444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE baby diapers industry market represents one of the most dynamic and rapidly evolving sectors within the country’s consumer goods landscape. Market dynamics indicate substantial growth driven by increasing birth rates, rising disposable income, and evolving parental preferences toward premium diaper products. The market encompasses both disposable and cloth diaper segments, with disposable diapers commanding the largest market share at approximately 92% of total market volume.

Consumer behavior patterns in the UAE reflect a strong preference for international brands and premium quality products, particularly among expatriate families who constitute a significant portion of the population. The market demonstrates robust growth potential, expanding at a compound annual growth rate (CAGR) of 6.2% over recent years. Regional distribution shows Dubai and Abu Dhabi accounting for nearly 68% of total market consumption, reflecting the concentration of urban populations and higher purchasing power in these emirates.

Product innovation continues to drive market expansion, with manufacturers introducing eco-friendly options, enhanced absorption technologies, and specialized products for different age groups. The market benefits from strong retail infrastructure, including hypermarkets, pharmacies, and increasingly popular e-commerce platforms that facilitate convenient access to diaper products across the UAE.

The UAE baby diapers industry market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, and retail of infant and toddler diaper products within the United Arab Emirates. This market includes various diaper types such as disposable diapers, cloth diapers, training pants, and specialized products designed for different developmental stages of children from newborn to potty training age.

Market scope extends beyond traditional diaper products to include related accessories such as diaper rash creams, wipes, and disposal systems. The industry serves diverse consumer segments including local Emirati families, expatriate communities, and tourists, each with distinct preferences and purchasing behaviors that shape market dynamics and product offerings.

Distribution channels within this market encompass traditional retail outlets, modern trade formats, pharmacies, and digital platforms, creating a multi-faceted marketplace that caters to varying consumer convenience and accessibility requirements across the UAE’s seven emirates.

Strategic analysis of the UAE baby diapers industry reveals a mature yet continuously evolving market characterized by strong brand loyalty, premium product preferences, and increasing environmental consciousness among consumers. Market penetration of disposable diapers remains exceptionally high, with penetration rates reaching 96% among urban households with infants and toddlers.

Competitive landscape features a mix of international giants and regional players, with premium brands capturing approximately 45% of market share despite representing higher price points. Consumer trends indicate growing demand for organic and eco-friendly diaper options, with this segment experiencing growth rates of 12% annually.

Digital transformation significantly impacts purchasing patterns, with online sales channels accounting for 28% of total diaper sales and continuing to expand rapidly. The market demonstrates resilience and consistent demand patterns, supported by stable demographics and strong economic fundamentals across the UAE.

Demographic drivers play a crucial role in shaping market demand, with the UAE maintaining steady birth rates and a young population structure that supports consistent diaper consumption. Consumer preferences reveal several key insights that define market dynamics:

Market maturity indicators suggest established distribution networks, sophisticated consumer knowledge, and stable competitive dynamics that create predictable demand patterns while maintaining opportunities for innovation and market expansion.

Population growth serves as the primary driver for the UAE baby diapers market, with consistent birth rates and a substantial expatriate population contributing to steady demand expansion. Economic prosperity across the UAE enables higher spending on premium baby care products, with families increasingly prioritizing quality and convenience over price considerations.

Urbanization trends significantly impact market growth, as urban lifestyles favor disposable diaper usage over traditional cloth alternatives. Working parent demographics create strong demand for convenient, reliable diaper solutions that support busy family schedules and dual-income household structures.

Healthcare awareness drives demand for advanced diaper technologies that promote infant skin health and prevent diaper rash. Retail infrastructure development enhances product accessibility through expanded hypermarket networks, specialized baby stores, and comprehensive e-commerce platforms that facilitate convenient purchasing experiences.

Cultural factors within the UAE’s diverse population create demand for products that meet various cultural preferences and requirements. Tourism industry contributes additional demand through visiting families who require convenient access to familiar diaper brands during their stay in the UAE.

Environmental concerns present significant challenges for the disposable diaper market, with increasing awareness of plastic waste and landfill impact creating consumer hesitation toward traditional diaper products. Regulatory pressures regarding waste management and environmental protection may influence future market dynamics and product development requirements.

Economic fluctuations can impact consumer spending patterns, particularly affecting premium product segments during periods of reduced disposable income. Import dependencies create vulnerability to supply chain disruptions and currency exchange rate fluctuations that may affect product pricing and availability.

Competition intensity among established brands creates pricing pressures and margin compression challenges for market participants. Cultural preferences in certain communities favor traditional cloth diaper usage, limiting market penetration opportunities in specific demographic segments.

