444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK anesthesia equipment market represents a critical segment of the nation’s healthcare infrastructure, encompassing sophisticated medical devices essential for surgical procedures and patient care. This dynamic market includes anesthesia machines, ventilators, monitors, and accessories that ensure patient safety during medical interventions. Market dynamics indicate robust growth driven by technological advancement, increasing surgical volumes, and enhanced patient safety requirements across NHS trusts and private healthcare facilities.

Healthcare modernization initiatives throughout the United Kingdom have significantly influenced market expansion, with hospitals investing in advanced anesthesia systems featuring integrated monitoring capabilities and improved safety protocols. The market demonstrates strong growth momentum at approximately 6.2% CAGR, reflecting increasing demand for sophisticated medical equipment and technological innovation in perioperative care.

Regional distribution shows concentrated demand in major metropolitan areas, with London, Manchester, Birmingham, and Edinburgh leading adoption rates. The market benefits from substantial NHS investment in medical equipment modernization and private sector expansion, creating opportunities for both established manufacturers and innovative technology providers.

The UK anesthesia equipment market refers to the comprehensive ecosystem of medical devices, systems, and accessories used to administer anesthesia and monitor patient vital signs during surgical procedures and medical interventions across British healthcare facilities. This market encompasses anesthesia delivery systems, patient monitoring equipment, airway management devices, and supporting accessories essential for safe perioperative care.

Market scope includes various equipment categories ranging from basic anesthesia machines to sophisticated integrated systems featuring advanced ventilation modes, comprehensive monitoring capabilities, and electronic medical record integration. The definition extends to maintenance services, training programs, and technological support systems that ensure optimal equipment performance and patient safety outcomes.

Strategic analysis reveals the UK anesthesia equipment market experiencing significant transformation driven by technological innovation, regulatory compliance requirements, and evolving patient care standards. The market demonstrates resilience despite economic challenges, with healthcare providers prioritizing equipment modernization to enhance surgical outcomes and operational efficiency.

Key market drivers include increasing surgical procedure volumes, aging population demographics, and mandatory safety standard compliance. Technology adoption rates show 78% of NHS trusts planning equipment upgrades within the next three years, indicating substantial market potential for advanced anesthesia systems and monitoring solutions.

Competitive landscape features established international manufacturers alongside emerging technology companies, creating dynamic market conditions with continuous innovation and competitive pricing strategies. Market segmentation reveals strong demand across hospital categories, from large teaching hospitals to specialized surgical centers and ambulatory care facilities.

Market intelligence indicates several critical trends shaping the UK anesthesia equipment landscape:

Primary growth drivers propelling the UK anesthesia equipment market include demographic shifts, technological advancement, and healthcare policy initiatives. The aging population requires increased surgical interventions, with surgical procedure volumes growing at approximately 4.3% annually across NHS facilities and private healthcare providers.

Technological innovation serves as a fundamental market driver, with healthcare providers seeking advanced anesthesia systems offering improved patient monitoring, enhanced safety features, and integrated clinical decision support. Modern equipment provides real-time data analytics, predictive maintenance capabilities, and seamless integration with hospital information systems.

Regulatory requirements mandate equipment upgrades to meet evolving safety standards and clinical guidelines. NHS trusts must comply with stringent quality assurance protocols, driving demand for certified anesthesia equipment meeting international safety standards and regulatory compliance requirements.

Quality improvement initiatives across the healthcare system emphasize patient safety and clinical outcomes, encouraging investment in advanced anesthesia equipment with enhanced monitoring capabilities and safety protocols. These initiatives support market growth through increased equipment procurement and modernization programs.

Budget constraints represent significant market challenges, particularly within NHS trusts facing funding pressures and competing capital investment priorities. Healthcare providers must balance equipment modernization needs with limited financial resources, potentially delaying procurement decisions and market growth.

Training requirements for advanced anesthesia equipment create implementation barriers, requiring comprehensive staff education programs and operational adjustments. Healthcare facilities must invest in training initiatives to ensure proper equipment utilization and maintain patient safety standards.

