444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE real time payments market represents a transformative segment of the nation’s financial technology landscape, driving unprecedented innovation in digital payment solutions. This dynamic market encompasses instant payment systems that enable immediate fund transfers between financial institutions, businesses, and consumers across the United Arab Emirates. Real time payment systems have emerged as a cornerstone of the UAE’s digital economy, facilitating seamless transactions that support the country’s vision of becoming a cashless society.

Market dynamics indicate robust growth driven by government initiatives, technological advancement, and changing consumer preferences toward digital payment methods. The UAE’s strategic position as a regional financial hub has accelerated the adoption of instant payment solutions, with financial institutions investing heavily in infrastructure development. Digital transformation initiatives across banking and fintech sectors have created a competitive environment fostering innovation in real time payment technologies.

Growth projections suggest the market will expand at a compound annual growth rate of 12.5% through the forecast period, supported by increasing smartphone penetration and government digitization programs. The integration of artificial intelligence and blockchain technology into payment systems has enhanced security and efficiency, driving broader market acceptance among businesses and consumers alike.

The UAE real time payments market refers to the comprehensive ecosystem of financial services and technologies that enable instantaneous electronic fund transfers between participating financial institutions and their customers within the United Arab Emirates. Real time payment systems process transactions immediately, typically within seconds, providing instant confirmation and settlement compared to traditional payment methods that may take hours or days to complete.

Core components of this market include payment infrastructure, clearing and settlement systems, mobile payment applications, and regulatory frameworks that govern instant payment operations. These systems operate continuously, processing transactions around the clock to meet the demands of modern digital commerce and consumer expectations for immediate payment processing.

Technology integration encompasses various payment channels including mobile banking applications, point-of-sale terminals, online payment gateways, and peer-to-peer transfer platforms. The market facilitates both person-to-person transfers and business-to-business transactions, supporting diverse use cases from retail purchases to corporate payments and government services.

Strategic analysis reveals the UAE real time payments market as a rapidly evolving sector characterized by strong government support, technological innovation, and increasing consumer adoption. The market benefits from the UAE’s advanced telecommunications infrastructure and progressive regulatory environment that encourages fintech innovation while maintaining robust security standards.

Key market drivers include the UAE’s National Payment System strategy, which aims to reduce cash dependency by 75% by 2026, and the widespread adoption of digital banking services accelerated by recent global events. Financial institutions are investing significantly in upgrading their payment infrastructure to support real time processing capabilities and meet evolving customer expectations.

Competitive landscape features a mix of traditional banks, fintech startups, and international payment service providers, all competing to capture market share in this high-growth segment. The integration of central bank digital currency initiatives and cross-border payment solutions presents additional opportunities for market expansion and innovation.

Market challenges include cybersecurity concerns, regulatory compliance requirements, and the need for interoperability between different payment systems. However, ongoing investments in security infrastructure and collaborative industry initiatives are addressing these challenges while maintaining market growth momentum.

Market intelligence indicates several critical insights shaping the UAE real time payments landscape. Consumer behavior has shifted dramatically toward digital payment preferences, with mobile payment adoption reaching 68% penetration among smartphone users in urban areas.

Technology trends show increasing integration of biometric authentication, artificial intelligence for fraud prevention, and blockchain technology for enhanced security and transparency in payment processing.

Primary growth drivers propelling the UAE real time payments market include comprehensive government digitization initiatives that prioritize cashless transaction adoption. The UAE Vision 2071 and associated digital transformation programs have created a supportive ecosystem for payment innovation, encouraging both public and private sector investment in real time payment infrastructure.

Consumer demand for instant payment solutions has intensified, driven by changing lifestyle patterns and expectations for immediate transaction processing. The proliferation of e-commerce platforms and digital services has created natural demand for seamless payment experiences that real time systems uniquely provide.

Technological advancement in mobile connectivity and smartphone adoption has enabled widespread access to digital payment services. The UAE’s advanced telecommunications infrastructure supports reliable real time payment processing, while 5G network deployment promises to enhance transaction speed and reliability further.

Banking sector transformation initiatives have accelerated as financial institutions recognize the competitive necessity of offering instant payment capabilities. Traditional banks are modernizing their core systems to support real time processing, while new fintech entrants are introducing innovative payment solutions that challenge established market players.

