444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE digital transformation market represents one of the most dynamic and rapidly evolving technology landscapes in the Middle East region. Digital transformation initiatives across the United Arab Emirates have gained unprecedented momentum, driven by the government’s ambitious Vision 2071 and the UAE Centennial Plan. The market encompasses comprehensive modernization efforts spanning cloud computing, artificial intelligence, Internet of Things (IoT), blockchain technology, and advanced analytics solutions.

Government-led initiatives have positioned the UAE as a regional leader in digital innovation, with smart city projects, e-government services, and Industry 4.0 implementations driving substantial growth. The market demonstrates robust expansion with a projected CAGR of 12.5% through the forecast period, reflecting the nation’s commitment to becoming a global digital hub. Enterprise adoption rates have reached 78% across major sectors, indicating widespread acceptance of digital technologies.

Key sectors driving transformation include banking and financial services, healthcare, retail, manufacturing, and government services. The integration of emerging technologies with traditional business models has created new opportunities for innovation and efficiency improvements. Cloud adoption rates have surged to 65% among UAE enterprises, while artificial intelligence implementation has grown by 45% year-over-year.

The UAE digital transformation market refers to the comprehensive ecosystem of technologies, services, and solutions that enable organizations across the United Arab Emirates to modernize their operations, enhance customer experiences, and create new business models through digital technologies. This market encompasses the adoption and integration of cloud computing, artificial intelligence, machine learning, IoT devices, blockchain solutions, and advanced data analytics platforms.

Digital transformation in the UAE context involves the strategic implementation of digital technologies to fundamentally change how businesses operate and deliver value to customers. It includes the digitization of processes, automation of workflows, enhancement of customer touchpoints, and the creation of data-driven decision-making capabilities. Organizations leverage these technologies to improve operational efficiency, reduce costs, accelerate innovation, and maintain competitive advantages in an increasingly digital economy.

The market scope extends beyond technology adoption to include consulting services, system integration, change management, and ongoing support services. It represents a holistic approach to business modernization that aligns with the UAE’s national digital agenda and smart city initiatives.

The UAE digital transformation market stands at the forefront of technological innovation in the Middle East, characterized by strong government support, substantial private sector investment, and accelerating adoption across multiple industries. Market dynamics reflect a mature understanding of digital technologies combined with aggressive implementation strategies that position the UAE as a regional digital leader.

Key growth drivers include the UAE’s National AI Strategy 2031, smart city initiatives across Dubai and Abu Dhabi, and the increasing demand for digital government services. Financial services lead digital adoption with 85% of banks implementing comprehensive digital transformation programs, followed by healthcare and retail sectors showing significant progress in technology integration.

Market participants range from global technology giants to local system integrators, creating a competitive landscape that fosters innovation and drives down implementation costs. Cloud-first strategies have become standard practice, with 72% of organizations prioritizing cloud migration as their primary digital initiative. The market benefits from substantial government investment in digital infrastructure and supportive regulatory frameworks that encourage innovation.

Future prospects remain highly positive, with emerging technologies like quantum computing, advanced robotics, and 5G networks creating new opportunities for digital transformation initiatives. The market’s maturity level and strategic importance to national economic diversification efforts ensure continued growth and investment.

Strategic insights reveal several critical factors shaping the UAE digital transformation landscape. Government leadership through initiatives like the UAE Digital Government Strategy has created a conducive environment for widespread technology adoption across public and private sectors.

Government Vision and Strategy serve as the primary catalyst for digital transformation across the UAE. The nation’s commitment to becoming a global leader in digital innovation drives substantial investment in technology infrastructure and creates favorable conditions for market growth. Smart city initiatives in Dubai and Abu Dhabi demonstrate government leadership in adopting cutting-edge technologies.

Economic diversification efforts beyond oil dependency have positioned technology and innovation as critical pillars of the UAE’s future economy. Digital transformation enables traditional industries to modernize and compete globally while creating new technology-driven sectors. The government’s focus on becoming a knowledge-based economy drives demand for advanced digital solutions.

Customer expectations for seamless digital experiences across all touchpoints push organizations to accelerate their transformation initiatives. Mobile-first consumers demand instant access to services, personalized experiences, and integrated digital journeys. This consumer behavior drives businesses to invest heavily in digital capabilities and customer experience platforms.

Competitive pressures from both regional and global players force UAE organizations to adopt digital technologies to maintain market position. Digital-native companies entering the market with innovative business models challenge traditional players to transform rapidly or risk losing market share.

