444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE consumer electronics market represents one of the most dynamic and rapidly evolving technology sectors in the Middle East region. Market dynamics indicate substantial growth driven by increasing digitalization, rising disposable incomes, and a tech-savvy population that embraces innovative electronic solutions. The market encompasses a comprehensive range of products including smartphones, laptops, tablets, gaming consoles, smart home devices, wearables, and entertainment systems.

Consumer behavior patterns in the UAE demonstrate a strong preference for premium and cutting-edge technology products, with adoption rates significantly higher than regional averages. The market benefits from the country’s strategic position as a regional hub for technology distribution and its progressive digital transformation initiatives. Growth projections suggest the market will expand at a robust 8.2% CAGR over the forecast period, driven by increasing smartphone penetration and smart home technology adoption.

Infrastructure development and government initiatives supporting digital economy growth have created favorable conditions for consumer electronics expansion. The UAE’s position as a major tourist destination and business hub further amplifies demand for various electronic devices and accessories.

The UAE consumer electronics market refers to the comprehensive ecosystem of electronic devices and gadgets designed for personal and household use within the United Arab Emirates. This market encompasses traditional electronics such as televisions, audio systems, and home appliances, alongside modern digital devices including smartphones, tablets, laptops, gaming equipment, and emerging technologies like smart home automation systems and wearable devices.

Market scope includes both imported and locally distributed products across various price segments, from budget-friendly options to premium luxury electronics. The definition extends to accessories, peripherals, and complementary products that enhance the functionality of primary electronic devices. Consumer electronics in the UAE context also encompasses the retail infrastructure, distribution networks, and service ecosystems that support product sales and customer satisfaction.

Strategic analysis reveals that the UAE consumer electronics market demonstrates exceptional resilience and growth potential, positioning itself as a regional leader in technology adoption and innovation. The market benefits from a unique combination of high purchasing power, government support for digital transformation, and a culturally diverse population with varying technology preferences and requirements.

Key performance indicators show smartphone penetration rates reaching 91% of the population, while smart home device adoption has grown by 34% annually. The market’s strength lies in its ability to quickly adopt emerging technologies and serve as a testing ground for new product launches targeting the broader Middle East region.

Competitive landscape features a mix of global technology giants, regional distributors, and local retailers, creating a dynamic ecosystem that benefits consumers through competitive pricing and extensive product variety. E-commerce platforms have gained significant traction, accounting for an increasing share of total electronics sales and reshaping traditional retail models.

Market intelligence reveals several critical insights that define the UAE consumer electronics landscape:

Economic prosperity stands as the primary driver of UAE consumer electronics market growth, with high per capita income levels enabling consumers to invest in premium technology products. The country’s strategic focus on becoming a knowledge-based economy has created an environment where technology adoption is not just encouraged but essential for participation in modern society.

Digital transformation initiatives launched by the UAE government, including smart city projects and digital government services, have accelerated consumer demand for compatible electronic devices. These initiatives create a ripple effect where consumers need updated technology to access services and participate fully in the digital ecosystem.

Tourism and expatriate population contribute significantly to market demand, with visitors and residents from diverse backgrounds bringing varied technology preferences and requirements. The constant influx of international visitors creates sustained demand for electronics, particularly mobile devices, cameras, and travel-friendly gadgets.

Infrastructure development including widespread 5G network deployment and fiber optic connectivity has created the foundation for advanced electronics adoption. Consumers are increasingly investing in devices capable of leveraging these infrastructure improvements for enhanced performance and functionality.

Price sensitivity among certain consumer segments poses challenges for market expansion, particularly in the mid-range and budget categories where competition is intense and margins are compressed. Economic fluctuations and changing oil prices can impact consumer spending patterns, affecting electronics purchases that are often considered discretionary.

Rapid technological obsolescence creates consumer hesitation in making significant electronics investments, as buyers may delay purchases anticipating newer, better, or cheaper alternatives. This phenomenon particularly affects categories like laptops, tablets, and gaming consoles where upgrade cycles are becoming shorter.

Import dependency exposes the market to currency fluctuations, supply chain disruptions, and international trade tensions that can affect product availability and pricing. The majority of consumer electronics are manufactured outside the UAE, making the market vulnerable to global supply chain challenges.

