444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE Oil Storage Terminal Market refers to the industry involved in the storage and distribution of oil and petroleum products in the United Arab Emirates (UAE). The UAE, located in the Middle East, is one of the leading players in the global oil and gas sector. With its strategic geographical location, state-of-the-art infrastructure, and advanced technologies, the UAE has emerged as a major hub for oil storage and trading activities.

An oil storage terminal is a facility used for storing crude oil and refined petroleum products, such as gasoline, diesel, and jet fuel. These terminals serve as vital components of the oil supply chain, ensuring a steady and reliable flow of energy resources to meet domestic and international demand. Oil storage terminals play a crucial role in maintaining energy security, supporting economic growth, and facilitating global trade.

Executive Summary

The UAE Oil Storage Terminal Market has experienced significant growth in recent years, driven by various factors such as increasing oil production, rising demand for petroleum products, expanding refinery capacities, and the country’s strategic position as a major transshipment point. This executive summary provides an overview of the key market insights, drivers, restraints, opportunities, and dynamics shaping the UAE Oil Storage Terminal Market.

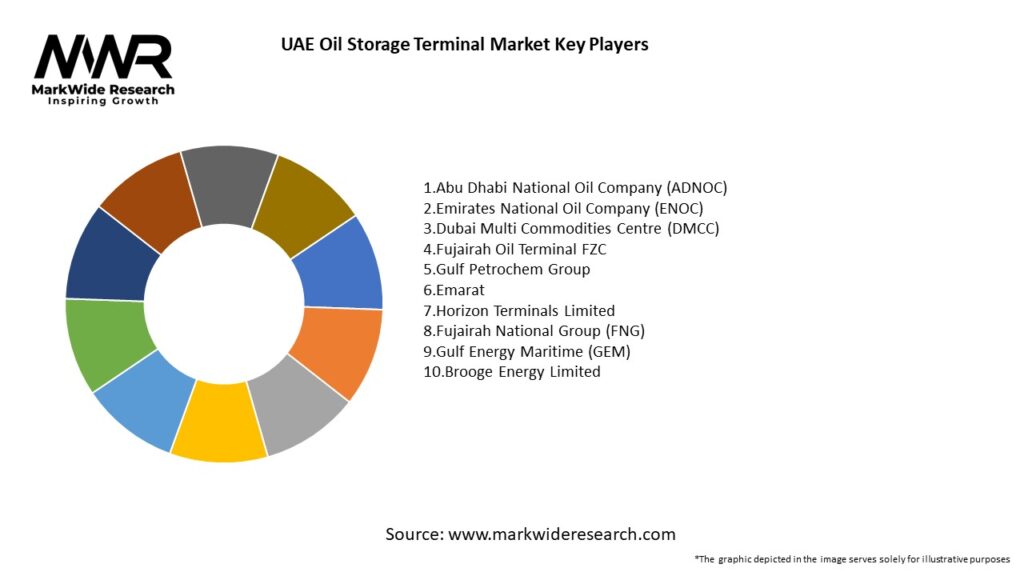

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

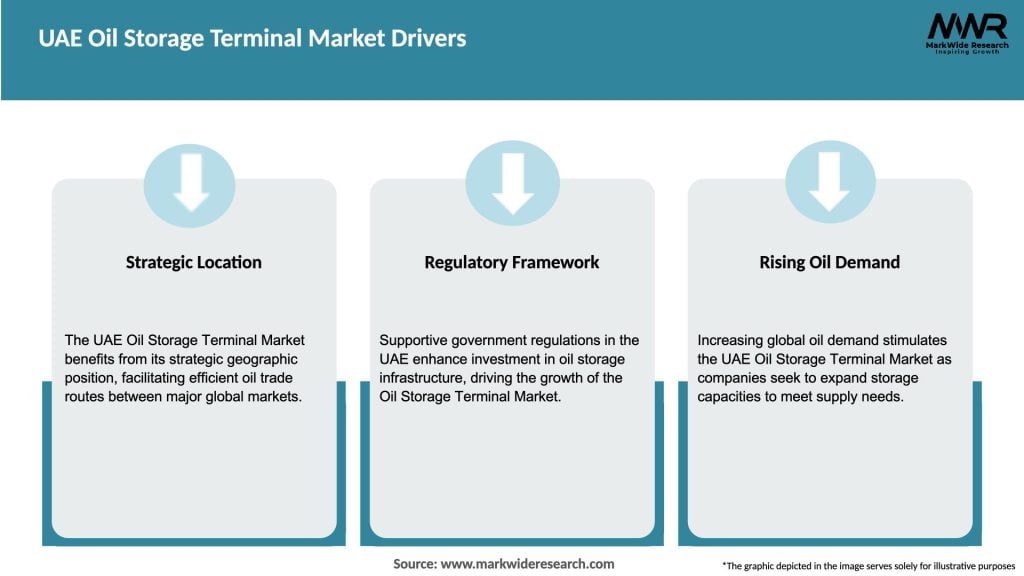

Several factors are driving the growth of the UAE Oil Storage Terminal Market:

Market Restraints

Despite the positive market outlook, the UAE Oil Storage Terminal Market faces some challenges:

Market Opportunities

The UAE Oil Storage Terminal Market presents several opportunities for industry participants:

Market Dynamics

The UAE Oil Storage Terminal Market is characterized by dynamic factors that shape its growth and development. These dynamics include:

Regional Analysis

The UAE Oil Storage Terminal Market is concentrated in key regions across the country. These regions include:

Competitive Landscape

Leading companies in the UAE Oil Storage Terminal Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

