444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE car rental market represents one of the most dynamic and rapidly expanding automotive service sectors in the Middle East region. Market dynamics indicate substantial growth driven by increasing tourism, business travel, and urbanization across the Emirates. The market encompasses various service categories including short-term rentals, long-term leasing, luxury vehicle rentals, and economy car services, catering to diverse customer segments ranging from tourists to corporate clients.

Tourism expansion continues to serve as a primary growth catalyst, with the UAE attracting millions of international visitors annually who require reliable transportation solutions. The market demonstrates remarkable resilience and adaptability, with rental companies increasingly adopting digital platforms and innovative service models to enhance customer experience. Growth projections suggest the market will expand at a compound annual growth rate of 8.2% over the forecast period, driven by infrastructure development and increasing disposable income levels.

Regional distribution shows Dubai commanding approximately 45% market share, followed by Abu Dhabi with 28% market presence, while other emirates collectively represent the remaining market portion. The competitive landscape features both international rental giants and local operators, creating a diverse ecosystem that benefits consumers through competitive pricing and service innovation.

The UAE car rental market refers to the comprehensive ecosystem of automotive rental services operating across the United Arab Emirates, encompassing short-term and long-term vehicle rental solutions for tourists, residents, and business travelers seeking flexible transportation alternatives to vehicle ownership.

Service categories within this market include daily and weekly rentals, monthly leasing arrangements, luxury and exotic car rentals, economy vehicle options, and specialized services such as chauffeur-driven vehicles and corporate fleet management. The market serves multiple customer segments including international tourists, business travelers, expatriate residents, and local consumers requiring temporary transportation solutions.

Digital transformation has revolutionized market operations, with online booking platforms, mobile applications, and contactless rental processes becoming standard industry practices. The market also encompasses ancillary services such as insurance coverage, GPS navigation systems, child safety seats, and additional driver options, creating comprehensive transportation solutions for diverse customer needs.

Market performance in the UAE car rental sector demonstrates exceptional growth momentum, supported by robust tourism recovery, increasing business activities, and evolving consumer preferences toward flexible mobility solutions. The market benefits from strategic government initiatives promoting tourism and business development, creating sustained demand for rental services across multiple customer segments.

Key growth drivers include the UAE’s position as a global business hub, increasing international tourism arrivals, and rising preference for rental services over vehicle ownership among expatriate populations. Digital adoption rates have reached 78% penetration among rental companies, significantly improving operational efficiency and customer satisfaction levels.

Competitive dynamics feature a balanced mix of international brands and local operators, with market leaders focusing on fleet modernization, service diversification, and geographic expansion. The market demonstrates strong resilience to economic fluctuations, supported by diversified customer bases and flexible pricing strategies that adapt to changing market conditions.

Customer behavior analysis reveals significant shifts toward online booking preferences, with digital channels accounting for increasing transaction volumes. The market demonstrates strong seasonal patterns aligned with tourism peaks and business activity cycles, requiring dynamic fleet management and pricing strategies.

Tourism expansion serves as the primary market driver, with the UAE’s strategic positioning as a global tourism destination creating sustained demand for rental services. Government initiatives promoting tourism development, including visa facilitation and infrastructure investments, directly contribute to market growth by increasing visitor arrivals and extending average stay durations.

Business travel growth represents another significant driver, as the UAE’s role as a regional business hub attracts corporate travelers requiring flexible transportation solutions. The expansion of free trade zones, business parks, and commercial districts creates consistent demand for both short-term and extended rental services among business professionals and corporate clients.

Urbanization trends and changing lifestyle preferences, particularly among expatriate populations, drive demand for rental services as alternatives to vehicle ownership. Rising costs of vehicle ownership, including insurance, maintenance, and parking fees, make rental services increasingly attractive for residents requiring occasional transportation access.

Infrastructure development across the Emirates enhances market accessibility and service delivery capabilities. Improved road networks, airport facilities, and urban connectivity create favorable conditions for rental operations while expanding potential customer reach to previously underserved areas.

