444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE shared office space market represents one of the most dynamic and rapidly evolving commercial real estate segments in the Middle East region. This innovative workspace solution has transformed the traditional office landscape across major emirates, particularly in Dubai, Abu Dhabi, and Sharjah. The market encompasses various flexible workspace models including coworking spaces, serviced offices, hot desks, and private office suites that cater to diverse business needs.

Market dynamics indicate substantial growth driven by the UAE’s strategic position as a regional business hub, government initiatives supporting entrepreneurship, and the increasing adoption of flexible work arrangements. The sector has experienced remarkable expansion with growth rates exceeding 15% annually in recent years, reflecting strong demand from startups, SMEs, and multinational corporations seeking cost-effective and flexible workspace solutions.

Digital transformation and changing work patterns have significantly influenced market development, with operators investing heavily in technology infrastructure, community-building initiatives, and premium amenities. The market demonstrates resilience and adaptability, particularly following global workplace transformations that have emphasized flexibility, collaboration, and employee well-being as key business priorities.

The UAE shared office space market refers to the commercial real estate segment that provides flexible, fully-serviced workspace solutions to businesses and professionals on short-term or flexible lease arrangements. These spaces offer shared amenities, networking opportunities, and scalable office solutions without the long-term commitments and capital investments associated with traditional office leases.

Shared office spaces encompass various models including coworking environments where multiple companies and individuals work in open collaborative spaces, serviced offices that provide private offices with shared facilities, and hybrid solutions that combine elements of both approaches. These facilities typically include high-speed internet, meeting rooms, reception services, printing facilities, kitchen areas, and professional networking events.

Market participants include established coworking operators, real estate developers, hospitality companies, and technology-enabled workspace providers who create flexible environments designed to foster productivity, innovation, and business growth. The concept has evolved beyond simple desk rental to comprehensive business ecosystems that support entrepreneurship, collaboration, and professional development.

The UAE shared office space market has emerged as a cornerstone of the country’s evolving commercial real estate landscape, driven by robust demand from diverse business segments and supported by favorable government policies promoting entrepreneurship and innovation. The market demonstrates exceptional growth potential with occupancy rates averaging 78% across major operators, indicating strong market acceptance and sustainable demand patterns.

Key market drivers include the UAE’s position as a regional business hub, increasing startup ecosystem development, corporate cost optimization strategies, and evolving workforce preferences for flexible work arrangements. The market benefits from significant infrastructure investments, world-class telecommunications networks, and strategic government initiatives that support business formation and foreign investment.

Competitive landscape features both international operators and local players who have adapted global coworking concepts to meet regional business culture and requirements. Market differentiation occurs through location selection, amenity offerings, community programming, and technology integration that enhances user experience and operational efficiency.

Future prospects remain highly positive with continued expansion expected across secondary locations, integration of advanced technologies, and development of specialized workspace solutions targeting specific industries and business segments. The market is positioned to benefit from ongoing economic diversification efforts and the UAE’s commitment to becoming a global innovation hub.

Strategic market insights reveal several critical factors shaping the UAE shared office space landscape. The following key observations provide comprehensive understanding of market dynamics and growth opportunities:

Economic diversification initiatives represent the primary driver of UAE shared office space market growth. The government’s commitment to reducing oil dependency and developing knowledge-based industries has created substantial demand for flexible workspace solutions that support entrepreneurship, innovation, and business development across various sectors.

Startup ecosystem development significantly contributes to market expansion as the UAE has become a regional hub for entrepreneurial activity. Government programs, incubators, accelerators, and venture capital availability have fostered a thriving startup community that relies heavily on flexible workspace solutions for cost-effective operations and networking opportunities.

Corporate cost optimization strategies drive demand from established businesses seeking to reduce real estate expenses while maintaining operational flexibility. Companies increasingly recognize the benefits of shared office spaces for reducing overhead costs, accessing premium locations, and providing employees with modern, amenity-rich work environments without long-term lease commitments.

