444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE modular kitchen market represents one of the most dynamic segments within the region’s construction and home improvement industry. Modular kitchen solutions have gained tremendous popularity across the Emirates, driven by rapid urbanization, changing lifestyle preferences, and increasing disposable income among residents. The market encompasses a comprehensive range of pre-fabricated kitchen components, including cabinets, countertops, storage solutions, and integrated appliances designed for modern living spaces.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This expansion reflects the UAE’s position as a regional hub for luxury living and innovative home design solutions. Dubai and Abu Dhabi lead market demand, accounting for approximately 75% of total market consumption, while emerging emirates like Sharjah and Ajman contribute to the growing market base.

Consumer preferences have shifted significantly toward customizable, space-efficient kitchen solutions that blend functionality with aesthetic appeal. The integration of smart technology, sustainable materials, and contemporary design elements has become increasingly important for UAE homeowners and property developers seeking to meet international standards and local cultural preferences.

The UAE modular kitchen market refers to the comprehensive ecosystem of pre-manufactured kitchen components and systems designed for residential and commercial applications across the United Arab Emirates. Modular kitchens consist of standardized units or modules that can be combined, customized, and configured to create complete kitchen solutions tailored to specific space requirements and user preferences.

Key characteristics of modular kitchen systems include factory-manufactured components, standardized dimensions, flexible configuration options, and professional installation services. These solutions typically incorporate cabinets, drawers, shelving units, countertops, backsplashes, and integrated storage systems that maximize space utilization while maintaining design coherence.

Market participants include manufacturers, distributors, retailers, interior designers, and installation specialists who collaborate to deliver complete kitchen solutions. The sector serves diverse customer segments, from individual homeowners and apartment dwellers to property developers, hospitality operators, and commercial establishments requiring efficient kitchen facilities.

Strategic analysis reveals the UAE modular kitchen market as a rapidly evolving sector characterized by innovation, customization, and premium positioning. The market benefits from the country’s robust construction industry, growing expatriate population, and increasing emphasis on modern living standards. Key growth drivers include urbanization trends, rising household incomes, and changing consumer lifestyles that prioritize convenience and aesthetic appeal.

Market segmentation demonstrates diverse opportunities across residential and commercial applications, with luxury and mid-range segments showing particularly strong performance. The residential sector accounts for approximately 68% of market demand, while commercial applications, including hotels, restaurants, and office spaces, represent significant growth potential.

Competitive landscape features both international brands and local manufacturers competing on quality, design innovation, and customer service. European and Italian brands maintain strong market presence, while regional manufacturers increasingly focus on cost-effective solutions tailored to local preferences and climate conditions.

Future prospects indicate continued expansion driven by smart home integration, sustainable materials adoption, and increasing demand for personalized kitchen solutions. The market is expected to benefit from ongoing infrastructure development, population growth, and evolving consumer expectations regarding home functionality and design.

Market intelligence reveals several critical insights shaping the UAE modular kitchen landscape. Consumer behavior analysis indicates a strong preference for European-style designs combined with functionality suited to Middle Eastern cooking practices and family structures.

Primary growth drivers propelling the UAE modular kitchen market include demographic shifts, economic development, and evolving lifestyle preferences. Urbanization trends continue to drive demand for efficient, modern kitchen solutions as more residents move to urban centers and seek contemporary living experiences.

Economic prosperity across the UAE has increased disposable income levels, enabling consumers to invest in premium home improvement solutions. The growing expatriate population, representing approximately 85% of the UAE’s total population, brings diverse cultural preferences and international design standards that fuel market demand for varied modular kitchen options.

Real estate development activities, particularly in Dubai and Abu Dhabi, create substantial demand for modular kitchen solutions in new residential and commercial projects. Property developers increasingly recognize that modern, well-designed kitchens significantly enhance property values and marketability to both local and international buyers.

