444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE contract logistics market represents a dynamic and rapidly evolving sector that serves as a critical backbone for the nation’s ambitious economic diversification strategy. As the United Arab Emirates continues to position itself as a global trade hub connecting Asia, Europe, and Africa, the demand for sophisticated contract logistics services has experienced unprecedented growth. The market encompasses comprehensive third-party logistics solutions including warehousing, distribution, transportation management, and value-added services that enable businesses to optimize their supply chain operations.

Strategic positioning within the UAE has made the country an attractive destination for international logistics providers and local companies seeking to expand their operational capabilities. The market is experiencing robust expansion driven by e-commerce growth, increasing manufacturing activities, and the government’s focus on developing world-class logistics infrastructure. With growth rates projected at approximately 8.5% CAGR over the forecast period, the sector demonstrates remarkable resilience and adaptability to changing market conditions.

Dubai and Abu Dhabi emerge as the primary logistics hubs, benefiting from state-of-the-art port facilities, advanced airport infrastructure, and strategic free zone developments. The market’s evolution reflects broader economic trends including digital transformation, sustainability initiatives, and the integration of advanced technologies such as artificial intelligence and Internet of Things solutions into traditional logistics operations.

The UAE contract logistics market refers to the comprehensive ecosystem of third-party logistics service providers that offer outsourced supply chain management solutions to businesses operating within the United Arab Emirates. This market encompasses specialized companies that manage warehousing, distribution, transportation, inventory management, and value-added services on behalf of their clients under contractual agreements.

Contract logistics providers differentiate themselves from traditional logistics companies by offering integrated, long-term partnerships that involve taking responsibility for specific aspects of their clients’ supply chain operations. These services typically include warehouse management, order fulfillment, inventory optimization, transportation coordination, and customized solutions tailored to specific industry requirements such as pharmaceuticals, automotive, retail, and manufacturing sectors.

Key characteristics of the UAE contract logistics market include multi-year service agreements, performance-based contracts, technology integration, and collaborative partnerships that enable businesses to focus on their core competencies while leveraging specialized logistics expertise. The market serves both domestic companies and international businesses seeking to establish or expand their presence in the Middle East and North Africa region.

Market dynamics in the UAE contract logistics sector reflect a mature yet rapidly evolving landscape characterized by increasing sophistication in service offerings and growing demand from diverse industry verticals. The market benefits from the UAE’s strategic geographic location, world-class infrastructure, and business-friendly regulatory environment that attracts both regional and international logistics service providers.

Technology adoption has emerged as a critical differentiator, with leading providers investing heavily in automation, artificial intelligence, and digital platforms to enhance operational efficiency and customer experience. The integration of advanced warehouse management systems, predictive analytics, and real-time tracking capabilities has become standard practice among top-tier service providers, driving approximately 25% improvement in operational efficiency across the sector.

Competitive landscape features a mix of global logistics giants, regional specialists, and emerging local players, each bringing unique capabilities and market insights. The market’s growth trajectory is supported by increasing outsourcing trends, with businesses recognizing the strategic value of partnering with specialized logistics providers to achieve cost optimization, scalability, and operational excellence.

Future prospects remain highly positive, driven by continued economic diversification, infrastructure development, and the UAE’s ambition to become a global logistics and trade hub. The market is expected to benefit from major events, infrastructure projects, and the country’s focus on developing advanced manufacturing and technology sectors.

Strategic insights reveal several fundamental trends shaping the UAE contract logistics market’s evolution and future direction:

Market maturation is evident through the increasing sophistication of service offerings, with providers expanding beyond traditional warehousing and transportation to include value-added services such as product customization, quality control, and reverse logistics management.

Economic diversification initiatives undertaken by the UAE government serve as the primary catalyst for contract logistics market expansion. The country’s strategic focus on reducing oil dependency and developing knowledge-based industries has created substantial demand for sophisticated supply chain solutions across multiple sectors including manufacturing, technology, healthcare, and retail.

Infrastructure development continues to drive market growth through massive investments in ports, airports, roads, and logistics facilities. The expansion of Dubai South, development of new industrial zones, and enhancement of existing free trade areas create opportunities for logistics providers to establish advanced distribution centers and fulfillment facilities.

E-commerce proliferation has emerged as a significant growth driver, with online retail adoption rates increasing substantially across the region. The demand for last-mile delivery services, omnichannel fulfillment, and specialized e-commerce logistics solutions has created new market segments and revenue opportunities for contract logistics providers.

Regional trade expansion benefits from the UAE’s strategic location and trade relationships with emerging markets in Africa, Asia, and the broader Middle East region. Companies seeking to establish regional distribution hubs increasingly rely on contract logistics providers to manage complex multi-country supply chains and navigate diverse regulatory requirements.

