444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE transformer market represents a dynamic and rapidly evolving sector within the country’s electrical infrastructure landscape. As the United Arab Emirates continues its ambitious journey toward economic diversification and sustainable development, the demand for reliable power transmission and distribution systems has reached unprecedented levels. Transformer technology serves as the backbone of the nation’s electrical grid, facilitating efficient power delivery across residential, commercial, and industrial sectors.

Market dynamics in the UAE are primarily driven by massive infrastructure development projects, including smart city initiatives, renewable energy integration, and industrial expansion. The country’s strategic position as a regional hub for trade and commerce has necessitated robust electrical infrastructure capable of supporting diverse energy requirements. Power transformers play a crucial role in this ecosystem, enabling voltage conversion and power distribution across various applications.

Growth projections indicate that the UAE transformer market is experiencing substantial expansion, with industry analysts forecasting a compound annual growth rate of 6.2% CAGR over the next five years. This growth trajectory reflects the country’s commitment to modernizing its electrical infrastructure while simultaneously pursuing sustainability goals through renewable energy integration and smart grid technologies.

The UAE transformer market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, installation, and maintenance of electrical transformers within the United Arab Emirates. These critical electrical devices facilitate voltage transformation, enabling efficient power transmission from generation sources to end-users across residential, commercial, and industrial applications.

Transformers in the UAE context serve multiple functions, including step-up voltage conversion for long-distance transmission, step-down transformation for local distribution, and specialized applications in industrial processes. The market encompasses various transformer types, including power transformers, distribution transformers, instrument transformers, and specialty transformers designed for specific applications such as renewable energy integration and smart grid implementation.

Market participants include international manufacturers, local distributors, system integrators, and service providers who collectively contribute to the development and maintenance of the UAE’s electrical infrastructure. The market’s scope extends beyond traditional power applications to include emerging sectors such as electric vehicle charging infrastructure, data centers, and renewable energy projects.

Strategic positioning of the UAE transformer market reflects the country’s broader economic transformation and infrastructure modernization initiatives. The market demonstrates robust growth potential driven by substantial investments in power generation, transmission, and distribution infrastructure. Government initiatives supporting renewable energy adoption and smart city development have created significant opportunities for advanced transformer technologies.

Market segmentation reveals diverse applications across multiple sectors, with power utilities representing the largest demand segment, followed by industrial applications and commercial developments. The integration of renewable energy sources, particularly solar power, has driven demand for specialized transformers capable of handling variable power inputs and grid synchronization requirements.

Competitive landscape features a mix of international manufacturers and regional players, with market leadership determined by technological innovation, service capabilities, and local market understanding. Key success factors include product reliability, compliance with UAE standards, after-sales support, and the ability to deliver customized solutions for specific applications.

Future outlook indicates continued market expansion supported by ongoing infrastructure projects, renewable energy targets, and digital transformation initiatives. The market is expected to benefit from increasing adoption of smart grid technologies and the growing emphasis on energy efficiency across all sectors.

Market intelligence reveals several critical insights that shape the UAE transformer market landscape. The following key insights provide strategic understanding of market dynamics and growth opportunities:

Primary drivers propelling the UAE transformer market forward encompass a diverse range of economic, technological, and regulatory factors. The country’s strategic vision for economic diversification has created unprecedented demand for reliable electrical infrastructure across multiple sectors.

Government initiatives represent the most significant market driver, with substantial investments in power generation and transmission infrastructure. The UAE’s National Energy Strategy 2050 emphasizes the development of a sustainable and efficient energy sector, requiring extensive transformer deployment across generation, transmission, and distribution networks. Smart city projects in Dubai and Abu Dhabi further amplify demand for advanced transformer technologies.

Renewable energy expansion serves as another critical driver, with the UAE targeting significant solar and wind power capacity additions. These renewable energy projects require specialized transformers for grid integration, voltage regulation, and power conditioning. The Mohammed bin Rashid Al Maktoum Solar Park and similar projects demonstrate the scale of transformer requirements for renewable energy infrastructure.