Lifestyle evolution among UAE residents emphasizes convenience, functionality, and aesthetic appeal in home design. Busy professional lifestyles drive demand for efficient kitchen solutions that maximize space utilization while minimizing maintenance requirements. Cultural integration also plays a role, as modular kitchens can be customized to accommodate traditional cooking practices alongside modern culinary preferences.

Market challenges facing the UAE modular kitchen sector include cost considerations, installation complexities, and competitive pressures. High initial investment requirements for premium modular kitchen solutions can limit market accessibility for price-sensitive consumer segments, particularly in the mid-range residential market.

Installation challenges related to skilled labor availability and project coordination can impact customer satisfaction and market growth. The requirement for specialized installation expertise and potential delays in project completion may deter some consumers from choosing modular kitchen solutions over traditional alternatives.

Market saturation in certain segments, particularly luxury residential applications, creates intense competition among suppliers and may pressure profit margins. The presence of numerous international and local competitors can make market differentiation challenging for new entrants and smaller players.

Economic fluctuations and their impact on construction activity and consumer spending can affect market demand. Changes in oil prices, government spending, and global economic conditions may influence both residential and commercial investment in kitchen renovation and new construction projects.

Emerging opportunities within the UAE modular kitchen market present significant potential for growth and innovation. Smart home integration represents a major opportunity as consumers increasingly seek connected kitchen solutions featuring automated systems, intelligent storage, and integrated technology platforms.

Sustainable solutions offer substantial growth potential as environmental consciousness increases among UAE consumers. Opportunities exist for manufacturers and suppliers who can provide eco-friendly materials, energy-efficient appliances, and sustainable production processes that align with the UAE’s environmental goals and consumer preferences.

Commercial sector expansion presents opportunities in hospitality, healthcare, and corporate facilities requiring modern kitchen solutions. The UAE’s position as a global business and tourism hub creates ongoing demand for commercial kitchen applications in hotels, restaurants, office buildings, and healthcare facilities.

Customization services represent a growing opportunity as consumers seek personalized solutions that reflect individual preferences and cultural requirements. Companies offering comprehensive design consultation, custom manufacturing, and specialized installation services can capture premium market segments and build strong customer relationships.

Market dynamics in the UAE modular kitchen sector reflect the interplay of supply and demand factors, competitive forces, and technological advancement. Supply chain efficiency has become increasingly important as manufacturers and distributors work to optimize inventory management, reduce lead times, and improve customer service levels.

Competitive intensity drives continuous innovation in product design, materials technology, and service delivery. Market participants invest heavily in research and development to create differentiated offerings that meet evolving consumer preferences while maintaining competitive pricing structures.

Technology adoption influences market dynamics through the integration of digital design tools, virtual reality showrooms, and online customization platforms. These technological advances enhance customer experience while improving operational efficiency for manufacturers and retailers.

Regulatory environment impacts market dynamics through building codes, safety standards, and import regulations that affect product specifications and market entry requirements. Companies must navigate these regulatory requirements while maintaining product quality and competitive positioning in the market.

Comprehensive research methodology employed in analyzing the UAE modular kitchen market combines primary and secondary research approaches to ensure data accuracy and market insight validity. Primary research includes structured interviews with industry participants, consumer surveys, and expert consultations with market professionals across the value chain.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and trend identification. Data triangulation methods ensure research findings accuracy through cross-verification of information sources and analytical approaches.

Market segmentation analysis utilizes both quantitative and qualitative research methods to identify distinct customer segments, competitive positioning, and growth opportunities. Research methodology includes analysis of pricing trends, distribution channels, and consumer behavior patterns across different market segments.

Forecasting models incorporate historical data analysis, trend extrapolation, and scenario planning to project future market developments. The methodology considers multiple variables including economic indicators, demographic trends, and industry-specific factors that influence market growth and evolution.

Regional distribution across the UAE modular kitchen market reveals distinct patterns reflecting economic development, population density, and consumer preferences. Dubai emirate leads market consumption with approximately 45% market share, driven by its large expatriate population, luxury residential developments, and commercial construction activity.