Storage and logistics costs associated with bulky diaper products impact distribution efficiency and retail margins. Seasonal demand variations create inventory management challenges and potential stock-out situations during peak consumption periods.

Sustainable product development presents substantial opportunities for market expansion, with eco-friendly and biodegradable diaper options addressing growing environmental consciousness among UAE consumers. Premium segment growth offers opportunities for brands to introduce innovative features and command higher margins through advanced absorption technologies and skin-care benefits.

E-commerce expansion creates opportunities for direct-to-consumer sales models, subscription services, and personalized product offerings that enhance customer convenience and loyalty. Regional export potential allows UAE-based distributors to serve neighboring GCC markets through established logistics networks and regional expertise.

Product diversification opportunities include specialized diapers for different activities, overnight protection, and sensitive skin formulations. Private label development enables retailers to capture higher margins while offering competitive pricing to price-sensitive consumer segments.

Technology integration through smart diapers with monitoring capabilities and mobile app connectivity represents emerging opportunities for tech-savvy parents. Bulk purchasing programs for institutions such as nurseries and healthcare facilities create additional revenue streams and market expansion possibilities.

Supply chain dynamics within the UAE baby diapers market reflect a complex interplay of international manufacturing, regional distribution, and local retail networks. Demand patterns demonstrate consistent baseline consumption with periodic spikes driven by promotional activities and seasonal factors.

Competitive dynamics feature intense rivalry among established international brands, with market share battles fought through product innovation, pricing strategies, and promotional campaigns. Consumer switching behavior remains relatively low due to strong brand loyalty, though price-sensitive segments show greater willingness to try alternative brands during promotional periods.

Inventory management challenges arise from the bulky nature of diaper products and the need to maintain adequate stock levels across multiple size categories and brand variants. Pricing dynamics reflect premium positioning strategies balanced against competitive pressures and consumer price sensitivity in certain market segments.

Innovation cycles drive continuous product improvements and feature enhancements that maintain consumer interest and justify premium pricing. Seasonal fluctuations create predictable demand patterns that enable effective inventory planning and promotional timing strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the UAE baby diapers industry market. Primary research includes consumer surveys, retailer interviews, and distributor consultations that provide direct market feedback and behavioral insights.

Secondary research encompasses analysis of industry reports, government statistics, import/export data, and retail sales information to establish market size and growth trends. Observational research through retail audits and shelf space analysis provides insights into product positioning and competitive dynamics.

Data validation processes ensure accuracy through cross-referencing multiple sources and verification of key statistics through industry stakeholder consultations. Market segmentation analysis utilizes demographic data, purchasing behavior patterns, and geographic distribution information to identify distinct consumer segments and their characteristics.

Trend analysis incorporates historical data patterns, seasonal variations, and emerging consumer preferences to project future market developments. Competitive intelligence gathering includes monitoring of pricing strategies, promotional activities, and new product launches across major market participants.

Dubai emirate dominates the UAE baby diapers market, accounting for approximately 42% of total market consumption due to its large expatriate population, high disposable income levels, and extensive retail infrastructure. Consumer preferences in Dubai favor premium international brands with advanced features and convenient packaging options.

Abu Dhabi represents the second-largest market segment with 26% market share, characterized by strong government sector employment and stable family incomes that support consistent premium product consumption. Retail distribution in Abu Dhabi benefits from well-developed hypermarket networks and specialized baby care stores.

Sharjah and Northern Emirates collectively account for 22% of market volume, with consumer behavior showing greater price sensitivity and preference for value-oriented product options. Distribution challenges in these regions include longer supply chains and smaller retail formats that may limit product variety.

Regional preferences vary based on demographic composition, with areas having higher concentrations of specific expatriate communities showing distinct brand preferences and purchasing patterns. Market penetration remains consistently high across all emirates, though product mix and price points vary according to local economic conditions and consumer profiles.

Market leadership in the UAE baby diapers industry is characterized by intense competition among several international brands that have established strong market positions through consistent quality, extensive distribution, and effective marketing strategies.

Competitive strategies focus on product differentiation through advanced absorption technologies, skin-care benefits, and convenient features such as wetness indicators and flexible fit designs. Market positioning varies from ultra-premium segments emphasizing organic materials to value segments offering competitive pricing without compromising basic functionality.

Distribution partnerships play crucial roles in competitive success, with brands securing prominent shelf space in major retail chains and developing exclusive arrangements with key distributors. Promotional activities include sampling programs, loyalty rewards, and digital marketing campaigns that build brand awareness and encourage trial among target consumers.

Product type segmentation reveals distinct market categories with varying growth trajectories and consumer preferences that shape overall market dynamics and competitive strategies.

