444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE surgical market represents one of the most dynamic and rapidly evolving healthcare sectors in the Middle East region. Healthcare infrastructure development across the Emirates has positioned the country as a leading medical tourism destination, driving substantial demand for advanced surgical procedures and technologies. The market encompasses a comprehensive range of surgical specialties including cardiovascular surgery, orthopedic procedures, neurosurgery, plastic surgery, and minimally invasive surgical techniques.

Market growth is primarily fueled by the UAE’s strategic vision to become a global healthcare hub, supported by significant government investments in medical infrastructure and technology adoption. The country’s aging population, increasing prevalence of chronic diseases, and rising healthcare awareness among residents contribute to the expanding surgical market landscape. Private healthcare facilities alongside government hospitals are continuously upgrading their surgical capabilities to meet international standards.

Technological advancement plays a crucial role in market expansion, with healthcare providers increasingly adopting robotic surgery systems, advanced imaging technologies, and minimally invasive surgical techniques. The market demonstrates strong growth potential with an estimated 8.5% CAGR projected over the forecast period, driven by medical tourism initiatives and healthcare sector diversification efforts.

The UAE surgical market refers to the comprehensive ecosystem of surgical services, medical devices, technologies, and healthcare infrastructure within the United Arab Emirates dedicated to performing various surgical procedures across multiple medical specialties. This market encompasses surgical equipment manufacturing, distribution, healthcare facility operations, medical professional services, and supporting technologies that enable safe and effective surgical interventions.

Market scope includes both public and private healthcare sectors, covering everything from routine outpatient procedures to complex specialized surgeries. The definition extends to surgical instruments, operating room equipment, anesthesia systems, surgical robotics, imaging technologies, and post-operative care solutions. Healthcare providers within this market range from large hospital networks to specialized surgical centers and ambulatory surgery facilities.

Geographic coverage spans all seven emirates, with major concentration in Dubai, Abu Dhabi, and Sharjah, where advanced medical facilities and specialized surgical centers are predominantly located. The market also encompasses medical tourism services, international patient care programs, and cross-border healthcare partnerships that contribute to the overall surgical services ecosystem.

Strategic positioning of the UAE as a regional healthcare leader has created unprecedented opportunities for surgical market expansion. The country’s commitment to healthcare excellence, combined with substantial infrastructure investments, has established a robust foundation for sustained market growth. Government initiatives including the UAE Vision 2071 and Dubai Health Strategy 2021 have accelerated healthcare sector development and surgical services enhancement.

Market dynamics reveal strong demand across multiple surgical specialties, with cardiovascular surgery, orthopedic procedures, and cosmetic surgery leading growth segments. The integration of advanced technologies such as artificial intelligence, robotic surgery systems, and telemedicine platforms has enhanced surgical outcomes and patient satisfaction rates. Medical tourism contributes approximately 25% of total surgical procedures, attracting patients from across the Middle East, Africa, and South Asia regions.

Competitive landscape features a mix of international healthcare providers, regional hospital networks, and specialized surgical centers. The market benefits from favorable regulatory environment, streamlined licensing processes, and government support for healthcare innovation. Investment flows from both public and private sectors continue to drive market expansion and technological advancement initiatives.

Market segmentation analysis reveals diverse opportunities across surgical specialties and service categories. The following key insights highlight critical market characteristics:

Market maturity varies across different surgical specialties, with cosmetic surgery and cardiac procedures showing advanced development levels, while emerging specialties like robotic surgery and precision medicine represent high-growth opportunities for market participants.

Government support serves as the primary catalyst for UAE surgical market expansion. The UAE government’s commitment to healthcare sector development through substantial budget allocations, infrastructure investments, and regulatory reforms has created an enabling environment for market growth. Healthcare spending increases and public-private partnership initiatives continue to drive surgical services expansion across the country.

Medical tourism initiatives represent a significant growth driver, with the UAE positioning itself as a premier destination for high-quality surgical procedures. The country’s strategic location, world-class facilities, and competitive pricing attract patients from across the region and beyond. Visa facilitation programs and medical tourism packages have streamlined the process for international patients seeking surgical care.

