444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE luxury goods market represents one of the most dynamic and rapidly expanding luxury retail sectors in the Middle East and North Africa region. Dubai and Abu Dhabi have emerged as premier luxury shopping destinations, attracting affluent consumers from across the globe with their world-class retail infrastructure and tax-free shopping environment. The market encompasses a comprehensive range of premium products including luxury fashion, jewelry, watches, cosmetics, automobiles, and lifestyle accessories.

Market dynamics in the UAE are driven by several unique factors including the country’s strategic location as a global trading hub, substantial expatriate population with high disposable income, and government initiatives promoting tourism and retail sector development. The luxury goods sector benefits from zero import duties on most luxury items, making the UAE an attractive destination for both luxury retailers and consumers seeking premium products at competitive prices.

Consumer demographics in the UAE luxury market are notably diverse, comprising wealthy Emiratis, high-income expatriates, and international tourists. The market demonstrates strong growth momentum with luxury consumption patterns showing consistent year-over-year expansion of approximately 8-12% annually. Dubai Mall and Mall of the Emirates serve as flagship luxury retail destinations, housing prestigious international brands and attracting millions of luxury shoppers annually.

The UAE luxury goods market refers to the comprehensive ecosystem of premium and ultra-premium consumer products sold within the United Arab Emirates, encompassing high-end fashion, jewelry, watches, cosmetics, automobiles, and lifestyle products that command premium pricing due to their superior quality, craftsmanship, brand prestige, and exclusivity.

Luxury goods in the UAE context are characterized by their exceptional quality, prestigious brand heritage, limited availability, and significant price premiums compared to mass-market alternatives. The market includes both established international luxury brands and emerging luxury labels that cater to the sophisticated tastes of the UAE’s affluent consumer base.

Market participants include luxury fashion houses, jewelry manufacturers, watch brands, cosmetics companies, automotive manufacturers, and specialty retailers who operate through various channels including flagship boutiques, department stores, online platforms, and exclusive showrooms. The UAE’s luxury market is distinguished by its multicultural consumer base and preference for authentic, high-quality products that reflect personal status and lifestyle aspirations.

The UAE luxury goods market continues to demonstrate remarkable resilience and growth potential, establishing itself as a regional luxury hub that attracts both international brands and discerning consumers. The market benefits from favorable economic conditions, strategic government initiatives, and a sophisticated consumer base with strong purchasing power and appreciation for premium products.

Key market drivers include the UAE’s position as a global business and tourism hub, substantial high-net-worth individual population, and favorable regulatory environment that supports luxury retail operations. The market shows particular strength in categories such as luxury fashion, fine jewelry, premium watches, and high-end cosmetics, with fashion and accessories representing approximately 35-40% of total luxury consumption.

Digital transformation is reshaping the luxury retail landscape in the UAE, with brands increasingly investing in omnichannel strategies that combine physical retail presence with sophisticated online platforms. The market demonstrates strong recovery momentum following global economic challenges, with luxury consumption patterns returning to pre-pandemic levels and showing continued growth trajectory.

Future prospects remain highly positive, supported by ongoing infrastructure development, increasing tourist arrivals, and growing domestic luxury consumption. The market is expected to benefit from major events and exhibitions that attract international visitors and showcase the UAE as a premier luxury destination.

Consumer behavior analysis reveals distinct luxury shopping patterns in the UAE, with consumers demonstrating strong brand loyalty, preference for authentic products, and willingness to pay premium prices for exceptional quality and service. The market shows seasonal fluctuations aligned with tourism patterns and major shopping festivals.

Economic prosperity serves as the fundamental driver of UAE’s luxury goods market, with the country’s strong GDP per capita and substantial high-net-worth individual population creating robust demand for premium products. The UAE’s strategic position as a regional business hub attracts affluent professionals and entrepreneurs who contribute significantly to luxury consumption patterns.

Tourism infrastructure plays a crucial role in market expansion, with Dubai and Abu Dhabi attracting millions of international visitors annually who contribute substantially to luxury goods sales. The UAE’s reputation as a luxury shopping destination is reinforced by world-class retail facilities, tax-free shopping benefits, and extensive product availability across all luxury categories.

Government initiatives supporting retail sector development and tourism promotion create favorable conditions for luxury market growth. Policies promoting foreign investment, business-friendly regulations, and infrastructure development contribute to the market’s continued expansion and international brand attraction.

Cultural factors including the UAE’s multicultural society and appreciation for quality craftsmanship drive demand for authentic luxury products. The country’s position as a cultural bridge between East and West creates unique opportunities for both traditional and contemporary luxury brands to establish strong market presence.

