444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE hospital equipment suppliers market represents a dynamic and rapidly evolving sector within the broader healthcare infrastructure landscape of the United Arab Emirates. This market encompasses a comprehensive range of medical devices, diagnostic equipment, surgical instruments, and healthcare technology solutions that serve the nation’s expanding healthcare network. Market dynamics indicate robust growth driven by government healthcare initiatives, increasing medical tourism, and rising demand for advanced medical technologies across both public and private healthcare facilities.

Healthcare infrastructure development in the UAE has accelerated significantly, with the market experiencing substantial expansion as healthcare providers seek to modernize their facilities and enhance patient care capabilities. The sector benefits from strong government support through initiatives like the UAE Vision 2071 and various healthcare transformation programs that prioritize medical excellence and innovation. Growth projections suggest the market will continue expanding at a compound annual growth rate of 8.2% through the forecast period, reflecting the nation’s commitment to becoming a global healthcare hub.

Regional positioning places the UAE as a strategic gateway for hospital equipment suppliers serving the broader Middle East and North Africa region. The country’s advanced logistics infrastructure, favorable business environment, and growing healthcare sector create optimal conditions for equipment suppliers to establish regional operations and serve diverse market segments ranging from primary care clinics to specialized tertiary care facilities.

The UAE hospital equipment suppliers market refers to the comprehensive ecosystem of companies, distributors, and service providers that supply medical devices, diagnostic equipment, surgical instruments, and healthcare technology solutions to hospitals, clinics, and healthcare facilities throughout the United Arab Emirates. This market encompasses both domestic suppliers and international companies operating within the UAE’s healthcare supply chain.

Market scope includes various categories of medical equipment ranging from basic patient monitoring devices to sophisticated imaging systems, surgical robotics, and digital health solutions. The supplier network serves diverse healthcare segments including government hospitals, private healthcare facilities, specialty clinics, and ambulatory care centers. Supply chain dynamics involve complex relationships between manufacturers, authorized distributors, local representatives, and end-user healthcare facilities, creating a multi-tiered market structure that facilitates equipment procurement, installation, maintenance, and ongoing technical support services.

Market fundamentals demonstrate strong growth momentum in the UAE hospital equipment suppliers market, driven by substantial healthcare infrastructure investments, demographic changes, and evolving patient care requirements. The market benefits from favorable regulatory frameworks, government healthcare initiatives, and increasing private sector participation in healthcare delivery. Key growth drivers include rising healthcare expenditure, which has increased by 12.5% annually over recent years, and expanding medical tourism initiatives that require world-class medical equipment and facilities.

Competitive landscape features a mix of international medical device manufacturers, regional distributors, and specialized equipment suppliers competing across various market segments. The market structure accommodates both premium technology solutions for advanced healthcare facilities and cost-effective equipment options for primary care settings. Technology adoption trends favor digital health solutions, minimally invasive surgical equipment, and integrated healthcare systems that enhance operational efficiency and patient outcomes.

Strategic opportunities emerge from the UAE’s position as a regional healthcare hub, growing elderly population, and increasing prevalence of chronic diseases requiring specialized medical equipment. The market outlook remains positive with continued government support for healthcare sector development and private sector investments in medical facility expansion and modernization projects.

Market segmentation reveals diverse opportunities across multiple equipment categories and healthcare facility types. The following key insights highlight critical market dynamics:

Government healthcare initiatives serve as primary market drivers, with substantial public investment in healthcare infrastructure development and facility modernization programs. The UAE government’s commitment to achieving world-class healthcare standards drives continuous equipment upgrades and technology adoption across public healthcare facilities. Healthcare Vision 2071 and related strategic initiatives create long-term demand for advanced medical equipment and innovative healthcare solutions.

Demographic trends significantly influence market growth, particularly the expanding elderly population and increasing prevalence of lifestyle-related diseases requiring specialized medical equipment. The UAE’s growing population, combined with rising life expectancy, creates sustained demand for diagnostic equipment, chronic disease management devices, and geriatric care solutions. Medical tourism growth of 15.8% annually further drives demand for premium medical equipment as healthcare facilities compete to attract international patients.

