444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE edible meat market represents a dynamic and rapidly evolving sector within the nation’s food industry, characterized by diverse consumer preferences and increasing demand for high-quality protein sources. Market dynamics indicate substantial growth potential driven by the country’s expanding population, rising disposable income, and evolving dietary habits. The market encompasses various meat categories including beef, chicken, lamb, goat, and seafood, with each segment experiencing distinct growth patterns and consumer adoption rates.

Consumer preferences in the UAE reflect a unique blend of traditional Middle Eastern dietary customs and international culinary influences. The market demonstrates strong demand for halal-certified products, premium quality cuts, and organic meat options. Growth trajectories show the market expanding at a robust CAGR of 6.2%, supported by increasing urbanization and changing lifestyle patterns across the Emirates.

Supply chain infrastructure has evolved significantly to meet growing demand, with enhanced cold storage facilities, improved distribution networks, and advanced processing capabilities. The market benefits from strategic geographic positioning, serving as a regional hub for meat trade and distribution throughout the Middle East and North Africa region.

The UAE edible meat market refers to the comprehensive ecosystem encompassing the production, processing, distribution, and retail of various meat products intended for human consumption within the United Arab Emirates. This market includes domestically produced meat, imported products, and value-added processed meat items that meet local regulatory standards and consumer preferences.

Market scope extends beyond traditional fresh meat to include frozen products, processed meats, ready-to-cook items, and specialty preparations catering to diverse cultural and dietary requirements. The definition encompasses both conventional and organic meat products, with particular emphasis on halal certification requirements that govern the majority of meat consumption in the region.

Regulatory framework plays a crucial role in market definition, with stringent food safety standards, import regulations, and quality control measures ensuring product integrity and consumer safety throughout the supply chain.

Market performance in the UAE edible meat sector demonstrates resilient growth patterns supported by favorable demographic trends and economic stability. The market exhibits strong fundamentals with increasing per capita meat consumption and growing preference for premium quality products. Key drivers include population growth, tourism expansion, and rising health consciousness among consumers.

Competitive landscape features a mix of international suppliers, regional processors, and local distributors creating a diverse and dynamic market environment. Major players focus on quality differentiation, supply chain efficiency, and meeting specific cultural and religious requirements of the local market.

Growth opportunities emerge from increasing demand for organic and grass-fed meat products, with premium segment adoption growing at approximately 8.5% annually. The market benefits from government initiatives supporting food security and local production capabilities, creating favorable conditions for sustained expansion.

Consumer behavior analysis reveals several critical insights shaping market development:

Population growth serves as a fundamental driver for the UAE edible meat market, with the country’s expanding demographic base creating sustained demand for protein sources. The diverse expatriate population contributes to market complexity and opportunity, bringing varied culinary traditions and meat consumption preferences that broaden market scope and potential.

Economic prosperity enables higher per capita spending on premium meat products, with rising disposable income supporting market premiumization trends. The UAE’s status as a regional business hub attracts high-income professionals who demonstrate strong purchasing power for quality meat products and specialty items.

Tourism expansion significantly impacts market demand, with the hospitality sector requiring substantial meat supplies to serve millions of annual visitors. Hotel and restaurant consumption accounts for approximately 35% of total market demand, creating stable demand patterns and opportunities for specialized suppliers.

Health awareness trends drive consumer preference shifts toward lean proteins, organic options, and grass-fed meat products. Growing understanding of nutrition benefits associated with high-quality meat consumption supports market growth and premiumization.

Government food security initiatives promote local production capabilities and supply chain resilience, creating favorable conditions for market development and investment in processing infrastructure.

Import dependency represents a significant market constraint, with the UAE relying heavily on imported meat products to meet domestic demand. This dependency creates vulnerability to international price fluctuations, supply chain disruptions, and geopolitical factors that can impact product availability and pricing stability.

Climate challenges limit local livestock production capabilities, with harsh desert conditions and limited water resources constraining domestic meat production potential. These environmental factors necessitate continued reliance on imports and impact overall market cost structures.

