444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE construction waste management market represents a rapidly evolving sector driven by the nation’s ambitious infrastructure development projects and increasing environmental consciousness. As the UAE continues its transformation into a global hub for business and tourism, the construction industry generates substantial volumes of waste that require sophisticated management solutions. Construction waste management has emerged as a critical component of sustainable development, with the market experiencing robust growth at a CAGR of 8.2% over the forecast period.

Dubai and Abu Dhabi lead the regional demand for advanced waste management solutions, particularly as mega-projects like Expo 2020 legacy developments and Vision 2071 initiatives continue to shape the urban landscape. The market encompasses various waste streams including concrete debris, steel scrap, wood waste, gypsum, and mixed construction materials. Recycling and recovery operations have gained significant traction, with approximately 45% of construction waste now being diverted from landfills through innovative processing technologies.

Government initiatives and regulatory frameworks have accelerated market growth, with the UAE implementing stringent waste management policies that mandate recycling quotas for construction projects. The integration of circular economy principles has transformed traditional waste disposal approaches, creating opportunities for specialized service providers and technology innovators in the construction waste management ecosystem.

The UAE construction waste management market refers to the comprehensive ecosystem of services, technologies, and infrastructure dedicated to the collection, processing, recycling, and disposal of waste materials generated from construction, renovation, and demolition activities across the United Arab Emirates. This market encompasses various stakeholders including waste collection companies, recycling facilities, equipment manufacturers, and regulatory bodies working together to minimize environmental impact while maximizing resource recovery.

Construction waste management involves systematic approaches to handle diverse material streams such as concrete, asphalt, metals, wood, plastics, and hazardous substances generated during building activities. The market includes specialized services like on-site sorting, transportation logistics, material recovery facilities, and advanced processing technologies that convert waste into reusable construction materials or alternative products.

Sustainable practices within this market focus on waste hierarchy principles including prevention, reduction, reuse, recycling, and responsible disposal. The UAE’s construction waste management market has evolved to incorporate innovative technologies such as mobile crushing units, automated sorting systems, and digital tracking platforms that enhance operational efficiency while supporting environmental compliance requirements.

Market dynamics in the UAE construction waste management sector reflect the nation’s commitment to sustainable development and circular economy principles. The market has experienced significant transformation driven by regulatory mandates, technological innovations, and increasing awareness of environmental stewardship among construction industry stakeholders. Waste diversion rates have improved substantially, with current recycling efficiency reaching approximately 52% of total construction waste generated across major emirates.

Key growth drivers include ongoing infrastructure development projects, implementation of green building standards, and government initiatives promoting waste reduction. The market benefits from substantial investments in processing infrastructure, with new material recovery facilities and recycling plants enhancing regional capacity. Digital transformation has emerged as a critical trend, with IoT-enabled tracking systems and AI-powered sorting technologies improving operational efficiency by 35% on average.

Competitive landscape features a mix of international waste management companies, regional service providers, and specialized technology vendors. Market consolidation trends have created opportunities for strategic partnerships and acquisitions, particularly as companies seek to expand their service portfolios and geographic coverage. Innovation focus areas include advanced material recovery technologies, sustainable transportation solutions, and integrated waste management platforms that provide end-to-end visibility across the waste management value chain.

Strategic insights reveal several critical factors shaping the UAE construction waste management market landscape. The following key insights provide comprehensive understanding of market dynamics and growth opportunities:

Government initiatives serve as the primary catalyst for UAE construction waste management market growth, with comprehensive regulatory frameworks mandating sustainable waste management practices across all construction projects. The UAE’s commitment to achieving zero waste to landfill targets by 2030 has created substantial demand for innovative waste processing and recycling solutions. Policy enforcement mechanisms ensure compliance with waste diversion requirements, driving consistent market expansion.

Infrastructure development projects continue to generate significant waste volumes, creating sustained demand for professional waste management services. Major initiatives including smart city developments, transportation networks, and hospitality projects require sophisticated waste handling capabilities. Construction activity levels remain robust, with ongoing projects maintaining steady waste generation that supports market growth and service provider expansion.

Environmental awareness among construction industry stakeholders has increased dramatically, with companies recognizing the importance of sustainable practices for brand reputation and regulatory compliance. Corporate sustainability commitments drive demand for comprehensive waste management solutions that demonstrate environmental stewardship. Green building certifications require documented waste management performance, further accelerating market adoption of professional services and advanced technologies.