Maintenance complexity of sophisticated anesthesia systems increases operational costs and requires specialized technical support. Healthcare providers face challenges managing equipment lifecycle costs, including preventive maintenance, repairs, and software updates necessary for optimal system performance.

Regulatory compliance requirements create market entry barriers for new manufacturers and increase development costs for existing suppliers. Stringent certification processes and ongoing compliance obligations may limit market competition and innovation pace.

Digital transformation initiatives across UK healthcare present substantial opportunities for anesthesia equipment manufacturers to develop integrated solutions featuring advanced connectivity, data analytics, and artificial intelligence capabilities. Healthcare providers seek systems enabling predictive maintenance, clinical decision support, and operational efficiency improvements.

Private healthcare expansion creates new market segments with different procurement patterns and technology adoption rates. Private hospitals and surgical centers often demonstrate faster equipment modernization cycles, providing opportunities for premium anesthesia systems and advanced monitoring solutions.

Ambulatory surgery growth represents an emerging market opportunity, with increasing procedures performed in outpatient settings requiring portable, efficient anesthesia equipment. This trend creates demand for compact, user-friendly systems suitable for diverse clinical environments.

Sustainability initiatives offer opportunities for manufacturers developing environmentally conscious anesthesia equipment with reduced environmental impact. Healthcare providers increasingly prioritize sustainable procurement practices, creating market demand for eco-friendly medical devices and systems.

Market dynamics reflect complex interactions between technological advancement, regulatory requirements, and healthcare delivery evolution. The UK anesthesia equipment market demonstrates resilience through economic uncertainties while adapting to changing clinical needs and patient safety expectations.

Supply chain considerations influence market dynamics, with manufacturers addressing component availability, logistics challenges, and service delivery requirements. Brexit implications continue affecting equipment procurement processes, regulatory compliance, and international supplier relationships.

Innovation cycles drive market evolution, with manufacturers investing in research and development to create next-generation anesthesia systems. Technology advancement rates show equipment replacement cycles averaging 8-12 years for major anesthesia systems, indicating predictable market demand patterns.

Competitive pressures encourage continuous improvement in product offerings, pricing strategies, and customer service capabilities. Market dynamics favor suppliers providing comprehensive solutions including equipment, training, maintenance, and technical support services.

Comprehensive market analysis employs multiple research methodologies to ensure accurate market assessment and reliable insights. Primary research includes structured interviews with healthcare professionals, procurement specialists, and clinical engineers across NHS trusts and private healthcare facilities throughout the United Kingdom.

Secondary research incorporates analysis of government healthcare statistics, NHS procurement data, regulatory publications, and industry reports from credible sources. This approach provides comprehensive market understanding and validates primary research findings through triangulation of multiple data sources.

Market segmentation analysis utilizes statistical modeling and trend analysis to identify growth patterns, regional variations, and technology adoption rates. Research methodology includes assessment of competitive landscape, pricing analysis, and technology trend evaluation to provide strategic market insights.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert consultation, and statistical verification. The methodology incorporates both quantitative analysis and qualitative insights to provide comprehensive market understanding and actionable intelligence.

London and Southeast England dominate the UK anesthesia equipment market, accounting for approximately 35% market share due to high concentration of major hospitals, teaching institutions, and private healthcare facilities. This region demonstrates strong demand for advanced anesthesia systems and premium monitoring equipment.

Northern England represents a significant market segment with major NHS trusts in Manchester, Liverpool, and Leeds driving equipment procurement. The region shows steady growth patterns with increasing investment in healthcare infrastructure and equipment modernization programs.

Scotland and Wales demonstrate unique market characteristics with centralized procurement processes and specific regulatory requirements. These regions show growing adoption rates for integrated anesthesia systems and telemedicine-enabled monitoring solutions, particularly in rural healthcare facilities.

Midlands region exhibits strong market potential with major hospital systems in Birmingham, Nottingham, and Coventry. The area benefits from healthcare investment initiatives and demonstrates increasing demand for advanced anesthesia equipment and training services.

