444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE transportation infrastructure market represents one of the most dynamic and rapidly evolving sectors in the Middle East region. Strategic investments in transportation networks have positioned the United Arab Emirates as a global hub for logistics, trade, and connectivity. The market encompasses comprehensive development across multiple transportation modes, including road networks, rail systems, airports, seaports, and integrated multimodal facilities.

Government initiatives under Vision 2071 and the UAE Centennial Plan have accelerated infrastructure development, with transportation projects receiving substantial funding allocations. The market demonstrates robust growth potential, driven by increasing urbanization, population growth, and the country’s strategic position as a gateway between East and West. Smart transportation technologies are being integrated across all infrastructure projects, enhancing efficiency and sustainability.

Regional connectivity remains a primary focus, with major projects like the Etihad Rail network and Dubai Metro expansion contributing to market expansion. The transportation infrastructure sector is experiencing growth at a significant CAGR, supported by continued government commitment and private sector participation. Sustainability initiatives are increasingly influencing project design and implementation, with green transportation solutions gaining prominence across the emirates.

The UAE transportation infrastructure market refers to the comprehensive ecosystem of physical assets, systems, and networks that facilitate the movement of people, goods, and services across the United Arab Emirates. This market encompasses the planning, development, construction, operation, and maintenance of transportation facilities including highways, bridges, tunnels, railways, airports, seaports, and integrated logistics hubs.

Infrastructure components within this market include both hard infrastructure such as roads, terminals, and facilities, as well as soft infrastructure including traffic management systems, digital platforms, and smart transportation technologies. The market also covers supporting elements like maintenance services, technology integration, and operational management systems that ensure efficient transportation network functionality.

Market participants include government entities, construction companies, technology providers, logistics operators, and financial institutions involved in infrastructure development and operation. The scope extends beyond traditional transportation modes to include emerging solutions like autonomous vehicle infrastructure, electric vehicle charging networks, and integrated mobility-as-a-service platforms.

Market dynamics in the UAE transportation infrastructure sector reflect the country’s ambitious vision to become a global transportation and logistics hub. The market is characterized by large-scale government investments, strategic public-private partnerships, and integration of cutting-edge technologies. Key growth drivers include population expansion, economic diversification efforts, and preparation for major international events.

Infrastructure development spans multiple emirates, with Dubai and Abu Dhabi leading major projects while other emirates focus on connectivity and regional integration. The market benefits from strong government support, with transportation infrastructure receiving priority in national development plans. Technology adoption rates are accelerating, with smart city initiatives driving demand for intelligent transportation systems.

Investment patterns show increasing emphasis on sustainable and resilient infrastructure, with green building standards and climate-resilient design becoming standard requirements. The market demonstrates strong fundamentals with continued growth expected across all transportation modes. Regional integration projects are creating new opportunities for cross-border connectivity and trade facilitation.

Strategic positioning of the UAE as a global transportation hub drives continuous infrastructure investment and development. The market exhibits several critical insights that shape its trajectory and growth potential:

Population growth serves as a fundamental driver for transportation infrastructure expansion across the UAE. The country’s population has been growing at approximately 1.5% annually, creating sustained demand for enhanced transportation networks and capacity expansion. Urbanization trends concentrate population growth in major metropolitan areas, requiring sophisticated transportation solutions to manage increasing mobility needs.

Economic diversification initiatives under the UAE’s long-term vision drive infrastructure investment beyond traditional sectors. The development of new economic zones, free trade areas, and industrial clusters requires comprehensive transportation connectivity. Tourism growth contributes significantly to infrastructure demand, with visitor numbers requiring expanded airport capacity, improved road networks, and enhanced public transportation systems.

Strategic geographic location positions the UAE as a natural hub for international trade and logistics, driving investment in port facilities, airports, and connecting infrastructure. Government commitment to infrastructure development remains unwavering, with transportation projects receiving consistent funding allocation in national budgets. Technology advancement creates opportunities for smart infrastructure implementation, improving efficiency and user experience across transportation networks.

High capital requirements for major transportation infrastructure projects can create funding challenges and project delays. The scale of investment needed for comprehensive infrastructure development requires careful financial planning and often necessitates international financing arrangements. Construction costs have been increasing due to material price volatility and skilled labor shortages in the construction sector.

