444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE poultry meat market represents a dynamic and rapidly evolving sector within the nation’s agricultural and food industry landscape. As one of the fastest-growing protein markets in the Middle East, the UAE has established itself as a significant consumer and importer of poultry products, driven by a diverse expatriate population and increasing health consciousness among consumers. The market encompasses various segments including chicken, turkey, duck, and other poultry varieties, with chicken meat dominating consumption patterns across the emirates.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 6.2% over recent years. This expansion is fueled by rising disposable incomes, urbanization trends, and the government’s strategic focus on food security initiatives. The UAE’s position as a regional hub for trade and commerce has further enhanced its role in the broader Middle Eastern poultry market, with Dubai and Abu Dhabi serving as key distribution centers for neighboring countries.

Consumer preferences have shifted significantly toward premium and organic poultry products, with health-conscious consumers driving demand for antibiotic-free and free-range options. The market benefits from a well-established cold chain infrastructure and modern retail networks, enabling efficient distribution of fresh and processed poultry products across the seven emirates. Additionally, the growing food service sector, including restaurants, hotels, and catering services, represents approximately 45% of total poultry consumption in the UAE.

The UAE poultry meat market refers to the comprehensive ecosystem encompassing the production, processing, distribution, and consumption of poultry-based protein products within the United Arab Emirates. This market includes all forms of domesticated bird meat, primarily chicken, but also extending to turkey, duck, quail, and other specialty poultry varieties consumed for nutritional and culinary purposes.

Market scope encompasses both fresh and processed poultry products, ranging from whole birds and cuts to value-added items such as marinated products, ready-to-cook meals, and frozen convenience foods. The definition extends beyond mere consumption to include the entire value chain, from breeding and farming operations to retail and food service distribution channels. Given the UAE’s limited domestic production capacity, the market heavily relies on imports from established poultry-producing nations, making it a significant component of the country’s food import strategy.

Strategic importance of this market lies in its role as a primary protein source for the UAE’s diverse population of over 10 million residents, including both nationals and expatriates from various cultural backgrounds. The market serves as a critical indicator of food security, consumer spending patterns, and the overall health of the nation’s food and beverage sector.

The UAE poultry meat market demonstrates exceptional resilience and growth potential, positioning itself as a cornerstone of the nation’s protein consumption landscape. With per capita poultry consumption reaching approximately 32 kilograms annually, the UAE ranks among the highest consumers of poultry meat in the Middle East region. This consumption pattern reflects both cultural preferences and the practical advantages of poultry as an affordable, versatile protein source.

Key market characteristics include a heavy reliance on imports, which account for over 85% of total supply, with major sourcing countries including Brazil, India, France, and the United States. The domestic production sector, while limited, focuses on premium and specialty products, contributing approximately 15% of market supply. The market structure is characterized by a mix of large-scale importers, regional distributors, and specialized retailers serving diverse consumer segments.

Growth drivers encompass population expansion, rising health awareness, increasing disposable incomes, and the continuous development of the food service industry. The market benefits from government initiatives promoting food security and local production capabilities, alongside investments in cold chain infrastructure and food safety standards. MarkWide Research analysis indicates that premium and organic segments are experiencing the fastest growth rates, reflecting evolving consumer preferences toward quality and sustainability.

Market segmentation reveals distinct consumption patterns across different emirates, with Dubai and Abu Dhabi accounting for the largest share of premium poultry consumption. The following key insights define the current market landscape:

Population growth serves as the primary driver of UAE poultry meat market expansion, with the country’s population increasing steadily due to continued immigration and economic development. The diverse demographic composition, including significant expatriate communities from South Asia, Southeast Asia, and Western countries, creates varied demand patterns that support market growth across different product categories and price segments.

Economic prosperity and rising disposable incomes enable consumers to prioritize protein-rich diets and premium food products. The UAE’s status as a high-income economy supports consistent demand for quality poultry products, including organic, free-range, and specialty items that command higher price points. This economic foundation provides stability for market participants and encourages investment in improved supply chain infrastructure.

Health consciousness among consumers drives demand for lean protein sources, with poultry meat being perceived as a healthier alternative to red meat. Growing awareness of nutrition and wellness trends supports the consumption of poultry products, particularly among younger demographics and health-focused consumer segments. The rise of fitness culture and dietary awareness further reinforces this driver.

Food service expansion continues to fuel market growth, with the UAE’s position as a global tourism destination supporting a robust hospitality industry. The proliferation of restaurants, hotels, catering services, and quick-service establishments creates sustained demand for poultry products across various preparation styles and quality grades.