Operational efficiency requirements drive organizations to automate processes, reduce manual interventions, and optimize resource utilization through digital technologies. Cost reduction pressures combined with the need for improved service quality create strong incentives for digital transformation investments.

Implementation complexity represents a significant challenge for organizations embarking on digital transformation journeys. Legacy system integration difficulties, data migration challenges, and the need for comprehensive change management often slow down transformation initiatives and increase implementation costs.

Cybersecurity concerns create hesitation among organizations considering cloud migration and digital platform adoption. Data privacy regulations and the need for robust security frameworks require substantial investment in cybersecurity infrastructure and expertise, potentially limiting the pace of transformation.

Skills shortage in critical technology areas constrains market growth, with organizations struggling to find qualified professionals in artificial intelligence, cloud computing, and advanced analytics. Talent competition drives up costs and extends project timelines, creating barriers for smaller organizations.

Cultural resistance to change within traditional organizations can slow digital transformation adoption. Employee reluctance to embrace new technologies and processes requires significant investment in training and change management programs, adding complexity to transformation initiatives.

High initial investment requirements for comprehensive digital transformation can be prohibitive for smaller organizations. ROI uncertainty and the long-term nature of transformation benefits may discourage some organizations from pursuing ambitious digital initiatives.

Emerging technology adoption presents substantial opportunities for market expansion, particularly in areas like quantum computing, advanced robotics, and edge computing. 5G network deployment across the UAE creates new possibilities for IoT applications, real-time analytics, and immersive technologies that can drive the next wave of digital transformation.

Cross-sector collaboration opportunities enable the development of integrated digital ecosystems that span multiple industries. Smart city initiatives create platforms for innovative solutions that combine transportation, healthcare, energy, and government services into cohesive digital experiences.

Regional expansion opportunities allow UAE-based digital transformation providers to leverage their expertise in neighboring markets. The UAE’s position as a regional hub creates opportunities to export digital transformation capabilities and solutions throughout the Middle East and Africa.

Sustainability integration with digital transformation initiatives aligns with global environmental goals and creates new market segments. Green technology solutions that combine digital transformation with environmental sustainability represent growing opportunities for innovation and differentiation.

Public-private partnerships in digital transformation create opportunities for collaborative innovation and shared investment in large-scale technology initiatives. Government procurement of digital transformation services provides stable revenue streams for market participants.

Market dynamics in the UAE digital transformation sector reflect a complex interplay of technological advancement, regulatory support, and competitive pressures. Technology evolution continues to accelerate, with artificial intelligence and machine learning capabilities becoming more sophisticated and accessible to organizations of all sizes.

Competitive intensity has increased significantly as global technology providers establish stronger presences in the UAE market. Local system integrators are forming strategic partnerships with international vendors to enhance their capabilities and compete effectively for large-scale transformation projects.

Customer sophistication levels have risen dramatically, with organizations developing more nuanced understanding of digital transformation benefits and implementation requirements. Procurement processes have become more strategic, focusing on long-term value creation rather than short-term cost minimization.

Investment patterns show increasing focus on outcome-based contracts and shared-risk models between clients and service providers. Performance metrics have evolved beyond traditional IT measures to include business impact indicators and customer experience improvements.

Regulatory evolution continues to shape market dynamics, with new data protection laws, cybersecurity requirements, and digital governance frameworks influencing technology adoption decisions. Compliance requirements create both challenges and opportunities for digital transformation providers.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UAE digital transformation market. Primary research includes extensive interviews with industry executives, technology vendors, government officials, and end-user organizations across various sectors.

Secondary research incorporates analysis of government publications, industry reports, financial statements, and technology vendor announcements. Market data is validated through triangulation of multiple sources and cross-verification with industry experts and market participants.

Quantitative analysis utilizes statistical modeling techniques to project market trends and growth patterns. Qualitative insights are gathered through focus groups, expert panels, and in-depth case study analysis of successful digital transformation implementations.

Technology assessment includes evaluation of emerging trends, adoption patterns, and competitive positioning of various digital transformation solutions. Market segmentation analysis provides detailed insights into sector-specific trends and growth opportunities.

Validation processes ensure data accuracy through peer review, expert consultation, and continuous monitoring of market developments. Regular updates to research findings reflect the dynamic nature of the digital transformation market.

