444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE used cars industry market represents one of the most dynamic and rapidly evolving automotive sectors in the Middle East region. Market dynamics indicate substantial growth driven by increasing consumer awareness, favorable economic conditions, and evolving purchasing preferences among residents and expatriates. The industry has experienced remarkable transformation with the integration of digital platforms, enhanced vehicle inspection services, and streamlined financing options that cater to diverse customer segments.

Consumer behavior patterns show a significant shift toward pre-owned vehicle purchases, with approximately 68% of automotive transactions in the UAE involving used cars. This trend reflects growing market maturity and consumer confidence in certified pre-owned vehicles. The market encompasses various vehicle categories, from luxury sedans and SUVs to commercial vehicles and motorcycles, serving both individual consumers and corporate fleet requirements.

Digital transformation has revolutionized the traditional used car trading landscape, with online platforms capturing approximately 45% of total market transactions. Advanced vehicle history reporting, comprehensive inspection services, and transparent pricing mechanisms have enhanced consumer trust and market accessibility. The integration of artificial intelligence and machine learning technologies has further optimized vehicle valuation processes and improved customer experience across multiple touchpoints.

The UAE used cars industry market refers to the comprehensive ecosystem encompassing the buying, selling, trading, and financing of pre-owned vehicles within the United Arab Emirates. This market includes authorized dealerships, independent traders, online platforms, auction houses, and various service providers that facilitate secondary automotive transactions across the seven emirates.

Market participants include individual sellers, certified dealers, automotive finance companies, insurance providers, vehicle inspection services, and digital marketplace operators. The industry operates under regulatory frameworks established by the UAE Ministry of Economy and local transportation authorities, ensuring consumer protection and market transparency through standardized procedures and quality assurance protocols.

Strategic analysis reveals the UAE used cars industry market as a cornerstone of the nation’s automotive sector, characterized by robust growth trajectories and innovative business models. The market benefits from the UAE’s position as a regional hub for automotive trade, attracting buyers from neighboring countries and contributing significantly to the broader economy through employment generation and revenue creation.

Key performance indicators demonstrate sustained market expansion with annual growth rates exceeding 12% over the past three years. The industry has successfully adapted to changing consumer preferences, incorporating advanced technologies and sustainable practices that align with the UAE’s Vision 2071 objectives. Digital platforms have emerged as primary transaction channels, facilitating approximately 78% of initial customer inquiries and significantly reducing traditional sales cycles.

Market segmentation reveals diverse customer demographics, with expatriate communities representing the largest consumer base, followed by UAE nationals and regional buyers. The luxury vehicle segment maintains strong performance, while economy and mid-range categories show consistent growth driven by first-time buyers and budget-conscious consumers seeking reliable transportation solutions.

Market intelligence indicates several critical insights that define the UAE used cars industry landscape:

Economic prosperity serves as the primary catalyst driving UAE used cars industry growth, with stable employment rates and disposable income levels supporting consistent consumer demand. The nation’s strategic location as a global business hub attracts international professionals who require reliable transportation solutions, creating sustained market demand across various vehicle categories and price segments.

Population dynamics significantly influence market expansion, with the UAE’s diverse expatriate community representing approximately 85% of the total population. This demographic composition creates unique purchasing patterns, as many residents prefer used vehicles due to temporary residency status and cost-effectiveness considerations. The continuous influx of skilled professionals and business investors maintains steady demand for quality pre-owned vehicles.

Infrastructure development across the emirates has enhanced connectivity and accessibility, making vehicle ownership more attractive and practical for residents. Extensive road networks, modern parking facilities, and efficient traffic management systems support increased vehicle utilization rates and justify investment in personal transportation solutions.

Financial sector evolution has introduced innovative financing products specifically designed for used car purchases, including flexible payment terms, competitive interest rates, and simplified approval processes. Islamic banking solutions and conventional financing options cater to diverse customer preferences and religious considerations, expanding market accessibility significantly.

Regulatory complexity presents ongoing challenges for market participants, particularly regarding import regulations, emission standards, and documentation requirements. Frequent policy updates and varying requirements across different emirates can create operational difficulties for dealers and confusion among consumers, potentially limiting market growth in certain segments.

Economic volatility in regional markets occasionally impacts consumer confidence and purchasing power, leading to temporary demand fluctuations. Global economic uncertainties, oil price variations, and geopolitical tensions can influence expatriate employment stability and subsequently affect used car market dynamics across various price categories.

