444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE red meat market represents a dynamic and rapidly evolving sector within the nation’s food industry, characterized by substantial growth driven by population expansion, rising disposable incomes, and evolving consumer preferences. The market encompasses various protein sources including beef, lamb, mutton, and goat meat, serving both domestic consumption and re-export activities across the Gulf Cooperation Council region.

Market dynamics indicate robust expansion with the sector experiencing consistent growth at a compound annual growth rate (CAGR) of 6.2% over recent years. This growth trajectory reflects the UAE’s strategic position as a regional hub for food distribution and its commitment to food security initiatives. The market benefits from diverse supply chains, including domestic production, imports from established suppliers, and innovative alternative protein solutions.

Consumer behavior patterns show increasing demand for premium quality red meat products, with 78% of consumers prioritizing product quality and safety standards. The market serves a multicultural population with varied dietary preferences, creating opportunities for specialized product offerings and niche market segments. Import dependency remains significant, with the UAE sourcing red meat from over 40 countries worldwide to meet domestic demand.

The UAE red meat market refers to the comprehensive ecosystem encompassing the production, import, processing, distribution, and consumption of red meat products within the United Arab Emirates. This market includes traditional protein sources such as beef, lamb, mutton, and goat meat, along with processed meat products and value-added offerings that cater to diverse consumer segments across the seven emirates.

Market scope extends beyond simple commodity trading to include sophisticated supply chain management, cold storage facilities, halal certification processes, and retail distribution networks. The sector integrates local livestock production with international sourcing strategies, creating a resilient food supply system that supports both domestic consumption and regional trade activities.

Strategic positioning of the UAE red meat market reflects the nation’s commitment to food security and economic diversification objectives. The sector demonstrates remarkable resilience and adaptability, successfully navigating global supply chain challenges while maintaining consistent product availability and quality standards. Market penetration across different consumer segments shows balanced distribution, with 42% of consumption concentrated in urban centers and the remainder distributed across suburban and rural areas.

Investment flows into the sector have intensified, with significant capital allocation toward infrastructure development, technology adoption, and supply chain optimization. The market benefits from government support through strategic initiatives, regulatory frameworks, and international trade agreements that facilitate efficient sourcing and distribution operations.

Competitive landscape features a mix of established international suppliers, regional distributors, and local processors, creating a dynamic environment that promotes innovation and service excellence. Market leaders focus on differentiation through quality assurance, sustainable sourcing practices, and customer-centric service delivery models.

Consumer preferences within the UAE red meat market reveal sophisticated demand patterns that reflect the nation’s cosmopolitan character and economic prosperity. The following insights highlight critical market dynamics:

Population growth serves as the primary catalyst for UAE red meat market expansion, with demographic trends indicating sustained demand increases across all consumer segments. The nation’s population growth rate of 1.3% annually creates consistent market expansion opportunities, while immigration patterns contribute to diverse consumption preferences that broaden market scope.

Economic prosperity enables higher per capita consumption of premium protein products, with rising disposable incomes supporting market premiumization trends. The UAE’s strategic economic diversification initiatives create employment opportunities that strengthen consumer purchasing power and drive demand for quality food products.

Tourism industry growth generates substantial demand from the hospitality sector, with hotels, restaurants, and catering services requiring consistent supplies of high-quality red meat products. The tourism sector’s recovery and expansion create additional consumption channels that support market growth.

Government food security initiatives promote market development through strategic reserve programs, import facilitation policies, and infrastructure investments. These initiatives enhance market stability and encourage private sector participation in supply chain development activities.

Import dependency creates vulnerability to global supply chain disruptions, price volatility, and geopolitical tensions that can impact product availability and cost structures. The UAE’s reliance on international suppliers for 85% of red meat consumption necessitates sophisticated risk management strategies and diversified sourcing approaches.

Climate challenges limit domestic production capabilities, with harsh environmental conditions restricting local livestock farming operations. Water scarcity and extreme temperatures create operational constraints that impact production costs and scalability potential for domestic suppliers.

Regulatory compliance requirements impose additional costs and operational complexity, particularly regarding halal certification, food safety standards, and import documentation procedures. These requirements, while ensuring quality and safety, can create barriers for smaller market participants.

Price sensitivity among certain consumer segments limits market expansion opportunities, particularly for premium product categories. Economic fluctuations and currency exchange rate variations can impact affordability and consumption patterns across different demographic groups.

