444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE energy bar market represents a rapidly expanding segment within the broader health and wellness industry, driven by increasing consumer awareness about nutritional supplementation and active lifestyle choices. Market dynamics in the United Arab Emirates reflect a sophisticated consumer base that prioritizes convenience, quality, and functional benefits in their dietary choices. The market encompasses various product categories including protein bars, meal replacement bars, sports nutrition bars, and organic energy bars, each catering to specific consumer needs and preferences.

Consumer behavior patterns indicate a significant shift toward health-conscious consumption, with the market experiencing robust growth at a compound annual growth rate (CAGR) of 8.2% over the forecast period. Demographic trends show that millennials and Generation Z consumers constitute approximately 68% of the total market demand, driving innovation in flavors, ingredients, and packaging formats. The market benefits from the UAE’s strategic position as a regional hub for food distribution and its diverse expatriate population that brings varied dietary preferences and consumption patterns.

Retail infrastructure supporting the energy bar market includes hypermarkets, supermarkets, convenience stores, online platforms, and specialized health food retailers. Distribution channels have evolved significantly, with e-commerce platforms capturing approximately 23% of total market share and showing accelerated growth post-pandemic. The market landscape reflects strong competition among international brands and emerging local manufacturers who are increasingly focusing on region-specific flavors and ingredients.

The UAE energy bar market refers to the commercial ecosystem encompassing the production, distribution, and consumption of portable nutrition bars designed to provide sustained energy, essential nutrients, and convenience for active consumers across the United Arab Emirates. Energy bars are formulated food products that typically combine carbohydrates, proteins, fats, vitamins, and minerals in convenient bar formats, serving various nutritional purposes from meal replacement to pre-workout fuel and post-exercise recovery.

Market definition includes various subcategories such as protein-enriched bars, fiber-rich bars, low-sugar alternatives, organic formulations, and specialized bars targeting specific dietary requirements including gluten-free, vegan, and keto-friendly options. Consumer applications span across fitness enthusiasts, busy professionals, students, travelers, and health-conscious individuals seeking convenient nutrition solutions that align with their lifestyle demands and dietary preferences.

Product characteristics within this market emphasize portability, shelf stability, nutritional density, and taste appeal, with manufacturers increasingly focusing on clean label ingredients, sustainable packaging, and functional benefits beyond basic energy provision. The market encompasses both imported international brands and locally manufactured products that cater to regional taste preferences and cultural dietary considerations.

Strategic market analysis reveals that the UAE energy bar market is positioned for sustained expansion, driven by evolving consumer lifestyles, increasing health awareness, and growing participation in fitness activities. Key market drivers include rising disposable income, urbanization trends, and the proliferation of fitness centers and wellness programs across the emirates. The market demonstrates resilience and adaptability, with manufacturers responding to consumer demands for transparency, sustainability, and functional nutrition.

Competitive landscape features a mix of established international brands and emerging local players, with market leaders focusing on product innovation, strategic partnerships, and expanded distribution networks. Consumer preferences show increasing demand for natural ingredients, with approximately 42% of consumers prioritizing organic and non-GMO formulations. The market benefits from supportive government initiatives promoting healthy lifestyles and the UAE’s vision to become a global wellness destination.

Growth trajectory indicates strong momentum across all major product segments, with protein bars leading market share and plant-based alternatives showing the highest growth rates. Market penetration varies across emirates, with Dubai and Abu Dhabi representing the largest consumption centers, while emerging markets in other emirates present significant expansion opportunities for manufacturers and retailers.

Consumer demographic analysis reveals distinct purchasing patterns and preferences that shape market dynamics across the UAE energy bar sector. Primary insights include the following critical market characteristics:

Market intelligence indicates that consumer education about nutritional benefits and ingredient transparency significantly influences purchasing decisions, with informed consumers willing to pay premium prices for products that meet their specific health and wellness goals.

