444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE color cosmetics market represents a dynamic and rapidly evolving sector within the broader beauty and personal care industry. This vibrant market encompasses a comprehensive range of products including foundations, lipsticks, eye makeup, blushers, and nail colors that cater to the diverse beauty preferences of the UAE’s multicultural population. Market dynamics indicate robust growth driven by increasing disposable income, growing beauty consciousness, and the influence of social media beauty trends.

Consumer behavior in the UAE demonstrates a strong preference for premium and luxury color cosmetics brands, reflecting the country’s affluent demographics and sophisticated beauty culture. The market benefits from the UAE’s strategic position as a regional beauty hub, attracting international brands and fostering local entrepreneurship in the cosmetics sector. Growth projections suggest the market will experience a compound annual growth rate of 6.8% over the forecast period, supported by expanding retail infrastructure and digital commerce adoption.

Regional characteristics of the UAE color cosmetics market include high penetration of international luxury brands, increasing demand for halal-certified products, and growing interest in sustainable and clean beauty formulations. The market serves both local consumers and the significant expatriate population, creating diverse demand patterns that drive innovation and product diversification across multiple price segments.

The UAE color cosmetics market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail of decorative beauty products designed to enhance facial features and overall appearance within the United Arab Emirates. This market includes traditional makeup categories such as face makeup, eye cosmetics, lip products, and nail care items that provide color, coverage, and aesthetic enhancement.

Market scope extends beyond basic cosmetic products to include innovative formulations, luxury collections, and specialized products catering to diverse skin tones and cultural preferences. The sector encompasses both mass-market and premium segments, serving consumers across various demographics and income levels while maintaining strong growth momentum through continuous product innovation and brand expansion.

Strategic analysis reveals the UAE color cosmetics market as a high-growth sector characterized by strong consumer demand, premium brand dominance, and increasing digitalization of beauty retail. The market demonstrates resilience and adaptability, successfully navigating global challenges while maintaining steady expansion through diversified product offerings and enhanced consumer engagement strategies.

Key performance indicators show that lip products account for 32% of total market share, followed by face makeup at 28% market share, highlighting consumer preferences for versatile and high-impact beauty products. The market benefits from favorable demographic trends, including a young, beauty-conscious population and significant expatriate community that drives demand for diverse product ranges and international brands.

Market positioning reflects the UAE’s status as a regional beauty destination, with Dubai and Abu Dhabi serving as key distribution hubs for luxury cosmetics brands entering the Middle East market. The sector’s growth trajectory remains positive, supported by increasing beauty awareness, social media influence, and expanding retail channels including e-commerce platforms and specialty beauty stores.

Consumer preferences in the UAE color cosmetics market reveal several distinctive trends that shape product development and marketing strategies:

Economic prosperity serves as a fundamental driver for the UAE color cosmetics market, with high disposable income levels enabling consumers to invest in premium beauty products. The country’s strong economic foundation, supported by diversification initiatives and tourism growth, creates favorable conditions for luxury and discretionary spending on cosmetics and beauty products.

Demographic advantages significantly contribute to market expansion, with 65% of the population under 35 years representing a key target demographic for color cosmetics brands. This young, digitally-savvy population demonstrates high engagement with beauty content, trend adoption, and willingness to experiment with new products and brands, driving continuous market growth and innovation.

Cultural diversity within the UAE creates unique market opportunities, as the significant expatriate population brings varied beauty preferences and purchasing behaviors. This multicultural environment encourages brands to develop comprehensive product ranges that cater to different skin tones, cultural preferences, and beauty traditions, expanding market potential and driving product innovation.

Digital transformation accelerates market growth through enhanced consumer engagement and accessibility. Social media platforms, beauty apps, and e-commerce channels create new touchpoints for brand interaction and product discovery, while virtual try-on technologies and online tutorials increase consumer confidence in purchasing color cosmetics through digital channels.

Regulatory complexities present challenges for color cosmetics brands operating in the UAE market, particularly regarding product registration, ingredient approvals, and halal certification requirements. These regulatory processes can create barriers to entry for new brands and may delay product launches, potentially limiting market expansion and innovation speed.

Climate considerations impose specific formulation requirements that may increase product development costs and complexity. The UAE’s hot and humid climate demands specialized formulations for long-lasting wear and heat resistance, which may require additional research and development investments and could limit the direct transfer of products from other markets.

Market saturation in certain premium segments creates intense competition among established brands, potentially limiting growth opportunities for new entrants. The dominance of international luxury brands may present challenges for local or emerging brands seeking to establish market presence and consumer recognition in highly competitive categories.

