444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE data center server market represents a rapidly expanding segment within the Middle East’s digital infrastructure landscape. As the United Arab Emirates continues its transformation into a global technology hub, the demand for robust server infrastructure has witnessed unprecedented growth. Digital transformation initiatives across government and private sectors are driving substantial investments in data center capabilities, with server technologies forming the backbone of this expansion.

Cloud adoption rates in the UAE have surged by approximately 78% over the past three years, creating significant demand for high-performance server solutions. The market encompasses various server types including rack servers, blade servers, tower servers, and micro servers, each serving specific organizational requirements. Enterprise digitization efforts, coupled with the UAE’s strategic positioning as a regional data hub, have established favorable conditions for sustained market growth.

Government initiatives such as the UAE Digital Government 2025 strategy and smart city projects across Dubai and Abu Dhabi are accelerating server infrastructure investments. The market benefits from the country’s strategic geographic location, connecting Europe, Asia, and Africa, making it an ideal location for regional data center operations. Hyperscale data centers are increasingly establishing presence in the UAE, driving demand for enterprise-grade server solutions with enhanced processing capabilities.

The UAE data center server market refers to the comprehensive ecosystem of server hardware, software, and related services deployed within data center facilities across the United Arab Emirates. This market encompasses the procurement, installation, maintenance, and upgrade of server systems that power cloud computing, enterprise applications, and digital services throughout the region.

Data center servers in the UAE context include physical and virtual server infrastructure designed to handle computational workloads, data storage, and network management functions. These systems range from traditional rack-mounted servers to modern hyperconverged infrastructure solutions that integrate computing, storage, and networking capabilities. Server technologies deployed in UAE data centers support various applications including artificial intelligence, machine learning, big data analytics, and Internet of Things implementations.

Market participants include server manufacturers, system integrators, cloud service providers, and end-user organizations across sectors such as banking, telecommunications, government, healthcare, and retail. The market also encompasses managed services, technical support, and professional services that ensure optimal server performance and reliability within UAE data center environments.

Strategic positioning of the UAE as a regional technology leader has created substantial opportunities within the data center server market. The convergence of digital transformation initiatives, cloud migration strategies, and emerging technology adoption is driving consistent demand for advanced server infrastructure. Market dynamics indicate strong growth potential supported by government investments in smart city initiatives and private sector digitization efforts.

Key market drivers include the UAE’s Vision 2071 strategy, which emphasizes technology leadership and innovation. Approximately 85% of UAE organizations have accelerated their digital transformation timelines, creating immediate demand for scalable server solutions. Cloud-first policies adopted by government entities and large enterprises are reshaping server procurement patterns, favoring flexible and scalable infrastructure solutions.

Competitive landscape features established global server manufacturers alongside regional system integrators and cloud service providers. The market demonstrates strong potential for continued expansion, supported by favorable regulatory frameworks, strategic geographic advantages, and sustained investment in digital infrastructure development across the Emirates.

Market intelligence reveals several critical insights shaping the UAE data center server landscape. Hyperscale deployments are becoming increasingly prevalent, with major cloud providers establishing significant infrastructure presence in the region. This trend is driving demand for high-density server configurations optimized for cloud workloads and distributed computing applications.

Digital transformation acceleration across UAE organizations represents the primary driver of server market growth. Government mandates for digital service delivery and private sector competitiveness requirements are creating sustained demand for modern server infrastructure. Cloud migration initiatives are particularly influential, with organizations seeking scalable server solutions that support hybrid and multi-cloud strategies.

Economic diversification efforts under the UAE’s Vision 2071 are driving investments in technology infrastructure across non-oil sectors. The development of financial technology, e-commerce, and digital services industries is creating specialized server requirements. Smart city projects in Dubai and Abu Dhabi are generating significant demand for edge computing servers and IoT-enabled infrastructure solutions.

Regional hub positioning continues to attract international organizations establishing Middle East operations in the UAE. This trend creates consistent demand for enterprise-grade server infrastructure capable of supporting regional operations. Data localization requirements and regulatory compliance needs are driving organizations to establish local server infrastructure rather than relying solely on international cloud services.

Emerging technology adoption including artificial intelligence, machine learning, and blockchain applications is creating demand for specialized server configurations. Organizations are investing in GPU-accelerated servers and high-performance computing solutions to support advanced analytics and AI workloads. 5G network deployment is creating additional requirements for edge server infrastructure to support low-latency applications and services.

