444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE POS system market represents a rapidly evolving technological landscape that has transformed the retail and hospitality sectors across the Emirates. This dynamic market encompasses traditional point-of-sale terminals, mobile payment solutions, cloud-based systems, and integrated retail management platforms that serve businesses ranging from small enterprises to large multinational corporations. The market has experienced substantial growth driven by digital transformation initiatives, government support for cashless transactions, and increasing consumer preference for contactless payment methods.

Market dynamics in the UAE reflect the country’s position as a regional hub for commerce and technology innovation. The adoption of advanced POS technologies has accelerated significantly, with businesses recognizing the need for comprehensive solutions that integrate inventory management, customer relationship management, and real-time analytics. The market demonstrates robust expansion with growth rates reaching 12.5% annually, positioning the UAE as one of the fastest-growing POS markets in the Middle East region.

Technological advancement continues to shape market evolution, with artificial intelligence, machine learning, and Internet of Things integration becoming standard features in modern POS systems. The market serves diverse sectors including retail, restaurants, hospitality, healthcare, and entertainment venues, each requiring specialized functionality and compliance with local regulations.

The UAE POS system market refers to the comprehensive ecosystem of point-of-sale technologies, software solutions, and related services that facilitate transaction processing, inventory management, and business operations across various industries in the United Arab Emirates. This market encompasses hardware components, software applications, payment processing services, and support systems that enable businesses to conduct sales transactions efficiently while maintaining detailed records and analytics.

Modern POS systems in the UAE market extend beyond simple transaction processing to include integrated business management capabilities. These solutions combine payment processing, inventory tracking, customer management, employee scheduling, and financial reporting into unified platforms that support business growth and operational efficiency. The market includes both traditional terminal-based systems and innovative mobile solutions that leverage tablets and smartphones.

Cloud-based solutions represent a significant portion of the market, offering businesses scalability, remote access, and reduced infrastructure costs. These systems enable real-time data synchronization across multiple locations, making them particularly valuable for businesses operating across the UAE’s diverse economic zones and free trade areas.

Strategic market positioning places the UAE POS system market at the forefront of regional technological adoption, driven by government initiatives promoting digital payments and smart city development. The market benefits from strong economic fundamentals, a tech-savvy consumer base, and supportive regulatory frameworks that encourage innovation in financial technology sectors.

Key growth drivers include the UAE’s Vision 2071 initiative, which emphasizes digital transformation across all sectors, and the Central Bank’s push for cashless transactions that has increased digital payment adoption by 78% over recent years. Small and medium enterprises represent the fastest-growing segment, adopting cloud-based POS solutions at unprecedented rates to compete effectively in the digital marketplace.

Market segmentation reveals diverse adoption patterns across industries, with retail and food service sectors leading implementation rates. The hospitality industry, crucial to UAE’s tourism economy, has embraced integrated POS solutions that combine payment processing with guest management and loyalty programs. Healthcare and professional services sectors are emerging as significant growth areas, requiring specialized compliance features and integration capabilities.

Competitive landscape features both international technology providers and regional specialists, creating a dynamic environment that fosters innovation and competitive pricing. The market demonstrates strong potential for continued expansion, supported by ongoing infrastructure development and increasing business digitization across all emirates.

Market intelligence reveals several critical insights that define the UAE POS system landscape and its future trajectory:

Technology trends indicate increasing sophistication in POS system capabilities, with businesses seeking comprehensive solutions that provide operational insights, customer analytics, and predictive capabilities. The market shows strong preference for scalable solutions that can grow with business expansion across multiple locations and market segments.

Government initiatives serve as primary catalysts for POS system adoption across the UAE, with digital transformation policies creating favorable conditions for technology implementation. The UAE’s commitment to becoming a cashless society by 2025 has accelerated business adoption of advanced payment processing systems, while smart city initiatives in Dubai and Abu Dhabi promote integrated technology solutions.

Economic diversification efforts have expanded the small and medium enterprise sector, creating substantial demand for affordable, scalable POS solutions. These businesses require systems that can handle multiple payment methods, integrate with e-commerce platforms, and provide detailed analytics to support growth strategies. The emergence of new business models, including food trucks, pop-up stores, and mobile services, drives demand for portable and flexible POS solutions.

Consumer behavior evolution significantly influences market dynamics, with increasing preference for contactless payments, mobile wallets, and integrated loyalty programs. The UAE’s diverse population, including significant expatriate communities, requires POS systems that support multiple languages, currencies, and payment methods. Tourism industry requirements further drive demand for systems capable of handling international cards and providing multilingual interfaces.