Economic incentives including tax benefits, reduced disposal fees, and material cost savings through recycling have improved the financial attractiveness of comprehensive waste management programs. Resource scarcity concerns and rising raw material costs have made waste-derived construction materials increasingly valuable, creating additional revenue opportunities for waste management service providers.

High capital requirements for establishing advanced waste processing facilities present significant barriers to market entry, particularly for smaller service providers seeking to expand their capabilities. Infrastructure investment needs including specialized equipment, processing facilities, and transportation assets require substantial financial resources that may limit market participation. Technology costs associated with automated sorting systems and digital tracking platforms can strain operational budgets for emerging companies.

Regulatory complexity and evolving compliance requirements create operational challenges for waste management service providers, requiring continuous investment in training, certification, and system updates. Permitting processes for new facilities and service expansions can be lengthy and complex, potentially delaying market entry or capacity expansion initiatives. Quality standards and environmental regulations require ongoing compliance monitoring and reporting capabilities.

Market fragmentation and intense competition have pressured profit margins, particularly in commodity recycling segments where pricing volatility affects revenue stability. Economic fluctuations in construction activity can impact waste generation volumes, creating revenue uncertainty for service providers. Skilled labor shortages in specialized waste management operations limit operational efficiency and service quality capabilities.

Transportation logistics challenges including traffic congestion, fuel costs, and route optimization complexities increase operational expenses and service delivery timeframes. Geographic constraints and limited processing facility locations can create service gaps in certain regions, affecting market coverage and customer accessibility.

Circular economy initiatives present substantial growth opportunities for innovative waste management companies capable of developing advanced material recovery and reprocessing capabilities. Resource recovery technologies that convert construction waste into high-value construction materials or alternative products offer significant revenue potential. Partnership opportunities with construction companies, material suppliers, and government agencies can create integrated service models that enhance market positioning.

Digital transformation initiatives including IoT integration, AI-powered analytics, and blockchain tracking systems offer opportunities to differentiate service offerings and improve operational efficiency. Smart waste management platforms that provide real-time monitoring, predictive analytics, and automated reporting capabilities can command premium pricing and enhance customer retention. Data monetization opportunities through waste generation insights and material flow analytics represent emerging revenue streams.

Export opportunities for processed construction materials and recycled products can expand market reach beyond domestic demand, particularly as regional countries seek sustainable construction materials. Technology licensing and consulting services for waste management system implementation in other markets offer scalable growth opportunities. Green financing availability for sustainable waste management projects provides access to favorable funding terms for expansion initiatives.

Specialized services including hazardous waste management, contaminated soil remediation, and historic building demolition waste handling offer high-margin opportunities for companies with specialized capabilities. Value-added services such as sustainability consulting, environmental impact assessment, and carbon footprint reporting can enhance service portfolios and customer relationships.

Supply and demand dynamics in the UAE construction waste management market reflect the interplay between construction activity levels, regulatory requirements, and processing capacity availability. Demand patterns show seasonal variations aligned with construction project timelines, with peak activity periods generating higher waste volumes that stress processing infrastructure. Capacity utilization rates across processing facilities average approximately 78%, indicating healthy demand levels while maintaining operational flexibility.

Pricing mechanisms vary significantly across different waste streams, with high-value materials like metals and concrete commanding premium processing fees while mixed waste streams face competitive pricing pressure. Service differentiation through quality certifications, environmental compliance, and value-added services enables premium pricing strategies. Contract structures increasingly favor long-term partnerships that provide revenue stability for service providers while ensuring reliable service delivery for customers.

Technology adoption rates continue accelerating, with approximately 65% of major service providers implementing digital tracking and monitoring systems to enhance operational visibility and customer reporting capabilities. Innovation cycles in processing equipment and sorting technologies drive continuous improvement in recovery rates and operational efficiency. Integration trends toward comprehensive service offerings that span collection, processing, and material sales create competitive advantages for full-service providers.

Market maturation indicators include consolidation activities, standardization of service offerings, and increasing focus on operational efficiency rather than pure capacity expansion. Customer sophistication levels have increased substantially, with construction companies demanding detailed reporting, sustainability metrics, and integrated service solutions that support their environmental objectives.

