444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE electric bike market represents a rapidly expanding segment within the country’s sustainable transportation ecosystem, driven by increasing environmental consciousness and government initiatives promoting green mobility solutions. Electric bicycles have gained significant traction across the Emirates, particularly in urban centers like Dubai and Abu Dhabi, where residents and tourists alike are embracing eco-friendly transportation alternatives. The market encompasses various categories including pedal-assist e-bikes, throttle-controlled models, and cargo electric bikes designed for commercial applications.

Market dynamics indicate substantial growth potential, with the sector experiencing a 12.5% annual growth rate as consumers increasingly prioritize sustainable mobility options. The integration of advanced battery technologies, smart connectivity features, and improved charging infrastructure has positioned the UAE as a key market for electric bike adoption in the Middle East region. Government support through various sustainability initiatives and infrastructure development projects continues to create favorable conditions for market expansion.

Consumer preferences have evolved significantly, with buyers seeking high-performance electric bikes that offer extended range capabilities, advanced safety features, and seamless integration with urban transportation networks. The market serves diverse user segments including daily commuters, recreational cyclists, delivery services, and tourism operators, each driving demand for specialized electric bike solutions tailored to their specific requirements.

The UAE electric bike market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, sales, and servicing of battery-powered bicycles within the United Arab Emirates. This market includes various stakeholders such as manufacturers, importers, retailers, service providers, and end-users who collectively contribute to the growth and development of electric mobility solutions in the region.

Electric bikes, also known as e-bikes or power-assisted bicycles, are two-wheeled vehicles equipped with electric motors that provide assistance to riders through pedaling or throttle control mechanisms. These innovative transportation solutions combine traditional cycling benefits with modern electric propulsion technology, offering users enhanced mobility options while reducing environmental impact and promoting sustainable urban transportation practices.

The market encompasses multiple product categories, distribution channels, and service offerings that cater to diverse consumer needs and preferences across the UAE’s dynamic urban landscape. Market participants include international manufacturers, local distributors, specialized retailers, and emerging technology companies focused on developing next-generation electric mobility solutions for the region’s unique climate and infrastructure conditions.

Strategic analysis reveals that the UAE electric bike market is positioned for sustained growth, driven by convergent factors including government sustainability initiatives, increasing urbanization, and evolving consumer mobility preferences. The market demonstrates strong potential across multiple segments, with particular strength in urban commuting applications and recreational usage patterns that align with the country’s tourism and lifestyle sectors.

Key performance indicators show impressive adoption rates, with electric bike sales experiencing a 18.3% increase in urban areas as consumers seek alternatives to traditional transportation methods. The market benefits from supportive regulatory frameworks, expanding charging infrastructure, and growing awareness of environmental sustainability issues among UAE residents and visitors.

Competitive landscape analysis indicates a diverse mix of international brands and emerging local players, each contributing unique value propositions to serve different market segments. Premium brands focus on high-performance models with advanced features, while value-oriented manufacturers target price-sensitive consumers seeking reliable basic transportation solutions.

Future projections suggest continued market expansion supported by technological advancements, infrastructure development, and increasing integration with smart city initiatives across the Emirates. The market is expected to benefit from ongoing investments in sustainable transportation infrastructure and growing consumer acceptance of electric mobility solutions.

Market intelligence reveals several critical insights that define the UAE electric bike landscape and its growth trajectory. These insights provide valuable understanding of consumer behavior, technological trends, and market dynamics that influence purchasing decisions and industry development.

Environmental consciousness serves as a primary driver for electric bike adoption in the UAE, as consumers and organizations increasingly prioritize sustainable transportation solutions that reduce carbon emissions and support national environmental goals. The government’s commitment to achieving net-zero emissions by 2050 has created strong momentum for clean mobility alternatives, positioning electric bikes as attractive options for environmentally conscious consumers.

Government initiatives play a crucial role in market development through supportive policies, infrastructure investments, and promotional campaigns that encourage sustainable transportation adoption. Various Emirates have launched programs to promote cycling culture, develop dedicated bike lanes, and integrate electric bikes into public transportation networks, creating favorable conditions for market growth.

