444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE medical aesthetic devices market represents a rapidly expanding sector within the country’s healthcare and beauty industry landscape. Medical aesthetic devices encompass a comprehensive range of sophisticated equipment designed for non-invasive and minimally invasive cosmetic procedures, including laser treatments, radiofrequency devices, ultrasound systems, and injectable delivery mechanisms. The market has experienced remarkable growth driven by increasing consumer awareness, rising disposable incomes, and the UAE’s position as a regional hub for medical tourism.

Market dynamics indicate substantial expansion opportunities, with the sector benefiting from technological advancements and growing acceptance of aesthetic procedures among diverse demographic groups. The UAE’s strategic location, world-class healthcare infrastructure, and supportive regulatory environment have positioned the country as a leading destination for advanced medical aesthetic treatments in the Middle East and North Africa region.

Growth trajectories demonstrate strong momentum, with the market experiencing a robust CAGR of 8.2% over recent years. This expansion reflects increasing demand for non-surgical cosmetic procedures, technological innovations in device capabilities, and the growing influence of social media on beauty standards and aesthetic awareness.

The UAE medical aesthetic devices market refers to the comprehensive ecosystem of advanced medical equipment, technologies, and systems specifically designed for cosmetic and aesthetic medical procedures within the United Arab Emirates healthcare sector. These devices encompass laser systems for skin rejuvenation, body contouring equipment, facial enhancement technologies, and specialized instruments for minimally invasive aesthetic treatments.

Medical aesthetic devices include energy-based systems utilizing laser, radiofrequency, ultrasound, and intense pulsed light technologies to address various cosmetic concerns such as skin aging, body fat reduction, hair removal, and facial rejuvenation. The market encompasses both standalone devices and integrated treatment platforms used by dermatologists, plastic surgeons, and certified aesthetic practitioners across the UAE’s healthcare facilities.

Market performance in the UAE medical aesthetic devices sector demonstrates exceptional growth potential, driven by increasing consumer sophistication and technological advancement. The market benefits from strong demographic trends, including a young, affluent population with high aesthetic awareness and disposable income levels supporting premium treatment options.

Key growth drivers include the UAE’s position as a medical tourism destination, with approximately 42% of aesthetic procedures performed on international patients seeking high-quality treatments. The market’s expansion is further supported by increasing adoption of non-invasive procedures, with 73% of treatments now utilizing advanced device-based technologies rather than traditional surgical approaches.

Technology integration plays a crucial role in market development, with artificial intelligence and machine learning capabilities increasingly incorporated into modern aesthetic devices. This technological evolution enhances treatment precision, reduces procedure times, and improves patient outcomes, contributing to higher adoption rates among healthcare providers and patients alike.

Market insights reveal several critical trends shaping the UAE medical aesthetic devices landscape:

Primary market drivers propelling the UAE medical aesthetic devices market include increasing consumer awareness and acceptance of aesthetic procedures. The growing influence of social media platforms and celebrity culture has significantly elevated aesthetic consciousness among UAE residents, creating substantial demand for advanced treatment options and cutting-edge device technologies.

Economic prosperity within the UAE provides strong foundational support for market growth, with high disposable income levels enabling consumers to invest in premium aesthetic treatments. The country’s economic diversification efforts and tourism industry development have created additional demand drivers, particularly from international visitors seeking high-quality aesthetic procedures.

Technological advancement represents another crucial driver, with continuous innovation in device capabilities, treatment effectiveness, and patient comfort levels. Modern aesthetic devices offer improved precision, reduced downtime, and enhanced safety profiles, making treatments more appealing to a broader consumer base and encouraging repeat procedures.

Medical tourism development significantly contributes to market expansion, with the UAE government’s strategic initiatives to position the country as a leading healthcare destination. This focus attracts international patients seeking advanced aesthetic treatments, creating sustained demand for state-of-the-art medical aesthetic devices across healthcare facilities.

Market restraints affecting the UAE medical aesthetic devices sector include high initial capital investment requirements for advanced device procurement. Healthcare facilities must allocate substantial resources for equipment acquisition, installation, and ongoing maintenance, which can limit market penetration among smaller clinics and independent practitioners.