Primary research methodologies employed in analyzing the UAE construction waste management market include comprehensive interviews with industry stakeholders, service providers, regulatory officials, and technology vendors. Data collection processes encompass structured surveys, focus group discussions, and expert consultations to gather qualitative insights and quantitative metrics. Field research activities include facility visits, operational assessments, and technology demonstrations to validate market dynamics and performance capabilities.

Secondary research sources include government publications, industry reports, regulatory filings, and academic studies that provide historical context and market trend analysis. Data validation processes involve cross-referencing multiple sources, statistical analysis, and expert review to ensure accuracy and reliability of market insights. Quantitative analysis techniques include market sizing calculations, growth rate projections, and competitive positioning assessments.

Market segmentation analysis employs both top-down and bottom-up approaches to identify service categories, customer segments, and geographic markets. Trend analysis methodologies include time-series data evaluation, correlation analysis, and predictive modeling to identify emerging opportunities and market dynamics. Competitive intelligence gathering includes company profiling, service portfolio analysis, and strategic initiative tracking.

Quality assurance measures include peer review processes, data triangulation methods, and continuous validation against market developments. MarkWide Research analytical frameworks ensure comprehensive coverage of market dimensions while maintaining objectivity and analytical rigor throughout the research process.

Dubai emirate dominates the UAE construction waste management market, accounting for approximately 42% of total market activity due to its extensive construction projects, tourism infrastructure, and commercial developments. Service infrastructure in Dubai includes multiple processing facilities, advanced recycling plants, and comprehensive collection networks that support high-volume waste management requirements. Regulatory enforcement in Dubai has been particularly stringent, driving rapid adoption of professional waste management services across construction projects.

Abu Dhabi represents the second-largest regional market, contributing approximately 35% of market share through major infrastructure projects, government facilities, and industrial developments. Government initiatives in Abu Dhabi include substantial investments in waste processing infrastructure and technology development programs. Strategic projects such as Masdar City and various Vision 2030 initiatives have created sustained demand for advanced waste management solutions.

Sharjah and Northern Emirates collectively account for approximately 23% of market activity, with growing industrial developments and residential construction projects driving demand for waste management services. Service availability in these regions has expanded significantly, with major service providers establishing satellite operations and processing capabilities. Cross-emirate coordination initiatives have improved waste transportation efficiency and processing capacity utilization.

Market integration across emirates has increased through standardized service offerings, shared processing facilities, and coordinated regulatory frameworks. Transportation networks enable efficient waste movement between generation sites and processing facilities, optimizing operational efficiency and cost-effectiveness. Regional specialization has emerged, with certain emirates focusing on specific waste streams or processing technologies based on local infrastructure and market conditions.

Market leadership in the UAE construction waste management sector is characterized by a mix of international companies, regional specialists, and technology-focused service providers. The competitive environment emphasizes service quality, environmental compliance, and technological innovation as key differentiating factors.

Competitive strategies include vertical integration, technology development, strategic partnerships, and geographic expansion initiatives. Service differentiation through specialized capabilities, digital platforms, and sustainability certifications has become increasingly important for market positioning. Innovation investments in processing technologies, automation systems, and data analytics capabilities drive competitive advantages and operational efficiency improvements.

By Waste Type: The market segments include concrete and masonry waste, metal waste, wood waste, gypsum and drywall, mixed construction debris, and hazardous construction materials. Concrete and masonry represent the largest segment due to high generation volumes and established recycling infrastructure. Metal waste commands premium processing fees due to high commodity values and efficient recovery processes.

By Service Type: Market segmentation encompasses collection and transportation, sorting and processing, recycling and recovery, disposal services, and consulting and advisory services. Integrated service offerings that combine multiple service types have gained market preference due to operational efficiency and simplified vendor management. Specialized services for hazardous materials and contaminated waste command premium pricing.

By End-User: Customer segments include residential construction, commercial construction, industrial construction, infrastructure projects, and demolition contractors. Commercial construction represents the largest customer segment due to project scale and regulatory compliance requirements. Infrastructure projects generate substantial waste volumes requiring specialized handling capabilities.

By Processing Method: The market includes mechanical processing, thermal treatment, chemical processing, and biological treatment methods. Mechanical processing dominates due to cost-effectiveness and material recovery efficiency. Advanced processing methods are gaining adoption for specialized waste streams and value-added product development.