Regulatory complexity surrounding halal certification, import procedures, and food safety standards can create barriers for new market entrants and complicate supply chain management. Compliance requirements demand significant investment in certification processes and quality control systems.

Price volatility in international commodity markets affects local meat prices, creating challenges for both suppliers and consumers in planning and budgeting. Currency fluctuations and global supply chain disruptions can significantly impact market stability.

Competition from alternative proteins emerges as plant-based and cultured meat options gain consumer acceptance, potentially limiting traditional meat market growth in certain segments.

Premium segment expansion offers substantial growth opportunities as UAE consumers increasingly seek high-quality, specialty meat products. The growing affluent population demonstrates willingness to pay premium prices for organic, grass-fed, and artisanal meat products, creating lucrative market niches for specialized suppliers.

Local production development presents opportunities for investment in domestic livestock farming and processing facilities. Government support for food security initiatives creates favorable conditions for establishing local production capabilities, reducing import dependency and improving supply chain control.

Technology integration opportunities include advanced cold chain management, blockchain traceability systems, and e-commerce platforms that enhance supply chain efficiency and consumer convenience. Digital adoption rates in food retail show 28% annual growth, indicating strong potential for technology-enabled market expansion.

Export potential emerges as the UAE’s strategic location and advanced infrastructure position the country as a regional distribution hub for processed meat products. Developing export capabilities to neighboring markets could significantly expand business opportunities for local processors.

Sustainable meat production initiatives align with growing environmental consciousness, creating opportunities for suppliers who can demonstrate sustainable sourcing and production practices.

Supply chain evolution characterizes the UAE edible meat market dynamics, with continuous improvements in logistics, storage, and distribution capabilities. Advanced cold chain infrastructure ensures product quality maintenance from import points to retail outlets, supporting market growth and consumer confidence.

Competitive intensity drives innovation and service improvements across the market, with suppliers focusing on differentiation through quality, convenience, and specialized offerings. Market consolidation trends emerge as larger players acquire smaller operations to achieve economies of scale and market coverage.

Consumer sophistication increases market complexity as buyers become more knowledgeable about meat quality, sourcing practices, and nutritional benefits. This trend drives suppliers to invest in transparency, certification, and premium product development to meet evolving expectations.

Seasonal demand patterns create dynamic market conditions, with significant consumption spikes during religious holidays and cultural celebrations. Ramadan period consumption typically increases by 45% above average levels, requiring careful inventory management and supply planning.

Price sensitivity variations across different consumer segments create opportunities for market segmentation and targeted product offerings, from value-oriented options to ultra-premium specialty products.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UAE edible meat market. Primary research includes extensive consumer surveys, industry interviews, and stakeholder consultations to capture current market conditions and future trends.

Secondary research incorporates analysis of government statistics, trade data, industry reports, and regulatory documentation to provide comprehensive market context. Data validation processes ensure information accuracy and reliability across all research components.

Market modeling techniques utilize statistical analysis and forecasting methods to project market trends and growth patterns. Quantitative analysis combines with qualitative insights to create comprehensive market understanding and strategic recommendations.

Industry expert consultations provide specialized knowledge and market insights from key stakeholders including suppliers, distributors, retailers, and regulatory officials. These consultations validate research findings and provide practical market perspectives.

Data triangulation methods ensure research accuracy by cross-referencing multiple information sources and validating findings through independent verification processes.

Dubai emirate dominates the UAE edible meat market, accounting for approximately 38% of total consumption due to its large population, extensive tourism industry, and concentration of hospitality businesses. The emirate’s advanced retail infrastructure and diverse consumer base drive demand for premium and specialty meat products.

Abu Dhabi represents the second-largest market segment with 32% market share, supported by government sector employment, oil industry presence, and growing residential communities. The emirate shows strong preference for high-quality meat products and traditional Middle Eastern cuts.

Sharjah and Northern Emirates collectively account for 22% of market demand, with growing populations and developing commercial sectors driving steady consumption growth. These regions show increasing adoption of modern retail formats and convenience-oriented meat products.

