444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE life and non-life insurance market represents one of the most dynamic and rapidly evolving insurance sectors in the Middle East region. Market dynamics indicate significant transformation driven by regulatory reforms, digital innovation, and changing consumer preferences across the Emirates. The insurance landscape encompasses comprehensive coverage solutions ranging from traditional life insurance policies to sophisticated non-life products including motor, health, property, and marine insurance segments.

Growth trajectories demonstrate robust expansion with the market experiencing a compound annual growth rate of 8.2% over recent years. This growth reflects increasing insurance penetration rates, mandatory insurance requirements, and rising awareness among UAE residents about financial protection needs. Digital transformation initiatives have revolutionized service delivery, enabling insurers to offer streamlined policy management and claims processing capabilities.

Regulatory framework developments under the Insurance Authority have strengthened market stability while promoting innovation and competition. The introduction of risk-based capital requirements and enhanced consumer protection measures has elevated industry standards. Market penetration rates show promising upward trends, with insurance density reaching 3.8% of GDP, positioning the UAE as a regional leader in insurance adoption.

The UAE life and non-life insurance market refers to the comprehensive ecosystem of insurance products and services offered within the United Arab Emirates, encompassing both life insurance policies that provide financial protection against mortality risks and non-life insurance products covering property, casualty, health, and other general insurance needs.

Life insurance components include term life, whole life, endowment policies, and group life coverage designed to provide financial security for beneficiaries. These products address long-term financial planning needs and estate protection requirements for UAE residents and expatriates. Non-life insurance segments encompass motor insurance, health insurance, property and casualty coverage, marine insurance, and specialized commercial lines serving diverse risk management needs across individual and corporate sectors.

Market structure comprises local and international insurance companies operating under UAE regulatory oversight, offering products through traditional distribution channels, digital platforms, and bancassurance partnerships. The sector serves a diverse customer base including UAE nationals, expatriate residents, and commercial enterprises requiring comprehensive risk management solutions.

Strategic positioning of the UAE insurance market reflects strong fundamentals supported by economic diversification, population growth, and regulatory modernization initiatives. The sector demonstrates resilience through balanced portfolios combining life and non-life products, with non-life insurance accounting for 78% of total premium volumes, primarily driven by mandatory motor and health insurance requirements.

Digital innovation emerges as a key differentiator, with insurers investing heavily in technology infrastructure to enhance customer experience and operational efficiency. Insurtech adoption rates have accelerated, with 45% of insurers implementing artificial intelligence and machine learning capabilities for underwriting and claims processing. These technological advances enable personalized product offerings and streamlined service delivery.

Market consolidation trends indicate strategic partnerships and mergers aimed at achieving scale economies and expanding market reach. Customer retention rates have improved to 82% industry-wide, reflecting enhanced service quality and product innovation. The competitive landscape features both established regional players and international insurance groups leveraging their global expertise in the UAE market.

Demographic drivers significantly influence market dynamics, with the UAE’s young and diverse population creating substantial demand for insurance products. Expatriate population comprising approximately 88% of total residents generates unique insurance needs, particularly in health and life insurance segments. This demographic profile supports sustained market growth and product diversification opportunities.

Regulatory mandates serve as primary market drivers, with compulsory motor insurance and mandatory health insurance requirements across emirates generating substantial premium volumes. Insurance Authority regulations have standardized market practices while promoting competition and innovation. These regulatory frameworks ensure consistent market growth and consumer protection standards.

Economic diversification initiatives under UAE Vision 2071 create new insurance opportunities across emerging sectors including renewable energy, technology, and tourism. Infrastructure development projects require comprehensive insurance coverage, driving demand for construction, engineering, and project-specific insurance products. The expanding business environment generates increased commercial insurance needs.

Population growth and urbanization trends contribute significantly to market expansion, with increasing numbers of residents requiring various insurance products. Rising disposable income levels enable greater insurance spending, particularly in life insurance and voluntary health coverage segments. Financial literacy improvements enhance consumer understanding of insurance benefits, driving voluntary product adoption.

Digital transformation accelerates market growth through improved accessibility and customer experience. Mobile-first approaches enable insurers to reach younger demographics effectively, while digital platforms reduce distribution costs and enhance service efficiency. Data analytics capabilities support personalized product development and risk assessment accuracy.

Price sensitivity among consumers, particularly in discretionary insurance segments, limits market penetration rates. Economic volatility can impact consumer spending on non-mandatory insurance products, affecting life insurance and voluntary coverage adoption. Competition intensity pressures profit margins, requiring insurers to balance competitive pricing with sustainable business models.