Demographic trends including population aging, lifestyle-related health conditions, and increasing healthcare awareness drive demand for surgical interventions. The growing expatriate population and rising disposable income levels contribute to increased utilization of private healthcare services and elective surgical procedures. Chronic disease prevalence particularly diabetes and cardiovascular conditions, necessitates surgical interventions and ongoing medical care.

Technological advancement adoption accelerates market growth through improved surgical outcomes, reduced recovery times, and enhanced patient experiences. Healthcare providers’ investments in cutting-edge surgical equipment, robotic systems, and digital health technologies attract both patients and medical professionals to the UAE market.

High implementation costs associated with advanced surgical technologies and equipment represent a significant market restraint. Healthcare facilities face substantial capital investment requirements for acquiring state-of-the-art surgical systems, maintaining equipment, and training medical staff. Operational expenses including specialized personnel, facility maintenance, and regulatory compliance add to the overall cost burden for market participants.

Skilled workforce shortage poses challenges for market expansion, particularly in specialized surgical fields requiring extensive training and experience. The competition for qualified surgeons, anesthesiologists, and surgical technicians creates recruitment difficulties and increases labor costs. Training requirements for new technologies and procedures demand significant time and resource investments from healthcare providers.

Regulatory complexity and evolving healthcare standards require continuous compliance efforts and documentation processes. Healthcare facilities must navigate multiple regulatory bodies, licensing requirements, and quality standards while maintaining operational efficiency. Insurance coverage limitations for certain procedures and international patients may restrict market accessibility and growth potential.

Market competition from regional healthcare hubs and established medical tourism destinations creates pressure on pricing and service differentiation. Healthcare providers must continuously invest in facility upgrades, technology advancement, and service enhancement to maintain competitive positioning in the regional market.

Emerging technologies present substantial opportunities for market expansion and service enhancement. The integration of artificial intelligence, machine learning, and precision medicine into surgical practices offers potential for improved outcomes and operational efficiency. Telemedicine platforms and remote surgical consultation services can extend market reach and provide specialized expertise to underserved areas.

Specialized surgical centers development represents a significant growth opportunity, particularly for high-volume, standardized procedures. Ambulatory surgery centers and day surgery facilities can provide cost-effective alternatives to traditional hospital-based procedures while maintaining quality standards. Niche specialties such as robotic surgery, minimally invasive procedures, and cosmetic surgery offer premium service opportunities.

Regional expansion and cross-border healthcare partnerships can leverage the UAE’s strategic location and advanced capabilities. Collaboration with healthcare providers in neighboring countries and medical tourism promotion in emerging markets can drive patient volume growth. Healthcare diplomacy initiatives and medical mission programs can establish the UAE as a regional healthcare leader.

Public-private partnerships offer opportunities for infrastructure development, technology sharing, and service delivery enhancement. Collaborative models can optimize resource utilization, share investment risks, and accelerate market development across different emirates and healthcare segments.

Supply chain dynamics within the UAE surgical market demonstrate increasing sophistication and integration. Healthcare providers are establishing strategic partnerships with medical device manufacturers, pharmaceutical companies, and technology suppliers to ensure reliable access to advanced surgical equipment and consumables. Local distribution networks have evolved to support just-in-time delivery systems and emergency supply requirements for surgical facilities.

Demand patterns show seasonal variations influenced by medical tourism cycles, expatriate population movements, and healthcare insurance renewal periods. Peak demand typically occurs during cooler months when international patients prefer to visit the UAE for elective procedures. Procedure scheduling optimization and capacity management have become critical success factors for healthcare providers.

Price dynamics reflect the market’s positioning between premium international standards and regional affordability requirements. Healthcare providers must balance cost competitiveness with quality maintenance to attract both local and international patients. Insurance reimbursement policies and government healthcare coverage programs significantly influence pricing strategies and market accessibility.

Innovation cycles in surgical technologies and techniques drive continuous market evolution. Healthcare facilities must regularly evaluate and adopt new technologies to maintain competitive advantages and meet evolving patient expectations. Research collaboration between healthcare providers, academic institutions, and technology companies accelerates innovation adoption and market development.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UAE surgical market landscape. Primary research involves extensive interviews with healthcare administrators, surgical specialists, medical device distributors, and healthcare policy makers across all seven emirates. Survey methodologies capture quantitative data on procedure volumes, technology adoption rates, and market trends from healthcare facilities of varying sizes and specialties.

