444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE biomedical waste management market represents a critical component of the nation’s healthcare infrastructure, experiencing unprecedented growth driven by expanding healthcare facilities and stringent regulatory frameworks. Healthcare institutions across the Emirates are increasingly prioritizing proper waste disposal protocols, creating substantial demand for specialized biomedical waste management services. The market encompasses comprehensive solutions including collection, treatment, transportation, and disposal of infectious medical waste generated by hospitals, clinics, laboratories, and pharmaceutical facilities.

Market dynamics indicate robust expansion with the sector growing at a CAGR of 8.2% through the forecast period. This growth trajectory reflects the UAE’s commitment to healthcare excellence and environmental sustainability. Government initiatives supporting healthcare infrastructure development, coupled with rising medical tourism, are driving increased biomedical waste generation across the region.

Healthcare expansion in major emirates, particularly Dubai and Abu Dhabi, has created significant opportunities for waste management service providers. The market benefits from advanced treatment technologies including autoclaving, incineration, and chemical treatment methods. Regulatory compliance remains a primary driver, with healthcare facilities mandated to follow strict waste segregation and disposal protocols established by federal and emirate-level authorities.

The UAE biomedical waste management market refers to the comprehensive ecosystem of services, technologies, and regulatory frameworks designed to safely collect, treat, transport, and dispose of medical waste generated by healthcare facilities throughout the United Arab Emirates. This specialized sector encompasses all activities related to managing infectious, pathological, pharmaceutical, and sharps waste that pose potential health and environmental risks.

Biomedical waste management involves systematic processes beginning with proper segregation at the point of generation, followed by secure collection, appropriate treatment using approved technologies, and final disposal in compliance with environmental regulations. The market includes service providers, technology suppliers, regulatory bodies, and healthcare institutions working collaboratively to ensure safe waste handling practices.

Key components of this market include waste collection services, treatment facility operations, transportation logistics, regulatory compliance consulting, and technology provision for on-site and off-site waste processing. The sector plays a vital role in protecting public health, healthcare worker safety, and environmental preservation while supporting the UAE’s growing healthcare infrastructure.

Market expansion in the UAE biomedical waste management sector reflects the nation’s rapid healthcare development and increasing focus on environmental sustainability. The market demonstrates strong growth potential driven by expanding hospital networks, rising patient volumes, and enhanced regulatory enforcement. Healthcare facilities are increasingly outsourcing waste management operations to specialized service providers, creating substantial business opportunities.

Technology adoption remains a key differentiator, with advanced treatment methods gaining traction across the region. Automated waste tracking systems, GPS-enabled collection vehicles, and real-time monitoring solutions are becoming standard practices. Service providers are investing in state-of-the-art treatment facilities to meet growing demand while ensuring regulatory compliance.

Regional distribution shows Dubai and Abu Dhabi commanding approximately 65% market share due to concentrated healthcare infrastructure and higher waste generation volumes. Northern emirates are experiencing accelerated growth as healthcare accessibility improves. Market consolidation trends indicate larger service providers acquiring smaller operators to expand geographic coverage and service capabilities.

Future prospects remain highly favorable, supported by government healthcare investments, medical tourism growth, and increasing awareness of proper waste management practices. The market is positioned for sustained expansion as healthcare infrastructure development continues across all emirates.

Market intelligence reveals several critical insights shaping the UAE biomedical waste management landscape:

MarkWide Research analysis indicates that healthcare facility expansion and regulatory compliance remain the primary market drivers, with technology adoption accelerating operational improvements across the sector.

Healthcare sector expansion serves as the fundamental driver of biomedical waste management market growth in the UAE. The nation’s commitment to becoming a regional healthcare hub has resulted in substantial investments in medical infrastructure, creating proportional increases in waste generation. Government initiatives supporting healthcare development, including the UAE Vision 2071 and various emirate-level health strategies, continue driving facility construction and capacity expansion.

Regulatory compliance requirements represent another critical driver, with federal and local authorities implementing stringent waste management regulations. Healthcare facilities face mandatory compliance with waste segregation, treatment, and disposal protocols, creating consistent demand for professional services. Penalty structures for non-compliance encourage healthcare institutions to engage qualified waste management providers.

Medical tourism growth significantly impacts waste generation volumes, with the UAE attracting increasing numbers of international patients seeking advanced medical treatments. This trend, supported by government medical tourism initiatives, creates sustained demand for biomedical waste management services. Population growth and aging demographics further contribute to healthcare utilization increases.

