444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE prefab wood buildings market represents a rapidly evolving sector within the country’s construction industry, driven by increasing demand for sustainable and cost-effective building solutions. Prefabricated wooden structures are gaining significant traction across the Emirates as developers, contractors, and homeowners recognize the numerous advantages these innovative construction methods offer. The market encompasses various applications including residential housing, commercial buildings, educational facilities, and recreational structures.

Market dynamics indicate robust growth potential, with the sector experiencing a 12.5% annual growth rate as sustainability concerns and construction efficiency requirements drive adoption. The UAE’s commitment to environmental sustainability, coupled with the government’s vision for diversified construction methodologies, has created favorable conditions for prefab wood building solutions. Advanced manufacturing techniques and improved wood treatment technologies have enhanced the durability and appeal of these structures in the region’s challenging climate.

Regional adoption varies across the Emirates, with Dubai and Abu Dhabi leading in terms of project implementation and regulatory support. The market benefits from increasing awareness of green building practices and the UAE’s strategic focus on reducing carbon emissions in the construction sector. Prefabricated construction methods offer significant advantages including reduced construction time, lower labor costs, and enhanced quality control compared to traditional building approaches.

The UAE prefab wood buildings market refers to the commercial sector encompassing the design, manufacturing, distribution, and installation of prefabricated wooden structures within the United Arab Emirates. Prefabricated wood buildings are structures where components are manufactured off-site in controlled factory environments before being transported and assembled at the final construction location.

These buildings utilize engineered wood products, sustainable timber materials, and advanced joinery techniques to create structures that meet modern construction standards while offering environmental benefits. The market includes various building types from single-family homes and multi-unit residential complexes to commercial offices, educational facilities, and specialized structures like visitor centers and recreational buildings.

Key characteristics of this market include emphasis on sustainable sourcing, compliance with UAE building codes, integration of modern amenities, and adaptation to local climate conditions. The sector represents a shift toward more efficient construction methodologies that align with the UAE’s sustainability goals and economic diversification strategies.

The UAE prefab wood buildings market demonstrates exceptional growth potential as the construction industry embraces sustainable and efficient building methodologies. Market expansion is driven by several key factors including government support for green construction, increasing environmental awareness, and the proven benefits of prefabricated construction approaches.

Residential applications currently dominate market demand, accounting for approximately 68% of total market activity, while commercial and institutional projects represent growing segments. The market benefits from technological advancements in wood treatment, improved fire resistance capabilities, and enhanced structural engineering that addresses regional climate challenges.

Competitive dynamics feature both international manufacturers establishing regional presence and local companies developing specialized capabilities. The market landscape includes established European and North American prefab specialists alongside emerging regional players who understand local market requirements and regulatory frameworks.

Future prospects remain highly positive, supported by continued government emphasis on sustainable construction, increasing project complexity, and growing acceptance of prefabricated solutions among developers and end-users. The integration of smart building technologies and renewable energy systems further enhances the appeal of prefab wood buildings in the UAE market.

Market insights reveal several critical trends shaping the UAE prefab wood buildings sector:

Several key factors drive growth in the UAE prefab wood buildings market, creating sustained demand across multiple sectors. Environmental sustainability represents the primary driver, as the UAE government and private sector increasingly prioritize carbon emission reduction and sustainable construction practices. The country’s commitment to achieving net-zero emissions by 2050 directly supports adoption of eco-friendly building solutions.

Construction efficiency requirements significantly influence market growth, with developers seeking faster project delivery and reduced labor dependency. Prefabricated construction methods address these needs by enabling parallel manufacturing and site preparation activities, substantially reducing overall project timelines. The controlled factory environment also ensures consistent quality standards regardless of weather conditions or on-site variables.

Economic factors contribute to market expansion through cost optimization opportunities and improved resource utilization. While initial material costs may be higher, the overall project economics often favor prefab solutions due to reduced labor requirements, minimized waste generation, and faster occupancy timelines. Additionally, the UAE’s focus on economic diversification supports innovative construction methodologies that enhance industry competitiveness.

Technological advancement in wood treatment, structural engineering, and building systems integration makes prefab wood buildings increasingly viable for UAE applications. Improved fire resistance, moisture protection, and thermal performance address traditional concerns about wooden structures in the regional climate. Smart building integration capabilities further enhance the appeal of these solutions for modern construction projects.

Despite positive growth prospects, the UAE prefab wood buildings market faces several challenges that may limit expansion in certain segments. Climate concerns represent a significant restraint, as traditional perceptions about wood durability in hot, humid environments persist among some developers and end-users. Although modern treatment technologies address these issues, market education remains necessary to overcome established preferences for concrete and steel construction.

