444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE paint industry market represents a dynamic and rapidly evolving sector within the broader construction and manufacturing landscape of the United Arab Emirates. This thriving market encompasses a comprehensive range of coating solutions, from architectural paints and decorative finishes to industrial coatings and specialty applications. Market growth has been consistently robust, driven by the nation’s ambitious infrastructure development projects, flourishing real estate sector, and expanding manufacturing base.

Regional dynamics play a crucial role in shaping market trends, with Dubai and Abu Dhabi leading consumption patterns while northern emirates contribute significantly to industrial paint demand. The market demonstrates remarkable resilience and adaptability, responding effectively to changing consumer preferences, environmental regulations, and technological advancements. Growth projections indicate sustained expansion at approximately 6.2% CAGR through the forecast period, reflecting strong underlying demand fundamentals.

Industry transformation is evident through increasing adoption of eco-friendly formulations, smart coating technologies, and premium decorative solutions. The market benefits from strategic geographic positioning, serving as a regional hub for paint distribution across the Middle East and North Africa. Innovation trends focus on sustainability, durability, and performance enhancement, aligning with the UAE’s vision for sustainable development and green building initiatives.

The UAE paint industry market refers to the comprehensive ecosystem of paint and coating manufacturers, distributors, retailers, and service providers operating within the United Arab Emirates. This market encompasses the production, import, distribution, and application of various paint products including architectural coatings, industrial paints, marine coatings, automotive refinish products, and specialty formulations designed for specific applications and environmental conditions.

Market scope extends beyond traditional paint products to include advanced coating technologies, surface preparation materials, application equipment, and related services. The industry serves diverse end-user segments including residential construction, commercial buildings, infrastructure projects, manufacturing facilities, and maintenance applications. Value chain integration involves raw material suppliers, paint manufacturers, distributors, contractors, and end consumers, creating a complex but efficient market structure.

Regulatory framework governs product standards, environmental compliance, and safety requirements, ensuring market participants adhere to international quality benchmarks while meeting local specifications. The market operates within a competitive landscape characterized by both international brands and regional players, fostering innovation and customer-focused solutions.

Strategic positioning of the UAE paint industry market reflects strong fundamentals driven by sustained construction activity, infrastructure development, and industrial expansion. The market demonstrates exceptional resilience with consistent growth patterns supported by government initiatives, private sector investments, and increasing consumer awareness of quality coating solutions. Market leadership is shared among established international brands and emerging regional players, creating a competitive yet collaborative environment.

Key performance indicators highlight robust demand across all major segments, with architectural paints maintaining the largest market share at approximately 58% of total consumption. Industrial coatings represent the fastest-growing segment, benefiting from manufacturing sector expansion and infrastructure modernization projects. Innovation adoption rates exceed regional averages, with eco-friendly products capturing 34% market penetration among premium segments.

Future trajectory appears highly favorable, supported by mega-projects, urban development initiatives, and increasing focus on sustainable building practices. The market benefits from strategic advantages including proximity to raw material sources, advanced logistics infrastructure, and skilled workforce availability. Investment flows continue to strengthen market capacity and technological capabilities, positioning the UAE as a regional paint industry hub.

Market intelligence reveals several critical insights shaping the UAE paint industry landscape. Demand patterns show strong correlation with construction cycles, real estate development, and industrial activity levels. The market exhibits seasonal variations with peak demand during cooler months when construction and maintenance activities intensify.

Consumer behavior analysis indicates increasing sophistication in product selection, with emphasis on durability, aesthetics, and environmental impact. Professional contractors represent the largest customer segment, followed by retail consumers and industrial end-users, each with distinct requirements and purchasing patterns.

Construction sector momentum serves as the primary driver for UAE paint industry growth, with ongoing mega-projects, residential developments, and commercial construction creating sustained demand for coating solutions. The government’s commitment to infrastructure development, including transportation networks, utilities, and public facilities, generates consistent requirements for both architectural and industrial paints.

Economic diversification initiatives drive manufacturing sector expansion, creating new demand streams for industrial coatings, protective finishes, and specialty applications. The UAE’s strategic focus on becoming a regional manufacturing hub attracts investments in facilities requiring comprehensive coating solutions for equipment protection, product finishing, and facility maintenance.

Tourism industry growth stimulates hospitality sector development, generating demand for premium decorative paints, specialty finishes, and maintenance coatings for hotels, resorts, and entertainment facilities. Population growth and urbanization trends create expanding residential markets requiring both new construction and renovation applications.