Competition intensity among market players has compressed profit margins and increased operational costs, particularly for smaller independent dealers. The proliferation of online platforms and direct seller-to-buyer transactions has disrupted traditional business models, requiring significant investments in technology and customer service capabilities.

Quality concerns regarding vehicle history, maintenance records, and hidden defects continue to challenge consumer confidence, despite improved inspection services and warranty programs. Instances of odometer tampering, accident history concealment, and inadequate disclosure practices can undermine market credibility and regulatory compliance efforts.

Digital transformation initiatives present substantial opportunities for market expansion and operational efficiency improvements. The integration of artificial intelligence, machine learning, and blockchain technologies can revolutionize vehicle valuation, history tracking, and customer experience delivery, creating competitive advantages for early adopters and technology-forward organizations.

Sustainability trends offer significant growth potential through electric vehicle adoption, hybrid technology integration, and circular economy practices. The UAE government’s commitment to environmental sustainability and carbon neutrality goals creates favorable conditions for eco-friendly vehicle segments and innovative recycling programs.

Regional expansion opportunities exist through enhanced cross-border trade facilitation and strategic partnerships with neighboring countries. The UAE’s position as a regional automotive hub can be leveraged to capture additional market share in export segments and establish comprehensive service networks across the Middle East region.

Financial innovation through fintech partnerships and alternative financing models can address underserved market segments and improve accessibility for diverse customer demographics. Subscription-based ownership models, peer-to-peer lending platforms, and flexible lease-to-own programs represent emerging opportunities for market differentiation and growth.

Supply chain optimization has become increasingly sophisticated, with inventory management systems utilizing predictive analytics and demand forecasting to maintain optimal stock levels. Advanced logistics networks facilitate efficient vehicle transportation across emirates and international borders, reducing operational costs and improving delivery timeframes for customers and dealers alike.

Customer experience evolution reflects changing expectations for transparency, convenience, and service quality throughout the purchase journey. Modern consumers demand comprehensive vehicle information, flexible viewing arrangements, and seamless transaction processes that can be initiated and completed through digital channels with minimal physical interaction requirements.

Pricing mechanisms have become more sophisticated through the integration of real-time market data, comparable sales analysis, and automated valuation models. These systems provide accurate pricing guidance for both buyers and sellers while reducing negotiation complexities and ensuring fair market value determination across different vehicle categories and conditions.

Regulatory alignment continues to evolve with international standards and best practices, enhancing consumer protection and market credibility. Ongoing collaboration between industry stakeholders and government authorities ensures that regulatory frameworks remain relevant and supportive of legitimate business activities while preventing fraudulent practices and protecting consumer interests.

Comprehensive data collection methodologies employed in analyzing the UAE used cars industry market incorporate multiple primary and secondary research approaches to ensure accuracy and reliability. Primary research includes structured interviews with industry executives, dealer surveys, consumer behavior studies, and transaction analysis across various market segments and geographic regions within the UAE.

Secondary research components encompass government statistical databases, industry association reports, regulatory filing analysis, and economic indicator correlation studies. MarkWide Research utilizes advanced analytical frameworks to synthesize quantitative and qualitative data sources, ensuring comprehensive market understanding and reliable trend identification across multiple dimensions of market performance.

Data validation processes include cross-referencing multiple information sources, statistical significance testing, and expert panel reviews to confirm findings accuracy and eliminate potential biases. Market modeling techniques incorporate historical performance analysis, current trend evaluation, and forward-looking scenario planning to provide robust insights for strategic decision-making purposes.

Dubai emirate dominates the UAE used cars industry market, accounting for approximately 42% of total transactions due to its large expatriate population, business hub status, and well-developed automotive infrastructure. The emirate’s strategic location, international connectivity, and diverse economic base create favorable conditions for both domestic consumption and regional export activities.

Abu Dhabi represents the second-largest market segment with approximately 28% market share, driven by government employment, oil sector activities, and substantial infrastructure investments. The capital emirate’s focus on luxury vehicle segments and corporate fleet requirements creates distinct market characteristics and premium pricing opportunities for quality pre-owned vehicles.

Sharjah and Northern Emirates collectively account for approximately 30% of market activity, characterized by price-sensitive consumers, commercial vehicle demand, and cross-border trade activities. These regions offer growth opportunities through affordable vehicle segments and specialized services catering to small business owners and budget-conscious individual buyers.

Regional connectivity facilitates seamless vehicle movement between emirates and supports integrated market operations. Modern transportation networks, standardized documentation processes, and unified regulatory frameworks enable efficient distribution and service delivery across the entire UAE market landscape.