Urban congestion challenges drive demand for alternative transportation solutions, particularly in densely populated areas where traditional vehicles face increasing traffic delays and parking limitations. Electric bikes offer practical solutions for navigating urban environments efficiently while avoiding common transportation bottlenecks that affect daily commuting experiences.

Health and wellness trends contribute to market growth as consumers seek active lifestyle options that combine physical exercise with convenient transportation. Electric bikes provide an ideal balance between physical activity and assisted mobility, appealing to health-conscious individuals who want to incorporate more movement into their daily routines without excessive physical strain.

Technological advancements in battery technology, motor efficiency, and smart connectivity features enhance the appeal and functionality of electric bikes, making them more attractive to tech-savvy consumers who value innovation and advanced features in their transportation choices.

High initial costs present a significant barrier to electric bike adoption, particularly for price-sensitive consumers who may find premium models financially challenging despite long-term operational savings. The substantial upfront investment required for quality electric bikes can deter potential buyers who are accustomed to lower-cost traditional bicycles or alternative transportation options.

Climate challenges in the UAE, including extreme heat during summer months, create usage limitations that may discourage year-round electric bike adoption. High temperatures can affect battery performance, rider comfort, and overall user experience, potentially limiting market growth during peak summer periods when outdoor activities are less favorable.

Infrastructure limitations in certain areas, including insufficient charging stations, limited bike lanes, and inadequate storage facilities, can hinder widespread electric bike adoption. While infrastructure development is progressing, gaps in coverage may create inconvenience for users and limit the practical appeal of electric bikes in some locations.

Regulatory uncertainties regarding electric bike classifications, usage regulations, and safety requirements may create confusion among consumers and retailers. Unclear or evolving regulations can impact market confidence and complicate decision-making processes for both buyers and sellers in the electric bike ecosystem.

Maintenance concerns related to specialized components, battery replacement costs, and service availability may deter some consumers who prefer simpler, lower-maintenance transportation options. The technical complexity of electric bikes compared to traditional bicycles can create apprehension about long-term ownership costs and service requirements.

Smart city integration presents substantial opportunities for electric bike market expansion as UAE cities continue developing intelligent transportation systems and connected infrastructure. The integration of electric bikes with smart city platforms, mobile applications, and IoT networks can create seamless user experiences and unlock new service models that enhance market appeal and functionality.

Tourism sector growth offers significant potential for electric bike market development, particularly as the UAE continues positioning itself as a global tourism destination. Hotels, resorts, and tour operators can leverage electric bikes to offer unique experiences, sustainable transportation options, and enhanced guest services that differentiate their offerings in competitive hospitality markets.

Corporate sustainability programs create opportunities for bulk sales and fleet applications as companies seek to reduce their environmental footprint and offer sustainable transportation benefits to employees. Corporate adoption can drive substantial volume growth while establishing electric bikes as mainstream business transportation solutions.

Delivery and logistics applications represent expanding opportunities as e-commerce growth drives demand for efficient last-mile delivery solutions. Electric bikes offer cost-effective, environmentally friendly alternatives for urban delivery services, particularly for time-sensitive and short-distance applications that benefit from traffic-avoiding capabilities.

Technology partnerships with automotive companies, tech firms, and mobility service providers can create innovative solutions and expand market reach through collaborative product development and integrated service offerings that leverage complementary expertise and resources.

Supply chain evolution is reshaping the UAE electric bike market as manufacturers adapt to changing demand patterns, component availability, and logistics requirements. The market has experienced supply chain adjustments that have influenced product availability, pricing strategies, and inventory management approaches across the distribution network.

Consumer behavior shifts demonstrate increasing sophistication in electric bike purchasing decisions, with buyers conducting more thorough research, comparing features, and seeking comprehensive after-sales support. This evolution has prompted retailers to enhance their service offerings and provide more detailed product information to meet elevated customer expectations.

Competitive intensity has increased as more brands enter the market, driving innovation, improving value propositions, and expanding product variety. This competitive pressure benefits consumers through better products, competitive pricing, and enhanced service levels while challenging market participants to differentiate their offerings effectively.

Seasonal demand patterns influence market dynamics, with peak sales periods typically occurring during cooler months when outdoor activities are more comfortable. Understanding these patterns helps stakeholders optimize inventory management, marketing campaigns, and service capacity to align with natural demand fluctuations.