Economic volatility in global markets can impact luxury consumption patterns in the UAE, as the market includes significant expatriate population whose spending patterns may be influenced by economic conditions in their home countries. Oil price fluctuations can also affect regional economic sentiment and luxury spending behavior.

Counterfeit products pose ongoing challenges to the legitimate luxury goods market, despite government efforts to combat intellectual property violations. The presence of counterfeit goods can undermine consumer confidence and affect brand value perception in certain market segments.

High operational costs associated with maintaining luxury retail presence in prime locations can limit market entry for some brands and affect pricing strategies. Premium retail space costs in key shopping destinations require significant investment commitments from luxury retailers.

Cultural sensitivities and regulatory requirements may limit certain luxury product categories or require modifications to marketing approaches. Brands must navigate local customs and regulations while maintaining their global brand identity and positioning.

Digital transformation presents significant opportunities for luxury brands to enhance customer engagement and expand market reach through sophisticated online platforms and digital marketing strategies. The growing adoption of e-commerce among luxury consumers creates new channels for brand interaction and sales generation.

Sustainable luxury represents an emerging opportunity as environmentally conscious consumers increasingly seek luxury products that align with sustainability values. Brands that successfully integrate sustainable practices and materials can differentiate themselves in the competitive luxury market.

Experiential luxury offers substantial growth potential as consumers increasingly value unique experiences alongside traditional luxury products. Opportunities exist for brands to create immersive retail experiences, exclusive events, and personalized services that enhance brand loyalty and customer lifetime value.

Regional expansion opportunities exist for successful luxury retailers to extend their presence across other GCC markets, leveraging their UAE success to establish broader regional market presence. The UAE can serve as a strategic hub for luxury brands targeting the broader Middle East market.

Supply chain dynamics in the UAE luxury market are characterized by sophisticated logistics networks that ensure efficient product distribution and inventory management. The country’s advanced transportation infrastructure and strategic location facilitate smooth import and distribution of luxury goods from global manufacturing centers.

Competitive dynamics reflect intense competition among international luxury brands seeking to establish and maintain market presence. Brands compete on factors including product quality, brand prestige, retail experience, customer service, and pricing strategies. The market demonstrates clear segmentation between ultra-luxury, premium luxury, and accessible luxury categories.

Consumer dynamics show evolving preferences toward personalization, authenticity, and unique experiences. Millennial and Gen Z consumers are increasingly influential in shaping market trends, with their preferences for digital engagement and sustainable luxury driving industry innovation and adaptation.

Regulatory dynamics remain generally favorable for luxury retail operations, with government policies supporting business development and consumer protection. The UAE’s commitment to intellectual property protection and anti-counterfeiting measures creates a secure environment for legitimate luxury brands to operate and invest in market development.

Primary research methodologies employed in analyzing the UAE luxury goods market include comprehensive surveys of luxury consumers, in-depth interviews with industry executives, and focus group discussions with target demographic segments. These primary research activities provide valuable insights into consumer behavior, preferences, and purchasing patterns.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial information to understand market trends, competitive landscape, and growth patterns. MarkWide Research utilizes multiple data sources to ensure comprehensive market coverage and analytical accuracy.

Market observation techniques include retail location visits, mystery shopping exercises, and analysis of promotional activities to understand market dynamics and competitive strategies. These observational methods provide real-time insights into market conditions and consumer interactions with luxury brands.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis, and expert consultation. The methodology incorporates both quantitative and qualitative research approaches to provide comprehensive market understanding and reliable forecasting capabilities.

Dubai dominates the UAE luxury goods market, accounting for approximately 60-65% of total luxury sales volume. The emirate’s position as a global tourism and business hub, combined with world-class retail infrastructure and tax-free shopping environment, makes it the premier luxury destination in the region. Dubai Mall, Mall of the Emirates, and City Walk serve as flagship luxury retail destinations.

Abu Dhabi represents the second-largest luxury market segment, contributing approximately 25-30% of total market activity. The capital’s growing tourism sector, cultural attractions, and affluent resident population drive steady luxury consumption growth. The Galleria and Yas Mall serve as primary luxury retail centers in Abu Dhabi.

Sharjah and Northern Emirates collectively account for the remaining 10-15% of luxury market activity, with growing retail infrastructure and increasing consumer affluence supporting market expansion. These regions show particular strength in traditional luxury categories such as jewelry and watches.