Import dependency represents a significant market restraint, exposing the UAE to supply chain vulnerabilities, price volatility, and potential trade disruptions. The heavy reliance on foreign suppliers creates challenges related to food security, quality control, and cost management, particularly during global supply chain disruptions or geopolitical tensions affecting major exporting countries.

Climate limitations pose substantial challenges for domestic poultry production expansion, with the UAE’s arid climate and extreme temperatures creating unfavorable conditions for large-scale poultry farming. High energy costs for climate control, water scarcity, and limited agricultural land availability constrain local production capabilities and increase operational expenses for domestic producers.

Regulatory compliance requirements and food safety standards, while necessary for consumer protection, create additional costs and complexity for market participants. Stringent import regulations, halal certification requirements, and evolving food safety protocols require continuous investment in compliance systems and quality assurance processes.

Price sensitivity among certain consumer segments limits market expansion potential, particularly for premium and specialty products. Economic fluctuations and changes in currency exchange rates can impact affordability and consumption patterns, especially among price-conscious demographic groups.

Local production expansion presents significant opportunities for market development, with government initiatives supporting food security through domestic agriculture development. Investment in modern poultry farming technologies, including climate-controlled facilities and sustainable production methods, could reduce import dependency and create value-added employment opportunities.

Premium segment growth offers substantial potential for market participants focusing on high-quality, organic, and specialty poultry products. Consumer willingness to pay premium prices for superior products creates opportunities for differentiation and margin improvement, particularly in urban markets with affluent consumer bases.

Technology integration throughout the supply chain presents opportunities for efficiency improvements and cost reduction. Implementation of advanced cold chain management, inventory optimization systems, and digital marketing platforms can enhance operational effectiveness and customer engagement.

Regional export potential leverages the UAE’s strategic location and infrastructure advantages to serve neighboring markets. Development of processing and packaging capabilities could position the UAE as a regional hub for value-added poultry products, creating additional revenue streams and market diversification opportunities.

Supply chain complexity characterizes the UAE poultry meat market, with multiple stakeholders involved in sourcing, importing, processing, and distribution activities. The market operates through established networks of international suppliers, local importers, wholesalers, and retailers, each contributing to the overall value chain efficiency and product availability across the emirates.

Competitive intensity varies across different market segments, with established importers and distributors maintaining strong positions in conventional products while newer entrants focus on premium and specialty categories. Market consolidation trends are evident among larger players seeking to achieve economies of scale and improve supply chain control.

Consumer behavior patterns demonstrate increasing sophistication and quality awareness, with shoppers becoming more selective about product origins, processing methods, and nutritional attributes. This evolution drives innovation in product development, packaging, and marketing approaches throughout the industry.

Regulatory environment continues to evolve, with authorities implementing enhanced food safety standards, traceability requirements, and sustainability guidelines. These developments influence operational practices and investment priorities for market participants, while also creating opportunities for companies that can demonstrate superior compliance capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UAE poultry meat market. Primary research activities include structured interviews with industry stakeholders, including importers, distributors, retailers, and food service operators, providing firsthand perspectives on market trends, challenges, and opportunities.

Secondary research incorporates analysis of government statistics, trade data, industry reports, and regulatory publications to establish market size, growth patterns, and structural characteristics. This approach ensures comprehensive coverage of quantitative and qualitative market dimensions, supporting robust analytical conclusions.

Data validation processes involve cross-referencing multiple sources and conducting follow-up interviews to verify key findings and assumptions. Market modeling techniques are employed to project future trends and assess the impact of various scenarios on market development.

Industry expertise contributes to research quality through collaboration with sector specialists, trade associations, and regulatory bodies. This engagement ensures that analysis reflects current market realities and incorporates relevant industry knowledge and experience.

Dubai emirate dominates the UAE poultry meat market, accounting for approximately 42% of total consumption, driven by its large population, diverse demographics, and extensive food service sector. The emirate’s role as a commercial hub and tourist destination supports high levels of poultry consumption across retail and hospitality channels, with premium products experiencing particularly strong demand in upscale establishments and affluent residential areas.

Abu Dhabi represents the second-largest market segment, contributing roughly 28% of national consumption, with consumption patterns reflecting both local preferences and the emirate’s role as the political and administrative capital. The presence of government institutions, international organizations, and major corporations creates steady demand for quality poultry products across various market segments.

Sharjah and Northern Emirates collectively account for 22% of market share, with consumption patterns influenced by more price-sensitive demographics and traditional preferences. These regions demonstrate strong demand for conventional poultry products, while also showing growing interest in premium options as economic conditions improve.