Regional consumption patterns vary based on demographic composition, with areas having higher expatriate populations showing greater diversity in meat preferences and international cuisine influences. Traditional Emirati preferences remain strong in certain regions, particularly for lamb and goat products.

Distribution network efficiency varies across regions, with Dubai and Abu Dhabi benefiting from advanced logistics infrastructure while northern emirates experience ongoing infrastructure development and improvement.

Market leadership in the UAE edible meat sector features a diverse mix of international suppliers, regional processors, and specialized distributors. The competitive environment emphasizes quality differentiation, supply chain efficiency, and meeting specific cultural requirements of the local market.

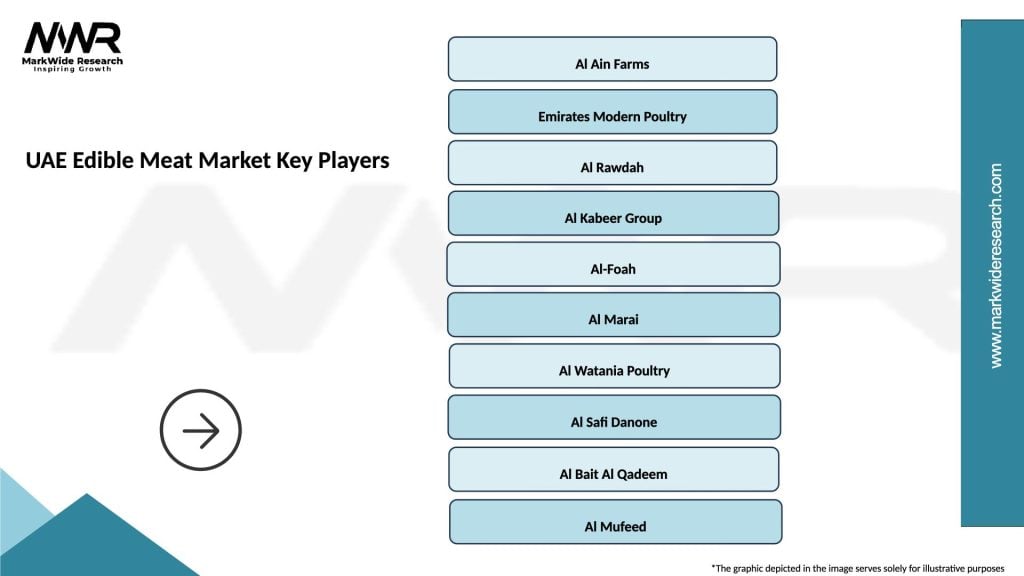

Key market players include:

Competitive strategies focus on supply chain optimization, quality certification, and developing specialized product offerings for different consumer segments. Market players invest heavily in cold chain infrastructure and technology to maintain product quality and extend shelf life.

By Product Type:

By Distribution Channel:

By Consumer Segment:

Poultry category maintains market leadership due to affordability, versatility, and broad consumer acceptance across cultural groups. Chicken consumption shows consistent growth with increasing preference for organic and free-range options. The segment benefits from established supply chains and competitive pricing structures.

Beef segment demonstrates premiumization trends with growing demand for high-grade cuts, wagyu, and grass-fed options. Consumer education about beef quality and preparation methods drives market sophistication and willingness to pay premium prices for superior products.

Lamb and mutton category maintains cultural significance with strong seasonal demand patterns tied to religious observances and traditional celebrations. The segment shows resilience despite higher price points, supported by cultural preferences and perceived quality benefits.

Seafood segment experiences rapid growth driven by health consciousness and dietary diversification. Fresh seafood demand increases with improved cold chain capabilities and consumer awareness of nutritional benefits. Seafood consumption growth reaches 12% annually in premium market segments.

Processed meat category expands with urbanization and lifestyle changes, offering convenience and extended shelf life. Innovation in flavors, packaging, and preparation methods drives segment growth and consumer adoption.

Suppliers and Processors benefit from stable demand growth, premium pricing opportunities, and expanding market segments. The UAE market offers reliable payment terms, established distribution networks, and opportunities for long-term partnerships with major retailers and foodservice operators.