Regulatory development continues evolving as authorities work to establish comprehensive frameworks for electric bike usage, safety standards, and infrastructure requirements. These regulatory changes create both opportunities and challenges for market participants who must adapt to new requirements while advocating for favorable policy development.

Comprehensive market analysis was conducted using multiple research approaches to ensure accurate and reliable insights into the UAE electric bike market. The methodology combined primary research through industry interviews, consumer surveys, and stakeholder consultations with secondary research utilizing industry reports, government data, and market intelligence sources.

Primary research activities included structured interviews with key market participants including manufacturers, distributors, retailers, and service providers to gather firsthand insights into market conditions, challenges, and opportunities. Consumer surveys were conducted across different Emirates to understand purchasing behavior, preferences, and satisfaction levels with existing electric bike products and services.

Secondary research involved analysis of industry publications, government statistics, trade association data, and regulatory documents to establish market context and validate primary research findings. This approach ensured comprehensive coverage of market factors and provided historical perspective on market development trends.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews to clarify findings, and applying statistical analysis techniques to ensure data accuracy and reliability. The research methodology emphasized objective analysis while accounting for regional market characteristics and cultural factors that influence electric bike adoption in the UAE.

Market segmentation analysis utilized demographic, geographic, and behavioral criteria to identify distinct consumer groups and market opportunities. This segmentation approach provided detailed insights into different market segments and their specific needs, preferences, and growth potential.

Dubai market leadership is evident in electric bike adoption rates, with the emirate accounting for approximately 45% of total market activity due to its advanced infrastructure, diverse population, and strong tourism sector. Dubai’s commitment to sustainable transportation and smart city initiatives has created favorable conditions for electric bike growth, supported by expanding cycling infrastructure and promotional programs.

Abu Dhabi’s strategic focus on sustainability and environmental initiatives has positioned the emirate as a significant market for electric bikes, particularly in government and corporate fleet applications. The capital’s emphasis on reducing carbon emissions and promoting clean transportation alternatives has driven institutional adoption and created demonstration effects that influence consumer behavior.

Sharjah and Northern Emirates represent emerging opportunities with growing interest in sustainable transportation solutions, though adoption rates remain lower than in Dubai and Abu Dhabi. These regions show potential for market expansion as infrastructure development progresses and consumer awareness increases through targeted marketing and education initiatives.

Regional preferences vary across Emirates, with Dubai consumers favoring premium models with advanced features, while other regions show stronger demand for value-oriented options that provide reliable basic transportation. Understanding these regional differences is crucial for manufacturers and retailers developing targeted marketing strategies and product portfolios.

Infrastructure development varies significantly across regions, with Dubai and Abu Dhabi leading in cycling lane development, charging station deployment, and integration with public transportation systems. This infrastructure disparity influences adoption patterns and creates opportunities for coordinated development initiatives that could accelerate market growth in underserved areas.

Market leadership is distributed among several key players who have established strong positions through different competitive strategies and market approaches. The competitive environment includes international brands, regional distributors, and emerging local players who collectively serve diverse market segments with varying value propositions.

Competitive strategies vary significantly, with premium brands emphasizing product quality, advanced features, and comprehensive service support, while value-oriented competitors focus on competitive pricing, accessibility, and basic functionality that meets essential transportation needs.

Product-based segmentation reveals distinct categories that serve different consumer needs and market applications. Each segment demonstrates unique characteristics in terms of pricing, features, target customers, and growth potential within the UAE market context.

By Product Type:

By Battery Type:

By Application:

Urban commuting category dominates market demand with approximately 60% market share, driven by practical transportation needs and increasing traffic congestion in major cities. Commuter-focused electric bikes typically feature comfortable riding positions, integrated lighting systems, and sufficient battery range for daily travel requirements. This segment shows strong growth potential as more professionals seek alternatives to car-based commuting.

Recreational cycling segment demonstrates robust growth as consumers increasingly prioritize active lifestyle choices and outdoor recreation activities. This category benefits from tourism sector growth and increasing interest in fitness-oriented transportation options that combine exercise with practical mobility. Weekend usage patterns and seasonal demand fluctuations characterize this segment’s market behavior.