Environmental awareness drives demand for sustainable paint solutions, with consumers and businesses increasingly selecting eco-friendly products that meet green building standards. Quality consciousness among consumers and professionals creates preference for premium products offering superior performance, durability, and aesthetic appeal. Technological advancement in coating formulations enables new applications and improved performance characteristics, expanding market opportunities.

Raw material volatility presents significant challenges for paint manufacturers, with fluctuating prices of key ingredients including resins, pigments, and solvents impacting production costs and profit margins. Supply chain disruptions can affect material availability and delivery schedules, potentially constraining production capacity and market supply.

Regulatory compliance requirements impose additional costs and operational complexities, particularly regarding environmental standards, safety regulations, and product certification processes. Skilled labor shortages in application services can limit market growth, especially for specialized coating applications requiring technical expertise and experience.

Economic cyclicality affects construction activity levels, creating periods of reduced demand that impact overall market performance. Competition intensity from both established brands and new market entrants can pressure pricing and profit margins, particularly in commodity paint segments.

Climate challenges including extreme temperatures, humidity, and sandstorm conditions require specialized formulations and application techniques, potentially increasing costs and complexity. Import dependencies for certain raw materials and finished products create exposure to currency fluctuations and international trade dynamics.

Sustainability trends create substantial opportunities for manufacturers developing eco-friendly paint formulations, low-VOC products, and recyclable packaging solutions. The growing emphasis on green building certifications and environmental compliance opens new market segments for specialized sustainable coating products.

Smart coating technologies present emerging opportunities in applications requiring self-cleaning surfaces, antimicrobial properties, thermal regulation, and other advanced functionalities. Industrial diversification creates demand for specialized coatings in aerospace, marine, oil and gas, and renewable energy sectors.

Export potential leverages the UAE’s strategic location and logistics infrastructure to serve regional markets across the Middle East, Africa, and South Asia. Digital transformation opportunities include e-commerce platforms, color matching technologies, and virtual consultation services enhancing customer experience and market reach.

Renovation markets offer significant growth potential as existing buildings require maintenance, refurbishment, and modernization. Specialty applications including decorative finishes, textured coatings, and architectural effects create premium market segments with higher margins. Service integration opportunities encompass color consultation, application training, and maintenance programs adding value beyond product sales.

Competitive dynamics within the UAE paint industry reflect a balanced mix of international brands and regional players, each leveraging distinct advantages in technology, distribution, pricing, or service capabilities. Market consolidation trends indicate strategic partnerships and acquisitions aimed at expanding product portfolios, geographic coverage, and technical capabilities.

Innovation cycles drive continuous product development, with manufacturers investing in research and development to create advanced formulations meeting evolving customer requirements. Customer relationship management becomes increasingly important as markets mature and differentiation shifts toward service quality and technical support.

Supply chain optimization efforts focus on improving efficiency, reducing costs, and enhancing responsiveness to market demands. Digital integration transforms traditional business models through online platforms, automated systems, and data-driven decision making processes.

Regulatory evolution continues shaping market dynamics through updated standards, environmental requirements, and safety protocols. Economic integration within the GCC region creates opportunities for market expansion and operational synergies. Technology transfer from global markets accelerates local innovation and capability development.

Comprehensive research approach combines primary and secondary data collection methods to ensure accurate and reliable market analysis. Primary research involves structured interviews with industry executives, distributors, contractors, and end-users to gather firsthand insights on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and validate primary findings. Data triangulation methods ensure consistency and reliability across multiple information sources.

Market sizing methodologies employ both top-down and bottom-up approaches, analyzing consumption patterns, production capacity, and trade flows to establish accurate market dimensions. Forecasting models incorporate economic indicators, construction activity projections, and industry growth drivers to project future market trends.

Quality assurance protocols include peer review processes, data validation procedures, and expert consultations to ensure research accuracy and credibility. Continuous monitoring systems track market developments and update analysis to reflect current conditions and emerging trends.

Dubai emirate represents the largest paint market within the UAE, accounting for approximately 42% of total consumption driven by extensive construction activity, tourism infrastructure, and commercial development projects. The emirate’s strategic position as a regional business hub creates consistent demand for both architectural and industrial coating solutions.

Abu Dhabi emirate holds significant market share at roughly 35% of national consumption, supported by government infrastructure projects, industrial development, and residential construction. The capital’s focus on sustainable development and green building initiatives drives demand for eco-friendly paint products and advanced coating technologies.

Northern emirates including Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively represent 23% of market demand, with growing industrial activities, residential developments, and infrastructure improvements contributing to steady market expansion.

Regional distribution networks efficiently serve all emirates through strategic warehouse locations, transportation infrastructure, and dealer networks. Market characteristics vary by emirate based on economic activities, population density, and development priorities, requiring tailored marketing and distribution strategies.

