444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE beauty industry market represents one of the most dynamic and rapidly evolving sectors in the Middle East, characterized by exceptional growth momentum and increasing consumer sophistication. This vibrant market encompasses a comprehensive range of beauty products and services, including skincare, cosmetics, haircare, fragrances, and professional beauty treatments. The region’s strategic position as a global business hub, combined with its diverse multicultural population and rising disposable income levels, has created an exceptionally fertile environment for beauty brands and retailers.

Market dynamics indicate robust expansion driven by several key factors, including the growing influence of social media, increasing beauty consciousness among consumers, and the rising participation of women in the workforce. The market demonstrates impressive growth rates, with industry analysts projecting a compound annual growth rate (CAGR) of 8.2% over the forecast period. This growth trajectory reflects the region’s evolving consumer preferences, technological advancements in beauty products, and the increasing penetration of international beauty brands.

Consumer behavior patterns reveal a sophisticated market where quality, innovation, and brand reputation play crucial roles in purchasing decisions. The UAE’s cosmopolitan population, comprising both local Emiratis and expatriates from various countries, creates diverse demand patterns that beauty companies must navigate strategically. Premium and luxury beauty segments continue to dominate market share, with consumers showing willingness to invest in high-quality products that deliver superior results and align with their lifestyle aspirations.

The UAE beauty industry market refers to the comprehensive ecosystem of businesses, products, and services dedicated to enhancing personal appearance and well-being within the United Arab Emirates. This market encompasses the manufacturing, distribution, retail, and service provision of beauty and personal care products, including cosmetics, skincare formulations, haircare products, fragrances, and professional beauty services such as salons, spas, and aesthetic treatments.

Market scope extends beyond traditional product categories to include emerging segments such as organic and natural beauty products, men’s grooming solutions, anti-aging treatments, and technologically advanced beauty devices. The industry serves diverse consumer segments ranging from budget-conscious shoppers to luxury beauty enthusiasts, with distribution channels spanning traditional retail outlets, department stores, specialty beauty retailers, online platforms, and direct-to-consumer models.

Industry stakeholders include international beauty conglomerates, regional manufacturers, local distributors, retail chains, independent beauty professionals, and service providers. The market’s definition also encompasses supporting industries such as packaging, marketing, logistics, and regulatory compliance services that enable the beauty ecosystem to function effectively within the UAE’s business environment.

Strategic analysis reveals that the UAE beauty industry market stands as a cornerstone of the region’s consumer goods sector, demonstrating exceptional resilience and growth potential. The market’s evolution reflects broader economic diversification efforts within the UAE, positioning beauty and personal care as significant contributors to the non-oil economy. Current market conditions indicate strong consumer demand across multiple beauty categories, with particular strength in premium skincare, luxury cosmetics, and innovative beauty technologies.

Key performance indicators highlight the market’s robust health, with beauty product sales showing consistent year-over-year growth and consumer spending patterns indicating increased frequency of beauty-related purchases. The market benefits from favorable demographic trends, including a young, affluent population with high beauty awareness and spending power. Digital transformation has emerged as a critical success factor, with online beauty sales representing approximately 23% of total market transactions.

Competitive landscape features a dynamic mix of established international brands and emerging local players, creating an environment that fosters innovation and consumer choice. Market leaders continue to invest heavily in product development, marketing initiatives, and retail expansion to maintain their competitive positions. The industry’s future outlook remains highly positive, supported by government initiatives promoting the UAE as a regional beauty and wellness destination.

Consumer preferences in the UAE beauty market demonstrate several distinctive characteristics that shape industry dynamics and growth opportunities:

Economic prosperity serves as the primary catalyst driving UAE beauty market expansion, with rising disposable incomes enabling consumers to allocate larger portions of their budgets to beauty and personal care products. The country’s robust economic growth, supported by diversification initiatives and strategic investments, has created a consumer base with significant purchasing power and willingness to invest in premium beauty solutions.

Demographic advantages significantly contribute to market growth, with the UAE’s young population profile creating sustained demand for beauty products. The median age of the population remains relatively low, and this demographic cohort demonstrates high beauty consciousness and active engagement with beauty trends. Additionally, the substantial expatriate population brings diverse beauty preferences and spending patterns that expand overall market opportunities.