Regulatory support from the Central Bank of the UAE has provided clear frameworks for real time payment system development, encouraging innovation while maintaining appropriate oversight and consumer protection measures.

Cybersecurity concerns represent significant challenges for real time payment system adoption, as instant transaction processing creates potential vulnerabilities that malicious actors may exploit. Financial institutions must invest heavily in advanced security infrastructure to protect against fraud and cyber attacks, increasing operational costs and complexity.

Regulatory compliance requirements impose substantial operational burdens on payment service providers, particularly regarding anti-money laundering and know-your-customer procedures. These compliance obligations can slow system implementation and increase costs for market participants.

Technical integration challenges arise when connecting diverse payment systems and ensuring interoperability between different platforms and financial institutions. Legacy banking systems may require significant upgrades to support real time payment processing, creating implementation barriers and costs.

Consumer education needs remain substantial, as many users require guidance on digital payment security practices and system capabilities. Limited digital literacy among certain demographic segments can slow adoption rates and market penetration.

Infrastructure dependencies on telecommunications networks and power systems create potential points of failure that could disrupt real time payment services. Market participants must invest in redundant systems and backup capabilities to ensure service reliability.

Cross-border payment expansion presents substantial growth opportunities as the UAE strengthens economic ties with regional and international partners. Real time payment corridors connecting the UAE with other GCC countries and major trading partners could significantly expand market scope and transaction volumes.

Central Bank Digital Currency initiatives offer transformative potential for the real time payments market, as digital dirham implementation could revolutionize payment processing and create new business models for financial service providers.

Small and medium enterprise adoption represents an underserved market segment with significant growth potential. Tailored real time payment solutions for SMEs could address specific business needs while expanding the overall market addressable base.

Internet of Things integration opportunities are emerging as connected devices require seamless payment capabilities for autonomous transactions. Smart city initiatives and IoT deployment create demand for embedded payment solutions that operate in real time.

Financial inclusion initiatives targeting underbanked populations could expand market reach while supporting social development objectives. Real time payment systems can provide accessible financial services to previously excluded demographic segments.

Islamic finance integration presents unique opportunities to develop Sharia-compliant real time payment solutions that serve the UAE’s diverse population while potentially expanding to other Islamic finance markets globally.

Competitive dynamics within the UAE real time payments market reflect intense rivalry between traditional banking institutions and innovative fintech companies. Established banks leverage their customer bases and regulatory relationships, while fintech startups introduce agile solutions and user-centric experiences that challenge conventional approaches.

Technology evolution drives continuous market transformation as artificial intelligence, machine learning, and blockchain technologies enhance payment system capabilities. These technological advances improve fraud detection accuracy by 85% while reducing transaction processing times and operational costs.

Regulatory evolution shapes market development through progressive policies that balance innovation encouragement with consumer protection requirements. The Central Bank of the UAE’s regulatory sandbox program enables controlled testing of new payment technologies while maintaining system stability.

Consumer behavior shifts toward digital-first payment preferences create market momentum, with younger demographics leading adoption trends. MarkWide Research analysis indicates that millennials and Gen Z consumers drive 78% of mobile payment growth in the UAE market.

Partnership ecosystems are forming between banks, fintech companies, telecommunications providers, and technology vendors to deliver comprehensive real time payment solutions. These collaborative relationships accelerate innovation while sharing development costs and risks among participants.

Comprehensive analysis of the UAE real time payments market employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes structured interviews with industry executives, financial institution leaders, fintech entrepreneurs, and regulatory officials to gather firsthand market intelligence.

Secondary research encompasses analysis of government publications, central bank reports, industry studies, and financial statements from key market participants. This approach provides quantitative data and trend analysis that supports primary research findings.

Market modeling techniques utilize statistical analysis and forecasting methods to project market growth trajectories and identify emerging trends. These models incorporate economic indicators, demographic data, and technology adoption patterns to generate reliable market projections.

Expert validation processes involve consultation with payment industry specialists, technology experts, and regulatory professionals to verify research findings and ensure analytical accuracy. This validation step enhances the credibility and reliability of market insights.