Regional connectivity between emirates facilitates cross-regional luxury shopping, with consumers frequently traveling between Dubai and Abu Dhabi for luxury purchases. The UAE’s compact geography and excellent transportation infrastructure support integrated luxury retail strategies across multiple emirates.

The competitive landscape in the UAE luxury goods market features a diverse mix of international luxury conglomerates, independent luxury brands, and regional luxury retailers. Competition is intense across all luxury categories, with brands competing on product quality, brand prestige, retail experience, and customer service excellence.

By Product Category: The UAE luxury goods market demonstrates clear segmentation across multiple product categories, each with distinct consumer bases and growth patterns. Fashion and accessories represent the largest segment, followed by jewelry and watches, cosmetics and fragrances, and luxury automobiles.

By Consumer Segment: Market segmentation by consumer demographics reveals distinct purchasing patterns and preferences across different customer groups.

Luxury Fashion dominates the UAE market with strong performance across all subcategories including ready-to-wear, leather goods, and accessories. European luxury fashion houses maintain particularly strong market positions, with consumers showing strong preference for authentic craftsmanship and heritage brands. The category benefits from year-round demand and seasonal collection launches.

Fine Jewelry represents a significant market segment with particular strength in precious metals and gemstone jewelry. The UAE’s cultural appreciation for gold and jewelry, combined with tax-free shopping benefits, creates favorable conditions for luxury jewelry sales. Traditional and contemporary designs both perform well in the market.

Luxury Watches show consistent growth with strong demand for mechanical timepieces and complications. Swiss watch brands maintain dominant market positions, though consumers also show interest in limited editions and exclusive releases. The category benefits from strong collector interest and investment potential.

Premium Cosmetics demonstrate robust growth driven by increasing beauty consciousness and preference for high-quality products. The category shows particular strength in skincare and fragrance segments, with consumers willing to pay premium prices for proven efficacy and luxury brand prestige.

For Luxury Brands: The UAE market offers exceptional opportunities for brand establishment and growth, with favorable business environment, sophisticated consumer base, and strategic location for regional expansion. Brands benefit from tax-free retail environment, strong intellectual property protection, and access to affluent consumer segments.

For Retailers: The market provides opportunities for profitable luxury retail operations with strong consumer demand, premium pricing acceptance, and growing market size. Retailers benefit from established luxury shopping destinations and sophisticated consumer expectations.

For Consumers: The UAE luxury market offers extensive product selection, competitive pricing due to tax-free environment, authentic products with warranty support, and exceptional retail experiences. Consumers benefit from access to latest collections and exclusive products.

For Investors: The luxury goods sector presents attractive investment opportunities with consistent growth patterns, strong consumer demand, and favorable market dynamics supporting long-term value creation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Integration is transforming the luxury retail landscape in the UAE, with brands investing heavily in omnichannel strategies that seamlessly blend physical and digital shopping experiences. Augmented reality and virtual try-on technologies are becoming standard features in luxury retail environments, enhancing customer engagement and purchase confidence.

Personalization has emerged as a critical trend, with luxury brands offering customized products, personalized shopping experiences, and exclusive services tailored to individual customer preferences. Data analytics and customer relationship management systems enable brands to deliver highly personalized luxury experiences that build long-term customer loyalty.

Sustainability Focus is gaining momentum as environmentally conscious consumers increasingly seek luxury products that align with their values. Brands are responding with sustainable materials, ethical sourcing practices, and circular economy initiatives that appeal to responsible luxury consumers.

Experiential Luxury continues to grow in importance, with consumers valuing unique experiences alongside traditional luxury products. Brands are creating immersive retail environments, exclusive events, and personalized services that enhance the overall luxury experience and justify premium pricing.

Retail Expansion activities continue across the UAE luxury market, with international brands opening flagship stores and expanding their physical presence in key shopping destinations. Mall of the Emirates and Dubai Mall have welcomed several new luxury boutiques, reinforcing the UAE’s position as a premier luxury shopping destination.

Technology Integration initiatives are reshaping luxury retail operations, with brands implementing advanced point-of-sale systems, inventory management solutions, and customer relationship management platforms. Artificial intelligence and machine learning technologies are being deployed to enhance customer service and optimize retail operations.

Partnership Developments between luxury brands and local retailers are creating new market opportunities and expanding distribution networks. These strategic partnerships leverage local market knowledge and established customer relationships to accelerate brand growth and market penetration.

Event Marketing has intensified with luxury brands organizing exclusive fashion shows, product launches, and VIP customer events to enhance brand visibility and customer engagement. Dubai Fashion Week and other luxury events provide platforms for brands to showcase their latest collections and connect with affluent consumers.