Workforce evolution and changing employee expectations regarding workplace flexibility, work-life balance, and collaborative environments support market growth. The rise of remote work, freelancing, and project-based employment creates sustained demand for flexible workspace solutions that accommodate diverse working styles and professional requirements.

Government policy support through business-friendly regulations, visa reforms, and initiatives promoting foreign investment and entrepreneurship creates favorable conditions for shared office space market development. Programs supporting SMEs, startups, and innovation-focused businesses directly benefit flexible workspace operators and their user communities.

High operational costs in prime locations present significant challenges for shared office space operators, particularly in premium areas of Dubai and Abu Dhabi where real estate prices remain elevated. These costs must be balanced against competitive pricing requirements to maintain accessibility for target user segments, creating pressure on profit margins and expansion capabilities.

Cultural adaptation challenges affect market penetration as traditional business practices and preferences for private offices remain prevalent among certain segments of the UAE business community. Overcoming these preferences requires significant investment in education, relationship building, and customized solutions that respect local business culture while promoting collaborative workspace benefits.

Economic volatility and cyclical downturns can significantly impact demand for flexible workspace solutions as businesses reduce expenses and postpone expansion plans. The market’s dependence on business formation rates and corporate growth makes it vulnerable to broader economic conditions and regional geopolitical factors that affect business confidence.

Regulatory complexity regarding commercial licensing, zoning requirements, and business setup procedures can create barriers for both operators and users of shared office spaces. Navigating different emirate-level regulations and ensuring compliance across multiple jurisdictions requires substantial resources and expertise.

Competition from traditional office space remains a constraint as landlords increasingly offer flexible lease terms and improved amenities to compete with shared office operators. This competition can limit market share growth and create pricing pressure that affects operator profitability and expansion strategies.

Secondary market expansion presents substantial growth opportunities as shared office space operators explore locations beyond traditional business districts. Emerging areas in Dubai, Abu Dhabi, and other emirates offer lower operational costs, growing business communities, and untapped demand from local enterprises and professionals seeking flexible workspace solutions.

Industry-specific solutions represent significant market potential through development of specialized coworking spaces targeting specific sectors such as technology, healthcare, media, finance, and creative industries. These focused environments can command premium pricing while providing tailored amenities, networking opportunities, and business support services that address sector-specific needs.

Technology integration opportunities enable operators to differentiate their offerings through advanced workspace management systems, IoT-enabled facilities, virtual reality meeting spaces, and AI-powered community matching platforms. These technological enhancements can improve operational efficiency, user experience, and revenue generation through value-added services.

Corporate partnership development offers substantial growth potential as large enterprises increasingly adopt flexible workspace strategies for project teams, satellite offices, and employee retention programs. Establishing strategic partnerships with multinational corporations can provide stable revenue streams and market credibility for shared office space operators.

Government sector engagement presents emerging opportunities as public sector organizations explore flexible workspace solutions for innovation labs, startup incubation programs, and collaborative projects with private sector partners. These partnerships can provide stable revenue sources while supporting broader economic development objectives.

Supply and demand dynamics in the UAE shared office space market demonstrate strong fundamentals with average occupancy rates maintaining 75-80% across established operators. Market equilibrium reflects careful capacity management by operators who balance expansion with demand growth to maintain healthy utilization rates and pricing power.

Pricing dynamics vary significantly based on location, amenities, and service levels, with premium locations commanding higher rates while emerging areas offer competitive pricing to attract users. Flexible pricing models including hourly, daily, monthly, and annual memberships provide options for diverse user segments and business requirements.

Competitive dynamics intensify as both international and local operators expand their presence, leading to innovation in service offerings, amenity packages, and community programming. Market leaders differentiate through location portfolios, technology platforms, and specialized services that create switching costs and user loyalty.

Investment dynamics show strong interest from real estate investors, private equity firms, and corporate venture capital seeking exposure to the growing flexible workspace sector. Capital availability supports expansion plans, technology investments, and market consolidation activities that shape competitive landscape evolution.