Dubai leads the UAE digital transformation market, accounting for approximately 45% of total market activity. The emirate’s position as a global business hub, combined with ambitious smart city initiatives, drives substantial demand for digital transformation services. Dubai’s Digital Strategy aims to make the city the world’s smartest by 2025, creating significant opportunities for technology providers.

Abu Dhabi represents the second-largest market segment with 35% market share, driven by government sector transformation and large-scale infrastructure projects. The capital’s focus on economic diversification and the development of technology clusters creates strong demand for comprehensive digital transformation solutions.

Northern Emirates including Sharjah, Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively account for 20% of market activity. These regions show growing interest in digital transformation, particularly in manufacturing, logistics, and small-to-medium enterprise segments.

Free zones across the UAE serve as innovation hubs that attract international technology companies and foster digital transformation adoption. Dubai Internet City, Abu Dhabi Global Market, and other specialized zones create concentrated demand for advanced digital solutions and services.

Cross-emirate collaboration on digital transformation initiatives creates opportunities for integrated solutions that span multiple regions. Federal government projects often require coordinated implementation across all emirates, driving demand for large-scale transformation capabilities.

The competitive landscape features a diverse mix of global technology giants, regional system integrators, and specialized consulting firms. Market leadership is distributed among several key players, each with distinct strengths and market positioning strategies.

Partnership strategies have become increasingly important, with global vendors collaborating with local integrators to enhance market reach and delivery capabilities. Competitive differentiation focuses on industry expertise, implementation speed, and outcome-based service models.

By Technology:

By Industry Vertical:

By Organization Size:

Cloud Computing dominates the digital transformation technology mix, with organizations prioritizing infrastructure modernization and scalability improvements. Hybrid cloud strategies have gained popularity, allowing organizations to balance security requirements with operational flexibility. Multi-cloud approaches are becoming standard practice among large enterprises seeking to avoid vendor lock-in.

Artificial Intelligence applications show rapid growth across customer service, fraud detection, and operational optimization use cases. Chatbot implementations have achieved 60% adoption rates in customer-facing organizations, while predictive analytics solutions are being deployed across supply chain and maintenance functions.

IoT deployments focus primarily on smart building management, asset tracking, and environmental monitoring applications. Industrial IoT implementations in manufacturing and logistics sectors demonstrate strong ROI through improved operational efficiency and predictive maintenance capabilities.

Blockchain adoption remains concentrated in financial services and government sectors, with applications in trade finance, digital identity, and supply chain transparency. Cryptocurrency regulations and central bank digital currency initiatives create new opportunities for blockchain technology providers.

Advanced Analytics platforms enable organizations to leverage growing data volumes for strategic decision-making. Real-time analytics capabilities are particularly valued in retail, healthcare, and financial services sectors where immediate insights drive competitive advantage.

Technology Vendors benefit from the UAE’s position as a regional innovation hub and gateway to broader Middle East and Africa markets. Government support for digital transformation creates stable demand and reduces market entry barriers for international technology providers.

System Integrators gain access to complex, high-value projects that require comprehensive digital transformation expertise. Partnership opportunities with global vendors enable local integrators to expand their capabilities and compete for larger contracts.

End-user Organizations achieve significant operational improvements through digital transformation initiatives. Cost reductions, enhanced customer experiences, and improved competitive positioning justify substantial technology investments and drive continued market growth.

Government Entities leverage digital transformation to improve citizen services, increase operational efficiency, and support economic diversification objectives. Smart city initiatives create platforms for innovation and attract international investment in technology sectors.

Investors find attractive opportunities in the growing digital transformation market, with strong government backing and favorable regulatory environment supporting long-term growth prospects. Venture capital and private equity interest in UAE technology companies continues to increase.

Skilled Professionals benefit from growing demand for digital transformation expertise, with competitive compensation packages and career advancement opportunities across multiple sectors and organizations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration has become a central theme across digital transformation initiatives, with organizations seeking to embed AI capabilities into core business processes. Conversational AI and intelligent automation solutions are being deployed to enhance customer service and operational efficiency across multiple sectors.

Cloud-First Strategies have evolved into cloud-native approaches, with organizations designing new applications and services specifically for cloud environments. Serverless computing and containerization technologies are gaining traction as organizations seek greater agility and cost optimization.

Data-Driven Decision Making has become a critical capability, with organizations investing heavily in data platforms and analytics capabilities. Real-time analytics and predictive modeling are being integrated into operational processes to enable proactive management and optimization.