Environmental regulations and sustainability requirements add complexity and cost to infrastructure projects. Compliance with international environmental standards and local sustainability initiatives requires additional investment in green technologies and materials. Land acquisition challenges in densely populated areas can complicate project implementation and increase development timelines.

Technical complexity of modern transportation infrastructure requires specialized expertise and advanced technology integration. The need for skilled professionals and technical capabilities can constrain project execution speed. Coordination challenges between multiple government entities and stakeholders can slow decision-making processes and project approval timelines.

Smart city initiatives across the UAE create substantial opportunities for intelligent transportation system implementation. The integration of IoT technologies, artificial intelligence, and data analytics in transportation infrastructure opens new markets for technology providers and system integrators. Autonomous vehicle preparation requires infrastructure modifications and new supporting systems, creating opportunities for specialized service providers.

Sustainability mandates drive demand for green transportation solutions, including electric vehicle infrastructure, renewable energy integration, and sustainable construction materials. Public-private partnership models offer opportunities for private sector participation in infrastructure development and operation. Regional integration projects create opportunities for cross-border transportation solutions and logistics optimization.

Maintenance and upgrade of existing infrastructure presents ongoing opportunities for service providers and technology companies. The need for digital transformation of transportation systems creates markets for software solutions, data management platforms, and cybersecurity services. Event-driven infrastructure requirements for major international events create temporary but significant market opportunities.

Supply and demand dynamics in the UAE transportation infrastructure market are influenced by rapid population growth, economic expansion, and strategic government planning. Demand drivers include increasing mobility needs, trade growth, and tourism expansion, while supply factors involve government investment capacity, private sector participation, and technical expertise availability.

Competitive dynamics feature both international and regional players competing for major infrastructure contracts. Technology evolution continuously reshapes market requirements, with smart infrastructure and sustainable solutions becoming standard expectations rather than premium options. Regulatory environment provides stability and clear guidelines for infrastructure development while encouraging innovation and efficiency improvements.

Investment flows demonstrate strong government commitment with increasing private sector involvement through various partnership models. Market maturation is evident in more sophisticated project requirements, higher quality standards, and integrated approach to infrastructure development. Regional cooperation initiatives influence market dynamics by creating opportunities for larger-scale, cross-border infrastructure projects.

Comprehensive analysis of the UAE transportation infrastructure market employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes interviews with government officials, infrastructure developers, construction companies, and technology providers involved in transportation projects across the emirates.

Secondary research encompasses analysis of government publications, infrastructure development plans, project announcements, and industry reports. Data collection methods include review of tender documents, project specifications, budget allocations, and completion statistics from various transportation infrastructure projects. Market sizing utilizes project databases, government spending data, and industry participant revenue information.

Analytical frameworks include SWOT analysis, Porter’s Five Forces assessment, and value chain analysis to understand market structure and competitive dynamics. Validation processes involve cross-referencing multiple data sources and expert consultation to ensure accuracy and reliability of findings and projections.

Dubai emirate leads transportation infrastructure development with approximately 35% market share, driven by major projects including Dubai Metro expansion, Al Maktoum International Airport development, and comprehensive road network upgrades. Strategic initiatives focus on smart transportation integration and preparation for Expo legacy projects. The emirate’s position as a global business hub drives continuous infrastructure investment and innovation.

Abu Dhabi emirate accounts for roughly 30% of market activity, with significant investments in Etihad Rail, Abu Dhabi International Airport expansion, and integrated transportation networks. Government focus on economic diversification drives infrastructure development supporting new industrial zones and tourism destinations. The emirate emphasizes sustainable infrastructure and smart city technologies in major projects.

Northern emirates including Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively represent approximately 25% of market share. Development priorities focus on connectivity to major emirates, port facility enhancement, and regional integration projects. Growth opportunities exist in improving inter-emirate connectivity and supporting local economic development initiatives.

Federal projects account for the remaining 10% of market activity, primarily involving cross-emirate infrastructure like Etihad Rail and federal highway systems. Coordination efforts between emirates create opportunities for integrated transportation solutions and standardized infrastructure approaches.

Market leadership in the UAE transportation infrastructure sector involves a mix of international construction giants, regional specialists, and government entities. The competitive environment is characterized by large-scale projects requiring substantial technical capabilities and financial resources.