Regulatory complexity poses challenges for market participants, particularly regarding building code compliance and approval processes. While the UAE has made progress in accommodating alternative construction methods, some regulations still favor traditional building approaches. The approval process for prefab wood buildings may require additional documentation and specialized expertise, potentially extending project timelines.

Supply chain considerations impact market development, as high-quality engineered wood products often require importation from specialized manufacturers. Transportation costs, delivery scheduling, and quality control during shipping can affect project economics and timelines. Local manufacturing capabilities remain limited, creating dependency on international suppliers for critical components.

Skills availability represents another constraint, as the local construction workforce may lack experience with prefabricated assembly techniques. Training requirements and the need for specialized installation expertise can increase project costs and complexity. Additionally, limited local technical support for maintenance and repairs may concern some potential customers.

Significant opportunities exist within the UAE prefab wood buildings market, driven by evolving construction requirements and government policy support. Sustainable development initiatives create substantial demand for environmentally responsible building solutions, with prefab wood buildings well-positioned to meet these requirements. The UAE’s commitment to green building standards and carbon emission reduction targets directly supports market expansion.

Tourism and hospitality sectors present substantial growth opportunities, particularly for eco-resorts, glamping facilities, and sustainable accommodation options. The UAE’s focus on diversifying its tourism offerings includes emphasis on environmental sustainability and unique guest experiences that prefab wood structures can effectively deliver. These applications often allow for premium pricing while demonstrating environmental responsibility.

Educational and institutional markets offer significant potential, as schools, universities, and government facilities increasingly prioritize sustainable construction. Prefabricated buildings can provide cost-effective solutions for temporary or permanent educational facilities while demonstrating environmental stewardship to students and communities. The faster construction timelines also minimize disruption to ongoing educational activities.

Residential market expansion opportunities include affordable housing initiatives and luxury sustainable homes. Government programs promoting homeownership and sustainable living create demand for cost-effective, environmentally responsible housing solutions. Additionally, high-end residential markets increasingly value sustainability and unique architectural features that prefab wood buildings can provide.

Market dynamics in the UAE prefab wood buildings sector reflect the interplay between traditional construction practices and innovative building methodologies. Supply-side factors include the availability of skilled manufacturers, quality of imported materials, and development of local assembly capabilities. The market benefits from increasing international manufacturer interest in establishing regional operations or partnerships.

Demand-side dynamics are influenced by growing environmental awareness, government policy support, and successful project demonstrations. MarkWide Research analysis indicates that client acceptance increases significantly after exposure to completed prefab wood building projects, suggesting that market growth will accelerate as more examples become available for evaluation.

Competitive dynamics feature both established international players and emerging local specialists. International companies bring proven technologies and extensive experience, while local firms offer market knowledge and regulatory expertise. This combination creates opportunities for partnerships and joint ventures that leverage complementary strengths.

Technology dynamics continue evolving, with improvements in wood treatment, structural systems, and building integration capabilities. Digital design tools, building information modeling, and automated manufacturing processes enhance the efficiency and appeal of prefabricated construction methods. These technological advances help address traditional concerns about quality control and customization limitations.

Comprehensive research methodology underlies this analysis of the UAE prefab wood buildings market, incorporating multiple data sources and analytical approaches to ensure accuracy and completeness. Primary research includes interviews with industry participants, including manufacturers, contractors, developers, and end-users, providing firsthand insights into market conditions, challenges, and opportunities.

Secondary research encompasses analysis of government publications, industry reports, trade association data, and academic studies related to prefabricated construction and sustainable building practices. This research provides historical context, regulatory framework understanding, and broader industry trend identification that informs market analysis.

Market observation includes site visits to completed projects, manufacturing facilities, and ongoing construction sites to understand practical implementation challenges and successes. These observations provide valuable insights into quality standards, construction processes, and client satisfaction levels that complement survey and interview data.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert review, and statistical analysis where appropriate. The methodology emphasizes qualitative insights while incorporating quantitative data to provide a comprehensive understanding of market dynamics and future prospects.

Regional analysis reveals significant variations in prefab wood buildings adoption across the UAE Emirates, with distinct market characteristics and growth patterns in different areas. Dubai leads market development with approximately 45% of total market activity, driven by its focus on innovation, sustainability initiatives, and diverse construction projects. The emirate’s emphasis on tourism, commercial development, and residential growth creates multiple applications for prefab wood building solutions.