Regulatory compliance requirements and certification processes can delay product launches and increase costs for manufacturers and distributors. Evolving regulations regarding data privacy, electromagnetic compatibility, and energy efficiency require ongoing adaptation from market participants.

Emerging technologies present substantial opportunities for market expansion, particularly in areas such as artificial intelligence, augmented reality, virtual reality, and Internet of Things applications. Early adoption of these technologies in the UAE market can establish competitive advantages and drive premium pricing strategies.

Smart city initiatives create demand for integrated electronic solutions that support urban living, including smart home systems, connected vehicles, and personal mobility devices. The UAE’s commitment to becoming a global smart city leader opens opportunities for innovative electronics manufacturers and solution providers.

E-commerce growth offers new channels for reaching consumers and expanding market reach beyond traditional retail limitations. Online platforms enable smaller brands to compete effectively and provide consumers with greater product variety and competitive pricing options.

Sustainability trends create opportunities for manufacturers focusing on energy-efficient, recyclable, and environmentally responsible electronics. Growing consumer awareness of environmental issues drives demand for products that align with sustainability values while maintaining performance standards.

Supply chain evolution continues to reshape the UAE consumer electronics market, with companies adapting to post-pandemic realities and geopolitical changes affecting global trade patterns. MarkWide Research analysis indicates that supply chain resilience has become a critical factor in maintaining market position and customer satisfaction.

Consumer behavior shifts toward online research and purchasing have accelerated digital transformation across the retail sector. Traditional electronics retailers are investing heavily in omnichannel capabilities to meet evolving customer expectations for seamless shopping experiences across multiple touchpoints.

Technology convergence is blurring traditional product category boundaries, with smartphones incorporating advanced camera capabilities, tablets serving as laptop replacements, and smart speakers evolving into comprehensive home automation hubs. This convergence creates both opportunities and challenges for manufacturers and retailers.

Price competition intensifies as global brands compete for market share, while local retailers leverage their understanding of consumer preferences and service capabilities to differentiate their offerings. The balance between price competitiveness and value-added services continues to evolve.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes consumer surveys, retailer interviews, and industry expert consultations to gather firsthand insights into market trends, consumer preferences, and competitive dynamics.

Secondary research encompasses analysis of government statistics, industry reports, company financial statements, and trade association data to validate primary findings and provide broader market context. This approach ensures comprehensive coverage of all market segments and stakeholder perspectives.

Data triangulation methods verify information accuracy by cross-referencing multiple sources and identifying consistent patterns across different data sets. Statistical analysis techniques help identify significant trends and project future market developments with confidence intervals.

Market modeling incorporates economic indicators, demographic trends, and technology adoption patterns to forecast market growth and segment performance. Regular model updates ensure projections remain relevant as market conditions evolve.

Dubai emirate dominates the UAE consumer electronics market, accounting for approximately 45% of total market activity due to its status as a commercial hub, tourist destination, and home to the largest expatriate population. The emirate’s advanced retail infrastructure and high concentration of electronics retailers create a competitive environment that benefits consumers.

Abu Dhabi represents the second-largest market segment with 28% market share, driven by government sector demand, oil industry professionals, and growing tourism sector. The capital’s focus on smart city development and digital government services creates sustained demand for advanced electronics.

Sharjah and Northern Emirates collectively account for 27% of market activity, with growing middle-class populations and increasing retail infrastructure development. These regions show strong growth potential as economic diversification efforts create new employment opportunities and increase disposable incomes.

Regional distribution patterns reflect the UAE’s urban concentration, with major cities serving as primary markets while smaller towns and rural areas represent emerging opportunities for market expansion through improved retail coverage and e-commerce penetration.

Market leadership is distributed among several key categories of players, each bringing distinct advantages and market approaches:

Competitive strategies focus on product differentiation, pricing optimization, distribution network expansion, and customer service excellence. Companies are increasingly investing in local partnerships and customized product offerings to better serve UAE market preferences.