Competitive strategies focus on technological innovation, sustainable construction practices, and strategic partnerships with government entities. Market differentiation occurs through specialized expertise, project delivery capabilities, and integration of smart infrastructure solutions.

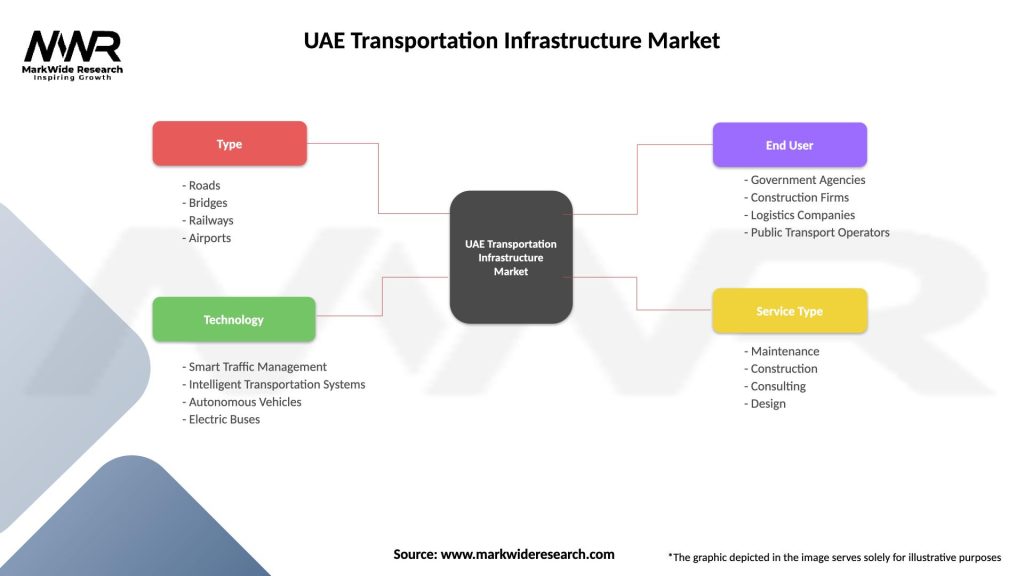

By Infrastructure Type:

By Technology Integration:

By Funding Model:

Road infrastructure dominates the market with the highest investment allocation, driven by continuous urban expansion and traffic growth. Highway development focuses on improving inter-emirate connectivity and supporting economic zone access. Smart traffic management systems are increasingly integrated into road projects, improving efficiency by approximately 25-30% in congestion reduction.

Rail infrastructure represents the fastest-growing segment, with metro system expansions and the Etihad Rail project driving significant investment. Public transportation adoption rates are increasing, with rail systems showing 15-20% annual ridership growth in major emirates. Integration with other transportation modes enhances overall system efficiency and user convenience.

Airport infrastructure continues expanding to accommodate growing passenger and cargo volumes. Capacity enhancement projects focus on terminal expansion, runway development, and cargo facility upgrades. Technology integration in airport operations improves processing efficiency and passenger experience significantly.

Port infrastructure development supports the UAE’s position as a regional logistics hub. Container handling capacity expansion and automation implementation improve operational efficiency. Integration with inland transportation networks enhances overall logistics chain performance.

Government entities benefit from improved economic competitiveness, enhanced quality of life for residents, and strengthened position as a regional hub. Infrastructure development supports economic diversification goals and creates employment opportunities across multiple sectors. Strategic positioning as a transportation hub attracts international businesses and investment.

Construction companies gain access to large-scale, long-term projects with stable revenue streams. Technology providers benefit from increasing demand for smart infrastructure solutions and system integration services. Local businesses experience improved connectivity and reduced logistics costs through enhanced transportation networks.

Residents and visitors benefit from improved mobility options, reduced travel times, and enhanced transportation convenience. Environmental benefits include reduced emissions through efficient transportation systems and sustainable infrastructure design. Economic benefits extend to improved productivity, reduced transportation costs, and enhanced business competitiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is reshaping transportation infrastructure with smart systems integration becoming standard practice. IoT implementation across transportation networks enables real-time monitoring, predictive maintenance, and optimized operations. Data analytics applications improve traffic flow management and infrastructure utilization efficiency.