Market Entry Strategy: MarkWide Research recommends that new luxury brands entering the UAE market should prioritize establishing physical retail presence in prime locations while simultaneously developing robust digital capabilities. The combination of flagship stores and sophisticated online platforms creates optimal market entry conditions.

Consumer Engagement: Brands should focus on creating personalized luxury experiences that cater to the diverse cultural preferences of UAE consumers. Multilingual customer service and culturally sensitive marketing approaches are essential for building strong customer relationships and brand loyalty.

Digital Investment: Continued investment in digital technologies and e-commerce capabilities is crucial for long-term success in the UAE luxury market. Brands should prioritize mobile-optimized platforms, social media engagement, and data analytics capabilities to understand and serve their customers effectively.

Sustainability Integration: Forward-thinking luxury brands should incorporate sustainability initiatives into their UAE operations to appeal to environmentally conscious consumers and differentiate themselves in the competitive market. Sustainable packaging and ethical sourcing practices can enhance brand reputation and customer loyalty.

The UAE luxury goods market is positioned for continued growth and expansion, supported by strong economic fundamentals, government initiatives promoting tourism and retail sector development, and evolving consumer preferences toward premium products and experiences. The market is expected to maintain its growth trajectory with annual expansion rates of approximately 8-12% over the forecast period.

Digital transformation will continue to reshape the luxury retail landscape, with brands investing in advanced technologies and omnichannel strategies to enhance customer experiences and operational efficiency. The integration of artificial intelligence, augmented reality, and personalization technologies will become standard practice among leading luxury retailers.

Sustainability initiatives will gain increasing importance as environmentally conscious consumers drive demand for responsible luxury products. Brands that successfully integrate sustainable practices while maintaining luxury quality and prestige will gain competitive advantages in the evolving market landscape.

Regional expansion opportunities will emerge as successful luxury brands leverage their UAE market presence to establish broader Middle East operations. The UAE’s strategic location and established luxury infrastructure make it an ideal hub for regional luxury retail expansion and distribution.

The UAE luxury goods market represents one of the most dynamic and promising luxury retail sectors globally, characterized by strong consumer demand, favorable business environment, and continued growth potential. The market’s unique combination of affluent local population, substantial expatriate community, and significant tourist influx creates robust demand for authentic luxury products across all categories.

Key success factors for luxury brands operating in the UAE include maintaining product authenticity, delivering exceptional customer service, investing in digital capabilities, and understanding the diverse cultural preferences of the consumer base. The market rewards brands that combine traditional luxury values with innovative retail approaches and personalized customer experiences.

Future prospects remain highly positive, with the UAE’s continued economic development, infrastructure expansion, and government support for retail sector growth creating favorable conditions for luxury market expansion. The integration of sustainability practices and digital technologies will be crucial for long-term success in this evolving market landscape.

Strategic positioning in the UAE luxury market requires comprehensive understanding of local consumer preferences, competitive dynamics, and regulatory environment. Brands that successfully navigate these factors while maintaining their luxury positioning and brand integrity will continue to thrive in this sophisticated and rewarding market.

What is UAE Luxury Goods?

UAE Luxury Goods refer to high-end products that are characterized by their premium quality, exclusivity, and high price points. This category includes luxury fashion, jewelry, watches, and high-end automobiles, catering to affluent consumers in the UAE.

