444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE dental market represents one of the most dynamic and rapidly expanding healthcare sectors in the Middle East region. Driven by increasing health awareness, rising disposable incomes, and a growing expatriate population, the dental care industry in the United Arab Emirates has experienced remarkable transformation over the past decade. The market encompasses a comprehensive range of services including preventive dentistry, restorative procedures, cosmetic treatments, orthodontics, and advanced surgical interventions.

Market growth has been particularly robust, with the sector expanding at a compound annual growth rate (CAGR) of 8.2% over recent years. This growth trajectory reflects the UAE’s commitment to establishing itself as a premier healthcare destination in the region. Dubai and Abu Dhabi lead the market development, accounting for approximately 75% of total dental service demand across the emirates.

Healthcare infrastructure development has been a key catalyst, with significant investments in state-of-the-art dental facilities, advanced equipment, and specialized training programs. The integration of cutting-edge technologies such as digital dentistry, 3D imaging, and minimally invasive procedures has positioned the UAE as a regional leader in dental innovation. Medical tourism contributes substantially to market expansion, with patients from neighboring countries seeking high-quality dental treatments at competitive prices.

The UAE dental market refers to the comprehensive ecosystem of dental healthcare services, products, and infrastructure operating within the United Arab Emirates. This market encompasses all aspects of oral healthcare delivery, from basic preventive care and routine check-ups to complex surgical procedures and specialized treatments. The market includes private dental clinics, hospital-based dental departments, specialized dental centers, dental laboratories, equipment suppliers, and pharmaceutical companies focused on oral health products.

Key components of the market include general dentistry services, specialized treatments such as orthodontics and periodontics, cosmetic dentistry procedures, oral surgery, and pediatric dental care. The market also encompasses the supply chain for dental equipment, materials, and consumables, as well as educational institutions providing dental training and continuing professional development.

Regulatory framework plays a crucial role in market definition, with the UAE Ministry of Health and Prevention, Dubai Health Authority, and Abu Dhabi Department of Health establishing standards for dental practice, facility licensing, and professional certification. This regulatory environment ensures quality standards while facilitating market growth and international recognition.

The UAE dental market demonstrates exceptional growth potential driven by demographic trends, economic prosperity, and healthcare sector modernization. Population growth, particularly among expatriate communities with higher healthcare expectations, continues to fuel demand for comprehensive dental services. The market benefits from a unique combination of local demand and medical tourism, creating multiple revenue streams for dental service providers.

Technology adoption represents a significant competitive advantage, with UAE dental practices increasingly implementing digital workflows, artificial intelligence diagnostics, and minimally invasive treatment modalities. Investment in infrastructure has resulted in world-class dental facilities that rival international standards, attracting both patients and skilled dental professionals to the region.

Market segmentation reveals strong performance across all categories, with cosmetic dentistry showing particularly robust growth of approximately 12% annually. Preventive care adoption has increased significantly, with 68% of residents now engaging in regular dental check-ups, representing a substantial improvement in oral health awareness.

Competitive landscape features a mix of international dental chains, regional healthcare groups, and independent practitioners, creating a dynamic environment that drives innovation and service quality improvements. Strategic partnerships between healthcare providers and insurance companies have expanded access to dental care across diverse population segments.

Demographic drivers fundamentally shape the UAE dental market landscape, with several key insights emerging from comprehensive market analysis:

Service utilization patterns reveal strong preference for comprehensive treatment plans, with patients increasingly seeking integrated approaches to oral health management. Digital dentistry adoption has accelerated significantly, with over 85% of dental practices now incorporating some form of digital technology in their treatment protocols.

Economic prosperity serves as the primary driver of UAE dental market expansion, with sustained GDP growth supporting increased healthcare spending across all population segments. Government initiatives promoting healthcare sector development have created favorable conditions for dental practice establishment and expansion, including streamlined licensing processes and infrastructure investment incentives.

Population growth continues to drive fundamental demand, with the UAE’s population expanding at approximately 1.5% annually. This growth, combined with increasing life expectancy and aging population segments, creates sustained demand for both preventive and restorative dental services. Expatriate communities bring diverse healthcare expectations and willingness to invest in premium dental care, contributing to market sophistication.

Healthcare awareness campaigns have significantly improved oral health consciousness, with public and private sector initiatives emphasizing the importance of regular dental care. Educational programs in schools and workplaces have increased preventive care adoption, creating a foundation for long-term market growth.