Technology advancement in medical devices creates opportunities for suppliers offering innovative solutions that improve patient outcomes and operational efficiency. Healthcare facilities increasingly seek equipment that integrates with electronic health records, provides remote monitoring capabilities, and supports minimally invasive procedures. Digital transformation initiatives across the healthcare sector drive demand for connected medical devices and smart healthcare solutions.

Private sector expansion contributes significantly to market growth as private healthcare providers invest in facility expansion and equipment modernization to compete effectively in the growing healthcare market. Private hospitals and specialty clinics often prioritize premium equipment solutions that differentiate their service offerings and attract discerning patients seeking advanced medical care.

High capital costs associated with advanced medical equipment present significant barriers for smaller healthcare facilities and limit market penetration in certain segments. The substantial investment required for premium diagnostic imaging systems, surgical robotics, and specialized treatment equipment can strain healthcare facility budgets and delay procurement decisions. Financing challenges particularly affect private clinics and smaller hospitals that lack access to large-scale capital funding.

Regulatory complexity in medical device approval and registration processes can create delays and additional costs for equipment suppliers entering the UAE market. Compliance with UAE FDA requirements, quality certifications, and ongoing regulatory obligations requires significant resources and expertise. Import procedures and customs regulations add complexity to the supply chain and can impact equipment availability and pricing.

Technical expertise requirements for operating and maintaining sophisticated medical equipment create challenges for healthcare facilities, particularly in specialized areas requiring highly trained technicians and ongoing professional development. The shortage of qualified biomedical engineers and equipment specialists can limit adoption of advanced technologies and increase operational costs.

Market competition intensity among equipment suppliers creates pricing pressures and margin compression, particularly in commodity equipment categories. Established international suppliers with strong brand recognition and extensive service networks maintain competitive advantages that can be difficult for newer market entrants to overcome.

Digital health transformation presents substantial opportunities for suppliers offering connected medical devices, telemedicine solutions, and integrated healthcare platforms. The acceleration of digital adoption in healthcare creates demand for equipment that supports remote patient monitoring, artificial intelligence applications, and data analytics capabilities. Smart hospital initiatives drive requirements for IoT-enabled medical devices and integrated technology solutions.

Preventive healthcare focus creates opportunities for suppliers of screening equipment, diagnostic devices, and wellness monitoring solutions as healthcare providers emphasize early detection and preventive care strategies. The shift toward value-based healthcare models favors equipment that supports population health management and chronic disease prevention programs.

Medical tourism expansion offers significant growth potential for premium equipment suppliers as healthcare facilities invest in world-class technology to attract international patients. Specialty medical tourism segments such as cosmetic surgery, fertility treatment, and advanced cardiac care require specialized equipment that commands premium pricing and service contracts.

Public-private partnerships in healthcare infrastructure development create opportunities for equipment suppliers to participate in large-scale facility development projects. These partnerships often involve long-term service agreements and comprehensive equipment packages that provide stable revenue streams and market presence.

Regional expansion opportunities emerge from the UAE’s strategic position as a regional healthcare hub, enabling suppliers to serve broader Middle East and African markets from UAE-based operations. The country’s advanced logistics infrastructure and business-friendly environment support regional distribution strategies and market development initiatives.

Supply chain evolution reflects changing relationships between manufacturers, distributors, and healthcare facilities as the market matures and becomes more sophisticated. Traditional distribution models are adapting to include direct manufacturer relationships, specialized service providers, and technology integration partners. Value-based procurement approaches increasingly emphasize total cost of ownership, clinical outcomes, and operational efficiency rather than initial equipment costs alone.

Technology convergence drives market dynamics as medical devices increasingly incorporate digital capabilities, artificial intelligence, and connectivity features. This convergence creates opportunities for suppliers that can provide integrated solutions combining hardware, software, and services. Interoperability requirements influence purchasing decisions as healthcare facilities seek equipment that integrates seamlessly with existing systems and workflows.

