444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE frozen food market represents one of the most dynamic and rapidly expanding segments within the nation’s food and beverage industry. Market dynamics indicate substantial growth driven by changing consumer lifestyles, increasing urbanization, and rising demand for convenient meal solutions. The market encompasses a diverse range of products including frozen vegetables, fruits, ready-to-eat meals, seafood, poultry, and bakery items that cater to the multicultural population of the United Arab Emirates.

Consumer preferences have shifted significantly toward frozen food products due to their extended shelf life, nutritional retention, and convenience factor. The market benefits from a robust cold chain infrastructure, advanced retail networks, and growing awareness about food safety standards. Growth projections suggest the market will experience a compound annual growth rate of 8.2% over the forecast period, driven by increasing expatriate population and evolving dietary habits.

Regional distribution shows Dubai and Abu Dhabi accounting for approximately 75% of market consumption, reflecting higher purchasing power and urbanization levels in these emirates. The market landscape includes both international brands and local manufacturers, creating a competitive environment that benefits consumers through product innovation and competitive pricing strategies.

The UAE frozen food market refers to the comprehensive ecosystem of frozen food products, distribution channels, and consumer segments operating within the United Arab Emirates. This market encompasses all food items that undergo freezing processes for preservation, extending from basic frozen vegetables and fruits to sophisticated ready-to-eat meals and gourmet frozen products designed for the diverse demographic composition of the UAE.

Market definition includes products maintained at temperatures below -18°C throughout the supply chain, ensuring food safety, nutritional preservation, and extended shelf life. The sector covers retail frozen foods sold through hypermarkets, supermarkets, and convenience stores, as well as food service frozen products supplied to restaurants, hotels, and catering establishments across the seven emirates.

Scope encompasses domestic consumption patterns, import dynamics, cold storage infrastructure, and regulatory frameworks governing frozen food safety standards. The market reflects the UAE’s position as a regional hub for food distribution and its role in serving diverse consumer preferences ranging from traditional Middle Eastern frozen products to international cuisine options.

Strategic analysis reveals the UAE frozen food market as a high-growth sector characterized by strong consumer adoption and expanding product portfolios. Key market drivers include rapid urbanization, increasing female workforce participation, and growing demand for convenient meal solutions among busy professionals and families. The market demonstrates resilience through diverse product offerings and robust distribution networks.

Market penetration has reached significant levels with approximately 68% of UAE households regularly purchasing frozen food products. This adoption rate reflects changing lifestyle patterns and increased acceptance of frozen foods as viable alternatives to fresh products. Premium segments show particularly strong growth, with organic and health-focused frozen products gaining substantial market traction.

Competitive landscape features a mix of global food giants and regional players, creating dynamic market conditions that drive innovation and product development. Distribution channels have evolved to include online platforms alongside traditional retail outlets, expanding market accessibility and consumer convenience. The market outlook remains positive with sustained growth expected across all major product categories.

Consumer behavior analysis reveals several critical insights shaping the UAE frozen food market. Primary market insights include:

Primary growth drivers propelling the UAE frozen food market include demographic shifts, lifestyle changes, and infrastructure development. Urbanization trends continue accelerating across all emirates, creating larger consumer bases concentrated in metropolitan areas with higher disposable incomes and modern shopping preferences.

Workforce dynamics significantly impact market growth, with increasing numbers of working professionals and dual-income households seeking convenient meal solutions. Time constraints associated with busy lifestyles drive demand for quick-preparation frozen foods that maintain quality and nutritional value. The growing expatriate population brings diverse culinary preferences, expanding market opportunities for international frozen food brands.

Infrastructure development supports market expansion through improved cold chain logistics, modern retail formats, and enhanced storage facilities. Government initiatives promoting food security and reducing food waste align with frozen food benefits, creating favorable regulatory environments. Technological advancements in freezing techniques and packaging innovations enhance product quality and consumer appeal, driving market adoption rates higher.

Market challenges facing the UAE frozen food sector include cost considerations, cultural preferences, and infrastructure limitations. High energy costs associated with maintaining cold chain requirements throughout distribution networks impact pricing strategies and profit margins for market participants. These operational expenses often translate to higher consumer prices compared to fresh alternatives.

Cultural factors present ongoing challenges as traditional preferences for fresh ingredients remain strong among certain demographic segments. Perception barriers regarding frozen food quality and nutritional value persist despite scientific evidence supporting frozen food benefits. Some consumers associate frozen products with processed foods, creating resistance to adoption in health-conscious segments.