Data triangulation methods cross-reference information from multiple sources to confirm market trends and eliminate potential biases in individual data sources. This rigorous approach ensures comprehensive and balanced market analysis.

Dubai emirate leads the UAE real time payments market, accounting for approximately 45% of total transaction volumes due to its status as the country’s commercial and financial center. The emirate’s advanced infrastructure and diverse business ecosystem create ideal conditions for payment innovation and adoption.

Abu Dhabi represents the second-largest market segment, driven by government sector digitization initiatives and the presence of major financial institutions. The capital’s focus on smart city development has accelerated real time payment system deployment across public services and utilities.

Sharjah and Northern Emirates show rapid growth in real time payment adoption, particularly in retail and small business segments. These regions benefit from spillover effects from Dubai and Abu Dhabi while developing their own fintech ecosystems.

Cross-emirate connectivity ensures seamless payment processing throughout the UAE, with standardized systems enabling instant transfers between different emirates. This integration supports the country’s unified digital payment strategy and enhances user experience.

Regional expansion initiatives are connecting UAE real time payment systems with neighboring GCC countries, creating broader payment corridors that facilitate regional trade and economic integration.

Market leadership in the UAE real time payments sector is distributed among several key players, each bringing unique strengths and capabilities to the competitive landscape.

Competitive strategies focus on user experience enhancement, security improvement, and service expansion to capture market share in this rapidly growing sector. Companies are investing in artificial intelligence and machine learning capabilities to differentiate their offerings.

By Transaction Type:

By Technology Platform:

By End User:

Mobile payment applications dominate the UAE real time payments market, representing the fastest-growing segment with annual growth rates exceeding 15%. These platforms benefit from widespread smartphone adoption and user preference for convenient, accessible payment methods.

Person-to-person transfers constitute the largest transaction volume category, driven by the UAE’s diverse expatriate population that frequently sends money to family members domestically and internationally. This segment shows consistent growth as digital payment adoption increases.

Business-to-business payments represent significant value potential as companies seek to streamline their payment processes and improve cash flow management. Real time B2B payments reduce settlement times and enhance business efficiency, driving adoption among corporate users.

Government payment initiatives are expanding rapidly as public sector digitization programs implement real time payment capabilities for citizen services, utility payments, and tax collection. These initiatives demonstrate government commitment to digital transformation while improving service delivery.

Cross-border payment capabilities are becoming increasingly important as the UAE strengthens its position as a regional financial hub. Real time international payment corridors facilitate trade and remittances while supporting economic diversification objectives.

Financial institutions benefit from real time payment systems through improved operational efficiency, reduced processing costs, and enhanced customer satisfaction. These systems enable banks to offer competitive services while generating new revenue streams from payment processing fees and value-added services.

Businesses and merchants gain significant advantages from instant payment receipt, improved cash flow management, and reduced payment processing complexity. Real time payments eliminate the uncertainty of traditional payment clearing times, enabling better financial planning and working capital optimization.

Consumers enjoy enhanced convenience, immediate transaction confirmation, and improved payment security through advanced authentication methods. Real time payment systems provide 24/7 availability and instant fund transfers that meet modern lifestyle requirements.

Government entities achieve improved service delivery, reduced administrative costs, and enhanced transparency in public financial transactions. Real time payment systems support digital government initiatives while improving citizen experience and reducing bureaucratic inefficiencies.

Technology providers access growing market opportunities through infrastructure development, software solutions, and security services required to support real time payment ecosystems. These companies benefit from ongoing system upgrades and expansion requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming real time payment systems through enhanced fraud detection, personalized user experiences, and predictive analytics capabilities. AI-powered systems can identify suspicious transactions within milliseconds while learning from user behavior patterns to improve security and convenience.

Blockchain technology adoption is increasing as payment providers seek to enhance transaction transparency, security, and cross-border payment efficiency. Distributed ledger technology offers potential solutions for complex payment routing and settlement challenges.

Biometric authentication methods are becoming standard features in real time payment applications, with fingerprint, facial recognition, and voice authentication improving security while simplifying user access. These technologies reduce fraud risk while enhancing user experience.

Open banking initiatives are creating new opportunities for payment innovation through API-based integration and third-party service development. These frameworks enable fintech companies to build innovative payment solutions while maintaining security and regulatory compliance.

