444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United Arab Emirates (UAE) condominiums and apartments market has experienced significant growth in recent years. As one of the most dynamic real estate markets in the Middle East, the UAE offers a diverse range of residential options, including condominiums and apartments, catering to the needs of both locals and expatriates. This market overview aims to provide insights into the meaning of condominiums and apartments, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants and stakeholders, SWOT analysis, key trends, the impact of Covid-19, industry developments, analyst suggestions, future outlook, and a concluding summary.

Meaning

Condominiums and apartments are types of residential properties that offer individual units within a larger building or complex. Condominiums, often referred to as condos, are privately owned units within a multi-unit building. Apartment buildings, on the other hand, are typically owned by a single entity and rented out to tenants. Both condominiums and apartments provide residents with shared amenities such as swimming pools, fitness centers, and parking facilities, making them popular choices for individuals and families seeking convenient and luxurious living spaces in the UAE.

Executive Summary

The UAE condominiums and apartments market is witnessing rapid growth due to several factors, including the country’s booming economy, increasing population, urbanization, and a strong demand for high-quality residential properties. The market offers a wide range of options, catering to various budgetary requirements and lifestyle preferences. However, the market also faces challenges such as rising construction costs, regulatory complexities, and competition from other real estate segments. Despite these challenges, the market presents significant opportunities for developers, investors, and stakeholders to capitalize on the growing demand for quality housing in the UAE.

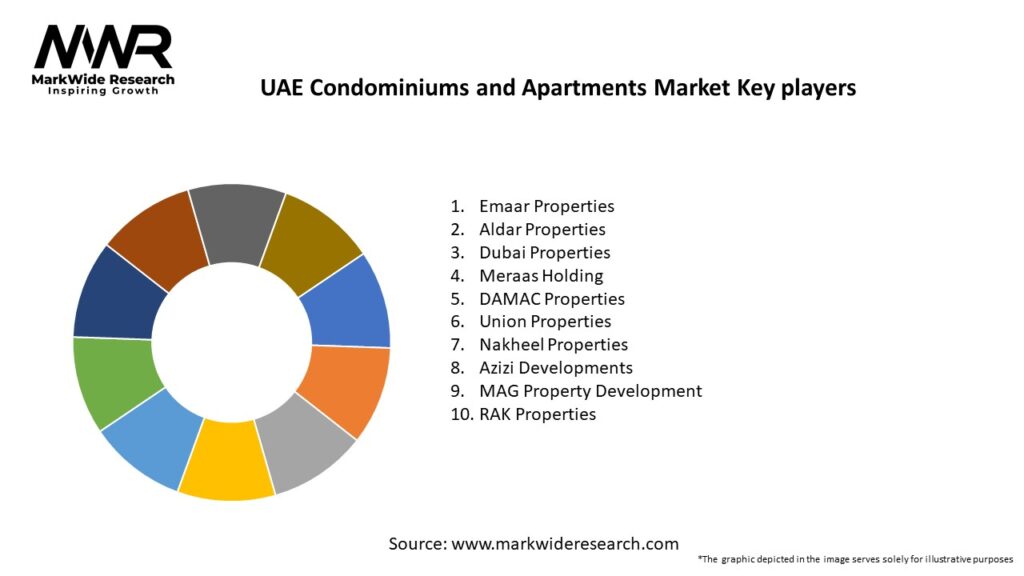

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The UAE condominiums and apartments market is characterized by a dynamic interplay of various factors. Demand for residential properties is influenced by population growth, economic conditions, government policies, and lifestyle preferences. Developers and investors need to carefully assess market dynamics and adapt their strategies to cater to changing consumer needs and market trends. Collaboration with architects, designers, and technology providers can help create unique selling propositions for condominium and apartment projects, ensuring competitiveness and long-term success in the market.

Regional Analysis

The UAE comprises seven emirates, each with its unique real estate market dynamics. Dubai, Abu Dhabi, and Sharjah are the most prominent emirates for condominiums and apartments, offering a diverse range of options to buyers and investors. Dubai, known for its iconic developments and vibrant lifestyle, attracts both domestic and international buyers. Abu Dhabi, the capital city, focuses on upscale developments and offers opportunities for luxury condominiums and apartments. Sharjah, with its affordable housing options, appeals to budget-conscious buyers and investors. Other emirates, including Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain, also contribute to the overall market but to a lesser extent.