Environmental awareness and sustainability commitments drive demand for advanced treatment technologies and environmentally responsible disposal methods. Healthcare institutions increasingly prioritize sustainable waste management practices as part of broader corporate social responsibility initiatives. Technology advancement in treatment methods and tracking systems enables more efficient and compliant waste management operations.

High operational costs present significant challenges for biomedical waste management service providers, particularly regarding specialized equipment, treatment facilities, and trained personnel requirements. The capital-intensive nature of establishing compliant treatment facilities can limit market entry for smaller operators. Technology investment requirements for advanced treatment systems and tracking technologies create substantial financial barriers.

Skilled workforce shortage affects the sector’s ability to scale operations effectively. Specialized training requirements for handling infectious waste and operating treatment equipment limit available personnel. Regulatory complexity across different emirates can create operational challenges for service providers seeking to expand geographically.

Transportation logistics in remote areas and between emirates can increase operational costs and complexity. Limited treatment facility capacity in certain regions may require long-distance waste transportation, impacting service economics. Seasonal demand fluctuations related to medical tourism patterns can create capacity planning challenges.

Competition from international providers entering the UAE market may pressure pricing and service margins. Established global waste management companies bring significant resources and experience, potentially challenging local operators. Technology obsolescence risks require continuous investment in equipment upgrades and system modernization.

Healthcare infrastructure expansion across northern emirates presents substantial growth opportunities for waste management service providers. Government investments in healthcare accessibility are creating new facilities requiring comprehensive waste management solutions. Specialized healthcare sectors including oncology, organ transplantation, and advanced surgical procedures generate high-value waste streams requiring specialized handling.

Technology integration opportunities include developing IoT-enabled waste tracking systems, automated segregation technologies, and predictive analytics for waste generation forecasting. Digital transformation initiatives in healthcare create demand for integrated waste management platforms connecting generators, collectors, and treatment facilities.

Public-private partnerships offer opportunities for large-scale waste management infrastructure development. Government entities seeking comprehensive waste management solutions may engage private sector partners for facility development and operation. Regional expansion into neighboring GCC markets leveraging UAE-based expertise and infrastructure represents significant growth potential.

Circular economy initiatives create opportunities for waste-to-energy projects and resource recovery from biomedical waste streams. Training and consulting services for healthcare facilities seeking to improve waste management practices represent additional revenue streams. Emergency preparedness services for pandemic or crisis situations requiring rapid waste management capacity scaling offer specialized market opportunities.

Supply chain dynamics in the UAE biomedical waste management market reflect complex interactions between waste generators, service providers, treatment facilities, and regulatory authorities. Healthcare facilities increasingly prefer comprehensive service packages including collection, treatment, and regulatory compliance support, driving service provider consolidation and capability expansion.

Competitive dynamics show established local providers competing with international entrants offering advanced technologies and global expertise. Market leaders are investing in technology differentiation and geographic expansion to maintain competitive advantages. Service quality and regulatory compliance capabilities serve as primary competitive differentiators rather than price alone.

Regulatory dynamics continue evolving with authorities implementing enhanced monitoring and enforcement mechanisms. Digital reporting requirements and real-time tracking mandates are reshaping operational processes. Stakeholder collaboration between healthcare facilities, waste management providers, and regulatory bodies is improving overall system efficiency.

Technology dynamics drive operational improvements with automation reducing manual handling by 40% and improving worker safety. Advanced treatment technologies are achieving higher waste volume reduction rates while ensuring complete pathogen elimination. Data analytics applications are enabling predictive maintenance and optimized collection routing, reducing operational costs significantly.

Primary research methodology encompasses comprehensive interviews with key stakeholders including healthcare facility managers, waste management service providers, regulatory officials, and technology suppliers. Survey instruments were designed to capture quantitative data on waste generation volumes, service preferences, technology adoption rates, and regulatory compliance challenges.

Secondary research involved extensive analysis of government publications, regulatory documents, industry reports, and academic studies related to biomedical waste management in the UAE. Data triangulation techniques ensured accuracy and reliability of market insights by cross-referencing multiple information sources.

Market sizing methodology utilized bottom-up approaches analyzing healthcare facility counts, bed capacities, patient volumes, and waste generation rates per facility type. Growth projections incorporated planned healthcare infrastructure developments, population growth forecasts, and regulatory implementation timelines.

