444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UK adhesives market represents a dynamic and rapidly evolving sector within the broader chemical industry, characterized by substantial growth potential and technological innovation. Industrial adhesives have become increasingly critical across multiple sectors, from automotive manufacturing to construction and packaging applications. The market demonstrates remarkable resilience and adaptability, with manufacturers continuously developing advanced formulations to meet stringent environmental regulations and performance requirements.

Market dynamics indicate robust expansion driven by increasing demand for lightweight materials in automotive applications and growing emphasis on sustainable packaging solutions. The sector benefits from the UK’s strong manufacturing base and strategic position as a gateway to European markets. Structural adhesives particularly show significant adoption rates, with penetration increasing by approximately 12% annually across key industrial segments.

Technology advancement remains a cornerstone of market development, with manufacturers investing heavily in research and development of bio-based adhesives and smart bonding solutions. The integration of nanotechnology and development of reactive hot-melt adhesives represent emerging trends that are reshaping traditional application methods and performance standards.

The UK adhesives market refers to the comprehensive ecosystem of adhesive products, technologies, and services operating within the United Kingdom’s industrial and commercial sectors. This market encompasses various adhesive types including structural adhesives, pressure-sensitive adhesives, hot-melt adhesives, and specialty formulations designed for specific industrial applications.

Adhesive technologies serve as critical bonding solutions across diverse industries, replacing traditional mechanical fastening methods with advanced chemical bonding systems. These products enable manufacturers to achieve superior performance characteristics including enhanced durability, weight reduction, and improved aesthetic appeal in finished products.

Market participants include raw material suppliers, adhesive manufacturers, distributors, and end-user industries spanning automotive, construction, packaging, electronics, and aerospace sectors. The market structure reflects both global multinational corporations and specialized regional players contributing to innovation and market development.

Strategic analysis reveals the UK adhesives market as a mature yet dynamic sector experiencing steady growth driven by industrial modernization and technological advancement. The market benefits from strong domestic demand and the UK’s position as a manufacturing hub for European operations.

Key growth drivers include increasing adoption of lightweight materials in automotive manufacturing, expansion of e-commerce driving packaging demand, and growing emphasis on sustainable construction practices. The automotive sector alone accounts for approximately 28% of total adhesive consumption, reflecting the industry’s shift toward advanced bonding technologies.

Competitive landscape features a mix of global chemical companies and specialized adhesive manufacturers, with innovation focused on developing environmentally friendly formulations and high-performance bonding solutions. Market consolidation continues as companies seek to expand their technological capabilities and geographic reach.

Future prospects remain positive, supported by ongoing industrial investment, infrastructure development projects, and increasing demand for advanced materials across multiple sectors. The market is expected to maintain steady growth trajectory with particular strength in specialty adhesive segments.

Market intelligence reveals several critical insights shaping the UK adhesives landscape and driving strategic decision-making across the value chain:

Industrial modernization serves as a primary catalyst for adhesive market expansion, with manufacturers increasingly adopting advanced bonding technologies to improve product performance and manufacturing efficiency. The shift toward automation and precision manufacturing processes requires adhesives that can deliver consistent performance under demanding conditions.

Automotive sector transformation represents a significant growth driver, particularly with the transition to electric vehicles requiring specialized thermal management solutions and lightweight construction materials. Structural bonding applications in automotive manufacturing have increased by approximately 15% over recent years, reflecting the industry’s commitment to weight reduction and improved fuel efficiency.

Construction industry growth continues to fuel demand for construction adhesives, sealants, and specialty bonding solutions. The emphasis on energy-efficient buildings and sustainable construction practices is driving adoption of advanced adhesive systems that contribute to improved building performance and environmental compliance.

E-commerce expansion has created substantial demand for packaging adhesives, with online retail growth driving innovation in tamper-evident sealing solutions and sustainable packaging materials. The packaging sector demonstrates consistent growth with adhesive consumption increasing steadily across multiple application areas.