Regulatory complexity creates compliance challenges, particularly for international insurers navigating local requirements and reporting standards. Capital adequacy requirements demand substantial financial resources, potentially limiting market entry for smaller players. Licensing procedures and ongoing regulatory obligations require significant administrative investments.

Talent shortage in specialized insurance roles constrains industry growth, with limited availability of experienced underwriters, actuaries, and claims specialists. Skills gaps in digital technologies and data analytics impact innovation capabilities. Training and development requirements represent ongoing operational costs for market participants.

Cultural factors influence insurance adoption, with some segments showing resistance to certain insurance concepts. Language barriers can complicate product communication and customer service delivery in the diverse UAE market. Trust building remains essential for expanding market penetration across different demographic segments.

Insurtech innovation presents significant opportunities for market disruption and growth acceleration. Artificial intelligence applications in underwriting, claims processing, and customer service can dramatically improve operational efficiency and customer satisfaction. Blockchain technology offers potential for enhanced transparency and fraud prevention capabilities.

Parametric insurance products addressing climate risks and business interruption scenarios represent emerging opportunities. Cyber insurance demand grows rapidly as businesses increase digital operations and face evolving cyber threats. Specialized coverage for emerging industries including fintech, e-commerce, and renewable energy sectors offers growth potential.

Cross-border expansion opportunities exist for UAE-based insurers leveraging their regional expertise and regulatory compliance capabilities. Reinsurance hub development positions the UAE as a regional center for risk distribution and capacity management. Islamic insurance growth aligns with regional preferences for Sharia-compliant financial products.

Partnership opportunities with technology companies, healthcare providers, and automotive manufacturers enable innovative product development and distribution strategies. Data monetization through analytics services and risk assessment capabilities creates additional revenue streams. Wellness programs integrated with insurance products offer differentiation opportunities and improved risk profiles.

Competitive intensity drives continuous innovation and service enhancement across the UAE insurance market. Market leaders maintain positions through comprehensive product portfolios, strong distribution networks, and superior customer service capabilities. New entrants leverage digital technologies and specialized offerings to capture market share in specific segments.

Customer expectations evolve rapidly, demanding seamless digital experiences, personalized products, and transparent pricing. Omnichannel strategies become essential for meeting diverse customer preferences across traditional and digital touchpoints. Claims experience quality significantly influences customer retention and brand reputation in the competitive landscape.

Regulatory evolution continues shaping market dynamics through enhanced consumer protection measures, capital requirements, and operational standards. Compliance costs impact profitability while regulatory clarity supports long-term market stability. International standards adoption aligns UAE practices with global best practices, facilitating international partnerships and investments.

Technology integration transforms traditional insurance operations, enabling real-time risk assessment, automated underwriting, and predictive analytics capabilities. Data-driven decision making improves risk selection and pricing accuracy while enhancing customer insights. Operational efficiency gains of 25-30% through digitalization support competitive positioning and profitability improvement.

Comprehensive analysis of the UAE life and non-life insurance market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes structured interviews with industry executives, regulatory officials, and key stakeholders across the insurance value chain. Survey methodologies capture consumer preferences, adoption patterns, and satisfaction levels across different demographic segments.

Secondary research encompasses analysis of regulatory filings, company annual reports, industry publications, and government statistics. Data triangulation validates findings across multiple sources to ensure consistency and accuracy. Market modeling techniques project future trends based on historical performance, regulatory changes, and economic indicators.

Quantitative analysis examines premium volumes, claims ratios, market share distributions, and financial performance metrics across market participants. Qualitative assessments evaluate competitive positioning, strategic initiatives, and market dynamics influencing industry evolution. Expert consultations provide insights into regulatory developments, technological trends, and market outlook perspectives.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Analytical frameworks apply established methodologies for market sizing, competitive analysis, and trend identification. Continuous monitoring tracks market developments and updates analysis to reflect current conditions and emerging trends.

Dubai emirate dominates the UAE insurance market, accounting for approximately 45% of total premium volumes due to its status as the commercial and financial hub. Business concentration in Dubai drives demand for commercial insurance lines while the large expatriate population supports life and health insurance growth. Regulatory infrastructure and international connectivity facilitate market development and innovation initiatives.

Abu Dhabi represents the second-largest market segment with 32% market share, supported by government sector insurance needs and major infrastructure projects. Oil and gas industry requirements generate substantial commercial insurance demand, while population growth drives personal lines expansion. Government initiatives promoting economic diversification create new insurance opportunities across emerging sectors.