Economic sensitivity to global market fluctuations can impact consumer spending on discretionary items like color cosmetics. While the UAE maintains economic stability, external factors such as oil price volatility or global economic uncertainties may influence consumer confidence and purchasing behavior in the beauty sector.

Digital commerce expansion presents significant growth opportunities for color cosmetics brands in the UAE market. The increasing adoption of online shopping, particularly accelerated by recent global events, creates new channels for brand engagement and product distribution. E-commerce penetration rates of 78% among UAE consumers indicate substantial potential for brands to develop comprehensive digital strategies and capture market share through innovative online experiences.

Sustainable beauty trends offer opportunities for brands to differentiate themselves through eco-friendly formulations and packaging solutions. Growing environmental consciousness among UAE consumers creates demand for clean beauty products, refillable packaging, and sustainable manufacturing practices, enabling brands to capture market share while contributing to environmental responsibility.

Local brand development represents an emerging opportunity as consumers show increasing interest in regional beauty brands that understand local preferences and cultural nuances. The development of UAE-based color cosmetics brands could capture market share by offering products specifically formulated for local climate conditions and cultural preferences while building strong emotional connections with consumers.

Professional makeup services expansion creates opportunities for brands to establish partnerships with beauty salons, makeup artists, and wedding service providers. The UAE’s thriving events and hospitality industry generates consistent demand for professional makeup services, creating B2B opportunities for color cosmetics brands to expand their market reach beyond direct consumer sales.

Supply chain evolution continues to reshape the UAE color cosmetics market through improved distribution networks and inventory management systems. The integration of advanced logistics solutions and regional distribution centers enhances product availability while reducing costs, enabling brands to maintain competitive pricing while ensuring consistent product supply across diverse retail channels.

Consumer engagement strategies have evolved significantly with the integration of digital technologies and personalized marketing approaches. Brands increasingly leverage data analytics, artificial intelligence, and customer relationship management systems to deliver targeted product recommendations and personalized shopping experiences that drive customer loyalty and repeat purchases.

Innovation cycles accelerate as brands respond to rapidly changing consumer preferences and technological advances. The market demonstrates product innovation rates of 42% annually, with brands continuously introducing new formulations, packaging designs, and application technologies to maintain competitive advantage and meet evolving consumer expectations.

Competitive intensity drives continuous improvement in product quality, customer service, and brand positioning strategies. Market leaders invest heavily in research and development, marketing campaigns, and retail partnerships to maintain market share while emerging brands focus on niche segments and innovative approaches to establish their presence in the competitive landscape.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UAE color cosmetics market. Primary research includes consumer surveys, focus groups, and in-depth interviews with key stakeholders including retailers, distributors, and industry experts to gather firsthand insights into market trends, consumer preferences, and competitive dynamics.

Secondary research incorporates analysis of industry reports, company financial statements, regulatory filings, and trade publications to validate primary research findings and provide comprehensive market context. This approach ensures data triangulation and enhances the reliability of market projections and trend analysis.

Data collection processes utilize both quantitative and qualitative research techniques, including online surveys, retail audits, and expert interviews conducted across major UAE cities. The research methodology ensures representative sampling across demographic segments, income levels, and geographic regions to provide accurate market insights and consumer behavior analysis.

Analytical frameworks incorporate statistical modeling, trend analysis, and comparative benchmarking to identify market patterns and forecast future developments. The research approach considers multiple variables including economic indicators, demographic trends, and competitive activities to provide comprehensive market intelligence for strategic decision-making.

Dubai market leadership establishes the emirate as the primary hub for color cosmetics retail and distribution in the UAE. Dubai accounts for 48% of total market share, driven by its large population, high tourist influx, and concentration of luxury retail destinations including Dubai Mall, Mall of the Emirates, and various beauty specialty stores that attract both local and international consumers.

Abu Dhabi market presence represents the second-largest regional segment, contributing 26% of market share with strong demand for premium color cosmetics products. The capital city’s affluent demographics and growing retail infrastructure support sustained market growth, while government initiatives promoting economic diversification create favorable conditions for beauty retail expansion.

Northern Emirates development shows increasing market potential as Sharjah, Ajman, and other northern emirates experience population growth and retail infrastructure expansion. These regions contribute 18% of market share collectively, with growing consumer awareness and increasing accessibility to international beauty brands driving market development and brand penetration.