Industrial growth across sectors including petrochemicals, manufacturing, and logistics creates substantial demand for industrial-grade transformers. The development of new industrial zones and free trade areas requires comprehensive electrical infrastructure, including various transformer types for different applications and voltage levels.

Market constraints affecting the UAE transformer market include several challenges that industry participants must navigate to achieve sustainable growth. These restraints primarily relate to economic, technical, and regulatory factors that can impact market development.

High capital costs associated with advanced transformer technologies represent a significant barrier, particularly for smaller projects and budget-constrained applications. The initial investment required for high-efficiency transformers and smart grid-enabled devices can be substantial, potentially limiting adoption in certain market segments. Economic volatility and fluctuating oil prices can also impact infrastructure spending and project timelines.

Technical challenges related to grid integration and compatibility issues can constrain market growth. The complexity of integrating new transformer technologies with existing electrical infrastructure requires careful planning and significant technical expertise. Skilled labor shortages in specialized areas such as transformer maintenance and smart grid technologies can limit market expansion.

Regulatory compliance requirements and evolving standards can create challenges for market participants. Ensuring compliance with UAE electrical codes, international standards, and environmental regulations requires ongoing investment in product development and certification processes. Supply chain disruptions and global material shortages can also impact transformer availability and pricing.

Emerging opportunities in the UAE transformer market present significant potential for growth and innovation across multiple sectors. The country’s commitment to technological advancement and sustainable development creates numerous avenues for market expansion and value creation.

Smart grid implementation represents one of the most promising opportunities, with utilities investing heavily in intelligent electrical networks. This transformation requires advanced transformers equipped with monitoring, control, and communication capabilities. Digital transformation initiatives across the energy sector create demand for IoT-enabled transformers that provide real-time performance data and predictive maintenance capabilities.

Electric vehicle infrastructure development presents substantial opportunities for specialized transformer applications. The UAE’s commitment to electric mobility requires extensive charging infrastructure, creating demand for transformers optimized for EV charging applications. Data center expansion driven by digital transformation and cloud computing adoption requires reliable power infrastructure, including high-efficiency transformers.

Export opportunities to regional markets leverage the UAE’s strategic location and established business networks. The country’s reputation for quality infrastructure and technical expertise positions local transformer suppliers to serve broader Middle East and Africa markets. Technology partnerships with international manufacturers can facilitate knowledge transfer and innovation development.

Market dynamics in the UAE transformer sector reflect the complex interplay of supply and demand factors, technological evolution, and regulatory influences. Understanding these dynamics is crucial for stakeholders seeking to navigate the market effectively and capitalize on emerging opportunities.

Supply-side dynamics are characterized by a mix of international manufacturers and local assembly operations. Major global transformer manufacturers have established regional presence through partnerships, joint ventures, and local manufacturing facilities. This approach enables them to serve the UAE market while maintaining cost competitiveness and ensuring compliance with local standards. Local content requirements and government preferences for regional suppliers influence supply chain strategies.

Demand-side dynamics are driven primarily by infrastructure development projects, industrial expansion, and renewable energy integration. The cyclical nature of large infrastructure projects can create fluctuations in demand, requiring suppliers to maintain flexible production and inventory strategies. Seasonal variations in construction activity and project scheduling also influence demand patterns throughout the year.

Technological dynamics are reshaping the market through digitalization, smart grid technologies, and energy efficiency improvements. The adoption of advanced materials, monitoring systems, and predictive maintenance capabilities is transforming traditional transformer applications. Innovation cycles and technology refresh requirements create ongoing opportunities for market participants who can deliver cutting-edge solutions.

Research approach for analyzing the UAE transformer market employs comprehensive methodologies combining primary and secondary research techniques. This multi-faceted approach ensures accurate market assessment and reliable insights for stakeholders across the value chain.