Competitive analysis methodology included detailed profiling of major service providers, assessment of market share distribution, and evaluation of competitive positioning strategies. Technology assessment involved analysis of treatment methods, tracking systems, and emerging innovations impacting market dynamics. Regional analysis methodology examined emirate-specific market characteristics, regulatory variations, and growth opportunities.

Dubai emirate dominates the UAE biomedical waste management market, accounting for approximately 35% of total market share due to its extensive healthcare infrastructure and high medical tourism volumes. The emirate hosts numerous world-class hospitals, specialized medical centers, and research facilities generating substantial biomedical waste volumes. Dubai Health Authority regulations drive strict compliance requirements, creating consistent demand for professional waste management services.

Abu Dhabi emirate represents the second-largest market segment with approximately 30% market share, supported by major healthcare institutions including Cleveland Clinic Abu Dhabi and Sheikh Khalifa Medical City. The emirate’s focus on healthcare excellence and medical research creates diverse waste streams requiring specialized handling. Government healthcare investments continue driving facility expansion and service demand.

Sharjah emirate shows strong growth potential with increasing healthcare facility development and population growth. The emirate’s strategic location and growing medical infrastructure create opportunities for waste management service expansion. Northern emirates including Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively represent emerging markets with accelerating healthcare development.

Cross-emirate operations are becoming increasingly common as service providers seek economies of scale and comprehensive geographic coverage. Transportation networks connecting emirates enable efficient waste collection and centralized treatment facility utilization. Regulatory harmonization efforts across emirates are simplifying multi-jurisdictional operations for service providers.

Market leadership in the UAE biomedical waste management sector is characterized by a mix of established local providers and international companies offering comprehensive service portfolios:

Competitive strategies focus on technology differentiation, regulatory compliance expertise, and comprehensive service offerings. Market leaders are investing in advanced treatment facilities, digital tracking systems, and specialized transportation fleets. Service integration trends show providers expanding beyond basic collection to offer complete waste management solutions including consulting and training services.

Market consolidation activities include strategic acquisitions and partnerships enabling geographic expansion and capability enhancement. Innovation focus areas include automated waste segregation, real-time tracking systems, and sustainable treatment technologies.

By Waste Type:

By Service Type:

By End User:

Infectious waste management represents the largest market category, driven by high generation volumes from patient care activities across all healthcare facility types. This category requires strict segregation protocols and specialized treatment methods to ensure complete pathogen elimination. Treatment efficiency improvements through advanced autoclaving technologies are achieving 99.9% pathogen reduction rates while minimizing environmental impact.

Sharps waste handling demands specialized containers, collection procedures, and treatment methods due to injury risks and potential contamination. Safety protocols for sharps management are becoming increasingly sophisticated, with puncture-resistant containers and automated handling systems reducing worker exposure risks.

Pharmaceutical waste management requires specialized knowledge of drug classifications, controlled substance regulations, and appropriate destruction methods. Chemotherapy waste handling represents a high-value specialized service requiring enhanced safety protocols and specialized treatment facilities.

Pathological waste processing involves sensitive handling requirements and specialized treatment methods ensuring complete tissue destruction. Religious and cultural considerations in the UAE context require respectful handling procedures and appropriate disposal methods. Laboratory waste management encompasses diverse chemical and biological waste streams requiring specialized expertise and treatment capabilities.

Healthcare facilities benefit from professional biomedical waste management through reduced regulatory compliance risks, improved staff safety, and operational efficiency gains. Outsourcing waste management allows healthcare providers to focus on core medical services while ensuring expert handling of hazardous materials. Cost predictability through service contracts enables better budget planning and resource allocation.

Service providers benefit from stable, recurring revenue streams and opportunities for service expansion as healthcare infrastructure grows. Technology investments in advanced treatment and tracking systems create competitive advantages and operational efficiencies. Regulatory expertise development enables premium service pricing and market differentiation.

Government stakeholders benefit from improved public health protection, environmental preservation, and regulatory compliance across the healthcare sector. Economic benefits include job creation, technology development, and support for healthcare sector growth objectives. Environmental protection through proper waste management supports sustainability goals and international environmental commitments.

Technology suppliers benefit from growing demand for advanced waste management equipment, tracking systems, and treatment technologies. Innovation opportunities in automation, digitalization, and sustainable treatment methods create new market segments and revenue streams.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents a dominant trend with healthcare facilities and waste management providers implementing comprehensive tracking systems, automated reporting, and real-time monitoring capabilities. IoT integration enables smart waste containers, GPS tracking, and predictive analytics for optimized collection routing and capacity planning.