Technology integration drives operational efficiency improvements and enables new service capabilities. The adoption of automation, artificial intelligence, and IoT solutions allows logistics providers to offer enhanced visibility, predictive analytics, and optimized operations that deliver measurable value to their clients.

High operational costs present ongoing challenges for contract logistics providers, particularly in prime locations where real estate prices and labor costs continue to rise. The need for advanced technology investments, specialized equipment, and skilled workforce development requires significant capital commitments that can impact profitability and market entry barriers.

Regulatory complexity across different emirates and free zones creates operational challenges for logistics providers serving multiple jurisdictions. Varying compliance requirements, documentation procedures, and regulatory frameworks necessitate sophisticated management systems and specialized expertise that increase operational complexity and costs.

Talent shortage in specialized logistics roles, particularly in technology, supply chain management, and operations leadership, constrains market growth and service quality improvements. The competition for skilled professionals drives up labor costs and requires substantial investments in training and development programs.

Economic volatility in regional markets and global trade uncertainties can impact demand patterns and client investment decisions. Fluctuations in oil prices, geopolitical tensions, and international trade policies create unpredictable market conditions that affect long-term planning and investment strategies.

Infrastructure constraints in certain areas, despite overall excellence, can limit expansion opportunities and operational efficiency. Traffic congestion, limited warehouse availability in prime locations, and capacity constraints during peak periods present ongoing operational challenges.

Expo 2020 legacy continues to create substantial opportunities for contract logistics providers through enhanced infrastructure, increased international business presence, and elevated UAE profile as a global business destination. The permanent facilities and improved connectivity established for the event provide long-term benefits for logistics operations and regional distribution strategies.

Manufacturing sector growth presents significant expansion opportunities as the UAE develops advanced manufacturing capabilities in aerospace, pharmaceuticals, food processing, and technology sectors. The increasing focus on local production and regional manufacturing hubs creates demand for specialized industrial logistics services and supply chain management solutions.

Healthcare logistics represents a high-growth opportunity driven by population growth, medical tourism, and pharmaceutical distribution requirements. The need for temperature-controlled storage, specialized handling procedures, and regulatory compliance creates opportunities for providers with healthcare expertise and advanced facilities.

Sustainability initiatives offer differentiation opportunities for logistics providers investing in green technologies, carbon-neutral operations, and environmental compliance solutions. Companies seeking to meet sustainability goals increasingly prioritize partners with demonstrated environmental responsibility and innovative green logistics capabilities.

Digital commerce expansion beyond traditional e-commerce into B2B platforms, social commerce, and cross-border trade creates new service requirements and market segments. The evolution of digital business models requires specialized fulfillment capabilities, technology integration, and flexible service offerings.

Competitive intensity continues to increase as both international and regional players expand their presence in the UAE market. This competition drives innovation, service quality improvements, and competitive pricing strategies that benefit clients while challenging providers to differentiate their offerings through specialized capabilities and superior performance.

Client expectations have evolved significantly, with businesses demanding greater transparency, real-time visibility, and measurable performance improvements from their logistics partners. The shift toward outcome-based contracts and performance metrics requires providers to invest in advanced tracking systems, analytics capabilities, and continuous improvement processes.

Technology disruption reshapes traditional logistics operations through automation, artificial intelligence, and predictive analytics. Providers must balance technology investments with operational requirements while ensuring seamless integration and measurable returns on investment. According to MarkWide Research analysis, technology adoption rates have accelerated by approximately 40% over the past three years.

Supply chain resilience has become a critical focus following global disruptions, with companies seeking logistics partners capable of providing flexible, adaptable solutions that can respond to unexpected challenges. This emphasis on resilience creates opportunities for providers with robust risk management capabilities and diversified service offerings.

Regional integration trends drive demand for logistics solutions that can seamlessly serve multiple markets across the GCC and broader MENA region. Providers with regional networks and cross-border expertise gain competitive advantages in serving multinational clients with complex distribution requirements.

Comprehensive analysis of the UAE contract logistics market employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. The research approach combines quantitative data analysis with qualitative market intelligence to provide a complete understanding of market dynamics, competitive landscape, and future trends.

Primary research involves extensive interviews with industry executives, logistics service providers, client companies, and regulatory authorities. These discussions provide firsthand insights into market challenges, opportunities, operational practices, and strategic priorities that shape the industry’s evolution.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements. This comprehensive data collection ensures broad market coverage and validates primary research findings through multiple independent sources.