Economic volatility poses challenges to market stability, as rental demand closely correlates with economic conditions affecting both tourism and business travel. Fluctuations in oil prices and regional economic uncertainties can impact consumer spending patterns and business travel budgets, directly affecting rental service demand.

Regulatory complexities create operational challenges for rental companies, particularly regarding licensing requirements, insurance regulations, and cross-emirate operations. Compliance costs and administrative burdens can limit market entry for smaller operators while increasing operational expenses for existing companies.

Competition intensity from ride-sharing services and public transportation alternatives affects market share, particularly in urban areas with well-developed transit systems. The growing popularity of app-based transportation services provides convenient alternatives to traditional car rentals for certain customer segments.

Seasonal demand fluctuations create operational challenges requiring dynamic fleet management and pricing strategies. Peak season capacity constraints and off-season overcapacity issues impact profitability and resource utilization efficiency across the industry.

Electric vehicle adoption presents significant growth opportunities as environmental consciousness increases among consumers and government policies promote sustainable transportation. Early adoption of electric and hybrid rental fleets can provide competitive advantages while aligning with national sustainability objectives.

Technology integration offers opportunities for service differentiation and operational efficiency improvements. Implementation of artificial intelligence, predictive analytics, and IoT technologies can enhance customer experiences while optimizing fleet utilization and maintenance scheduling.

Market expansion into underserved geographic areas and customer segments presents growth potential. Development of specialized services for specific demographics, such as luxury travelers, adventure tourists, or long-term residents, can create new revenue streams and market positioning advantages.

Partnership opportunities with hospitality, aviation, and tourism sectors can drive customer acquisition and service integration. Strategic alliances with hotels, airlines, and travel agencies can create seamless customer experiences while expanding market reach through established distribution channels.

Supply and demand balance in the UAE car rental market demonstrates cyclical patterns influenced by tourism seasons, business cycles, and economic conditions. Fleet utilization rates typically range from 65% during off-peak periods to 85% during peak seasons, requiring sophisticated demand forecasting and fleet management strategies.

Pricing dynamics reflect competitive pressures and demand fluctuations, with companies employing dynamic pricing models to optimize revenue and fleet utilization. Market leaders leverage data analytics and machine learning algorithms to adjust pricing in real-time based on demand patterns, competitor actions, and market conditions.

Customer acquisition costs vary significantly across channels, with digital marketing and partnership programs generally providing more cost-effective customer acquisition compared to traditional advertising methods. Customer retention rates average 42% for leisure travelers and 68% for corporate clients, highlighting the importance of service quality and loyalty programs.

Operational efficiency improvements through technology adoption and process optimization continue to drive margin improvements across the industry. Companies investing in digital transformation and automation report operational cost reductions of 15-20% while improving customer satisfaction scores.

Primary research methodologies employed in analyzing the UAE car rental market include comprehensive surveys of rental companies, customer interviews, and industry expert consultations. Data collection encompasses both quantitative metrics such as fleet sizes, utilization rates, and pricing data, as well as qualitative insights regarding market trends, customer preferences, and competitive strategies.

Secondary research involves analysis of government statistics, tourism data, economic indicators, and industry reports to establish market context and validate primary research findings. MarkWide Research utilizes multiple data sources to ensure comprehensive market coverage and analytical accuracy.

Market segmentation analysis employs statistical modeling techniques to identify distinct customer segments, geographic patterns, and service category performance. Advanced analytics tools process large datasets to uncover market trends, demand patterns, and growth opportunities across different market segments.

Competitive analysis incorporates company financial data, market share estimates, service offerings comparison, and strategic positioning assessment. Research methodologies ensure objective evaluation of market dynamics while maintaining confidentiality of proprietary business information.

Dubai dominates the UAE car rental market with approximately 45% market share, driven by its status as the primary tourism and business destination. The emirate’s extensive hospitality infrastructure, international airport connectivity, and diverse attractions create sustained demand for rental services across multiple customer segments.