Secondary research incorporates analysis of government healthcare statistics, regulatory filings, industry reports, and academic publications related to surgical market development in the UAE. Healthcare facility databases, medical licensing records, and insurance claim data provide valuable insights into market structure and growth patterns. Comparative analysis with regional healthcare markets helps contextualize the UAE’s position and competitive advantages.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical verification methods to ensure research accuracy and reliability. Market sizing methodologies combine top-down and bottom-up approaches, incorporating healthcare facility capacity, procedure volumes, and technology adoption rates. Forecasting models utilize historical trends, demographic projections, and policy impact assessments to project future market development scenarios.

Stakeholder engagement throughout the research process ensures comprehensive coverage of market perspectives and emerging trends. Regular consultation with industry experts, healthcare professionals, and policy makers provides ongoing validation and refinement of research findings and market projections.

Dubai emirate dominates the UAE surgical market with approximately 45% market share, driven by its position as a leading medical tourism destination and concentration of premium healthcare facilities. The emirate hosts numerous internationally accredited hospitals and specialized surgical centers that attract patients from across the region. Dubai Health Authority initiatives and medical tourism promotion programs have established the city as a regional healthcare hub.

Abu Dhabi represents the second-largest market segment with 33% market share, benefiting from substantial government healthcare investments and the presence of major hospital networks. The emirate’s focus on healthcare excellence and medical research creates opportunities for advanced surgical procedures and technology adoption. Healthcare infrastructure development projects continue to expand surgical capacity and capabilities.

Sharjah and Northern Emirates collectively account for 22% of the surgical market, with growing healthcare infrastructure and increasing accessibility to specialized surgical services. These regions benefit from proximity to Dubai and Abu Dhabi while offering more cost-effective healthcare options for certain patient segments. Regional healthcare development initiatives aim to reduce patient travel requirements and improve local access to surgical services.

Cross-emirate collaboration and healthcare system integration facilitate patient referrals, specialist consultations, and resource sharing across the UAE. Telemedicine platforms and digital health networks enable coordination between healthcare facilities in different emirates, optimizing surgical care delivery and patient outcomes.

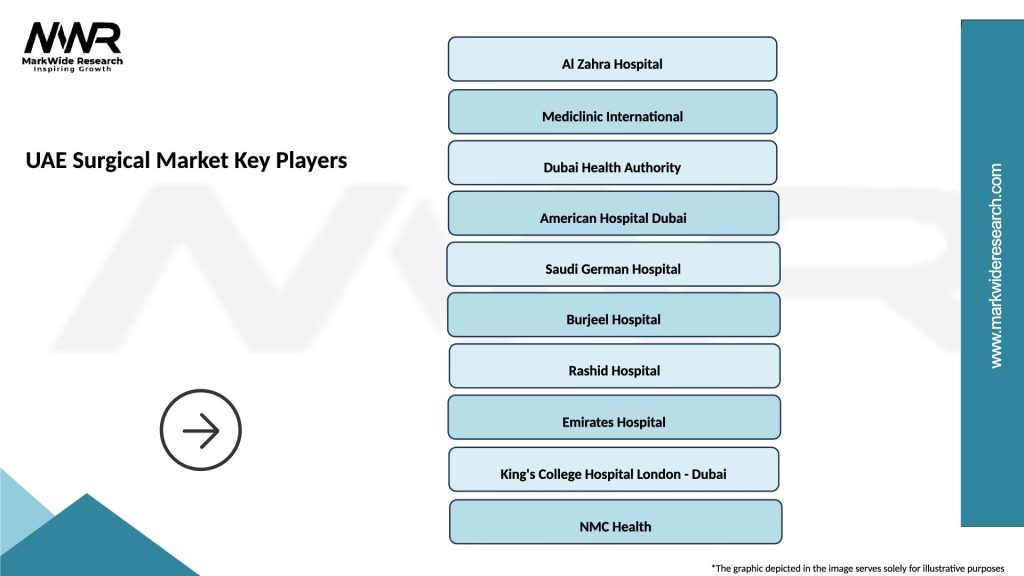

Market leadership is distributed among several major healthcare providers, each with distinct competitive advantages and specialization areas. The competitive environment fosters innovation, quality improvement, and service differentiation across the surgical market.

