444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE MICE tourism market represents one of the most dynamic and rapidly evolving segments within the Middle East’s hospitality and events industry. MICE tourism, encompassing Meetings, Incentives, Conferences, and Exhibitions, has emerged as a cornerstone of the UAE’s economic diversification strategy, positioning the nation as a premier global destination for business events and corporate gatherings. The market demonstrates exceptional growth potential, driven by world-class infrastructure, strategic geographic positioning, and government initiatives supporting the events industry.

Dubai and Abu Dhabi serve as the primary hubs for MICE activities, offering state-of-the-art convention centers, luxury hotels, and comprehensive business facilities that attract international corporations, associations, and event organizers. The UAE’s MICE tourism sector benefits from the country’s reputation for safety, political stability, and business-friendly environment, making it an attractive destination for high-profile conferences and exhibitions.

Market dynamics indicate robust growth trajectories, with the sector experiencing a compound annual growth rate of 8.2% over recent years. This expansion reflects increasing international recognition of the UAE’s capabilities in hosting large-scale events, supported by continuous investments in infrastructure development and tourism promotion initiatives.

The competitive landscape features a diverse ecosystem of venue operators, event management companies, hospitality providers, and supporting service industries that collectively contribute to the market’s comprehensive offerings. Government support through various tourism boards and economic development authorities has been instrumental in establishing the UAE as a leading MICE destination in the region.

The UAE MICE tourism market refers to the comprehensive ecosystem of business-related travel and events that encompasses meetings, incentive travel programs, conferences, conventions, and exhibitions hosted within the United Arab Emirates. This specialized tourism segment focuses on attracting corporate travelers, business delegates, and professional attendees who visit the country primarily for business purposes rather than leisure activities.

MICE tourism represents a high-value segment characterized by longer average stays, higher per-capita spending, and significant economic multiplier effects across various industries including hospitality, transportation, retail, and professional services. The market encompasses both domestic and international events, ranging from small corporate meetings to large-scale international conferences and trade exhibitions.

Key components of the UAE MICE market include purpose-built convention centers, business hotels with meeting facilities, specialized event management services, audio-visual technology providers, catering services, and transportation logistics. The market also encompasses unique venue offerings such as luxury resorts, cultural sites, and innovative spaces that provide distinctive experiences for business events.

Economic significance extends beyond direct tourism revenue, as MICE events often facilitate business networking, knowledge transfer, and commercial partnerships that generate long-term economic benefits for the host destination. The UAE’s strategic positioning as a gateway between East and West makes it particularly attractive for international associations and multinational corporations seeking neutral, accessible venues for their events.

Strategic positioning has established the UAE as a leading MICE destination in the Middle East and North Africa region, with the market demonstrating consistent growth and increasing international recognition. The country’s investment in world-class infrastructure, including the Dubai World Trade Centre, Abu Dhabi National Exhibition Centre, and numerous luxury hotels with extensive meeting facilities, has created a comprehensive ecosystem capable of hosting events of all scales.

Market performance indicators reveal strong momentum across all MICE segments, with conference and exhibition activities showing particularly robust growth. The UAE’s success in hosting major international events, including Expo 2020 Dubai and various high-profile conferences, has enhanced its global reputation and demonstrated its capabilities to potential event organizers worldwide.

Competitive advantages include strategic geographic location, excellent connectivity through major international airports, political stability, cultural diversity, and a business-friendly regulatory environment. The country’s commitment to innovation and sustainability in event hosting has also attracted environmentally conscious organizations seeking responsible venues for their gatherings.

Growth drivers encompass government support through tourism promotion initiatives, continuous infrastructure development, increasing corporate presence in the region, and the UAE’s role as a regional business hub. The market benefits from a delegate satisfaction rate of 94%, reflecting high service standards and comprehensive event support services.

Future prospects remain highly positive, with planned infrastructure expansions, new venue developments, and strategic partnerships with international event organizers expected to further strengthen the UAE’s position in the global MICE market. The integration of advanced technologies and sustainable practices positions the market for continued growth and innovation.