Product category segmentation reveals distinct market dynamics across different electronics segments:

By Product Type:

By Price Range:

By Distribution Channel:

Smartphone category demonstrates the highest growth velocity with 12% annual growth driven by 5G adoption, camera technology improvements, and frequent model updates. Consumer preference for premium brands remains strong, with flagship models commanding significant market share despite higher prices.

Smart home devices represent the fastest-growing segment with increasing consumer interest in home automation, security systems, and energy management solutions. Integration capabilities and voice control features are becoming standard expectations rather than premium features.

Gaming electronics show robust growth among younger demographics, with console sales, gaming accessories, and streaming equipment experiencing sustained demand. The rise of esports and gaming content creation drives demand for professional-grade equipment.

Wearable technology adoption accelerates as health consciousness increases and device capabilities expand beyond basic fitness tracking to comprehensive health monitoring and communication features. Integration with healthcare systems and insurance programs creates additional value propositions.

Computing devices market evolves toward portable, high-performance solutions that support remote work, content creation, and entertainment needs. Hybrid work models drive demand for versatile devices that perform well in various environments.

Manufacturers benefit from the UAE’s strategic location as a regional distribution hub, enabling efficient market access across the GCC region. The country’s advanced logistics infrastructure and free trade zones provide cost-effective operations and streamlined supply chain management.

Retailers gain advantages from high consumer purchasing power, diverse market segments, and growing e-commerce adoption that expands customer reach beyond physical store limitations. The competitive environment drives innovation in customer service and retail experience.

Consumers enjoy access to the latest technology products, competitive pricing due to market competition, and comprehensive after-sales support from established service networks. The market’s maturity ensures product availability and reliable warranty services.

Government stakeholders benefit from technology sector contribution to economic diversification, job creation, and digital transformation objectives. The electronics market supports broader smart city initiatives and digital government service delivery.

Service providers find opportunities in device maintenance, technical support, installation services, and training programs that help consumers maximize their electronics investments. Extended warranty and insurance services create additional revenue streams.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence integration emerges as a dominant trend across all electronics categories, with consumers increasingly expecting AI-powered features in smartphones, home appliances, and entertainment systems. This trend drives premium pricing and creates differentiation opportunities for manufacturers.

Sustainability consciousness influences purchasing decisions as consumers become more aware of environmental impact. Electronics manufacturers respond with energy-efficient designs, recyclable materials, and take-back programs that appeal to environmentally conscious buyers.

5G technology adoption accelerates across the UAE, creating demand for compatible devices and enabling new applications in augmented reality, cloud gaming, and IoT connectivity. Network infrastructure improvements drive consumer electronics upgrades to leverage enhanced capabilities.

Health and wellness focus drives growth in wearable devices, health monitoring equipment, and fitness-related electronics. The COVID-19 pandemic has heightened awareness of health technology benefits, creating sustained demand for relevant products.

Remote work normalization continues to influence electronics purchasing patterns, with increased demand for home office equipment, video conferencing tools, and productivity-enhancing devices. This trend reshapes traditional consumer electronics categories and usage patterns.

Major retail expansions have transformed the UAE electronics landscape, with international chains establishing flagship stores and local retailers upgrading their facilities to compete effectively. These developments improve consumer access to products and services while intensifying market competition.

E-commerce platform investments by both global and regional players have revolutionized electronics retail, offering consumers greater convenience, competitive pricing, and expanded product selection. Mobile commerce growth particularly impacts younger consumer segments.

Technology partnerships between manufacturers, retailers, and service providers create integrated ecosystems that enhance customer experience and loyalty. These collaborations often result in exclusive product launches and customized solutions for the UAE market.

Regulatory framework updates address emerging technologies, data privacy concerns, and consumer protection requirements. New regulations shape market dynamics and require industry adaptation to maintain compliance while serving customer needs effectively.

Innovation centers and research facilities established by major technology companies in the UAE demonstrate long-term commitment to the market and create opportunities for localized product development and testing.

Market participants should focus on omnichannel retail strategies that seamlessly integrate online and offline customer experiences. MWR analysis suggests that companies investing in unified commerce platforms will gain competitive advantages in customer acquisition and retention.