Abu Dhabi represents the second-largest market segment, accounting for roughly 30% of total demand. The emirate’s focus on sustainable development, government sector growth, and high-end residential projects creates substantial opportunities for premium modular kitchen solutions.

Northern Emirates including Sharjah, Ajman, Ras Al Khaimah, and Fujairah collectively represent approximately 20% of market demand. These regions show growing potential driven by affordable housing developments, population growth, and increasing consumer awareness of modular kitchen benefits.

Market characteristics vary significantly across regions, with Dubai and Abu Dhabi emphasizing luxury and premium segments while northern emirates focus more on value-oriented solutions. Cultural preferences and income levels influence product selection, with higher-income areas showing greater adoption of smart technology and premium materials.

Competitive environment in the UAE modular kitchen market features diverse participants ranging from international luxury brands to local manufacturers and specialized service providers. Market leadership is distributed among several key players who compete on design innovation, quality, and customer service excellence.

Competitive strategies include product differentiation, service excellence, strategic partnerships, and market expansion initiatives. Companies increasingly focus on digital marketing, showroom experiences, and customer relationship management to build brand loyalty and market share.

Market segmentation analysis reveals multiple dimensions for categorizing the UAE modular kitchen market based on application, price range, materials, and customer demographics. Application-based segmentation distinguishes between residential and commercial markets, each with distinct requirements and growth characteristics.

By Application:

By Price Range:

By Material Type:

Category analysis provides detailed insights into specific product segments within the UAE modular kitchen market. Cabinet systems represent the largest category, accounting for approximately 40% of total market value, driven by their central role in kitchen functionality and storage solutions.

Countertop solutions constitute a significant market category with growing demand for premium materials including quartz, granite, and engineered stone surfaces. Consumer preferences increasingly favor durable, low-maintenance surfaces that combine aesthetic appeal with practical functionality for daily use.

Storage and organization systems show strong growth potential as consumers seek innovative solutions for maximizing space efficiency in compact living environments. Pull-out drawers, corner solutions, and vertical storage systems gain popularity among UAE consumers prioritizing organization and accessibility.

Integrated appliances represent a growing category as consumers seek seamless design integration and space optimization. Built-in refrigerators, dishwashers, and cooking appliances that blend with modular kitchen designs show increasing adoption rates across residential and commercial applications.

Industry participants in the UAE modular kitchen market enjoy numerous benefits from market participation and strategic positioning. Manufacturers benefit from growing market demand, opportunities for product innovation, and potential for premium pricing in luxury segments that value quality and design excellence.

Retailers and distributors gain advantages from recurring customer relationships, opportunities for service-based revenue streams, and potential for market expansion across different emirates and customer segments. Installation specialists benefit from steady demand for professional services and opportunities to build long-term customer relationships.

Property developers realize benefits through enhanced property values, faster sales cycles, and differentiation in competitive real estate markets. Modern modular kitchens significantly improve property marketability and appeal to both local and international buyers seeking contemporary living solutions.

End consumers benefit from improved functionality, enhanced property values, and lifestyle improvements through well-designed kitchen spaces. Modular solutions offer flexibility for future modifications, warranty protection, and professional installation services that ensure optimal performance and longevity.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the UAE modular kitchen market reflect evolving consumer preferences, technological advancement, and design innovation. Smart kitchen integration represents a major trend as consumers increasingly seek connected appliances, automated storage systems, and intelligent lighting solutions that enhance functionality and convenience.

Sustainable design practices gain momentum as environmental consciousness increases among UAE consumers. Eco-friendly materials, energy-efficient appliances, and sustainable manufacturing processes become important considerations for both consumers and manufacturers seeking to align with environmental goals and regulations.

Minimalist aesthetics continue to dominate design preferences, with consumers favoring clean lines, neutral color palettes, and uncluttered spaces that create sense of openness and sophistication. Handle-less designs, integrated appliances, and seamless surfaces contribute to the minimalist trend while maximizing functionality.