Competitive strategies include technology differentiation, specialist recruitment, facility expansion, and strategic partnerships with international healthcare organizations. Market participants continuously invest in advanced surgical equipment, training programs, and quality accreditation to maintain competitive positioning.

By Surgical Specialty:

By Technology Type:

By Facility Type:

Cardiovascular Surgery represents the most established and technologically advanced segment within the UAE surgical market. The category benefits from significant government support, international partnerships, and advanced technology adoption. Cardiac procedures attract substantial medical tourism, particularly from neighboring countries seeking specialized interventions. Growth drivers include aging population, lifestyle-related cardiovascular diseases, and increasing awareness of preventive cardiac care.

Orthopedic Surgery demonstrates strong growth potential driven by sports-related injuries, aging population, and lifestyle factors. The segment benefits from advanced imaging technologies, minimally invasive techniques, and specialized rehabilitation programs. Joint replacement procedures show particular strength due to the active lifestyle preferences of UAE residents and medical tourists seeking high-quality orthopedic care.

Cosmetic Surgery represents a rapidly growing category with strong appeal to both local residents and medical tourists. The UAE’s position as a luxury destination and cultural acceptance of aesthetic procedures drive market expansion. Advanced techniques and internationally trained specialists contribute to the segment’s reputation for quality and safety.

Minimally Invasive Surgery across all specialties shows accelerating adoption rates due to patient preferences for reduced recovery times and improved outcomes. Healthcare providers invest heavily in training and equipment to meet growing demand for these advanced surgical approaches. Technology integration and surgeon expertise development remain critical success factors for this category.

Healthcare Providers benefit from the UAE’s strategic position as a regional medical hub, enabling access to diverse patient populations and premium pricing opportunities. The supportive regulatory environment, government healthcare investments, and infrastructure development create favorable operating conditions. Revenue diversification through medical tourism and specialized services provides financial stability and growth opportunities.

Medical Device Manufacturers gain access to a sophisticated healthcare market with high technology adoption rates and willingness to invest in advanced surgical equipment. The UAE serves as a regional distribution hub and testing ground for new medical technologies. Partnership opportunities with healthcare providers facilitate market entry and product development initiatives.

Healthcare Professionals benefit from career advancement opportunities, competitive compensation packages, and access to cutting-edge medical technologies. The UAE’s multicultural environment and international patient base provide diverse clinical experiences and professional development opportunities. Continuing education programs and research collaboration enhance professional growth prospects.

Patients receive access to world-class surgical care, advanced treatment options, and internationally accredited healthcare facilities. The competitive market environment drives quality improvement and service innovation while maintaining cost competitiveness compared to other international destinations. Medical tourism packages and comprehensive care programs enhance patient experience and outcomes.

Government Stakeholders achieve healthcare sector diversification objectives, economic development goals, and improved healthcare outcomes for residents. The surgical market contributes to GDP growth, employment creation, and the UAE’s reputation as a global healthcare destination. Knowledge economy development and medical research advancement support long-term strategic objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Health Integration represents a transformative trend reshaping surgical practices across the UAE. Healthcare providers are implementing electronic health records, telemedicine platforms, and AI-powered diagnostic tools to enhance surgical planning and patient care coordination. Remote monitoring systems and digital patient engagement platforms improve post-operative care and reduce hospital readmission rates.

Robotic Surgery Adoption continues accelerating across multiple surgical specialties, with healthcare facilities investing in advanced robotic platforms and surgeon training programs. The trend toward precision surgery and minimally invasive techniques drives demand for sophisticated surgical robots and navigation systems. Patient preferences for reduced scarring and faster recovery times support continued robotic surgery expansion.

Personalized Medicine and precision surgery approaches are gaining traction, with genetic testing, biomarker analysis, and individualized treatment protocols becoming standard practice. Genomic medicine integration into surgical planning enables more targeted interventions and improved patient outcomes. Healthcare providers are investing in molecular diagnostics and personalized treatment capabilities.

