444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The UAE container glass market has witnessed significant growth in recent years. Container glass refers to glass packaging used for various products, including beverages, food, pharmaceuticals, and cosmetics. It offers numerous advantages such as durability, transparency, and the ability to preserve the quality and freshness of products. The market in the UAE has been driven by factors such as the growing demand for packaged products, increasing urbanization, and the expanding food and beverage industry.

Meaning

Container glass, also known as glass packaging, refers to the use of glass materials for packaging various products. It is commonly used in the form of bottles, jars, and other containers for beverages, food, pharmaceuticals, and cosmetics. Container glass provides a transparent and durable packaging solution that helps in preserving the quality, taste, and freshness of the packaged products. It offers several advantages, including recyclability, non-reactivity, and the ability to maintain the integrity of the contents.

Executive Summary

The UAE container glass market has experienced robust growth due to factors such as the rising demand for packaged products, increasing disposable income, and the expanding food and beverage industry. The market is characterized by the presence of both domestic and international glass manufacturers. The key players in the market are focusing on product innovation, sustainable packaging solutions, and strategic collaborations to gain a competitive edge. The COVID-19 pandemic had a temporary impact on the market, but it is expected to recover as economic activities resume and consumer confidence improves.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The UAE container glass market is driven by various dynamic factors, including changing consumer preferences, industry trends, technological advancements, and regulatory initiatives. These dynamics influence the market growth, competition, and opportunities for industry players. Understanding the market dynamics is crucial for glass manufacturers, suppliers, and stakeholders to make informed decisions and stay competitive in the market.

Regional Analysis

The UAE container glass market is divided into different regions, including Dubai, Abu Dhabi, Sharjah, and others. These regions serve as key hubs for manufacturing, trade, and consumption of glass-packaged products. Dubai, being a major international business and tourism hub, has witnessed significant growth in the container glass market due to the presence of a large number of hotels, restaurants, and retail outlets. Abu Dhabi, the capital city, has also experienced a surge in demand for container glass, driven by its expanding hospitality and retail sectors. Sharjah and other regions contribute to the overall growth of the market by accommodating manufacturing facilities and catering to local and regional demand.

Competitive Landscape

Leading Companies in the UAE Container Glass Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

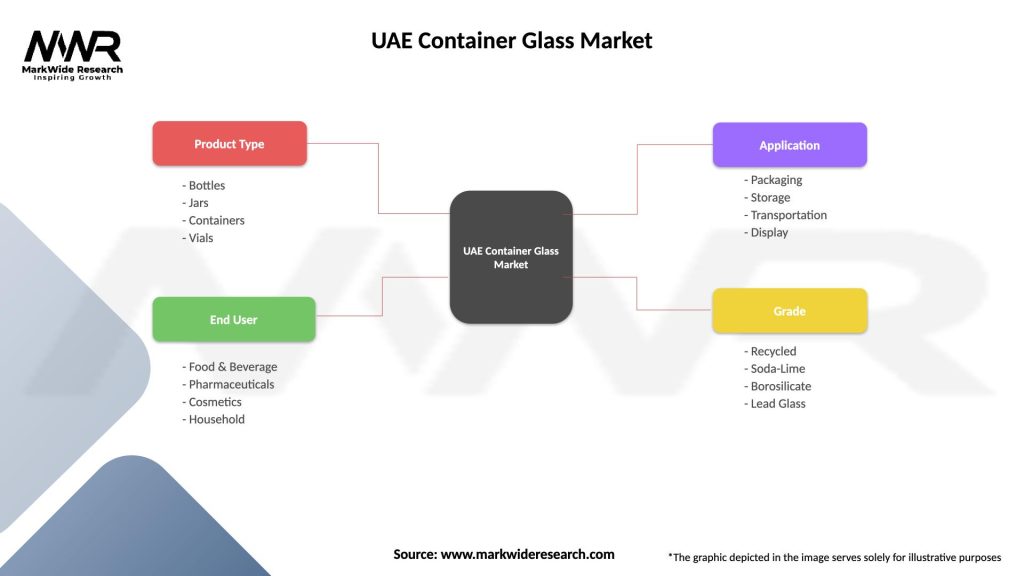

Segmentation

The UAE container glass market can be segmented based on the following factors:

Segmentation allows a better understanding of the market dynamics and helps manufacturers target specific customer segments. It enables them to tailor their products, marketing strategies, and distribution channels accordingly.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The UAE container glass market offers several benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT analysis of the UAE container glass market provides insights into its strengths, weaknesses, opportunities, and threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a temporary impact on the UAE container glass market, primarily due to disruptions in the supply chain and a decline in consumer demand. The initial lockdown measures and restrictions on economic activities affected the production, distribution, and consumption of glass-packaged products. However, as the situation improved and restrictions were lifted, the market witnessed a gradual recovery.