Abu Dhabi represents the second-largest market segment with 28% market presence, supported by government activities, business districts, and cultural attractions. The capital’s focus on business tourism and government-related travel creates steady demand for both economy and luxury rental services.

Sharjah and Northern Emirates collectively account for 18% market share, with growing tourism development and business activities driving market expansion. These regions offer opportunities for market penetration through competitive pricing and specialized service offerings targeting local customer preferences.

Regional connectivity improvements and cross-emirate travel patterns create opportunities for integrated service offerings spanning multiple emirates. Companies with comprehensive geographic coverage can capture larger market shares by serving customers requiring inter-emirate transportation solutions.

Market leadership is distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment features both global rental brands and regional operators, creating diverse service offerings and pricing options for consumers.

Competitive strategies focus on service differentiation, technology adoption, fleet modernization, and strategic partnerships. Market leaders invest heavily in digital platforms, customer experience improvements, and operational efficiency enhancements to maintain competitive advantages.

By Vehicle Type: The market segments into economy cars, mid-size vehicles, luxury cars, SUVs, and specialty vehicles including sports cars and exotic rentals. Economy vehicles represent the largest segment due to price sensitivity among tourists and budget-conscious customers, while luxury segments show strong growth among high-net-worth individuals.

By Customer Type: Segmentation includes leisure travelers, business customers, residents, and corporate clients. Leisure travelers constitute the largest customer segment, driven by tourism activities, while corporate clients provide stable revenue streams through long-term contracts and regular usage patterns.

By Rental Duration: Services are categorized into daily rentals, weekly packages, monthly leases, and long-term arrangements. Daily rentals dominate transaction volumes, while monthly and long-term rentals generate higher per-customer revenue and improved fleet utilization rates.

By Distribution Channel: Market channels include direct bookings, online platforms, travel agencies, hotel partnerships, and airport locations. Online channels show rapid growth with increasing digital adoption, while airport locations remain crucial for capturing arriving tourists and business travelers.

Economy Vehicle Segment maintains market leadership through competitive pricing and broad customer appeal. This category serves price-sensitive customers including budget tourists, young travelers, and residents requiring basic transportation. Fleet composition emphasizes fuel efficiency, reliability, and low maintenance costs to support competitive pricing strategies.

Luxury Vehicle Category demonstrates strong growth potential driven by increasing affluent tourism and business travel. High-net-worth individuals and luxury travelers seek premium experiences, creating demand for exotic cars, luxury sedans, and high-end SUVs. This segment generates superior profit margins despite lower transaction volumes.

SUV and Crossover Segment shows robust demand growth, particularly among families and adventure tourists exploring desert and mountain destinations. These vehicles offer versatility for both urban driving and off-road adventures, appealing to diverse customer preferences and usage scenarios.

Electric and Hybrid Category represents an emerging segment with significant growth potential as environmental consciousness increases. Early adopters include environmentally conscious tourists and corporate clients with sustainability mandates, creating opportunities for market differentiation and premium positioning.

Rental Companies benefit from growing market demand, diversified revenue streams, and opportunities for service innovation. Digital transformation enables operational efficiency improvements, customer experience enhancements, and data-driven decision making that optimize fleet utilization and pricing strategies.

Customers gain access to flexible transportation solutions without ownership responsibilities, including maintenance, insurance, and depreciation costs. Rental services provide vehicle variety, convenient locations, and competitive pricing that often proves more economical than ownership for occasional users.

Tourism Industry benefits from enhanced visitor experiences through reliable transportation access, supporting longer stays and increased spending. Car rental availability enables tourists to explore diverse destinations independently, contributing to tourism sector growth and economic development.

Government Stakeholders realize economic benefits through job creation, tax revenues, and tourism industry support. The rental sector contributes to transportation infrastructure utilization while reducing urban congestion through shared mobility solutions and efficient fleet management.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation continues reshaping customer interactions and operational processes throughout the industry. Mobile applications, contactless rentals, and artificial intelligence integration enhance customer convenience while improving operational efficiency and cost management for rental companies.