Cultural evolution within UAE society has led to increased acceptance and celebration of beauty and self-care practices. Traditional cultural values now harmoniously coexist with modern beauty trends, creating unique market dynamics where both traditional and contemporary beauty approaches thrive. This cultural shift has particularly benefited the women’s beauty segment while also opening new opportunities in men’s grooming and family-oriented beauty products.

Digital transformation continues to revolutionize how consumers discover, research, and purchase beauty products. The widespread adoption of smartphones and social media platforms has created new pathways for beauty brand engagement and customer acquisition. E-commerce platforms and digital marketing strategies have become essential components of successful beauty business models in the UAE market.

Regulatory complexities present ongoing challenges for beauty companies operating in the UAE market, particularly regarding product registration, ingredient approvals, and compliance with local standards. While the regulatory framework aims to ensure consumer safety and product quality, the compliance process can be time-consuming and costly for new market entrants and companies introducing innovative products.

Intense competition creates pressure on profit margins and requires significant investment in marketing and brand differentiation. The market’s attractiveness has drawn numerous international and regional players, resulting in a crowded competitive landscape where companies must continuously innovate and invest to maintain market share. Price competition, particularly in mass-market segments, can erode profitability and limit growth opportunities for smaller players.

Supply chain challenges occasionally impact product availability and cost structures, particularly for companies relying on international suppliers. Global supply chain disruptions, currency fluctuations, and logistics complexities can affect inventory management and pricing strategies. Companies must develop resilient supply chain networks to ensure consistent product availability and competitive pricing.

Cultural sensitivities require careful navigation when developing marketing strategies and product positioning. Beauty companies must balance global brand consistency with local cultural requirements, which can complicate product development and marketing approaches. Missteps in cultural understanding can result in negative consumer reactions and damage brand reputation in this culturally diverse market.

Emerging segments present substantial growth opportunities for forward-thinking beauty companies willing to invest in innovation and market development. The natural and organic beauty segment shows particularly strong potential, driven by increasing consumer awareness of ingredient safety and environmental sustainability. Companies that can successfully develop and market clean beauty products tailored to local preferences stand to capture significant market share in this expanding category.

Technology integration offers numerous opportunities for beauty companies to differentiate their offerings and enhance customer experiences. Augmented reality applications for virtual try-ons, artificial intelligence for personalized product recommendations, and smart beauty devices represent emerging opportunities that align with UAE consumers’ technology adoption patterns. Companies that successfully integrate technology into their beauty solutions can create competitive advantages and build stronger customer relationships.

Male grooming expansion represents one of the fastest-growing opportunities within the UAE beauty market. Traditional gender roles continue to evolve, and men increasingly embrace skincare, grooming, and personal care products. This demographic shift creates opportunities for specialized men’s beauty lines, targeted marketing campaigns, and dedicated retail spaces that cater to male consumers’ specific needs and preferences.

Professional services growth reflects increasing consumer willingness to invest in expert beauty treatments and personalized services. Opportunities exist for advanced aesthetic treatments, customized skincare consultations, and premium salon services that deliver superior results and experiences. The integration of medical aesthetics with traditional beauty services presents particularly promising growth potential.

Supply and demand equilibrium in the UAE beauty market demonstrates healthy balance with slight demand exceeding supply in premium segments, creating favorable conditions for established brands and new market entrants. Consumer demand continues to outpace supply in specialized categories such as halal-certified beauty products, organic formulations, and technologically advanced beauty devices. This demand-supply dynamic supports pricing power for innovative products and encourages continued investment in market expansion.

Competitive intensity varies significantly across different beauty categories, with skincare and cosmetics experiencing the highest competition levels while emerging segments like men’s grooming and natural beauty products offer more favorable competitive environments. Market leaders maintain their positions through continuous innovation, strategic partnerships, and substantial marketing investments, while challenger brands focus on niche segments and differentiated value propositions.

Price sensitivity patterns reveal that UAE consumers demonstrate low price sensitivity for products that deliver superior quality and results, particularly in skincare and luxury cosmetics categories. However, price consciousness increases in mass-market segments where functional benefits are similar across competing products. This dynamic creates opportunities for premium positioning while requiring careful value engineering for mass-market offerings.