Abu Dhabi represents the second-largest market segment, accounting for roughly 32% of regional activity. The capital’s focus on sustainable development, government facility construction, and high-end residential projects supports steady market growth. Masdar City and other sustainable development initiatives demonstrate government commitment to innovative construction methodologies.

Sharjah and the Northern Emirates collectively represent approximately 23% of market activity, with growing interest in sustainable construction and cost-effective building solutions. These regions often focus on residential applications and smaller commercial projects where prefabricated construction offers clear advantages in terms of cost and construction timeline.

Regional preferences vary based on local regulations, climate considerations, and market maturity. Dubai and Abu Dhabi typically pursue more complex projects with advanced building systems, while other emirates may prioritize cost-effectiveness and proven solutions. This regional variation creates opportunities for different types of prefab wood building providers to serve specific market segments effectively.

The competitive landscape in the UAE prefab wood buildings market includes diverse participants ranging from established international manufacturers to emerging local specialists. Market leaders typically combine proven technology, extensive experience, and strong financial resources to serve large-scale projects and demanding clients.

Competitive strategies vary significantly, with some companies emphasizing technological innovation, others focusing on cost competitiveness, and many highlighting sustainability credentials. Partnership approaches are common, allowing international expertise to combine with local market knowledge and regulatory compliance capabilities.

Market positioning often centers on specific applications or client segments, such as luxury residential, commercial buildings, or institutional projects. This specialization allows companies to develop targeted expertise and build strong reputations within particular market niches.

Market segmentation in the UAE prefab wood buildings sector reflects diverse applications, construction methods, and client requirements. By Application: The market divides into residential, commercial, institutional, and specialized structures, each with distinct characteristics and growth patterns.

Residential Segment:

Commercial Segment:

By Construction Method: Segmentation includes panelized systems, modular construction, timber frame, and hybrid approaches that combine wood with other materials. Each method offers specific advantages for different applications and project requirements.

Category-wise analysis reveals distinct trends and opportunities within different segments of the UAE prefab wood buildings market. Residential categories demonstrate the strongest growth momentum, driven by increasing environmental awareness among homeowners and government support for sustainable housing initiatives.

Luxury Residential Category: This segment shows particular strength, with affluent clients increasingly valuing sustainability and unique architectural features. High-end prefab wood buildings often incorporate advanced building systems, smart home technology, and premium finishes that command significant price premiums while demonstrating environmental responsibility.

Commercial Office Category: Growing emphasis on employee wellness and corporate sustainability drives demand for prefab wood office buildings. These structures offer improved indoor air quality, natural aesthetics, and reduced environmental impact that align with modern corporate values and employee expectations.

Educational Facility Category: Schools and universities increasingly recognize the benefits of prefab construction for both permanent and temporary facilities. The faster construction timelines minimize disruption to educational activities, while the sustainable characteristics support institutional environmental goals and provide educational opportunities about sustainable construction.

Hospitality Category: Tourism facilities utilizing prefab wood buildings can differentiate themselves through environmental responsibility while potentially reducing construction costs and timelines. This category particularly benefits from the UAE’s focus on sustainable tourism and unique guest experiences.

Industry participants and stakeholders in the UAE prefab wood buildings market realize numerous advantages through engagement with this growing sector. Developers benefit from reduced construction timelines, improved quality control, and enhanced sustainability credentials that appeal to environmentally conscious buyers and tenants.

Contractors gain competitive advantages through prefab construction expertise, including reduced weather dependency, lower labor requirements, and improved project predictability. The controlled manufacturing environment minimizes quality issues and rework, leading to higher profit margins and improved client satisfaction.

End-users receive multiple benefits including faster occupancy, consistent quality, and reduced environmental impact. Prefab wood buildings often provide superior indoor air quality, natural aesthetics, and energy efficiency compared to traditional construction methods. Additionally, the sustainability characteristics support corporate environmental goals and personal values.

Government stakeholders benefit from industry growth through job creation, economic diversification, and progress toward environmental goals. The prefab wood buildings sector supports the UAE’s vision for sustainable development while potentially reducing construction costs for public facilities and housing programs.

Investors find opportunities in a growing market with strong fundamentals and government support. The sector offers potential for both financial returns and positive environmental impact, aligning with increasing emphasis on sustainable investing and environmental, social, and governance considerations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key trends shaping the UAE prefab wood buildings market reflect broader changes in construction practices, environmental awareness, and technology adoption. Sustainability integration represents the most significant trend, with clients increasingly prioritizing environmental impact alongside traditional considerations of cost, quality, and timeline.