Primary research involves direct engagement with key market participants, including transformer manufacturers, distributors, system integrators, and end-users. Structured interviews and surveys provide firsthand insights into market trends, challenges, and opportunities. Industry expert consultations with electrical engineers, project managers, and utility professionals offer technical perspectives on market developments and future requirements.

Secondary research encompasses analysis of government publications, industry reports, trade statistics, and regulatory documents. This approach provides comprehensive market context and validates primary research findings. Data triangulation techniques ensure accuracy and reliability of market assessments by cross-referencing multiple information sources.

Market modeling utilizes statistical analysis and forecasting techniques to project future market trends and growth patterns. Economic indicators, infrastructure spending data, and project pipeline analysis inform quantitative market projections. Scenario analysis considers various market conditions and their potential impact on transformer demand and supply dynamics.

Regional distribution of the UAE transformer market reveals significant variations across the seven emirates, with each region presenting unique characteristics and growth opportunities. Understanding these regional dynamics is essential for market participants developing targeted strategies and resource allocation plans.

Dubai represents the largest regional market segment, accounting for approximately 35% market share due to its status as a commercial and financial hub. The emirate’s ambitious smart city initiatives, extensive real estate development, and growing industrial base drive substantial transformer demand. Dubai Electricity and Water Authority (DEWA) projects and private sector developments contribute significantly to market growth in this region.

Abu Dhabi holds approximately 30% market share, driven by government infrastructure projects, oil and gas industry requirements, and renewable energy developments. The emirate’s focus on economic diversification and sustainable development creates demand for advanced transformer technologies. Masdar City and other sustainable development projects showcase innovative transformer applications.

Northern Emirates including Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively represent 25% market share. These regions experience growth driven by industrial development, port expansions, and residential construction. Free trade zones and manufacturing facilities in these emirates require specialized transformer solutions for various applications.

Cross-emirate projects and federal infrastructure initiatives account for the remaining 10% market share, including national grid interconnections and strategic infrastructure developments that span multiple emirates.

Competitive environment in the UAE transformer market features a diverse mix of international manufacturers, regional players, and local distributors. Market leadership is determined by factors including technological capabilities, service quality, local presence, and ability to deliver customized solutions for specific applications.

International manufacturers maintain strong market positions through advanced technology offerings and comprehensive service capabilities:

Regional players and local distributors complement international manufacturers by providing specialized services, local market knowledge, and customized solutions. These companies often focus on specific market segments or applications where they can leverage their regional expertise and customer relationships.

Competitive strategies include technology innovation, service excellence, local manufacturing, and strategic partnerships. Market leaders invest heavily in research and development, local talent development, and customer support capabilities to maintain their competitive positions.