Innovation cycles in the UAE beauty market accelerate continuously, with consumers expecting regular product updates and new formulations. Successful companies maintain robust research and development capabilities and establish efficient product launch processes to capitalize on emerging trends and consumer preferences. The market rewards innovation with strong sales performance and brand loyalty, making continuous innovation essential for long-term success.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights and projections. Primary research activities include extensive consumer surveys, focus group discussions, and in-depth interviews with industry stakeholders, beauty professionals, and retail partners. These primary research efforts provide direct insights into consumer behavior, preferences, and purchasing patterns that drive market dynamics.

Secondary research components encompass detailed analysis of industry reports, government statistics, trade publications, and company financial statements to establish market size, growth trends, and competitive positioning. Regulatory filings, patent applications, and product launch announcements provide additional data points for understanding market evolution and future direction.

Data validation processes ensure research findings accuracy through triangulation of multiple data sources and cross-verification of key market metrics. Industry expert consultations and retail partner feedback sessions provide additional validation of research conclusions and market projections. Statistical analysis techniques and econometric modeling support quantitative findings and growth forecasts.

Market segmentation analysis utilizes advanced analytical frameworks to identify distinct consumer groups, product categories, and distribution channels. Geographic analysis considers regional variations within the UAE, while demographic segmentation explores age, income, and cultural factors that influence beauty purchasing behavior. This comprehensive analytical approach provides actionable insights for strategic decision-making and market entry planning.

Dubai market dominance continues as the emirate maintains its position as the UAE’s beauty industry epicenter, accounting for approximately 48% of total market activity. Dubai’s cosmopolitan population, extensive retail infrastructure, and status as a regional shopping destination create ideal conditions for beauty brand success. The emirate’s numerous shopping malls, luxury retail districts, and international airport duty-free operations provide multiple touchpoints for consumer engagement and product sales.

Abu Dhabi’s growing influence reflects the capital’s increasing importance as a beauty market, driven by rising affluence and expanding retail infrastructure. The emirate’s focus on luxury lifestyle and cultural development has attracted premium beauty brands and created demand for high-end beauty services. Government initiatives promoting Abu Dhabi as a cultural and business hub support continued beauty market expansion in the region.

Northern Emirates development shows promising growth potential as Sharjah, Ajman, and other northern emirates experience economic development and population growth. These regions offer opportunities for beauty companies seeking to expand beyond the primary Dubai and Abu Dhabi markets. Local consumer preferences in northern emirates often favor value-oriented products while maintaining quality expectations, creating distinct market dynamics.

Cross-emirate distribution networks enable beauty companies to efficiently serve the entire UAE market through strategic logistics and retail partnerships. Successful beauty brands establish comprehensive distribution coverage that ensures product availability across all emirates while adapting marketing and product mix to regional preferences. This geographic diversification strategy reduces market concentration risk and maximizes growth opportunities.

Market leadership in the UAE beauty industry features a dynamic competitive environment with several key players maintaining strong positions across different product categories:

Competitive strategies focus on brand differentiation, product innovation, and customer experience enhancement. Leading companies invest heavily in research and development to create products that address specific regional needs and preferences. Strategic partnerships with local distributors and retailers enable effective market penetration and consumer engagement.

Emerging competitors include regional beauty brands and direct-to-consumer companies that leverage digital platforms and social media marketing to build brand awareness and customer loyalty. These companies often focus on niche segments or specific consumer needs that may be underserved by larger multinational corporations.