Northern Emirates including Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively represent 23% of market activity. Manufacturing and logistics sectors in these emirates require specialized insurance coverage, while growing residential populations drive personal insurance demand. Economic development initiatives in these regions support market expansion opportunities.

Cross-emirate operations enable insurers to leverage economies of scale while serving diverse market needs across different emirates. Regulatory harmonization facilitates seamless operations across emirate boundaries, supporting market efficiency and competition. Distribution network optimization considers regional preferences and demographic characteristics to maximize market penetration effectiveness.

Market leadership in the UAE insurance sector reflects a combination of local expertise, international backing, and comprehensive service capabilities. Established players maintain competitive advantages through extensive distribution networks, brand recognition, and diversified product portfolios serving both life and non-life segments.

Competitive strategies focus on digital transformation, customer experience enhancement, and product innovation to maintain market position. Strategic partnerships with banks, automotive dealers, and healthcare providers expand distribution reach and customer acquisition capabilities. Merger and acquisition activities reshape the competitive landscape as companies seek scale advantages and market consolidation benefits.

Product segmentation divides the UAE insurance market into distinct categories based on coverage types and customer needs. Life insurance products include term life, whole life, endowment policies, and group life coverage addressing mortality protection and savings requirements. Non-life insurance segments encompass motor, health, property, marine, and commercial lines serving diverse risk management needs.

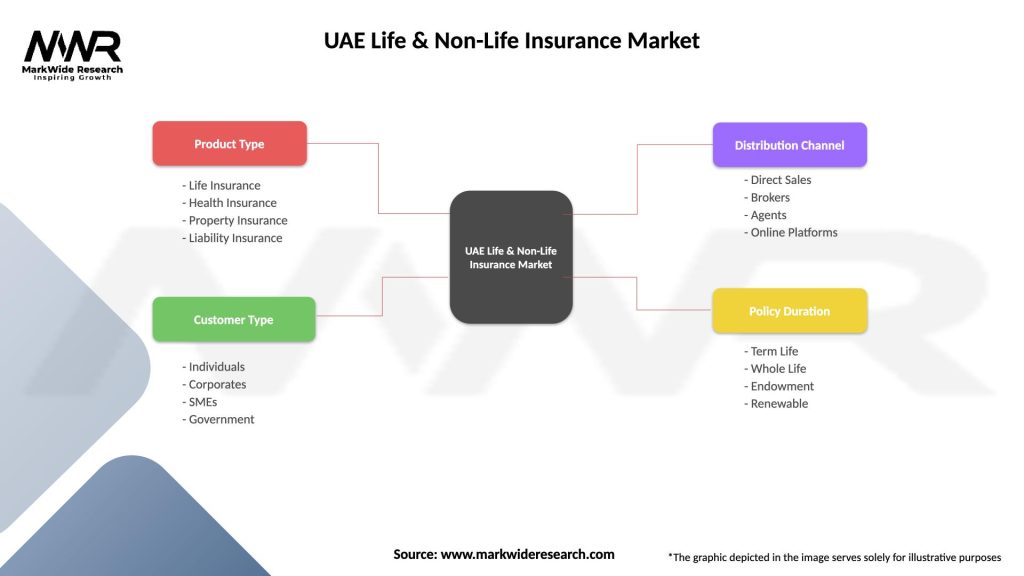

By Product Type:

By Distribution Channel:

Motor insurance maintains its position as the dominant non-life segment, benefiting from mandatory coverage requirements and steady vehicle sales growth. Comprehensive coverage adoption increases as consumers recognize the value of protection beyond basic third-party liability. Usage-based insurance products emerge as innovative solutions offering personalized pricing based on driving behavior and vehicle usage patterns.

Health insurance experiences rapid expansion driven by mandatory coverage implementation across emirates and growing health awareness. Corporate group policies represent significant premium volumes while individual health insurance adoption increases among expatriate populations. Wellness programs integrated with health insurance policies offer value-added services and improved risk profiles.

Life insurance growth reflects increasing financial literacy and long-term planning awareness among UAE residents. Term life products gain popularity for their affordability and straightforward coverage, while investment-linked policies appeal to customers seeking combined protection and savings benefits. Group life insurance through employer-sponsored programs provides significant market volume.

Property insurance serves both residential and commercial segments with coverage against fire, theft, and natural disasters. High-value residential properties require specialized coverage solutions, while commercial property insurance supports the growing business sector. Construction insurance addresses risks associated with ongoing infrastructure development projects.