Primary growth drivers propelling the UAE energy bar market forward encompass demographic, economic, and lifestyle factors that create sustained demand for convenient nutrition solutions. Health consciousness trends represent the most significant driver, with increasing consumer awareness about the importance of balanced nutrition and active lifestyles driving market expansion across all demographic segments.

Urbanization and lifestyle changes contribute significantly to market growth, as busy professionals and students seek convenient nutrition options that fit their demanding schedules. Fitness industry growth in the UAE, with gym memberships increasing by approximately 15% annually, creates substantial demand for sports nutrition products including energy bars. The proliferation of fitness centers, yoga studios, and outdoor activity groups generates consistent consumer base for energy and protein bars.

Economic prosperity and rising disposable income levels enable consumers to invest in premium nutrition products, supporting market premiumization trends. Expatriate population diversity brings varied dietary preferences and consumption habits, creating opportunities for specialized products catering to different cultural and dietary requirements. Government initiatives promoting healthy lifestyles and wellness tourism further support market growth by creating awareness and encouraging healthy consumption patterns.

Technological advancement in food processing and packaging enables manufacturers to develop innovative products with improved taste, texture, and nutritional profiles, attracting new consumers and encouraging repeat purchases among existing customers.

Significant challenges facing the UAE energy bar market include high competition from alternative snack options, price sensitivity among certain consumer segments, and regulatory complexities surrounding health claims and ingredient approvals. Cost considerations present barriers for price-conscious consumers, particularly in the mid-income segment, where energy bars compete with more affordable snack alternatives.

Cultural dietary restrictions and preferences may limit market penetration for certain product formulations, requiring manufacturers to invest in specialized product development and certification processes. Shelf life limitations and storage requirements for natural and organic formulations create logistical challenges in the hot climate conditions prevalent in the UAE, potentially affecting product quality and consumer satisfaction.

Market saturation in premium segments creates intense competition among established brands, making it challenging for new entrants to gain market share without significant marketing investments. Consumer skepticism regarding health claims and ingredient quality requires substantial investment in consumer education and transparency initiatives to build trust and credibility.

Supply chain complexities for imported ingredients and finished products can result in price volatility and availability issues, particularly during global disruptions or seasonal demand fluctuations. Regulatory compliance requirements for health and nutrition claims necessitate ongoing investment in research, documentation, and approval processes that may delay product launches and increase operational costs.

Emerging opportunities in the UAE energy bar market present significant potential for growth and innovation, driven by evolving consumer preferences and untapped market segments. Plant-based nutrition trends offer substantial growth potential, with vegan and vegetarian energy bars showing increasing consumer acceptance and market penetration rates of approximately 18% annually.

Personalized nutrition represents a frontier opportunity, with consumers increasingly seeking products tailored to their specific dietary needs, fitness goals, and health conditions. Functional ingredients including adaptogens, probiotics, and superfoods present opportunities for product differentiation and premium positioning in the market.

E-commerce expansion offers significant growth potential, particularly in reaching consumers in remote areas and providing convenient subscription-based delivery services. Corporate wellness programs present B2B opportunities for bulk sales and customized product development for workplace nutrition initiatives.

Regional expansion within the GCC market using the UAE as a hub provides opportunities for manufacturers to leverage established distribution networks and brand recognition. Sustainable packaging innovations align with growing environmental consciousness among consumers, creating opportunities for brands to differentiate through eco-friendly initiatives.

Partnership opportunities with fitness centers, health clubs, and wellness centers can create dedicated distribution channels and build brand loyalty among target consumer segments.

Complex market dynamics shape the UAE energy bar market through the interplay of supply-side factors, demand-side influences, and external environmental conditions. Supply chain dynamics involve multiple stakeholders including ingredient suppliers, manufacturers, distributors, and retailers, each contributing to the overall market ecosystem and influencing pricing, availability, and product quality.