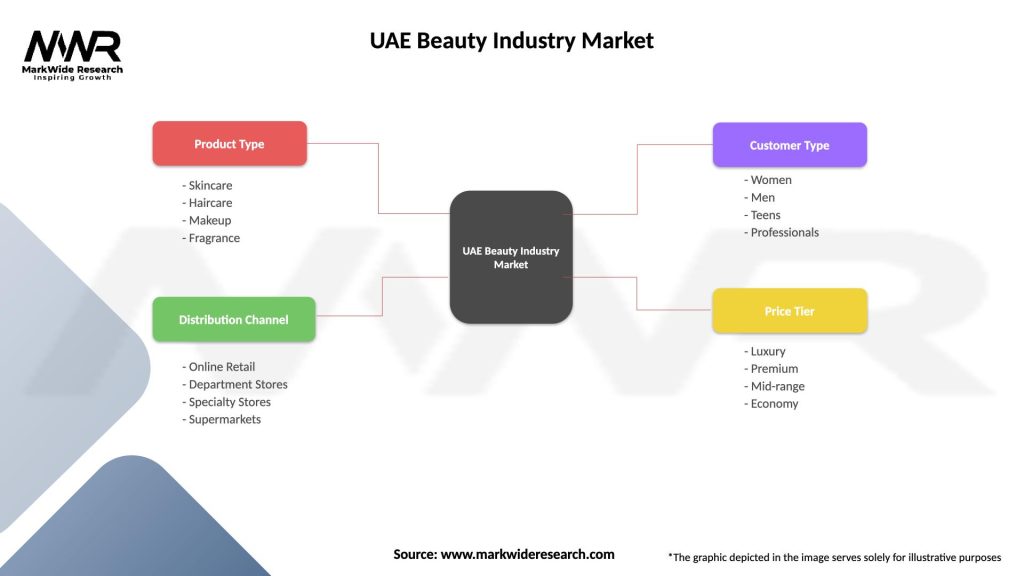

Product category segmentation reveals distinct market dynamics and growth patterns across different beauty product types:

By Product Type:

By Consumer Demographics:

By Price Positioning:

Skincare category leadership reflects UAE consumers’ prioritization of skin health and appearance, driven by climate considerations and increasing awareness of skincare benefits. The harsh desert climate and intense sun exposure create specific skincare needs that successful brands address through specialized formulations. Anti-aging products, sun protection, and hydrating treatments perform particularly well, with consumers willing to invest in premium solutions that deliver visible results.

Color cosmetics evolution shows adaptation to local preferences and cultural considerations while maintaining international beauty standards. Long-wearing formulations that withstand heat and humidity perform exceptionally well, as do products that complement the diverse skin tones represented in the UAE’s multicultural population. Social media influence drives trend adoption, with beauty influencers significantly impacting product popularity and sales performance.

Fragrance market strength builds on cultural appreciation for fine fragrances and personal scenting traditions. The UAE market demonstrates particular affinity for luxury fragrances, with consumers often maintaining collections of multiple scents for different occasions. Oud-based fragrances and Middle Eastern-inspired scents perform well alongside international designer fragrances, creating a unique market dynamic that blends traditional and contemporary preferences.

Haircare innovation addresses specific challenges related to climate, water quality, and diverse hair types represented in the UAE population. Professional-grade treatments and salon-quality products for home use show strong growth, reflecting consumers’ desire for superior hair health and appearance. Heat protection and moisture-intensive treatments are particularly popular given environmental factors that can stress hair health.

Revenue growth opportunities abound for beauty companies that successfully navigate the UAE market’s unique characteristics and consumer preferences. The market’s strong growth trajectory, supported by favorable demographics and economic conditions, provides sustainable revenue expansion potential for both established brands and new market entrants. Companies that invest in understanding local preferences and developing appropriate product offerings can achieve significant market share gains.

Brand building advantages emerge from the UAE’s position as a regional hub and its influence on broader Middle Eastern beauty trends. Success in the UAE market often translates to credibility and opportunities in neighboring markets, creating a multiplier effect for brand investment. The country’s cosmopolitan population and international business environment provide ideal testing grounds for new products and marketing approaches.

Innovation acceleration results from exposure to diverse consumer needs and preferences that drive product development and improvement. The UAE market’s receptivity to new technologies and formulations encourages companies to invest in research and development, leading to innovations that can be applied globally. Consumer feedback and market performance data from the UAE provide valuable insights for product refinement and expansion strategies.