Commercial applications represent the fastest-growing category, with delivery services and logistics companies recognizing the operational benefits of electric bikes for urban distribution. This segment shows strong potential for fleet sales and customized solutions that address specific business requirements such as cargo capacity, durability, and cost-effectiveness.

Premium segment attracts affluent consumers seeking high-performance electric bikes with advanced features, superior build quality, and comprehensive service support. This category commands higher profit margins and demonstrates strong brand loyalty, though it represents a smaller volume compared to mainstream market segments.

Entry-level segment serves price-sensitive consumers and first-time electric bike buyers who prioritize affordability and basic functionality. This category plays a crucial role in market expansion by making electric bikes accessible to broader consumer groups and creating upgrade pathways for future purchases.

Manufacturers benefit from expanding market opportunities, diversified revenue streams, and the ability to leverage technological innovations to create competitive advantages. The growing market provides platforms for product development, brand building, and market share expansion through strategic positioning and customer-focused innovation initiatives.

Retailers and distributors gain access to high-growth market segments with attractive profit margins and opportunities for service-based revenue generation. The electric bike market offers retailers chances to differentiate their offerings, build customer relationships through specialized services, and develop expertise in emerging mobility technologies.

Consumers receive enhanced mobility options that combine environmental sustainability with practical transportation benefits. Electric bikes provide cost-effective alternatives to traditional transportation methods while offering health benefits, convenience, and reduced environmental impact that align with modern lifestyle preferences and values.

Government stakeholders achieve sustainability goals, reduced traffic congestion, and improved air quality through electric bike adoption. The market supports national environmental objectives while creating economic opportunities and promoting innovation in clean transportation technologies.

Tourism operators can enhance guest experiences through sustainable transportation options that provide unique ways to explore destinations while supporting environmental responsibility initiatives. Electric bike integration creates differentiation opportunities and appeals to environmentally conscious travelers.

Corporate users benefit from sustainable transportation solutions that support corporate social responsibility goals while providing practical employee benefits and potential cost savings compared to traditional fleet vehicles for appropriate applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration represents a dominant trend as manufacturers incorporate IoT capabilities, GPS tracking, mobile app connectivity, and advanced battery management systems into electric bike designs. These smart features enhance user experience, provide valuable data insights, and create opportunities for service-based business models that extend beyond traditional product sales.

Subscription and sharing models are emerging as alternative ownership approaches that make electric bikes more accessible while reducing individual ownership costs. These models appeal to consumers who prefer flexible access to transportation options without long-term commitments or maintenance responsibilities.

Customization and personalization trends show consumers increasingly seeking electric bikes tailored to their specific needs, preferences, and usage patterns. Manufacturers are responding with modular designs, customizable features, and personalized service offerings that create unique value propositions for different market segments.

Sustainability focus extends beyond basic electric propulsion to encompass entire product lifecycles, including sustainable materials, recyclable components, and environmentally responsible manufacturing processes. This comprehensive sustainability approach appeals to environmentally conscious consumers and supports corporate responsibility initiatives.

Integration with public transportation creates seamless multi-modal transportation experiences that combine electric bikes with buses, metros, and other public transit options. This integration trend supports urban mobility strategies and enhances the practical appeal of electric bikes for comprehensive transportation solutions.

Performance enhancement continues driving product development with focus on extended battery range, faster charging capabilities, improved motor efficiency, and enhanced durability for demanding usage conditions. These performance improvements address key consumer concerns and expand electric bike applicability across different use cases.

Infrastructure expansion initiatives across the UAE have significantly improved conditions for electric bike adoption, with major cities investing in dedicated cycling lanes, charging stations, and bike-friendly urban design elements. These infrastructure developments create more favorable environments for electric bike usage and demonstrate government commitment to sustainable transportation solutions.

Partnership agreements between electric bike manufacturers and local distributors have strengthened market presence and improved customer service capabilities. These partnerships combine international expertise with local market knowledge to create more effective go-to-market strategies and customer support systems.