Demand fluctuations correlate with seasonal patterns, fitness trends, and economic conditions, with peak demand typically occurring during fitness-focused months and New Year resolution periods. Competitive dynamics intensify as new brands enter the market, driving innovation in product formulations, packaging, and marketing strategies while potentially compressing profit margins across the industry.

Regulatory dynamics continue evolving as health authorities refine guidelines for nutritional claims, ingredient approvals, and labeling requirements, requiring manufacturers to maintain compliance while pursuing innovation. Consumer behavior dynamics shift in response to health trends, social media influence, and peer recommendations, creating opportunities for brands that can effectively engage with their target audiences.

Technology dynamics influence manufacturing processes, distribution efficiency, and consumer engagement, with digital platforms enabling direct-to-consumer sales and personalized marketing approaches. Economic dynamics including currency fluctuations, import costs, and local economic conditions affect pricing strategies and market accessibility for different consumer segments.

Comprehensive research methodology employed in analyzing the UAE energy bar market combines quantitative and qualitative research approaches to provide accurate and actionable market insights. Primary research includes consumer surveys, retailer interviews, manufacturer consultations, and expert opinion gathering to understand market dynamics from multiple stakeholder perspectives.

Data collection methods encompass online surveys targeting energy bar consumers across different emirates, in-depth interviews with retail managers and distributors, and focus group discussions with target demographic segments. Secondary research involves analysis of industry reports, government statistics, trade publications, and company financial statements to validate primary findings and identify market trends.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing consumption patterns, retail sales data, and import/export statistics to establish accurate market parameters. Competitive analysis includes brand performance evaluation, pricing analysis, distribution network assessment, and marketing strategy review to understand competitive positioning and market share dynamics.

Quality assurance measures include data triangulation, expert validation, and cross-referencing multiple sources to ensure research accuracy and reliability. MarkWide Research methodology incorporates real-time market monitoring and continuous data updates to maintain current and relevant market intelligence for stakeholders and decision-makers.

Geographic market distribution across the UAE reveals distinct consumption patterns and growth opportunities in different emirates, with Dubai and Abu Dhabi leading market development and consumption volumes. Dubai market represents approximately 45% of total consumption, driven by its diverse expatriate population, extensive retail infrastructure, and high concentration of fitness facilities and health-conscious consumers.

Abu Dhabi region accounts for roughly 28% of market share, characterized by higher disposable income levels and growing wellness tourism initiatives that support premium product segments. Sharjah and Northern Emirates collectively represent 27% of the market, showing strong growth potential as retail infrastructure expands and consumer awareness increases.

Consumer preferences vary by region, with Dubai consumers showing higher acceptance of international brands and innovative flavors, while Abu Dhabi consumers demonstrate preference for premium and organic formulations. Distribution network density correlates with population centers, with urban areas showing higher product availability and variety compared to suburban and rural locations.

Growth rates differ across regions, with emerging areas in Sharjah and Ajman showing higher percentage growth as market penetration increases, while mature markets in Dubai and Abu Dhabi focus on premiumization and product innovation. Retail channel preferences also vary regionally, with Dubai showing higher e-commerce adoption while other emirates maintain stronger preference for traditional retail channels.

Market competition in the UAE energy bar sector features a diverse mix of international brands, regional players, and emerging local manufacturers, each competing for market share through differentiated strategies and value propositions. Leading market participants include:

Competitive strategies include product innovation, strategic partnerships with retailers and fitness centers, digital marketing initiatives, and expansion of distribution networks. Market leaders maintain competitive advantages through brand recognition, product quality, and established consumer loyalty, while newer entrants compete through competitive pricing, unique formulations, and targeted marketing approaches.

Innovation focus areas include clean label ingredients, sustainable packaging, functional benefits, and personalized nutrition solutions that address specific consumer needs and preferences in the UAE market.

