can improve cost control and quality assurance while reducing supply chain risks. Automation and digital technologies can enhance production efficiency and product consistency. Sustainability initiatives should encompass environmental impact reduction, circular economy principles, and stakeholder engagement to build long-term market position.

Long-term prospects for the UK anti-caking market remain highly positive, supported by fundamental growth drivers and emerging opportunities across multiple sectors. The market is projected to maintain robust growth momentum, with compound annual growth rates exceeding industry averages through continued innovation and market expansion. Food processing industry growth, pharmaceutical sector development, and industrial diversification provide sustained demand drivers for anti-caking solutions.

Innovation trajectories point toward more sophisticated and specialized products meeting specific application requirements. Nanotechnology applications will enable more effective formulations with reduced environmental impact. Smart packaging integration may incorporate anti-caking functionality directly into packaging materials. Biotechnology advances could create entirely new categories of bio-based anti-caking agents with enhanced performance characteristics.

Market evolution will likely feature increased consolidation among smaller players while maintaining competitive diversity. Digital transformation will become standard practice, enabling more efficient operations and enhanced customer service. Sustainability will transition from differentiator to basic requirement, driving continuous improvement in environmental performance. International expansion will accelerate as UK companies leverage their expertise and quality reputation in global markets, with emerging economies representing the highest growth potential.

The UK anti-caking market represents a dynamic and evolving sector with substantial growth potential across multiple application areas and geographic regions. Market fundamentals remain strong, supported by expanding food processing activities, pharmaceutical industry growth, and increasing industrial applications. The sector benefits from established manufacturing capabilities, comprehensive regulatory frameworks, and strategic positioning for international market access.

Key success factors include innovation in natural and sustainable products, operational excellence in manufacturing and supply chain management, and strategic market expansion initiatives. Companies that effectively balance traditional market service with emerging opportunity development will achieve sustainable competitive advantages. The integration of digital technologies, sustainability practices, and customer-centric approaches will define market leadership in the coming years.

Future market development will be characterized by continued growth, technological advancement, and international expansion. The UK’s reputation for quality and regulatory compliance provides a strong foundation for global market participation. As consumer preferences evolve toward natural and sustainable products, the market will adapt through innovation and strategic positioning, ensuring continued relevance and growth potential in the global anti-caking industry.

What is Anti-Caking?

Anti-caking refers to the process and substances used to prevent the formation of lumps in powdered materials. This is crucial in various industries, including food, pharmaceuticals, and chemicals, where consistent texture and flowability are essential.

What are the key players in the UK Anti-Caking Market?

Key players in the UK Anti-Caking Market include Evonik Industries, BASF, and Clariant, which provide a range of anti-caking agents for different applications. These companies focus on innovation and quality to meet the diverse needs of their customers, among others.

What are the growth factors driving the UK Anti-Caking Market?

The growth of the UK Anti-Caking Market is driven by the increasing demand for processed food products and the need for improved shelf life. Additionally, the rise in the pharmaceutical sector and the use of anti-caking agents in various industrial applications contribute to market expansion.

What challenges does the UK Anti-Caking Market face?

The UK Anti-Caking Market faces challenges such as stringent regulations regarding food safety and the potential for adverse health effects from certain anti-caking agents. Additionally, fluctuating raw material prices can impact production costs and market stability.

What opportunities exist in the UK Anti-Caking Market?

Opportunities in the UK Anti-Caking Market include the development of natural and organic anti-caking agents in response to consumer demand for clean label products. Furthermore, advancements in technology can lead to more effective formulations and applications across various industries.

What trends are shaping the UK Anti-Caking Market?

Trends in the UK Anti-Caking Market include a growing preference for sustainable and eco-friendly anti-caking solutions. Additionally, innovations in product formulations and the increasing use of anti-caking agents in non-food applications are also notable trends.

UK Anti-Caking Market

| Segmentation Details | Description |

|---|---|

| Product Type | Calcium Carbonate, Sodium Bicarbonate, Silica, Talc |

| Application | Food Industry, Pharmaceuticals, Agriculture, Cosmetics |

| End User | Manufacturers, Distributors, Retailers, Wholesalers |

| Packaging Type | Bags, Drums, Bulk Containers, Sachets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Anti-Caking Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at