Capital investment requirements for advanced server infrastructure can present challenges for smaller organizations and startups. The high cost of enterprise-grade servers, particularly those optimized for AI and high-performance computing workloads, may limit adoption among cost-sensitive organizations. Technical complexity associated with modern server deployments requires specialized expertise that may not be readily available in all market segments.

Skills shortage in server administration and data center management represents a significant constraint. The rapid evolution of server technologies requires continuous training and certification, creating ongoing challenges for organizations seeking to maintain optimal server performance. Vendor dependency concerns may limit adoption of proprietary server solutions, particularly among organizations prioritizing technology independence.

Regulatory compliance requirements can add complexity and cost to server deployments. Organizations must ensure server infrastructure meets various regulatory standards, which may require additional investment in security features and compliance monitoring capabilities. Energy costs associated with high-density server deployments can impact total cost of ownership calculations, particularly for organizations operating in multiple locations.

Market saturation in certain segments may limit growth opportunities for new entrants. Established relationships between large organizations and preferred server vendors can create barriers for alternative solution providers. Technology refresh cycles may create temporary demand fluctuations as organizations balance performance requirements with budget constraints.

Artificial intelligence adoption presents substantial opportunities for specialized server solutions. Organizations across sectors are investing in AI capabilities, creating demand for GPU-accelerated servers and machine learning-optimized infrastructure. Edge computing expansion offers opportunities for distributed server deployments supporting IoT applications and real-time data processing requirements.

Sustainability initiatives are creating opportunities for energy-efficient server technologies. Organizations are increasingly prioritizing green data center solutions, driving demand for servers with improved power efficiency and reduced environmental impact. Liquid cooling technologies and advanced thermal management solutions are gaining traction as organizations seek to optimize server performance while minimizing energy consumption.

Hyperconverged infrastructure adoption presents opportunities for integrated server solutions that combine computing, storage, and networking capabilities. This trend simplifies data center management while providing scalability benefits that appeal to growing organizations. Container orchestration and microservices architectures are driving demand for servers optimized for containerized workloads.

Sector-specific solutions offer opportunities for customized server configurations. Healthcare organizations require servers with enhanced security features, while financial services demand high-availability configurations. Government cloud initiatives are creating opportunities for servers meeting specific security and compliance requirements. Managed services opportunities are expanding as organizations seek to outsource server management while focusing on core business activities.

Supply chain evolution is reshaping server procurement patterns in the UAE market. Organizations are diversifying supplier relationships to ensure continuity and competitive pricing. Local assembly capabilities are developing, with some manufacturers establishing regional facilities to serve Middle East markets more effectively. This trend is reducing delivery times and providing greater customization opportunities for UAE customers.

Technology convergence is creating new server categories that blur traditional boundaries between computing, storage, and networking infrastructure. Software-defined infrastructure approaches are gaining adoption, allowing organizations to optimize server utilization through virtualization and automation technologies. This shift is changing procurement patterns from hardware-centric to solution-oriented approaches.

Service delivery models are evolving beyond traditional hardware sales to include comprehensive managed services and infrastructure-as-a-service offerings. Organizations are increasingly interested in outcome-based pricing models that align server costs with business performance metrics. Subscription-based server solutions are gaining traction, particularly among organizations seeking to optimize cash flow and reduce capital expenditure requirements.

Market consolidation trends are creating opportunities for strategic partnerships and acquisitions. Smaller system integrators are partnering with global server manufacturers to enhance their solution portfolios. Channel partner programs are becoming more sophisticated, providing enhanced support and incentives for organizations promoting specific server technologies within the UAE market.

Comprehensive market analysis was conducted through multiple research methodologies to ensure accurate representation of the UAE data center server market landscape. Primary research included structured interviews with key market participants including server manufacturers, system integrators, cloud service providers, and end-user organizations across various industry sectors.

Secondary research encompassed analysis of industry reports, government publications, vendor documentation, and market intelligence databases. Quantitative analysis was performed on market data including server shipments, pricing trends, and technology adoption rates. Qualitative insights were gathered through expert interviews and industry roundtable discussions.

Market segmentation analysis was conducted across multiple dimensions including server type, deployment model, industry vertical, and geographic distribution within the UAE. Competitive landscape assessment included evaluation of market share, product portfolios, pricing strategies, and go-to-market approaches employed by key market participants.

Trend analysis incorporated evaluation of emerging technologies, regulatory developments, and economic factors influencing server market dynamics. Validation processes included cross-referencing findings with industry experts and conducting follow-up interviews to ensure accuracy and completeness of market insights. MarkWide Research methodologies ensured comprehensive coverage of market dynamics and future growth potential.