Service model transformation shifts focus from equipment sales to comprehensive service partnerships that include maintenance, training, upgrades, and performance optimization. Healthcare facilities increasingly prefer suppliers that can provide ongoing support and ensure optimal equipment performance throughout the asset lifecycle. Outcome-based contracts are gaining traction, with 28% of major equipment purchases now including performance guarantees.

Market consolidation trends influence competitive dynamics as larger suppliers acquire specialized companies and expand their product portfolios and service capabilities. This consolidation creates both opportunities and challenges for smaller suppliers while potentially improving service delivery and technology integration for healthcare customers.

Primary research methodology encompasses comprehensive interviews with key stakeholders across the UAE hospital equipment suppliers market, including equipment manufacturers, distributors, healthcare facility procurement managers, and industry experts. Data collection involves structured questionnaires, in-depth interviews, and focus group discussions to gather qualitative insights and quantitative data on market trends, competitive dynamics, and growth projections.

Secondary research incorporates analysis of industry reports, government healthcare statistics, regulatory filings, and company financial statements to validate primary research findings and provide comprehensive market context. Sources include UAE Ministry of Health data, healthcare facility annual reports, equipment supplier company information, and industry association publications.

Market sizing methodology employs bottom-up and top-down approaches to estimate market segments and growth projections. Bottom-up analysis aggregates equipment procurement data from individual healthcare facilities, while top-down analysis utilizes healthcare expenditure statistics and equipment spending ratios to validate market estimates.

Data validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and statistical analysis to identify and resolve inconsistencies. Quality assurance measures include peer review of research findings and validation of key statistics through independent sources.

Dubai healthcare market represents the largest regional segment, accounting for 42% of total equipment procurement across the UAE. The emirate’s position as a medical tourism destination and commercial hub drives substantial investment in premium medical equipment and advanced healthcare technologies. Dubai’s private healthcare sector shows particularly strong growth in specialty equipment procurement for cosmetic surgery, fertility treatment, and advanced diagnostic services.

Abu Dhabi market dynamics reflect the capital’s focus on government healthcare initiatives and large-scale public hospital development projects. The emirate’s substantial healthcare infrastructure investments create opportunities for comprehensive equipment packages and long-term service contracts. Public sector procurement in Abu Dhabi emphasizes value-based purchasing and standardization across healthcare facilities.

Northern Emirates including Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively represent growing market opportunities as these regions expand their healthcare infrastructure and modernize existing facilities. These markets often favor cost-effective equipment solutions while maintaining quality standards appropriate for their patient populations and service requirements.

Cross-emirate coordination in healthcare planning creates opportunities for suppliers that can provide standardized solutions across multiple regions while accommodating local requirements and preferences. Regional healthcare networks and shared service initiatives influence equipment procurement strategies and create economies of scale for larger purchases.