Technological advancement in adhesive chemistry enables development of high-performance solutions for emerging applications including electronics assembly, renewable energy systems, and advanced manufacturing processes. These innovations expand market opportunities and create new revenue streams for industry participants.

Raw material volatility presents ongoing challenges for adhesive manufacturers, with fluctuating prices of petroleum-based feedstocks and specialty chemicals impacting production costs and profit margins. Supply chain disruptions can significantly affect manufacturing operations and customer relationships.

Environmental regulations impose increasing compliance requirements, particularly regarding volatile organic compound emissions and chemical safety standards. While driving innovation, these regulations also increase development costs and may limit certain application areas for traditional adhesive formulations.

Technical complexity in adhesive selection and application requires specialized knowledge and training, potentially limiting adoption in smaller manufacturing operations. The need for precise application conditions and curing processes can create barriers to entry for some market segments.

Economic uncertainty affecting key end-user industries can impact adhesive demand, particularly in cyclical sectors such as automotive and construction. Market participants must navigate varying demand patterns and maintain operational flexibility to address economic fluctuations.

Competition from alternative technologies including mechanical fastening systems and welding techniques continues to challenge adhesive adoption in certain applications. Manufacturers must continuously demonstrate value propositions and performance advantages to maintain market position.

Sustainable adhesives represent a significant growth opportunity, with increasing demand for bio-based formulations and environmentally friendly bonding solutions. The development of renewable raw material sources and biodegradable adhesive systems opens new market segments and aligns with corporate sustainability initiatives.

Advanced manufacturing applications in aerospace, electronics, and renewable energy sectors offer substantial growth potential for high-performance adhesive solutions. These industries require specialized bonding technologies that command premium pricing and provide opportunities for long-term partnerships.

Smart adhesives incorporating responsive properties and sensing capabilities represent an emerging opportunity for value-added products. Applications in structural health monitoring and adaptive bonding systems could create entirely new market categories.

Export market expansion leverages the UK’s technological expertise and manufacturing capabilities to serve international markets, particularly in developing economies where industrial growth is driving adhesive demand. Strategic partnerships and joint ventures can facilitate market entry and expansion.

Digital transformation initiatives enable development of smart application systems, predictive maintenance solutions, and data-driven optimization of adhesive performance. These technological advances create opportunities for service-based business models and enhanced customer relationships.

Supply chain dynamics continue to evolve as manufacturers adapt to changing raw material availability and cost structures. MarkWide Research analysis indicates that companies implementing regional sourcing strategies achieve approximately 12% better supply chain resilience compared to those relying solely on global supply networks.

Innovation cycles in adhesive technology are accelerating, with new product development timelines shortening as manufacturers respond to rapidly changing customer requirements. The integration of artificial intelligence and machine learning in product development processes is enabling faster formulation optimization and performance prediction.

Customer relationship evolution reflects a shift toward collaborative partnerships between adhesive suppliers and end-users, with increased emphasis on co-development projects and application-specific solutions. This trend creates opportunities for differentiation and value creation beyond traditional product supply relationships.

Regulatory landscape changes continue to influence market dynamics, with new environmental standards and safety requirements driving innovation in adhesive chemistry and application methods. Companies that proactively address regulatory requirements often gain competitive advantages through early market entry with compliant solutions.

Market consolidation trends are reshaping competitive dynamics, with strategic acquisitions enabling companies to expand technological capabilities and market reach. This consolidation creates opportunities for specialized players while intensifying competition in core market segments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market intelligence. Primary research activities include extensive interviews with industry executives, technical specialists, and key stakeholders across the adhesive value chain.

Data collection processes incorporate both quantitative and qualitative research approaches, utilizing industry surveys, expert consultations, and detailed analysis of company financial reports and market publications. This multi-faceted approach ensures comprehensive coverage of market dynamics and trends.

Market segmentation analysis examines adhesive categories by technology type, application area, and end-user industry to provide detailed insights into specific market segments. Regional analysis considers local market conditions, regulatory environments, and competitive landscapes affecting market development.