Sustainability focus drives adoption of environmentally friendly treatment technologies and waste-to-energy initiatives. Circular economy principles are influencing waste management strategies with emphasis on resource recovery and environmental impact minimization. Carbon footprint reduction initiatives are promoting local treatment facilities and optimized transportation routes.

Service integration trends show providers expanding beyond basic collection to offer comprehensive solutions including regulatory compliance consulting, staff training, and waste minimization programs. Customized service packages tailored to specific healthcare facility types and waste generation patterns are becoming standard offerings.

Automation advancement includes robotic waste sorting, automated treatment systems, and AI-powered waste classification technologies. Safety enhancement through technology includes contactless waste handling systems and advanced personal protective equipment. MWR analysis indicates that technology adoption rates are accelerating with 75% of major facilities implementing digital tracking systems within the past two years.

Regulatory enhancements include implementation of digital waste tracking mandates and enhanced penalty structures for non-compliance. Federal coordination efforts are harmonizing waste management regulations across emirates, simplifying multi-jurisdictional operations for service providers.

Technology investments by major service providers include new treatment facility construction with advanced autoclaving and incineration capabilities. Bee’ah’s expansion of biomedical waste treatment capacity demonstrates market confidence and growth expectations. International partnerships are bringing advanced technologies and global best practices to the UAE market.

Healthcare facility developments including new hospital construction and specialty center expansion are creating substantial waste management service opportunities. Medical tourism initiatives supported by government entities are driving increased patient volumes and corresponding waste generation.

Training program development by industry associations and service providers is addressing skilled workforce shortages and improving overall sector capabilities. Research and development initiatives focus on sustainable treatment technologies and waste minimization strategies. Public-private partnerships are emerging for large-scale waste management infrastructure development and operation.

Service providers should prioritize technology investments in digital tracking systems and automated treatment capabilities to maintain competitive advantages and meet evolving regulatory requirements. Geographic expansion into northern emirates presents significant growth opportunities as healthcare infrastructure development accelerates.

Healthcare facilities should evaluate comprehensive service partnerships that include regulatory compliance support and staff training programs. Waste minimization strategies and sustainable practices should be integrated into facility operations to reduce costs and environmental impact.

Technology suppliers should focus on developing integrated solutions combining waste tracking, treatment optimization, and regulatory compliance capabilities. Local partnerships with established service providers can accelerate market entry and technology adoption.

Government stakeholders should continue regulatory harmonization efforts across emirates while supporting technology adoption and workforce development initiatives. Public-private partnerships for infrastructure development can accelerate market growth while ensuring adequate treatment capacity.

Investment opportunities exist in advanced treatment technologies, digital platform development, and specialized service capabilities. MarkWide Research recommends focusing on sustainability-oriented solutions and comprehensive service integration to capture emerging market opportunities.

Market expansion prospects remain highly favorable with continued healthcare infrastructure development and increasing regulatory enforcement driving sustained demand growth. Technology advancement will continue reshaping operational practices with automation, digitalization, and sustainable treatment methods becoming standard industry practices.

Geographic growth opportunities in northern emirates and potential regional expansion into neighboring GCC markets offer substantial revenue potential for established providers. Service diversification into consulting, training, and specialized waste stream management will create additional revenue streams and competitive differentiation.

Regulatory evolution toward enhanced digital reporting and real-time monitoring will require continued technology investments but will improve overall system efficiency and compliance. Sustainability requirements will drive adoption of environmentally friendly treatment technologies and circular economy principles.

Market consolidation trends are expected to continue with larger providers acquiring smaller operators to achieve economies of scale and comprehensive geographic coverage. International competition will intensify as global providers recognize UAE market opportunities, driving innovation and service quality improvements.

Growth projections indicate the market will maintain robust expansion with CAGR exceeding 8% through the forecast period, supported by healthcare sector growth, regulatory compliance requirements, and technology adoption trends.

The UAE biomedical waste management market represents a dynamic and rapidly expanding sector driven by healthcare infrastructure growth, regulatory compliance requirements, and increasing environmental awareness. Market fundamentals remain strong with consistent demand generation from expanding healthcare facilities and rising patient volumes across all emirates.

Technology integration and service diversification are reshaping competitive dynamics, creating opportunities for providers offering comprehensive solutions beyond basic waste collection and disposal. Regulatory support and government healthcare investments provide a stable foundation for sustained market growth and development.