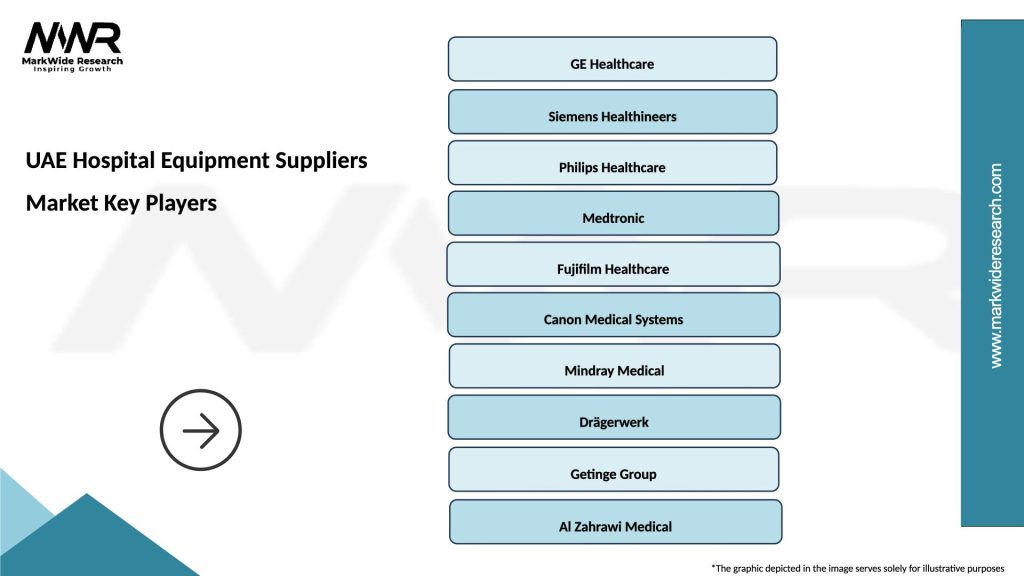

Market leadership is distributed among several categories of suppliers, each serving different market segments and customer requirements. The competitive landscape includes:

Competitive strategies vary among suppliers, with established international companies leveraging brand recognition and comprehensive service capabilities, while emerging suppliers compete on innovation, pricing, and specialized solutions. Local partnerships play crucial roles in market success, with many international suppliers establishing relationships with UAE-based distributors and service providers.

By Equipment Type:

By End User:

By Technology Level:

Diagnostic Imaging Equipment dominates the market with strong demand for MRI systems, CT scanners, and advanced ultrasound equipment. Healthcare facilities prioritize imaging technology that provides superior image quality, faster scan times, and enhanced patient comfort. AI-enhanced imaging solutions show particularly strong growth as facilities seek to improve diagnostic accuracy and workflow efficiency.

Patient Monitoring Systems experience robust growth driven by increasing patient acuity and emphasis on continuous monitoring capabilities. Remote monitoring solutions gain traction as healthcare providers seek to extend care beyond traditional facility boundaries. Wireless monitoring technology adoption reaches 73% of major hospitals, reflecting preferences for flexible and scalable monitoring solutions.

Surgical Equipment markets show strong demand for minimally invasive surgery systems, robotic surgical platforms, and advanced visualization technologies. Healthcare facilities invest in surgical equipment that reduces patient recovery times, improves surgical outcomes, and enhances surgeon capabilities. Robotic surgery adoption increases significantly among private hospitals seeking to differentiate their service offerings.

Laboratory Equipment procurement focuses on automated systems that improve testing efficiency, reduce turnaround times, and ensure accurate results. Point-of-care testing devices gain popularity for their ability to provide rapid results and improve patient care workflows. Molecular diagnostics equipment shows strong growth driven by personalized medicine initiatives and infectious disease testing requirements.

Healthcare Facilities benefit from access to advanced medical equipment that improves patient care quality, operational efficiency, and clinical outcomes. Modern equipment enables healthcare providers to offer comprehensive services, attract qualified medical professionals, and compete effectively in the growing healthcare market. Technology integration capabilities enhance workflow efficiency and support evidence-based medical practice.

Equipment Suppliers gain access to a growing market with strong government support and increasing healthcare investment. The UAE’s strategic location provides opportunities for regional expansion and serves as a gateway to broader Middle East and African markets. Long-term service contracts provide stable revenue streams and ongoing customer relationships.

Patients benefit from access to world-class medical technology that enables accurate diagnosis, effective treatment, and improved health outcomes. Advanced medical equipment supports minimally invasive procedures, reduced recovery times, and enhanced patient experience throughout the care continuum.

Healthcare Professionals gain access to sophisticated tools that enhance their clinical capabilities, improve diagnostic accuracy, and support evidence-based medical practice. Modern equipment often includes training and support programs that advance professional development and clinical expertise.