Customer Experience Transformation drives significant investment in omnichannel platforms and personalization technologies. Digital customer journeys are being redesigned to provide seamless experiences across all touchpoints and interaction channels.

Cybersecurity Integration has become embedded in digital transformation planning, with security-by-design principles being applied to all technology initiatives. Zero-trust architectures and advanced threat detection systems are becoming standard components of transformation projects.

Sustainability Focus is increasingly influencing digital transformation decisions, with organizations seeking solutions that reduce environmental impact while improving operational efficiency. Green IT practices and energy-efficient technologies are becoming important selection criteria.

Government Digital Transformation initiatives have accelerated significantly, with major announcements including the UAE Digital Government Strategy 2025 and comprehensive e-government service modernization programs. Digital identity systems and blockchain-based government services represent significant technological advances.

Banking Sector Innovation continues to lead digital transformation adoption, with major UAE banks launching comprehensive digital banking platforms and AI-powered customer service solutions. Open banking initiatives and fintech partnerships are reshaping the financial services landscape.

Smart City Projects in Dubai and Abu Dhabi have achieved significant milestones, with integrated IoT platforms, intelligent transportation systems, and citizen engagement portals demonstrating successful large-scale digital transformation implementations.

Healthcare Digitization has accelerated, particularly following the COVID-19 pandemic, with telemedicine platforms, electronic health records, and AI-powered diagnostic tools being deployed across the healthcare system.

Education Technology adoption has surged, with comprehensive digital learning platforms, virtual classroom solutions, and AI-powered educational tools being implemented across schools and universities throughout the UAE.

Industrial Automation projects in manufacturing and logistics sectors demonstrate successful Industry 4.0 implementations, with predictive maintenance, automated quality control, and intelligent supply chain management systems delivering measurable benefits.

MarkWide Research recommends that organizations prioritize comprehensive digital transformation strategies that align with long-term business objectives rather than pursuing isolated technology implementations. Strategic planning should focus on creating integrated digital ecosystems that enhance customer experiences and operational efficiency.

Investment priorities should emphasize cloud infrastructure, artificial intelligence capabilities, and advanced analytics platforms as foundational technologies for digital transformation success. Organizations should allocate sufficient resources for change management and skills development to ensure successful technology adoption.

Partnership strategies with experienced system integrators and technology vendors can accelerate transformation timelines and reduce implementation risks. Collaborative approaches that combine global expertise with local market knowledge typically deliver superior outcomes.

Cybersecurity considerations must be integrated into all digital transformation planning from the earliest stages. Security investments should be viewed as enablers of digital transformation rather than constraints on technology adoption.

Pilot project approaches allow organizations to test digital transformation concepts and build internal capabilities before committing to large-scale implementations. Iterative development and continuous improvement methodologies reduce risks and improve outcomes.

Skills development programs should be established early in digital transformation journeys to ensure organizations have the necessary capabilities to leverage new technologies effectively. Training investments in digital literacy and advanced technology skills are essential for transformation success.

The UAE digital transformation market is positioned for continued strong growth, driven by government commitment to digital innovation and increasing private sector adoption of advanced technologies. Emerging technologies including quantum computing, advanced robotics, and 6G networks will create new transformation opportunities over the next decade.

Market maturation will lead to more sophisticated digital transformation approaches, with organizations focusing on outcome-based implementations and measurable business impact. Integration complexity will drive demand for comprehensive platforms that unify multiple digital capabilities.

Regional leadership in digital transformation will position the UAE as an export hub for digital solutions and expertise throughout the Middle East and Africa. Cross-border digital initiatives and regional technology partnerships will expand market opportunities for UAE-based providers.

Sustainability integration will become increasingly important, with digital transformation initiatives required to demonstrate environmental benefits alongside operational improvements. Green technology solutions will represent a growing market segment with strong government support.

Workforce transformation will accelerate, with digital skills becoming essential across all sectors and job functions. Continuous learning and adaptation will become critical capabilities for organizations and individuals participating in the digital economy.

MWR analysis indicates that the market will continue expanding at robust rates, with new technology categories and use cases emerging regularly. Innovation ecosystems combining government support, private investment, and international expertise will drive sustained market growth and technological advancement.

The UAE digital transformation market represents a dynamic and rapidly evolving landscape characterized by strong government leadership, substantial private sector investment, and accelerating technology adoption across multiple industries. Market fundamentals remain robust, with supportive regulatory frameworks, world-class infrastructure, and strategic positioning as a regional innovation hub driving continued growth.