Technology collaborations with automotive companies and tech firms have accelerated innovation in electric bike systems, particularly in areas such as battery technology, motor efficiency, and smart connectivity features. These collaborations leverage complementary expertise to develop more advanced and competitive products.

Regulatory framework development has provided clearer guidelines for electric bike usage, safety standards, and infrastructure requirements. These regulatory developments create more predictable operating environments for market participants while ensuring consumer safety and market stability.

Corporate adoption programs by major employers have demonstrated the viability of electric bikes for employee transportation and corporate sustainability initiatives. These programs create visibility for electric bike benefits and influence broader market acceptance through demonstration effects.

Tourism sector integration has expanded through partnerships between electric bike providers and hotels, tour operators, and destination management companies. These integrations create new distribution channels and demonstrate electric bike value propositions in recreational and tourism applications.

Market entry strategies should focus on understanding regional preferences and developing targeted approaches for different Emirates, as consumer needs and infrastructure conditions vary significantly across the UAE. MarkWide Research analysis indicates that successful market participants adapt their strategies to local conditions while maintaining consistent brand positioning and quality standards.

Product portfolio optimization requires balancing premium offerings with accessible entry-level options to serve diverse market segments effectively. Companies should consider developing region-specific models that address climate challenges, infrastructure limitations, and cultural preferences while maintaining competitive pricing strategies.

Service network development represents a critical success factor, as consumers increasingly value comprehensive after-sales support, maintenance services, and technical assistance. Establishing robust service capabilities can create competitive advantages and improve customer satisfaction levels that drive repeat purchases and referrals.

Partnership strategies with local businesses, government entities, and tourism operators can accelerate market penetration and create sustainable competitive advantages. Strategic partnerships provide access to distribution channels, customer bases, and market insights that would be difficult to develop independently.

Technology investment in smart features, connectivity capabilities, and performance enhancements should align with consumer preferences and market trends. Companies should prioritize innovations that provide tangible user benefits while considering cost implications and market acceptance factors.

Marketing approaches should emphasize education, demonstration, and experience-based promotion to overcome consumer unfamiliarity and address misconceptions about electric bike capabilities. Effective marketing strategies combine digital channels with experiential marketing to build awareness and drive trial among target audiences.

Long-term growth prospects for the UAE electric bike market remain highly positive, supported by sustained government commitment to sustainability, continued urbanization, and evolving consumer transportation preferences. The market is expected to experience continued expansion with growth rates projected at 15.2% annually over the next five years as adoption barriers decrease and market conditions improve.

Technology evolution will continue driving market development through improvements in battery technology, motor efficiency, and smart connectivity features that enhance user experience and expand application possibilities. Emerging technologies such as artificial intelligence, advanced materials, and integrated mobility platforms will create new opportunities for product differentiation and market growth.

Infrastructure development is expected to accelerate as smart city initiatives progress and sustainable transportation becomes increasingly prioritized in urban planning. Expanded cycling infrastructure, charging networks, and integration with public transportation systems will create more favorable conditions for electric bike adoption across all market segments.

Market maturation will likely result in increased competition, improved product quality, and more sophisticated consumer demands that drive continuous innovation and service enhancement. This maturation process will benefit consumers through better products and services while creating opportunities for market leaders to establish sustainable competitive advantages.

Regional expansion beyond current market centers presents significant growth opportunities as infrastructure development and consumer awareness spread to underserved areas. This expansion will require adapted strategies that address local conditions while maintaining product quality and service standards.

Integration opportunities with broader mobility ecosystems, smart city platforms, and sustainable transportation networks will create new value propositions and business models that extend beyond traditional product sales to encompass comprehensive mobility solutions.

The UAE electric bike market represents a dynamic and rapidly evolving sector with substantial growth potential driven by convergent factors including government sustainability initiatives, technological advancement, and changing consumer preferences toward environmentally responsible transportation solutions. Market analysis reveals strong fundamentals supporting continued expansion, with particular strength in urban commuting applications and growing opportunities in tourism and commercial segments.

Strategic positioning within this market requires understanding of regional variations, consumer preferences, and infrastructure development patterns that influence adoption rates and purchasing decisions. Successful market participants demonstrate adaptability to local conditions while maintaining product quality and service excellence that build customer loyalty and market reputation.