Cross-emirate projects create opportunities for large-scale paint supply contracts and specialized coating applications. Logistics optimization leverages the UAE’s compact geography and excellent transportation infrastructure to ensure efficient product distribution and customer service across all regions.

Market leadership is distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment fosters innovation, quality improvement, and customer service excellence.

Competitive strategies emphasize product differentiation, technical service, distribution excellence, and customer relationship management. Market positioning varies from premium brands focusing on quality and performance to value-oriented products targeting cost-conscious segments.

Product segmentation reveals distinct market categories with unique characteristics, growth patterns, and competitive dynamics. Application-based segmentation provides insights into end-user requirements and market opportunities across different sectors.

By Product Type:

By Technology:

By End-User:

Architectural paints dominate market volume and revenue, driven by continuous construction activity and renovation projects. This category benefits from steady demand patterns, brand loyalty, and opportunities for premium product positioning. Growth drivers include population expansion, urbanization trends, and increasing quality consciousness among consumers.

Industrial coatings represent the fastest-growing segment, supported by manufacturing sector expansion and infrastructure development. This category requires technical expertise, specialized formulations, and strong customer relationships. Market opportunities exist in emerging industries including renewable energy, aerospace, and advanced manufacturing.

Marine coatings benefit from the UAE’s strategic maritime position and growing shipping industry. This specialized segment requires advanced technology, regulatory compliance, and global service capabilities. Performance requirements include corrosion protection, antifouling properties, and environmental compliance.

Automotive paints serve both original equipment manufacturers and refinish markets, with growth linked to vehicle sales and maintenance activities. This segment emphasizes color matching, durability, and application efficiency. Technology trends include waterborne formulations and advanced color effects.

Specialty coatings address specific performance requirements including fire resistance, antimicrobial properties, and decorative effects. This premium segment offers higher margins and growth potential through innovation and customization. Market development focuses on emerging applications and advanced functionalities.

Manufacturers benefit from strong market demand, diverse application opportunities, and potential for product innovation. The UAE market offers strategic advantages including proximity to raw materials, skilled workforce availability, and excellent logistics infrastructure. Growth opportunities exist through market expansion, technology development, and value-added services.

Distributors and retailers enjoy consistent demand patterns, established customer relationships, and opportunities for service differentiation. Market advantages include brand portfolio diversity, geographic coverage, and technical support capabilities. Revenue streams encompass product sales, application services, and customer consultation.

Contractors and applicators benefit from steady project flow, technical training opportunities, and access to advanced products and equipment. Professional development includes certification programs, application techniques, and safety training. Business growth opportunities exist through specialization, quality service, and customer relationship management.

End-users gain access to high-quality products, technical support, and comprehensive solutions meeting specific requirements. Value proposition includes product performance, aesthetic appeal, and long-term durability. Service benefits encompass color consultation, application guidance, and maintenance support.

Investors find attractive opportunities in a growing market with strong fundamentals, diverse applications, and innovation potential. Investment advantages include market stability, growth prospects, and strategic positioning within the regional economy.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping the UAE paint industry, with manufacturers developing eco-friendly formulations, reducing VOC content, and implementing sustainable packaging solutions. Environmental compliance drives product innovation and creates competitive advantages for early adopters of green technologies.

Digital transformation accelerates across all market segments, with companies implementing e-commerce platforms, digital color matching systems, and virtual consultation services. Technology adoption enhances customer experience, improves operational efficiency, and creates new business models.

Smart coating technologies gain traction in premium segments, offering advanced functionalities including self-cleaning surfaces, antimicrobial properties, and thermal regulation. Innovation focus addresses specific market needs while creating differentiation opportunities and higher value propositions.

Service integration becomes increasingly important as markets mature and competition intensifies. Value-added services including color consultation, application training, and maintenance programs enhance customer relationships and create additional revenue streams.

Quality consciousness continues growing among consumers and professionals, driving demand for premium products offering superior performance, durability, and aesthetic appeal. Brand preference strengthens for manufacturers demonstrating consistent quality and technical support.

Manufacturing capacity expansion initiatives by major players demonstrate confidence in long-term market growth prospects. Recent investments in production facilities, research and development centers, and distribution infrastructure strengthen market supply capabilities and competitive positioning.

Strategic partnerships between international brands and local distributors enhance market penetration and customer service capabilities. Collaboration agreements focus on technology transfer, market development, and operational synergies creating mutual benefits for all stakeholders.

Product innovation accelerates with introduction of advanced formulations addressing specific market requirements including extreme weather resistance, rapid application, and enhanced durability. Technology development focuses on sustainable solutions and performance enhancement.