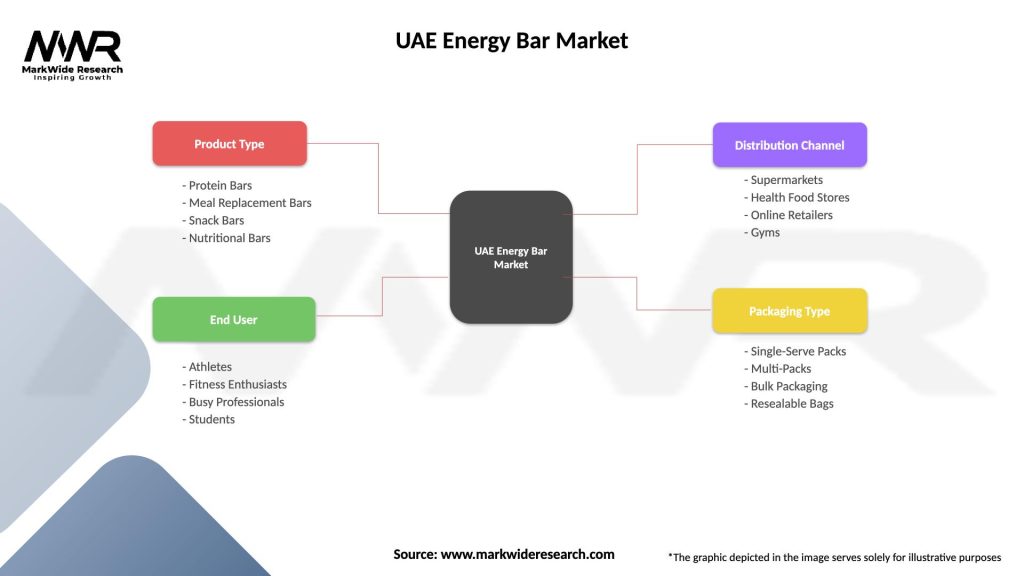

Market segmentation analysis reveals distinct categories within the UAE energy bar market, each serving specific consumer needs and demonstrating unique growth characteristics and competitive dynamics.

By Product Type:

By Ingredient Type:

By Distribution Channel:

Protein bar category dominates the UAE energy bar market, driven by increasing fitness participation and muscle-building trends among consumers. Consumer preferences in this category favor high protein content, low sugar formulations, and appealing taste profiles that support fitness goals without compromising on palatability.

Meal replacement bars show strong growth potential as busy lifestyles drive demand for convenient nutrition solutions that provide balanced macronutrients and essential vitamins and minerals. Target consumers include working professionals, students, and individuals following structured diet plans who require portable meal alternatives.

Organic and natural bars represent the fastest-growing category, with consumers increasingly prioritizing clean ingredients, sustainable sourcing, and transparent labeling. Premium positioning in this category allows manufacturers to command higher margins while building brand loyalty among health-conscious consumers.

Sports nutrition bars cater specifically to athletes and serious fitness enthusiasts, featuring specialized formulations for pre-workout energy, post-workout recovery, and endurance support. Partnership opportunities with gyms, sports clubs, and fitness influencers drive category growth and brand awareness.

Specialty dietary bars including gluten-free, vegan, and keto-friendly options address specific dietary requirements and lifestyle choices, representing niche but profitable market segments with dedicated consumer bases and premium pricing potential.

Manufacturers benefit from the UAE energy bar market through access to affluent consumer base, strategic geographic location for regional distribution, and supportive business environment that encourages innovation and investment. Operational advantages include efficient logistics infrastructure, skilled workforce availability, and proximity to key ingredient suppliers in the region.

Retailers gain from high-margin product categories, consistent consumer demand, and opportunities for private label development that enhance profitability and customer loyalty. Category management benefits include cross-selling opportunities with complementary health and wellness products, seasonal demand patterns that support inventory planning, and premium positioning potential.

Consumers benefit from increasing product variety, competitive pricing due to market competition, and improved product quality driven by manufacturer innovation and regulatory oversight. Convenience benefits include widespread product availability, online purchasing options, and portable nutrition solutions that support active lifestyles.