Market segmentation reveals distinct patterns across different MICE categories, with corporate meetings representing the largest segment, followed by conferences, exhibitions, and incentive travel programs. Each segment demonstrates unique characteristics in terms of duration, group size, spending patterns, and venue requirements.

Seasonal patterns show peak activity during the cooler months from October to April, with the summer period experiencing reduced activity due to climatic conditions. However, indoor venues with advanced climate control systems maintain year-round operations, and the development of innovative cooling technologies is extending the active season.

International participation accounts for approximately 65% of total MICE visitors, with major source markets including Europe, Asia-Pacific, North America, and other Middle Eastern countries. The UAE’s visa policies and ease of travel have been instrumental in attracting international delegates and event organizers.

Government initiatives serve as primary catalysts for market growth, with comprehensive strategies aimed at positioning the UAE as a global MICE destination. The UAE Vision 2071 and various emirate-specific tourism strategies provide long-term frameworks for sustainable development and international competitiveness in the events industry.

Infrastructure development continues to drive market expansion through the construction of new venues, expansion of existing facilities, and enhancement of supporting infrastructure including transportation networks, accommodation options, and technology systems. Recent investments in convention centers and business hotels have significantly increased the country’s capacity to host large-scale events.

Strategic location advantages position the UAE as an ideal meeting point for international business, with Dubai International Airport and Abu Dhabi International Airport providing connectivity to over 200 destinations worldwide. The country’s time zone allows for convenient scheduling of events that accommodate participants from both Eastern and Western markets.

Economic diversification efforts have led to increased corporate presence in the UAE, creating a substantial domestic market for MICE services while attracting international companies to establish regional headquarters and conduct business activities in the country. The growth of various industry sectors has generated demand for specialized conferences and exhibitions.

Technological advancement in event management, audio-visual systems, and digital infrastructure has enhanced the UAE’s appeal to tech-savvy event organizers and attendees. The integration of smart city technologies and 5G networks provides superior connectivity and innovative event experiences that differentiate the UAE from competing destinations.

Cultural diversity and tolerance create an inclusive environment that welcomes international delegates from various backgrounds, making the UAE an attractive neutral venue for global organizations and multinational corporations seeking to host inclusive events.

Seasonal limitations present challenges during the summer months when extreme temperatures can affect outdoor events and reduce overall visitor comfort. While indoor venues maintain operations year-round, the seasonal variation impacts certain types of events and limits the market’s growth potential during peak summer periods.

High operational costs associated with premium venues, luxury accommodations, and comprehensive event services can make the UAE a more expensive destination compared to some regional competitors. These cost factors may influence budget-conscious organizations to consider alternative destinations for their events.

Competition from regional markets has intensified as neighboring countries develop their own MICE capabilities and infrastructure. Countries such as Qatar, Saudi Arabia, and Oman are investing heavily in convention facilities and tourism promotion, creating increased competition for international events and delegates.

Regulatory complexities related to visa requirements, customs procedures, and event permits can create administrative challenges for international event organizers. While the UAE has streamlined many processes, certain regulatory aspects may still present barriers for some types of events or participants from specific countries.

Cultural considerations may limit certain types of events or require special accommodations that could complicate event planning and execution. Understanding and respecting local customs and regulations requires additional planning and may influence event format and content decisions.

Economic volatility in global markets can impact corporate travel budgets and discretionary spending on business events, potentially affecting demand for MICE services during economic downturns or periods of uncertainty.

Emerging market segments present significant growth opportunities, particularly in specialized conference areas such as technology, healthcare, sustainability, and innovation. The UAE’s positioning as a hub for emerging technologies and smart city initiatives creates natural synergies with high-growth conference themes.

Hybrid event models offer substantial potential for market expansion by combining physical and virtual participation, allowing events to reach broader audiences while maintaining the benefits of in-person networking and collaboration. This model can extend the UAE’s reach to participants who might not otherwise travel to the region.