Validation procedures include cross-referencing multiple data sources, conducting follow-up interviews with key respondents, and applying statistical analysis techniques to ensure data accuracy and reliability. Market projections incorporate scenario analysis to account for various potential market conditions.

Industry expertise from technical specialists and market analysts provides context and interpretation for quantitative data, ensuring that research findings reflect actual market conditions and provide actionable insights for strategic decision-making.

England dominates the UK adhesives market, accounting for approximately 72% of total market activity, driven by concentrated manufacturing operations in the Midlands and Southeast regions. Major automotive and aerospace manufacturing facilities create substantial demand for structural and specialty adhesives.

Scotland represents a significant market segment, particularly for marine and offshore applications, with specialized adhesive requirements for harsh environmental conditions. The region’s renewable energy sector, including wind power installations, drives demand for weather-resistant bonding solutions.

Wales contributes meaningfully to market activity through its manufacturing base, particularly in automotive components and construction materials. The region’s focus on sustainable manufacturing practices aligns with growing demand for environmentally friendly adhesive solutions.

Northern Ireland demonstrates steady market growth, supported by cross-border trade relationships and manufacturing operations serving both UK and European markets. The region’s strategic location provides advantages for companies serving multiple geographic markets.

Regional specialization patterns reflect local industrial strengths, with certain areas developing expertise in specific adhesive applications or technologies. This geographic clustering creates centers of excellence and supports knowledge transfer within the industry.

Market leadership is distributed among several global chemical companies and specialized adhesive manufacturers, each bringing distinct technological capabilities and market focus areas:

Competitive strategies emphasize innovation, customer service, and technical support capabilities. Companies invest heavily in research and development to maintain technological leadership and respond to evolving customer requirements.

By Technology:

By Application:

Structural adhesives demonstrate the strongest growth trajectory, with demand increasing by approximately 14% annually driven by automotive lightweighting initiatives and construction industry modernization. These high-performance solutions command premium pricing and offer superior profit margins for manufacturers.

Packaging adhesives represent the largest volume segment, benefiting from e-commerce expansion and sustainable packaging trends. Water-based formulations are gaining market share as companies prioritize environmental compliance and worker safety considerations.

Specialty adhesives for electronics and aerospace applications show consistent growth despite smaller volumes, driven by technological advancement and increasing performance requirements. These segments offer opportunities for differentiation and value-added services.

Construction adhesives benefit from infrastructure investment and building renovation activities, with particular strength in flooring and insulation applications. The segment shows resilience during economic fluctuations due to maintenance and repair demand.

Industrial assembly adhesives serve diverse manufacturing operations, with growth tied to overall industrial production levels and automation trends. These applications often require technical support and custom formulation capabilities.

Manufacturers benefit from adhesive technologies through improved production efficiency, reduced assembly costs, and enhanced product performance characteristics. Automated application systems enable consistent quality and reduced labor requirements while improving workplace safety conditions.

End-users gain significant advantages including weight reduction in finished products, improved aesthetic appeal, and enhanced durability compared to traditional mechanical fastening methods. Adhesive bonding often enables design flexibility and cost optimization in product development.

Supply chain participants benefit from stable demand patterns and opportunities for value-added services including technical support, custom formulation, and application training. Long-term customer relationships provide revenue stability and growth opportunities.

Environmental stakeholders benefit from industry trends toward sustainable adhesive formulations and reduced environmental impact. Bio-based adhesives and solvent-free formulations contribute to improved air quality and reduced carbon footprint.

Economic development benefits include job creation in manufacturing and research activities, export revenue generation, and support for downstream industries. The adhesive sector contributes to overall industrial competitiveness and innovation capacity.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the adhesives market, with companies investing heavily in bio-based raw materials and environmentally friendly formulations. This shift is driven by both regulatory requirements and customer demand for sustainable solutions.

Smart adhesives incorporating sensing capabilities and responsive properties are emerging as a key innovation area, enabling applications in structural health monitoring and adaptive bonding systems. These advanced materials command premium pricing and create new market opportunities.