Market leadership features established international manufacturers with strong UK presence and comprehensive product portfolios. The competitive landscape demonstrates dynamic conditions with continuous innovation, strategic partnerships, and customer service differentiation.

Competitive strategies emphasize technology innovation, customer service excellence, and comprehensive support services. Market leaders invest in research and development, strategic partnerships, and training programs to maintain competitive advantages and market position.

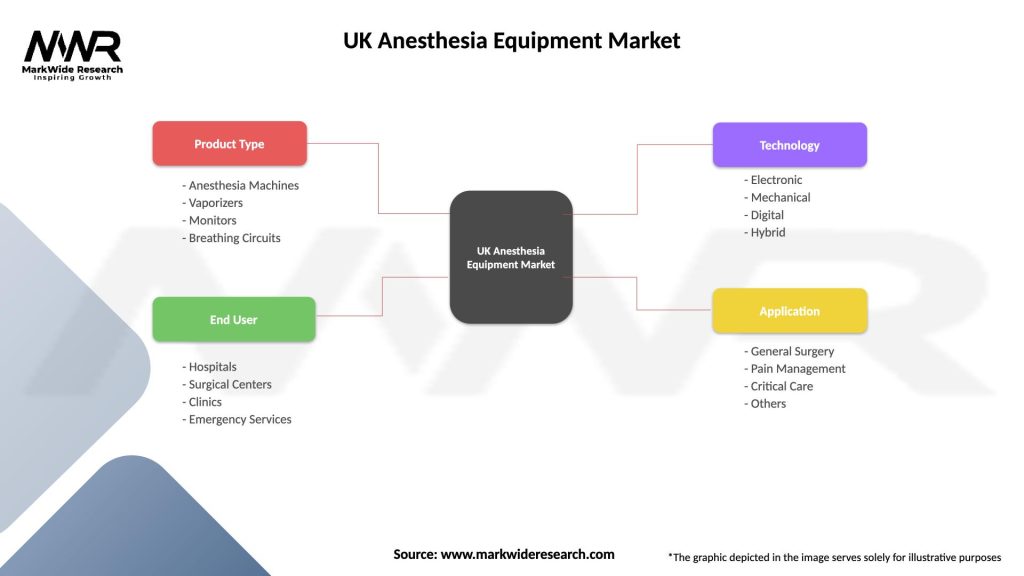

By Product Type:

By End User:

By Technology:

Anesthesia machines represent the largest market segment, with healthcare providers prioritizing integrated systems offering advanced ventilation modes, comprehensive monitoring, and electronic medical record connectivity. Modern machines feature touchscreen interfaces, automated safety checks, and predictive maintenance capabilities.

Patient monitoring systems demonstrate strong growth driven by enhanced safety requirements and clinical decision support needs. Advanced monitors provide real-time data analytics, trend analysis, and alarm management systems improving patient outcomes and clinical workflow efficiency.

Airway management devices show increasing sophistication with video laryngoscopes, advanced supraglottic airways, and difficult airway management tools. This category benefits from clinical training programs and evidence-based practice guidelines promoting optimal patient care.

Accessories and consumables provide recurring revenue opportunities with regular replacement requirements and clinical protocol compliance. This segment includes breathing circuits, filters, masks, and monitoring sensors essential for anesthesia delivery and patient safety.

Healthcare providers benefit from advanced anesthesia equipment through improved patient safety, enhanced clinical outcomes, and operational efficiency gains. Modern systems reduce manual processes, provide comprehensive monitoring, and support evidence-based clinical decision making.

Clinical staff experience workflow improvements through intuitive equipment interfaces, automated safety features, and integrated documentation systems. Advanced anesthesia equipment reduces cognitive workload and enhances focus on patient care and clinical expertise.

Patients receive enhanced safety benefits through sophisticated monitoring systems, predictive analytics, and evidence-based anesthesia protocols. Modern equipment provides precise drug delivery, comprehensive vital sign monitoring, and improved perioperative care quality.