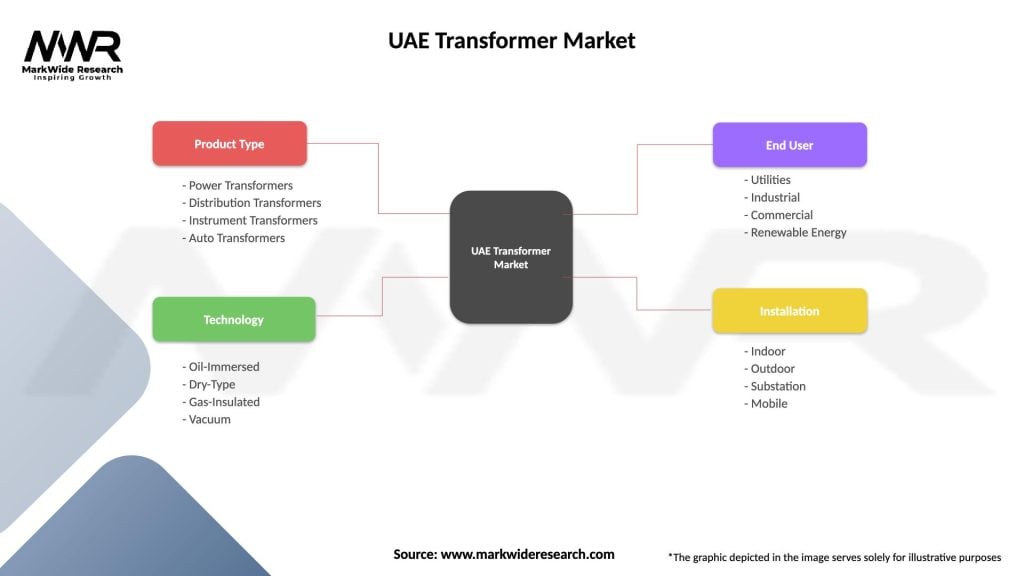

Market segmentation of the UAE transformer market reveals diverse applications and technology categories that serve different customer needs and market requirements. Understanding these segments is crucial for developing targeted strategies and identifying growth opportunities.

By Product Type:

By Application:

By Voltage Level:

Category analysis provides detailed insights into specific transformer segments and their unique characteristics within the UAE market. Each category presents distinct opportunities and challenges that influence market dynamics and competitive strategies.

Power Transformers Category: This segment represents the highest-value applications, typically serving utility transmission networks and large industrial facilities. Market growth in this category is driven by grid expansion projects and renewable energy integration requirements. The segment demands high reliability, advanced monitoring capabilities, and compliance with international standards. Technology trends include digitalization, condition monitoring, and enhanced efficiency ratings.

Distribution Transformers Category: The largest volume segment serving local distribution networks across residential, commercial, and light industrial applications. Market drivers include urban development, population growth, and infrastructure modernization. This category emphasizes cost-effectiveness, standardization, and local availability. Innovation focus includes smart grid compatibility and energy efficiency improvements.

Renewable Energy Transformers: An emerging category driven by the UAE’s renewable energy targets and solar power development. These transformers require specialized features for grid integration, voltage regulation, and power quality management. Growth potential is substantial, with increasing solar installations and energy storage projects driving demand.

Industrial Transformers: Specialized category serving diverse industrial applications with customized voltage levels, configurations, and environmental specifications. Market characteristics include project-based demand, technical complexity, and long-term service relationships. Growth is linked to industrial expansion and economic diversification initiatives.

Industry participants in the UAE transformer market can realize significant benefits through strategic positioning and value-added service offerings. Understanding these benefits enables stakeholders to develop effective market strategies and capitalize on emerging opportunities.

For Manufacturers:

For Distributors and Service Providers:

For End Users:

Strategic analysis of the UAE transformer market through SWOT framework reveals critical internal and external factors influencing market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market trends shaping the UAE transformer industry reflect broader technological evolution, sustainability initiatives, and digital transformation across the energy sector. These trends influence product development, market strategies, and investment decisions.

Digitalization and Smart Grid Integration: The most significant trend involves incorporating digital technologies into transformer operations. Smart transformers equipped with sensors, communication capabilities, and data analytics are becoming standard requirements for new installations. This trend supports grid optimization, predictive maintenance, and real-time monitoring capabilities that enhance system reliability and efficiency.

Energy Efficiency Focus: Increasing emphasis on energy conservation drives demand for high-efficiency transformers that minimize losses during operation. Efficiency standards are becoming more stringent, with utilities and industrial customers prioritizing transformers that deliver 98%+ efficiency ratings. This trend aligns with the UAE’s sustainability goals and energy conservation initiatives.

Renewable Energy Integration: The growing renewable energy sector requires specialized transformer solutions for grid integration and power conditioning. Grid-tie transformers for solar installations and energy storage systems represent rapidly growing market segments. These applications demand transformers capable of handling variable power inputs and maintaining grid stability.

Modular and Prefabricated Solutions: Market preference is shifting toward modular transformer solutions that enable faster installation and reduced construction time. Prefabricated substations and containerized transformer solutions are gaining popularity for their deployment speed and standardized quality.

Industry developments in the UAE transformer market demonstrate the dynamic nature of the sector and highlight significant milestones that shape market evolution. These developments reflect technological advancement, strategic partnerships, and major project implementations.