Concrete and Masonry Waste: This category represents the highest volume segment, with recycling rates exceeding 85% due to established processing infrastructure and strong demand for recycled aggregates. Processing technologies include mobile crushing units, stationary plants, and advanced screening systems that produce various aggregate grades. Market demand for recycled concrete products continues growing due to cost advantages and environmental benefits.

Metal Waste Recovery: Steel, aluminum, and other metal waste streams offer the highest value recovery potential, with recovery rates approaching 95% due to efficient sorting and processing capabilities. Automated sorting technologies including magnetic separation and eddy current systems enhance recovery efficiency and purity levels. Export opportunities for processed metals provide additional revenue streams beyond domestic markets.

Wood Waste Management: Timber and wood waste processing has evolved to include biomass fuel production, engineered wood products, and landscaping materials. Processing innovations include chipping, grinding, and treatment systems that maximize material recovery and product quality. Contamination challenges from treated lumber and composite materials require specialized handling and processing capabilities.

Mixed Waste Streams: Complex waste mixtures require advanced sorting technologies and integrated processing approaches to maximize material recovery. AI-powered sorting systems and optical recognition technologies have improved separation efficiency by 40% on average. Quality control measures ensure recovered materials meet specification requirements for construction applications.

Construction Companies benefit from comprehensive waste management services through reduced disposal costs, improved project efficiency, and enhanced environmental compliance. Regulatory compliance support minimizes legal risks and ensures adherence to waste diversion requirements. Sustainability reporting capabilities enhance corporate environmental credentials and support green building certifications.

Waste Management Service Providers gain access to growing market opportunities, diversified revenue streams, and long-term customer relationships. Technology investments in processing equipment and digital platforms create competitive advantages and operational efficiency improvements. Partnership opportunities with construction companies and material suppliers enable integrated service delivery and market expansion.

Government Agencies achieve environmental objectives through reduced landfill usage, improved resource recovery, and enhanced regulatory compliance across construction projects. Economic benefits include job creation, infrastructure development, and reduced environmental remediation costs. Policy effectiveness is enhanced through industry collaboration and comprehensive waste management infrastructure.

Material Suppliers benefit from access to recycled construction materials, reduced raw material costs, and sustainable product offerings. Supply chain integration with waste management providers creates circular economy opportunities and cost optimization potential. Quality assurance programs ensure recycled materials meet construction specification requirements.

Environmental Stakeholders see significant benefits through reduced environmental impact, resource conservation, and circular economy advancement. Carbon footprint reduction through waste diversion and material recovery supports climate change mitigation objectives. Ecosystem protection through reduced landfill usage and contamination prevention enhances environmental sustainability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Integration has emerged as a transformative trend, with IoT sensors, RFID tracking, and blockchain technology enabling real-time monitoring of waste streams from generation to final processing. Smart waste management platforms provide comprehensive visibility, automated reporting, and predictive analytics that optimize collection routes and processing schedules. Data analytics capabilities enable performance optimization and customer insights that drive service improvements.

Circular Economy Implementation continues gaining momentum, with construction companies and waste managers collaborating to create closed-loop material flows. Design for disassembly principles are being integrated into construction projects to facilitate future waste management and material recovery. Product stewardship programs are expanding to include manufacturer responsibility for end-of-life material management.

Advanced Processing Technologies including AI-powered sorting, robotic separation, and molecular recycling are revolutionizing material recovery capabilities. Automation systems reduce labor requirements while improving sorting accuracy and processing efficiency. Quality enhancement technologies ensure recovered materials meet stringent construction specification requirements.

Sustainability Reporting requirements have intensified, with construction projects requiring detailed documentation of waste management performance and environmental impact metrics. Carbon accounting integration tracks greenhouse gas emissions associated with waste management activities. Certification programs validate environmental performance and support green building initiatives.

Service Integration trends favor comprehensive service providers capable of managing entire waste streams from collection through final product delivery. Partnership models between waste managers, construction companies, and material suppliers create integrated value chains. Outcome-based contracting aligns service provider incentives with customer environmental objectives.

Infrastructure Expansion initiatives have significantly enhanced regional processing capacity, with multiple new facilities commissioned across the UAE featuring advanced sorting and processing technologies. Capacity additions include specialized plants for concrete recycling, metal recovery, and mixed waste processing that improve service availability and reduce transportation costs. Technology upgrades at existing facilities have enhanced processing efficiency and material recovery rates.