Dubai emirate represents the largest segment of the UAE data center server market, accounting for approximately 45% of total market activity. The emirate’s position as a regional business hub and its advanced telecommunications infrastructure create favorable conditions for data center investments. Dubai Internet City and surrounding technology zones host numerous data centers requiring sophisticated server infrastructure.

Abu Dhabi contributes approximately 35% of market demand, driven primarily by government initiatives and large enterprise requirements. The capital’s focus on smart city development and digital government services creates sustained demand for high-performance server solutions. Masdar City and other sustainable development projects are driving adoption of energy-efficient server technologies.

Sharjah and Northern Emirates represent emerging opportunities within the server market, contributing approximately 20% of total demand. These regions are experiencing growth in manufacturing and logistics sectors, creating requirements for specialized server infrastructure supporting supply chain management and industrial IoT applications. Free zone developments in these emirates are attracting technology companies requiring server infrastructure.

Cross-emirate connectivity initiatives are creating opportunities for distributed server deployments that support disaster recovery and business continuity requirements. Organizations are implementing multi-site server architectures to ensure service availability and regulatory compliance. Regional data center hubs are developing in strategic locations to serve both local and international customers.

Market leadership in the UAE data center server segment is characterized by intense competition among global technology vendors and regional system integrators. Established players leverage comprehensive product portfolios and extensive partner networks to maintain market position while emerging competitors focus on specialized solutions and competitive pricing strategies.

Regional system integrators play crucial roles in server market dynamics, providing localized support and customized solutions. These organizations often maintain partnerships with multiple server vendors, allowing them to offer comprehensive solutions tailored to specific customer requirements. Value-added services including installation, configuration, and ongoing support are becoming increasingly important competitive differentiators.

Server type segmentation reveals diverse requirements across the UAE data center market. Rack servers maintain the largest market share due to their versatility and standardized form factors that simplify data center management. These systems are particularly popular among organizations requiring scalable computing capacity with predictable performance characteristics.

By Server Type:

By Deployment Model:

By Industry Vertical:

Enterprise servers represent the most mature segment within the UAE market, characterized by established procurement processes and long-term vendor relationships. Organizations in this category typically require high-availability configurations with comprehensive support services. Performance optimization and reliability are primary selection criteria, with cost considerations secondary to operational requirements.

Hyperscale servers constitute a rapidly growing category driven by cloud service provider expansion in the UAE. These systems emphasize density, efficiency, and standardization to support large-scale cloud operations. Custom configurations are common in this segment, with vendors working closely with hyperscale operators to optimize server designs for specific workload requirements.

Edge servers represent an emerging category with significant growth potential. These systems are designed for distributed deployments supporting IoT applications, content delivery, and real-time data processing. Compact form factors and enhanced environmental tolerance are key characteristics, enabling deployment in non-traditional data center environments.

AI-optimized servers form a specialized category addressing artificial intelligence and machine learning workloads. These systems typically incorporate GPU acceleration and high-speed interconnects to support parallel processing requirements. Performance per watt optimization is crucial in this category due to the intensive computational requirements of AI applications.

Server manufacturers benefit from the UAE’s strategic position as a regional technology hub, providing access to Middle East and African markets through local presence. The country’s stable political environment and business-friendly policies create favorable conditions for long-term investment and partnership development. Government support for technology initiatives provides additional market opportunities and validation for server technology investments.

System integrators gain advantages through comprehensive solution portfolios that address diverse customer requirements. The UAE market’s sophistication allows integrators to develop specialized expertise and premium service offerings. Partnership opportunities with global vendors provide access to advanced technologies and competitive positioning in the regional market.

End-user organizations benefit from competitive server markets that drive innovation and cost optimization. Access to global technology vendors and local support services ensures comprehensive solution availability. Regulatory frameworks provide clarity and confidence for technology investments while supporting business growth objectives.

Cloud service providers leverage the UAE’s connectivity advantages and growing digital economy to expand their regional presence. Government initiatives supporting cloud adoption create favorable market conditions and customer demand. Data sovereignty requirements provide opportunities for local infrastructure investments and service differentiation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Hyperconverged infrastructure adoption is accelerating across UAE organizations seeking simplified data center management. This trend combines computing, storage, and networking capabilities into integrated server solutions, reducing complexity and operational overhead. Software-defined approaches are becoming standard, allowing organizations to optimize resource utilization through automation and virtualization technologies.