Sustainability Focus drives increasing adoption of electric and hybrid vehicles within rental fleets. Environmental consciousness among customers and corporate sustainability mandates create demand for eco-friendly transportation options, positioning early adopters for competitive advantages.

Subscription Models emerge as alternatives to traditional rental arrangements, offering customers flexible access to vehicles through monthly or annual subscriptions. These models provide predictable revenue streams for operators while meeting evolving customer preferences for access over ownership.

Autonomous Vehicle Preparation involves industry players exploring future integration of self-driving technologies. While full autonomy remains years away, companies are investing in connected vehicle technologies and preparing operational frameworks for eventual autonomous fleet integration.

Fleet Electrification Initiatives accelerate across major rental companies, with several operators announcing significant investments in electric vehicle acquisitions. These initiatives align with UAE sustainability goals while positioning companies for future regulatory requirements and customer preferences.

Strategic Partnership Expansion includes new alliances between rental companies and hospitality providers, airlines, and technology platforms. These partnerships create integrated customer experiences while expanding distribution channels and market reach for participating companies.

Technology Platform Upgrades involve comprehensive digital transformation projects including mobile app enhancements, AI-powered customer service, and predictive maintenance systems. MWR analysis indicates these investments improve customer satisfaction while reducing operational costs.

Market Consolidation Activities include mergers, acquisitions, and strategic investments as companies seek scale advantages and market position strengthening. These activities reshape competitive dynamics while creating opportunities for operational synergies and service integration.

Investment Priorities should focus on digital platform development, fleet modernization, and customer experience enhancement. Companies investing in technology infrastructure and sustainable vehicle options are better positioned for long-term market success and competitive differentiation.

Market Expansion Strategies should target underserved geographic areas and specialized customer segments. Opportunities exist in secondary emirates, niche markets such as adventure tourism, and corporate services requiring customized transportation solutions.

Partnership Development represents a crucial strategy for market growth and customer acquisition. Strategic alliances with hotels, airlines, and travel platforms can significantly expand market reach while reducing customer acquisition costs through established distribution channels.

Operational Efficiency Focus should emphasize data analytics, predictive maintenance, and dynamic pricing optimization. Companies leveraging advanced analytics for fleet management and pricing decisions achieve superior financial performance and market positioning.

Market growth prospects remain positive, supported by UAE’s continued development as a global tourism and business destination. MarkWide Research projects sustained expansion driven by infrastructure investments, tourism promotion, and evolving transportation preferences among residents and visitors.

Technology integration will accelerate, with artificial intelligence, IoT devices, and predictive analytics becoming standard operational tools. These technologies will enable more efficient fleet management, personalized customer experiences, and predictive maintenance programs that reduce operational costs.

Sustainability initiatives will gain prominence as environmental regulations tighten and customer preferences shift toward eco-friendly options. Electric vehicle adoption within rental fleets is expected to reach 25% penetration within the next five years, driven by government incentives and customer demand.

Market consolidation may continue as companies seek scale advantages and operational efficiencies. Strategic partnerships and acquisitions will likely reshape the competitive landscape while creating opportunities for service integration and geographic expansion across the region.

The UAE car rental market demonstrates exceptional growth potential supported by robust tourism development, business activity expansion, and evolving consumer preferences toward flexible mobility solutions. Market dynamics favor companies that embrace digital transformation, invest in sustainable fleet options, and develop strategic partnerships to enhance customer reach and service delivery.

Competitive advantages will increasingly depend on technology adoption, operational efficiency, and customer experience differentiation. Companies that successfully integrate advanced analytics, sustainable vehicle options, and seamless digital platforms are positioned to capture disproportionate market share and achieve superior financial performance.