Technological infrastructure development, including widespread 5G deployment and robust internet connectivity, enables advanced POS system capabilities such as real-time inventory synchronization, cloud-based analytics, and integrated customer management. The availability of reliable telecommunications infrastructure supports the adoption of cloud-based solutions that offer enhanced functionality and reduced operational costs.

Implementation costs represent significant barriers for smaller businesses, particularly those operating on tight margins in competitive markets. While cloud-based solutions have reduced upfront costs, ongoing subscription fees, transaction processing charges, and integration expenses can strain budgets for micro and small enterprises. The need for staff training and potential business disruption during system implementation creates additional cost considerations.

Security concerns continue to influence adoption decisions, with businesses requiring robust cybersecurity measures to protect customer data and financial transactions. The increasing sophistication of cyber threats necessitates ongoing security updates and compliance measures that add complexity and cost to POS system operations. Data privacy regulations and payment card industry compliance requirements create additional operational burdens.

Technical complexity challenges some businesses, particularly those with limited IT expertise or resources. Integration with existing systems, customization requirements, and ongoing maintenance needs can overwhelm smaller organizations. The rapid pace of technological change requires continuous system updates and feature adaptations that may exceed some businesses’ technical capabilities.

Market fragmentation creates confusion for buyers navigating numerous vendor options, each offering different features, pricing models, and support levels. The lack of standardization across solutions can complicate decision-making processes and increase the risk of selecting inappropriate systems that fail to meet long-term business needs.

Emerging sectors present substantial growth opportunities for POS system providers, particularly in healthcare, education, and professional services where digital transformation is accelerating. The expansion of e-commerce and omnichannel retail strategies creates demand for integrated POS solutions that seamlessly connect online and offline sales channels. Government sector digitization initiatives offer opportunities for specialized POS solutions tailored to public service requirements.

Technology integration opportunities include artificial intelligence, machine learning, and Internet of Things capabilities that can enhance POS system functionality. Predictive analytics, automated inventory management, and personalized customer experiences represent areas where advanced technology can create competitive advantages. The integration of augmented reality and virtual reality technologies opens new possibilities for enhanced customer engagement and training applications.

Regional expansion potential exists as UAE-based businesses expand operations across the Middle East and Africa regions, requiring POS solutions that can support multi-country operations. The UAE’s position as a regional business hub creates opportunities for POS providers to serve international companies establishing regional headquarters and operations centers.

Vertical specialization offers opportunities for developing industry-specific solutions that address unique requirements in sectors such as automotive, jewelry, pharmaceuticals, and luxury goods. These specialized markets often require features such as serial number tracking, compliance reporting, and integration with industry-specific regulations and standards.

Competitive forces shape the UAE POS system market through continuous innovation, pricing pressures, and service differentiation strategies. Established international providers compete with regional specialists and emerging technology companies, creating a dynamic environment that benefits customers through improved features and competitive pricing. The market demonstrates healthy competition with no single vendor dominating across all segments.

Technology evolution drives market dynamics through regular introduction of new features, improved user interfaces, and enhanced integration capabilities. Cloud computing adoption has fundamentally changed market dynamics by reducing barriers to entry for new providers while enabling existing vendors to offer more sophisticated solutions. Mobile technology integration continues to reshape customer expectations and system capabilities.

Regulatory environment influences market dynamics through evolving compliance requirements, data protection regulations, and payment industry standards. The implementation of VAT and ongoing updates to financial regulations create ongoing demand for system updates and compliance features. Central Bank initiatives promoting digital payments and financial inclusion drive market expansion and technology adoption.

Customer expectations continue to evolve, demanding more sophisticated features, better user experiences, and comprehensive support services. Businesses increasingly expect POS systems to provide business intelligence, customer insights, and operational optimization capabilities beyond basic transaction processing. The demand for real-time reporting and analytics has become a standard requirement across all market segments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UAE POS system market. Primary research includes structured interviews with industry stakeholders, including POS system vendors, retail businesses, hospitality operators, and technology integrators. These interviews provide firsthand insights into market trends, challenges, and opportunities from various perspectives across the value chain.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and vendor documentation to establish market context and validate primary research findings. Financial reports from publicly traded companies provide insights into market performance and growth trends, while regulatory documents offer understanding of compliance requirements and policy impacts.

Market segmentation analysis utilizes both quantitative and qualitative approaches to identify key market segments, growth patterns, and competitive dynamics. Survey data from businesses across different industries and size categories provides statistical foundation for market sizing and trend analysis. Focus groups with end users offer deeper insights into user preferences, pain points, and future requirements.