Sustainability initiatives drive adoption of green building standards, renewable energy integration, and environmentally friendly construction materials. Carbon neutrality goals influence infrastructure design and operational requirements. Circular economy principles are increasingly applied in infrastructure development and waste management.

Autonomous vehicle preparation requires infrastructure modifications including smart traffic signals, dedicated lanes, and communication systems. Electric vehicle infrastructure expansion includes charging station networks and grid integration capabilities. Shared mobility solutions influence infrastructure planning and design requirements.

Resilience planning incorporates climate change adaptation and disaster preparedness into infrastructure design. Modular construction techniques improve project efficiency and reduce construction timelines. Integrated planning approaches consider multiple transportation modes and land use patterns in infrastructure development.

Etihad Rail expansion represents the largest railway infrastructure project in the UAE, connecting all emirates and extending to neighboring countries. Phase completion milestones demonstrate progress toward full network operational capability. The project showcases advanced rail technology integration and sustainable construction practices.

Dubai Metro expansion includes new lines and station additions to serve growing urban areas and major developments. Route 2020 completion connected the metro system to Al Maktoum International Airport, enhancing multimodal connectivity. Technology upgrades include advanced passenger information systems and automated operations.

Abu Dhabi airport expansion involves terminal capacity increases and runway development to accommodate growing passenger volumes. Smart airport technologies implementation improves passenger processing efficiency and operational management. Sustainability features include energy-efficient systems and waste reduction programs.

Port infrastructure modernization across UAE ports includes automation implementation and capacity expansion projects. MarkWide Research analysis indicates that port automation improvements have enhanced operational efficiency by approximately 40-45% in container handling operations. Integration with inland transportation networks strengthens logistics chain performance.

Strategic recommendations for market participants emphasize the importance of technology integration and sustainability focus in infrastructure development. Investment priorities should align with government vision and long-term economic development goals. Partnership strategies with government entities and international expertise providers enhance project success probability.

Technology adoption should focus on proven solutions with clear return on investment and operational benefits. Sustainability compliance is becoming mandatory rather than optional, requiring early integration in project planning. Workforce development investments in local technical capabilities reduce dependency on international expertise.

Risk management strategies should address construction cost volatility, regulatory changes, and environmental challenges. Market positioning should emphasize specialized expertise, proven track record, and ability to deliver complex projects. Innovation focus on smart infrastructure solutions and sustainable technologies creates competitive advantages.

Regional expansion opportunities exist for companies with strong UAE presence to leverage experience in neighboring markets. Long-term planning should consider evolving transportation needs and emerging technology trends. Stakeholder engagement with government entities and community representatives ensures project alignment with broader development goals.

Market projections indicate continued robust growth in the UAE transportation infrastructure sector, driven by sustained government investment and economic development requirements. Technology integration will accelerate, with smart infrastructure becoming standard across all new projects. Sustainability requirements will increasingly influence project design and material selection.

Investment patterns show growing emphasis on multimodal integration and seamless connectivity between transportation modes. MWR projections suggest that smart transportation systems adoption will reach 75-80% of new infrastructure projects within the next five years. Regional connectivity projects will create new opportunities for cross-border transportation solutions.

Emerging technologies including autonomous vehicles, artificial intelligence, and advanced materials will reshape infrastructure requirements. Climate resilience will become a critical design consideration for all transportation infrastructure projects. Public-private partnerships will continue expanding as preferred project delivery models.

Market evolution toward integrated transportation ecosystems will require coordination between multiple infrastructure types and operators. Digital infrastructure will become as important as physical infrastructure in transportation system effectiveness. Maintenance and upgrade markets will grow as existing infrastructure requires modernization and technology integration.

The UAE transportation infrastructure market represents a dynamic and rapidly evolving sector with substantial growth potential driven by government vision, economic diversification, and strategic positioning as a global hub. Market fundamentals remain strong with consistent government investment, growing demand from population and economic expansion, and increasing integration of smart technologies.

Key success factors for market participants include technology expertise, sustainability focus, and ability to deliver complex projects within challenging timelines and specifications. Future opportunities will increasingly center on smart infrastructure solutions, sustainable construction practices, and integrated transportation systems that enhance overall network efficiency and user experience.