Regional distribution networks efficiently serve all emirates through established logistics infrastructure, with Dubai serving as the primary import and distribution hub for the entire country. The remaining 8% of consumption is distributed among the smaller emirates, reflecting their population sizes and economic activities.

Market leadership is distributed among several major importers and distributors who have established strong relationships with international suppliers and domestic customers. The competitive environment features both multinational companies and regional players, each leveraging different strategies to maintain market position and drive growth.

Competitive strategies include product differentiation, supply chain optimization, brand building, and strategic partnerships with international suppliers. Companies are increasingly investing in technology, sustainability initiatives, and premium product development to maintain competitive advantages in the evolving market landscape.

By Product Type:

By Processing Level:

By Distribution Channel:

Premium and Organic Segment demonstrates the strongest growth trajectory, with consumers increasingly willing to pay higher prices for products that meet specific quality, health, and sustainability criteria. This category benefits from rising health consciousness and environmental awareness among affluent consumer segments, particularly in Dubai and Abu Dhabi.

Conventional Fresh Products maintain the largest market share due to their affordability and widespread availability across all distribution channels. This segment serves price-sensitive consumers and traditional cooking preferences, with whole birds and basic cuts remaining popular choices for family consumption and traditional recipes.

Frozen and Processed Categories appeal to convenience-oriented consumers, including working professionals and smaller households seeking easy preparation options. The growth of this segment reflects changing lifestyle patterns and the increasing pace of urban life in the UAE.

Food Service Segment requires specialized products and packaging formats to meet the operational needs of restaurants, hotels, and catering services. This category emphasizes consistency, portion control, and cost-effectiveness while maintaining quality standards appropriate for commercial food preparation.

Market Growth Potential offers significant opportunities for revenue expansion and business development across all segments of the poultry value chain. The combination of population growth, economic prosperity, and evolving consumer preferences creates a favorable environment for sustained market development and investment returns.

Diversification Opportunities enable companies to expand their product portfolios and target different consumer segments, reducing dependency on single product categories or customer groups. The market’s segmentation allows for specialized positioning and niche market development strategies.

Supply Chain Efficiency benefits from the UAE’s strategic location, world-class infrastructure, and business-friendly environment. Companies can leverage these advantages to optimize their operations, reduce costs, and improve service levels to customers throughout the region.

Innovation Platform provides opportunities for product development, technology adoption, and market differentiation. The sophisticated consumer base and competitive environment encourage continuous improvement and innovation across all aspects of the business.

Regional Hub Potential allows companies to use the UAE as a base for serving broader Middle Eastern and African markets, creating economies of scale and diversifying revenue sources beyond domestic consumption.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and Wellness Focus drives consumer preferences toward organic, antibiotic-free, and free-range poultry products. This trend reflects growing awareness of nutrition, food safety, and sustainable farming practices among UAE consumers, particularly in urban areas with higher education levels and disposable incomes.

Convenience and Ready-to-Cook Products gain popularity as busy lifestyles and smaller household sizes influence purchasing decisions. Pre-marinated, portioned, and value-added poultry products cater to time-conscious consumers seeking convenient meal solutions without compromising on quality or taste.

Digital Commerce Expansion transforms distribution channels, with online grocery platforms and direct-to-consumer delivery services gaining market share. MWR data indicates that digital channels are growing at 25% annually, driven by smartphone adoption and changing shopping behaviors, particularly among younger demographics.

Sustainability and Traceability become increasingly important factors in consumer decision-making, with demand growing for products that demonstrate environmental responsibility and transparent supply chain practices. Companies are responding by implementing tracking systems and sustainable packaging solutions.

Premium Positioning strategies focus on quality differentiation, with brands emphasizing superior taste, texture, and nutritional benefits to justify higher price points and build customer loyalty in competitive market conditions.

Government Food Security Initiatives include substantial investments in domestic agriculture development, with specific programs targeting poultry production capacity expansion. These initiatives aim to reduce import dependency and enhance national food security through technology adoption and infrastructure development.

Cold Chain Infrastructure Expansion continues across the UAE, with major investments in refrigerated storage facilities, transportation networks, and distribution centers. These developments improve product quality, reduce waste, and enable more efficient supply chain operations throughout the country.

Regulatory Framework Evolution includes enhanced food safety standards, traceability requirements, and import certification processes. Recent developments focus on strengthening consumer protection while maintaining efficient trade flows and market accessibility for qualified suppliers.

Technology Adoption Acceleration encompasses implementation of advanced inventory management systems, automated processing equipment, and digital marketing platforms. Companies are investing in technology solutions to improve operational efficiency and customer engagement capabilities.