Key success factors for market participants include comprehensive strategic planning, strong partnership relationships, and deep understanding of local market requirements and cultural considerations. Organizations that invest in foundational technologies, skills development, and change management capabilities are best positioned to capitalize on market opportunities.

Future prospects remain highly positive, with emerging technologies, sustainability requirements, and regional expansion opportunities creating new avenues for growth and innovation. The UAE’s commitment to digital leadership and economic diversification ensures continued market expansion and technological advancement, making it an attractive destination for digital transformation investments and expertise.

What is Digital Transformation?

Digital transformation refers to the integration of digital technology into all areas of a business, fundamentally changing how it operates and delivers value to customers. It encompasses various aspects such as process automation, data analytics, and customer engagement strategies.

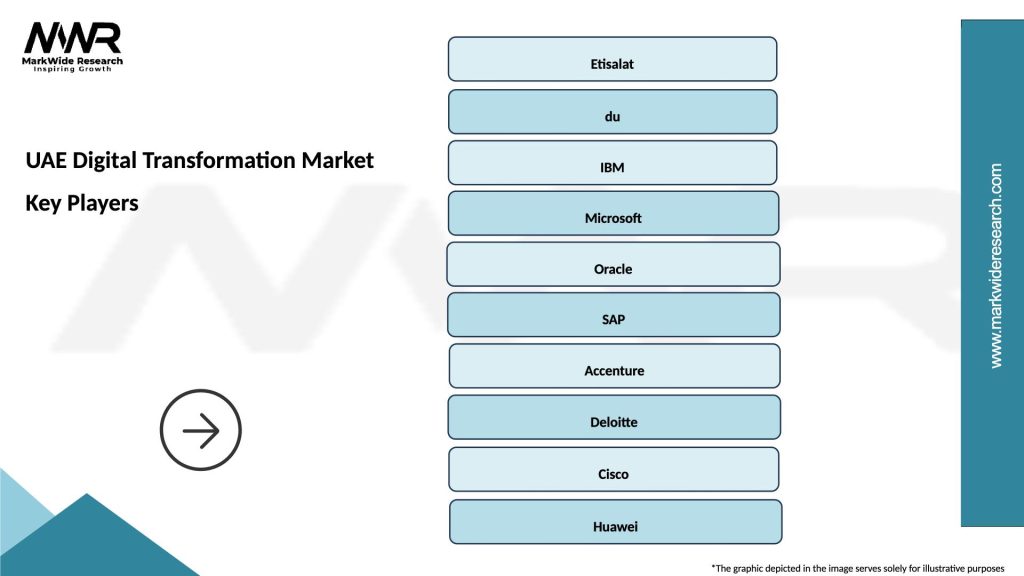

What are the key players in the UAE Digital Transformation Market?

Key players in the UAE Digital Transformation Market include companies like Etisalat, du, and IBM, which provide a range of digital solutions and services. These companies are actively involved in enhancing digital infrastructure and offering innovative technologies to businesses, among others.

What are the main drivers of the UAE Digital Transformation Market?

The main drivers of the UAE Digital Transformation Market include the increasing demand for improved customer experiences, the need for operational efficiency, and the growing adoption of cloud computing. Additionally, government initiatives promoting smart city projects are also fueling growth.

What challenges does the UAE Digital Transformation Market face?

Challenges in the UAE Digital Transformation Market include data security concerns, resistance to change within organizations, and the high costs associated with implementing new technologies. These factors can hinder the pace of digital adoption among businesses.

What opportunities exist in the UAE Digital Transformation Market?

Opportunities in the UAE Digital Transformation Market include the potential for startups to innovate in areas like artificial intelligence and the Internet of Things. Additionally, sectors such as healthcare and education are ripe for digital transformation initiatives.

What trends are shaping the UAE Digital Transformation Market?

Trends shaping the UAE Digital Transformation Market include the rise of artificial intelligence and machine learning, the increasing importance of data analytics, and the shift towards remote work solutions. These trends are influencing how businesses operate and engage with customers.

UAE Digital Transformation Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, Edge Computing |

| Solution | AI Solutions, IoT Platforms, Data Analytics, Cybersecurity Tools |

| End User | Government, Healthcare Providers, Educational Institutions, Retailers |

| Technology | Blockchain, Machine Learning, Augmented Reality, 5G |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Digital Transformation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at