Technology assessment involves evaluation of current and emerging technologies, their adoption rates, and potential market impact. Expert interviews with technology developers, system integrators, and industry analysts provide forward-looking perspectives on market evolution and innovation trends. MarkWide Research methodology ensures comprehensive coverage of all market aspects while maintaining objectivity and analytical rigor.

Dubai emirate leads the UAE POS system market with approximately 45% market share, driven by its position as a commercial and tourism hub. The emirate’s diverse economy, including retail, hospitality, and financial services sectors, creates substantial demand for sophisticated POS solutions. Dubai’s smart city initiatives and digital transformation programs accelerate adoption of advanced payment technologies and integrated business management systems.

Abu Dhabi represents the second-largest market segment, accounting for roughly 30% of market activity, with strong growth in government sector implementations and large enterprise deployments. The emirate’s focus on economic diversification and technology adoption creates opportunities for comprehensive POS solutions that support various industries including healthcare, education, and manufacturing.

Sharjah and Northern Emirates demonstrate rapid growth in POS system adoption, particularly among small and medium enterprises seeking cost-effective solutions. These regions show increasing preference for cloud-based systems that offer scalability and reduced infrastructure requirements. The manufacturing and logistics sectors in these areas drive demand for specialized POS solutions with inventory management and supply chain integration capabilities.

Free zones across all emirates present unique market dynamics, with international businesses requiring POS solutions that support multi-currency transactions, compliance with various international standards, and integration with global business systems. These areas demonstrate higher adoption rates of advanced features such as multi-language support, international payment processing, and cross-border reporting capabilities.

Market leadership in the UAE POS system sector is distributed among several key players, each offering distinct advantages and targeting specific market segments:

Competitive strategies focus on differentiation through industry specialization, local support services, and integration capabilities. International providers leverage global experience and comprehensive feature sets, while regional companies compete through local market knowledge, customized solutions, and competitive pricing. The market supports multiple competitive approaches, from comprehensive enterprise solutions to specialized niche offerings.

Innovation competition drives continuous improvement in user interfaces, mobile capabilities, and analytical features. Vendors increasingly compete on the basis of artificial intelligence integration, predictive analytics, and automated business optimization capabilities. Customer support and implementation services have become key differentiators in a market where technical capabilities are increasingly similar across providers.

By Deployment Model:

By Component:

By Industry Vertical:

By Business Size:

Retail sector demonstrates the highest adoption rates of advanced POS features, with businesses seeking integrated solutions that combine point-of-sale, inventory management, customer relationship management, and e-commerce capabilities. Fashion retailers particularly value features such as size and color variant tracking, seasonal inventory management, and integrated loyalty programs. Electronics retailers require serial number tracking, warranty management, and integration with supplier systems.

Food service industry shows strong preference for mobile POS solutions that enable tableside ordering and payment processing. Quick-service restaurants prioritize speed and efficiency features, including kitchen display systems and automated ordering capabilities. Fine dining establishments focus on features that enhance customer experience, such as split billing, customizable menu options, and integration with reservation systems.

Hospitality sector requires comprehensive solutions that integrate POS functionality with property management systems, guest services, and revenue management tools. Hotels and resorts value features such as room charging capabilities, multi-outlet management, and integration with booking systems. The sector demonstrates willingness to invest in premium solutions that enhance guest experience and operational efficiency.

Healthcare segment represents an emerging opportunity with specific requirements for patient data integration, insurance processing, and regulatory compliance. Pharmacies require features such as prescription tracking, insurance claim processing, and integration with healthcare systems. Medical clinics value appointment scheduling integration, patient history access, and billing system connectivity.

Business operators benefit from comprehensive POS systems through improved operational efficiency, enhanced customer experiences, and detailed business insights. Modern systems provide real-time inventory tracking, automated reordering capabilities, and comprehensive reporting that enables data-driven decision making. Integration with accounting systems reduces manual data entry and improves financial accuracy.

Customers experience benefits through faster transaction processing, multiple payment options, and personalized service enabled by customer history and preference tracking. Loyalty program integration provides value through rewards and personalized offers, while mobile payment options offer convenience and security. Digital receipts and integrated customer service features enhance overall satisfaction.

Technology providers benefit from the growing market through expanding customer bases, recurring revenue from cloud-based subscriptions, and opportunities for value-added services. The market’s growth trajectory provides sustainable business opportunities, while technological advancement creates competitive advantages for innovative providers.

Economic stakeholders benefit from increased efficiency in commercial transactions, improved tax collection through digital records, and enhanced business intelligence that supports economic planning. The digitization of commerce contributes to the UAE’s smart city initiatives and supports the transition toward a knowledge-based economy.