User behavior dynamics indicate increasing sophistication in workspace selection criteria, with factors such as community quality, networking opportunities, technology infrastructure, and sustainability practices becoming important decision factors beyond basic amenities and pricing considerations.

Comprehensive market research for the UAE shared office space market employs multiple data collection and analysis methodologies to ensure accuracy, reliability, and depth of insights. The research approach combines quantitative and qualitative techniques to capture market dynamics, competitive landscape, and future growth prospects.

Primary research activities include structured interviews with shared office space operators, real estate developers, corporate users, and industry experts to gather firsthand insights on market trends, challenges, and opportunities. Survey methodologies capture user preferences, satisfaction levels, and decision-making factors that influence workspace selection and utilization patterns.

Secondary research analysis incorporates government statistics, industry reports, real estate data, and economic indicators to establish market context and validate primary research findings. MarkWide Research databases provide historical trends, competitive intelligence, and market sizing information that supports comprehensive market analysis.

Market observation techniques involve site visits, facility assessments, and operational analysis of major shared office space providers to understand service delivery models, user experience factors, and operational efficiency metrics. This hands-on research approach provides practical insights into market dynamics and competitive positioning.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis techniques that identify trends, patterns, and market relationships. Quality assurance procedures maintain research integrity and reliability throughout the analysis process.

Dubai emirate dominates the UAE shared office space market with approximately 65% market share, driven by its position as a regional business hub, extensive infrastructure, and concentration of multinational corporations. Key areas including Dubai International Financial Centre (DIFC), Dubai Media City, and Dubai Internet City host numerous shared office operators serving diverse business communities.

Abu Dhabi market represents the second-largest segment with roughly 25% market share, characterized by government sector demand, oil and gas industry presence, and growing technology and innovation initiatives. The emirate’s focus on economic diversification and startup ecosystem development creates sustained demand for flexible workspace solutions.

Sharjah and Northern Emirates comprise emerging markets with combined market share of approximately 10%, offering growth opportunities through lower operational costs and increasing business activity. These markets attract operators seeking expansion opportunities and businesses requiring cost-effective workspace solutions outside major urban centers.

Free zone concentrations across all emirates represent significant market segments as these specialized business districts attract international companies and entrepreneurs requiring flexible workspace solutions. Free zones offer regulatory advantages, business setup facilitation, and concentrated professional communities that support shared office space demand.

Geographic expansion trends indicate movement toward suburban and secondary locations as operators seek to capture demand from growing residential communities and businesses seeking alternatives to expensive central business district locations. This expansion pattern creates opportunities for market penetration and user base diversification.

Market leadership in the UAE shared office space sector features a mix of international operators and regional players who have established strong market positions through strategic location selection, service differentiation, and community building initiatives. The competitive environment continues to evolve as new entrants and existing players expand their presence.