Strategic Partnerships and Acquisitions reshape the competitive landscape, with companies forming alliances to strengthen supply chains, expand product portfolios, and access new market segments. These developments reflect the industry’s maturation and consolidation trends.

Diversification Strategy recommendations emphasize the importance of expanding product portfolios to include premium, organic, and specialty poultry products that command higher margins and appeal to evolving consumer preferences. Companies should consider investing in value-added processing capabilities and brand development to differentiate their offerings in competitive market conditions.

Supply Chain Optimization should focus on reducing import dependency through strategic partnerships with multiple international suppliers and exploring domestic production opportunities. MarkWide Research analysis suggests that companies with diversified supply sources demonstrate greater resilience to market disruptions and price volatility.

Technology Investment Priorities should include digital commerce platforms, inventory management systems, and customer relationship management tools to improve operational efficiency and market responsiveness. Companies that embrace technology adoption are better positioned to capture growth opportunities in evolving market segments.

Market Segmentation Focus requires targeted approaches for different consumer groups, with premium positioning for affluent segments and value-oriented strategies for price-sensitive customers. Understanding demographic preferences and purchasing behaviors enables more effective marketing and product development strategies.

Sustainability Integration becomes increasingly important for long-term market success, with companies needing to demonstrate environmental responsibility and ethical sourcing practices to meet evolving consumer expectations and regulatory requirements.

Market expansion prospects remain positive, with continued population growth, economic development, and evolving consumer preferences supporting sustained demand growth across all poultry market segments. The UAE’s strategic position and infrastructure advantages provide a solid foundation for long-term market development and regional expansion opportunities.

Technology integration will accelerate throughout the supply chain, with advanced cold chain management, inventory optimization, and digital commerce platforms becoming standard operational requirements. Companies that successfully adopt these technologies will gain competitive advantages in efficiency, cost management, and customer service capabilities.

Premium segment growth is projected to continue outpacing conventional products, with organic, free-range, and specialty poultry products experiencing robust demand growth. This trend reflects the UAE’s economic prosperity and consumers’ increasing willingness to pay premium prices for superior quality and health benefits.

Domestic production development may gradually reduce import dependency, with government initiatives and private investments supporting climate-controlled farming operations and processing facilities. While challenges remain significant, technological advances and policy support create opportunities for local production expansion.

Regional hub development potential positions the UAE as a processing and distribution center for broader Middle Eastern and African markets, creating additional growth opportunities beyond domestic consumption patterns and supporting market diversification strategies.

The UAE poultry meat market represents a dynamic and growing sector with substantial opportunities for industry participants across all segments of the value chain. Despite challenges related to import dependency and climate constraints, the market benefits from strong economic fundamentals, diverse consumer demographics, and excellent infrastructure that support sustained growth and development.

Key success factors for market participants include product diversification, supply chain optimization, technology adoption, and strategic positioning to capture growth opportunities in premium and convenience segments. Companies that can effectively balance quality, affordability, and innovation while maintaining efficient operations are best positioned for long-term success in this competitive environment.

Future market development will be shaped by evolving consumer preferences, technological advances, regulatory changes, and regional economic conditions. The combination of population growth, rising disposable incomes, and increasing health consciousness creates a favorable environment for continued market expansion and investment opportunities across all poultry market segments in the UAE.

What is Poultry Meat?

Poultry meat refers to the flesh of domesticated birds, primarily chickens, turkeys, ducks, and geese, raised for human consumption. It is a significant source of protein and is widely consumed in various cuisines around the world.