Strategic positioning of the UAE as a regional transportation hub will continue driving infrastructure investment and creating opportunities for both local and international market participants. The market’s evolution toward intelligent, sustainable, and integrated transportation networks positions it for continued growth and innovation in the years ahead.

What is UAE Transportation Infrastructure?

UAE Transportation Infrastructure refers to the systems and facilities that support the movement of people and goods within the United Arab Emirates. This includes roads, railways, airports, and ports that facilitate efficient transportation and logistics.

What are the key players in the UAE Transportation Infrastructure Market?

Key players in the UAE Transportation Infrastructure Market include companies like Abu Dhabi Ports, Dubai Airports, and Etihad Rail, which are involved in various aspects of transportation development and management, among others.

What are the main drivers of growth in the UAE Transportation Infrastructure Market?

The main drivers of growth in the UAE Transportation Infrastructure Market include rapid urbanization, increasing tourism, and government investments in infrastructure projects aimed at enhancing connectivity and economic diversification.

What challenges does the UAE Transportation Infrastructure Market face?

Challenges in the UAE Transportation Infrastructure Market include high construction costs, regulatory hurdles, and the need for sustainable practices to minimize environmental impact while expanding infrastructure.

What opportunities exist in the UAE Transportation Infrastructure Market?

Opportunities in the UAE Transportation Infrastructure Market include the development of smart transportation systems, expansion of public transit networks, and investment in green infrastructure to support sustainability goals.

What trends are shaping the UAE Transportation Infrastructure Market?

Trends shaping the UAE Transportation Infrastructure Market include the integration of technology in transportation systems, increased focus on sustainability, and the development of multimodal transport solutions to enhance efficiency.

UAE Transportation Infrastructure Market

| Segmentation Details | Description |

|---|---|

| Type | Roads, Bridges, Railways, Airports |

| Technology | Smart Traffic Management, Intelligent Transportation Systems, Autonomous Vehicles, Electric Buses |

| End User | Government Agencies, Construction Firms, Logistics Companies, Public Transport Operators |

| Service Type | Maintenance, Construction, Consulting, Design |

Please note: The segmentation can be entirely customized to align with our client’s needs.

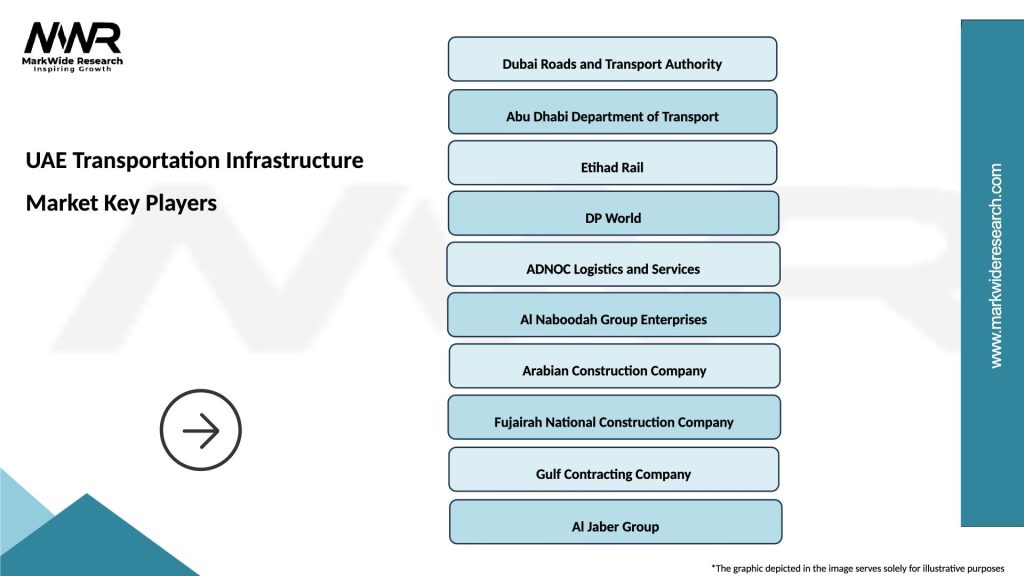

Leading companies in the UAE Transportation Infrastructure Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at