Regional distribution strategies reflect the geographic concentration of population and economic activity, with brands focusing on major urban centers while gradually expanding to smaller emirates. The development of regional distribution networks and e-commerce capabilities enables brands to serve diverse geographic markets while maintaining efficient supply chain operations and customer service standards.

Market leadership in the UAE color cosmetics sector is characterized by the dominance of international luxury brands that have established strong presence through premium retail partnerships and comprehensive product portfolios. Leading companies maintain competitive advantage through brand recognition, product innovation, and extensive distribution networks.

Competitive strategies focus on brand differentiation through product innovation, celebrity endorsements, and digital marketing campaigns that resonate with UAE consumers. Companies invest significantly in local market adaptation, including shade range expansion, cultural sensitivity in marketing, and partnerships with regional influencers and beauty experts.

Product category segmentation reveals distinct market dynamics across different color cosmetics categories, with each segment demonstrating unique growth patterns and consumer preferences:

By Product Type:

By Price Segment:

By Distribution Channel:

Lip products dominance reflects strong consumer preference for versatile and high-impact beauty products that suit the UAE’s social and professional environments. The category benefits from frequent repurchase cycles, seasonal color trends, and the influence of social media beauty content that drives experimentation with new shades and formulations.

Face makeup evolution demonstrates increasing sophistication in consumer preferences, with growing demand for long-wearing, heat-resistant formulations that perform well in the UAE’s climate. The segment shows strong growth in complexion products that offer natural coverage while providing sun protection and skincare benefits.

Eye makeup innovation drives category growth through advanced formulations including waterproof, smudge-proof, and long-lasting products that meet consumer demands for durability and performance. The category benefits from cultural preferences for dramatic eye makeup and the influence of regional beauty traditions that emphasize eye enhancement.

Nail products expansion reflects growing interest in nail art and self-expression through color and design. The category shows potential for growth through innovative formulations, quick-dry technologies, and gel-like finishes that appeal to busy consumers seeking professional-quality results at home.

Premium segment strength indicates consumer willingness to invest in high-quality products that offer superior performance, packaging, and brand prestige. This segment benefits from the UAE’s affluent demographics and cultural appreciation for luxury goods and premium beauty experiences.

Brand manufacturers benefit from the UAE’s strategic location as a regional hub for Middle East and North Africa markets, enabling efficient distribution and market entry strategies. The country’s advanced retail infrastructure and logistics capabilities provide manufacturers with opportunities to establish regional operations and serve broader geographic markets from a single location.

Retail partners gain advantages through the UAE’s high consumer spending power and strong demand for premium beauty products. Retailers can achieve attractive margins through luxury brand partnerships while benefiting from consistent foot traffic in major shopping destinations and growing e-commerce adoption that expands market reach.

Consumers receive access to the latest global beauty trends and innovations through the UAE’s position as an early adopter market for international brands. The competitive market environment ensures product quality, diverse selection, and competitive pricing while advanced retail experiences including virtual try-on technologies enhance shopping convenience.

Beauty professionals including makeup artists and salon operators benefit from access to professional-grade products and training opportunities provided by international brands. The thriving events and hospitality industry creates consistent demand for professional makeup services, supporting career development and business growth opportunities.

Economic stakeholders benefit from the color cosmetics market’s contribution to retail sector growth, employment generation, and tax revenue. The industry supports various ancillary services including logistics, marketing, and retail operations while contributing to the UAE’s reputation as a regional beauty and fashion destination.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean beauty movement gains momentum in the UAE market as consumers increasingly prioritize products with natural ingredients, sustainable packaging, and transparent formulations. This trend drives innovation in product development and creates opportunities for brands that can successfully combine performance with clean beauty credentials while maintaining the luxury positioning expected by UAE consumers.

Personalization technology transforms the color cosmetics shopping experience through AI-powered shade matching, virtual try-on applications, and customized product recommendations. MarkWide Research indicates that 73% of UAE consumers show interest in personalized beauty solutions, driving brands to invest in technology platforms that enhance customer engagement and satisfaction.

Inclusive beauty standards reshape product development priorities as brands expand shade ranges and develop products for diverse skin tones and undertones. This trend reflects the UAE’s multicultural demographics and growing awareness of representation in beauty marketing, creating competitive advantages for brands that successfully address inclusivity in their product portfolios.

Social commerce integration revolutionizes how consumers discover and purchase color cosmetics through social media platforms, influencer partnerships, and user-generated content. The integration of shopping features within social media apps creates seamless purchase experiences while leveraging the power of peer recommendations and beauty community engagement.