Retailers gain from high-margin meat categories, customer traffic generation, and opportunities for private label development. Meat departments serve as destination categories that drive overall store visits and basket size increases.

Consumers enjoy access to diverse, high-quality meat products with improved safety standards and traceability. Market competition drives innovation in product offerings, convenience features, and competitive pricing across different quality segments.

Government stakeholders benefit from increased food security, economic diversification, and job creation in processing and distribution sectors. Market development supports strategic objectives for reduced import dependency and enhanced supply chain resilience.

Technology providers find opportunities in cold chain solutions, traceability systems, and e-commerce platforms that support market modernization and efficiency improvements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization trend dominates market development as consumers increasingly seek high-quality, specialty meat products. This trend drives growth in organic, grass-fed, and artisanal meat segments, with suppliers investing in premium product lines and marketing strategies to capture value-conscious consumers.

Health and wellness focus influences purchasing decisions, with growing preference for lean cuts, antibiotic-free products, and nutritionally enhanced meat options. Consumer education about protein benefits and healthy preparation methods supports market expansion and product innovation.

Convenience orientation drives demand for ready-to-cook, pre-marinated, and portion-controlled meat products. Busy lifestyles and dual-income households create opportunities for value-added products that reduce preparation time while maintaining quality and taste.

Digital transformation accelerates with online ordering, home delivery services, and mobile applications becoming integral to meat retail operations. E-commerce adoption in meat purchases grows at 25% annually, particularly among younger consumers and urban populations.

Sustainability consciousness emerges as consumers become more aware of environmental impacts associated with meat production. This trend creates opportunities for suppliers who can demonstrate sustainable sourcing, reduced carbon footprints, and ethical production practices.

Traceability demands increase as consumers seek transparency about meat origins, processing methods, and quality standards. Blockchain technology and QR code systems enable enhanced product tracking and consumer confidence.

Infrastructure investments continue expanding with new cold storage facilities, processing plants, and distribution centers enhancing market capacity and efficiency. Recent developments include state-of-the-art facilities in Dubai and Abu Dhabi that improve supply chain capabilities and product quality maintenance.

Technology adoption accelerates across the industry with implementation of automated processing equipment, advanced inventory management systems, and digital customer engagement platforms. These developments improve operational efficiency and customer service quality.

Regulatory enhancements strengthen food safety standards and import procedures, with updated halal certification requirements and enhanced traceability mandates. These developments improve consumer confidence while creating compliance challenges for market participants.

Partnership formations between international suppliers and local distributors create stronger market presence and improved service capabilities. Strategic alliances enable better market penetration and risk sharing in the competitive environment.

Product innovation focuses on health-conscious formulations, convenience features, and cultural adaptations that meet evolving consumer preferences. New product launches emphasize premium quality, unique flavors, and specialized preparation methods.

Sustainability initiatives gain momentum with suppliers implementing environmentally responsible practices, waste reduction programs, and sustainable packaging solutions. According to MarkWide Research analysis, sustainability-focused initiatives show 18% higher consumer acceptance rates compared to conventional approaches.

Market positioning strategies should focus on quality differentiation and cultural relevance to succeed in the competitive UAE environment. Companies should invest in understanding local preferences while maintaining international quality standards to capture both traditional and expatriate consumer segments.

Supply chain optimization represents a critical success factor, with recommendations for enhanced cold chain management, strategic inventory positioning, and diversified supplier relationships. Building resilient supply chains helps mitigate risks associated with import dependency and global disruptions.

Technology integration should prioritize customer-facing solutions including e-commerce platforms, mobile applications, and digital payment systems. Backend technology investments in inventory management and traceability systems provide operational advantages and regulatory compliance benefits.

Premium segment focus offers the highest growth potential and profitability, with recommendations for developing specialized product lines, premium packaging, and targeted marketing strategies. Building brand equity in premium segments provides competitive advantages and pricing power.