Regulatory updates strengthen environmental standards and safety requirements, driving industry-wide improvements in product quality and manufacturing processes. Compliance initiatives create opportunities for differentiation while ensuring market sustainability.

Market consolidation activities include acquisitions, mergers, and strategic alliances aimed at expanding geographic coverage, product portfolios, and technical capabilities. Industry restructuring creates stronger, more competitive market participants.

MarkWide Research analysis indicates that market participants should prioritize sustainability initiatives and eco-friendly product development to capture growing demand for environmentally responsible solutions. Investment recommendations focus on research and development capabilities, sustainable manufacturing processes, and green product portfolios.

Strategic positioning should emphasize technical expertise, customer service excellence, and value-added solutions rather than competing solely on price. Differentiation strategies include specialized formulations, application support, and comprehensive service offerings addressing specific customer requirements.

Digital transformation investments are essential for maintaining competitive relevance and enhancing customer engagement. Technology adoption should encompass e-commerce platforms, digital marketing, and automated systems improving operational efficiency and customer experience.

Market expansion opportunities exist through geographic diversification, new application development, and strategic partnerships. Growth strategies should balance organic development with strategic acquisitions and alliances creating synergistic benefits.

Risk management protocols should address supply chain vulnerabilities, raw material price volatility, and regulatory compliance requirements. Operational resilience requires diversified sourcing, flexible manufacturing, and comprehensive quality management systems.

Long-term prospects for the UAE paint industry remain highly favorable, supported by sustained economic growth, infrastructure development, and industrial diversification initiatives. Market projections indicate continued expansion at approximately 6.8% CAGR over the next five years, driven by construction activity, manufacturing growth, and increasing quality consciousness.

Technological advancement will continue reshaping market dynamics through smart coatings, sustainable formulations, and digital integration. Innovation trends focus on performance enhancement, environmental compliance, and customer experience improvement. MWR forecasts suggest that eco-friendly products will capture 45% market share within premium segments by 2028.

Market evolution toward higher value-added products and services creates opportunities for differentiation and margin improvement. Competitive landscape will likely see continued consolidation, strategic partnerships, and technology-driven innovation as key success factors.

Regional integration within the GCC and broader Middle East creates expansion opportunities for UAE-based manufacturers and distributors. Export potential leverages strategic location, quality reputation, and logistics infrastructure to serve growing regional markets.

Sustainability imperatives will increasingly influence product development, manufacturing processes, and customer preferences. Environmental regulations and green building standards will drive demand for sustainable coating solutions and create competitive advantages for early adopters.

The UAE paint industry market demonstrates exceptional strength and growth potential, supported by robust construction activity, industrial expansion, and strategic economic positioning. Market fundamentals remain solid with diverse demand drivers, competitive dynamics fostering innovation, and strong regulatory framework ensuring quality standards.

Future success will depend on manufacturers’ ability to adapt to changing market requirements, embrace sustainability trends, and leverage technological advancement. Strategic priorities should focus on product innovation, service excellence, and market expansion while maintaining operational efficiency and quality standards.

Investment opportunities abound for stakeholders willing to commit to long-term market development, technology advancement, and customer relationship building. The UAE paint industry market offers compelling prospects for sustainable growth and profitability within the dynamic Middle Eastern economy.

What is UAE Paint?

UAE Paint refers to the various types of coatings and finishes used in residential, commercial, and industrial applications within the United Arab Emirates. This includes decorative paints, protective coatings, and specialty finishes that cater to the unique climate and aesthetic preferences of the region.

