444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE major domestic appliances market represents one of the most dynamic and rapidly evolving sectors in the Middle East region. This market encompasses essential household appliances including refrigerators, washing machines, air conditioners, dishwashers, and cooking appliances that form the backbone of modern residential living. Market dynamics in the UAE are driven by a unique combination of factors including rapid urbanization, increasing disposable income, and a growing expatriate population that demands high-quality home appliances.

Consumer preferences in the UAE have shifted significantly toward energy-efficient and smart appliances, reflecting both environmental consciousness and the desire for convenience. The market demonstrates robust growth potential with 8.2% annual growth rate in smart appliance adoption, driven by technological advancement and government initiatives promoting energy efficiency. Premium appliance segments continue to gain traction among affluent consumers who prioritize quality, durability, and advanced features.

Regional characteristics play a crucial role in shaping market demand, with the harsh desert climate creating substantial demand for cooling appliances and water-efficient technologies. The UAE’s position as a regional hub for trade and commerce has attracted numerous international appliance manufacturers, creating a highly competitive landscape that benefits consumers through diverse product offerings and competitive pricing strategies.

The UAE major domestic appliances market refers to the comprehensive ecosystem of large household appliances designed for residential use, including cooling systems, laundry equipment, kitchen appliances, and cleaning devices. This market encompasses both traditional appliances and innovative smart home solutions that integrate connectivity and automation features to enhance user experience and operational efficiency.

Market scope includes various product categories such as refrigerators, freezers, washing machines, dryers, air conditioners, dishwashers, ovens, cooktops, and water heaters. These appliances serve essential functions in modern households, contributing to comfort, convenience, and quality of life for residents across the UAE’s diverse demographic landscape.

Industry definition extends beyond mere product sales to encompass installation services, maintenance support, warranty programs, and after-sales service networks. The market includes both built-in and freestanding appliances, catering to different housing types from luxury villas to compact apartments, reflecting the UAE’s varied residential architecture and lifestyle preferences.

Market performance in the UAE major domestic appliances sector demonstrates consistent expansion driven by population growth, housing development, and evolving consumer expectations. The market benefits from strong economic fundamentals, government support for energy efficiency initiatives, and increasing awareness of smart home technologies among tech-savvy consumers.

Key growth drivers include the UAE’s Vision 2071 sustainability goals, which promote energy-efficient appliances, and the country’s rapid digital transformation that encourages smart appliance adoption. Consumer spending patterns show a 12.5% increase in premium appliance purchases, indicating growing preference for high-quality, feature-rich products that offer long-term value and enhanced functionality.

Competitive landscape features a mix of global brands and regional players, with international manufacturers establishing strong distribution networks and local partnerships. The market shows particular strength in cooling appliances due to climatic conditions, while smart appliances represent the fastest-growing segment with 15.3% adoption rate among new homeowners and renovation projects.

Future prospects remain positive, supported by ongoing infrastructure development, population growth, and increasing focus on sustainable living practices. The integration of artificial intelligence and Internet of Things technologies continues to drive innovation and create new market opportunities for manufacturers and retailers alike.

Consumer behavior analysis reveals distinct preferences shaped by the UAE’s multicultural population and climate-specific requirements. The following insights highlight critical market characteristics:

Market segmentation shows distinct patterns across different emirates, with Dubai and Abu Dhabi leading in premium appliance adoption while northern emirates focus more on value-oriented products. Seasonal variations significantly impact sales, particularly for cooling appliances during summer months and cooking appliances during Ramadan period.

Economic prosperity serves as the primary catalyst for UAE major domestic appliances market expansion. Rising disposable income levels enable consumers to invest in high-quality appliances that offer enhanced functionality and long-term value. Government initiatives promoting energy efficiency through rebate programs and building codes create additional demand for environmentally friendly appliances.

Population growth and urbanization continue to drive fundamental market demand as new households require complete appliance sets. The UAE’s 3.2% annual population growth creates consistent demand for domestic appliances across all categories. Housing development projects and real estate expansion generate bulk purchasing opportunities for developers and create replacement demand in existing properties.

Technological advancement attracts consumers seeking convenience and efficiency through smart home integration. The proliferation of high-speed internet and smartphone adoption enables seamless connectivity between appliances and user devices. Climate considerations specific to the UAE create sustained demand for cooling appliances and energy-efficient solutions designed for extreme weather conditions.