Sustainability initiatives should become integral to business strategy, with investments in sustainable sourcing, environmental responsibility, and transparent communication about production practices. These initiatives align with growing consumer consciousness and regulatory trends.

Partnership development with local stakeholders, including retailers, foodservice operators, and government entities, creates market advantages and reduces operational risks. Strategic partnerships enable better market penetration and shared resource utilization.

Market growth prospects remain positive with continued expansion expected across all major segments. MWR projections indicate sustained growth driven by population increases, economic development, and evolving consumer preferences toward premium and convenient meat products.

Technology integration will accelerate market transformation with advanced supply chain solutions, enhanced customer experiences, and improved operational efficiency. Digital platforms will become increasingly important for market participation and competitive advantage.

Sustainability focus will intensify as environmental consciousness grows and regulatory requirements evolve. Companies that proactively adopt sustainable practices will gain competitive advantages and consumer preference benefits.

Product innovation will continue driving market differentiation with emphasis on health benefits, convenience features, and cultural adaptations. Innovation adoption rates show 15% annual increases in premium market segments, indicating strong consumer receptivity to new products.

Market consolidation may accelerate as larger players seek economies of scale and market coverage advantages. Strategic acquisitions and partnerships will reshape the competitive landscape while improving overall market efficiency.

Regional expansion opportunities will emerge as the UAE strengthens its position as a regional food hub, with potential for export development and cross-border trade facilitation creating additional growth avenues for market participants.

The UAE edible meat market presents compelling opportunities for growth and development, supported by favorable demographic trends, economic prosperity, and evolving consumer preferences. Market fundamentals remain strong with increasing demand for premium quality products, convenience-oriented solutions, and sustainable options driving expansion across all major segments.

Strategic success factors include quality differentiation, supply chain excellence, technology integration, and cultural sensitivity in product development and marketing approaches. Companies that effectively combine international best practices with local market understanding will capture the greatest opportunities in this dynamic environment.

Future market development will be characterized by continued premiumization, digital transformation, and sustainability focus, creating opportunities for innovative companies while challenging traditional approaches. The market’s evolution toward greater sophistication and quality consciousness provides a foundation for sustained growth and profitability for well-positioned participants in the UAE edible meat sector.

What is Edible Meat?

Edible meat refers to the flesh of animals that is suitable for human consumption. This includes various types of meat such as beef, poultry, pork, and lamb, which are commonly consumed in many cuisines around the world.

What are the key companies in the UAE Edible Meat Market?

Key companies in the UAE Edible Meat Market include Al Ain Farms, Emirates Modern Poultry, and Al Rawdah, among others. These companies play a significant role in the production and distribution of various meat products in the region.

What are the growth factors driving the UAE Edible Meat Market?

The growth of the UAE Edible Meat Market is driven by increasing population, rising disposable incomes, and a growing preference for protein-rich diets. Additionally, the expansion of food service sectors and retail chains contributes to market growth.

What challenges does the UAE Edible Meat Market face?

The UAE Edible Meat Market faces challenges such as fluctuating meat prices, stringent regulations on food safety, and competition from alternative protein sources. These factors can impact supply chains and consumer choices.

What opportunities exist in the UAE Edible Meat Market?

Opportunities in the UAE Edible Meat Market include the rising demand for organic and halal meat products, as well as the potential for export to neighboring regions. Innovations in meat processing and packaging also present growth avenues.

What trends are shaping the UAE Edible Meat Market?

Trends in the UAE Edible Meat Market include a shift towards sustainable and ethically sourced meat, increased consumer awareness about health and nutrition, and the adoption of technology in meat production and distribution. These trends are influencing consumer preferences and industry practices.

UAE Edible Meat Market

| Segmentation Details | Description |

|---|---|

| Product Type | Beef, Chicken, Lamb, Goat |

| Distribution Channel | Supermarkets, Online Retail, Butcher Shops, Food Service |

| End User | Households, Restaurants, Catering Services, Food Manufacturers |

| Packaging Type | Vacuum Sealed, Canned, Fresh, Frozen |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Edible Meat Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at