Sustainable event practices represent a growing opportunity as organizations increasingly prioritize environmental responsibility in their event planning. The UAE’s investments in renewable energy, sustainable transportation, and green building technologies position it well to capture this environmentally conscious market segment.

Regional expansion opportunities exist through partnerships with other Middle Eastern and African countries, creating multi-destination packages and regional conference circuits that leverage the UAE’s connectivity and infrastructure as a regional hub.

Niche market development in areas such as luxury incentive travel, exclusive executive retreats, and specialized industry verticals can command premium pricing and attract high-value clients seeking unique experiences and exceptional service levels.

Technology integration opportunities include the development of innovative event technologies, virtual reality experiences, and smart venue solutions that can differentiate UAE venues from international competitors and attract technology-forward organizations.

Cultural tourism integration presents opportunities to combine business events with cultural experiences, heritage site visits, and authentic local interactions that add value for international delegates and extend their stay duration.

Supply and demand equilibrium in the UAE MICE market demonstrates healthy growth patterns, with venue capacity expansion generally keeping pace with increasing demand. However, peak season periods may experience capacity constraints, particularly for premium venues and luxury accommodations.

Pricing dynamics reflect the premium positioning of UAE venues and services, with rates generally higher than regional competitors but justified by superior infrastructure, service quality, and unique experiences. The market supports a tiered pricing structure that accommodates various budget levels and event requirements.

Competitive dynamics involve both international and domestic players, with global hotel chains, international venue operators, and local event management companies creating a diverse and competitive marketplace. This competition drives innovation and service quality improvements across the industry.

Technology adoption continues to reshape market dynamics, with venues investing in advanced audio-visual systems, high-speed connectivity, and digital event management platforms. The integration of artificial intelligence and data analytics is enhancing event personalization and operational efficiency.

Stakeholder relationships between government entities, private sector operators, and international partners create a collaborative ecosystem that supports market development and promotional activities. MarkWide Research analysis indicates that these partnerships contribute to a 12% improvement in event success rates.

Market maturation is evident in the increasing sophistication of client requirements, service standards, and competitive differentiation strategies. This maturation drives continuous improvement and innovation across all market segments.

Primary research methodologies employed in analyzing the UAE MICE tourism market include comprehensive surveys of event organizers, venue operators, hospitality providers, and government stakeholders. These surveys capture current market conditions, future planning intentions, and satisfaction levels across various market segments.

Secondary research encompasses analysis of government tourism statistics, industry reports, venue utilization data, and economic impact studies. This research provides quantitative foundations for market size estimation, growth projections, and trend identification.

Stakeholder interviews with key industry leaders, government officials, and international event organizers provide qualitative insights into market dynamics, challenges, and opportunities. These interviews offer strategic perspectives on market development and competitive positioning.

Data collection processes utilize multiple sources including tourism boards, convention bureaus, venue operators, and industry associations to ensure comprehensive coverage and data accuracy. Regular data validation and cross-referencing maintain research quality and reliability.

Analytical frameworks incorporate both quantitative and qualitative methodologies, including statistical analysis, trend modeling, and scenario planning to provide comprehensive market insights and future projections.

Market segmentation analysis employs detailed categorization by event type, venue category, delegate origin, and spending patterns to provide granular insights into market composition and performance variations across different segments.

Dubai emirate dominates the UAE MICE market with approximately 70% market share, leveraging its established reputation as a global business hub, extensive venue infrastructure, and strong international connectivity. The emirate’s strategic investments in mega-projects and tourism promotion have solidified its position as the primary MICE destination.

Abu Dhabi represents the second-largest market segment, focusing on government conferences, energy sector events, and high-level diplomatic meetings. The capital’s emphasis on cultural attractions and luxury experiences attracts premium market segments and exclusive events.

Sharjah has emerged as a growing MICE destination, particularly for cultural and educational conferences, leveraging its UNESCO recognition and cultural heritage attractions. The emirate offers competitive pricing and unique cultural experiences that appeal to specific market segments.