Strengths:

Weaknesses:

Opportunities:

Threats:

Cloud-first adoption represents the dominant trend in the UAE POS system market, with businesses increasingly preferring cloud-based solutions for their scalability, cost-effectiveness, and automatic updates. This trend is particularly strong among small and medium enterprises that benefit from reduced IT infrastructure requirements and predictable subscription-based pricing models.

Mobile integration continues to reshape the market as businesses adopt tablet-based POS systems and mobile payment processing capabilities. The trend toward mobility enables new business models such as pop-up stores, food trucks, and field service operations while providing established businesses with flexibility in customer service delivery.

Artificial intelligence integration is becoming increasingly prevalent, with POS systems incorporating machine learning algorithms for inventory optimization, fraud detection, and customer behavior analysis. These capabilities enable businesses to make data-driven decisions and automate routine operational tasks.

Omnichannel integration drives demand for POS systems that seamlessly connect online and offline sales channels, providing unified inventory management and customer experiences. This trend is particularly important for retailers operating both physical stores and e-commerce platforms.

Contactless payment adoption has accelerated significantly, with businesses implementing NFC-enabled terminals and mobile wallet support to meet customer preferences for touch-free transactions. This trend has been reinforced by health and safety considerations and changing consumer behavior patterns.

Regulatory advancement includes the Central Bank of UAE’s continued promotion of digital payment systems and the implementation of new cybersecurity standards for payment processing systems. These developments create both opportunities and compliance requirements for POS system providers and users.

Technology partnerships between international POS providers and local system integrators have expanded market reach and improved customer support capabilities. These collaborations enable global technology companies to better serve the UAE market while providing local partners with access to advanced solutions.

Industry consolidation has occurred through acquisitions and mergers among POS system providers, creating larger companies with more comprehensive solution portfolios. This consolidation trend enables providers to offer more integrated solutions while potentially reducing market competition.

Innovation initiatives include the development of industry-specific solutions tailored to UAE market requirements, such as Arabic language support, local payment method integration, and compliance with regional business practices. These developments demonstrate the market’s maturation and specialization.

Infrastructure development includes the expansion of 5G networks and improved internet connectivity that enables more sophisticated POS system capabilities and real-time data processing. These infrastructure improvements support the adoption of cloud-based solutions and advanced analytical features.

Strategic positioning recommendations for businesses include careful evaluation of long-term requirements before selecting POS systems, considering factors such as scalability, integration capabilities, and total cost of ownership. MarkWide Research analysis suggests that businesses should prioritize solutions that offer flexibility and growth potential over lowest initial cost.

Technology adoption strategies should focus on cloud-based solutions for most businesses, particularly small and medium enterprises that can benefit from reduced IT complexity and automatic updates. However, large enterprises with specific security or customization requirements may still benefit from hybrid or on-premise solutions.

Vendor selection should emphasize local support capabilities, implementation experience in the UAE market, and long-term viability of the provider. Businesses should evaluate not only current features but also the vendor’s roadmap for future development and their ability to adapt to changing market requirements.

Implementation planning should include comprehensive staff training, data migration strategies, and contingency plans for system transitions. Businesses should allocate sufficient time and resources for proper implementation to maximize the benefits of their POS system investment.

Security considerations should be prioritized throughout the selection and implementation process, including evaluation of data encryption, access controls, and compliance with payment industry standards. Regular security updates and monitoring should be incorporated into ongoing operational procedures.

Market trajectory indicates continued strong growth in the UAE POS system market, driven by ongoing digital transformation initiatives and expanding business adoption across all sectors. The market is expected to maintain double-digit growth rates over the next five years, supported by government policies promoting cashless transactions and smart city development.

Technology evolution will continue to drive market development through integration of artificial intelligence, machine learning, and Internet of Things capabilities. Future POS systems will offer increasingly sophisticated analytical capabilities, predictive features, and automated optimization tools that transform them from transaction processing tools into comprehensive business management platforms.

Market expansion will occur both through deeper penetration in existing sectors and expansion into emerging areas such as healthcare, education, and government services. The growing small business sector will continue to drive demand for affordable, easy-to-use solutions, while enterprise requirements will push development of more sophisticated integration and management capabilities.

Regional influence of the UAE POS system market will grow as local businesses expand operations across the Middle East and Africa regions, creating demand for multi-country solutions and establishing the UAE as a regional technology hub. This expansion will benefit both local and international POS system providers operating in the market.

Innovation focus will shift toward user experience enhancement, automated business optimization, and integration with emerging technologies such as augmented reality and blockchain. These developments will create new competitive advantages for early adopters while establishing new standards for POS system capabilities and performance.