Healthcare professionals can leverage energy bars as tools for patient education about convenient nutrition options, portion control, and balanced macronutrient intake. Fitness professionals benefit from product partnerships, client education opportunities, and additional revenue streams through product recommendations and endorsements.

Investors find attractive opportunities in a growing market with strong fundamentals, diverse consumer base, and potential for regional expansion using the UAE as a strategic hub for GCC market penetration.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement represents the most significant trend shaping the UAE energy bar market, with consumers increasingly demanding transparency in ingredient sourcing, processing methods, and nutritional content. Manufacturers respond by simplifying ingredient lists, eliminating artificial additives, and highlighting natural and organic components in their formulations and marketing communications.

Personalized nutrition emerges as a key trend, with consumers seeking products tailored to their specific dietary needs, fitness goals, and health conditions. Technology integration enables brands to offer customized recommendations based on individual preferences, activity levels, and nutritional requirements.

Sustainability focus influences consumer purchasing decisions, driving demand for eco-friendly packaging, ethically sourced ingredients, and environmentally responsible manufacturing practices. Brand differentiation increasingly relies on sustainability credentials and corporate social responsibility initiatives that resonate with environmentally conscious consumers.

Functional ingredients gain prominence as consumers seek additional health benefits beyond basic nutrition, including probiotics for digestive health, adaptogens for stress management, and superfoods for antioxidant support. Premium positioning of functional bars allows manufacturers to command higher prices while meeting evolving consumer expectations for health optimization.

Digital engagement transforms how brands connect with consumers, utilizing social media, influencer partnerships, and direct-to-consumer platforms to build brand awareness and loyalty among target demographics.

Recent industry developments in the UAE energy bar market reflect dynamic growth and innovation across multiple dimensions of the business ecosystem. Product innovation accelerates with manufacturers introducing novel flavors inspired by regional preferences, including date and nut combinations, Middle Eastern spices, and traditional dessert flavors that appeal to local and expatriate consumers.

Strategic partnerships between international brands and local distributors enhance market penetration and consumer accessibility, while collaborations with fitness centers and health clubs create dedicated distribution channels and brand visibility opportunities. Manufacturing investments include establishment of local production facilities by international brands seeking to reduce costs and improve supply chain efficiency.

Regulatory developments include updated guidelines for health claims, nutritional labeling requirements, and import standards that ensure product quality and consumer safety while maintaining market accessibility for compliant manufacturers. Technology adoption encompasses advanced manufacturing processes, sustainable packaging innovations, and digital marketing platforms that enhance operational efficiency and consumer engagement.

Market consolidation activities include acquisitions of local brands by international companies seeking to expand their regional presence and product portfolios. MarkWide Research analysis indicates that these developments collectively contribute to market maturation and increased competition that ultimately benefits consumers through improved product quality and competitive pricing.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing key challenges in the competitive UAE energy bar market environment. Product development should prioritize clean label formulations, functional ingredients, and regional flavor preferences that differentiate brands and build consumer loyalty.

Distribution strategy optimization should emphasize omnichannel approaches that combine traditional retail presence with robust e-commerce capabilities and direct-to-consumer engagement. Partnership development with fitness centers, health clubs, and wellness programs can create dedicated sales channels and enhance brand credibility among target consumers.

Marketing investments should focus on digital platforms, social media engagement, and influencer partnerships that effectively reach and engage with younger demographic segments who represent the primary growth opportunity. Sustainability initiatives including eco-friendly packaging and ethical sourcing practices can provide competitive differentiation and appeal to environmentally conscious consumers.

Regional expansion strategies should leverage UAE market success as a platform for GCC market penetration, utilizing established distribution networks and brand recognition to accelerate growth in neighboring markets. Innovation focus should address emerging trends including personalized nutrition, plant-based formulations, and functional ingredients that provide additional health benefits beyond basic energy provision.