Partnership opportunities with local distributors, retailers, and service providers create synergistic relationships that benefit all stakeholders. These partnerships provide market access, local expertise, and operational efficiency while supporting the development of the broader beauty ecosystem. Successful collaborations often lead to long-term strategic relationships that support sustained growth and market expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean beauty movement gains significant momentum as UAE consumers become increasingly conscious of ingredient safety and environmental impact. This trend drives demand for products with natural, organic, and sustainably sourced ingredients while maintaining efficacy and luxury positioning. Beauty brands that successfully communicate their clean beauty credentials while delivering superior performance capture growing market share in this expanding segment.

Personalization revolution transforms how beauty products are developed, marketed, and sold, with consumers expecting customized solutions that address their specific needs and preferences. Advanced technologies enable personalized product recommendations, custom formulations, and targeted marketing approaches that enhance customer satisfaction and loyalty. Companies investing in personalization capabilities gain competitive advantages and build stronger customer relationships.

Social commerce integration reshapes beauty retail as social media platforms become primary channels for product discovery, evaluation, and purchase. Beauty influencers, user-generated content, and social shopping features create new pathways for consumer engagement and conversion. Successful beauty brands develop comprehensive social commerce strategies that leverage multiple platforms and content formats to reach and engage target audiences.

Wellness convergence blurs traditional boundaries between beauty and health products as consumers adopt holistic approaches to personal care. Beauty products that deliver wellness benefits, such as stress reduction, mood enhancement, or health improvement, resonate strongly with health-conscious consumers. This trend creates opportunities for innovative product development and positioning that addresses both beauty and wellness needs.

Inclusive beauty expansion reflects growing demand for products that serve diverse skin tones, hair types, and beauty needs represented in the UAE’s multicultural population. Brands that develop comprehensive shade ranges, culturally sensitive formulations, and inclusive marketing approaches capture broader market opportunities and build stronger brand loyalty among diverse consumer segments.

Retail innovation initiatives continue transforming the beauty shopping experience through technology integration and enhanced customer service offerings. Major retailers invest in augmented reality try-on technologies, personalized consultation services, and omnichannel shopping experiences that bridge online and offline interactions. These developments improve customer satisfaction and drive sales conversion while creating competitive differentiation.

Local manufacturing expansion reflects growing interest in establishing production capabilities within the UAE to serve regional markets more efficiently. Several international beauty companies explore local manufacturing partnerships and facility development to reduce supply chain complexity and improve market responsiveness. These initiatives support the UAE’s economic diversification goals while creating employment opportunities and technology transfer.

Sustainability initiatives gain prominence as beauty companies implement comprehensive environmental responsibility programs addressing packaging, ingredients, and operations. MarkWide Research indicates that sustainability-focused initiatives influence 67% of consumer purchasing decisions in the premium beauty segment. Companies that successfully integrate sustainability into their business models while maintaining product quality and performance achieve competitive advantages and brand differentiation.

Digital transformation acceleration encompasses comprehensive technology adoption across beauty industry operations, from product development and manufacturing to marketing and customer service. Artificial intelligence, data analytics, and automation technologies enable more efficient operations and enhanced customer experiences. Beauty companies that successfully leverage digital technologies achieve operational excellence and market leadership positions.

Market entry strategies should prioritize understanding local consumer preferences and cultural nuances while maintaining global brand consistency. New market entrants benefit from partnering with established local distributors who possess market knowledge and retail relationships. Successful market entry requires significant investment in brand building, product adaptation, and customer education to establish market presence and credibility.

Product development focus should address specific regional needs such as climate adaptation, cultural preferences, and diverse demographic requirements. Companies that invest in research and development tailored to UAE market conditions achieve superior product performance and customer satisfaction. Innovation should balance international beauty trends with local preferences to create products that resonate with target consumers.

Digital marketing optimization requires comprehensive social media strategies that leverage multiple platforms and content formats to reach diverse consumer segments. Beauty brands should invest in influencer partnerships, user-generated content campaigns, and social commerce capabilities to maximize digital marketing effectiveness. Data analytics and performance measurement enable continuous optimization of digital marketing investments.

Distribution channel diversification reduces market risk and maximizes consumer reach through multiple touchpoints including traditional retail, e-commerce, and direct-to-consumer channels. Companies should develop omnichannel strategies that provide consistent brand experiences across all customer interaction points. Strategic retail partnerships and selective distribution approaches can enhance brand positioning and profitability.

