444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE oil and gas upstream market represents one of the most significant energy sectors in the Middle East, encompassing exploration, drilling, and production activities across the Emirates. Strategic positioning in global energy markets has established the UAE as a critical player in hydrocarbon production, with substantial reserves driving continued investment and technological advancement. The upstream sector demonstrates robust growth potential with current production capacity expanding at approximately 4.2% annually through enhanced recovery techniques and new field developments.

Market dynamics indicate strong momentum driven by government initiatives, technological innovation, and strategic partnerships with international oil companies. The UAE’s upstream operations span both onshore and offshore fields, with advanced extraction technologies enabling efficient resource recovery from conventional and unconventional reserves. Digital transformation initiatives are revolutionizing operational efficiency, with smart field technologies contributing to 15% improvement in production optimization across major facilities.

Regional leadership in the upstream sector reflects comprehensive infrastructure development, regulatory framework enhancement, and sustained investment in exploration activities. The market benefits from strategic geographic location, providing access to global markets while maintaining competitive production costs through technological advancement and operational excellence.

The UAE oil and gas upstream market refers to the comprehensive sector encompassing exploration, development, and production activities for crude oil and natural gas resources within the United Arab Emirates territory. This market segment includes all activities from initial geological surveys and seismic studies through drilling operations, well completion, and hydrocarbon extraction from subsurface reservoirs.

Upstream operations constitute the foundation of the UAE’s energy value chain, involving sophisticated technological processes to locate, access, and extract hydrocarbon resources from both onshore and offshore fields. The sector encompasses exploration activities utilizing advanced geophysical techniques, drilling operations employing cutting-edge equipment, and production processes incorporating enhanced recovery methods to maximize resource extraction efficiency.

Market scope extends beyond traditional extraction activities to include reservoir management, field development planning, and production optimization through digital technologies. The upstream segment serves as the primary source of raw materials for downstream refining and petrochemical operations, making it fundamental to the UAE’s energy security and economic diversification strategies.

Strategic analysis reveals the UAE oil and gas upstream market as a dynamic sector characterized by technological innovation, operational excellence, and sustainable growth trajectories. Production capacity continues expanding through enhanced recovery techniques, with current operations achieving 92% field efficiency rates across major production facilities. The market demonstrates resilience through diversified portfolio management and strategic international partnerships.

Key performance indicators highlight significant achievements in operational optimization, with digital transformation initiatives contributing to 18% reduction in operational costs over recent periods. Investment patterns show sustained commitment to exploration activities, field development projects, and technology advancement programs supporting long-term production sustainability.

Market positioning reflects the UAE’s commitment to maintaining global energy leadership while advancing environmental stewardship through cleaner production technologies. Regulatory framework enhancements support investor confidence and operational transparency, creating favorable conditions for continued market expansion and international collaboration.

Fundamental market insights reveal several critical factors driving upstream sector development in the UAE:

Market intelligence indicates strong correlation between technological advancement and production efficiency improvements, with smart field technologies contributing significantly to operational optimization across the upstream value chain.

Primary market drivers propelling UAE oil and gas upstream sector growth encompass multiple strategic and operational factors. Government initiatives supporting energy sector development create favorable investment conditions, with policy frameworks encouraging technological innovation and operational excellence. Strategic location advantages provide access to global markets while maintaining competitive production costs through efficient logistics and transportation networks.

Technological advancement serves as a fundamental growth driver, with digital transformation initiatives enabling enhanced reservoir management and production optimization. Smart field technologies contribute to operational efficiency improvements, while advanced drilling techniques expand access to previously challenging reserves. Enhanced recovery methods extend field life cycles and maximize resource extraction from existing assets.

International partnerships facilitate knowledge transfer and technology sharing, accelerating innovation adoption and operational capability enhancement. Investment climate improvements through regulatory framework development attract foreign direct investment and support large-scale project implementation. Energy security priorities drive continued exploration and development activities, ensuring sustainable production capacity to meet domestic and export demand requirements.

Market challenges facing the UAE oil and gas upstream sector include several operational and strategic constraints. Capital intensity requirements for exploration and development projects create significant financial barriers, particularly for smaller operators seeking market entry. Technical complexity associated with advanced extraction technologies demands specialized expertise and sophisticated equipment investments.

Environmental regulations impose operational constraints requiring compliance with stringent emission standards and environmental protection protocols. Regulatory complexity can create administrative challenges for project approval and implementation processes, potentially extending development timelines. Market volatility in global commodity prices affects investment decisions and project economics, influencing long-term planning strategies.