Supply chain vulnerabilities include dependence on imported products and potential disruptions affecting product availability. Regulatory compliance requirements for food safety standards and labeling regulations create operational complexities for market participants. Storage limitations in smaller retail outlets and consumer homes can restrict product variety and purchasing patterns, particularly affecting bulk buying behaviors.

Emerging opportunities in the UAE frozen food market span product innovation, market expansion, and technological integration. Health-focused segments present significant growth potential as consumers increasingly seek nutritious frozen options including organic vegetables, lean proteins, and functional foods with added vitamins and minerals.

E-commerce expansion offers substantial opportunities for market growth through online grocery platforms and direct-to-consumer delivery services. Digital transformation enables better inventory management, personalized marketing, and enhanced customer experiences. Subscription models for frozen food delivery create recurring revenue streams while providing consumer convenience.

Product diversification opportunities include ethnic cuisine expansion, premium gourmet options, and specialized dietary products for diabetic, gluten-free, and vegan consumers. Foodservice sector growth in hospitality and catering industries creates B2B market expansion opportunities. Sustainability initiatives focusing on eco-friendly packaging and reduced food waste align with consumer environmental consciousness, creating competitive advantages for forward-thinking brands.

Market forces shaping the UAE frozen food landscape include supply-demand interactions, competitive pressures, and regulatory influences. Demand patterns show seasonal variations with higher consumption during summer months when fresh produce quality may decline and convenience becomes more valued. Supply chain efficiency improvements have reduced costs and improved product availability across diverse retail channels.

Competitive dynamics intensify as international brands compete with local manufacturers for market share. Price competition remains significant, particularly in commodity frozen products, while premium segments allow for differentiation through quality and innovation. Brand positioning strategies focus on convenience, quality, and cultural relevance to capture diverse consumer segments.

Technology integration transforms market operations through improved freezing techniques, smart packaging solutions, and data-driven inventory management. Consumer engagement evolves through digital marketing channels and social media platforms, enabling targeted communication and brand building. Regulatory evolution continues shaping market standards for food safety, labeling requirements, and import regulations affecting product availability and pricing structures.

Comprehensive research approach employed multiple data collection methods to ensure accurate market analysis and reliable insights. Primary research included structured interviews with industry stakeholders, consumer surveys across all seven emirates, and focus group discussions with diverse demographic segments representing the UAE’s multicultural population.

Secondary research encompassed analysis of government statistics, trade association reports, and industry publications to validate primary findings and establish market context. Data triangulation methods ensured information accuracy through cross-verification of multiple sources and statistical validation techniques.

Market sizing methodology utilized bottom-up and top-down approaches, analyzing consumption patterns, import statistics, and retail sales data. Forecasting models incorporated economic indicators, demographic trends, and historical growth patterns to project future market development. Quality assurance protocols included peer review processes and expert validation to ensure research reliability and actionable insights for market participants.

Geographic distribution across the UAE reveals distinct consumption patterns and market characteristics in different emirates. Dubai emirate leads market consumption with approximately 45% market share, driven by its cosmopolitan population, extensive retail infrastructure, and high disposable income levels. The emirate’s position as a commercial hub attracts diverse international brands and supports premium product segments.

Abu Dhabi emirate accounts for roughly 30% of market consumption, reflecting its status as the capital and significant expatriate population. Government sector employment provides stable income levels supporting consistent frozen food purchases. The emirate shows strong demand for family-sized frozen products and bulk purchasing behaviors.

Northern emirates including Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively represent 25% of market share. These regions demonstrate growing adoption rates as retail infrastructure expands and consumer awareness increases. Price-sensitive segments show stronger preference for value-oriented frozen products, while premium segments remain concentrated in Dubai and Abu Dhabi markets.