Regulatory Evolution includes implementation of extended producer responsibility programs, enhanced waste tracking requirements, and stricter environmental performance standards. Policy updates have clarified recycling quotas, quality specifications, and reporting requirements for construction projects. Enforcement mechanisms have been strengthened to ensure compliance with waste management regulations.

Strategic Partnerships between international technology providers and regional service companies have accelerated innovation adoption and capability development. Joint ventures have enabled knowledge transfer, technology deployment, and market expansion initiatives. Acquisition activities have consolidated market fragmentation and created integrated service platforms.

Technology Innovations include deployment of mobile processing units, automated sorting systems, and digital tracking platforms that enhance operational flexibility and service quality. Research and development investments have focused on advanced material recovery technologies and sustainable processing methods. Pilot programs are testing emerging technologies including chemical recycling and bio-based processing methods.

Market Recognition through industry awards, sustainability certifications, and government acknowledgments has elevated the profile of leading waste management companies. Best practice sharing initiatives have accelerated industry-wide adoption of innovative approaches and technologies. MarkWide Research analysis indicates that industry recognition programs have contributed to improved service standards and customer confidence levels.

Investment Priorities should focus on digital transformation initiatives, advanced processing technologies, and integrated service platform development. Technology adoption in automation, data analytics, and customer interface systems will create competitive advantages and operational efficiency improvements. Infrastructure development in underserved regions presents expansion opportunities for service providers seeking geographic diversification.

Strategic Positioning recommendations emphasize service differentiation through specialized capabilities, quality certifications, and comprehensive reporting systems. Partnership development with construction companies, material suppliers, and technology providers can create integrated value propositions and customer retention advantages. Sustainability leadership through environmental performance and innovation initiatives will enhance market positioning.

Operational Excellence initiatives should prioritize process optimization, quality management, and customer service enhancement programs. Performance monitoring systems enable continuous improvement and customer satisfaction optimization. Training and development programs for specialized personnel will address skill gaps and improve service quality capabilities.

Market Expansion strategies should consider regional diversification, service portfolio expansion, and export market development opportunities. Acquisition targets in complementary service areas or geographic markets can accelerate growth and capability development. Innovation investments in emerging technologies and processing methods will create future competitive advantages.

Risk Management approaches should address regulatory compliance, market volatility, and technology disruption challenges. Diversification strategies across customer segments, service types, and geographic markets can reduce revenue concentration risks. Financial planning for capital investments and operational flexibility will support sustainable growth initiatives.

Market growth projections indicate continued expansion driven by sustained construction activity, regulatory enforcement, and environmental awareness initiatives. Technology advancement will accelerate material recovery capabilities and operational efficiency improvements, with automation adoption expected to reach 75% of processing facilities within the forecast period. Service integration trends will favor comprehensive providers capable of managing entire waste value chains.

Innovation trajectory suggests significant developments in AI-powered sorting, molecular recycling, and sustainable processing technologies that will expand material recovery possibilities. Digital platforms will become standard infrastructure for waste tracking, performance monitoring, and customer interface management. Circular economy principles will drive development of new business models and revenue streams based on material recovery and reuse.

Regulatory evolution will likely include enhanced environmental standards, expanded producer responsibility programs, and stricter quality requirements for recycled materials. Policy support for circular economy initiatives will create additional market opportunities and investment incentives. International alignment with global sustainability standards will influence local regulatory development and market requirements.

Competitive dynamics will favor companies with strong technology capabilities, comprehensive service portfolios, and proven environmental performance records. Market consolidation is expected to continue, creating larger integrated service providers with enhanced capabilities and geographic coverage. MWR forecasts indicate that successful companies will be those that effectively combine operational excellence with innovation leadership and customer partnership approaches.

Investment outlook remains positive, with continued capital allocation toward infrastructure development, technology advancement, and market expansion initiatives. Sustainability focus will drive premium valuations for companies demonstrating strong environmental performance and circular economy contributions. Export opportunities for processed materials and technology services will create additional growth avenues for leading market participants.

The UAE construction waste management market represents a dynamic and rapidly evolving sector characterized by strong regulatory support, technological innovation, and growing environmental consciousness. Market growth has been driven by comprehensive government policies, sustained construction activity, and increasing recognition of circular economy principles among industry stakeholders. Service providers have responded with significant investments in processing infrastructure, advanced technologies, and integrated service platforms that enhance operational efficiency and environmental performance.