Technology advancement drives market evolution through improved treatment outcomes, reduced treatment times, and enhanced patient experiences. Digital dentistry solutions, including CAD/CAM systems, intraoral scanners, and 3D printing technologies, have revolutionized treatment delivery while creating new revenue opportunities for dental practices.

Medical tourism development positions the UAE as a regional healthcare hub, attracting patients from neighboring countries seeking high-quality dental treatments. Government support for medical tourism through visa facilitation and healthcare promotion initiatives continues to expand this important market segment.

High treatment costs represent a significant barrier to market expansion, particularly for complex procedures and advanced treatments. Despite growing insurance coverage, many dental services remain partially or completely out-of-pocket expenses, limiting accessibility for certain population segments. Cost sensitivity among price-conscious consumers can restrict demand for premium services and advanced treatment options.

Regulatory complexity poses challenges for new market entrants, with stringent licensing requirements and compliance obligations creating barriers to practice establishment. Professional certification requirements, while ensuring quality standards, can limit the availability of qualified dental professionals and increase operational costs for healthcare providers.

Competition intensity has increased significantly as the market matures, with numerous providers competing for market share across all service categories. Price competition in certain segments can pressure profit margins and limit investment in advanced technologies or facility improvements.

Cultural considerations may influence treatment acceptance and patient compliance, particularly for certain demographic groups with specific cultural or religious considerations regarding dental care. Language barriers can impact service delivery quality and patient satisfaction in some cases.

Economic volatility in global markets can impact discretionary healthcare spending, particularly for cosmetic and elective dental procedures. Insurance limitations for certain treatments may restrict market growth in specific service categories.

Digital transformation presents substantial opportunities for market expansion through improved efficiency, enhanced patient experiences, and new service delivery models. Teledentistry and remote consultation services offer potential for reaching underserved populations and providing convenient access to dental expertise.

Preventive care expansion represents a significant growth opportunity, with increasing awareness of oral health’s impact on overall wellness driving demand for comprehensive preventive programs. Corporate wellness programs incorporating dental health components create new market channels and revenue streams for dental service providers.

Specialized services development offers opportunities for differentiation and premium pricing, particularly in areas such as implant dentistry, orthodontics, and cosmetic procedures. Advanced treatment modalities including laser dentistry, regenerative procedures, and minimally invasive techniques attract patients seeking cutting-edge care.

Medical tourism growth continues to present expansion opportunities, with the UAE’s strategic location and reputation for healthcare excellence attracting patients from across the region. Package deals combining dental treatment with tourism experiences can enhance the value proposition for international patients.

Public-private partnerships offer opportunities for market expansion through collaborative initiatives in public health, education, and community outreach programs. Insurance market development creates opportunities for expanded coverage and improved treatment accessibility across diverse population segments.

Supply and demand dynamics in the UAE dental market reflect the interplay between growing patient needs and expanding service capacity. Demand drivers include population growth, increasing health awareness, and rising disposable incomes, while supply factors encompass practice expansion, technology adoption, and professional development initiatives.

Competitive dynamics have intensified as the market matures, with providers differentiating through service quality, technology adoption, and patient experience enhancement. Market consolidation trends are emerging, with larger healthcare groups acquiring independent practices to achieve economies of scale and expand service offerings.

Technology disruption continues to reshape market dynamics through digital dentistry adoption, artificial intelligence integration, and automated treatment planning systems. Innovation cycles are accelerating, with new technologies and treatment modalities regularly entering the market and creating competitive advantages for early adopters.

Regulatory evolution influences market dynamics through updated standards, licensing requirements, and quality assurance measures. Policy changes regarding healthcare insurance, medical tourism, and professional certification can significantly impact market structure and competitive positioning.

Economic factors including GDP growth, inflation rates, and currency stability affect market dynamics through their impact on healthcare spending patterns and investment decisions. Regional economic integration creates opportunities for cross-border patient flows and professional mobility.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UAE dental market landscape. Primary research involves extensive interviews with dental professionals, healthcare administrators, patients, and industry stakeholders to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of government publications, healthcare statistics, industry reports, and academic studies to establish market context and validate primary findings. Data triangulation techniques ensure consistency and reliability across multiple information sources.

Quantitative analysis includes statistical modeling of market trends, growth projections, and segmentation analysis based on available data sources. Qualitative assessment incorporates expert opinions, stakeholder perspectives, and market observation to provide comprehensive understanding of market dynamics.

Market segmentation analysis examines various dimensions including service types, patient demographics, geographic distribution, and competitive positioning. Trend analysis identifies emerging patterns and future market directions through longitudinal data examination and expert consultation.