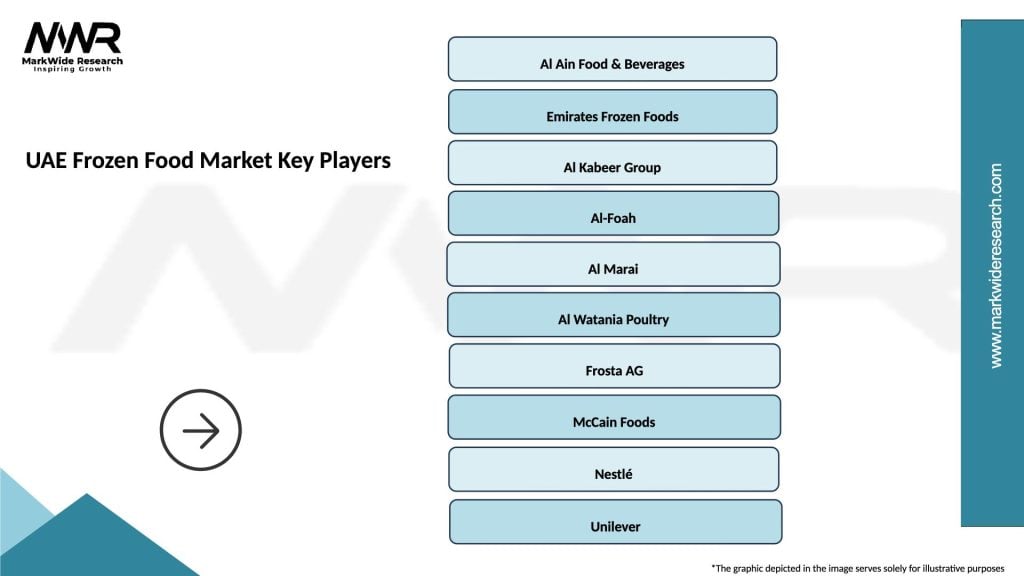

Market competition features a diverse mix of international food corporations, regional manufacturers, and local distributors creating dynamic competitive conditions. Leading market participants include:

Competitive strategies focus on product innovation, distribution expansion, and brand building through targeted marketing campaigns. Market consolidation trends show larger players acquiring regional brands to expand product portfolios and market reach.

Product segmentation reveals diverse categories serving different consumer needs and preferences across the UAE market. By product type, the market divides into several key segments:

Distribution channel segmentation shows hypermarkets and supermarkets commanding the largest share, followed by convenience stores and emerging online platforms. Consumer segmentation includes expatriate families, young professionals, and local Emirati households with distinct purchasing patterns and preferences.

Frozen vegetables category demonstrates strong growth driven by health consciousness and cooking convenience. Premium organic segments show particularly robust expansion as consumers prioritize nutritional quality and environmental sustainability. Mixed vegetable products gain popularity for their versatility and time-saving benefits in meal preparation.

Ready-to-eat meals segment experiences rapid growth with innovation rates exceeding 15% annually as manufacturers introduce new flavors and cuisines. Ethnic cuisine options perform exceptionally well, reflecting the UAE’s multicultural population and diverse taste preferences. Health-focused meals including low-sodium, high-protein, and portion-controlled options capture growing market segments.

Frozen seafood category benefits from the UAE’s coastal location and strong seafood consumption traditions. Premium imported varieties command significant market share among affluent consumers, while value-oriented products serve price-conscious segments. Halal-certified options remain essential for market success, ensuring compliance with religious dietary requirements across consumer segments.

Manufacturers benefit from the UAE’s strategic location as a regional distribution hub, enabling efficient market access across the Middle East and North Africa region. Economies of scale opportunities arise through serving diverse consumer segments and expanding product portfolios to meet varied preferences and dietary requirements.

Retailers gain advantages through frozen food categories’ higher profit margins compared to fresh products and reduced inventory waste due to extended shelf life. Consumer loyalty develops through consistent product availability and quality, creating stable revenue streams and repeat purchase behaviors.

Consumers receive benefits including meal preparation convenience, nutritional value retention, and cost savings through reduced food waste. Product variety enables access to international cuisines and seasonal products year-round, enhancing dietary diversity and culinary experiences. Food safety assurance through regulated cold chain management provides confidence in product quality and health standards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness trends dominate market evolution as consumers increasingly seek nutritious frozen options without artificial preservatives or excessive sodium content. Clean label products gain significant traction, with manufacturers responding through reformulated recipes and transparent ingredient listings. Organic frozen foods experience robust growth rates as environmental consciousness influences purchasing decisions.

Convenience innovation drives product development through single-serve portions, microwave-ready packaging, and quick-cooking solutions. Smart packaging technologies including QR codes for nutritional information and cooking instructions enhance consumer experiences. Meal kit concepts adapted for frozen formats provide complete meal solutions with minimal preparation requirements.

Sustainability initiatives influence market trends through eco-friendly packaging materials, reduced plastic usage, and carbon footprint reduction programs. Local sourcing efforts where possible reduce transportation costs and appeal to environmentally conscious consumers. Digital engagement through social media marketing and influencer partnerships builds brand awareness among younger demographic segments, according to MarkWide Research analysis.

Recent market developments include major capacity expansions by leading manufacturers to meet growing demand across the region. Strategic partnerships between international brands and local distributors enhance market penetration and consumer accessibility. Technology investments in automated cold storage facilities improve efficiency and reduce operational costs.

Product launches focus on health-conscious segments with new organic lines, plant-based alternatives, and functional foods enriched with vitamins and minerals. Acquisition activities consolidate market positions as larger players acquire regional brands to expand product portfolios and distribution networks.