Skilled workforce requirements present ongoing challenges, with specialized technical expertise essential for advanced upstream operations. Infrastructure limitations in certain regions may constrain development opportunities, requiring substantial investment in supporting facilities and transportation networks. Geopolitical factors can influence market stability and international partnership opportunities, affecting strategic planning and investment allocation decisions.

Significant opportunities exist within the UAE oil and gas upstream market for expansion and innovation. Unconventional resource development presents substantial potential for production capacity enhancement through advanced extraction technologies and enhanced recovery techniques. Offshore exploration opportunities offer access to untapped reserves, with technological advancement enabling economic development of deepwater resources.

Digital transformation initiatives create opportunities for operational optimization and cost reduction through artificial intelligence, machine learning, and Internet of Things applications. Carbon capture and storage technologies present opportunities for environmental compliance enhancement while maintaining production efficiency. Strategic partnerships with international technology providers enable access to cutting-edge solutions and operational expertise.

Market diversification opportunities include natural gas development for domestic consumption and export markets, supporting energy transition objectives. Technology commercialization presents opportunities for local innovation development and intellectual property creation. Workforce development programs create opportunities for human capital enhancement and knowledge transfer from international partners to local talent pools.

Complex market dynamics shape the UAE oil and gas upstream sector through interconnected operational, regulatory, and economic factors. Supply and demand equilibrium influences production planning and investment allocation, with global market conditions affecting strategic decision-making processes. Technological evolution continuously transforms operational capabilities, enabling enhanced efficiency and production optimization across upstream activities.

Competitive landscape dynamics reflect both domestic and international player interactions, with strategic partnerships and joint ventures facilitating market development. Regulatory environment evolution supports market transparency and investor confidence while ensuring environmental compliance and operational safety standards. Investment flows respond to market conditions and policy frameworks, influencing project development timelines and capacity expansion plans.

Innovation cycles drive continuous improvement in extraction technologies and operational methodologies, with research and development investments supporting competitive advantage maintenance. Market integration with global energy systems creates opportunities for strategic positioning and value chain optimization. Sustainability considerations increasingly influence operational practices and investment decisions, aligning with environmental stewardship objectives and regulatory requirements.

Comprehensive research methodology employed in analyzing the UAE oil and gas upstream market incorporates multiple data sources and analytical approaches. Primary research involves direct engagement with industry stakeholders, including operators, service providers, and regulatory authorities to gather firsthand insights on market conditions and operational challenges. Secondary research encompasses analysis of industry reports, government publications, and technical literature to establish market context and historical trends.

Data collection processes utilize structured interviews, surveys, and field observations to capture quantitative and qualitative information on market dynamics. Statistical analysis employs advanced modeling techniques to identify trends, correlations, and predictive indicators supporting market forecasting and strategic planning. Validation procedures ensure data accuracy and reliability through cross-referencing multiple sources and expert review processes.

Analytical framework incorporates market segmentation analysis, competitive landscape assessment, and regulatory impact evaluation to provide comprehensive market understanding. Forecasting models utilize historical data patterns and current market indicators to project future trends and growth trajectories. Quality assurance protocols maintain research integrity through systematic verification and peer review processes throughout the analysis development cycle.

Regional distribution within the UAE oil and gas upstream market reflects diverse geological formations and operational characteristics across different Emirates. Abu Dhabi dominates upstream activities with approximately 78% market share, hosting major onshore and offshore fields including significant conventional and unconventional reserves. Operational infrastructure in Abu Dhabi supports large-scale production activities with advanced extraction technologies and comprehensive processing facilities.

Dubai and Northern Emirates contribute approximately 15% market share through specialized upstream operations focusing on enhanced recovery techniques and technological innovation. Offshore developments in federal waters present opportunities for collaborative projects between different Emirates, facilitating resource sharing and operational efficiency improvements. Regional coordination mechanisms support integrated planning and infrastructure development across Emirates boundaries.

Geographic advantages vary across regions, with coastal areas offering offshore exploration opportunities while inland regions provide access to conventional onshore reserves. Infrastructure connectivity between regions enables efficient resource transportation and processing optimization. Investment distribution reflects regional resource potential and operational complexity, with major projects concentrated in areas offering optimal economic returns and technical feasibility.

Competitive environment in the UAE oil and gas upstream market features a diverse mix of national oil companies, international operators, and specialized service providers. Market leadership is established through operational excellence, technological innovation, and strategic asset portfolio management.