Commercial lines encompass diverse specialized products including professional indemnity, directors and officers, cyber liability, and trade credit insurance. SME insurance represents a growing opportunity as small and medium enterprises recognize the importance of comprehensive risk management. Industry-specific solutions address unique risks in sectors such as healthcare, education, and technology.

Insurance companies benefit from the UAE’s stable regulatory environment, growing economy, and diverse customer base. Market opportunities exist across multiple segments with potential for sustainable growth and profitability. Regulatory support for innovation enables companies to develop new products and services while maintaining consumer protection standards.

Consumers gain access to comprehensive insurance solutions protecting against various risks while benefiting from competitive pricing and improved service quality. Digital platforms provide convenient policy management and claims processing capabilities. Regulatory oversight ensures fair treatment and transparent pricing across the market.

Brokers and agents leverage market growth opportunities to expand their client base and service offerings. Technology tools enhance their ability to provide comparative analysis and expert advice to customers. Professional development programs support skill enhancement and industry knowledge advancement.

Reinsurers benefit from the UAE’s position as a regional hub for risk distribution and capacity management. Diversified risk portfolios across life and non-life segments provide balanced exposure and stable returns. Regulatory framework supports international reinsurance operations and partnerships.

Government stakeholders achieve policy objectives including financial sector development, consumer protection, and economic diversification through a robust insurance market. Tax revenues from insurance operations contribute to government finances while employment generation supports economic development goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first strategies transform customer interactions and operational processes across the UAE insurance market. Mobile applications enable policy purchase, claims reporting, and customer service access, with digital adoption rates reaching 67% among younger demographics. Artificial intelligence applications in chatbots, underwriting, and claims processing improve efficiency and customer satisfaction.

Personalization trends drive product development and pricing strategies based on individual risk profiles and preferences. Data analytics enable insurers to offer customized coverage options and dynamic pricing models. Usage-based insurance products gain traction in motor insurance, while wellness programs integrate with health insurance offerings.

Sustainability focus influences product development and investment strategies across the insurance sector. Green insurance products support environmentally friendly practices and renewable energy projects. ESG considerations impact investment decisions and corporate governance practices among insurance companies.

Regulatory technology adoption streamlines compliance processes and reporting requirements. RegTech solutions automate regulatory reporting while ensuring accuracy and timeliness. Risk management systems integrate regulatory requirements with operational processes for enhanced compliance efficiency.

Customer experience enhancement becomes a key differentiator in the competitive landscape. Omnichannel strategies provide seamless interactions across digital and traditional touchpoints. Claims digitization reduces processing times and improves customer satisfaction through transparent and efficient settlement processes.

Regulatory modernization initiatives by the Insurance Authority introduce risk-based capital requirements and enhanced consumer protection measures. Solvency II alignment strengthens financial stability while promoting international best practices. Digital regulation frameworks support insurtech innovation while maintaining appropriate oversight and consumer protection.

Market consolidation activities include strategic mergers and acquisitions aimed at achieving scale economies and market expansion. Partnership agreements between local and international insurers leverage complementary strengths and market access capabilities. Bancassurance expansion creates new distribution channels and customer acquisition opportunities.

Technology investments accelerate across the industry with focus on digital platforms, data analytics, and automation capabilities. Cloud adoption enables scalable infrastructure and improved operational flexibility. Blockchain pilots explore applications in claims processing, policy administration, and fraud prevention.

Product innovation addresses emerging risks and customer needs through specialized coverage solutions. Cyber insurance products develop rapidly to address growing digital risks. Parametric insurance solutions offer innovative approaches to weather-related and business interruption risks. Microinsurance products target underserved market segments with affordable coverage options.

Talent development initiatives address skills gaps through training programs, professional certifications, and university partnerships. Digital skills enhancement programs prepare workforce for technology-driven market evolution. Leadership development programs build local expertise and reduce dependence on expatriate talent.

MarkWide Research recommends that insurance companies prioritize digital transformation initiatives to remain competitive in the evolving market landscape. Investment in technology infrastructure should focus on customer-facing applications, data analytics capabilities, and operational automation to achieve sustainable competitive advantages.

Product diversification strategies should address emerging risks and underserved market segments to drive growth beyond traditional insurance lines. Specialized coverage development for cyber risks, climate change impacts, and new economy sectors offers significant revenue potential. Takaful products expansion aligns with regional preferences and cultural considerations.

Distribution channel optimization should balance digital convenience with personalized service delivery. Omnichannel strategies enable customers to interact through their preferred channels while maintaining consistent service quality. Partnership development with fintech companies, healthcare providers, and automotive manufacturers creates new customer acquisition opportunities.