Regulatory developments include updated food safety standards and labeling requirements that enhance consumer protection and market transparency. Infrastructure projects expanding cold storage capacity and improving logistics networks support continued market growth. Digital transformation initiatives integrate IoT technologies for better inventory management and supply chain optimization across the industry.

Strategic recommendations for market participants include diversifying product portfolios to capture emerging health and wellness segments while maintaining competitive positioning in traditional categories. Investment priorities should focus on cold chain infrastructure, digital marketing capabilities, and sustainable packaging solutions to meet evolving consumer expectations.

Market entry strategies for new participants should emphasize partnership approaches with established distributors and retailers to leverage existing networks and consumer relationships. Product differentiation through unique flavors, cultural authenticity, and premium quality positioning can command higher margins in competitive market conditions.

Operational excellence requires continuous improvement in supply chain efficiency, inventory management, and customer service delivery. Brand building investments in digital marketing and consumer education about frozen food benefits can expand market acceptance and drive category growth. MWR analysis suggests focusing on omnichannel distribution strategies to capture both traditional retail and emerging e-commerce opportunities.

Market projections indicate sustained growth momentum with expanding consumer acceptance and continued product innovation driving category development. Demographic trends including population growth and urbanization will support long-term demand expansion across all emirates. Technology adoption in manufacturing and distribution will enhance efficiency and product quality.

Growth opportunities remain substantial in health-focused segments, ethnic cuisine varieties, and premium product categories. E-commerce penetration is expected to reach 25% of total sales within the forecast period, driven by convenience preferences and digital shopping adoption. Sustainability initiatives will become increasingly important for competitive differentiation and consumer appeal.

Market evolution will likely include greater product customization, improved nutritional profiles, and enhanced packaging innovations. Regional expansion opportunities exist as infrastructure development reaches smaller emirates and consumer awareness increases. Investment flows into the sector will support capacity expansion and technology upgrades, positioning the UAE frozen food market for continued robust growth and development.

The UAE frozen food market represents a dynamic and rapidly expanding sector with substantial growth potential driven by demographic trends, lifestyle changes, and infrastructure development. Market fundamentals remain strong with increasing consumer acceptance, diverse product offerings, and robust distribution networks supporting continued expansion across all emirates.

Strategic opportunities abound for market participants willing to invest in product innovation, digital transformation, and sustainable practices. Consumer trends toward health consciousness, convenience, and cultural diversity create multiple avenues for growth and differentiation in competitive market conditions.

Future success will depend on adaptability to changing consumer preferences, operational excellence in cold chain management, and strategic positioning in emerging segments. The market outlook remains highly positive with sustained growth expected across all major product categories and distribution channels, making the UAE frozen food market an attractive opportunity for both established players and new entrants seeking to capitalize on the region’s dynamic food sector evolution.

What is Frozen Food?

Frozen food refers to food items that have been preserved by freezing, allowing for longer shelf life and convenience. This category includes a variety of products such as vegetables, meats, and ready-to-eat meals.

What are the key players in the UAE Frozen Food Market?

Key players in the UAE Frozen Food Market include Al Ain Farms, Americana Group, and Gulf Food Industries, among others. These companies are known for their diverse product offerings and strong distribution networks.

What are the growth factors driving the UAE Frozen Food Market?

The growth of the UAE Frozen Food Market is driven by increasing consumer demand for convenience foods, busy lifestyles, and the rising popularity of online grocery shopping. Additionally, the expansion of retail chains is enhancing product availability.

What challenges does the UAE Frozen Food Market face?

The UAE Frozen Food Market faces challenges such as fluctuating raw material prices and competition from fresh food alternatives. Additionally, maintaining the cold chain logistics is crucial for product quality and safety.

What opportunities exist in the UAE Frozen Food Market?

Opportunities in the UAE Frozen Food Market include the growing trend of health-conscious eating, which is leading to an increase in demand for frozen fruits and vegetables. Furthermore, innovations in packaging and preservation techniques are expected to enhance product appeal.

What trends are shaping the UAE Frozen Food Market?

Trends in the UAE Frozen Food Market include the rise of plant-based frozen products and the increasing popularity of ethnic frozen meals. Additionally, sustainability practices in sourcing and packaging are becoming more prominent among consumers.

UAE Frozen Food Market

| Segmentation Details | Description |

|---|---|

| Product Type | Frozen Vegetables, Frozen Fruits, Frozen Meat, Frozen Seafood |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Hypermarkets |

| End User | Households, Restaurants, Catering Services, Food Manufacturers |

| Packaging Type | Bulk Packaging, Retail Packaging, Vacuum Sealed, Tray Packs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Frozen Food Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at