Market leadership is distributed among several key player categories, each contributing unique value propositions and competitive advantages:

Competitive differentiation strategies include technology innovation, customer service excellence, pricing transparency, warranty offerings, and specialized market segment focus. Market leaders invest significantly in digital capabilities, quality assurance programs, and customer relationship management systems to maintain competitive advantages and market share positions.

By Vehicle Type:

By Price Range:

By Customer Type:

Luxury vehicle segment demonstrates exceptional resilience and growth potential, with premium brands maintaining strong resale values and consistent demand from affluent consumers. This category benefits from the UAE’s high-income demographics and status-conscious consumer behavior, creating opportunities for specialized dealers and premium service providers.

Economy vehicle category serves the largest customer base, including young professionals, small business owners, and budget-conscious families. This segment emphasizes reliability, fuel efficiency, and affordable maintenance costs, driving demand for popular Asian and European brands with proven track records and widespread service network availability.

Commercial vehicle segment supports the UAE’s robust logistics and construction industries, with consistent demand for trucks, vans, and specialized equipment. This category requires specialized financing solutions, extended warranty programs, and comprehensive after-sales support to meet business operational requirements and minimize downtime risks.

Electric and hybrid vehicles represent an emerging category with significant growth potential, driven by government sustainability initiatives and increasing environmental awareness among consumers. This segment requires specialized knowledge, charging infrastructure considerations, and innovative financing solutions to overcome adoption barriers and capture market opportunities.

Dealers and retailers benefit from expanded market reach through digital platforms, improved inventory management systems, and enhanced customer relationship capabilities. Advanced analytics and market intelligence tools enable better pricing strategies, inventory optimization, and customer targeting, resulting in improved profitability and operational efficiency across business operations.

Financial institutions gain access to a large and growing customer base seeking automotive financing solutions, creating opportunities for portfolio diversification and revenue growth. The used car market’s stability and asset-backed nature provide attractive risk-return profiles for lending institutions and investment organizations.

Technology providers find substantial opportunities in developing innovative solutions for vehicle valuation, history tracking, customer experience enhancement, and operational automation. The industry’s digital transformation creates demand for specialized software, mobile applications, and integrated platform solutions that improve efficiency and customer satisfaction.

Consumers enjoy increased choice, transparent pricing, comprehensive vehicle information, and convenient transaction processes. Enhanced quality assurance programs, warranty offerings, and financing options make used car ownership more accessible and reliable for diverse customer segments and income levels.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first approach has become the dominant trend, with consumers increasingly preferring online research, virtual vehicle tours, and contactless transaction processes. Mobile applications and web platforms now facilitate approximately 82% of initial customer interactions, fundamentally changing traditional sales methodologies and customer engagement strategies across the industry.

Subscription and flexible ownership models are gaining traction among younger consumers and expatriate professionals who value flexibility over traditional ownership. These innovative approaches address changing lifestyle preferences and provide alternatives to conventional purchase or lease arrangements, creating new revenue streams for forward-thinking market participants.

Sustainability integration reflects growing environmental consciousness and government policy alignment, with increased focus on fuel-efficient vehicles, electric mobility solutions, and responsible disposal practices. This trend creates opportunities for specialized service providers and positions the UAE market as a leader in sustainable automotive practices within the regional context.

Data-driven decision making has revolutionized pricing strategies, inventory management, and customer targeting through advanced analytics and machine learning applications. MWR analysis indicates that data-driven dealers achieve approximately 15% higher profit margins compared to traditional operators, demonstrating the competitive advantages of technology adoption and analytical capabilities.

Regulatory enhancements have strengthened consumer protection through mandatory vehicle history reporting, standardized inspection procedures, and transparent pricing requirements. Recent legislation updates have improved market credibility and reduced fraudulent activities, creating a more trustworthy environment for both buyers and sellers across all market segments.

Technology partnerships between traditional dealers and fintech companies have introduced innovative financing solutions, streamlined approval processes, and enhanced customer experience delivery. These collaborations have reduced transaction times and improved accessibility for diverse customer demographics, particularly younger consumers and small business owners.

Infrastructure investments in inspection facilities, logistics networks, and customer service centers have improved operational efficiency and service quality standards. Major market players have expanded their physical presence while simultaneously developing digital capabilities, creating omnichannel experiences that meet evolving customer expectations and preferences.