Future success requires balanced investment in traditional service excellence and innovative technology solutions that meet evolving customer expectations. The market’s continued expansion, supported by UAE’s strategic positioning and infrastructure development, creates substantial opportunities for industry participants who adapt to changing market dynamics while maintaining operational excellence and customer focus.

What is UAE Car Rental?

UAE Car Rental refers to the service of renting vehicles for short-term use in the United Arab Emirates, catering to both residents and tourists. This service includes a variety of vehicle types, from economy cars to luxury vehicles, to meet diverse customer needs.

What are the key players in the UAE Car Rental Market?

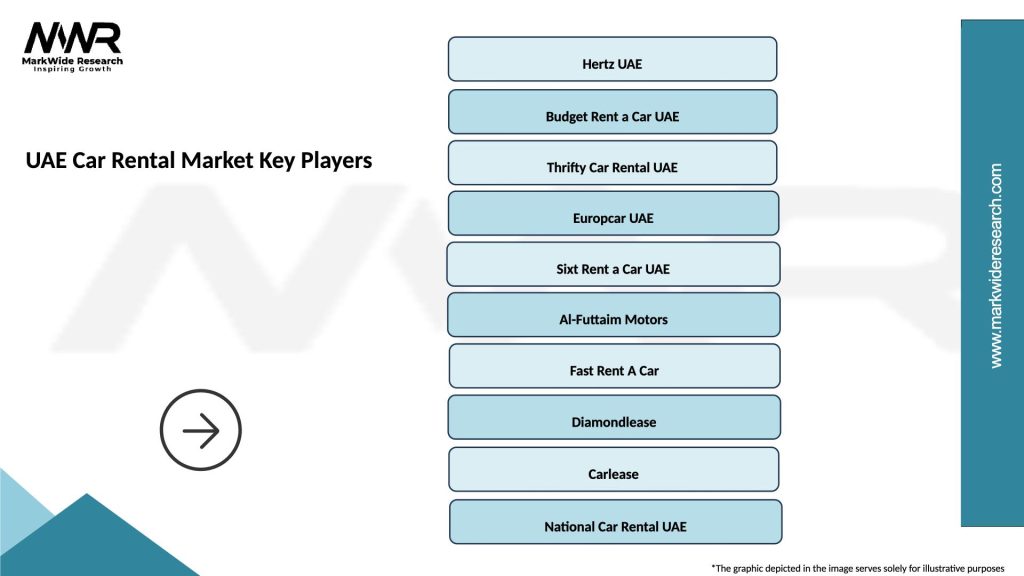

Key players in the UAE Car Rental Market include companies like Hertz, Sixt, and Thrifty, which offer a range of rental options and services. These companies compete on factors such as vehicle availability, pricing, and customer service, among others.

What are the growth factors driving the UAE Car Rental Market?

The growth of the UAE Car Rental Market is driven by factors such as increasing tourism, a growing expatriate population, and the rise of ride-sharing services. Additionally, the convenience of renting vehicles for short durations appeals to both tourists and locals.

What challenges does the UAE Car Rental Market face?

The UAE Car Rental Market faces challenges such as regulatory compliance, fluctuating demand due to seasonal tourism, and competition from ride-sharing platforms. These factors can impact pricing strategies and operational efficiency.

What opportunities exist in the UAE Car Rental Market?

Opportunities in the UAE Car Rental Market include the expansion of electric vehicle rentals and the integration of technology for enhanced customer experiences. Additionally, partnerships with hotels and travel agencies can drive growth.

What trends are shaping the UAE Car Rental Market?

Trends in the UAE Car Rental Market include the increasing demand for luxury and premium vehicles, the adoption of contactless rental processes, and a focus on sustainability through eco-friendly vehicle options. These trends reflect changing consumer preferences and technological advancements.

UAE Car Rental Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | SUV, Sedan, Hatchback, Luxury |

| Customer Type | Business, Leisure, Government, Tourists |

| Rental Duration | Short-term, Long-term, Weekly, Monthly |

| Booking Channel | Online, Travel Agency, Direct, Phone |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Car Rental Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at