Sustainability focus is driving development of environmentally conscious payment solutions that reduce paper usage and carbon footprint compared to traditional payment methods. Digital-first approaches align with UAE sustainability objectives and corporate responsibility initiatives.

Central Bank initiatives have accelerated market development through the launch of the UAE’s Instant Payment Platform, which provides standardized infrastructure for real time payment processing across participating financial institutions. This initiative represents a significant milestone in payment system modernization.

Partnership announcements between traditional banks and fintech companies are reshaping the competitive landscape, with collaborative approaches enabling rapid innovation and market expansion. These partnerships combine banking expertise with technological agility to deliver enhanced payment solutions.

International expansion efforts by UAE-based payment companies are establishing the country as a regional fintech hub, with several companies launching services in neighboring markets and attracting international investment.

Technology investments in artificial intelligence, blockchain, and cybersecurity infrastructure are strengthening the UAE’s position as a leader in payment innovation. MWR data indicates that technology spending in the payment sector has increased by 40% over the past two years.

Regulatory developments including updated payment service provider licensing requirements and consumer protection measures are creating a more robust framework for market growth while maintaining appropriate oversight and security standards.

Strategic recommendations for market participants include prioritizing cybersecurity investments to build consumer trust and regulatory compliance. Companies should allocate significant resources to advanced security infrastructure and fraud prevention systems to maintain competitive advantage and market credibility.

Partnership strategies should focus on creating comprehensive payment ecosystems that serve diverse customer needs while leveraging complementary capabilities. Collaboration between banks, fintech companies, and technology providers can accelerate innovation and market penetration.

Customer education initiatives are essential for driving adoption among less digitally savvy segments of the population. Companies should invest in user-friendly interfaces, educational content, and customer support to broaden their market reach and improve user experience.

Technology roadmaps should incorporate emerging technologies like artificial intelligence, blockchain, and biometric authentication to maintain competitive positioning and meet evolving customer expectations. Early adoption of innovative technologies can provide significant competitive advantages.

Regulatory engagement is crucial for navigating the evolving policy landscape and influencing favorable regulatory developments. Active participation in industry associations and regulatory consultations can help shape market-friendly policies while ensuring compliance.

Growth projections for the UAE real time payments market remain highly positive, with continued expansion expected across all major segments. The market is positioned to benefit from ongoing digital transformation initiatives, increasing smartphone penetration, and evolving consumer payment preferences.

Technology evolution will continue driving market innovation, with artificial intelligence, blockchain, and biometric authentication becoming standard features in payment systems. These technologies will enhance security, improve user experience, and enable new payment use cases and business models.

Regional integration initiatives will expand market opportunities through cross-border payment corridors and harmonized regulatory frameworks across GCC countries. These developments will position the UAE as a regional payment hub while facilitating trade and economic integration.

Central bank digital currency implementation could fundamentally transform the payment landscape, creating new opportunities for innovation while potentially disrupting existing business models. Market participants should prepare for this technological shift through strategic planning and infrastructure development.

Market maturation will likely lead to consolidation among smaller players while creating opportunities for specialized service providers. Companies that establish strong market positions and technological capabilities are expected to benefit from this evolution. MarkWide Research projects that market concentration will increase as successful companies expand their market share through organic growth and strategic acquisitions.

The UAE real time payments market represents a dynamic and rapidly evolving sector that is fundamental to the country’s digital transformation objectives and economic diversification strategy. Strong government support, advanced infrastructure, and progressive regulatory frameworks have created an environment conducive to innovation and growth in payment technologies.

Market fundamentals remain robust, with increasing consumer adoption, business digitization, and technological advancement driving sustained growth across all market segments. The integration of artificial intelligence, blockchain technology, and biometric authentication is enhancing system capabilities while improving security and user experience.

Competitive dynamics will continue evolving as traditional financial institutions and innovative fintech companies compete and collaborate to capture market opportunities. Success in this market requires strategic focus on customer experience, security, and technological innovation while maintaining regulatory compliance and operational excellence.