Regulatory compliance requirements, while ensuring quality standards, can create barriers for device manufacturers and healthcare providers. Stringent certification processes, import regulations, and ongoing compliance monitoring require significant administrative resources and can delay market entry for new technologies and devices.

Skilled operator shortage represents a significant constraint, as advanced medical aesthetic devices require specialized training and certification for safe and effective operation. The limited availability of qualified technicians and practitioners can restrict device utilization rates and limit market expansion potential.

Cultural considerations may influence market development in certain demographic segments, with varying acceptance levels for aesthetic procedures across different cultural and religious backgrounds. These factors can impact market penetration rates and require targeted marketing approaches for different consumer segments.

Emerging opportunities in the UAE medical aesthetic devices market include expanding treatment applications and technological innovations. The development of combination therapy platforms and multi-functional devices creates opportunities for comprehensive treatment solutions, enabling healthcare providers to offer diverse services with single device investments.

Market expansion opportunities exist through geographic diversification beyond Dubai and Abu Dhabi, with growing aesthetic awareness in other emirates creating demand for advanced device installations. The development of satellite clinics and mobile treatment services presents additional avenues for market growth and device utilization.

Technology integration opportunities include artificial intelligence incorporation, telemedicine capabilities, and personalized treatment protocols. These advancements can enhance treatment outcomes, improve patient experiences, and create competitive advantages for early adopters in the healthcare sector.

Partnership opportunities with international device manufacturers, training institutions, and healthcare networks can accelerate market development and technology transfer. Strategic collaborations can facilitate knowledge sharing, reduce operational costs, and enhance service quality across the aesthetic medicine sector.

Market dynamics within the UAE medical aesthetic devices sector reflect complex interactions between technological advancement, consumer demand, and regulatory frameworks. The market demonstrates strong resilience and adaptability, with rapid adoption of innovative technologies and treatment methodologies driving continuous evolution in device capabilities and applications.

Competitive dynamics intensify as international manufacturers establish local presence and distribution networks. This competition drives innovation, improves service quality, and creates favorable pricing conditions for healthcare providers seeking advanced aesthetic device solutions.

Consumer behavior patterns show increasing sophistication and treatment awareness, with patients actively researching device technologies and treatment options before making decisions. This trend encourages healthcare providers to invest in latest-generation devices and comprehensive training programs to meet elevated patient expectations.

Regulatory dynamics continue evolving to balance market growth with patient safety requirements. Recent regulatory updates have streamlined certain approval processes while maintaining stringent quality standards, creating more favorable conditions for device manufacturers and healthcare providers.

Research methodology employed for analyzing the UAE medical aesthetic devices market incorporates comprehensive primary and secondary research approaches. Primary research includes extensive interviews with healthcare providers, device manufacturers, distributors, and industry experts to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of government publications, industry reports, regulatory documents, and healthcare facility databases to establish market baselines and identify growth patterns. This approach ensures comprehensive coverage of market segments, geographic regions, and technology categories within the UAE aesthetic devices landscape.

Data validation processes include cross-referencing multiple sources, statistical analysis of market trends, and expert review of findings to ensure accuracy and reliability. The methodology incorporates both quantitative analysis of market metrics and qualitative assessment of industry dynamics and future prospects.

Market segmentation analysis utilizes detailed categorization by device type, application area, end-user segment, and geographic distribution to provide granular insights into market performance and growth opportunities across different sectors of the UAE medical aesthetic devices market.

Regional distribution within the UAE medical aesthetic devices market shows significant concentration in Dubai and Abu Dhabi, which collectively account for approximately 78% of total device installations. These emirates benefit from established healthcare infrastructure, high-income demographics, and strong medical tourism industries that support premium aesthetic device markets.

Dubai’s market leadership reflects its position as a regional business and tourism hub, with numerous international healthcare chains and luxury aesthetic clinics investing in state-of-the-art device technologies. The emirate’s cosmopolitan population and strong expatriate community create diverse demand patterns for various aesthetic treatments and device applications.

Abu Dhabi demonstrates strong market potential through government healthcare initiatives and substantial investment in medical infrastructure development. The emirate’s focus on healthcare excellence and medical tourism development supports continued expansion of advanced aesthetic device installations across public and private healthcare facilities.