Competitive strategies emphasize technological differentiation, operational efficiency, and strategic partnership development to maintain market position and drive growth opportunities.

Market segmentation analysis reveals multiple classification approaches for the UAE oil and gas upstream sector. By Resource Type: The market divides into crude oil production representing approximately 82% market share and natural gas operations accounting for 18% market share. Operational complexity varies between conventional and unconventional resource extraction, with enhanced recovery techniques increasingly important for mature field optimization.

By Location: Geographic segmentation distinguishes between onshore operations comprising 65% market share and offshore activities representing 35% market share. Onshore operations benefit from established infrastructure and operational familiarity, while offshore developments offer access to significant untapped reserves requiring advanced technological solutions.

By Technology: Segmentation includes conventional extraction methods, enhanced oil recovery techniques, and digital transformation applications. Advanced technologies increasingly dominate new project development, with smart field solutions and artificial intelligence applications driving operational optimization. Service segmentation encompasses drilling services, production optimization, reservoir management, and maintenance operations supporting comprehensive upstream value chain requirements.

Detailed category analysis provides specific insights into different upstream market segments. Exploration Activities: Seismic surveys and geological studies continue expanding into frontier areas, with 3D and 4D seismic technologies enabling detailed subsurface mapping and reservoir characterization. Advanced imaging techniques improve exploration success rates while reducing operational risks and environmental impact.

Drilling Operations: Technological advancement in drilling techniques includes horizontal drilling, multilateral wells, and managed pressure drilling systems. Drilling efficiency improvements achieve 25% reduction in average drilling time through advanced equipment and operational optimization. Automated drilling systems enhance precision and safety while reducing operational costs and environmental footprint.

Production Operations: Enhanced oil recovery techniques including water flooding, gas injection, and chemical flooding extend field life and maximize resource recovery. Digital production systems enable real-time monitoring and optimization, improving operational efficiency and reducing maintenance requirements. Artificial lift systems support production optimization in mature fields, maintaining economic viability through technological innovation and operational excellence.

Substantial benefits accrue to various stakeholders participating in the UAE oil and gas upstream market. Operators benefit from advanced technological capabilities, regulatory support, and strategic geographic positioning enabling competitive advantage in global markets. Investment returns reflect operational efficiency improvements and production optimization through digital transformation initiatives.

Service providers gain access to sophisticated project opportunities requiring specialized expertise and advanced technological solutions. Technology vendors benefit from market demand for innovative solutions supporting operational optimization and environmental compliance. Local communities receive economic benefits through employment opportunities, infrastructure development, and local content requirements supporting economic diversification.

Government stakeholders achieve strategic objectives including energy security, economic diversification, and revenue generation through upstream sector development. International partners access attractive investment opportunities with supportive regulatory frameworks and operational infrastructure. Environmental benefits result from advanced technologies reducing operational impact and supporting sustainability objectives through cleaner production methods and emission reduction initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends are reshaping the UAE oil and gas upstream market landscape. Digital transformation accelerates across all operational aspects, with artificial intelligence and machine learning applications optimizing production processes and predictive maintenance programs. Smart field technologies enable real-time monitoring and automated control systems, improving operational efficiency and reducing human intervention requirements.

Environmental sustainability increasingly influences operational practices, with carbon capture and storage technologies gaining prominence. Enhanced oil recovery techniques continue advancing, with chemical flooding and thermal recovery methods extending field life cycles. Automation integration reduces operational costs while improving safety performance and operational consistency.

Partnership models evolve toward strategic alliances combining technological expertise with operational capabilities. Workforce transformation reflects increasing digitalization requirements, with specialized training programs developing technical capabilities. Regulatory evolution supports innovation adoption while maintaining environmental protection and operational safety standards. Investment patterns shift toward technology-enabled projects offering superior operational efficiency and environmental performance.

Recent industry developments demonstrate significant progress in UAE oil and gas upstream sector advancement. ADNOC’s strategic partnerships with international technology companies accelerate innovation adoption and operational capability enhancement. Digital transformation initiatives across major operators achieve measurable improvements in production efficiency and cost optimization.

Regulatory framework enhancements support investor confidence and operational transparency while maintaining environmental compliance standards. Infrastructure investments in processing facilities and transportation networks expand operational capacity and market access capabilities. Technology commercialization programs promote local innovation development and intellectual property creation.