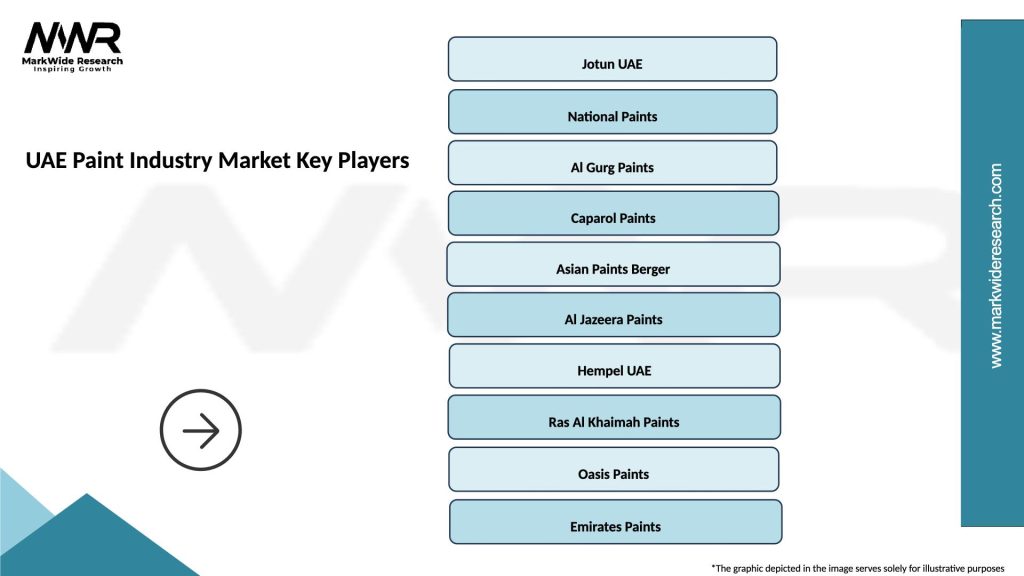

What are the key players in the UAE Paint Industry Market?

Key players in the UAE Paint Industry Market include companies like Jotun, National Paints, and Berger Paints, which are known for their wide range of products and innovative solutions. These companies compete in various segments such as decorative paints, industrial coatings, and protective finishes, among others.

What are the growth factors driving the UAE Paint Industry Market?

The growth of the UAE Paint Industry Market is driven by factors such as rapid urbanization, increasing construction activities, and a rising demand for eco-friendly and sustainable paint solutions. Additionally, the expansion of the real estate sector and infrastructure projects contribute significantly to market growth.

What challenges does the UAE Paint Industry Market face?

The UAE Paint Industry Market faces challenges such as fluctuating raw material prices and stringent environmental regulations. Additionally, competition from low-cost imports and the need for continuous innovation to meet consumer preferences can hinder market growth.

What opportunities exist in the UAE Paint Industry Market?

Opportunities in the UAE Paint Industry Market include the growing trend towards sustainable and eco-friendly products, as well as advancements in technology that enhance paint performance. The increasing focus on renovation and refurbishment projects also presents significant growth potential.

What trends are shaping the UAE Paint Industry Market?

Trends shaping the UAE Paint Industry Market include the rise of smart coatings that offer additional functionalities, such as self-cleaning and anti-bacterial properties. Furthermore, the demand for customized colors and finishes is increasing, reflecting changing consumer preferences in interior design.

UAE Paint Industry Market

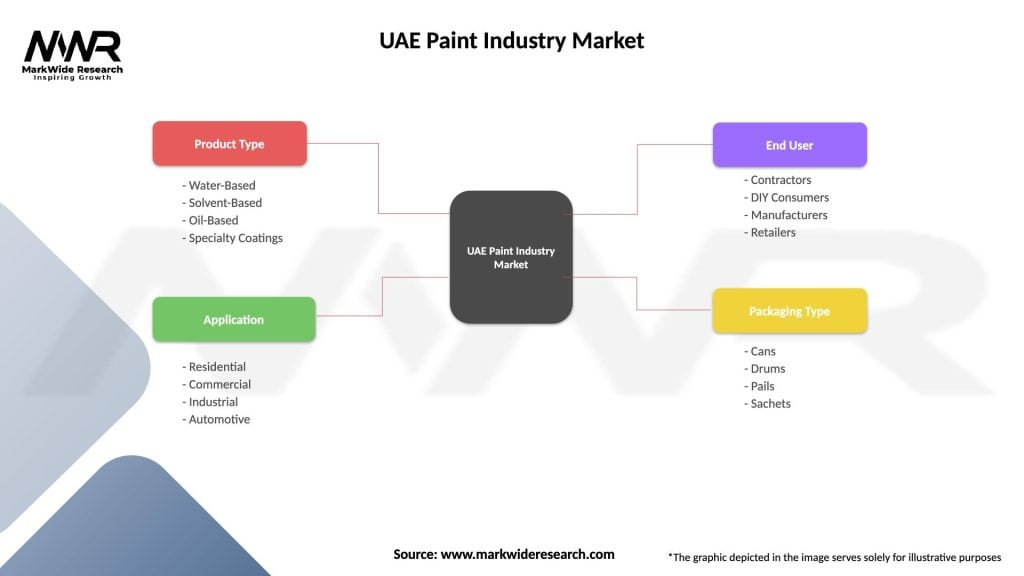

| Segmentation Details | Description |

|---|---|

| Product Type | Water-Based, Solvent-Based, Oil-Based, Specialty Coatings |

| Application | Residential, Commercial, Industrial, Automotive |

| End User | Contractors, DIY Consumers, Manufacturers, Retailers |

| Packaging Type | Cans, Drums, Pails, Sachets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Paint Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at