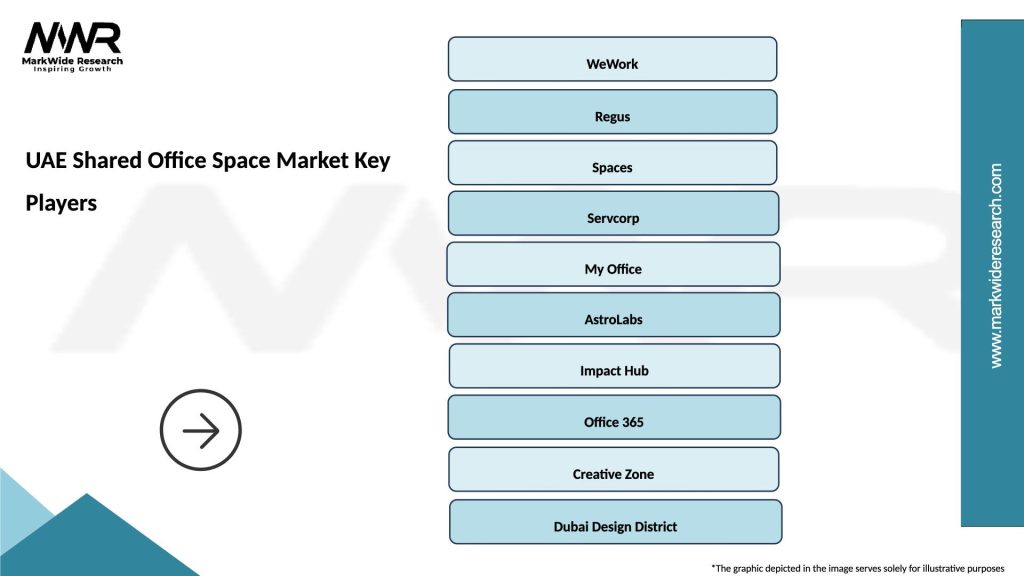

Key market participants include:

Competitive differentiation occurs through location portfolios, amenity packages, technology platforms, community programming, and pricing strategies that target specific user segments and business requirements. Market leaders invest heavily in user experience, operational efficiency, and brand development to maintain competitive advantages.

Market consolidation trends indicate potential for mergers, acquisitions, and strategic partnerships as operators seek to achieve scale economies, expand geographic coverage, and enhance service capabilities. These activities reshape competitive dynamics and market structure over time.

By Space Type:

By User Segment:

By Industry Focus:

Premium coworking spaces represent the fastest-growing segment with annual growth rates exceeding 20%, driven by demand for high-quality amenities, prime locations, and comprehensive business services. These facilities command premium pricing while providing exceptional user experiences, advanced technology infrastructure, and exclusive networking opportunities.

Budget-friendly options serve price-sensitive segments including startups, freelancers, and small businesses requiring basic workspace solutions without extensive amenities. This category focuses on operational efficiency, competitive pricing, and essential services that meet fundamental workspace requirements.

Industry-specific spaces demonstrate strong performance through targeted solutions for technology, finance, creative, and professional service sectors. These specialized environments provide tailored amenities, compliance features, and networking opportunities that address specific industry requirements and professional standards.

Corporate solutions emerge as a significant growth category as large enterprises adopt flexible workspace strategies for project teams, innovation labs, and employee retention programs. These solutions require customized service levels, security features, and integration capabilities that meet corporate standards and requirements.

Hybrid models combining coworking and traditional office elements gain popularity among businesses seeking flexibility while maintaining some level of privacy and control. These solutions provide scalable options that adapt to changing business needs and growth patterns.

For Businesses and Entrepreneurs:

For Real Estate Investors and Developers:

For Government and Economic Development:

Strengths:

Weaknesses:

Opportunities:

Threats:

Hybrid work model adoption represents the most significant trend shaping the UAE shared office space market as companies implement flexible work arrangements combining remote work with collaborative office time. This trend drives demand for flexible workspace solutions that accommodate varying occupancy patterns and support both individual productivity and team collaboration requirements.

Technology-enabled workspace management becomes increasingly important as operators invest in IoT sensors, mobile applications, and AI-powered platforms that optimize space utilization, enhance user experience, and provide data-driven insights for operational improvements. These technological enhancements differentiate operators and improve operational efficiency.

Wellness and sustainability focus influences workspace design and operations as users prioritize health-conscious environments, green building certifications, and sustainable practices. Operators respond by incorporating biophilic design elements, air quality monitoring, wellness programs, and environmentally responsible operational practices.

Community-centric programming evolves beyond basic networking events to include educational workshops, mentorship programs, industry-specific meetups, and business development initiatives that create value for members and strengthen user engagement. These programs become key differentiators in competitive markets.

Flexible membership models expand to include hourly access, day passes, project-based arrangements, and corporate packages that accommodate diverse user needs and budget requirements. This flexibility attracts broader user segments and increases market accessibility for various business types and professional situations.

Major expansion announcements from leading operators indicate continued market confidence with several international and regional players announcing new location openings across Dubai, Abu Dhabi, and emerging markets. These expansions reflect strong demand fundamentals and operator commitment to market growth despite economic uncertainties.