Technology integration presents significant opportunities for market enhancement through digital platforms, supply chain optimization, and customer engagement solutions. E-commerce adoption accelerates, with online grocery sales showing 25% annual growth rates that create new distribution channels and customer touchpoints.

Value-added processing offers differentiation opportunities through product innovation, convenience features, and specialized preparation methods. Market participants can capture higher margins by developing products that address specific consumer needs and preferences.

Regional expansion potential exists through the UAE’s strategic location and established trade relationships with neighboring countries. The nation’s position as a regional hub creates opportunities for re-export activities and supply chain services that extend market reach.

Sustainable sourcing initiatives align with global trends and consumer preferences, creating competitive advantages for companies that implement environmentally responsible practices. Traceability systems and sustainability certifications become valuable market differentiators.

Supply chain complexity characterizes the UAE red meat market, with multiple stakeholders coordinating activities across international borders to ensure consistent product availability. MarkWide Research analysis indicates that successful market participants invest heavily in supply chain visibility and risk management capabilities to maintain competitive positioning.

Demand fluctuations create both challenges and opportunities, with seasonal variations requiring sophisticated inventory management and forecasting capabilities. Religious observances, cultural celebrations, and tourism patterns influence consumption cycles that market participants must anticipate and accommodate.

Price dynamics reflect global commodity markets, currency exchange rates, and local competitive pressures. Market participants employ various strategies to manage price volatility, including long-term supplier contracts, hedging mechanisms, and flexible pricing models that maintain competitiveness while protecting margins.

Quality standards continue evolving as consumer expectations increase and regulatory requirements become more stringent. Companies invest in quality assurance systems, certification programs, and traceability technologies to meet market demands and maintain consumer trust.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research activities include stakeholder interviews, consumer surveys, and industry expert consultations that provide firsthand insights into market conditions and trends.

Secondary research incorporates government statistics, trade association reports, and industry publications to establish baseline data and validate primary research findings. This approach ensures comprehensive coverage of market dynamics and competitive landscape factors.

Data validation processes include cross-referencing multiple sources, statistical analysis, and expert review procedures that enhance research credibility and accuracy. Market projections utilize established forecasting models that account for historical trends and future growth drivers.

Quantitative analysis focuses on measurable market indicators including consumption patterns, price trends, and growth rates, while qualitative research explores consumer behavior, industry challenges, and strategic opportunities that shape market development.

Dubai emirate dominates the UAE red meat market with approximately 35% market share, driven by its large population, tourism industry, and commercial activity. The emirate’s sophisticated retail infrastructure and diverse consumer base create substantial demand for various red meat products and premium offerings.

Abu Dhabi represents the second-largest market segment with 28% market share, benefiting from government sector employment, oil industry activities, and strategic food security initiatives. The emirate’s focus on sustainability and food security creates opportunities for innovative supply chain solutions and local production initiatives.

Sharjah and Northern Emirates collectively account for 22% market share, with growing populations and industrial development driving consumption increases. These regions show strong potential for market expansion as infrastructure development and economic diversification activities accelerate.

Regional distribution networks connect the UAE market with neighboring GCC countries, creating opportunities for cross-border trade and supply chain optimization. The UAE’s strategic location enables efficient distribution to regional markets while benefiting from economies of scale in procurement and logistics operations.

Market leadership features a combination of international suppliers, regional distributors, and local processors that create a dynamic competitive environment. Leading companies differentiate through quality assurance, supply chain efficiency, and customer service excellence.

Competitive strategies emphasize quality differentiation, supply chain reliability, and customer relationship management. Market participants invest in technology, infrastructure, and human resources to maintain competitive advantages and capture market share growth opportunities.

Product segmentation within the UAE red meat market reflects diverse consumer preferences and application requirements across various market segments:

By Product Type:

By Distribution Channel:

Fresh meat category dominates market volume with consumers preferring unprocessed products for home preparation. This segment benefits from cultural cooking traditions and quality perceptions associated with fresh products. Cold chain infrastructure investments support category growth by ensuring product quality and safety throughout distribution networks.

Processed meat products show accelerated growth driven by lifestyle changes and convenience demands. Ready-to-cook items appeal to busy professionals and younger demographics, while traditional processed products maintain steady demand among established consumer segments.

Premium and organic segments demonstrate strong growth potential as affluent consumers prioritize quality and health considerations. These categories command higher margins and create differentiation opportunities for market participants willing to invest in specialized sourcing and marketing strategies.