International expansion initiatives by leading UAE-based platforms have extended market reach and created additional revenue opportunities through regional operations and strategic partnerships. These developments position the UAE as a regional automotive hub and demonstrate the scalability of successful business models beyond domestic market boundaries.

Technology investment should remain a top priority for market participants seeking sustainable competitive advantages and operational efficiency improvements. Companies should focus on customer-facing applications, backend automation systems, and data analytics capabilities that enhance decision-making processes and improve customer satisfaction metrics across all touchpoints.

Quality assurance programs require continuous enhancement to address persistent consumer concerns and build market credibility. Implementing comprehensive inspection protocols, transparent reporting systems, and robust warranty programs will differentiate quality-focused operators and justify premium pricing strategies in competitive market conditions.

Strategic partnerships with financial institutions, technology providers, and logistics companies can create synergistic benefits and expand service capabilities without significant capital investments. Collaborative approaches enable market participants to access specialized expertise and resources while focusing on core competencies and customer relationship management.

Market diversification through geographic expansion, customer segment development, and service line extensions can reduce dependency on single revenue sources and create additional growth opportunities. Companies should evaluate regional expansion possibilities and consider adjacent market segments that leverage existing capabilities and infrastructure investments.

Long-term growth prospects for the UAE used cars industry market remain highly positive, supported by continued economic development, population growth, and infrastructure expansion across the emirates. MarkWide Research projections indicate sustained market expansion with annual growth rates expected to exceed 10% over the next five years, driven by digital transformation initiatives and evolving consumer preferences.

Technology integration will accelerate significantly, with artificial intelligence, blockchain, and Internet of Things applications becoming standard industry practices rather than competitive differentiators. These technological advances will improve operational efficiency, enhance customer experience, and create new business models that reshape traditional automotive retail paradigms.

Sustainability focus will intensify as government policies and consumer preferences align with environmental objectives and circular economy principles. The transition toward electric and hybrid vehicles will create new market segments and require specialized infrastructure, service capabilities, and financing solutions to support widespread adoption.

Regional integration opportunities will expand through improved trade facilitation, standardized regulations, and enhanced logistics networks connecting the UAE with neighboring markets. This development will position the UAE as the definitive regional hub for used car trade and create additional revenue streams through export activities and cross-border services.

The UAE used cars industry market represents a dynamic and rapidly evolving sector that has successfully adapted to changing consumer preferences, technological innovations, and regulatory requirements. With robust growth trajectories, comprehensive digital transformation, and strong government support, the market is well-positioned for continued expansion and development across multiple dimensions of business activity.

Strategic opportunities abound for market participants who embrace technology integration, prioritize customer experience, and maintain focus on quality assurance and transparency. The combination of favorable economic conditions, diverse consumer demographics, and supportive regulatory frameworks creates an environment conducive to innovation, growth, and sustainable business development across all market segments and price categories.

Future success in the UAE used cars industry market will depend on the ability to balance traditional automotive retail expertise with modern digital capabilities, customer-centric service delivery, and sustainable business practices. Organizations that successfully navigate this evolution while maintaining operational excellence and customer trust will capture the most significant opportunities in this thriving and strategically important market sector.

What is UAE Used Cars?

UAE Used Cars refers to pre-owned vehicles that are available for sale in the United Arab Emirates. This market includes a variety of car brands and models, catering to diverse consumer preferences and budgets.

What are the key players in the UAE Used Cars Industry Market?