Future success in the UAE electric bike market will depend on continued innovation, strategic partnerships, and comprehensive service offerings that address evolving consumer needs and market conditions. The market offers significant opportunities for companies that can effectively combine technological capabilities with market understanding and customer-focused strategies that create sustainable competitive advantages in this growing sector.

What is Electric Bike?

Electric bikes, or e-bikes, are bicycles equipped with an electric motor that assists with pedaling. They are designed for various applications, including commuting, recreational riding, and delivery services.

What are the key players in the UAE Electric Bike Market?

Key players in the UAE Electric Bike Market include companies like Dubai Electric Transport, E-Bike UAE, and Cycle Hub, among others. These companies are involved in manufacturing, distributing, and promoting electric bikes across the region.

What are the growth factors driving the UAE Electric Bike Market?

The growth of the UAE Electric Bike Market is driven by increasing urbanization, rising fuel prices, and a growing emphasis on sustainable transportation solutions. Additionally, government initiatives promoting eco-friendly mobility contribute to market expansion.

What challenges does the UAE Electric Bike Market face?

The UAE Electric Bike Market faces challenges such as limited charging infrastructure and high initial costs for consumers. Additionally, regulatory hurdles and safety concerns can hinder widespread adoption.

What opportunities exist in the UAE Electric Bike Market?

Opportunities in the UAE Electric Bike Market include the potential for growth in tourism-related e-bike rentals and the development of smart city initiatives that integrate e-bikes into public transport systems. The increasing focus on health and fitness also presents a favorable environment for e-bike adoption.

What trends are shaping the UAE Electric Bike Market?

Trends in the UAE Electric Bike Market include advancements in battery technology, the rise of shared mobility services, and increasing consumer interest in eco-friendly transportation options. Additionally, the integration of smart features in e-bikes is becoming more prevalent.

UAE Electric Bike Market

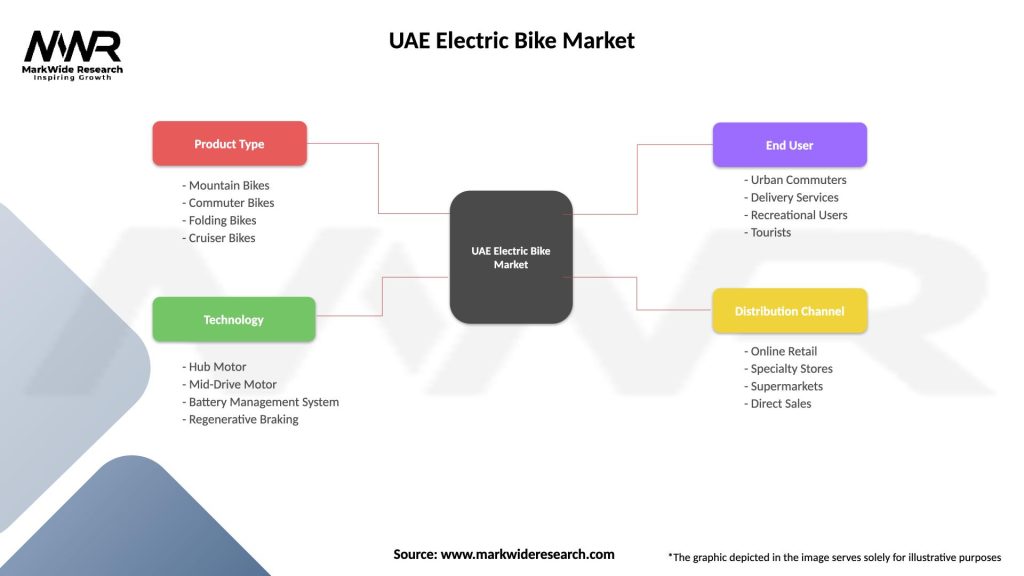

| Segmentation Details | Description |

|---|---|

| Product Type | Mountain Bikes, Commuter Bikes, Folding Bikes, Cruiser Bikes |

| Technology | Hub Motor, Mid-Drive Motor, Battery Management System, Regenerative Braking |

| End User | Urban Commuters, Delivery Services, Recreational Users, Tourists |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Electric Bike Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at