Cultural diversity within the UAE population drives demand for specialized appliances catering to different cooking styles, food storage needs, and lifestyle preferences. Tourism industry growth indirectly supports the market through hospitality sector demand and increased awareness of international appliance brands among visitors who later become residents.

High initial costs associated with premium appliances can limit market penetration among price-sensitive consumer segments. While the UAE enjoys relative economic prosperity, significant appliance purchases still require careful budget consideration, particularly for young families and entry-level professionals establishing their first homes.

Import dependency creates vulnerability to global supply chain disruptions and currency fluctuations that can impact product availability and pricing. Logistics challenges related to appliance transportation, installation, and service delivery in remote areas of the UAE can increase operational costs and limit market reach for some manufacturers.

Rapid technological change can create consumer hesitation as buyers may delay purchases anticipating newer features or better value propositions. Energy infrastructure limitations in some areas may restrict the adoption of high-power appliances, particularly in older residential developments with limited electrical capacity.

Cultural adaptation requirements for international brands can increase product development costs and time-to-market for specialized features. Seasonal demand fluctuations create inventory management challenges for retailers and can impact cash flow patterns throughout the year, requiring sophisticated demand forecasting and supply chain management.

Smart home integration presents substantial growth opportunities as consumers increasingly seek connected appliances that enhance convenience and energy management. The UAE’s advanced telecommunications infrastructure and high smartphone penetration create ideal conditions for smart appliance adoption. Energy efficiency programs supported by government initiatives offer manufacturers opportunities to develop and market specialized products that meet local sustainability goals.

Replacement market potential continues to expand as earlier appliance installations reach end-of-life cycles, creating opportunities for upgraded products with enhanced features and efficiency. Commercial sector growth in hospitality, healthcare, and education creates additional demand channels beyond residential applications.

Customization services represent emerging opportunities for manufacturers and retailers to differentiate their offerings through personalized appliance solutions. Financing programs and flexible payment options can expand market accessibility and accelerate adoption among younger demographics and growing families.

Sustainability focus creates opportunities for eco-friendly appliances and recycling programs that appeal to environmentally conscious consumers. Regional expansion potential exists for successful UAE market players to leverage their experience in neighboring GCC countries with similar market characteristics and consumer preferences.

Supply chain evolution continues to reshape the UAE major domestic appliances market through improved distribution networks and enhanced customer service capabilities. Manufacturer strategies increasingly focus on local partnerships and regional assembly operations to reduce costs and improve responsiveness to market demands.

Consumer education initiatives by manufacturers and retailers help drive awareness of energy efficiency benefits and smart appliance features. Digital transformation impacts both sales channels and product functionality, with 35% of consumers now researching appliances online before making purchase decisions.

Competitive intensity drives continuous innovation and pricing optimization as brands seek to differentiate their offerings in a crowded marketplace. Service quality becomes increasingly important as a differentiating factor, with consumers valuing comprehensive warranty coverage and responsive technical support.

Regulatory environment influences product specifications and energy efficiency standards, creating both challenges and opportunities for manufacturers to develop compliant products. Economic cycles impact consumer spending patterns and purchasing timing, requiring flexible marketing and inventory strategies to maintain market position during various economic conditions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UAE major domestic appliances market. Primary research includes structured interviews with industry executives, retail managers, and consumer focus groups representing diverse demographic segments across the UAE’s seven emirates.

Secondary research incorporates analysis of government statistics, trade association reports, manufacturer financial statements, and retail sales data to establish market trends and sizing parameters. MarkWide Research utilizes proprietary analytical frameworks to synthesize quantitative and qualitative data sources for comprehensive market understanding.

Data collection methods include online surveys, telephone interviews, and in-person retail observations to capture real-time market dynamics and consumer behavior patterns. Statistical analysis employs advanced modeling techniques to project market trends and validate research findings through multiple data triangulation approaches.

Industry validation ensures research accuracy through expert panel reviews and cross-verification with established market participants. Continuous monitoring of market developments enables regular updates to research findings and maintains relevance of insights for strategic decision-making purposes.

Dubai emirate leads the UAE major domestic appliances market with 38% market share, driven by its large population, high disposable income levels, and concentration of luxury residential developments. Consumer preferences in Dubai favor premium brands and smart appliances, reflecting the emirate’s cosmopolitan character and tech-savvy population.