Northern Emirates present emerging opportunities for market expansion, with growing aesthetic awareness and healthcare facility development creating demand for modern device technologies. These regions show increasing adoption rates for entry-level and mid-range aesthetic devices as market penetration expands beyond traditional urban centers.

Competitive landscape analysis reveals a dynamic market environment with strong participation from international device manufacturers and local distributors. The market features both established global leaders and emerging technology companies competing across various device categories and price segments.

Leading market participants include:

Market competition intensifies through continuous innovation, comprehensive training programs, and enhanced service support offerings. Companies differentiate through technology advancement, clinical efficacy, and comprehensive customer support services.

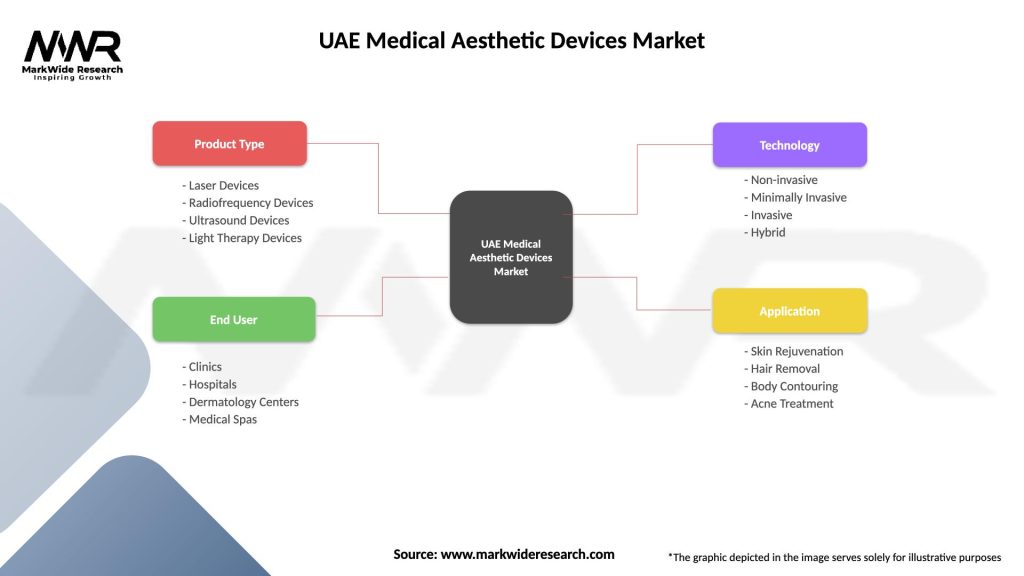

Market segmentation analysis provides detailed insights into various categories within the UAE medical aesthetic devices market:

By Device Type:

By Application:

Laser device category maintains market leadership with approximately 45% market share, driven by versatile applications and proven clinical efficacy across multiple aesthetic treatments. Advanced laser technologies continue evolving with improved precision, reduced downtime, and enhanced patient comfort levels.

Radiofrequency devices demonstrate strong growth potential through innovative combination therapies and multi-polar technologies. These devices offer excellent safety profiles and consistent results for skin tightening and body contouring applications, making them popular choices among healthcare providers and patients.

Ultrasound technology gains market traction through non-invasive treatment capabilities and minimal downtime requirements. High-intensity focused ultrasound devices provide effective alternatives to surgical procedures, appealing to patients seeking natural-looking results without invasive interventions.

Combination platforms represent emerging market segments, offering multiple treatment modalities within single device systems. These comprehensive solutions provide healthcare facilities with versatile treatment capabilities while optimizing space utilization and operational efficiency.

Healthcare providers benefit from advanced medical aesthetic devices through enhanced treatment capabilities, improved patient outcomes, and expanded service offerings. Modern devices enable practitioners to address diverse aesthetic concerns with precision and efficiency, supporting practice growth and patient satisfaction.

Patients gain access to cutting-edge treatment technologies with improved safety profiles, reduced downtime, and enhanced results. Advanced devices offer more comfortable treatment experiences and natural-looking outcomes, encouraging patient loyalty and treatment adherence.

Device manufacturers benefit from growing market demand, technological advancement opportunities, and strategic partnerships with healthcare providers. The expanding market creates opportunities for innovation, product development, and market share growth across various device categories.