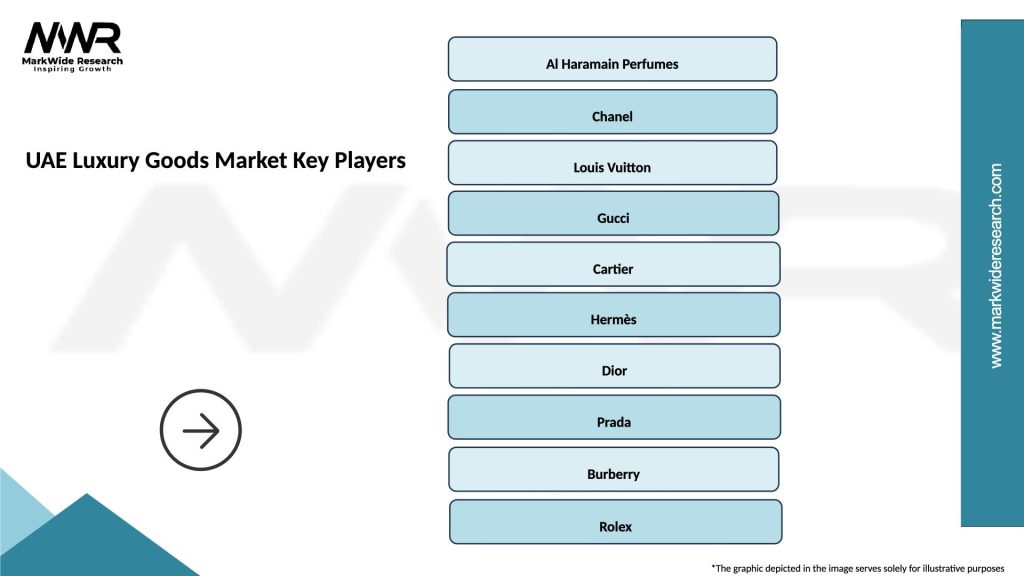

What are the key players in the UAE Luxury Goods Market?

Key players in the UAE Luxury Goods Market include brands like Louis Vuitton, Gucci, and Chanel, which dominate the fashion segment, as well as Rolex and Cartier in the luxury watch sector. These companies are known for their strong brand presence and extensive distribution networks in the region, among others.

What are the growth factors driving the UAE Luxury Goods Market?

The UAE Luxury Goods Market is driven by factors such as a growing affluent population, increasing tourism, and a rising demand for premium products. Additionally, the influence of social media and luxury lifestyle trends contribute to consumer interest in high-end goods.

What challenges does the UAE Luxury Goods Market face?

Challenges in the UAE Luxury Goods Market include economic fluctuations that can affect consumer spending, competition from online retailers, and changing consumer preferences towards sustainability. These factors can impact sales and brand loyalty in the luxury segment.

What opportunities exist in the UAE Luxury Goods Market?

Opportunities in the UAE Luxury Goods Market include the expansion of e-commerce platforms, the rise of personalized shopping experiences, and the growing interest in sustainable luxury products. Brands that adapt to these trends may find new avenues for growth.

What trends are shaping the UAE Luxury Goods Market?

Trends in the UAE Luxury Goods Market include a shift towards experiential luxury, where consumers seek unique experiences over products, and an increasing focus on digital engagement. Additionally, the integration of technology in retail, such as augmented reality, is becoming more prevalent.

UAE Luxury Goods Market

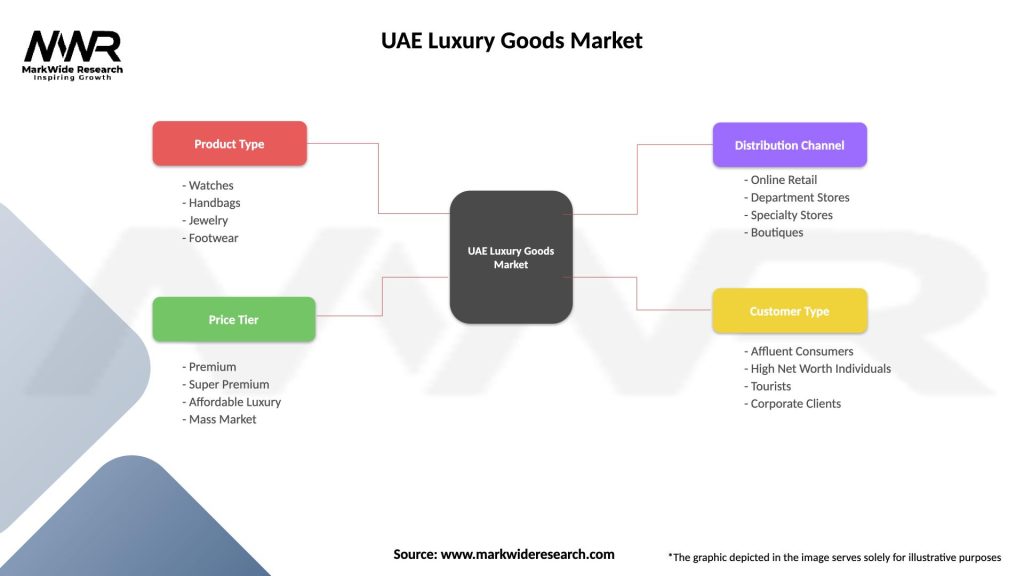

| Segmentation Details | Description |

|---|---|

| Product Type | Watches, Handbags, Jewelry, Footwear |

| Price Tier | Premium, Super Premium, Affordable Luxury, Mass Market |

| Distribution Channel | Online Retail, Department Stores, Specialty Stores, Boutiques |

| Customer Type | Affluent Consumers, High Net Worth Individuals, Tourists, Corporate Clients |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Luxury Goods Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at