Abu Dhabi represents the second-largest market segment with 28% market share, characterized by government employee housing programs and large-scale residential projects. Energy efficiency focus is particularly strong in Abu Dhabi due to government sustainability initiatives and utility cost considerations.

Sharjah and Ajman collectively account for 22% market share, with consumer preferences leaning toward value-oriented appliances that offer reliable performance at competitive prices. Family-oriented demographics in these emirates drive demand for larger capacity appliances and multi-functional products.

Northern emirates including Ras Al Khaimah, Fujairah, and Umm Al Quwain represent 12% market share with growing potential as infrastructure development and population growth accelerate. Market penetration strategies in these regions focus on establishing distribution networks and service capabilities to support expanding consumer bases.

Cross-emirate trends show increasing convergence in consumer preferences as mobility between emirates increases and brand awareness spreads through digital marketing channels. Regional variations persist in specific product categories based on local climate conditions and housing characteristics.

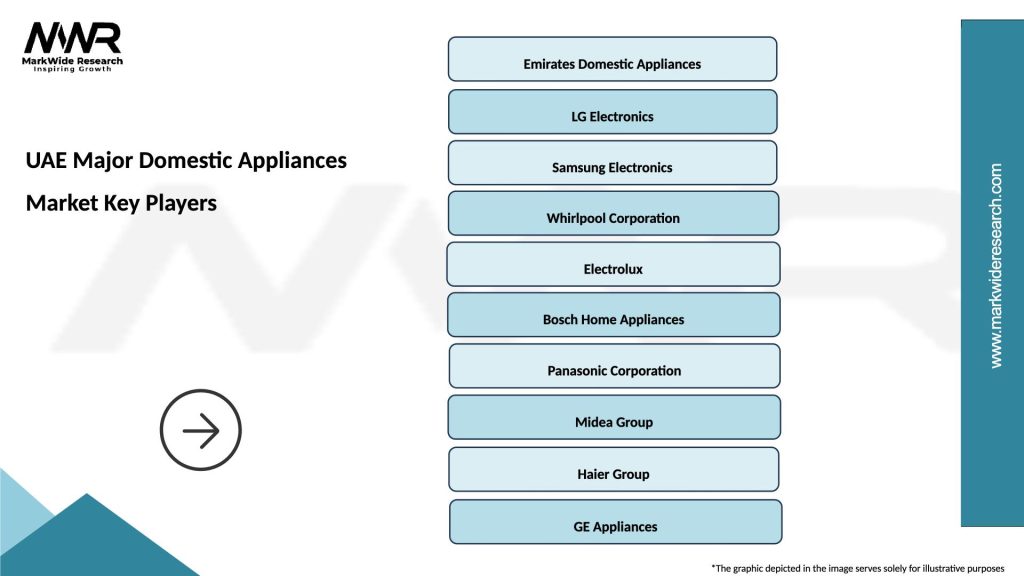

Market leadership in the UAE major domestic appliances sector is distributed among several international and regional players, each with distinct competitive advantages and market positioning strategies. The competitive environment remains dynamic with continuous innovation and strategic partnerships driving market evolution.

Competitive strategies focus on product differentiation through smart features, energy efficiency, and localized design elements. Distribution partnerships with major retailers and online platforms remain crucial for market access and customer reach. After-sales service quality increasingly influences competitive positioning as consumers prioritize long-term support and warranty coverage.

Product category segmentation reveals distinct market dynamics across different appliance types, with cooling appliances representing the largest segment due to UAE’s climate requirements. Market distribution shows refrigerators and air conditioners commanding significant market shares, while emerging categories like smart home appliances demonstrate rapid growth potential.

By Product Type:

By Technology Level:

By Distribution Channel:

Refrigeration appliances maintain market leadership with consistent demand driven by food storage requirements and the UAE’s hot climate. Consumer preferences increasingly favor larger capacity models with advanced cooling technology and energy-efficient operation. Smart refrigerators with connectivity features show 18% growth rate as consumers seek convenience and food management capabilities.

Air conditioning systems represent a critical market segment with year-round demand and frequent replacement cycles. Energy efficiency ratings significantly influence purchasing decisions as consumers seek to manage electricity costs. Inverter technology and smart climate control features drive premium segment growth and manufacturer differentiation strategies.

Laundry appliances demonstrate steady growth with increasing preference for water and energy-efficient models. Front-loading washers gain market share due to superior cleaning performance and reduced water consumption. Washer-dryer combinations appeal to space-conscious consumers in apartments and smaller homes.