Competitive Landscape

Leading Companies in the UAE Condominiums and Apartments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

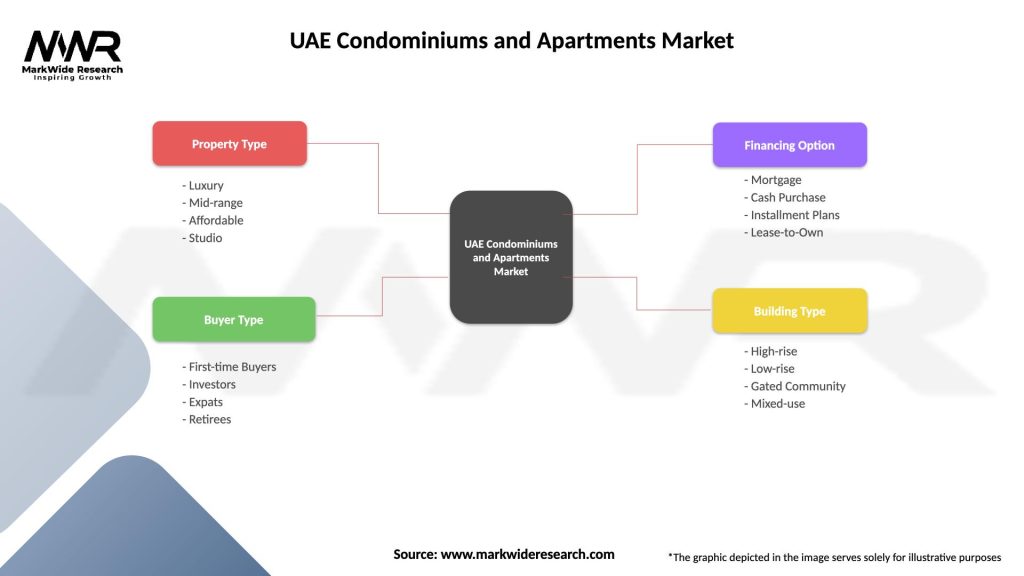

Segmentation

The UAE condominiums and apartments market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the UAE condominiums and apartments market. During the initial stages of the pandemic, the market experienced a temporary slowdown due to travel restrictions, lockdown measures, and economic uncertainties. However, as the situation improved, the market rebounded quickly, driven by pent-up demand, attractive property prices, and favorable financing options. The pandemic also accelerated certain trends, such as the adoption of remote work, which led to increased interest in spacious condominiums and apartments with dedicated home office spaces. Overall, the market demonstrated resilience and adaptability during the challenging times, with developers and investors adjusting their strategies to meet changing customer needs.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the UAE condominiums and apartments market remains positive. The country’s strong economic growth, increasing population, infrastructure development, and government support for the real estate sector provide a solid foundation for continued market expansion. While challenges such as rising construction costs and regulatory complexities persist, the market offers significant opportunities for developers, investors, and stakeholders. The integration of technology, sustainable practices, and innovative designs will shape the future of the market, catering to evolving customer needs and preferences. With careful planning, adaptation to market dynamics, and a focus on customer satisfaction, the condominiums and apartments market in the UAE is expected to thrive in the coming years.

Conclusion

The UAE condominiums and apartments market presents a dynamic landscape with abundant opportunities and challenges. The market overview provided insights into the meaning of condominiums and apartments, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants and stakeholders, SWOT analysis, key trends, the impact of Covid-19, industry developments, analyst suggestions, future outlook, and a concluding summary. As the UAE continues to grow and develop, the condominiums and apartments market will play a crucial role in meeting the residential needs of its diverse population and attracting both domestic and international buyers and investors.

What is UAE Condominiums and Apartments?

UAE Condominiums and Apartments refer to residential units within multi-family buildings, offering various amenities and services. These properties are popular among both local and expatriate populations, providing options for rental and ownership in urban areas.

What are the key players in the UAE Condominiums and Apartments Market?

Key players in the UAE Condominiums and Apartments Market include Emaar Properties, Aldar Properties, and Damac Properties, among others. These companies are known for their large-scale developments and innovative residential projects.

What are the growth factors driving the UAE Condominiums and Apartments Market?

The growth of the UAE Condominiums and Apartments Market is driven by factors such as urbanization, a growing expatriate population, and increasing demand for affordable housing. Additionally, government initiatives to boost real estate investment contribute to market expansion.

What challenges does the UAE Condominiums and Apartments Market face?

The UAE Condominiums and Apartments Market faces challenges such as regulatory hurdles, market saturation in certain areas, and fluctuating property prices. These factors can impact investor confidence and overall market stability.

What opportunities exist in the UAE Condominiums and Apartments Market?

Opportunities in the UAE Condominiums and Apartments Market include the development of smart homes, eco-friendly buildings, and mixed-use developments. These trends cater to the evolving preferences of residents and investors alike.

What trends are shaping the UAE Condominiums and Apartments Market?

Trends in the UAE Condominiums and Apartments Market include a shift towards luxury living, increased focus on sustainability, and the integration of technology in residential spaces. These trends reflect changing consumer preferences and advancements in construction methods.

UAE Condominiums and Apartments Market

| Segmentation Details | Description |

|---|---|

| Property Type | Luxury, Mid-range, Affordable, Studio |

| Buyer Type | First-time Buyers, Investors, Expats, Retirees |

| Financing Option | Mortgage, Cash Purchase, Installment Plans, Lease-to-Own |

| Building Type | High-rise, Low-rise, Gated Community, Mixed-use |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the UAE Condominiums and Apartments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at