Market segmentation analysis examines the contract logistics market across multiple dimensions including service types, industry verticals, geographic regions, and company sizes. This detailed segmentation provides granular insights into market dynamics and growth opportunities within specific market segments.

Competitive intelligence gathering involves systematic analysis of major market participants, their service offerings, pricing strategies, geographic coverage, and strategic initiatives. This analysis provides insights into competitive positioning and market share dynamics across different segments.

Dubai emirate maintains its position as the dominant logistics hub, capturing approximately 55% of the total contract logistics market. The emirate benefits from world-class port facilities at Jebel Ali, Dubai International Airport, and extensive free zone developments that attract international businesses seeking regional distribution capabilities.

Abu Dhabi represents the second-largest market segment with approximately 25% market share, driven by government sector demand, oil and gas industry requirements, and growing manufacturing activities. The emirate’s focus on economic diversification and industrial development creates substantial opportunities for specialized logistics services.

Sharjah has emerged as an important logistics center, particularly for manufacturing and industrial activities, capturing roughly 12% of the market. The emirate’s strategic location, competitive costs, and industrial infrastructure make it attractive for companies seeking cost-effective logistics solutions with good connectivity.

Northern Emirates including Ras Al Khaimah, Fujairah, Ajman, and Umm Al Quwain collectively represent approximately 8% of the market. These emirates offer specialized advantages such as port facilities, industrial zones, and cost-effective operations that serve specific market segments and regional distribution requirements.

Free zones across all emirates play a crucial role in market development, providing specialized logistics facilities, regulatory advantages, and business-friendly environments that attract international companies. The concentration of businesses within free zones creates high-density demand for contract logistics services and specialized facilities.

Market leadership is distributed among several categories of providers, each bringing distinct capabilities and market positioning strategies:

Competitive strategies focus on technology differentiation, industry specialization, and geographic expansion. Leading providers invest heavily in automation, digital platforms, and specialized facilities to maintain competitive advantages and meet evolving client requirements.

Market consolidation trends indicate increasing merger and acquisition activity as companies seek to expand capabilities, geographic coverage, and market share. Strategic partnerships and joint ventures also play important roles in market development and service enhancement.

By Service Type:

By Industry Vertical:

By Technology Integration:

Warehousing and Distribution represents the largest market segment, driven by increasing demand for sophisticated storage solutions and omnichannel fulfillment capabilities. Modern warehouses incorporate advanced automation, climate control systems, and flexible layouts that can adapt to changing client requirements and seasonal fluctuations.

Transportation Management services have evolved beyond basic freight forwarding to include comprehensive logistics coordination, route optimization, and real-time tracking capabilities. The integration of digital platforms and predictive analytics enables providers to offer enhanced visibility and performance optimization.

E-commerce Fulfillment has emerged as a high-growth category, requiring specialized capabilities including rapid order processing, flexible packaging options, and last-mile delivery coordination. The segment demands significant technology investments and operational flexibility to meet consumer expectations for speed and accuracy.

Healthcare Logistics requires specialized expertise in temperature-controlled environments, regulatory compliance, and chain of custody procedures. The segment offers higher margins but demands substantial investments in specialized facilities, equipment, and trained personnel.

Automotive Logistics focuses on just-in-time delivery, parts management, and aftermarket services. The segment requires deep industry knowledge, specialized handling capabilities, and close integration with manufacturing and retail operations.

Cost Optimization represents the primary benefit for businesses partnering with contract logistics providers. Companies can reduce fixed costs, eliminate capital investments in facilities and equipment, and convert fixed logistics costs into variable expenses that scale with business volume.

Operational Excellence through specialized expertise and advanced technology enables businesses to achieve performance levels that would be difficult to attain independently. Contract logistics providers bring industry best practices, continuous improvement processes, and operational efficiency that enhance overall supply chain performance.

Scalability and Flexibility allow businesses to adapt quickly to market changes, seasonal fluctuations, and growth opportunities without significant infrastructure investments. Contract logistics providers offer flexible capacity, geographic expansion capabilities, and service modifications that support business agility.

Technology Access provides businesses with advanced logistics technologies, analytics capabilities, and digital platforms without substantial capital investments. Leading providers continuously upgrade their technology infrastructure, ensuring clients benefit from the latest innovations and operational improvements.

Risk Mitigation through professional logistics management reduces operational risks, regulatory compliance challenges, and supply chain disruptions. Experienced providers bring risk management expertise, insurance coverage, and contingency planning that protect business operations.

Market Access facilitation enables businesses to enter new markets, expand geographic reach, and serve customers more effectively through established logistics networks and local market expertise.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation Integration continues to reshape warehouse operations and logistics processes. Advanced robotics, automated storage and retrieval systems, and artificial intelligence applications are becoming standard features in modern logistics facilities, driving efficiency improvements of approximately 30% in leading operations.