Multi-functional products gain popularity as consumers seek efficiency and value in their beauty routines. Products that combine color, skincare benefits, and sun protection appeal to busy lifestyles while addressing climate-specific needs such as long-lasting wear and heat resistance that are particularly relevant in the UAE market.

Digital transformation initiatives accelerate across the UAE color cosmetics market as brands invest in omnichannel retail strategies, virtual consultation services, and augmented reality applications. These developments enhance customer experience while providing brands with valuable consumer data and insights that inform product development and marketing strategies.

Sustainability commitments drive significant changes in packaging design, ingredient sourcing, and manufacturing processes as brands respond to growing environmental consciousness among UAE consumers. Major companies announce ambitious sustainability goals including recyclable packaging, carbon-neutral operations, and responsible sourcing initiatives that reshape industry standards.

Local partnership expansion sees international brands establishing stronger relationships with UAE-based distributors, retailers, and beauty service providers. These partnerships enable better market understanding, cultural adaptation, and customer service while supporting local economic development and creating employment opportunities in the beauty sector.

Innovation laboratories and research facilities established in the UAE by major cosmetics companies reflect the market’s growing importance and the need for climate-specific product development. These investments in local research capabilities enable brands to develop formulations optimized for regional conditions while accelerating time-to-market for new products.

Regulatory harmonization efforts streamline product approval processes and create more efficient pathways for international brands entering the UAE market. These developments reduce barriers to entry while maintaining safety standards, encouraging innovation and competition that benefits consumers through expanded product choices and competitive pricing.

Market entry strategies should prioritize understanding local consumer preferences, cultural sensitivities, and climate-specific requirements when developing products for the UAE market. Successful brands invest in market research, local partnerships, and product adaptation to ensure alignment with consumer expectations and regulatory requirements while maintaining brand authenticity and positioning.

Digital investment priorities should focus on creating comprehensive online experiences that combine product discovery, virtual try-on capabilities, and seamless purchase processes. MWR analysis suggests that brands achieving digital integration rates above 85% demonstrate superior customer engagement and retention compared to traditional retail-focused competitors.

Sustainability integration represents a critical competitive differentiator as environmental consciousness grows among UAE consumers. Brands should develop comprehensive sustainability strategies that address packaging, ingredients, and manufacturing processes while communicating these initiatives effectively to build brand loyalty and attract environmentally conscious consumers.

Partnership development with local influencers, makeup artists, and beauty professionals creates authentic brand connections and drives consumer trust. These partnerships should focus on long-term relationships that provide mutual value while ensuring cultural appropriateness and brand alignment with local beauty standards and preferences.

Innovation focus areas should prioritize long-lasting formulations, heat resistance, and multi-functional benefits that address specific UAE market needs. Brands that successfully combine performance innovation with luxury positioning and cultural sensitivity are most likely to achieve sustainable competitive advantage in this dynamic market.

Growth trajectory for the UAE color cosmetics market remains positive with projected expansion driven by demographic advantages, economic stability, and increasing beauty consciousness. The market is expected to maintain a compound annual growth rate of 6.8% through the forecast period, supported by innovation in product formulations, expansion of distribution channels, and growing digital commerce adoption.

Technology integration will continue reshaping the market landscape through advanced personalization capabilities, artificial intelligence applications, and augmented reality experiences that enhance customer engagement. These technological advances will create new opportunities for brand differentiation while improving customer satisfaction and loyalty through more relevant and convenient shopping experiences.

Sustainability evolution will become increasingly important as environmental consciousness grows and regulatory requirements evolve. Brands that successfully integrate sustainable practices into their operations while maintaining product performance and luxury positioning will gain competitive advantages and capture growing market segments focused on responsible consumption.

Market expansion opportunities will emerge through geographic diversification within the UAE, development of new product categories, and expansion of professional beauty services. The growing events industry, tourism sector, and expatriate population will continue driving demand for diverse color cosmetics products and services.

Competitive landscape evolution will likely see increased consolidation among smaller players while creating opportunities for innovative brands that can successfully address niche market segments or unmet consumer needs. The market will reward brands that demonstrate agility, cultural sensitivity, and commitment to continuous innovation in product development and customer experience.

The UAE color cosmetics market represents a dynamic and opportunity-rich sector characterized by strong consumer demand, premium brand preference, and continuous innovation. The market’s growth trajectory reflects favorable demographic trends, economic prosperity, and increasing beauty consciousness among the diverse UAE population. Strategic positioning as a regional hub creates additional advantages for brands seeking to establish presence in the broader Middle East market.