Halal-certified products represent the dominant market category, with certification requirements influencing sourcing decisions, supplier selection, and processing operations. This category’s importance extends beyond religious compliance to encompass quality assurance and consumer trust factors.

Market participants benefit from the UAE’s strategic location, sophisticated infrastructure, and supportive regulatory environment that facilitate efficient business operations and market access. The nation’s commitment to food security creates stable demand conditions and government support for industry development initiatives.

Suppliers and exporters gain access to a affluent consumer market with growing demand for quality products. The UAE’s position as a regional hub provides opportunities for market expansion beyond domestic consumption to include re-export activities and regional distribution services.

Consumers benefit from product variety, quality assurance, and competitive pricing resulting from market competition and regulatory oversight. Food safety standards and halal certification requirements ensure product quality and religious compliance that meet diverse consumer needs.

Government stakeholders achieve food security objectives through market development, strategic reserves, and diversified supply chains that reduce dependency risks. The sector contributes to economic diversification goals while supporting employment and business development opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across the UAE red meat market, with companies investing in e-commerce platforms, mobile applications, and digital marketing strategies. Online grocery adoption shows sustained growth with 30% of consumers regularly purchasing meat products through digital channels.

Sustainability focus influences consumer purchasing decisions and corporate strategies, with companies implementing traceability systems, environmental certifications, and responsible sourcing practices. Carbon footprint reduction initiatives gain importance as environmental consciousness increases among consumers and stakeholders.

Premium product demand continues expanding as affluent consumers seek high-quality, specialty, and artisanal meat products. Grass-fed, organic, and antibiotic-free options command premium pricing and create differentiation opportunities for market participants.

Convenience orientation drives product innovation toward ready-to-cook, pre-marinated, and portion-controlled offerings that address busy lifestyles and cooking skill variations. Meal kit integration creates new distribution channels and value proposition opportunities.

Infrastructure investments enhance market capabilities through expanded cold storage facilities, automated processing equipment, and advanced logistics systems. These developments improve efficiency, reduce waste, and support market growth across all segments.

Technology adoption accelerates with companies implementing blockchain traceability, artificial intelligence for demand forecasting, and Internet of Things sensors for supply chain monitoring. MWR research indicates that technology investments improve operational efficiency by 15-20% while enhancing customer satisfaction.

Strategic partnerships between local distributors and international suppliers create integrated value chains that improve market responsiveness and cost competitiveness. These collaborations enhance product availability while reducing supply chain risks.

Regulatory enhancements strengthen food safety standards, streamline import procedures, and support market transparency initiatives. Government investments in inspection capabilities and certification systems improve consumer confidence and market integrity.

Market participants should prioritize supply chain diversification strategies that reduce dependency risks while maintaining cost competitiveness. Multiple sourcing relationships and strategic inventory management help mitigate supply disruptions and price volatility impacts.

Technology investments offer significant returns through operational efficiency improvements and customer engagement enhancements. Companies should focus on digital platforms, automation technologies, and data analytics capabilities that create competitive advantages.

Product differentiation through quality, convenience, and sustainability features provides market positioning opportunities in an increasingly competitive environment. Brand development and customer loyalty programs support premium pricing strategies and market share protection.

Regional expansion strategies leverage the UAE’s strategic location and trade relationships to access broader markets while achieving economies of scale. Cross-border opportunities require careful market analysis and regulatory compliance planning.

Market growth prospects remain positive with demographic trends, economic development, and infrastructure investments supporting sustained expansion. MarkWide Research projections indicate continued growth momentum with the market expected to maintain a compound annual growth rate of 5.8% over the next five years.

Technology integration will accelerate market transformation through improved efficiency, enhanced customer experiences, and innovative product offerings. Artificial intelligence and automation technologies will optimize supply chain operations while reducing costs and improving service quality.

Sustainability initiatives will become increasingly important as environmental consciousness grows among consumers and regulatory requirements evolve. Companies that proactively implement sustainable practices will gain competitive advantages and market positioning benefits.

Regional integration opportunities will expand as GCC economic cooperation deepens and trade barriers continue reducing. The UAE’s position as a regional hub will strengthen, creating additional growth opportunities for market participants with regional expansion capabilities.

The UAE red meat market represents a dynamic and growing sector with substantial opportunities for market participants willing to invest in quality, innovation, and customer service excellence. Despite challenges related to import dependency and climate limitations, the market benefits from strong demographic trends, economic prosperity, and supportive infrastructure that create favorable conditions for sustained growth.