Sustainability Initiatives have gained significant momentum as companies prioritize environmental responsibility and carbon footprint reduction. Green logistics practices, renewable energy adoption, and sustainable packaging solutions are increasingly important factors in provider selection and contract negotiations.

Omnichannel Integration reflects the evolving retail landscape where businesses require seamless coordination across online and offline channels. Contract logistics providers are developing specialized capabilities to support unified inventory management, flexible fulfillment options, and consistent customer experiences.

Data Analytics and predictive intelligence are transforming logistics operations through enhanced visibility, performance optimization, and proactive problem resolution. MWR research indicates that advanced analytics adoption has increased by 45% among leading providers over the past two years.

Collaborative Logistics models are emerging where multiple companies share resources, facilities, and transportation capacity to achieve cost efficiencies and environmental benefits. These collaborative approaches require sophisticated coordination and technology integration.

Last-Mile Innovation focuses on solving the final delivery challenge through drone technology, autonomous vehicles, and alternative delivery methods. Urban logistics solutions and sustainable last-mile options are becoming critical differentiators in the market.

Infrastructure Investments continue at unprecedented levels with major logistics parks, automated warehouses, and multimodal facilities under development across the UAE. These investments enhance capacity, capability, and competitiveness of the overall logistics ecosystem.

Technology Partnerships between logistics providers and technology companies are accelerating innovation and digital transformation. Strategic alliances enable faster deployment of advanced solutions and shared development of industry-specific applications.

Regulatory Enhancements include streamlined customs procedures, digital documentation systems, and improved trade facilitation measures that reduce operational complexity and enhance efficiency for contract logistics providers.

Sustainability Certifications and green building standards are becoming standard requirements for new logistics facilities. Environmental compliance and sustainability reporting are increasingly important factors in client selection and contract renewals.

Workforce Development initiatives include specialized training programs, certification courses, and partnerships with educational institutions to address talent shortages and develop skilled logistics professionals.

Market Consolidation through mergers, acquisitions, and strategic partnerships continues to reshape the competitive landscape. These developments create larger, more capable providers with enhanced service offerings and geographic coverage.

Technology Investment should remain a top priority for contract logistics providers seeking to maintain competitive advantages and meet evolving client expectations. Focus areas should include automation, data analytics, and digital customer interfaces that enhance operational efficiency and service quality.

Industry Specialization offers opportunities for differentiation and premium pricing in sectors such as healthcare, automotive, and e-commerce. Developing deep expertise, specialized facilities, and industry-specific capabilities can create sustainable competitive advantages.

Geographic Expansion within the GCC region and broader MENA markets should be considered by providers seeking growth opportunities and risk diversification. Regional networks and cross-border capabilities become increasingly valuable as trade integration advances.

Sustainability Integration should be embedded into operational strategies and service offerings to meet growing client demands for environmental responsibility. Green logistics capabilities can become significant differentiators and support premium pricing strategies.

Talent Development requires sustained investment in recruitment, training, and retention programs to address skill shortages and support business growth. Partnerships with educational institutions and professional development programs are essential for long-term success.

Client Partnership approaches should emphasize collaborative relationships, performance-based contracts, and shared value creation rather than traditional transactional service models. Deep client integration and strategic partnerships drive higher margins and longer-term relationships.

Market expansion prospects remain highly positive, supported by continued economic diversification, infrastructure development, and the UAE’s strategic positioning as a global logistics hub. The market is expected to benefit from major infrastructure projects, international events, and growing regional trade volumes.

Technology transformation will continue to reshape the industry through artificial intelligence, Internet of Things, and blockchain applications that enhance transparency, efficiency, and security. According to MarkWide Research projections, technology-enabled services will represent approximately 75% of market demand by 2028.

Service evolution toward more sophisticated, integrated solutions will drive market differentiation and value creation. Providers that can offer end-to-end supply chain management, industry-specific expertise, and technology-enabled services will capture premium market segments.

Sustainability requirements will become increasingly important as environmental regulations tighten and corporate sustainability commitments expand. Green logistics capabilities will transition from competitive advantages to market entry requirements.

Regional integration trends will create opportunities for providers with multi-country capabilities and cross-border expertise. The development of regional trade agreements and economic integration initiatives will drive demand for sophisticated logistics solutions.

Market maturation will lead to increased consolidation, specialization, and performance-based service models. Companies that can demonstrate measurable value creation and operational excellence will thrive in the evolving competitive landscape.