Healthcare facilities enhance their competitive positioning through advanced device investments, attracting discerning patients and supporting premium pricing strategies. State-of-the-art equipment enables facilities to differentiate their services and establish market leadership in aesthetic medicine.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology integration emerges as a dominant trend, with artificial intelligence and machine learning capabilities increasingly incorporated into modern aesthetic devices. These advanced features enhance treatment precision, personalize therapy protocols, and improve patient outcomes through data-driven treatment optimization.

Combination therapy approaches gain popularity among healthcare providers and patients, with multi-modal treatment platforms offering comprehensive solutions for complex aesthetic concerns. This trend drives demand for versatile devices capable of delivering multiple treatment modalities within single systems.

Minimally invasive procedures continue expanding market share, with patients increasingly preferring treatments offering natural-looking results with minimal downtime. This preference drives innovation in device technologies focused on non-invasive and minimally invasive treatment capabilities.

Personalized treatment protocols become standard practice, with advanced devices offering customizable parameters and treatment settings based on individual patient characteristics and aesthetic goals. This trend enhances treatment efficacy and patient satisfaction levels across various procedure types.

Recent industry developments include significant investments in research and development by leading device manufacturers, focusing on next-generation technologies and enhanced treatment capabilities. These developments aim to improve patient outcomes, reduce treatment times, and expand application possibilities for aesthetic procedures.

Regulatory updates have streamlined certain approval processes while maintaining stringent safety standards, creating more favorable conditions for device manufacturers and healthcare providers. Recent changes facilitate faster market entry for innovative technologies while ensuring patient safety and treatment efficacy.

Training initiatives expand across the UAE healthcare sector, with comprehensive education programs developed to address skilled operator shortages and ensure safe device utilization. These programs support market growth by enabling more healthcare providers to offer advanced aesthetic treatments.

Partnership agreements between international manufacturers and local distributors strengthen market presence and service capabilities. These collaborations enhance technology transfer, improve customer support, and accelerate adoption of advanced aesthetic devices across UAE healthcare facilities.

Market expansion strategies should focus on geographic diversification beyond traditional urban centers, with targeted investments in emerging emirates showing growing aesthetic awareness and healthcare infrastructure development. This approach can unlock new market opportunities and reduce dependence on saturated urban markets.

Technology investment priorities should emphasize versatile, multi-functional devices offering comprehensive treatment capabilities within single platforms. Healthcare providers should consider combination therapy systems that maximize treatment options while optimizing space utilization and operational efficiency.

Training development initiatives require immediate attention to address skilled operator shortages and ensure safe device utilization across healthcare facilities. Comprehensive education programs and certification processes will support market growth and maintain high treatment standards.

MarkWide Research analysis suggests that strategic partnerships between device manufacturers, healthcare providers, and training institutions can accelerate market development and technology adoption. These collaborations should focus on knowledge sharing, operational efficiency, and service quality enhancement.

Future market prospects for the UAE medical aesthetic devices sector remain highly positive, with continued growth expected across all major device categories and application areas. The market is projected to maintain robust expansion, driven by technological advancement, increasing consumer awareness, and supportive economic conditions.

Technology evolution will continue shaping market development, with artificial intelligence, machine learning, and personalized treatment protocols becoming standard features in next-generation aesthetic devices. These advancements will enhance treatment precision, improve patient outcomes, and create new market opportunities.

Market maturation is expected to bring increased competition, driving innovation and improving cost-effectiveness across device categories. This evolution will benefit healthcare providers and patients through enhanced treatment options, improved technologies, and more competitive pricing structures.

Growth projections indicate sustained market expansion with an anticipated CAGR of 8.5% over the next five years, supported by demographic trends, economic prosperity, and continuous technological advancement. MWR forecasts suggest that the market will continue attracting significant investment and innovation, maintaining its position as a leading regional aesthetic devices market.

The UAE medical aesthetic devices market represents a dynamic and rapidly expanding sector with exceptional growth potential and strong fundamentals supporting continued development. The market benefits from favorable demographic trends, economic prosperity, advanced healthcare infrastructure, and strategic positioning as a regional medical tourism destination.

Key success factors include technological innovation, comprehensive training programs, strategic partnerships, and geographic expansion beyond traditional urban centers. Healthcare providers and device manufacturers that focus on these areas will be well-positioned to capitalize on emerging opportunities and achieve sustainable growth in this competitive market environment.