Kitchen appliances show diversification with growing demand for specialized cooking equipment reflecting the UAE’s multicultural population. Built-in appliances gain popularity in luxury residential projects, while smart cooking features attract tech-savvy consumers seeking convenience and precision in food preparation.

Water heating systems require climate-specific adaptations with emphasis on efficiency and reliability. Solar water heaters gain traction supported by government sustainability initiatives and long-term cost savings. Instant water heaters appeal to consumers seeking space-saving solutions and on-demand hot water availability.

Manufacturers benefit from the UAE’s strategic location as a regional hub, enabling efficient distribution to neighboring markets and reduced logistics costs. Market access to affluent consumer segments provides opportunities for premium product positioning and higher profit margins. Government support for energy efficiency creates favorable conditions for innovative product development and market differentiation.

Retailers and distributors enjoy strong consumer demand and growing market size that supports business expansion and revenue growth. Digital transformation opportunities enable enhanced customer engagement and operational efficiency through online platforms and data analytics. Service sector development creates additional revenue streams through installation, maintenance, and extended warranty programs.

Consumers benefit from competitive pricing, diverse product selection, and advanced appliance features that enhance quality of life. Energy-efficient appliances provide long-term cost savings and environmental benefits. Smart home integration offers convenience and control capabilities that align with modern lifestyle preferences.

Government stakeholders achieve sustainability goals through increased adoption of energy-efficient appliances and reduced environmental impact. Economic development benefits include job creation in retail, service, and logistics sectors. Infrastructure efficiency improves through reduced peak electricity demand from efficient appliances.

Real estate developers enhance property value and marketability through inclusion of premium appliances in residential projects. Hospitality sector benefits from reliable, efficient appliances that reduce operational costs and enhance guest satisfaction. Financial institutions find opportunities in appliance financing and consumer credit products.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration emerges as the dominant trend shaping the UAE major domestic appliances market. Internet of Things capabilities enable remote monitoring, predictive maintenance, and energy optimization features that appeal to tech-savvy consumers. Voice control integration with popular smart home assistants creates seamless user experiences and drives adoption among younger demographics.

Energy efficiency advancement continues as a critical trend driven by both environmental consciousness and cost considerations. Inverter technology adoption across appliance categories provides significant energy savings and improved performance. Solar integration capabilities in water heaters and other appliances align with UAE’s renewable energy initiatives.

Customization and personalization trends reflect the UAE’s diverse population and varying lifestyle preferences. Modular appliance designs allow consumers to configure products according to specific needs and space constraints. Cultural adaptation features cater to different cooking styles and food storage requirements across various ethnic communities.

Subscription and service models gain traction as consumers seek comprehensive appliance solutions beyond initial purchase. Maintenance contracts and upgrade programs provide ongoing value and ensure optimal appliance performance throughout product lifecycles. Circular economy principles drive appliance recycling and refurbishment programs that appeal to environmentally conscious consumers.

Major product launches in the UAE market demonstrate manufacturer commitment to local consumer preferences and climate requirements. Samsung’s introduction of AI-powered refrigerators with Arabic language support exemplifies localization efforts. LG’s expansion of its smart appliance portfolio includes features specifically designed for Middle Eastern cooking styles and food storage needs.

Strategic partnerships between international manufacturers and local distributors strengthen market presence and service capabilities. Retail expansion initiatives include new showroom concepts that showcase smart home integration and provide interactive customer experiences. MarkWide Research analysis indicates these developments significantly enhance brand visibility and consumer engagement levels.

Technology investments focus on developing climate-resilient appliances that perform optimally in UAE’s extreme weather conditions. Manufacturing partnerships with regional facilities reduce costs and improve supply chain efficiency. Digital platform development enables enhanced customer service and support capabilities through mobile applications and online portals.

Sustainability initiatives include appliance recycling programs and energy efficiency certification processes. Government collaborations support development of products that meet national sustainability goals and energy conservation targets. Innovation centers established by major manufacturers focus on developing next-generation appliances tailored to regional market requirements.

Market entry strategies should prioritize understanding local consumer preferences and climate-specific requirements that differentiate the UAE market from other regions. Distribution network development remains crucial for success, requiring partnerships with established retailers and investment in service infrastructure across all emirates.

Product positioning should emphasize energy efficiency and smart features while maintaining competitive pricing strategies. Brand building efforts must account for the UAE’s multicultural population and diverse communication preferences. Digital marketing strategies should leverage high internet penetration and social media usage patterns among target demographics.