Talent acquisition and development programs should address critical skills gaps in digital technologies, data analytics, and specialized insurance expertise. Local talent development reduces operational costs while building sustainable competitive capabilities. Continuous learning programs ensure workforce adaptation to evolving market requirements.

Risk management enhancement through advanced analytics and predictive modeling improves underwriting accuracy and claims management efficiency. Data quality initiatives support better decision-making and regulatory compliance. Cybersecurity investments protect against increasing digital threats while maintaining customer trust and regulatory compliance.

Growth projections for the UAE life and non-life insurance market indicate sustained expansion driven by demographic trends, regulatory support, and economic diversification. Market maturation will likely shift focus from volume growth to value creation through improved customer experience and operational efficiency. Innovation acceleration through technology adoption will reshape traditional insurance business models.

Digital transformation will continue revolutionizing customer interactions, with artificial intelligence penetration expected to reach 75% across major insurers within five years. Blockchain implementation may transform claims processing and policy administration, while Internet of Things integration enables real-time risk monitoring and prevention.

Regulatory evolution will likely introduce additional consumer protection measures and market development initiatives. International standards adoption will facilitate cross-border operations and investment flows. Sustainability requirements may influence product development and investment strategies across the insurance sector.

Market consolidation trends will continue as companies seek scale advantages and operational efficiencies. Strategic partnerships between traditional insurers and insurtech companies will accelerate innovation and market development. Regional expansion opportunities will leverage UAE expertise in broader Middle East markets.

Customer expectations will drive continued service enhancement and product personalization initiatives. MWR analysis suggests that companies successfully adapting to digital-first customer preferences while maintaining service quality will achieve superior market positioning and financial performance in the evolving UAE insurance landscape.

The UAE life and non-life insurance market demonstrates remarkable resilience and growth potential, supported by strong regulatory frameworks, economic diversification, and technological innovation. Market dynamics reflect a mature yet evolving sector adapting to changing customer needs and emerging risks while maintaining financial stability and consumer protection standards.

Strategic opportunities abound for market participants willing to invest in digital transformation, product innovation, and customer experience enhancement. Competitive advantages will increasingly depend on technology adoption, operational efficiency, and ability to serve diverse customer segments effectively. Regulatory support for innovation creates favorable conditions for sustainable market development.

Future success in the UAE insurance market will require balanced approaches combining traditional insurance expertise with digital capabilities and customer-centric strategies. Market leaders will be those organizations successfully navigating technological disruption while maintaining strong risk management practices and regulatory compliance. The sector’s continued evolution promises exciting opportunities for stakeholders committed to excellence and innovation in serving the UAE’s dynamic insurance needs.

What is Life & Non-Life Insurance?

Life & Non-Life Insurance refers to the two main categories of insurance products. Life insurance provides financial protection to beneficiaries upon the policyholder’s death, while non-life insurance covers various risks such as property damage, liability, and health-related expenses.

What are the key players in the UAE Life & Non-Life Insurance Market?

Key players in the UAE Life & Non-Life Insurance Market include companies like Abu Dhabi National Insurance Company, Dubai Insurance Company, and Oman Insurance Company, among others.

What are the growth factors driving the UAE Life & Non-Life Insurance Market?

The growth of the UAE Life & Non-Life Insurance Market is driven by factors such as increasing awareness of insurance products, a growing population, and the expansion of the healthcare sector, which boosts demand for health insurance.

What challenges does the UAE Life & Non-Life Insurance Market face?

Challenges in the UAE Life & Non-Life Insurance Market include regulatory compliance issues, intense competition among insurers, and the need for digital transformation to meet changing consumer expectations.

What opportunities exist in the UAE Life & Non-Life Insurance Market?

Opportunities in the UAE Life & Non-Life Insurance Market include the potential for innovative insurance products tailored to specific demographics, the rise of insurtech solutions, and increasing demand for comprehensive coverage options.

What trends are shaping the UAE Life & Non-Life Insurance Market?

Trends in the UAE Life & Non-Life Insurance Market include the adoption of digital platforms for policy management, a focus on customer-centric services, and the integration of artificial intelligence to enhance underwriting processes.

UAE Life & Non-Life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Life Insurance, Health Insurance, Property Insurance, Liability Insurance |

| Customer Type | Individuals, Corporates, SMEs, Government |

| Distribution Channel | Direct Sales, Brokers, Agents, Online Platforms |

| Policy Duration | Term Life, Whole Life, Endowment, Renewable |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Life & Non-Life Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at