Future success in the UAE medical aesthetic devices market will depend on adaptability to evolving consumer preferences, continuous investment in advanced technologies, and commitment to maintaining high safety and efficacy standards. The market’s strong foundation and positive outlook make it an attractive opportunity for stakeholders across the aesthetic medicine value chain.

What is Medical Aesthetic Devices?

Medical Aesthetic Devices refer to equipment and tools used in non-surgical cosmetic procedures aimed at enhancing physical appearance. These devices include lasers, injectables, and skin rejuvenation technologies, among others.

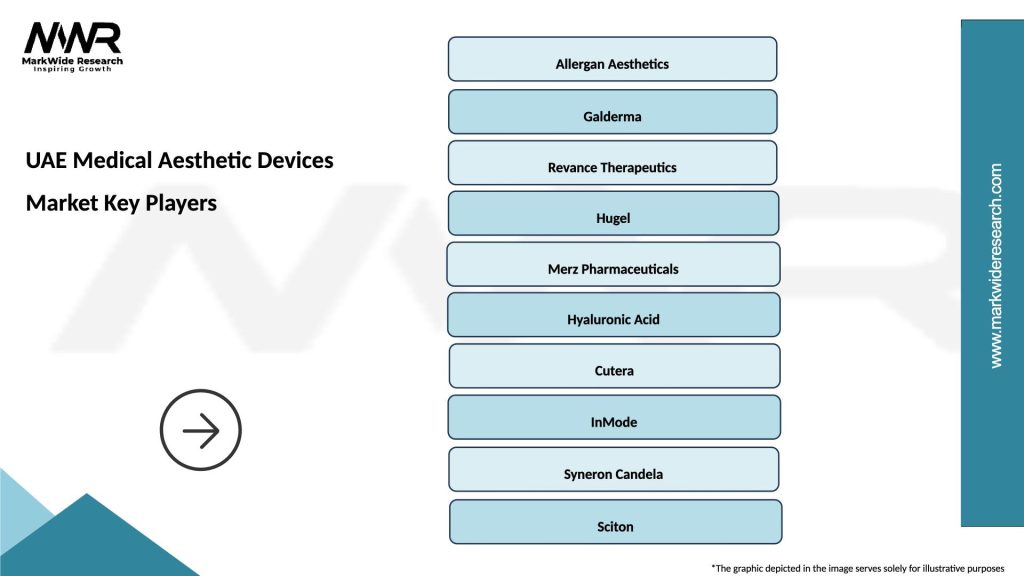

What are the key players in the UAE Medical Aesthetic Devices Market?

Key players in the UAE Medical Aesthetic Devices Market include Allergan, Merz Pharmaceuticals, and Galderma, which are known for their innovative products in the aesthetic field, among others.

What are the main drivers of growth in the UAE Medical Aesthetic Devices Market?

The growth of the UAE Medical Aesthetic Devices Market is driven by increasing consumer demand for non-invasive procedures, advancements in technology, and a growing awareness of aesthetic treatments among the population.

What challenges does the UAE Medical Aesthetic Devices Market face?

Challenges in the UAE Medical Aesthetic Devices Market include regulatory hurdles, high competition among providers, and the need for continuous innovation to meet evolving consumer preferences.

What opportunities exist in the UAE Medical Aesthetic Devices Market?

Opportunities in the UAE Medical Aesthetic Devices Market include the expansion of aesthetic clinics, increasing investment in research and development, and the rising trend of personalized aesthetic treatments.

What trends are shaping the UAE Medical Aesthetic Devices Market?

Trends in the UAE Medical Aesthetic Devices Market include the growing popularity of minimally invasive procedures, the integration of artificial intelligence in treatment planning, and an increasing focus on sustainable and eco-friendly products.

UAE Medical Aesthetic Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Laser Devices, Radiofrequency Devices, Ultrasound Devices, Light Therapy Devices |

| End User | Clinics, Hospitals, Dermatology Centers, Medical Spas |

| Technology | Non-invasive, Minimally Invasive, Invasive, Hybrid |

| Application | Skin Rejuvenation, Hair Removal, Body Contouring, Acne Treatment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Medical Aesthetic Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at