Strategic partnerships between shared office operators and real estate developers, hospitality companies, and technology providers create integrated solutions that enhance user experience and operational efficiency. These collaborations enable operators to access prime locations, leverage existing infrastructure, and offer comprehensive business solutions.

Technology platform launches by various operators introduce advanced booking systems, community networking applications, and workspace management tools that improve user experience and operational efficiency. MarkWide Research analysis indicates that technology adoption rates among operators have increased by over 40% in recent years.

Government initiative support includes new programs promoting entrepreneurship, startup incubation, and innovation hubs that directly benefit shared office space operators through increased demand and potential partnership opportunities. These initiatives strengthen market fundamentals and long-term growth prospects.

Investment activity remains robust with private equity firms, real estate investment trusts, and corporate venture capital continuing to invest in shared office space operators and related technology platforms. This capital availability supports market expansion and innovation initiatives across the sector.

Market entry strategies for new operators should focus on differentiation through specialized services, unique locations, or targeted user segments rather than competing directly with established players on price or general offerings. Success requires clear value propositions and sustainable competitive advantages that create user loyalty and pricing power.

Technology investment priorities should emphasize user experience enhancement, operational efficiency improvements, and data analytics capabilities that provide insights for business optimization. Operators investing in comprehensive technology platforms demonstrate better performance metrics and user satisfaction rates compared to those relying on basic service offerings.

Geographic expansion considerations suggest opportunities in secondary markets and emerging business districts where operational costs are lower and competition is less intense. However, market entry requires careful demand assessment and understanding of local business culture and requirements.

Partnership development strategies should target real estate developers, corporate clients, and government entities that can provide stable revenue streams, market credibility, and expansion opportunities. Strategic partnerships often prove more valuable than purely transactional relationships in building sustainable market positions.

Service portfolio optimization recommendations include developing specialized offerings for specific industries, corporate solutions for enterprise clients, and value-added services that generate additional revenue streams beyond basic workspace rental. Diversified service portfolios provide stability and growth opportunities in competitive markets.

Long-term market prospects for the UAE shared office space sector remain highly positive with continued growth expected across all emirates driven by economic diversification, entrepreneurship promotion, and evolving workplace preferences. MWR projections indicate sustained expansion with annual growth rates of 12-15% anticipated over the next five years.

Market evolution trends point toward increased specialization, technology integration, and service sophistication as operators compete for market share and user loyalty. Future success will depend on ability to adapt to changing user needs, economic conditions, and competitive dynamics while maintaining operational efficiency and profitability.

Geographic expansion is expected to continue with operators exploring opportunities in secondary locations, suburban areas, and specialized districts that offer lower costs and untapped demand. This expansion pattern will create more accessible workspace options and support broader economic development across the UAE.

Technology advancement will drive significant changes in workspace design, operations, and user experience with artificial intelligence, virtual reality, and IoT technologies becoming standard features rather than competitive differentiators. Operators must invest continuously in technology to remain competitive and meet evolving user expectations.

Market maturation will likely lead to consolidation activities, strategic partnerships, and increased focus on operational excellence as competition intensifies and growth rates moderate. Successful operators will be those that build sustainable competitive advantages through superior locations, exceptional service delivery, and strong community development.

The UAE shared office space market represents a dynamic and rapidly evolving sector that has become integral to the country’s commercial real estate landscape and economic development strategy. Strong fundamentals including government support, economic diversification initiatives, and changing workplace preferences create favorable conditions for sustained market growth and expansion opportunities.

Market participants benefit from the UAE’s strategic position as a regional business hub, world-class infrastructure, and diverse economy that generates consistent demand from various business segments and professional communities. The sector’s resilience and adaptability have been demonstrated through successful navigation of economic challenges and rapid adaptation to changing workplace requirements.

Future success in this market will require continued innovation, technology adoption, and service differentiation as competition intensifies and user expectations evolve. Operators that focus on community building, operational excellence, and strategic partnerships will be best positioned to capitalize on growth opportunities and build sustainable market positions in this dynamic and promising sector.