Major Project Implementations: Several landmark projects have showcased advanced transformer technologies and established new market benchmarks. The Mohammed bin Rashid Al Maktoum Solar Park has deployed numerous specialized transformers for solar power integration, demonstrating the market’s capacity for large-scale renewable energy projects. Dubai Metro expansion and other transportation infrastructure projects have required specialized transformer solutions for rail applications.

Technology Partnerships: Strategic collaborations between international manufacturers and local partners have enhanced market capabilities and service offerings. Joint ventures and technology transfer agreements have facilitated local manufacturing capabilities and knowledge development. These partnerships enable global companies to establish regional presence while providing local partners with access to advanced technologies.

Regulatory Developments: Updates to UAE electrical standards and codes have influenced transformer specifications and market requirements. Energy efficiency regulations and smart grid standards have driven product innovation and market differentiation. Environmental regulations have also influenced transformer design and materials selection.

Investment Announcements: Significant investments in manufacturing facilities, service centers, and research capabilities demonstrate market confidence and long-term commitment. Capacity expansions by major manufacturers indicate positive market outlook and growth expectations.

Strategic recommendations for UAE transformer market participants focus on leveraging emerging opportunities while addressing market challenges and competitive pressures. MarkWide Research analysis suggests several key strategies for sustainable market success.

Technology Investment: Companies should prioritize investment in digital technologies and smart grid capabilities to meet evolving market requirements. IoT integration and predictive maintenance capabilities are becoming essential differentiators. Organizations that develop expertise in these areas will gain competitive advantages and capture premium market segments.

Local Presence Development: Establishing strong local presence through service centers, technical support, and customer relationships is crucial for market success. Local partnerships can provide market access and cultural understanding while reducing operational costs. Companies should invest in local talent development and technical training programs.

Sustainability Focus: Aligning product offerings with UAE sustainability goals and energy efficiency requirements will create market opportunities. Green transformer technologies and environmentally friendly materials should be prioritized in product development strategies. Companies should also consider circular economy principles in their business models.

Market Diversification: While utility and government projects remain important, companies should diversify across industrial, commercial, and emerging sectors. Renewable energy and data center applications offer significant growth potential. Export opportunities to regional markets should also be explored to reduce dependence on domestic demand.

Future prospects for the UAE transformer market appear highly positive, supported by continued infrastructure investment, renewable energy expansion, and digital transformation initiatives. Market projections indicate sustained growth across multiple segments and applications over the next decade.

Growth trajectory is expected to maintain momentum with projected compound annual growth rates of 6.2% CAGR through 2030. This growth will be driven primarily by renewable energy projects, smart city developments, and industrial expansion. Government commitments to infrastructure spending and economic diversification provide strong foundation for market expansion.

Technology evolution will continue reshaping the market through digitalization, artificial intelligence, and advanced materials. Smart transformers with integrated monitoring and control capabilities will become standard requirements. Energy storage integration and grid flexibility requirements will drive demand for specialized transformer solutions.

Market maturation will lead to increased focus on service excellence, lifecycle management, and value-added offerings. Predictive maintenance and performance optimization services will become important revenue streams. Companies that develop comprehensive service capabilities will gain competitive advantages in the mature market environment.

Regional expansion opportunities will emerge as UAE-based companies leverage their experience and capabilities to serve broader Middle East and Africa markets. The country’s position as a regional hub will facilitate export growth and market diversification strategies.

Market assessment of the UAE transformer sector reveals a dynamic and growing industry with substantial opportunities for stakeholders across the value chain. The market benefits from strong government support, robust economic fundamentals, and clear growth drivers including infrastructure development and renewable energy expansion.

Strategic positioning in this market requires understanding of local requirements, technology trends, and competitive dynamics. Companies that invest in digital capabilities, local presence, and customer relationships will be best positioned to capture market opportunities and achieve sustainable growth.