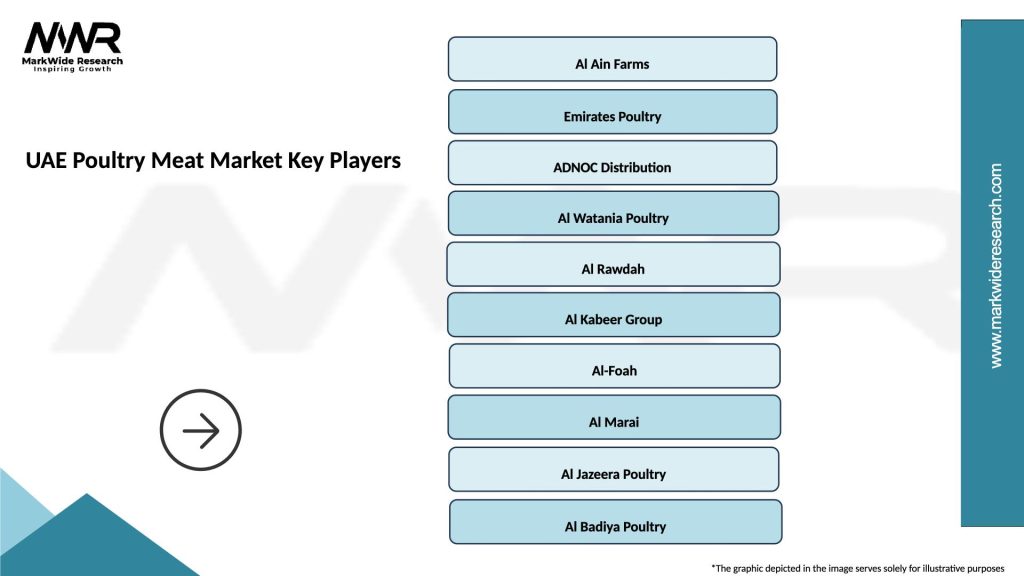

What are the key players in the UAE Poultry Meat Market?

Key players in the UAE Poultry Meat Market include Al Ain Farms, Emirates Poultry, and Al Watania Poultry, among others. These companies are involved in various aspects of poultry production, processing, and distribution.

What are the growth factors driving the UAE Poultry Meat Market?

The growth of the UAE Poultry Meat Market is driven by increasing consumer demand for protein-rich foods, a growing population, and the rising trend of convenience foods. Additionally, health awareness and the preference for fresh poultry products contribute to market expansion.

What challenges does the UAE Poultry Meat Market face?

The UAE Poultry Meat Market faces challenges such as fluctuating feed prices, strict regulations regarding food safety, and competition from imported poultry products. These factors can impact production costs and market pricing.

What opportunities exist in the UAE Poultry Meat Market?

Opportunities in the UAE Poultry Meat Market include the potential for organic and free-range poultry products, as well as the expansion of e-commerce platforms for poultry sales. Additionally, increasing health consciousness among consumers presents avenues for growth.

What trends are shaping the UAE Poultry Meat Market?

Trends in the UAE Poultry Meat Market include a shift towards sustainable farming practices, the rise of plant-based alternatives, and innovations in poultry processing technologies. These trends reflect changing consumer preferences and environmental considerations.

UAE Poultry Meat Market

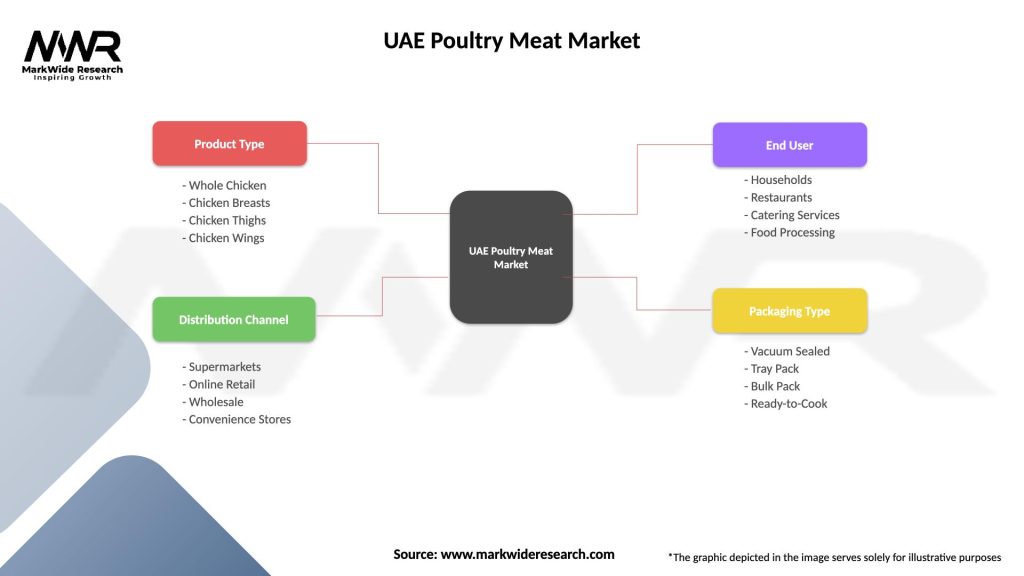

| Segmentation Details | Description |

|---|---|

| Product Type | Whole Chicken, Chicken Breasts, Chicken Thighs, Chicken Wings |

| Distribution Channel | Supermarkets, Online Retail, Wholesale, Convenience Stores |

| End User | Households, Restaurants, Catering Services, Food Processing |

| Packaging Type | Vacuum Sealed, Tray Pack, Bulk Pack, Ready-to-Cook |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Poultry Meat Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at