Sustainability Initiatives in healthcare operations are becoming increasingly important, with surgical facilities implementing green technologies, waste reduction programs, and energy-efficient systems. Environmental responsibility considerations influence equipment procurement, facility design, and operational procedures across the healthcare sector.

Value-Based Care models are emerging, with emphasis on patient outcomes, quality metrics, and cost-effectiveness rather than volume-based service delivery. Healthcare providers are developing outcome measurement systems and quality improvement programs to demonstrate value and attract patients seeking high-quality surgical care.

Infrastructure Expansion projects across the UAE continue to enhance surgical capacity and capabilities. Major hospital construction projects, surgical center developments, and medical city initiatives expand access to specialized surgical services. Healthcare zones and medical free zones attract international healthcare providers and medical technology companies to establish regional operations.

Technology Partnerships between UAE healthcare providers and international medical technology companies accelerate innovation adoption and clinical excellence. Collaborative agreements for robotic surgery systems, AI-powered diagnostics, and advanced imaging technologies enhance surgical capabilities. Research collaborations with academic institutions and medical device manufacturers drive clinical innovation and best practice development.

Regulatory Enhancements including updated medical device regulations, healthcare quality standards, and patient safety protocols strengthen the regulatory framework supporting surgical market growth. Accreditation programs and quality certification initiatives ensure international standards compliance and patient safety assurance.

Workforce Development initiatives including medical education programs, surgical training centers, and continuing professional development opportunities address skilled workforce requirements. International recruitment programs and residency training partnerships with leading medical institutions enhance surgical expertise and clinical capabilities.

Medical Tourism Promotion campaigns and healthcare diplomacy initiatives position the UAE as a premier destination for surgical procedures. Marketing partnerships with international healthcare facilitators and insurance providers expand patient access and market reach across target regions.

Strategic Focus on specialized surgical centers and niche procedures can provide competitive differentiation and premium pricing opportunities. Healthcare providers should consider developing centers of excellence for specific surgical specialties where they can achieve market leadership and attract regional patients. MarkWide Research analysis indicates that specialized facilities demonstrate higher profitability and patient satisfaction rates compared to general surgical services.

Technology Investment priorities should emphasize robotic surgery platforms, AI-powered diagnostic tools, and digital health integration systems that enhance surgical outcomes and operational efficiency. Healthcare facilities should develop comprehensive technology adoption strategies that include staff training, workflow optimization, and patient education components. Innovation partnerships with technology companies can accelerate implementation and reduce investment risks.

Market Expansion strategies should leverage the UAE’s strategic location and established healthcare reputation to capture growing regional demand for specialized surgical procedures. Healthcare providers should consider establishing satellite facilities, telemedicine services, and medical mission programs to extend market reach. Cross-border partnerships and healthcare diplomacy initiatives can facilitate market expansion and patient access.

Quality Differentiation through international accreditation, outcome measurement, and patient experience programs can justify premium pricing and attract discerning patients. Healthcare providers should invest in quality management systems, clinical excellence programs, and patient satisfaction initiatives. Transparency initiatives including outcome reporting and quality metrics publication can build trust and market reputation.

Workforce Development investments in surgical training, continuing education, and retention programs are essential for maintaining competitive advantages and clinical excellence. Healthcare providers should establish partnerships with medical schools, residency programs, and international training institutions to ensure adequate skilled workforce supply.

Market trajectory for the UAE surgical market remains strongly positive, with continued growth expected across all major segments and specialties. The combination of government support, infrastructure development, and regional demand growth creates favorable conditions for sustained market expansion. Growth projections indicate the market will maintain robust development with an estimated 8.5% CAGR over the next five years.

Technology evolution will continue driving market transformation, with artificial intelligence, machine learning, and precision medicine becoming standard components of surgical practice. Healthcare providers that successfully integrate these technologies while maintaining clinical excellence will capture disproportionate market share. Innovation adoption rates are expected to accelerate as technology costs decrease and clinical benefits become more evident.