International collaboration agreements facilitate knowledge transfer and best practice sharing across operational domains. Workforce development initiatives enhance local technical capabilities through training programs and educational partnerships. Environmental compliance programs demonstrate commitment to sustainable operations while maintaining production efficiency. Research and development investments support technological advancement and competitive advantage maintenance in global markets.

Strategic recommendations from MarkWide Research analysis emphasize several critical areas for UAE oil and gas upstream market development. Technology investment should prioritize digital transformation initiatives offering measurable operational improvements and cost reduction opportunities. Partnership strategies should focus on knowledge transfer and capability development rather than purely financial arrangements.

Operational excellence programs should emphasize continuous improvement methodologies and performance optimization across all upstream activities. Workforce development initiatives require sustained investment in technical training and capability enhancement to support advanced operational requirements. Environmental compliance should be integrated into operational planning rather than treated as separate regulatory requirement.

Innovation adoption should follow systematic evaluation processes ensuring technology alignment with operational objectives and economic viability. Market diversification strategies should consider natural gas development opportunities supporting energy transition objectives. Regulatory engagement should maintain proactive approach ensuring policy alignment with industry development objectives and operational requirements.

Future prospects for the UAE oil and gas upstream market indicate sustained growth driven by technological advancement and operational optimization. Production capacity is projected to expand at 3.8% annually through enhanced recovery techniques and new field development projects. Digital transformation initiatives will continue driving operational efficiency improvements and cost reduction across upstream value chain activities.

Technology integration will accelerate with artificial intelligence and machine learning applications becoming standard operational tools. Environmental compliance requirements will drive innovation in cleaner production technologies and emission reduction systems. International partnerships will expand, facilitating access to advanced technologies and operational expertise from global industry leaders.

Investment patterns will increasingly favor technology-enabled projects offering superior operational performance and environmental compliance. Workforce transformation will continue reflecting digitalization requirements and advanced technical skill development. Market positioning will strengthen through operational excellence and technological leadership, maintaining competitive advantage in global energy markets. Regulatory framework evolution will support continued innovation adoption while ensuring environmental protection and operational safety standards.

Comprehensive analysis reveals the UAE oil and gas upstream market as a dynamic and technologically advanced sector positioned for sustained growth and innovation. Strategic advantages including substantial resource base, advanced infrastructure, and supportive regulatory framework create favorable conditions for continued market development and international competitiveness.

Technology leadership through digital transformation initiatives and operational optimization programs drives efficiency improvements and cost reduction across upstream activities. Market opportunities in unconventional resource development, offshore exploration, and enhanced recovery techniques offer significant potential for production capacity expansion and operational excellence enhancement.

Future success will depend on continued investment in technological advancement, workforce development, and environmental compliance while maintaining operational efficiency and competitive positioning. The UAE oil and gas upstream market demonstrates strong fundamentals and strategic positioning supporting long-term growth and contribution to national economic objectives and global energy security requirements.

What is Oil and Gas Upstream?

Oil and Gas Upstream refers to the exploration and production segment of the oil and gas industry, focusing on the extraction of crude oil and natural gas from the earth. This includes activities such as drilling, reservoir management, and production operations.