Smart building integration is becoming standard practice, with prefab wood buildings incorporating advanced building management systems, renewable energy integration, and IoT connectivity. This trend enhances the appeal of prefabricated solutions by demonstrating technological sophistication and operational efficiency.

Customization capabilities continue expanding, addressing previous concerns about design limitations in prefabricated construction. Advanced manufacturing techniques and digital design tools enable high levels of customization while maintaining the efficiency benefits of factory-based production.

Hybrid construction approaches are gaining popularity, combining wood prefab components with other materials to optimize performance, cost, and regulatory compliance. These approaches allow designers to leverage the benefits of prefab wood construction while addressing specific project requirements or constraints.

Circular economy principles increasingly influence market development, with emphasis on material sourcing, waste reduction, and end-of-life considerations. MWR analysis indicates that approximately 78% of new projects now incorporate circular economy considerations in material selection and construction planning.

Recent industry developments demonstrate the dynamic nature of the UAE prefab wood buildings market and indicate future growth directions. Regulatory advancement includes updated building codes that better accommodate alternative construction methods and streamlined approval processes for sustainable building projects.

Technology partnerships between international prefab manufacturers and local construction companies are expanding, bringing proven expertise to the UAE market while developing local capabilities. These partnerships often include technology transfer, training programs, and joint project development initiatives.

Government pilot projects showcase prefab wood building applications in public facilities, demonstrating official support and providing valuable case studies for private sector adoption. These projects often incorporate advanced sustainability features and serve as testing grounds for new technologies and approaches.

Manufacturing facility development includes plans for local production capabilities that would reduce costs, improve delivery schedules, and create employment opportunities. Several international companies have announced intentions to establish regional manufacturing or assembly operations.

Educational initiatives by industry associations and government agencies are increasing awareness of prefab construction benefits and addressing traditional concerns about wood building durability and performance. These programs target architects, engineers, developers, and potential end-users.

Industry analysts recommend several strategic approaches for maximizing success in the UAE prefab wood buildings market. Market education remains critical, with successful companies investing significantly in demonstrating the benefits and capabilities of prefabricated construction methods through completed projects, educational programs, and industry partnerships.

Local partnership development is essential for international companies seeking to establish market presence. Partnerships with established UAE construction firms, architects, and developers provide market knowledge, regulatory expertise, and client relationships that accelerate market entry and growth.

Technology investment should focus on climate adaptation, building system integration, and digital design capabilities that address specific UAE market requirements. Companies that can demonstrate superior performance in hot, humid conditions while offering advanced building features will achieve competitive advantages.

Regulatory engagement through industry associations and government consultation processes helps shape favorable policy development while ensuring compliance with evolving requirements. Active participation in building code development and sustainability initiatives positions companies as industry leaders.

Quality demonstration through showcase projects, client testimonials, and performance data builds market confidence and addresses traditional concerns about prefab wood building durability and performance. Successful companies invest in high-profile projects that serve as marketing tools and technical demonstrations.

Future prospects for the UAE prefab wood buildings market remain highly positive, supported by strong fundamentals and favorable market trends. MarkWide Research projections indicate continued robust growth driven by increasing environmental awareness, government policy support, and demonstrated project successes that build market confidence.

Market expansion is expected across all major segments, with residential applications maintaining leadership while commercial and institutional projects show accelerating growth. The integration of smart building technologies and renewable energy systems will enhance the appeal of prefab wood buildings and support premium pricing strategies.

Technology advancement will continue addressing traditional concerns about wood construction in challenging climates while expanding design possibilities and performance capabilities. Improvements in fire resistance, moisture protection, and structural systems will broaden the range of suitable applications.

Local manufacturing development is anticipated to reduce costs, improve delivery schedules, and create employment opportunities while supporting the UAE’s economic diversification goals. This development will enhance market competitiveness and reduce dependency on international supply chains.

Regulatory evolution is expected to increasingly favor sustainable construction methods, creating additional advantages for prefab wood building solutions. Government initiatives supporting carbon emission reduction and sustainable development will continue driving market growth and creating new opportunities for industry participants.

The UAE prefab wood buildings market represents a dynamic and rapidly growing sector with substantial potential for continued expansion. Strong market fundamentals including government policy support, increasing environmental awareness, and demonstrated project successes create favorable conditions for sustained growth across residential, commercial, and institutional applications.

Key success factors for market participants include investment in market education, development of local partnerships, technology advancement addressing regional requirements, and demonstration of superior project outcomes. Companies that effectively address traditional concerns about wood construction while showcasing the benefits of prefabricated building methods will achieve competitive advantages and market leadership positions.