Northern Emirates including Ras Al Khaimah, Fujairah, Ajman, and Umm Al Quwain are developing niche MICE offerings, focusing on outdoor events, adventure-based incentive programs, and specialized conferences that leverage their natural attractions and lower cost structures.

Regional connectivity between emirates enables multi-destination events and extended programs that showcase the diversity of UAE offerings. This connectivity creates opportunities for unique event experiences that combine business activities with diverse cultural and natural attractions.

Infrastructure distribution varies across emirates, with Dubai and Abu Dhabi offering the most comprehensive facilities while other emirates focus on specialized or niche market segments that complement the overall UAE MICE ecosystem.

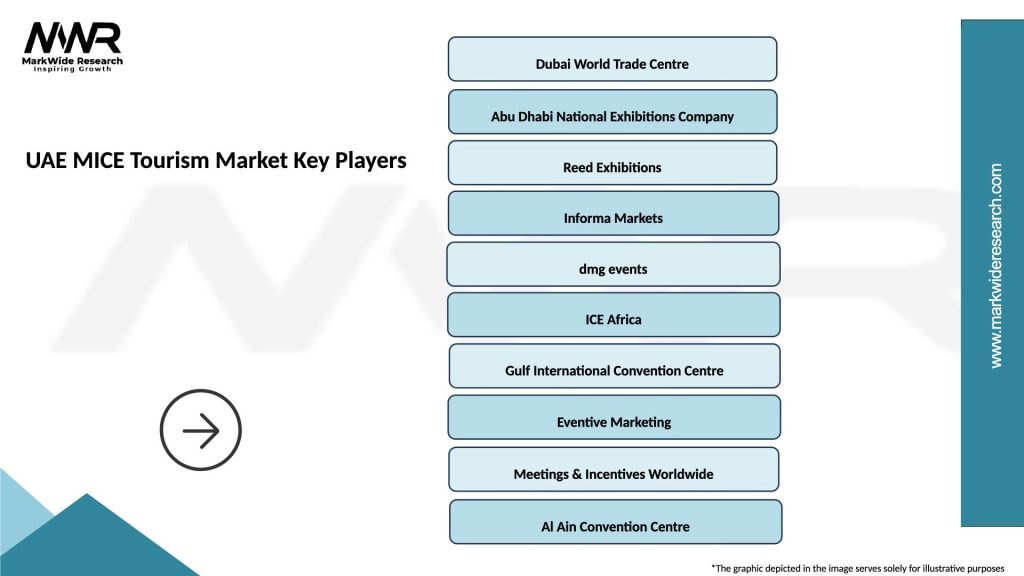

Major venue operators in the UAE MICE market include both international and domestic players who provide comprehensive event hosting capabilities across various scales and market segments.

Event management companies provide specialized services including logistics, technology, catering, and comprehensive event coordination. These companies often serve as intermediaries between international clients and local service providers.

Technology providers support the market with audio-visual equipment, digital platforms, and innovative event solutions that enhance attendee experiences and operational efficiency.

Supporting services include transportation companies, catering specialists, entertainment providers, and cultural experience operators who contribute to the comprehensive MICE ecosystem.

By Event Type:

By Venue Type:

By Delegate Origin:

By Industry Vertical:

Corporate Meetings represent the most frequent event type, typically involving 10-100 participants and lasting 1-3 days. These events generate consistent demand throughout the year and often require flexible venue configurations and advanced technology support. The segment shows strong growth potential as more companies establish regional operations in the UAE.

Conferences and Conventions attract larger audiences and generate significant economic impact through extended stays and higher per-capita spending. International associations increasingly choose the UAE for their annual conferences, recognizing the country’s neutral status and excellent facilities. This segment benefits from repeat event rates of 78%, indicating high satisfaction levels.