Validation processes ensure research accuracy through peer review, stakeholder feedback, and cross-referencing with established industry benchmarks. Continuous monitoring maintains research currency through ongoing market observation and periodic updates.

Dubai emerges as the dominant regional market, accounting for approximately 45% of total dental service demand across the UAE. The emirate’s cosmopolitan population, robust economy, and medical tourism infrastructure create ideal conditions for dental market growth. Dubai Healthcare City serves as a focal point for specialized dental services, attracting both local and international patients seeking advanced treatments.

Abu Dhabi represents the second-largest market segment, contributing roughly 30% of national demand. The capital’s focus on healthcare excellence and substantial government investment in medical infrastructure supports continued market expansion. Cleveland Clinic Abu Dhabi and other major healthcare institutions provide comprehensive dental services integrated with broader medical care.

Sharjah and Northern Emirates collectively account for approximately 25% of market activity, with growing populations and improving healthcare infrastructure driving steady demand growth. Regional development initiatives focus on improving healthcare accessibility and establishing specialized dental centers to serve local communities.

Geographic distribution patterns reflect population density and economic activity concentration, with urban centers demonstrating higher service utilization rates and greater willingness to invest in premium dental care. Rural and remote areas present opportunities for mobile dental services and telemedicine applications.

Cross-emirate patient flows are common, particularly for specialized treatments and advanced procedures, indicating market integration and patient willingness to travel for quality care. Regional coordination in healthcare planning ensures efficient resource allocation and service accessibility across all emirates.

Market leadership is distributed among several key categories of dental service providers, each contributing unique strengths to the competitive landscape:

Competitive differentiation occurs through various strategies including technology adoption, service specialization, patient experience enhancement, and pricing optimization. Quality certifications such as JCI accreditation provide competitive advantages in attracting discerning patients and medical tourists.

Market consolidation trends are emerging as larger organizations acquire independent practices to achieve economies of scale and expand geographic coverage. Strategic partnerships between dental providers and insurance companies create competitive advantages through improved patient access and streamlined billing processes.

Innovation leadership has become increasingly important, with leading providers investing in cutting-edge technologies, advanced treatment modalities, and digital patient engagement platforms. Professional development initiatives ensure staff competency and maintain competitive positioning in the evolving market landscape.

Service-based segmentation reveals distinct market dynamics across different categories of dental care:

By Service Type:

By Patient Demographics:

By Technology Level:

General dentistry maintains its position as the foundation of the UAE dental market, with preventive care adoption reaching 72% among regular patients. Routine maintenance services including cleanings, examinations, and basic restorative work provide stable revenue streams for dental practices while building long-term patient relationships.

Cosmetic dentistry demonstrates exceptional growth potential, driven by social media influence, professional appearance considerations, and increasing disposable income. Smile makeovers and aesthetic treatments have become increasingly popular, with demand growing at approximately 15% annually among affluent population segments.

Orthodontic services show strong performance across all age groups, with adult orthodontics representing a particularly dynamic segment. Clear aligner therapy has gained significant traction, appealing to professionals and image-conscious individuals seeking discreet treatment options.

Implant dentistry represents a high-value segment with excellent growth prospects, supported by aging population trends and increasing awareness of tooth replacement options. Advanced implant techniques including immediate loading and computer-guided surgery enhance treatment outcomes and patient satisfaction.

Pediatric dentistry benefits from growing family populations and increased parental awareness of early dental care importance. Preventive programs in schools and community centers support market development while establishing lifelong oral health habits.

Dental practitioners benefit from the UAE’s supportive business environment, diverse patient population, and commitment to healthcare excellence. Professional development opportunities abound through continuing education programs, international conferences, and collaboration with leading healthcare institutions.

Healthcare investors find attractive opportunities in the growing dental market, with strong returns supported by increasing demand, premium pricing potential, and favorable regulatory environment. Market stability and growth prospects make dental services an appealing investment category within the broader healthcare sector.

Patients benefit from access to world-class dental care, advanced treatment options, and competitive pricing compared to other international healthcare destinations. Quality assurance through regulatory oversight and professional standards ensures reliable treatment outcomes and patient safety.

Insurance providers can expand their market presence through dental coverage offerings, meeting growing demand for comprehensive healthcare benefits. Risk management through preventive care emphasis helps control long-term costs while improving member satisfaction.