Edge computing deployment is expanding rapidly as organizations implement IoT applications and real-time data processing capabilities. This trend is driving demand for ruggedized servers capable of operating in distributed environments. 5G network rollout is creating additional edge computing requirements, particularly for telecommunications and smart city applications.

Artificial intelligence integration is becoming mainstream across various industry sectors, driving demand for GPU-accelerated servers and specialized computing platforms. Organizations are investing in AI capabilities to enhance customer experiences and operational efficiency. Machine learning workloads require servers with high-performance computing capabilities and advanced cooling systems.

Sustainability initiatives are influencing server selection criteria, with organizations prioritizing energy-efficient technologies. Green data center concepts are gaining traction, driving adoption of servers with improved power efficiency and reduced environmental impact. Liquid cooling technologies are becoming more prevalent as organizations seek to optimize server performance while minimizing energy consumption.

Major cloud providers continue expanding their UAE presence through significant data center investments. These developments are driving demand for hyperscale server configurations optimized for cloud workloads. Local data center construction projects are creating opportunities for server vendors and system integrators to establish long-term partnerships with facility operators.

Government digitization initiatives are accelerating across all Emirates, creating sustained demand for enterprise-grade server infrastructure. Smart city projects in Dubai and Abu Dhabi are driving requirements for edge computing servers and IoT-enabled infrastructure solutions. These initiatives often include specific requirements for local data processing and storage capabilities.

Financial sector transformation is creating opportunities for high-performance server solutions supporting digital banking and fintech applications. Regulatory compliance requirements are driving adoption of servers with enhanced security features and audit capabilities. Open banking initiatives are creating additional requirements for API-capable server infrastructure.

Healthcare digitization is emerging as a significant growth driver, with organizations investing in servers supporting electronic health records and telemedicine applications. Data privacy requirements in healthcare are creating demand for servers with advanced security and encryption capabilities. MarkWide Research analysis indicates that healthcare sector server investments are expected to grow significantly over the forecast period.

Market participants should focus on developing comprehensive solution portfolios that address diverse customer requirements across industry verticals. Specialization strategies in emerging areas such as AI-optimized servers and edge computing solutions can provide competitive advantages. Organizations should invest in local technical expertise and support capabilities to differentiate their offerings in the competitive UAE market.

Partnership development with regional system integrators and cloud service providers can enhance market reach and customer access. Channel partner programs should emphasize training and certification to ensure quality solution delivery. Vendors should consider establishing local assembly or configuration capabilities to reduce delivery times and provide greater customization options.

Sustainability positioning will become increasingly important as organizations prioritize environmental responsibility. Server vendors should emphasize energy efficiency and environmental benefits in their marketing and sales approaches. Total cost of ownership calculations should include energy consumption and cooling requirements to demonstrate long-term value propositions.

Technology roadmap alignment with emerging trends such as quantum computing and advanced AI applications will be crucial for long-term success. Organizations should invest in research and development to ensure their server solutions can support future workload requirements. Customer education initiatives can help organizations understand the benefits of advanced server technologies and accelerate adoption rates.

Long-term growth prospects for the UAE data center server market remain highly positive, supported by continued digital transformation initiatives and emerging technology adoption. Government commitment to technology leadership through Vision 2071 provides sustained policy support for infrastructure investments. The market is expected to benefit from continued economic diversification efforts and the UAE’s positioning as a regional technology hub.

Technology evolution will continue driving server market dynamics, with artificial intelligence, edge computing, and quantum computing creating new requirements and opportunities. 5G network deployment will accelerate edge computing adoption, creating demand for distributed server infrastructure. Organizations will increasingly require servers capable of supporting multiple workload types through software-defined approaches.

Market maturation will lead to more sophisticated procurement processes and outcome-based service models. Subscription-based server solutions are expected to gain traction as organizations seek to optimize capital expenditure and align costs with business outcomes. Managed services opportunities will expand as organizations focus on core business activities while outsourcing infrastructure management.

Regional expansion opportunities will emerge as the UAE serves as a hub for broader Middle East and Africa market development. Cross-border connectivity initiatives will create requirements for servers supporting international data flows and regulatory compliance. MWR projections indicate that the market will continue experiencing robust growth driven by digital transformation acceleration and emerging technology adoption across all Emirates.

The UAE data center server market represents a dynamic and rapidly evolving segment with substantial growth potential driven by digital transformation initiatives, government support, and strategic geographic advantages. Market fundamentals remain strong, supported by continued investment in technology infrastructure and the UAE’s positioning as a regional hub for business and innovation.