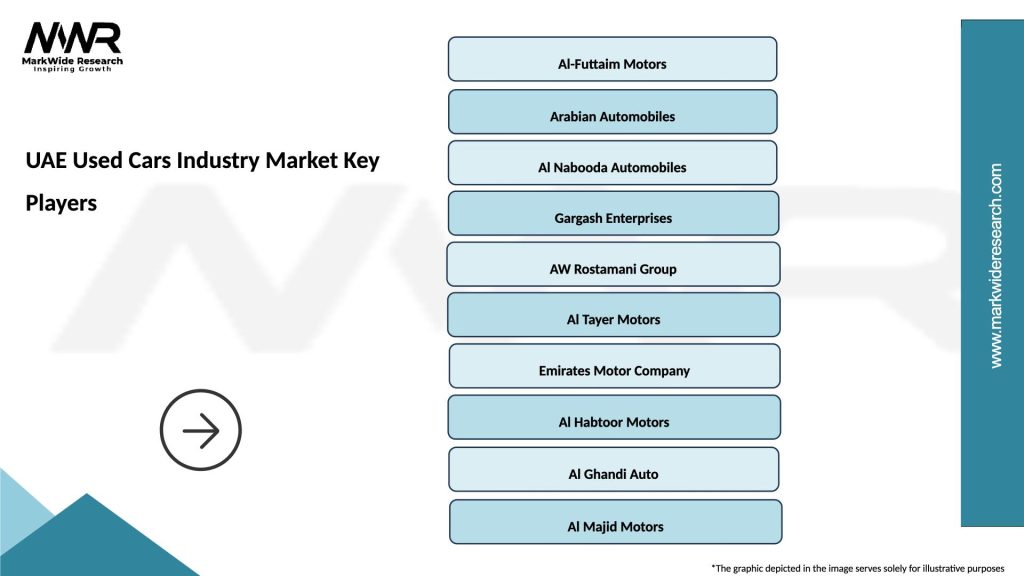

Key players in the UAE Used Cars Industry Market include Al-Futtaim Automall, DubiCars, and CarSwitch, among others. These companies provide platforms for buying and selling used vehicles, often offering additional services such as financing and warranties.

What are the growth factors driving the UAE Used Cars Industry Market?

The growth of the UAE Used Cars Industry Market is driven by factors such as increasing disposable income, a growing population, and a rising demand for affordable transportation options. Additionally, the expansion of online platforms has made it easier for consumers to access used car listings.

What challenges does the UAE Used Cars Industry Market face?

The UAE Used Cars Industry Market faces challenges such as fluctuating vehicle prices, competition from new car sales, and concerns over vehicle quality and reliability. These factors can impact consumer confidence and purchasing decisions.

What opportunities exist in the UAE Used Cars Industry Market?

Opportunities in the UAE Used Cars Industry Market include the potential for growth in online sales platforms and the increasing popularity of certified pre-owned vehicles. Additionally, the rise of eco-friendly vehicles presents a new segment for used car sales.

What trends are shaping the UAE Used Cars Industry Market?

Trends in the UAE Used Cars Industry Market include the growing use of digital platforms for buying and selling cars, an increase in demand for SUVs and electric vehicles, and a focus on customer experience enhancements. These trends are influencing how consumers interact with the used car market.

UAE Used Cars Industry Market

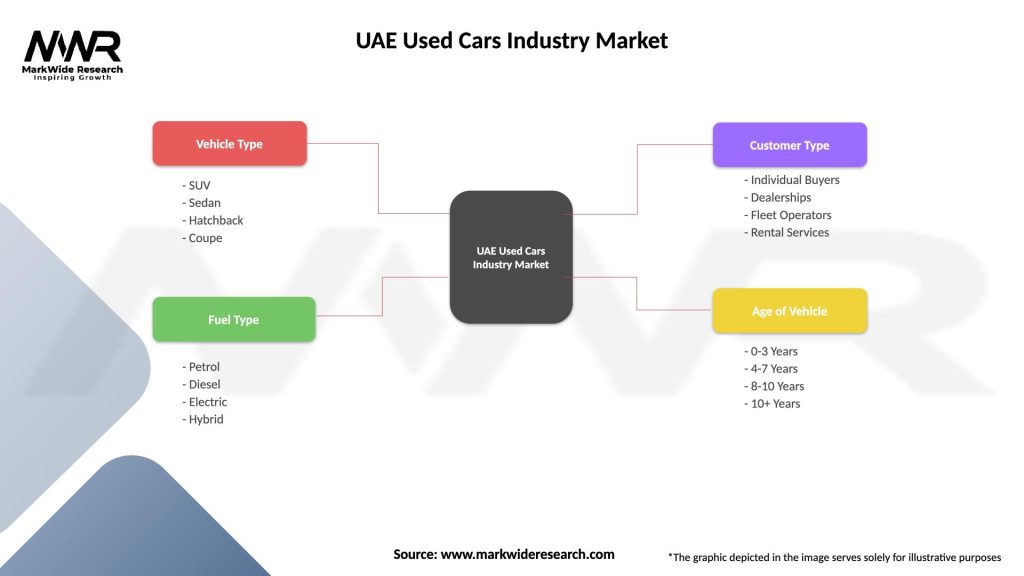

| Segmentation Details | Description |

|---|---|

| Vehicle Type | SUV, Sedan, Hatchback, Coupe |

| Fuel Type | Petrol, Diesel, Electric, Hybrid |

| Customer Type | Individual Buyers, Dealerships, Fleet Operators, Rental Services |

| Age of Vehicle | 0-3 Years, 4-7 Years, 8-10 Years, 10+ Years |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Used Cars Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at