Growth trajectory projections indicate continued robust expansion of the UAE beauty industry market, supported by favorable demographic trends, economic stability, and evolving consumer preferences. Market analysts project sustained growth rates exceeding regional averages, with particular strength in premium segments and innovative product categories. The market’s maturation will likely lead to increased sophistication in consumer preferences and higher expectations for product quality and brand experience.

Technology integration advancement will accelerate as beauty companies adopt artificial intelligence, augmented reality, and personalization technologies to enhance customer experiences and operational efficiency. Smart beauty devices, virtual consultation services, and personalized product recommendations will become standard market offerings. Companies that successfully integrate technology while maintaining human touch and personal service will achieve competitive advantages.

Sustainability transformation will reshape industry practices as environmental consciousness becomes increasingly important to consumers and regulators. Beauty companies will need to develop comprehensive sustainability strategies addressing packaging, ingredients, manufacturing, and distribution. MWR analysis suggests that sustainable beauty products could represent 35% of market share within the next five years, driven by consumer demand and regulatory requirements.

Market consolidation trends may emerge as competition intensifies and companies seek scale advantages through mergers, acquisitions, and strategic partnerships. Successful companies will likely be those that achieve optimal balance between global scale and local market adaptation. Innovation capabilities, brand strength, and distribution efficiency will become key differentiators in an increasingly competitive landscape.

The UAE beauty industry market represents a compelling growth opportunity characterized by strong fundamentals, favorable demographics, and evolving consumer sophistication. Market dynamics indicate sustained expansion potential supported by economic prosperity, cultural evolution, and technological advancement. Success in this market requires deep understanding of local preferences, strategic investment in innovation, and comprehensive approach to brand building and customer engagement.

Strategic implications for industry participants emphasize the importance of balancing global expertise with local market adaptation to achieve sustainable competitive advantages. Companies that successfully navigate cultural sensitivities, regulatory requirements, and competitive pressures while delivering superior products and experiences will capture significant market opportunities. The market’s evolution toward premiumization, personalization, and sustainability creates new avenues for growth and differentiation.

Future success factors will increasingly center on innovation capabilities, digital transformation, and sustainability leadership as the market matures and consumer expectations evolve. Beauty companies that invest in these critical areas while maintaining focus on product quality and customer satisfaction will be best positioned to capitalize on the UAE beauty market’s continued growth and expansion potential.

What is UAE Beauty Industry?

The UAE Beauty Industry encompasses a wide range of products and services related to personal care, cosmetics, skincare, and wellness. It includes various segments such as makeup, hair care, and fragrance, catering to diverse consumer preferences and trends.

What are the key players in the UAE Beauty Industry Market?

Key players in the UAE Beauty Industry Market include companies like Al Haramain Perfumes, Amara Cosmetics, and L’Oreal Middle East. These companies are known for their innovative products and strong market presence, among others.

What are the growth factors driving the UAE Beauty Industry Market?

The growth of the UAE Beauty Industry Market is driven by factors such as increasing disposable income, a growing population, and rising awareness of personal grooming. Additionally, the influence of social media and beauty trends plays a significant role in shaping consumer behavior.

What challenges does the UAE Beauty Industry Market face?

The UAE Beauty Industry Market faces challenges such as intense competition, regulatory compliance, and changing consumer preferences. Additionally, economic fluctuations can impact consumer spending on beauty products and services.

What opportunities exist in the UAE Beauty Industry Market?

Opportunities in the UAE Beauty Industry Market include the rise of e-commerce, increasing demand for organic and natural products, and the potential for expansion into emerging markets. Brands can leverage these trends to innovate and reach new customer segments.

What trends are shaping the UAE Beauty Industry Market?

Trends shaping the UAE Beauty Industry Market include the growing popularity of cruelty-free and vegan products, the rise of personalized beauty solutions, and the integration of technology in beauty services. These trends reflect changing consumer values and preferences.

UAE Beauty Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Skincare, Haircare, Makeup, Fragrance |

| Distribution Channel | Online Retail, Department Stores, Specialty Stores, Supermarkets |

| Customer Type | Women, Men, Teens, Professionals |

| Price Tier | Luxury, Premium, Mid-range, Economy |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Beauty Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at