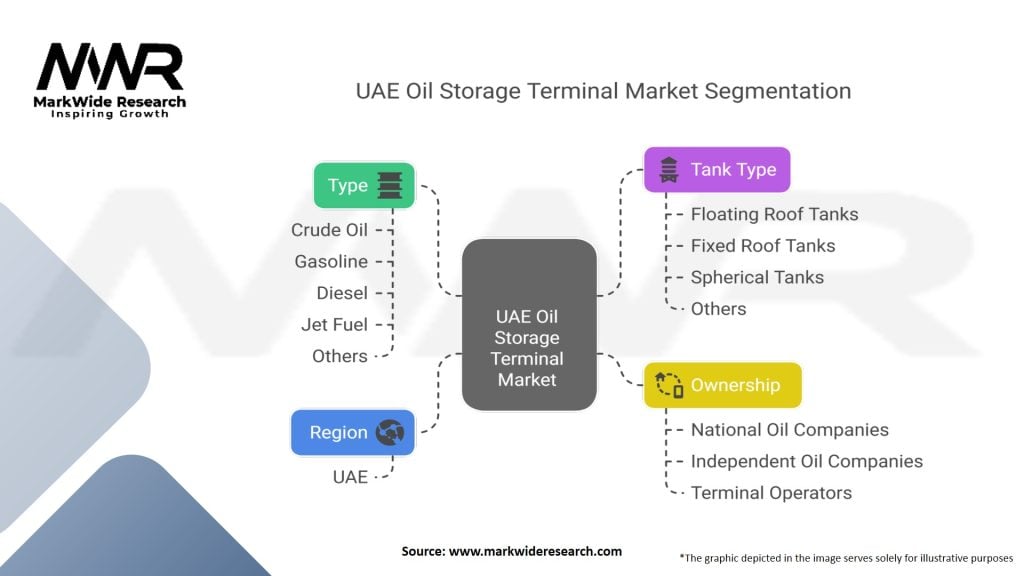

The UAE Oil Storage Terminal Market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The UAE Oil Storage Terminal Market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis provides an assessment of the UAE Oil Storage Terminal Market’s strengths, weaknesses, opportunities, and threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the UAE Oil Storage Terminal Market, as it did on the global oil and gas industry. The pandemic led to a sharp decline in oil demand, primarily due to reduced transportation activities and economic slowdown. This demand shock resulted in storage capacity constraints, leading to temporary oversupply and a drop in oil prices. However, as the world recovers from the pandemic, oil demand is expected to rebound, driving the need for efficient storage terminals to meet the recovering demand and support economic revival.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the UAE Oil Storage Terminal Market is positive, driven by factors such as increasing oil production, rising demand for petroleum products, infrastructure development, and the country’s strategic position as a global oil hub. As the UAE continues to diversify its economy and invest in renewable energy sources, the storage terminal industry will witness further opportunities for growth and innovation. Technological advancements, sustainability initiatives, and international partnerships will play pivotal roles in shaping the future landscape of the UAE Oil Storage Terminal Market.

Conclusion

The UAE Oil Storage Terminal Market is a vital component of the country’s oil and gas sector, providing storage and distribution infrastructure for crude oil and petroleum products. The market has experienced significant growth, driven by increasing oil production, rising demand for energy resources, infrastructure expansion, and strategic partnerships. While facing challenges such as price volatility and regulatory compliance, the market presents opportunities for industry participants, including infrastructure expansion, technological advancements, energy transition, and international trade. Collaboration, sustainability, and digital transformation will be key factors in shaping the market’s future outlook, ensuring its continued growth, and contributing to the UAE’s energy security and economic development.

What is the UAE oil storage terminal?

The UAE oil storage terminal refers to facilities designed for the storage of crude oil and refined petroleum products in the United Arab Emirates. These terminals play a crucial role in the oil supply chain, enabling the management of inventory and distribution to various markets.

Who are the key players in the UAE Oil Storage Terminal Market?

Key players in the UAE Oil Storage Terminal Market include companies such as ADNOC, VTTI, and Gulf Petrochem, which operate significant storage facilities and contribute to the region’s oil logistics infrastructure, among others.

What are the main drivers of growth in the UAE Oil Storage Terminal Market?

The main drivers of growth in the UAE Oil Storage Terminal Market include increasing global oil demand, strategic geographic positioning for oil trade, and investments in infrastructure development to enhance storage capacity.

What challenges does the UAE Oil Storage Terminal Market face?

Challenges in the UAE Oil Storage Terminal Market include regulatory compliance issues, fluctuating oil prices affecting profitability, and the need for advanced technology to improve operational efficiency.

What opportunities exist in the UAE Oil Storage Terminal Market?

Opportunities in the UAE Oil Storage Terminal Market include the expansion of renewable energy storage solutions, the development of smart terminal technologies, and the potential for increased foreign investment in storage infrastructure.

What trends are shaping the UAE Oil Storage Terminal Market?

Trends shaping the UAE Oil Storage Terminal Market include the adoption of digital technologies for monitoring and management, a shift towards sustainability practices, and the integration of automated systems to enhance operational efficiency.

UAE Oil Storage Terminal Market

| Segmentation | Details |

|---|---|

| Type | Crude Oil, Gasoline, Diesel, Jet Fuel, Others |

| Tank Type | Floating Roof Tanks, Fixed Roof Tanks, Spherical Tanks, Others |

| Ownership | National Oil Companies, Independent Oil Companies, Terminal Operators |

| Region | UAE |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Oil Storage Terminal Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at