Service excellence represents a key differentiator in the competitive landscape, requiring investment in technical training and customer support capabilities. Inventory management strategies must account for seasonal demand variations and supply chain complexities. Partnership development with real estate developers and hospitality operators can create additional market opportunities.

Innovation focus should align with government sustainability initiatives and consumer preferences for smart home integration. Pricing strategies must balance premium positioning with value perception among price-conscious segments. Market expansion opportunities exist in underserved emirates and emerging residential developments.

Long-term growth prospects for the UAE major domestic appliances market remain positive, supported by continued population growth, economic development, and technological advancement. Smart appliance adoption is projected to reach 45% penetration rate within the next five years as connectivity infrastructure improves and consumer awareness increases.

Sustainability focus will intensify as government initiatives and consumer preferences align toward energy-efficient and environmentally responsible products. Market consolidation may occur as smaller players struggle to compete with established brands offering comprehensive product portfolios and service networks. MWR projections indicate continued market expansion driven by replacement demand and new household formation.

Technology integration will accelerate with artificial intelligence, machine learning, and advanced sensors becoming standard features across appliance categories. Customization capabilities will expand through modular designs and software-based feature updates that extend product lifecycles and enhance user experiences.

Regional market leadership position of the UAE will strengthen as manufacturers use the country as a hub for broader Middle East and North Africa market penetration. Innovation ecosystems will develop around smart home technologies and sustainable appliance solutions, attracting investment and talent to support continued market evolution and growth.

The UAE major domestic appliances market demonstrates remarkable resilience and growth potential, driven by strong economic fundamentals, technological advancement, and evolving consumer preferences. Market dynamics reflect the unique characteristics of the UAE’s diverse population, climate requirements, and strategic position as a regional hub for commerce and innovation.

Key success factors for market participants include understanding local consumer needs, investing in service excellence, and embracing technological innovation that enhances user experience and energy efficiency. Competitive advantages emerge from strategic partnerships, comprehensive product portfolios, and commitment to sustainability initiatives that align with government objectives and consumer values.

Future opportunities abound in smart appliance integration, energy efficiency advancement, and market expansion across the broader GCC region. Industry stakeholders who adapt to changing market conditions, invest in local capabilities, and prioritize customer satisfaction will be well-positioned to capitalize on continued market growth and evolution in the years ahead.

What is Major Domestic Appliances?

Major domestic appliances refer to large machines used for household tasks, including refrigerators, washing machines, and ovens. These appliances are essential for modern living, providing convenience and efficiency in daily chores.

What are the key players in the UAE Major Domestic Appliances Market?

Key players in the UAE Major Domestic Appliances Market include companies like LG Electronics, Samsung, and Whirlpool. These companies compete by offering innovative products and advanced technologies to meet consumer demands, among others.

What are the growth factors driving the UAE Major Domestic Appliances Market?

The growth of the UAE Major Domestic Appliances Market is driven by factors such as increasing urbanization, rising disposable incomes, and a growing preference for energy-efficient appliances. Additionally, the expansion of the real estate sector contributes to higher demand for these products.

What challenges does the UAE Major Domestic Appliances Market face?

The UAE Major Domestic Appliances Market faces challenges such as intense competition, fluctuating raw material prices, and changing consumer preferences. These factors can impact profitability and market stability.

What opportunities exist in the UAE Major Domestic Appliances Market?

Opportunities in the UAE Major Domestic Appliances Market include the growing trend of smart home technology and increasing demand for sustainable appliances. Manufacturers can capitalize on these trends by developing innovative products that cater to environmentally conscious consumers.

What trends are shaping the UAE Major Domestic Appliances Market?

Trends shaping the UAE Major Domestic Appliances Market include the rise of smart appliances, which offer connectivity and automation features, and a focus on energy efficiency. Additionally, there is a growing interest in stylish designs that complement modern home aesthetics.

UAE Major Domestic Appliances Market

| Segmentation Details | Description |

|---|---|

| Product Type | Refrigerators, Washing Machines, Ovens, Dishwashers |

| Technology | Smart Appliances, Energy-Efficient, IoT-Enabled, Conventional |

| End User | Residential, Commercial, Hospitality, Retail |

| Distribution Channel | Online Retail, Specialty Stores, Hypermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Major Domestic Appliances Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at