Future market development will be driven by continued technology advancement, expanding applications, and growing acceptance among developers and end-users. The integration of smart building systems, renewable energy, and advanced sustainability features will enhance the appeal and performance of prefab wood buildings while supporting the UAE’s broader environmental and economic goals. The market outlook remains highly positive, with substantial opportunities for growth and innovation in the coming years.

What is Prefab Wood Buildings?

Prefab wood buildings are structures made from prefabricated wooden components that are manufactured off-site and assembled on-site. They are known for their efficiency, sustainability, and versatility in various applications such as residential, commercial, and recreational buildings.

What are the key players in the UAE Prefab Wood Buildings Market?

Key players in the UAE Prefab Wood Buildings Market include companies like Algeco, Al Futtaim Carillion, and Emirates Modular. These companies are involved in the design, manufacturing, and construction of prefab wood structures, catering to various sectors such as hospitality and residential.

What are the growth factors driving the UAE Prefab Wood Buildings Market?

The growth of the UAE Prefab Wood Buildings Market is driven by factors such as increasing demand for sustainable construction, rapid urbanization, and the need for cost-effective building solutions. Additionally, government initiatives promoting green building practices contribute to market expansion.

What challenges does the UAE Prefab Wood Buildings Market face?

The UAE Prefab Wood Buildings Market faces challenges such as regulatory hurdles, limited awareness of prefab technology, and competition from traditional construction methods. These factors can hinder the adoption of prefab wood solutions in certain segments.

What opportunities exist in the UAE Prefab Wood Buildings Market?

Opportunities in the UAE Prefab Wood Buildings Market include the growing trend of eco-friendly construction, advancements in building technology, and increasing investments in infrastructure projects. These factors create a favorable environment for the expansion of prefab wood solutions.

What trends are shaping the UAE Prefab Wood Buildings Market?

Trends shaping the UAE Prefab Wood Buildings Market include the integration of smart building technologies, a focus on modular construction, and the use of sustainable materials. These trends are influencing design and construction practices, making prefab wood buildings more appealing.

UAE Prefab Wood Buildings Market

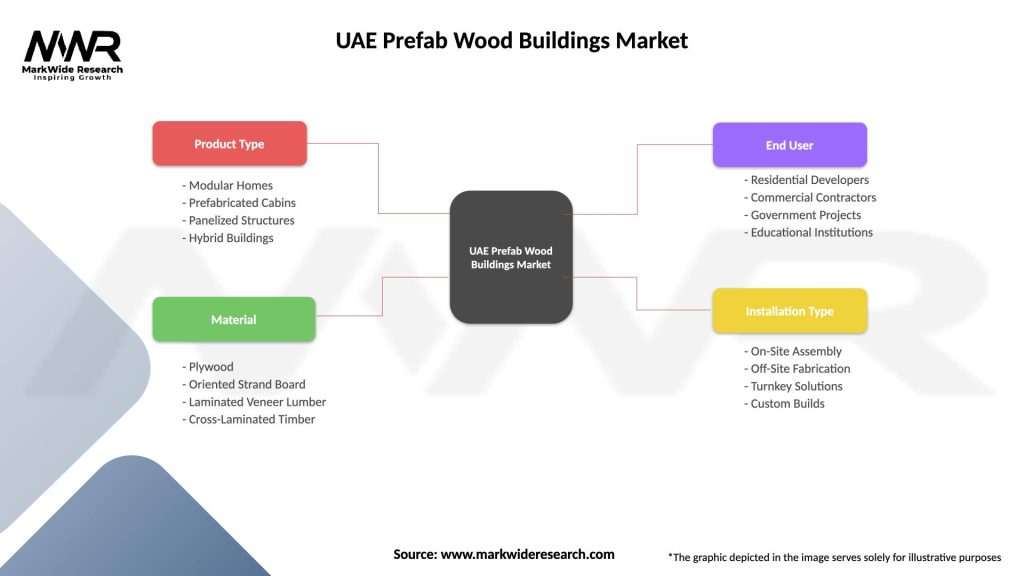

| Segmentation Details | Description |

|---|---|

| Product Type | Modular Homes, Prefabricated Cabins, Panelized Structures, Hybrid Buildings |

| Material | Plywood, Oriented Strand Board, Laminated Veneer Lumber, Cross-Laminated Timber |

| End User | Residential Developers, Commercial Contractors, Government Projects, Educational Institutions |

| Installation Type | On-Site Assembly, Off-Site Fabrication, Turnkey Solutions, Custom Builds |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Prefab Wood Buildings Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at