Future success in this market will depend on technology adoption, regulatory compliance expertise, and ability to provide integrated solutions meeting evolving healthcare facility needs. The sector’s critical role in public health protection and environmental preservation ensures continued importance and growth potential within the UAE’s healthcare ecosystem.

What is Biomedical Waste Management?

Biomedical Waste Management refers to the processes and practices involved in the handling, treatment, and disposal of waste generated from healthcare activities, including hospitals, laboratories, and clinics. This waste can include sharps, infectious materials, and chemical waste that require special attention to prevent health risks and environmental contamination.

What are the key players in the UAE Biomedical Waste Management Market?

Key players in the UAE Biomedical Waste Management Market include companies such as Veolia Environmental Services, Dulsco, and EcoWaste, which provide waste collection, treatment, and disposal services tailored to healthcare facilities, among others.

What are the main drivers of the UAE Biomedical Waste Management Market?

The main drivers of the UAE Biomedical Waste Management Market include the increasing volume of medical waste generated due to rising healthcare activities, stringent regulations regarding waste disposal, and growing awareness of environmental sustainability among healthcare providers.

What challenges does the UAE Biomedical Waste Management Market face?

The UAE Biomedical Waste Management Market faces challenges such as inadequate infrastructure for waste segregation and treatment, high operational costs, and the need for continuous training of personnel handling hazardous waste to ensure compliance with safety standards.

What opportunities exist in the UAE Biomedical Waste Management Market?

Opportunities in the UAE Biomedical Waste Management Market include the development of advanced waste treatment technologies, increasing partnerships between public and private sectors for efficient waste management solutions, and the potential for expanding services to emerging healthcare facilities.

What trends are shaping the UAE Biomedical Waste Management Market?

Trends shaping the UAE Biomedical Waste Management Market include the adoption of digital solutions for tracking waste management processes, increased focus on recycling and resource recovery from biomedical waste, and the implementation of stricter regulations to enhance safety and environmental protection.

UAE Biomedical Waste Management Market

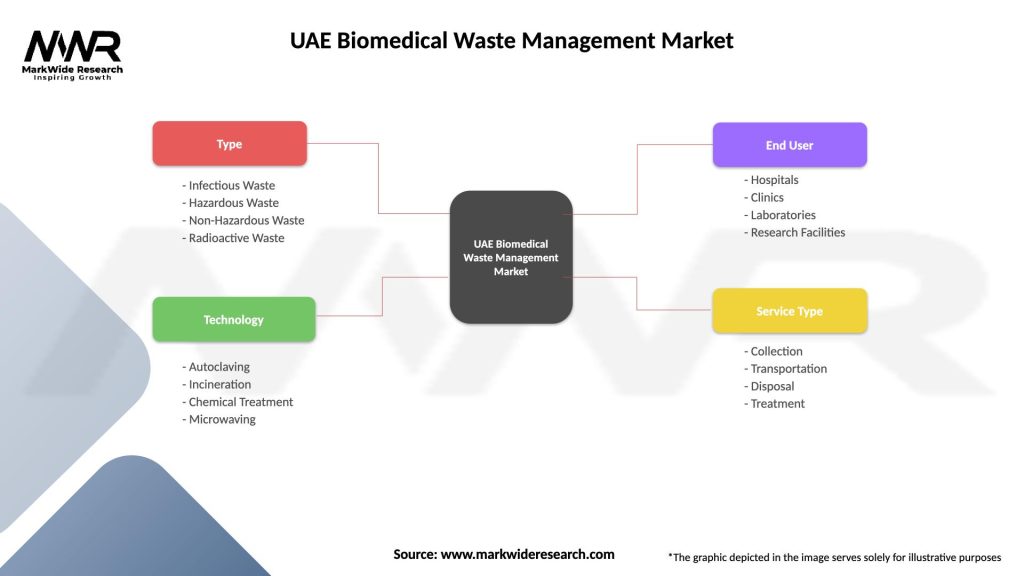

| Segmentation Details | Description |

|---|---|

| Type | Infectious Waste, Hazardous Waste, Non-Hazardous Waste, Radioactive Waste |

| Technology | Autoclaving, Incineration, Chemical Treatment, Microwaving |

| End User | Hospitals, Clinics, Laboratories, Research Facilities |

| Service Type | Collection, Transportation, Disposal, Treatment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Biomedical Waste Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at