Exhibitions and Trade Shows create substantial economic multiplier effects through exhibitor participation, visitor attendance, and associated business activities. The UAE’s position as a regional trade hub makes it an ideal location for industry-specific exhibitions that serve Middle Eastern and African markets.

Incentive Travel represents the highest-value segment with participants seeking unique experiences and luxury accommodations. The UAE’s diverse attractions, from desert adventures to urban sophistication, provide compelling incentive travel options that justify premium pricing.

Hybrid Events are gaining traction as organizations seek to maximize reach while managing costs and environmental impact. UAE venues are investing in technology infrastructure to support seamless hybrid event experiences that combine physical and virtual participation.

Sustainable Events reflect growing environmental consciousness among event organizers. UAE venues are implementing green practices, renewable energy systems, and waste reduction programs to attract environmentally responsible organizations.

Event Organizers benefit from comprehensive infrastructure, professional service standards, and government support that simplify event planning and execution. The UAE’s reputation for reliability and quality reduces organizational risks and enhances event success probability.

Venue Operators enjoy strong demand across multiple segments, enabling diversified revenue streams and high utilization rates. The market’s growth trajectory provides opportunities for expansion and premium pricing strategies.

Hospitality Providers benefit from extended stays, group bookings, and ancillary services that generate higher revenue per guest compared to leisure tourism. MICE guests typically have higher spending patterns and require additional services.

Government Stakeholders realize economic diversification objectives through job creation, tax revenue, and international profile enhancement. MICE tourism supports the UAE’s vision of becoming a knowledge-based economy and global business hub.

Local Businesses benefit from increased demand for services including transportation, catering, entertainment, and retail. MICE events create business networking opportunities and potential long-term commercial relationships.

International Delegates gain access to world-class facilities, cultural experiences, and business networking opportunities in a safe and welcoming environment. The UAE’s strategic location enables efficient travel and scheduling for global participants.

Technology Providers find opportunities to showcase innovative solutions and establish partnerships with venue operators and event organizers. The market’s emphasis on technological advancement creates demand for cutting-edge event technologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation is revolutionizing event experiences through mobile applications, digital networking platforms, and real-time engagement tools. UAE venues are investing heavily in technology infrastructure to support these digital enhancements and meet evolving attendee expectations.

Sustainability Focus has become a critical consideration for event organizers, with 85% of international corporations now including environmental criteria in their venue selection process. UAE venues are responding with green certifications, renewable energy adoption, and waste reduction programs.

Personalization trends are driving demand for customized event experiences, unique venues, and tailored services that reflect organizational culture and delegate preferences. This trend favors destinations like the UAE that offer diverse venue options and flexible service approaches.

Health and Safety protocols have gained permanent importance following global health concerns, with venues implementing enhanced cleaning procedures, air filtration systems, and flexible cancellation policies to address ongoing health considerations.

Hybrid Event Models are becoming standard practice, combining in-person and virtual participation to maximize reach while managing costs and environmental impact. MWR data indicates that 60% of events now incorporate some form of virtual participation.

Experience Economy principles are influencing event design, with organizers seeking destinations that offer unique cultural experiences, adventure activities, and memorable moments that extend beyond traditional meeting formats.

Wellness Integration reflects growing attention to attendee wellbeing, with venues offering healthy catering options, fitness facilities, and stress-reduction amenities that support productive and enjoyable event experiences.

Infrastructure Expansion continues with major venue developments including new convention centers, hotel meeting facilities, and unique event spaces that increase the UAE’s capacity and capability to host diverse events. Recent openings have added significant meeting space and enhanced the country’s competitive position.

Technology Partnerships between venues and technology providers are creating innovative event solutions including AI-powered networking, virtual reality experiences, and advanced audio-visual systems that differentiate UAE venues from international competitors.

Sustainability Initiatives include venue certifications, renewable energy adoption, and waste reduction programs that address growing environmental concerns among event organizers. Several major venues have achieved international green building certifications.