Automation integration continues to advance, with adhesive application systems becoming increasingly sophisticated and precise. Robotic application systems and real-time quality monitoring improve consistency while reducing labor costs and improving workplace safety.

Customization demand is increasing as customers seek application-specific solutions rather than standard formulations. This trend creates opportunities for specialized suppliers and value-added services while challenging traditional mass-production approaches.

Digital transformation initiatives are enabling predictive maintenance, performance optimization, and data-driven decision making throughout the adhesive value chain. These technological advances improve efficiency and create new service opportunities.

Recent innovations in adhesive technology include development of ultra-fast curing systems, temperature-resistant formulations, and hybrid adhesive-sealant products that combine multiple performance characteristics. These advances expand application possibilities and improve manufacturing efficiency.

Strategic partnerships between adhesive manufacturers and end-user industries are becoming more common, with collaborative development projects focusing on specific application requirements and performance optimization. These relationships create competitive advantages and market differentiation.

Manufacturing investments in UK facilities demonstrate continued confidence in the market, with companies expanding production capacity and implementing advanced manufacturing technologies. These investments support local employment and strengthen supply chain resilience.

Regulatory developments continue to influence product development priorities, with new environmental standards driving innovation in low-emission formulations and sustainable packaging solutions. Proactive compliance strategies provide competitive advantages in regulated markets.

Acquisition activity reflects ongoing market consolidation as companies seek to expand technological capabilities and geographic reach. Strategic acquisitions enable access to new technologies and customer relationships while achieving operational synergies.

Investment priorities should focus on sustainable adhesive technologies and advanced manufacturing capabilities to capitalize on emerging market opportunities. Companies that establish early leadership in bio-based formulations are likely to achieve competitive advantages as environmental regulations intensify.

Market positioning strategies should emphasize technical expertise and customer service capabilities rather than competing solely on price. Value-added services including application support and custom formulation can differentiate suppliers and improve profit margins.

Geographic expansion opportunities exist in emerging markets where industrial growth is driving adhesive demand. MWR analysis suggests that companies with strong technical capabilities can achieve market share gains of 8-12% annually in developing economies through strategic partnerships.

Technology development should prioritize smart adhesives and digital integration capabilities to address evolving customer requirements. Investment in research and development capabilities will be critical for maintaining competitive position in premium market segments.

Supply chain optimization initiatives should focus on regional sourcing strategies and supply security to reduce vulnerability to global disruptions. Companies implementing diversified sourcing approaches demonstrate improved operational resilience and cost stability.

Market prospects remain positive for the UK adhesives sector, supported by ongoing industrial investment, infrastructure development, and technological innovation. The transition to sustainable manufacturing practices creates opportunities for companies developing environmentally friendly adhesive solutions.

Growth projections indicate continued expansion across key application areas, with particular strength expected in automotive, construction, and packaging segments. MarkWide Research forecasts suggest the market will maintain steady growth with specialty adhesives showing the strongest performance trajectory at approximately 16% annual growth.

Technology evolution will continue to drive market development, with smart adhesives and bio-based formulations representing the most promising growth areas. Companies investing in these technologies are positioned to capture emerging opportunities and achieve premium market positioning.

Competitive dynamics will likely intensify as market consolidation continues and new technologies emerge. Success will depend on innovation capabilities, customer relationships, and operational efficiency rather than traditional competitive factors.

Regulatory environment changes will continue to influence market development, with environmental standards becoming increasingly stringent. Companies that proactively address regulatory requirements will gain competitive advantages and market access opportunities.

The UK adhesives market represents a mature yet dynamic sector with substantial growth potential driven by technological innovation and evolving customer requirements. Market participants benefit from strong domestic demand, advanced manufacturing capabilities, and strategic position for serving European markets.

Key success factors include investment in sustainable technologies, development of specialized application expertise, and maintenance of strong customer relationships. Companies that effectively balance innovation with operational efficiency are positioned to achieve sustained competitive advantages.