Product portfolio diversification across price segments enables companies to capture broader market opportunities while maintaining premium positioning in key categories. Balanced portfolios help mitigate risks associated with economic fluctuations and changing consumer preferences.

Local partnership development with UAE-based distributors, retailers, and service providers creates market advantages through better customer understanding, efficient distribution, and enhanced after-sales support capabilities.

Sustainability initiatives should be integrated into product development, packaging, and operations to align with growing consumer environmental consciousness. Companies demonstrating genuine commitment to sustainability will differentiate themselves in competitive markets.

Technology innovation focus on emerging areas such as AI, IoT, and 5G applications positions companies for future growth opportunities. Early investment in these technologies creates competitive moats and premium pricing potential.

Long-term growth prospects for the UAE consumer electronics market remain positive, supported by continued economic development, population growth, and technology advancement. The market is expected to maintain robust growth rates of 7.5% annually over the next five years, driven by emerging technology adoption and infrastructure improvements.

Technology evolution will continue reshaping product categories and consumer expectations, with artificial intelligence, augmented reality, and Internet of Things becoming standard features rather than premium additions. This evolution creates opportunities for early adopters while challenging companies that fail to innovate.

Market maturation in traditional categories will drive companies toward value-added services, customization, and ecosystem integration to maintain growth and profitability. Service-based revenue models will become increasingly important as hardware commoditization continues.

Regional expansion opportunities position the UAE as a launching pad for broader Middle East and Africa market penetration. Companies establishing strong UAE presence can leverage this foundation for regional growth strategies and market development initiatives.

Digital transformation acceleration across all sectors of the UAE economy will sustain demand for advanced electronics and create new market segments. Government smart city initiatives and private sector digitalization efforts provide long-term growth drivers for the electronics market.

The UAE consumer electronics market stands as a testament to the country’s successful economic diversification and digital transformation journey. With strong fundamentals including high purchasing power, advanced infrastructure, and government support for technology adoption, the market is well-positioned for continued growth and innovation.

Strategic opportunities abound for companies that can effectively navigate the competitive landscape while meeting evolving consumer expectations for quality, innovation, and value. The market’s role as a regional hub creates additional advantages for businesses seeking broader Middle East market access and growth opportunities.

Future success in the UAE consumer electronics market will depend on companies’ ability to adapt to changing consumer behaviors, embrace emerging technologies, and deliver integrated solutions that enhance customer experiences. As the market continues evolving, those organizations that prioritize innovation, sustainability, and customer-centricity will capture the greatest share of growth opportunities in this dynamic and promising market.

What is Consumer Electronics?

Consumer electronics refer to electronic devices intended for everyday use, typically in private homes. This includes products such as smartphones, televisions, and home appliances that enhance consumer convenience and entertainment.

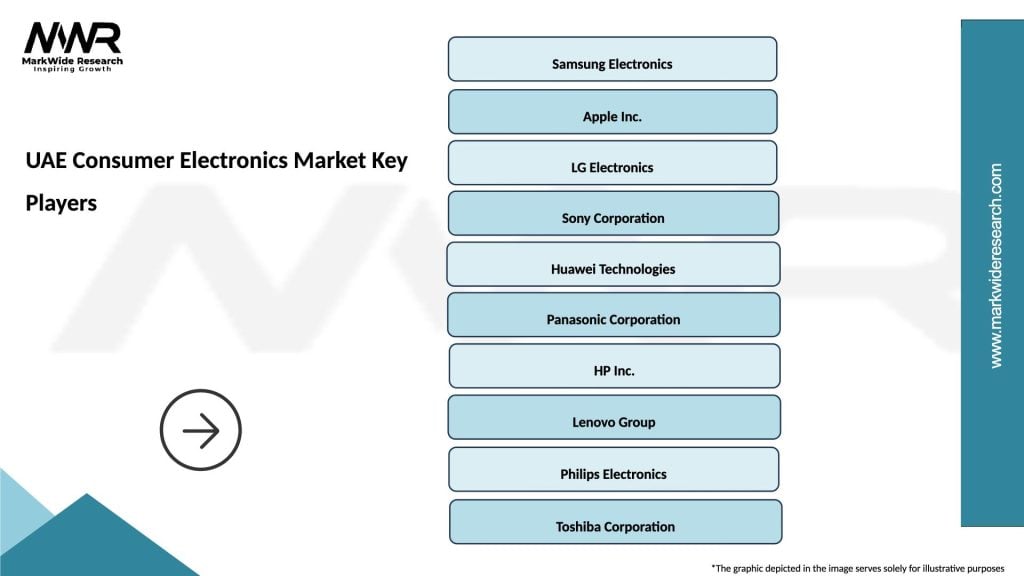

What are the key players in the UAE Consumer Electronics Market?