Long-term market prospects for the UAE energy bar market remain highly positive, supported by favorable demographic trends, increasing health consciousness, and continued economic development that sustains consumer purchasing power. Growth projections indicate sustained expansion at a CAGR of 8.2% over the next five years, driven by market penetration increases and premiumization trends across all major product categories.

Innovation trajectory will likely focus on personalized nutrition solutions, functional ingredients, and sustainable packaging that address evolving consumer preferences and environmental concerns. Technology integration will enhance manufacturing efficiency, supply chain optimization, and consumer engagement through digital platforms and data-driven marketing approaches.

Market maturation will bring increased competition and consolidation, with successful brands distinguished by their ability to innovate, build consumer loyalty, and adapt to changing market conditions. Regional expansion opportunities will enable successful UAE market participants to leverage their experience and brand recognition for growth in other GCC markets.

Consumer evolution will continue driving demand for transparency, sustainability, and functional benefits that support health and wellness goals. MWR projections suggest that brands investing in these areas will capture disproportionate market share and achieve sustainable competitive advantages in the evolving market landscape.

The UAE energy bar market represents a dynamic and rapidly growing segment within the broader health and wellness industry, characterized by strong consumer demand, favorable demographic trends, and significant opportunities for innovation and expansion. Market fundamentals remain robust, supported by affluent consumer base, excellent retail infrastructure, and government initiatives promoting healthy lifestyles and wellness tourism.

Competitive landscape continues evolving with new entrants, product innovations, and strategic partnerships that enhance market accessibility and consumer choice. Growth drivers including health consciousness, urbanization, and fitness industry expansion provide sustainable momentum for continued market development across all major product categories and distribution channels.

Future success in the UAE energy bar market will depend on manufacturers’ ability to innovate, adapt to changing consumer preferences, and build strong brand loyalty through quality, transparency, and value delivery. Strategic positioning that emphasizes clean ingredients, functional benefits, and sustainability credentials will likely determine market leadership in the evolving competitive environment, making the UAE energy bar market an attractive opportunity for both established players and new entrants seeking growth in the dynamic Middle Eastern market.

What is Energy Bar?

Energy bars are convenient snack options designed to provide a quick source of energy, often made from a blend of carbohydrates, proteins, and fats. They are popular among athletes and health-conscious consumers for their portability and nutritional benefits.

What are the key players in the UAE Energy Bar Market?

Key players in the UAE Energy Bar Market include companies like Quest Nutrition, Clif Bar & Company, and RXBAR, which offer a variety of energy bar products catering to different consumer preferences, among others.

What are the growth factors driving the UAE Energy Bar Market?

The UAE Energy Bar Market is driven by increasing health awareness, a growing trend towards fitness and active lifestyles, and the rising demand for convenient snack options among busy consumers.

What challenges does the UAE Energy Bar Market face?

Challenges in the UAE Energy Bar Market include intense competition among brands, fluctuating ingredient prices, and consumer skepticism regarding the nutritional claims of energy bars.

What future opportunities exist in the UAE Energy Bar Market?

Future opportunities in the UAE Energy Bar Market include the introduction of innovative flavors, the expansion of plant-based and organic options, and the potential for partnerships with fitness centers and health food stores.

What trends are shaping the UAE Energy Bar Market?

Trends in the UAE Energy Bar Market include a shift towards clean-label products, increased focus on sustainability in packaging, and the incorporation of superfoods and functional ingredients to enhance nutritional value.

UAE Energy Bar Market

| Segmentation Details | Description |

|---|---|

| Product Type | Protein Bars, Meal Replacement Bars, Snack Bars, Nutritional Bars |

| End User | Athletes, Fitness Enthusiasts, Busy Professionals, Students |

| Distribution Channel | Supermarkets, Health Food Stores, Online Retailers, Gyms |

| Packaging Type | Single-Serve Packs, Multi-Packs, Bulk Packaging, Resealable Bags |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Energy Bar Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at