Government Stakeholders achieve healthcare system objectives through improved medical infrastructure, enhanced healthcare quality, and increased patient satisfaction. Advanced medical equipment supports public health initiatives and positions the UAE as a regional healthcare leader.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Integration emerges as a dominant trend with healthcare facilities increasingly seeking medical equipment that integrates with electronic health records, provides data analytics capabilities, and supports telemedicine applications. Connected medical devices adoption accelerates as healthcare providers recognize the value of real-time data and remote monitoring capabilities.

Artificial Intelligence Integration in medical equipment gains momentum with AI-enhanced diagnostic imaging, predictive analytics, and automated clinical decision support systems. Healthcare facilities invest in AI-capable equipment to improve diagnostic accuracy, reduce interpretation time, and enhance clinical outcomes. AI adoption rates in diagnostic imaging reach 45% of major healthcare facilities.

Minimally Invasive Technology continues to drive equipment procurement decisions as healthcare providers seek solutions that reduce patient trauma, shorten recovery times, and improve surgical outcomes. Robotic surgery systems, advanced laparoscopic equipment, and image-guided therapy solutions show strong growth across multiple medical specialties.

Point-of-Care Testing expansion reflects healthcare providers’ desire to deliver rapid diagnostic results and improve patient care workflows. Portable diagnostic equipment and bedside testing devices gain popularity for their ability to provide immediate results and support clinical decision-making at the point of care.

Sustainability Focus influences equipment procurement decisions as healthcare facilities increasingly consider environmental impact, energy efficiency, and sustainable design in their purchasing criteria. Equipment suppliers respond with eco-friendly solutions and comprehensive recycling programs.

Regulatory Updates include streamlined approval processes for certain medical device categories and enhanced post-market surveillance requirements. The UAE FDA continues to align its regulations with international standards while maintaining appropriate safety and efficacy requirements for medical equipment.

Technology Partnerships between international equipment manufacturers and UAE healthcare facilities create opportunities for clinical research, technology validation, and market development. These partnerships often include training programs, research collaboration, and technology transfer initiatives.

Healthcare Facility Expansions across the UAE create substantial equipment procurement opportunities as new hospitals, specialty clinics, and ambulatory care centers require comprehensive medical equipment packages. Major facility development projects often include long-term equipment service agreements and technology upgrade provisions.

Service Model Innovation includes outcome-based contracts, equipment-as-a-service offerings, and comprehensive maintenance agreements that shift focus from equipment sales to ongoing performance partnerships. MarkWide Research analysis indicates that service-based revenue models account for an increasing share of supplier revenues.

Digital Health Initiatives by healthcare providers drive demand for connected medical devices, telemedicine equipment, and integrated healthcare platforms. Government digital health strategies support technology adoption and create market opportunities for innovative equipment suppliers.

Market Entry Strategy recommendations for new suppliers include establishing local partnerships, obtaining necessary regulatory approvals, and developing comprehensive service capabilities before entering the competitive UAE market. Success requires understanding local healthcare needs, regulatory requirements, and customer preferences.

Technology Investment priorities should focus on digital health capabilities, AI integration, and connectivity features that align with healthcare facility modernization objectives. Suppliers should invest in solutions that demonstrate clear clinical and operational benefits while providing strong return on investment for healthcare customers.

Service Excellence becomes increasingly important as healthcare facilities seek suppliers that can provide comprehensive support throughout the equipment lifecycle. Recommendations include developing local service capabilities, training programs, and rapid response maintenance services that ensure optimal equipment performance.

Partnership Development with local distributors, service providers, and healthcare facilities creates sustainable competitive advantages and market presence. Strategic partnerships should focus on mutual value creation, knowledge sharing, and long-term relationship building.

Regulatory Compliance requires ongoing attention to UAE FDA requirements, quality standards, and post-market obligations. Suppliers should establish robust compliance programs and maintain current knowledge of regulatory changes and requirements.

Growth Trajectory remains positive with continued healthcare infrastructure development, increasing medical tourism, and expanding private healthcare sector driving sustained demand for medical equipment. Market expansion is expected to continue at a compound annual growth rate of 8.2% through the forecast period, supported by government healthcare initiatives and demographic trends.