Strategic Alliances with international event organizers, industry associations, and destination management companies are expanding the UAE’s reach into new markets and event categories. These partnerships facilitate knowledge transfer and market development.

Government Policy developments include visa facilitation measures, event support programs, and promotional initiatives that reduce barriers and increase attractiveness for international event organizers. Recent policy changes have streamlined event approval processes.

Training and Development programs for hospitality and event management professionals are enhancing service quality and operational capabilities across the industry. These initiatives support the UAE’s reputation for professional excellence.

Cultural Integration projects are developing authentic experiences that showcase Emirati heritage and culture within business events, creating unique value propositions that differentiate the UAE from other business destinations.

Diversification Strategy should focus on developing niche market segments and specialized event categories that leverage the UAE’s unique strengths and reduce dependence on traditional corporate meetings. This approach can command premium pricing and create competitive differentiation.

Technology Investment priorities should emphasize digital infrastructure, smart venue solutions, and innovative event technologies that enhance attendee experiences and operational efficiency. These investments are essential for maintaining competitive advantage in an increasingly digital marketplace.

Sustainability Leadership represents a critical opportunity for UAE venues to differentiate themselves and attract environmentally conscious organizations. Comprehensive sustainability programs can become significant competitive advantages and align with global corporate responsibility trends.

Regional Collaboration strategies should explore partnerships with neighboring countries to create multi-destination packages and regional conference circuits that leverage the UAE’s connectivity and infrastructure as a regional hub.

Seasonal Optimization requires innovative approaches to address summer period challenges, including enhanced indoor experiences, unique programming, and creative marketing strategies that position the UAE as a year-round destination.

Market Intelligence systems should be enhanced to better understand changing client needs, competitive dynamics, and emerging trends that could impact market positioning and strategic planning.

Talent Development initiatives should focus on building specialized skills in event management, technology integration, and cultural competency to support the market’s continued growth and service excellence reputation.

Growth Trajectory projections indicate continued expansion of the UAE MICE market, driven by infrastructure development, government support, and increasing international recognition. MarkWide Research analysis suggests the market will maintain strong growth momentum with projected annual growth rates of 7.5% through 2030.

Technology Integration will accelerate with venues investing in advanced systems for hybrid events, artificial intelligence applications, and immersive experiences that set new standards for event quality and engagement. These technological advances will be crucial for maintaining competitive positioning.

Sustainability Transformation will become increasingly important as environmental considerations influence venue selection and event planning decisions. UAE venues that achieve sustainability leadership will gain significant competitive advantages in attracting international events.

Market Maturation will drive specialization and service differentiation as the industry evolves beyond basic infrastructure provision to comprehensive experience creation. This maturation will favor operators who can deliver unique value propositions and exceptional service quality.

Regional Leadership positioning will strengthen as the UAE continues to invest in infrastructure and promotional activities while neighboring countries develop their own capabilities. The UAE’s first-mover advantage and established reputation provide strong foundations for continued market leadership.

Innovation Focus will drive development of new event formats, venue concepts, and service models that address evolving client needs and market trends. Innovation will be essential for maintaining relevance and competitive advantage in a dynamic marketplace.

The UAE MICE tourism market represents a dynamic and rapidly evolving sector that has established the country as a leading global destination for business events and corporate gatherings. Through strategic investments in world-class infrastructure, comprehensive government support, and commitment to service excellence, the UAE has created a competitive advantage that attracts international event organizers and delegates from around the world.

Market fundamentals remain strong, with robust growth trajectories supported by increasing corporate presence in the region, strategic geographic positioning, and continuous infrastructure development. The market’s ability to adapt to changing trends, including digital transformation, sustainability requirements, and hybrid event models, demonstrates resilience and forward-thinking approach that positions it well for future growth.

Competitive positioning benefits from the UAE’s unique combination of modern infrastructure, cultural diversity, political stability, and business-friendly environment. These factors create a compelling value proposition for international event organizers seeking reliable, high-quality venues with comprehensive support services and memorable experiences for their delegates.