Customization and personalization trends reflect consumer desire for unique solutions that accommodate individual preferences, cultural requirements, and specific spatial constraints. Modular flexibility, custom sizing, and personalized storage solutions enable consumers to create kitchens that reflect their lifestyle and functional needs.

Recent industry developments highlight the dynamic nature of the UAE modular kitchen market and ongoing innovation across the value chain. Technology partnerships between kitchen manufacturers and smart home technology providers create integrated solutions that appeal to tech-savvy consumers seeking connected living experiences.

Sustainability initiatives by major manufacturers include adoption of recycled materials, energy-efficient production processes, and sustainable supply chain practices. These developments respond to growing environmental awareness and government sustainability goals across the UAE.

Showroom innovations incorporate virtual reality technology, augmented reality design tools, and interactive displays that enhance customer experience and facilitate design decision-making. Digital transformation initiatives improve customer engagement while streamlining the design and ordering process.

Strategic partnerships between international brands and local distributors expand market reach while providing localized service and support capabilities. These collaborations combine global expertise with local market knowledge to better serve UAE consumers and commercial customers.

Strategic recommendations for UAE modular kitchen market participants focus on differentiation, customer experience enhancement, and market expansion opportunities. MarkWide Research analysis suggests that companies should prioritize technology integration and sustainability initiatives to capture emerging market segments and build competitive advantages.

Market positioning strategies should emphasize unique value propositions that address specific customer needs and preferences. Companies should focus on developing comprehensive service offerings that include design consultation, professional installation, and after-sales support to build customer loyalty and recurring revenue streams.

Innovation investment in smart technology integration, sustainable materials, and customization capabilities will be critical for long-term market success. Manufacturers and retailers should collaborate with technology partners to develop integrated solutions that meet evolving consumer expectations for connected living environments.

Geographic expansion strategies should consider the unique characteristics and growth potential of different emirates while adapting product offerings and marketing approaches to local preferences and economic conditions. Northern emirates represent particular opportunities for value-oriented solutions and market penetration.

Future prospects for the UAE modular kitchen market indicate continued growth driven by demographic trends, economic development, and evolving consumer preferences. Market expansion is expected to benefit from ongoing urbanization, population growth, and increasing emphasis on modern living standards across all emirates.

Technology integration will play an increasingly important role in market development as smart home adoption accelerates and consumers seek connected kitchen solutions. Artificial intelligence, IoT connectivity, and automated systems will become standard features in premium modular kitchen offerings.

Sustainability considerations will drive product development and manufacturing processes as environmental consciousness increases among consumers and regulatory requirements evolve. Circular economy principles, renewable materials, and energy efficiency will become key differentiators in the market.

Market maturation is expected to lead to increased service competition, with companies focusing on customer experience, customization capabilities, and comprehensive solution offerings. MWR projections indicate that successful market participants will be those who can adapt to changing consumer needs while maintaining quality and innovation leadership.

The UAE modular kitchen market represents a dynamic and rapidly evolving sector with substantial growth potential driven by demographic trends, economic prosperity, and changing lifestyle preferences. Market analysis reveals opportunities across multiple segments, from luxury residential applications to commercial installations, each requiring tailored approaches and specialized solutions.

Key success factors include innovation in design and technology, commitment to quality and service excellence, and ability to adapt to local preferences while maintaining international standards. Companies that can effectively combine global expertise with local market knowledge will be best positioned to capture growth opportunities and build sustainable competitive advantages.

Future market development will be shaped by technology integration, sustainability initiatives, and evolving consumer expectations for personalized solutions. The integration of smart technology, sustainable materials, and customization capabilities will define the next phase of market evolution and competitive differentiation.

Strategic positioning in the UAE modular kitchen market requires comprehensive understanding of customer needs, competitive dynamics, and regulatory environment. Success will depend on companies’ ability to deliver innovative solutions that combine functionality, aesthetics, and value while building strong customer relationships and market presence across the diverse UAE market landscape.

What is Modular Kitchen?