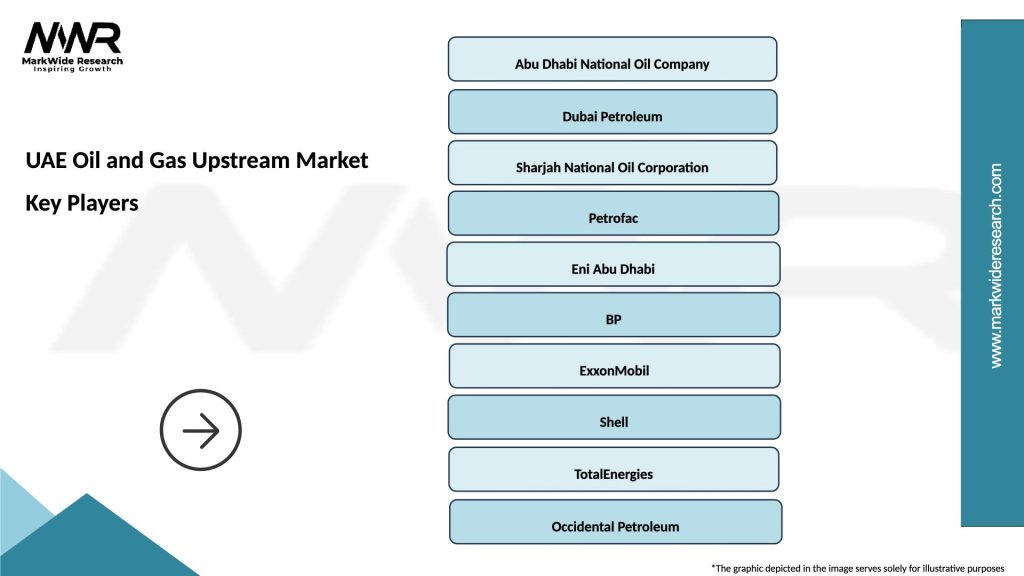

What are the key players in the UAE Oil and Gas Upstream Market?

Key players in the UAE Oil and Gas Upstream Market include Abu Dhabi National Oil Company (ADNOC), Dubai Petroleum, and Occidental Petroleum, among others. These companies are involved in exploration, drilling, and production activities within the region.

What are the main drivers of the UAE Oil and Gas Upstream Market?

The main drivers of the UAE Oil and Gas Upstream Market include the increasing global energy demand, technological advancements in extraction methods, and the country’s vast hydrocarbon reserves. Additionally, government initiatives to enhance production efficiency play a significant role.

What challenges does the UAE Oil and Gas Upstream Market face?

The UAE Oil and Gas Upstream Market faces challenges such as fluctuating oil prices, environmental regulations, and the need for sustainable practices. These factors can impact investment decisions and operational costs in the sector.

What opportunities exist in the UAE Oil and Gas Upstream Market?

Opportunities in the UAE Oil and Gas Upstream Market include the potential for enhanced oil recovery techniques, investment in renewable energy integration, and partnerships with international firms for technology transfer. These avenues can lead to increased production and efficiency.

What trends are shaping the UAE Oil and Gas Upstream Market?

Trends shaping the UAE Oil and Gas Upstream Market include the adoption of digital technologies for exploration and production, a focus on sustainability and reduced carbon emissions, and the increasing role of artificial intelligence in operational efficiency. These trends are transforming how companies operate in the sector.

UAE Oil and Gas Upstream Market

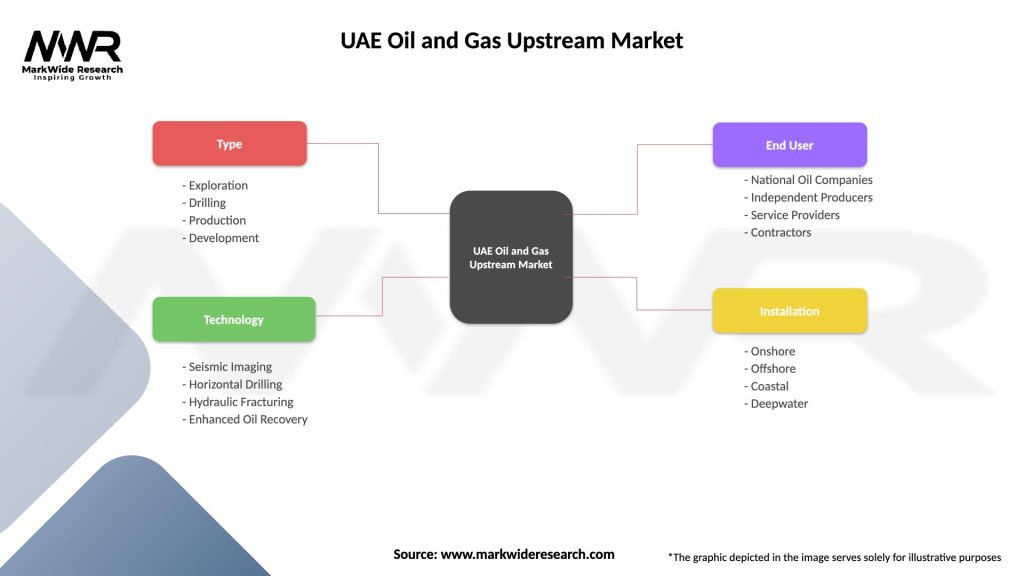

| Segmentation Details | Description |

|---|---|

| Type | Exploration, Drilling, Production, Development |

| Technology | Seismic Imaging, Horizontal Drilling, Hydraulic Fracturing, Enhanced Oil Recovery |

| End User | National Oil Companies, Independent Producers, Service Providers, Contractors |

| Installation | Onshore, Offshore, Coastal, Deepwater |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Oil and Gas Upstream Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at