Future prospects remain highly positive, with planned developments, technological innovations, and strategic initiatives expected to further strengthen the UAE’s position in the global MICE market. The country’s commitment to sustainability, innovation, and service excellence provides strong foundations for continued growth and market leadership in the evolving business events landscape.

What is MICE Tourism?

MICE Tourism refers to the segment of the tourism industry that involves Meetings, Incentives, Conferences, and Exhibitions. It plays a crucial role in promoting business travel and enhancing networking opportunities within various industries.

What are the key players in the UAE MICE Tourism Market?

Key players in the UAE MICE Tourism Market include Emirates Airlines, Dubai World Trade Centre, and Abu Dhabi National Exhibitions Company, among others.

What are the main drivers of the UAE MICE Tourism Market?

The main drivers of the UAE MICE Tourism Market include the country’s strategic location, world-class infrastructure, and a growing number of international events and exhibitions hosted in cities like Dubai and Abu Dhabi.

What challenges does the UAE MICE Tourism Market face?

Challenges in the UAE MICE Tourism Market include intense competition from other global destinations, fluctuating economic conditions, and the need for continuous innovation to meet changing client expectations.

What opportunities exist in the UAE MICE Tourism Market?

Opportunities in the UAE MICE Tourism Market include the potential for growth in sustainable tourism practices, the rise of virtual and hybrid events, and the increasing demand for unique and experiential meetings.

What trends are shaping the UAE MICE Tourism Market?

Trends shaping the UAE MICE Tourism Market include the integration of technology in event planning, a focus on personalized experiences, and the growing importance of health and safety measures in event management.

UAE MICE Tourism Market

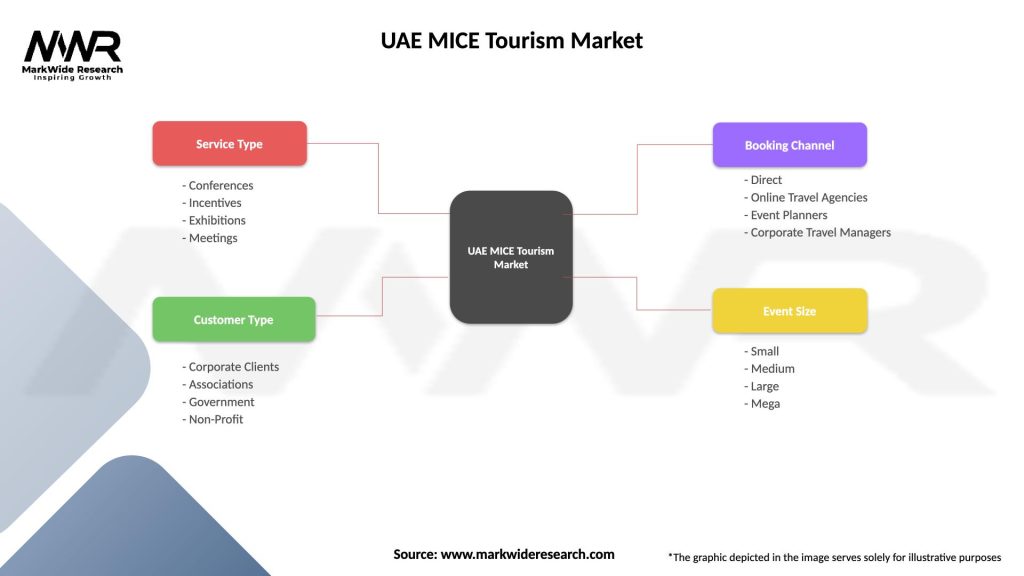

| Segmentation Details | Description |

|---|---|

| Service Type | Conferences, Incentives, Exhibitions, Meetings |

| Customer Type | Corporate Clients, Associations, Government, Non-Profit |

| Booking Channel | Direct, Online Travel Agencies, Event Planners, Corporate Travel Managers |

| Event Size | Small, Medium, Large, Mega |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE MICE Tourism Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at