Healthcare administrators achieve operational benefits through equipment lifecycle management, predictive maintenance capabilities, and total cost of ownership optimization. Advanced systems provide data analytics supporting quality improvement initiatives and regulatory compliance requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a transformative trend, with anesthesia equipment incorporating machine learning algorithms for predictive analytics, clinical decision support, and automated safety monitoring. This technology advancement enhances patient care quality and reduces human error potential.

Connectivity and interoperability represent critical trends driving equipment selection decisions. Healthcare providers prioritize systems offering seamless integration with hospital information systems, electronic health records, and clinical workflow management platforms.

Sustainability initiatives influence procurement decisions, with healthcare facilities seeking anesthesia equipment featuring reduced environmental impact, energy efficiency, and sustainable manufacturing practices. This trend aligns with NHS environmental responsibility commitments and carbon reduction goals.

Personalized anesthesia delivery gains prominence through advanced monitoring systems providing patient-specific dosing recommendations, physiological response prediction, and individualized care protocols. This approach improves clinical outcomes and reduces adverse events.

Technology partnerships between equipment manufacturers and software developers create innovative solutions combining hardware excellence with advanced analytics capabilities. These collaborations produce integrated systems offering comprehensive patient monitoring and clinical decision support.

Regulatory updates from MHRA and international standards organizations influence equipment design requirements, safety protocols, and compliance obligations. Recent developments emphasize cybersecurity, data protection, and interoperability standards for connected medical devices.

Training program expansion addresses growing complexity of modern anesthesia equipment through comprehensive education initiatives, simulation-based learning, and competency assessment programs. Healthcare providers invest in staff development to maximize equipment utilization and patient safety.

Service model evolution includes predictive maintenance, remote monitoring, and outcome-based contracts providing comprehensive equipment lifecycle management. These developments reduce operational costs and ensure optimal system performance throughout equipment lifespan.

MarkWide Research analysis indicates healthcare providers should prioritize integrated anesthesia systems offering comprehensive monitoring, data analytics, and workflow optimization capabilities. Investment in advanced equipment provides long-term value through improved patient outcomes and operational efficiency.

Strategic procurement recommendations emphasize total cost of ownership evaluation, including equipment purchase price, maintenance costs, training requirements, and operational benefits. Healthcare facilities should consider lifecycle costs and value propositions when making equipment selection decisions.

Technology adoption strategies should include comprehensive staff training programs, change management initiatives, and ongoing competency development. Successful implementation requires organizational commitment to education and continuous improvement processes.

Partnership development with equipment manufacturers should focus on comprehensive service agreements, training support, and technology upgrade pathways. Strong vendor relationships ensure optimal equipment performance and access to latest technological innovations.

Market projections indicate continued growth driven by technological advancement, demographic trends, and healthcare modernization initiatives. The UK anesthesia equipment market demonstrates resilience and adaptation capability, positioning for sustained expansion over the forecast period.

Technology evolution will emphasize artificial intelligence, machine learning, and predictive analytics integration into anesthesia systems. Future equipment will provide enhanced clinical decision support, automated safety monitoring, and personalized patient care capabilities with efficiency improvements reaching 25-30% in clinical workflows.

MWR analysis suggests increasing market consolidation among equipment manufacturers, creating opportunities for comprehensive solution providers offering integrated systems, services, and support capabilities. This trend will benefit healthcare providers through simplified procurement processes and enhanced vendor relationships.

Regulatory landscape evolution will continue emphasizing patient safety, cybersecurity, and interoperability requirements. Future compliance standards will drive equipment innovation and create market opportunities for manufacturers meeting advanced regulatory expectations.

The UK anesthesia equipment market represents a dynamic and essential component of the nation’s healthcare infrastructure, demonstrating robust growth potential despite economic challenges and budget constraints. Market evolution reflects technological advancement, regulatory compliance requirements, and changing clinical needs driving continuous innovation and improvement.

Strategic opportunities exist for healthcare providers, equipment manufacturers, and service providers willing to invest in advanced technology, comprehensive training, and patient safety initiatives. The market rewards innovation, quality, and customer service excellence while demanding compliance with stringent regulatory standards and clinical requirements.