During the pandemic, there was an increased focus on hygiene and safety, leading to a surge in the demand for packaged products, including those packaged in glass containers. Glass packaging offers advantages such as non-reactivity and a protective barrier against external factors, which appealed to consumers seeking safe and reliable packaging solutions. The market also witnessed an acceleration in the adoption of sustainable packaging practices, including glass packaging, as consumers became more conscious of the environmental impact of their choices.

Glass manufacturers and suppliers implemented various measures to ensure business continuity and meet the changing market demands. These measures included implementing strict hygiene and safety protocols in manufacturing facilities, optimizing the supply chain, and adapting to e-commerce channels for product distribution. As economic activities gradually resumed and consumer confidence improved, the market started to recover, and the demand for container glass increased.

Key Industry Developments

The UAE container glass market has witnessed several key industry developments, including:

Analyst Suggestions

Based on market trends and insights, analysts suggest the following strategies for industry participants in the UAE container glass market:

Future Outlook

The future outlook for the UAE container glass market is positive, with several factors driving its growth. The market is expected to witness steady expansion due to the increasing demand for packaged products, the growth of the food and beverage industry, and the focus on sustainable packaging solutions. Technological advancements in glass manufacturing processes will continue to drive innovation, improve product quality, and address the fragility and transportation challenges associated with glass packaging.

The market is likely to witness increased competition from alternative packaging materials, but the unique properties of glass, such as transparency, non-reactivity, and sustainability, will help maintain its relevance and demand. The expanding pharmaceutical and cosmetics industries, along with the growing e-commerce sector, present significant opportunities for glass manufacturers to diversify their customer base and cater to specialized packaging needs.

Analysts predict that the UAE container glass market will experience a positive growth trajectory in the coming years, supported by factors such as favorable government policies, economic stability, and consumer preferences for premium and sustainable products. To capitalize on these opportunities, industry participants should focus on innovation, sustainability, market expansion, and digital transformation to stay competitive and meet the evolving demands of the market.

Conclusion

The UAE container glass market has experienced significant growth driven by factors such as the increasing demand for packaged products, expansion of the food and beverage industry, and the focus on sustainable packaging solutions. Glass containers offer numerous advantages such as transparency, non-reactivity, and recyclability, making them an ideal choice for various industries.

While the market faces challenges such as competition from alternative packaging materials and transportation concerns, it also presents several opportunities such as the growing demand for premium alcoholic beverages, increasing focus on sustainability, and technological advancements in glass manufacturing processes.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

What are the key players in the UAE Container Glass Market?

Key players in the UAE Container Glass Market include Emirates Glass LLC, Al Hamra Glass, and Dubai Glass among others. These companies are involved in the production and supply of various container glass products for different industries.

What are the growth factors driving the UAE Container Glass Market?

The growth of the UAE Container Glass Market is driven by increasing demand for sustainable packaging solutions, the rise in the beverage industry, and the growing trend of eco-friendly products. Additionally, the expansion of the food and pharmaceutical sectors contributes to market growth.

What challenges does the UAE Container Glass Market face?

The UAE Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials, and fluctuations in raw material prices. These factors can impact profitability and market stability.

What opportunities exist in the UAE Container Glass Market?

Opportunities in the UAE Container Glass Market include the increasing focus on recycling and sustainability, innovations in glass manufacturing technologies, and the expansion of e-commerce, which drives demand for packaging solutions. These trends can lead to new product developments and market expansion.

What trends are shaping the UAE Container Glass Market?

Trends shaping the UAE Container Glass Market include the growing preference for lightweight glass containers, advancements in glass design and functionality, and the rising consumer awareness regarding environmental sustainability. These trends are influencing product offerings and market strategies.

UAE Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Containers, Vials |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Application | Packaging, Storage, Transportation, Display |

| Grade | Recycled, Soda-Lime, Borosilicate, Lead Glass |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the UAE Container Glass Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at