Technology Evolution will continue to shape market dynamics with increasing emphasis on digital health solutions, artificial intelligence applications, and integrated healthcare platforms. Healthcare facilities will increasingly prioritize equipment that supports value-based care models and improves operational efficiency.

Market Maturation will likely result in increased consolidation among suppliers, more sophisticated procurement processes, and greater emphasis on total cost of ownership and clinical outcomes. MWR projections suggest that service-based revenue models will account for 40% of total supplier revenues within the next five years.

Regional Integration opportunities will expand as the UAE strengthens its position as a regional healthcare hub and medical equipment distribution center. Suppliers with strong UAE presence will be well-positioned to serve broader Middle East and African markets.

Innovation Focus will drive continued investment in research and development, clinical validation, and technology advancement. Healthcare facilities will increasingly seek equipment suppliers that can provide innovative solutions addressing emerging healthcare challenges and opportunities.

The UAE hospital equipment suppliers market presents substantial opportunities for growth and development within a dynamic and supportive healthcare environment. Strong government commitment to healthcare excellence, expanding medical tourism, and increasing private sector participation create favorable conditions for equipment suppliers across multiple market segments. The market’s strategic position as a regional healthcare hub provides additional opportunities for suppliers seeking to establish broader Middle East and African market presence.

Success factors in this market include understanding local healthcare needs, developing comprehensive service capabilities, maintaining regulatory compliance, and building strong partnerships with healthcare facilities and local service providers. Technology innovation, particularly in digital health and AI applications, will continue to drive market differentiation and competitive advantage.

Future prospects remain positive with continued healthcare infrastructure investment, demographic trends supporting healthcare demand growth, and ongoing technology advancement creating new market opportunities. Suppliers that can adapt to evolving healthcare needs, provide comprehensive solutions, and demonstrate clear value propositions will be well-positioned for long-term success in the UAE hospital equipment suppliers market.

What is Hospital Equipment?

Hospital equipment refers to the various tools, devices, and machinery used in healthcare settings to diagnose, monitor, and treat patients. This includes surgical instruments, diagnostic machines, and patient care equipment.

Who are the key players in the UAE Hospital Equipment Suppliers Market?

Key players in the UAE Hospital Equipment Suppliers Market include companies like Al Zahrawi Medical, Gulf Medical, and Medtronic, which provide a range of medical devices and equipment for hospitals and clinics, among others.

What are the main drivers of growth in the UAE Hospital Equipment Suppliers Market?

The main drivers of growth in the UAE Hospital Equipment Suppliers Market include the increasing demand for advanced medical technologies, the expansion of healthcare facilities, and a growing emphasis on patient safety and quality of care.

What challenges does the UAE Hospital Equipment Suppliers Market face?

Challenges in the UAE Hospital Equipment Suppliers Market include stringent regulatory requirements, high competition among suppliers, and the need for continuous innovation to meet evolving healthcare needs.

What opportunities exist in the UAE Hospital Equipment Suppliers Market?

Opportunities in the UAE Hospital Equipment Suppliers Market include the rising trend of telemedicine, the integration of artificial intelligence in medical devices, and the growing focus on preventive healthcare solutions.

What trends are shaping the UAE Hospital Equipment Suppliers Market?

Trends shaping the UAE Hospital Equipment Suppliers Market include the increasing adoption of minimally invasive surgical equipment, advancements in imaging technologies, and the shift towards personalized medicine.

UAE Hospital Equipment Suppliers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Diagnostic Equipment, Surgical Instruments, Patient Monitors, Imaging Systems |

| Technology | Telemedicine, Robotics, Wearable Devices, 3D Printing |

| End User | Private Hospitals, Public Clinics, Rehabilitation Centers, Diagnostic Labs |

| Application | Emergency Care, Surgical Procedures, Patient Monitoring, Rehabilitation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Hospital Equipment Suppliers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at