Technology suppliers find a receptive market for innovative dental equipment, materials, and digital solutions, with practices actively seeking competitive advantages through technology adoption. Partnership opportunities with local distributors and service providers facilitate market entry and expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital dentistry adoption continues to accelerate, with practices increasingly implementing comprehensive digital workflows from diagnosis through treatment delivery. Artificial intelligence integration in diagnostic imaging and treatment planning enhances accuracy while improving efficiency and patient outcomes.

Minimally invasive treatments gain popularity as patients seek conservative approaches with faster recovery times and improved comfort. Laser dentistry applications expand across multiple treatment categories, offering precision and reduced post-operative complications.

Preventive care emphasis reflects growing understanding of oral health’s connection to overall wellness, with practices developing comprehensive prevention programs and patient education initiatives. MarkWide Research indicates that preventive service utilization has increased by 28% over the past three years.

Personalized treatment approaches leverage genetic testing, advanced diagnostics, and patient-specific factors to optimize treatment outcomes. Precision dentistry concepts incorporate individual risk assessment and customized prevention strategies.

Sustainability initiatives gain importance as practices adopt environmentally friendly materials, energy-efficient equipment, and waste reduction programs. Green dentistry practices appeal to environmentally conscious patients while reducing operational costs.

Patient experience enhancement through digital engagement platforms, streamlined appointment scheduling, and comprehensive communication systems improves satisfaction and loyalty. Virtual consultations and remote monitoring capabilities expand access while maintaining quality care standards.

Regulatory updates have strengthened quality standards and patient safety requirements, with enhanced licensing procedures and continuing education mandates for dental professionals. Accreditation programs provide frameworks for quality improvement and international recognition.

Technology partnerships between dental practices and technology companies accelerate innovation adoption and create competitive advantages. Strategic alliances facilitate knowledge transfer and best practice sharing across the industry.

Educational initiatives including new dental training programs and specialized certification courses address professional development needs while ensuring adequate workforce supply. International collaborations with leading dental schools enhance educational quality and research capabilities.

Infrastructure investments in specialized dental facilities and equipment upgrades support market expansion and service quality improvements. Public-private partnerships facilitate healthcare infrastructure development while ensuring sustainable financing models.

Insurance market evolution includes expanded dental coverage options and innovative benefit designs that improve treatment accessibility. Corporate wellness programs increasingly incorporate comprehensive dental benefits as part of employee health initiatives.

Market positioning strategies should focus on differentiation through service quality, technology adoption, and patient experience enhancement rather than price competition alone. Specialization opportunities in niche areas such as geriatric dentistry, special needs patients, or advanced surgical procedures can provide competitive advantages.

Technology investment should prioritize solutions that improve both clinical outcomes and operational efficiency, with careful consideration of return on investment and patient acceptance. Digital integration across all practice operations can enhance competitiveness while improving patient satisfaction.

Partnership development with insurance providers, corporate clients, and healthcare institutions can expand market reach while providing stable revenue streams. MWR analysis suggests that practices with strong partnership networks achieve 23% higher revenue growth compared to independent operators.

Quality certification and accreditation should be pursued to enhance credibility and attract quality-conscious patients, particularly in the medical tourism segment. Continuous professional development ensures staff competency and maintains competitive positioning.

Market expansion strategies should consider underserved geographic areas and demographic segments while maintaining service quality standards. Scalable business models that can accommodate growth while preserving quality and efficiency are essential for long-term success.

Long-term growth prospects for the UAE dental market remain highly positive, supported by demographic trends, economic development, and healthcare sector modernization. Population growth projections indicate continued expansion in demand for dental services across all categories and geographic regions.

Technology evolution will continue to reshape the market landscape, with emerging innovations in artificial intelligence, robotics, and regenerative medicine creating new treatment possibilities and market opportunities. Digital health integration will become increasingly important for competitive positioning and operational efficiency.

Medical tourism development is expected to accelerate, with the UAE strengthening its position as a regional healthcare hub through continued infrastructure investment and service quality improvements. International patient volumes are projected to grow at approximately 11% annually over the next five years.

Regulatory evolution will likely emphasize quality assurance, patient safety, and professional standards while supporting market growth and innovation adoption. Policy initiatives promoting healthcare accessibility and insurance coverage expansion will create additional growth opportunities.

Market consolidation trends are expected to continue, with larger healthcare organizations acquiring independent practices to achieve economies of scale and expand service offerings. Strategic partnerships and collaborative models will become increasingly important for market success and sustainability.

The UAE dental market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by favorable demographics, economic prosperity, and healthcare sector modernization. Market fundamentals remain strong, supported by increasing health awareness, expanding insurance coverage, and growing medical tourism activity.