Competitive landscape evolution has created opportunities for companies that effectively combine operational excellence with innovation leadership and customer partnership approaches. Technology adoption continues accelerating, with digital platforms, automation systems, and advanced processing methods transforming traditional waste management operations. Market maturation indicators suggest a shift toward quality-focused competition and comprehensive service differentiation rather than pure capacity expansion.

Future prospects remain highly favorable, with continued market expansion expected through sustained construction activity, regulatory evolution, and technological advancement. Success factors for market participants include strategic positioning in high-growth segments, investment in advanced capabilities, and development of integrated service offerings that address comprehensive customer requirements. The UAE construction waste management market is well-positioned to support the nation’s sustainability objectives while creating substantial value for industry participants and environmental stakeholders.

What is Construction Waste Management?

Construction Waste Management refers to the processes involved in handling waste generated during construction activities, including the collection, transportation, recycling, and disposal of materials such as concrete, wood, metals, and plastics.

What are the key players in the UAE Construction Waste Management Market?

Key players in the UAE Construction Waste Management Market include companies like Bee’ah, Dulsco, and Veolia, which provide waste management services and solutions tailored to the construction sector, among others.

What are the main drivers of the UAE Construction Waste Management Market?

The main drivers of the UAE Construction Waste Management Market include the rapid urbanization and infrastructure development in the region, increasing government regulations on waste disposal, and a growing emphasis on sustainability and recycling practices.

What challenges does the UAE Construction Waste Management Market face?

Challenges in the UAE Construction Waste Management Market include the lack of awareness about waste segregation, limited recycling facilities, and the high costs associated with waste management services.

What opportunities exist in the UAE Construction Waste Management Market?

Opportunities in the UAE Construction Waste Management Market include the potential for innovative recycling technologies, the development of sustainable construction practices, and increased investment in waste-to-energy projects.

What trends are shaping the UAE Construction Waste Management Market?

Trends shaping the UAE Construction Waste Management Market include the adoption of smart waste management solutions, increased collaboration between public and private sectors, and a focus on circular economy principles to minimize waste generation.

UAE Construction Waste Management Market

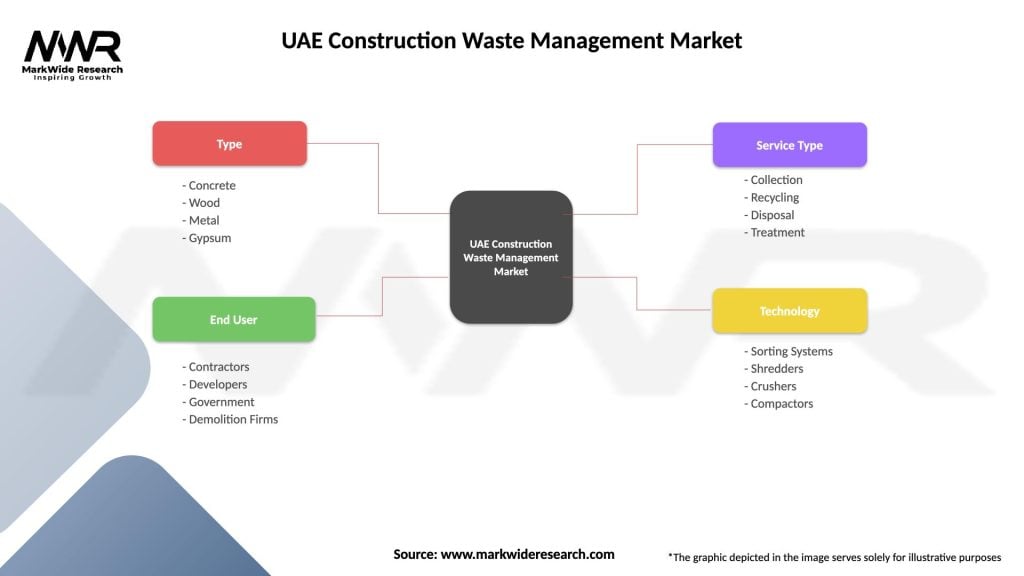

| Segmentation Details | Description |

|---|---|

| Type | Concrete, Wood, Metal, Gypsum |

| End User | Contractors, Developers, Government, Demolition Firms |

| Service Type | Collection, Recycling, Disposal, Treatment |

| Technology | Sorting Systems, Shredders, Crushers, Compactors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Construction Waste Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at