A modular kitchen refers to a modern kitchen design that utilizes pre-made cabinets and modules, allowing for flexible layouts and efficient use of space. This design is popular for its customization options and ease of installation.

What are the key players in the UAE Modular Kitchen Market?

Key players in the UAE Modular Kitchen Market include companies like IKEA, Alno, and Nobilia, which offer a range of modular kitchen solutions tailored to various consumer preferences and styles, among others.

What are the growth factors driving the UAE Modular Kitchen Market?

The growth of the UAE Modular Kitchen Market is driven by increasing urbanization, rising disposable incomes, and a growing preference for modern and space-efficient kitchen designs. Additionally, the influence of interior design trends plays a significant role.

What challenges does the UAE Modular Kitchen Market face?

The UAE Modular Kitchen Market faces challenges such as high competition among manufacturers, fluctuating material costs, and the need for continuous innovation to meet changing consumer preferences. These factors can impact profitability and market share.

What opportunities exist in the UAE Modular Kitchen Market?

Opportunities in the UAE Modular Kitchen Market include the growing trend of smart kitchens, increasing demand for eco-friendly materials, and the expansion of online retail channels. These trends present avenues for companies to innovate and reach new customers.

What trends are shaping the UAE Modular Kitchen Market?

Trends shaping the UAE Modular Kitchen Market include the integration of technology in kitchen designs, such as smart appliances and automated systems, as well as a focus on sustainable materials and minimalist aesthetics. These trends reflect changing consumer lifestyles and preferences.

UAE Modular Kitchen Market

| Segmentation Details | Description |

|---|---|

| Product Type | Base Cabinets, Wall Cabinets, Kitchen Islands, Countertops |

| Material | Wood, Laminate, Metal, Glass |

| Design Style | Modern, Traditional, Rustic, Contemporary |

| End User | Residential, Commercial, Hospitality, Retail |

Please note: The segmentation can be entirely customized to align with our client’s needs.

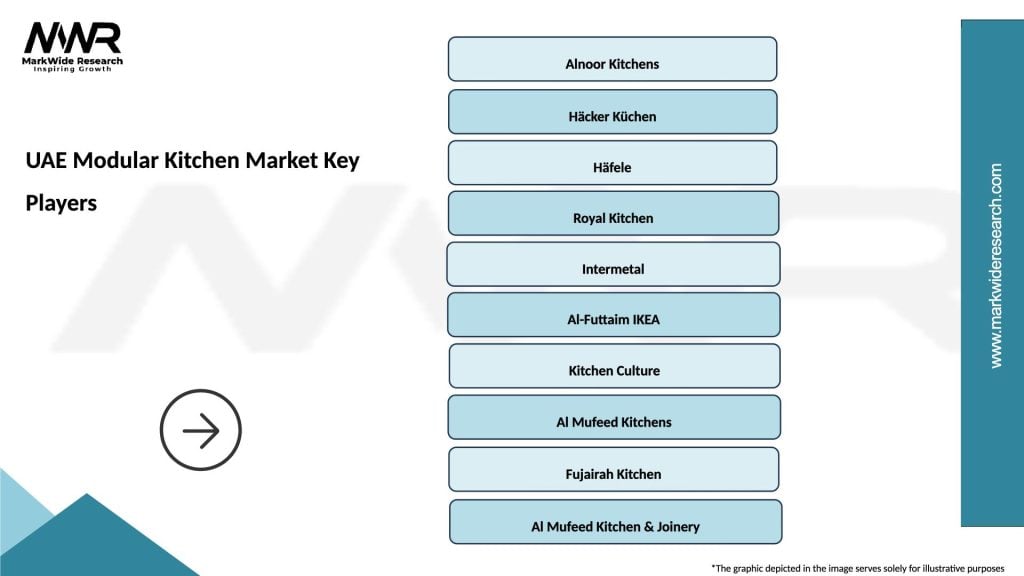

Leading companies in the UAE Modular Kitchen Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at