Future success in the UK anesthesia equipment market will depend on adaptability, technology integration, and commitment to patient safety and clinical excellence. Organizations embracing digital transformation, sustainability initiatives, and comprehensive service models will achieve competitive advantages and market leadership positions in this evolving healthcare landscape.

What is Anesthesia Equipment?

Anesthesia equipment refers to the devices and tools used to administer anesthesia to patients during surgical procedures. This includes machines for delivering gases, monitoring systems, and various accessories that ensure patient safety and comfort.

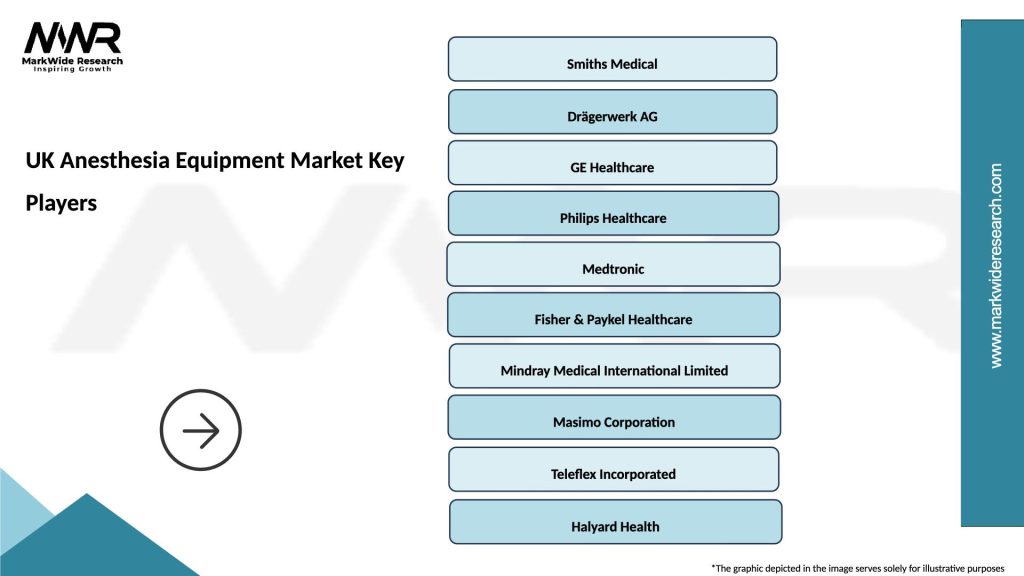

What are the key players in the UK Anesthesia Equipment Market?

Key players in the UK Anesthesia Equipment Market include companies like Drägerwerk AG, GE Healthcare, and Philips Healthcare, which provide a range of anesthesia machines and monitoring systems, among others.

What are the growth factors driving the UK Anesthesia Equipment Market?

The UK Anesthesia Equipment Market is driven by factors such as the increasing number of surgical procedures, advancements in anesthesia technology, and a growing emphasis on patient safety and monitoring.

What challenges does the UK Anesthesia Equipment Market face?

Challenges in the UK Anesthesia Equipment Market include high costs of advanced equipment, regulatory compliance issues, and the need for continuous training of healthcare professionals to operate complex devices.

What opportunities exist in the UK Anesthesia Equipment Market?

Opportunities in the UK Anesthesia Equipment Market include the development of innovative anesthesia delivery systems, the integration of artificial intelligence for better monitoring, and the expansion of telemedicine in anesthesia practices.

What trends are shaping the UK Anesthesia Equipment Market?

Trends in the UK Anesthesia Equipment Market include the increasing adoption of portable anesthesia machines, the rise of minimally invasive surgical techniques, and a focus on sustainability in manufacturing practices.

UK Anesthesia Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Anesthesia Machines, Vaporizers, Monitors, Breathing Circuits |

| End User | Hospitals, Surgical Centers, Clinics, Emergency Services |

| Technology | Electronic, Mechanical, Digital, Hybrid |

| Application | General Surgery, Pain Management, Critical Care, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Anesthesia Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at