Medical tourism expansion represents the most significant growth opportunity, with the UAE positioned to capture increasing regional and international demand for high-quality surgical procedures. MWR projections suggest medical tourism could account for 35% of total surgical procedures within the next decade, driven by healthcare infrastructure advantages and competitive positioning.

Regional integration and cross-border healthcare partnerships will create new opportunities for market expansion and service delivery optimization. The UAE’s role as a regional healthcare hub will strengthen through strategic partnerships, medical diplomacy initiatives, and healthcare export programs. Collaborative models with neighboring countries will enhance market reach and patient access.

Sustainability considerations and value-based care models will increasingly influence market development, with emphasis on environmental responsibility, cost-effectiveness, and patient outcomes. Healthcare providers that successfully balance quality, sustainability, and affordability will achieve competitive advantages in the evolving market landscape.

The UAE surgical market represents one of the most dynamic and promising healthcare sectors in the Middle East region, characterized by strong government support, advanced infrastructure, and growing regional demand. The market’s strategic positioning as a medical tourism destination, combined with substantial investments in technology and healthcare infrastructure, creates exceptional opportunities for sustained growth and development.

Market fundamentals remain robust, with diverse growth drivers including demographic trends, medical tourism expansion, technology adoption, and healthcare sector diversification initiatives. The competitive landscape fosters innovation and quality improvement while maintaining cost competitiveness compared to other international healthcare destinations. Regulatory support and streamlined business processes facilitate market entry and expansion for healthcare providers and medical technology companies.

Future prospects indicate continued market expansion across all major segments, with particular strength in specialized surgical procedures, robotic surgery, and minimally invasive techniques. The integration of digital health technologies, artificial intelligence, and precision medicine will further enhance the UAE’s competitive positioning and clinical capabilities. Strategic investments in workforce development, technology adoption, and quality improvement will determine market leadership positions.

Success factors for market participants include technology differentiation, quality excellence, strategic partnerships, and patient-centered service delivery. Healthcare providers that successfully combine clinical excellence with operational efficiency and patient experience will capture the greatest market opportunities. The UAE surgical market is well-positioned to achieve its vision of becoming a global healthcare hub while delivering exceptional value to patients, healthcare providers, and stakeholders across the healthcare ecosystem.

What is Surgical?

Surgical refers to medical procedures that involve the use of instruments to treat injuries, diseases, or deformities. This includes various types of surgeries such as orthopedic, cardiovascular, and cosmetic procedures.

What are the key players in the UAE Surgical Market?

Key players in the UAE Surgical Market include companies like Medtronic, Johnson & Johnson, and Stryker, which provide a range of surgical instruments and technologies. These companies are known for their innovative solutions in minimally invasive surgeries, robotic surgery systems, and surgical implants, among others.

What are the growth factors driving the UAE Surgical Market?

The UAE Surgical Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in surgical technologies, and a growing demand for minimally invasive procedures. Additionally, the rise in healthcare expenditure and the establishment of specialized surgical centers contribute to market growth.

What challenges does the UAE Surgical Market face?

Challenges in the UAE Surgical Market include high costs associated with advanced surgical technologies and a shortage of skilled surgical professionals. Regulatory hurdles and the need for continuous training and education in surgical techniques also pose significant challenges.

What opportunities exist in the UAE Surgical Market?

Opportunities in the UAE Surgical Market include the expansion of telemedicine and remote surgical consultations, as well as the development of innovative surgical devices. The increasing focus on patient safety and outcomes also presents avenues for growth in surgical practices.

What trends are shaping the UAE Surgical Market?

Trends in the UAE Surgical Market include the rise of robotic-assisted surgeries, the integration of artificial intelligence in surgical planning, and the growing emphasis on personalized medicine. These trends are transforming surgical practices and improving patient outcomes.

UAE Surgical Market

| Segmentation Details | Description |

|---|---|

| Product Type | Surgical Instruments, Surgical Sutures, Electrosurgical Devices, Surgical Implants |

| End User | Hospitals, Ambulatory Surgical Centers, Clinics, Research Laboratories |

| Technology | Robotic Surgery, Minimally Invasive Surgery, Laser Surgery, Traditional Surgery |

| Application | Orthopedic Surgery, Cardiovascular Surgery, Neurological Surgery, General Surgery |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Surgical Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at