Market dynamics indicate sustained growth potential driven by digital transformation, sustainability trends, and evolving consumer preferences toward personalized and inclusive beauty solutions. The competitive landscape rewards brands that successfully combine product innovation, cultural sensitivity, and comprehensive distribution strategies while maintaining strong digital presence and customer engagement capabilities.

Future success in the UAE color cosmetics market will depend on brands’ ability to adapt to local preferences, invest in sustainable practices, and leverage technology to enhance customer experiences. Companies that demonstrate commitment to understanding and serving the unique needs of UAE consumers while maintaining global brand standards and innovation capabilities are positioned to capture significant market opportunities and achieve sustainable growth in this vibrant and evolving market.

What is Color Cosmetics?

Color cosmetics refer to products that are used to enhance or alter the appearance of the face, eyes, lips, and nails. These products include items such as foundation, lipstick, eyeshadow, and nail polish, which are popular among consumers for personal grooming and beauty enhancement.

What are the key players in the UAE Color Cosmetics Market?

Key players in the UAE Color Cosmetics Market include companies like L’Oréal, Estée Lauder, and Revlon, which offer a wide range of products catering to diverse consumer preferences. These companies compete on factors such as product innovation, branding, and distribution channels, among others.

What are the growth factors driving the UAE Color Cosmetics Market?

The UAE Color Cosmetics Market is driven by factors such as increasing disposable income, a growing interest in beauty and personal care among consumers, and the influence of social media on beauty trends. Additionally, the rise in e-commerce has made these products more accessible to a wider audience.

What challenges does the UAE Color Cosmetics Market face?

Challenges in the UAE Color Cosmetics Market include intense competition among brands, changing consumer preferences, and regulatory compliance regarding product safety and ingredients. These factors can impact market dynamics and brand positioning.

What opportunities exist in the UAE Color Cosmetics Market?

Opportunities in the UAE Color Cosmetics Market include the growing demand for organic and cruelty-free products, as well as the potential for expansion into emerging consumer segments. Additionally, brands can leverage digital marketing strategies to reach younger audiences effectively.

What trends are shaping the UAE Color Cosmetics Market?

Trends in the UAE Color Cosmetics Market include the increasing popularity of multifunctional products, the rise of clean beauty, and the incorporation of technology in product development. Consumers are also leaning towards personalized beauty solutions that cater to individual needs.

UAE Color Cosmetics Market

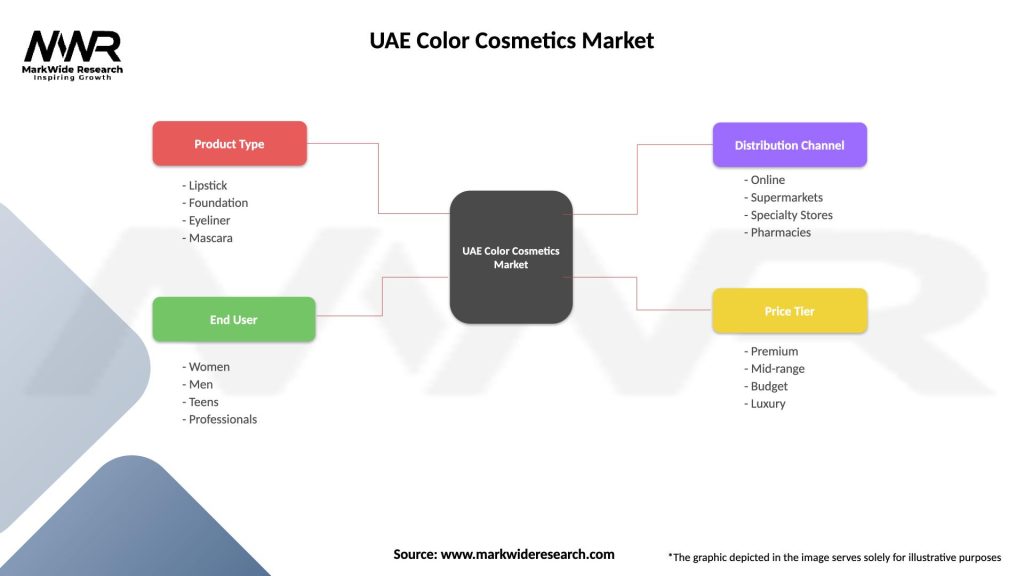

| Segmentation Details | Description |

|---|---|

| Product Type | Lipstick, Foundation, Eyeliner, Mascara |

| End User | Women, Men, Teens, Professionals |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Pharmacies |

| Price Tier | Premium, Mid-range, Budget, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Color Cosmetics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at