Key success factors for market participants include developing comprehensive solution portfolios, establishing strong local partnerships, and maintaining alignment with emerging technology trends. The market’s sophistication creates opportunities for premium solutions and value-added services, while competitive dynamics drive continuous innovation and cost optimization.

Future growth will be driven by artificial intelligence adoption, edge computing expansion, and sustainability initiatives that reshape server requirements and procurement patterns. Organizations that successfully navigate these trends while maintaining focus on customer needs and operational excellence will be well-positioned to capitalize on the UAE’s continued digital transformation journey and establish leadership positions in this dynamic market environment.

What is Data Center Server?

Data Center Server refers to the specialized servers used in data centers to manage, store, and process large volumes of data. These servers are designed for high performance, reliability, and scalability to support various applications and services.

What are the key players in the UAE Data Center Server Market?

Key players in the UAE Data Center Server Market include companies like Etisalat, du, and Gulf Data Hub. These companies provide a range of services including cloud computing, colocation, and managed hosting solutions, among others.

What are the main drivers of growth in the UAE Data Center Server Market?

The main drivers of growth in the UAE Data Center Server Market include the increasing demand for cloud services, the rise of big data analytics, and the expansion of IoT applications. Additionally, government initiatives to promote digital transformation are also contributing to market growth.

What challenges does the UAE Data Center Server Market face?

The UAE Data Center Server Market faces challenges such as high operational costs, the need for skilled workforce, and concerns regarding data security and compliance. These factors can hinder the growth and efficiency of data center operations.

What opportunities exist in the UAE Data Center Server Market?

Opportunities in the UAE Data Center Server Market include the growing adoption of artificial intelligence and machine learning technologies, as well as the increasing need for disaster recovery solutions. The expansion of smart city initiatives also presents new avenues for growth.

What trends are shaping the UAE Data Center Server Market?

Trends shaping the UAE Data Center Server Market include the shift towards edge computing, the integration of renewable energy sources, and the rise of hyper-converged infrastructure. These trends are driving innovation and efficiency in data center operations.

UAE Data Center Server Market

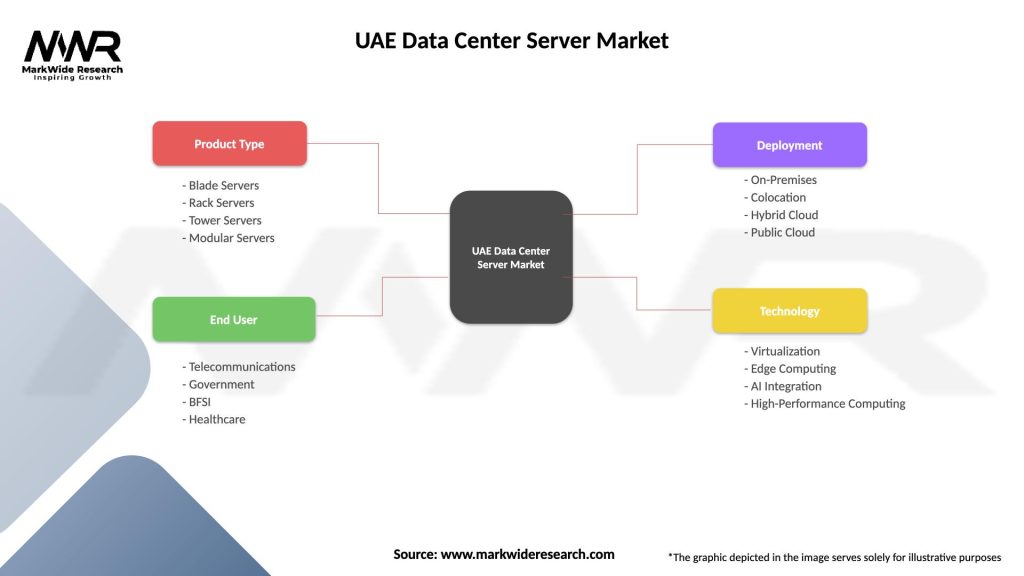

| Segmentation Details | Description |

|---|---|

| Product Type | Blade Servers, Rack Servers, Tower Servers, Modular Servers |

| End User | Telecommunications, Government, BFSI, Healthcare |

| Deployment | On-Premises, Colocation, Hybrid Cloud, Public Cloud |

| Technology | Virtualization, Edge Computing, AI Integration, High-Performance Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Data Center Server Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at