Future opportunities exist across multiple market segments, with particular promise in sustainable adhesives, smart bonding systems, and advanced manufacturing applications. The market’s diversity provides stability while enabling growth through technological advancement and market expansion.

Strategic priorities should focus on sustainability initiatives, digital transformation, and customer-centric innovation to address evolving market requirements. Companies that successfully navigate these trends while maintaining operational excellence will achieve superior market performance and long-term growth in the UK adhesives market.

What is Adhesives?

Adhesives are substances used to bond materials together, providing strength and durability in various applications. They are widely used in industries such as construction, automotive, and packaging.

What are the key players in the UK Adhesives Market?

Key players in the UK Adhesives Market include companies like Henkel, Bostik, and Sika, which offer a range of adhesive solutions for different applications, including construction and automotive, among others.

What are the growth factors driving the UK Adhesives Market?

The UK Adhesives Market is driven by increasing demand in the construction and automotive sectors, as well as innovations in adhesive technologies that enhance performance and sustainability.

What challenges does the UK Adhesives Market face?

Challenges in the UK Adhesives Market include fluctuating raw material prices and stringent regulations regarding environmental impact, which can affect production and pricing strategies.

What opportunities exist in the UK Adhesives Market?

Opportunities in the UK Adhesives Market include the growing trend towards eco-friendly adhesives and the expansion of applications in industries such as electronics and healthcare, which require specialized bonding solutions.

What trends are shaping the UK Adhesives Market?

Trends in the UK Adhesives Market include the development of smart adhesives that respond to environmental changes and the increasing use of adhesives in sustainable construction practices, reflecting a shift towards greener solutions.

UK Adhesives Market

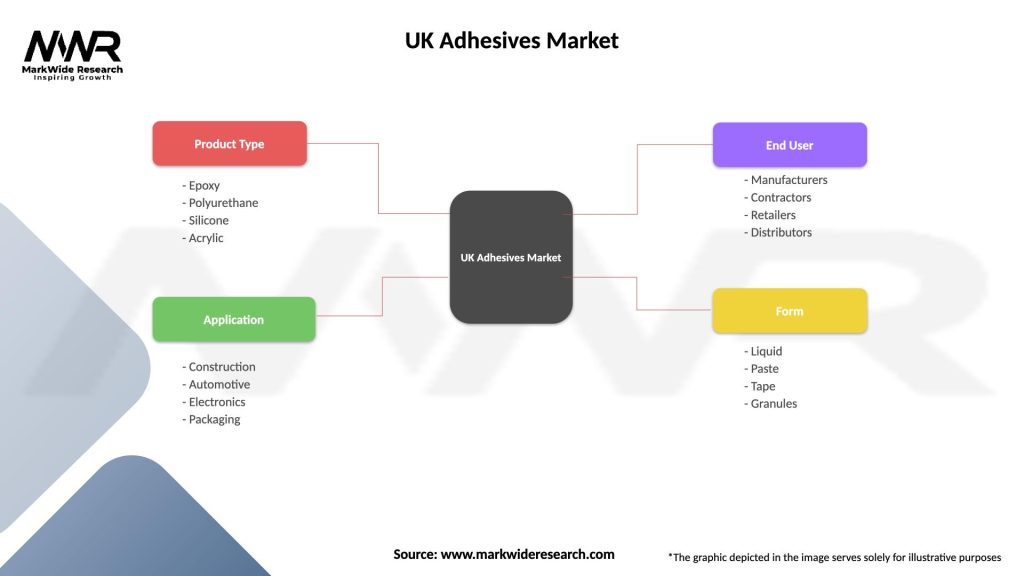

| Segmentation Details | Description |

|---|---|

| Product Type | Epoxy, Polyurethane, Silicone, Acrylic |

| Application | Construction, Automotive, Electronics, Packaging |

| End User | Manufacturers, Contractors, Retailers, Distributors |

| Form | Liquid, Paste, Tape, Granules |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UK Adhesives Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at