Strategic success in this market requires comprehensive understanding of consumer preferences, regulatory requirements, and competitive dynamics. Companies that prioritize supply chain reliability, product quality, and customer satisfaction will be best positioned to capture market share and achieve sustainable growth in this evolving marketplace.

Future market development will be shaped by technology adoption, sustainability initiatives, and regional integration trends that create both opportunities and challenges for industry participants. The UAE’s commitment to food security and economic diversification ensures continued government support for market development while maintaining the regulatory framework necessary for consumer protection and industry growth.

What is Red Meat?

Red meat refers to meat that is red when raw and includes beef, lamb, and goat. It is a significant source of protein and essential nutrients in many diets, particularly in regions where it is a staple food.

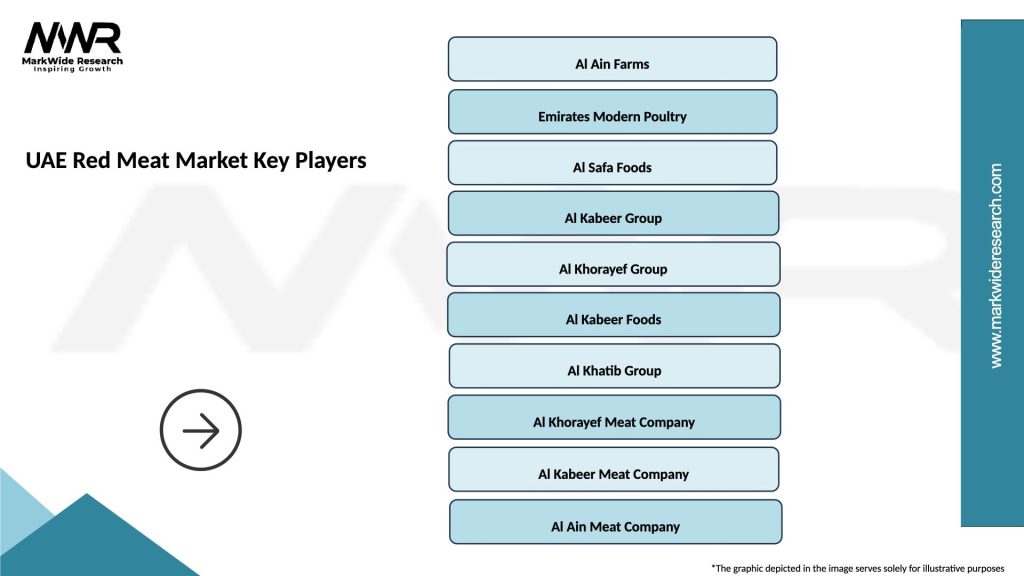

What are the key players in the UAE Red Meat Market?

Key players in the UAE Red Meat Market include Al Ain Farms, Al Safa Foods, and Emirates Meat Company, among others. These companies are involved in various aspects of production, processing, and distribution of red meat products.

What are the growth factors driving the UAE Red Meat Market?

The growth of the UAE Red Meat Market is driven by increasing consumer demand for high-protein diets, a growing population, and the rise of the food service industry. Additionally, cultural preferences for red meat in traditional dishes contribute to market expansion.

What challenges does the UAE Red Meat Market face?

The UAE Red Meat Market faces challenges such as fluctuating meat prices, supply chain disruptions, and increasing competition from alternative protein sources. Regulatory compliance and sustainability concerns also pose significant hurdles for market players.

What opportunities exist in the UAE Red Meat Market?

Opportunities in the UAE Red Meat Market include the potential for product innovation, such as organic and grass-fed options, and the expansion of e-commerce platforms for meat sales. Additionally, increasing tourism can boost demand in the hospitality sector.

What trends are shaping the UAE Red Meat Market?

Trends in the UAE Red Meat Market include a growing preference for locally sourced and ethically produced meat, as well as an increase in meat alternatives. Health-conscious consumers are also driving demand for leaner cuts and value-added products.

UAE Red Meat Market

| Segmentation Details | Description |

|---|---|

| Product Type | Beef, Lamb, Goat, Poultry |

| Distribution Channel | Supermarkets, Online Retail, Butcher Shops, Wholesale |

| End User | Restaurants, Households, Hotels, Catering Services |

| Packaging Type | Vacuum Sealed, Chilled, Frozen, Canned |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Red Meat Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at