The UAE POS system market represents a dynamic and rapidly evolving sector that plays a crucial role in the country’s digital transformation journey. With strong government support, robust economic fundamentals, and increasing business adoption across all sectors, the market demonstrates exceptional growth potential and innovation opportunities. The transition toward cloud-based solutions, mobile integration, and artificial intelligence capabilities positions the UAE as a regional leader in POS technology adoption.

Market fundamentals remain strong, supported by diverse industry demand, technological infrastructure development, and favorable regulatory environment. The combination of international technology providers and local market expertise creates a competitive landscape that benefits customers through improved solutions and competitive pricing. As businesses continue to recognize the strategic value of comprehensive POS systems, adoption rates are expected to accelerate across all market segments.

Future success in the UAE POS system market will depend on providers’ ability to deliver integrated solutions that address evolving business requirements while maintaining security, reliability, and cost-effectiveness. The market’s trajectory toward more sophisticated, AI-enabled systems that provide comprehensive business intelligence represents both an opportunity and a challenge for all stakeholders in this dynamic and promising sector.

What is POS System?

A POS System, or Point of Sale System, refers to the hardware and software that businesses use to process sales transactions. It typically includes a combination of a cash register, payment processing, and inventory management functionalities.

What are the key players in the UAE POS System Market?

Key players in the UAE POS System Market include companies like Talabat, Zomato, and PayTabs, which provide various solutions for payment processing and sales management, among others.

What are the main drivers of growth in the UAE POS System Market?

The main drivers of growth in the UAE POS System Market include the increasing adoption of digital payment methods, the rise of e-commerce, and the demand for efficient inventory management solutions across retail and hospitality sectors.

What challenges does the UAE POS System Market face?

Challenges in the UAE POS System Market include the high cost of advanced systems, the need for continuous software updates, and the potential for cybersecurity threats that can compromise transaction security.

What opportunities exist in the UAE POS System Market?

Opportunities in the UAE POS System Market include the integration of AI and machine learning for enhanced customer insights, the growth of mobile payment solutions, and the expansion of POS systems into new sectors like healthcare and education.

What trends are shaping the UAE POS System Market?

Trends shaping the UAE POS System Market include the shift towards cloud-based POS solutions, the increasing use of contactless payment options, and the incorporation of analytics tools to improve business decision-making.

UAE POS System Market

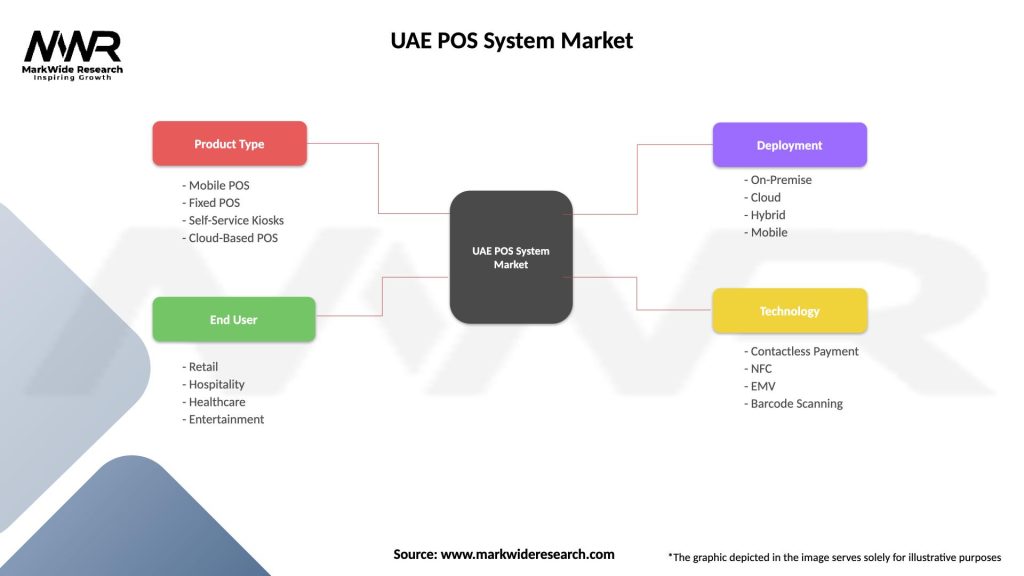

| Segmentation Details | Description |

|---|---|

| Product Type | Mobile POS, Fixed POS, Self-Service Kiosks, Cloud-Based POS |

| End User | Retail, Hospitality, Healthcare, Entertainment |

| Deployment | On-Premise, Cloud, Hybrid, Mobile |

| Technology | Contactless Payment, NFC, EMV, Barcode Scanning |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE POS System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at