What is Shared Office Space?

Shared office space refers to a collaborative workspace where individuals or companies share office facilities and resources. This model is popular among freelancers, startups, and small businesses looking for flexible and cost-effective office solutions.

What are the key players in the UAE Shared Office Space Market?

Key players in the UAE Shared Office Space Market include WeWork, Regus, and Spaces, which offer a variety of flexible workspace solutions. These companies provide amenities such as meeting rooms, high-speed internet, and networking opportunities, among others.

What are the growth factors driving the UAE Shared Office Space Market?

The growth of the UAE Shared Office Space Market is driven by the increasing number of startups, the rise of remote work, and the demand for flexible leasing options. Additionally, the need for cost-effective office solutions is encouraging businesses to adopt shared workspaces.

What challenges does the UAE Shared Office Space Market face?

Challenges in the UAE Shared Office Space Market include intense competition among providers, fluctuating demand due to economic conditions, and the need for continuous innovation to meet evolving client needs. These factors can impact occupancy rates and profitability.

What opportunities exist in the UAE Shared Office Space Market?

Opportunities in the UAE Shared Office Space Market include the expansion of coworking spaces in emerging areas, the integration of technology for enhanced user experience, and the potential for partnerships with local businesses. These factors can help attract a diverse clientele.

What trends are shaping the UAE Shared Office Space Market?

Trends in the UAE Shared Office Space Market include the rise of hybrid work models, increased focus on wellness and sustainability in workspace design, and the growing popularity of niche coworking spaces tailored to specific industries. These trends are influencing how spaces are designed and utilized.

UAE Shared Office Space Market

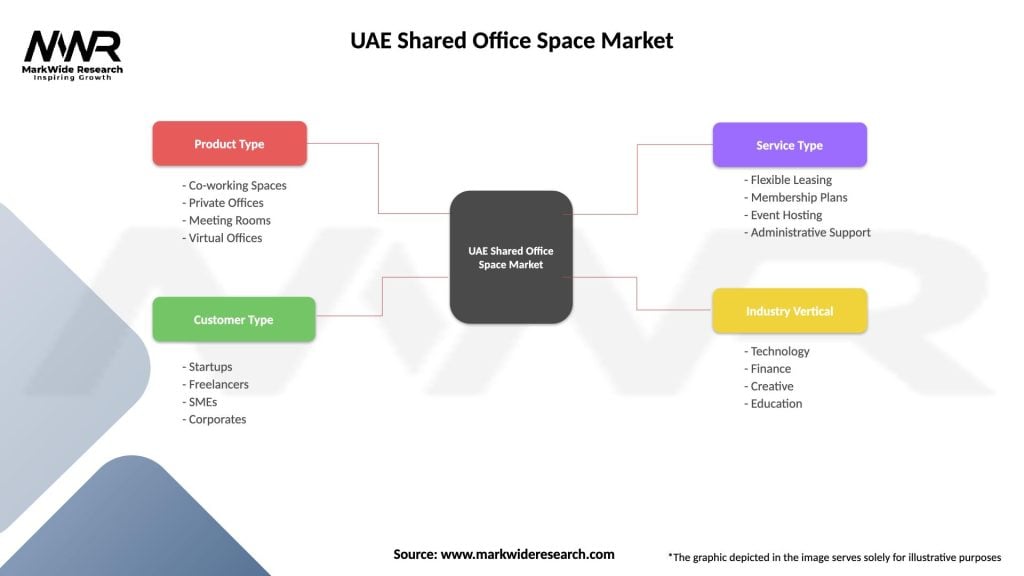

| Segmentation Details | Description |

|---|---|

| Product Type | Co-working Spaces, Private Offices, Meeting Rooms, Virtual Offices |

| Customer Type | Startups, Freelancers, SMEs, Corporates |

| Service Type | Flexible Leasing, Membership Plans, Event Hosting, Administrative Support |

| Industry Vertical | Technology, Finance, Creative, Education |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Shared Office Space Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at