Key players in the UAE Consumer Electronics Market include Samsung, LG, and Sony, which are known for their innovative products and strong market presence. Other notable companies include Huawei and Apple, among others.

What are the main drivers of growth in the UAE Consumer Electronics Market?

The main drivers of growth in the UAE Consumer Electronics Market include increasing disposable income, a growing population, and rising demand for smart home devices. Additionally, advancements in technology and consumer preferences for high-quality electronics contribute to market expansion.

What challenges does the UAE Consumer Electronics Market face?

The UAE Consumer Electronics Market faces challenges such as intense competition, rapid technological changes, and fluctuating consumer preferences. Additionally, economic factors and supply chain disruptions can impact market stability.

What opportunities exist in the UAE Consumer Electronics Market?

Opportunities in the UAE Consumer Electronics Market include the growing trend of smart home technology and the increasing adoption of wearable devices. Furthermore, the rise of e-commerce presents new avenues for reaching consumers.

What trends are shaping the UAE Consumer Electronics Market?

Trends shaping the UAE Consumer Electronics Market include the shift towards sustainable and energy-efficient products, the integration of artificial intelligence in devices, and the increasing popularity of online shopping. These trends reflect changing consumer behaviors and technological advancements.

UAE Consumer Electronics Market

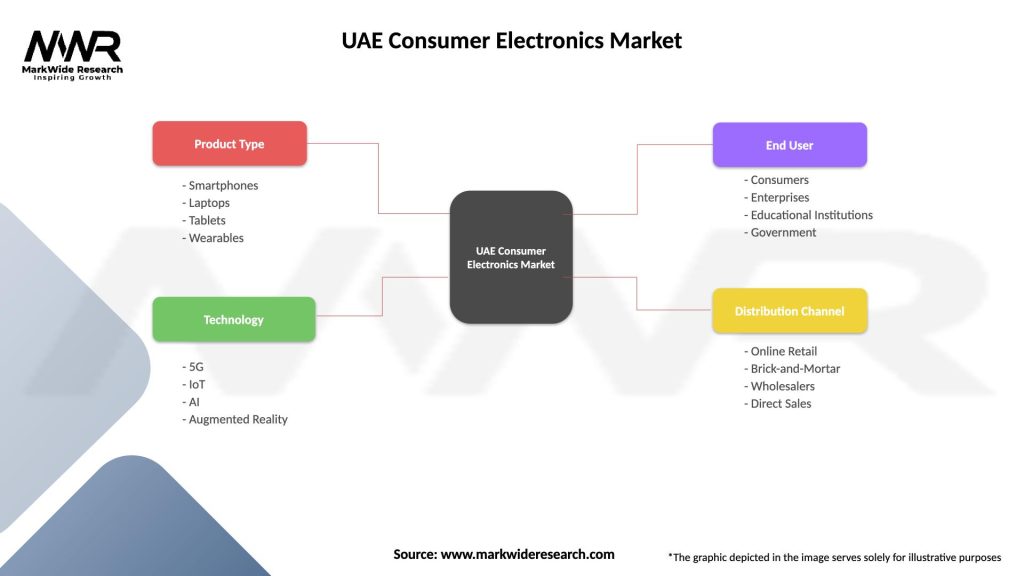

| Segmentation Details | Description |

|---|---|

| Product Type | Smartphones, Laptops, Tablets, Wearables |

| Technology | 5G, IoT, AI, Augmented Reality |

| End User | Consumers, Enterprises, Educational Institutions, Government |

| Distribution Channel | Online Retail, Brick-and-Mortar, Wholesalers, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Consumer Electronics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at