The UAE contract logistics market represents a dynamic and rapidly evolving sector that plays a crucial role in the country’s economic diversification and regional trade leadership. The market’s strong fundamentals, including strategic location, world-class infrastructure, and supportive business environment, provide a solid foundation for continued growth and development.

Technology integration and digital transformation continue to reshape the industry, creating opportunities for providers that can leverage advanced solutions to deliver superior performance and customer value. The emphasis on automation, data analytics, and sustainable operations will define competitive success in the evolving market landscape.

Future growth will be driven by economic diversification, e-commerce expansion, and the UAE’s continued development as a global logistics hub. Companies that can adapt to changing market conditions, invest in technology and talent, and develop specialized capabilities will be well-positioned to capitalize on emerging opportunities and achieve sustainable success in this dynamic market.

What is Contract Logistics?

Contract logistics refers to the outsourcing of logistics services to a third-party provider, which manages the entire supply chain process. This includes transportation, warehousing, and distribution, tailored to meet specific client needs.

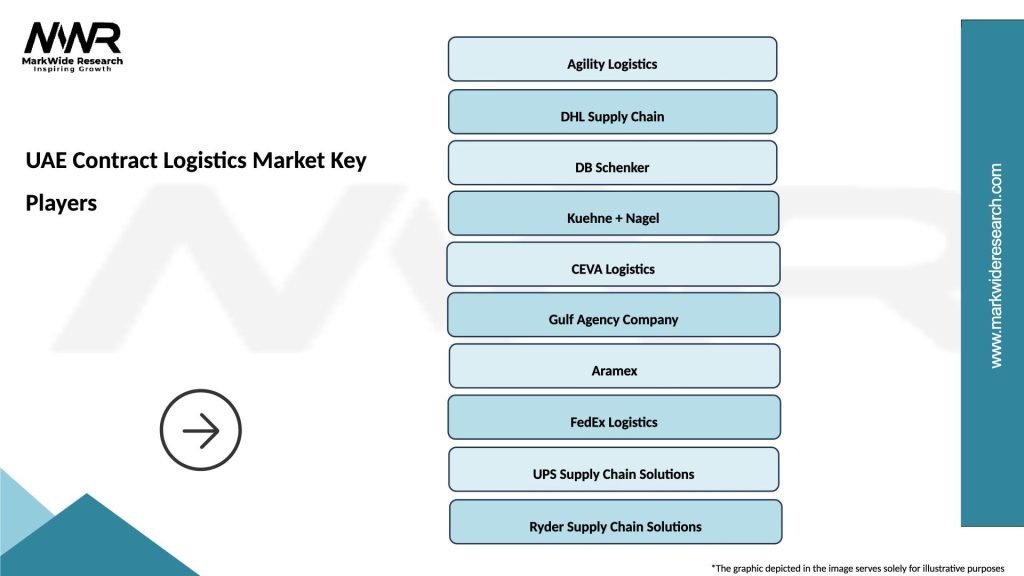

What are the key players in the UAE Contract Logistics Market?

Key players in the UAE Contract Logistics Market include Agility Logistics, DB Schenker, and Kuehne + Nagel, among others. These companies provide a range of services including freight forwarding, warehousing, and supply chain management.

What are the main drivers of growth in the UAE Contract Logistics Market?

The main drivers of growth in the UAE Contract Logistics Market include the increasing demand for e-commerce, the expansion of manufacturing sectors, and the need for efficient supply chain solutions. Additionally, the UAE’s strategic location as a logistics hub enhances its appeal.

What challenges does the UAE Contract Logistics Market face?

Challenges in the UAE Contract Logistics Market include regulatory compliance, fluctuating fuel prices, and the need for technological advancements. These factors can impact operational efficiency and cost management.

What opportunities exist in the UAE Contract Logistics Market?

Opportunities in the UAE Contract Logistics Market include the growth of the e-commerce sector, advancements in automation and technology, and the increasing focus on sustainability in logistics operations. These trends can lead to innovative service offerings.

What trends are shaping the UAE Contract Logistics Market?

Trends shaping the UAE Contract Logistics Market include the rise of digital logistics solutions, increased investment in green logistics practices, and the adoption of data analytics for supply chain optimization. These trends are transforming how logistics services are delivered.

UAE Contract Logistics Market

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Warehousing, Freight Forwarding, Value-Added Services |

| End User | Retail, E-commerce, Automotive OEMs, Pharmaceuticals |

| Technology | Warehouse Management Systems, Transportation Management Systems, IoT Solutions, Automation |

| Distribution Channel | Direct Sales, Online Platforms, Third-Party Logistics, Brokers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Contract Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at