Future success will depend on adaptability to evolving market conditions, commitment to innovation, and ability to deliver value-added solutions that meet customer needs. The UAE transformer market offers significant potential for companies that can navigate its complexities and capitalize on its growth opportunities while contributing to the country’s sustainable development goals.

What is Transformer?

Transformers are electrical devices that transfer electrical energy between two or more circuits through electromagnetic induction. They are essential in power distribution and voltage regulation in various applications, including residential, commercial, and industrial sectors.

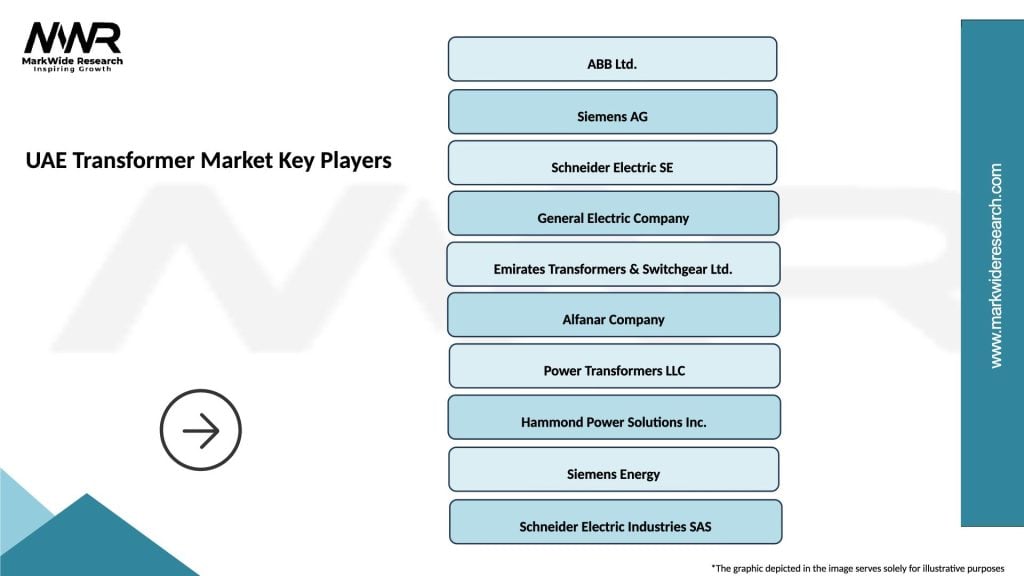

What are the key players in the UAE Transformer Market?

Key players in the UAE Transformer Market include ABB, Siemens, Schneider Electric, and General Electric, among others. These companies are known for their innovative transformer solutions and extensive service networks across the region.

What are the growth factors driving the UAE Transformer Market?

The UAE Transformer Market is driven by increasing urbanization, rising demand for electricity, and investments in renewable energy projects. Additionally, the expansion of infrastructure and industrial sectors contributes to the market’s growth.

What challenges does the UAE Transformer Market face?

The UAE Transformer Market faces challenges such as fluctuating raw material prices and the need for regular maintenance and upgrades. Additionally, competition from alternative energy solutions can impact traditional transformer demand.

What opportunities exist in the UAE Transformer Market?

Opportunities in the UAE Transformer Market include the growing adoption of smart grid technologies and the increasing focus on energy efficiency. The shift towards sustainable energy sources also presents avenues for innovation and development.

What trends are shaping the UAE Transformer Market?

Trends in the UAE Transformer Market include the integration of digital technologies for monitoring and management, the rise of eco-friendly transformer designs, and the increasing use of transformers in renewable energy applications. These trends are reshaping how transformers are designed and utilized.

UAE Transformer Market

| Segmentation Details | Description |

|---|---|

| Product Type | Power Transformers, Distribution Transformers, Instrument Transformers, Auto Transformers |

| Technology | Oil-Immersed, Dry-Type, Gas-Insulated, Vacuum |

| End User | Utilities, Industrial, Commercial, Renewable Energy |

| Installation | Indoor, Outdoor, Substation, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Transformer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at