Technology adoption and service quality improvements continue to differentiate the UAE dental market within the regional healthcare landscape. Digital dentistry integration, minimally invasive treatment approaches, and personalized care models position the market for continued expansion and innovation.

Competitive dynamics favor providers who can effectively combine clinical excellence, technology adoption, and superior patient experiences while maintaining operational efficiency. Market opportunities abound for organizations that can navigate the evolving landscape while delivering consistent quality and value to diverse patient populations.

Future success in the UAE dental market will depend on adaptability, innovation, and commitment to quality standards that meet the expectations of an increasingly sophisticated patient base. Strategic positioning and continuous improvement will be essential for capturing growth opportunities while building sustainable competitive advantages in this dynamic and promising market.

What is Dental?

Dental refers to the branch of medicine that focuses on the diagnosis, prevention, and treatment of diseases and conditions related to the teeth, gums, and oral cavity. It encompasses various practices including orthodontics, periodontics, and oral surgery.

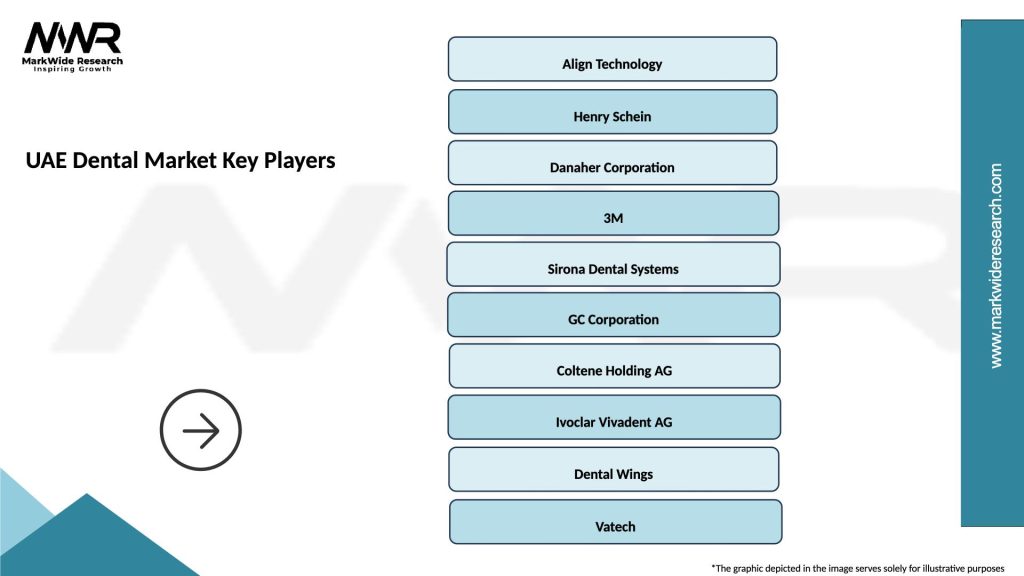

What are the key players in the UAE Dental Market?

Key players in the UAE Dental Market include companies such as Align Technology, Dentsply Sirona, and Straumann, which provide a range of dental products and services. These companies are known for their innovations in dental technology and equipment, among others.

What are the growth factors driving the UAE Dental Market?

The UAE Dental Market is driven by factors such as increasing awareness of oral health, a growing aging population, and advancements in dental technology. Additionally, the rise in dental tourism in the UAE contributes to market growth.

What challenges does the UAE Dental Market face?

Challenges in the UAE Dental Market include high competition among dental service providers and the need for continuous investment in advanced technologies. Regulatory compliance and maintaining high standards of care also pose challenges for practitioners.

What opportunities exist in the UAE Dental Market?

Opportunities in the UAE Dental Market include the expansion of dental services in underserved areas and the potential for growth in cosmetic dentistry. The increasing demand for preventive dental care also presents significant opportunities for practitioners.

What trends are shaping the UAE Dental Market?

Trends in the UAE Dental Market include the integration of digital technologies such as teledentistry and AI-driven diagnostics. There is also a growing emphasis on minimally invasive procedures and personalized dental care solutions.

UAE Dental Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dental Implants, Orthodontics, Restorative Materials, Preventive Care |

| End User | Private Clinics, Dental Hospitals, Research Institutions, Government Facilities |

| Technology | 3D Printing, CAD/CAM, Laser Dentistry, Digital Imaging |

| Distribution Channel | Direct Sales, Online Retail, Distributors, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Dental Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at