Future prospects for the UAE real time payments market appear highly favorable, with continued growth expected through expanding use cases, regional integration, and emerging technologies. Companies that invest in advanced capabilities, strategic partnerships, and customer-centric solutions are well-positioned to capitalize on the significant opportunities this market presents in supporting the UAE’s vision of becoming a leading digital economy.

What is Real Time Payments?

Real Time Payments refer to payment systems that allow for the immediate transfer of funds between bank accounts, enabling transactions to be completed in real-time. This system enhances the efficiency of financial transactions across various sectors, including retail, e-commerce, and services.

What are the key players in the UAE Real Time Payments Market?

Key players in the UAE Real Time Payments Market include Emirates NBD, Abu Dhabi Commercial Bank, and Mashreq Bank, among others. These institutions are actively involved in developing and implementing real-time payment solutions to enhance customer experience and streamline transactions.

What are the growth factors driving the UAE Real Time Payments Market?

The growth of the UAE Real Time Payments Market is driven by increasing smartphone penetration, the rise of e-commerce, and a growing preference for digital payment solutions. Additionally, government initiatives to promote cashless transactions are further fueling market expansion.

What challenges does the UAE Real Time Payments Market face?

The UAE Real Time Payments Market faces challenges such as cybersecurity threats, regulatory compliance issues, and the need for interoperability among different payment systems. These factors can hinder the seamless adoption of real-time payment solutions.

What opportunities exist in the UAE Real Time Payments Market?

Opportunities in the UAE Real Time Payments Market include the potential for innovation in payment technologies, the expansion of cross-border payment solutions, and the increasing demand for faster transaction methods among consumers and businesses.

What trends are shaping the UAE Real Time Payments Market?

Trends shaping the UAE Real Time Payments Market include the integration of artificial intelligence for fraud detection, the rise of contactless payments, and the growing adoption of blockchain technology for secure transactions. These innovations are enhancing the overall payment experience.

UAE Real Time Payments Market

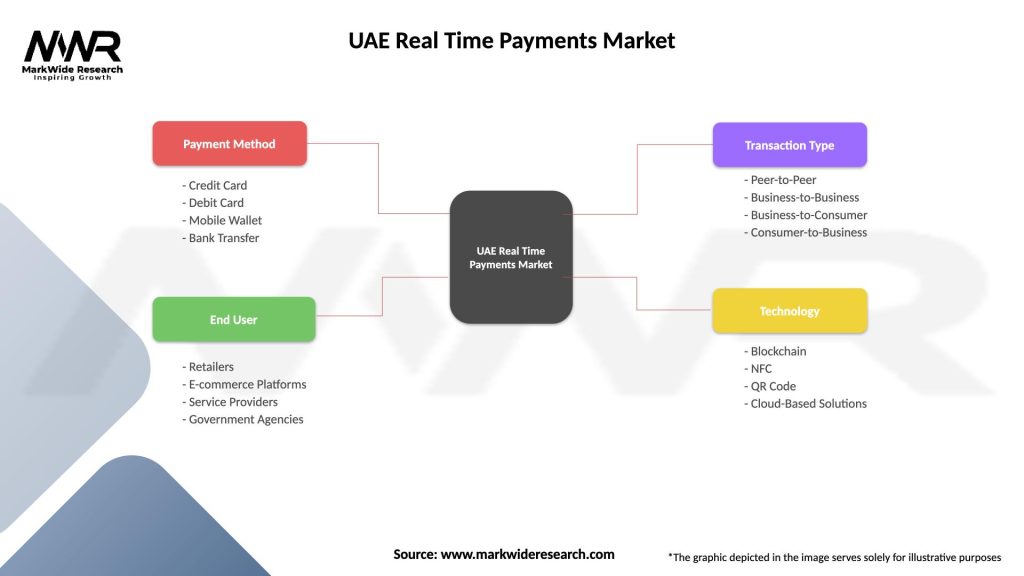

| Segmentation Details | Description |

|---|---|

| Payment Method | Credit Card, Debit Card, Mobile Wallet, Bank Transfer |

| End User | Retailers, E-commerce Platforms, Service Providers, Government Agencies |

| Transaction Type | Peer-to-Peer, Business-to-Business, Business-to-Consumer, Consumer-to-Business |

| Technology | Blockchain, NFC, QR Code, Cloud-Based Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Real Time Payments Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at