By Product Type:

By Age Group:

By Distribution Channel:

Premium category analysis reveals strong consumer willingness to pay higher prices for advanced features, organic materials, and trusted brand names. Premium products command approximately 45% market share by value despite representing smaller volume percentages, indicating successful value proposition communication to target consumers.

Mid-tier category represents the largest volume segment, balancing quality and affordability to serve mainstream consumer needs. Product features in this category focus on reliable absorption, comfortable fit, and competitive pricing that appeals to budget-conscious families without compromising essential functionality.

Economy category serves price-sensitive consumers and bulk purchasers, with emphasis on basic functionality and value pricing. Market dynamics in this segment include private label growth and promotional pricing strategies that maintain accessibility for lower-income households.

Specialty categories including organic, hypoallergenic, and eco-friendly diapers show rapid growth rates exceeding 15% annually as consumer awareness and environmental consciousness continue to expand. Innovation focus in specialty segments drives premium pricing and margin expansion opportunities for manufacturers and retailers.

Manufacturers benefit from the UAE’s strategic geographic location, enabling efficient distribution to regional markets and cost-effective supply chain management. Market stability provides predictable demand patterns that support production planning and inventory management optimization.

Retailers gain from high inventory turnover rates and consistent consumer demand that generates reliable revenue streams. Category management opportunities include cross-selling related baby care products and building customer loyalty through comprehensive product offerings.

Distributors enjoy established logistics networks and strong relationships with retail partners that facilitate market penetration and expansion opportunities. Portfolio diversification across multiple brands and price segments reduces risk and maximizes market coverage potential.

Consumers benefit from extensive product choice, competitive pricing, and convenient access through multiple distribution channels. Product innovation continuously improves functionality and comfort while addressing specific needs such as sensitive skin care and environmental concerns.

Healthcare providers gain from improved infant hygiene standards and reduced diaper-related skin conditions through advanced product technologies. Economic stakeholders benefit from job creation, tax revenue generation, and contribution to the UAE’s diversified economy development goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability trend dominates current market developments, with consumers increasingly seeking biodegradable and eco-friendly diaper options. Organic material usage in diaper manufacturing shows significant growth, with organic cotton and bamboo fiber products gaining market acceptance despite premium pricing.

Digital integration transforms purchasing behaviors, with mobile apps, subscription services, and smart inventory management becoming standard consumer expectations. Personalization trends include customized diaper sizing, absorption levels, and delivery schedules based on individual baby needs and family preferences.

Health consciousness drives demand for hypoallergenic, chemical-free, and dermatologically tested products that prioritize infant skin health. Convenience innovation includes easy-tear sides, wetness indicators, and improved fastening systems that simplify diaper changing processes for busy parents.

Premium positioning continues expanding as parents prioritize quality over price for baby care products. Brand collaboration with healthcare professionals and pediatricians enhances credibility and influences purchasing decisions among health-conscious consumers.

Product innovation accelerates with manufacturers introducing advanced absorption technologies that extend wear time and improve comfort. Sustainable packaging initiatives reduce plastic usage and introduce recyclable materials that address environmental concerns while maintaining product protection.

Distribution expansion includes new retail partnerships and exclusive arrangements with major hypermarket chains and pharmacy networks. E-commerce integration deepens through improved logistics capabilities, same-day delivery services, and enhanced online customer experience platforms.

Market consolidation trends include strategic acquisitions and partnerships that strengthen distribution networks and expand product portfolios. Technology adoption encompasses manufacturing process improvements that enhance product quality while reducing production costs and environmental impact.

Regulatory compliance initiatives ensure products meet evolving safety standards and environmental requirements. Consumer education programs build awareness about proper diaper usage, disposal methods, and the benefits of premium product features.

MarkWide Research analysis indicates that market participants should prioritize sustainable product development to address growing environmental consciousness among UAE consumers. Investment focus should emphasize eco-friendly materials, biodegradable options, and packaging innovations that reduce environmental impact while maintaining product performance standards.

Digital transformation represents a critical success factor, with companies needing to enhance e-commerce capabilities, develop subscription services, and create personalized customer experiences. Data analytics utilization can improve demand forecasting, inventory management, and targeted marketing campaigns that increase customer retention and lifetime value.

Premium positioning strategies should emphasize unique value propositions such as advanced absorption technologies, skin-care benefits, and convenience features that justify higher price points. Brand differentiation through healthcare partnerships, pediatrician endorsements, and clinical testing results can strengthen market positioning and consumer trust.

Regional expansion opportunities should leverage the UAE’s strategic location and established distribution networks to serve broader GCC markets. Partnership strategies with local retailers, healthcare providers, and parenting communities can enhance market penetration and brand awareness across target consumer segments.

Market projections indicate continued growth driven by stable demographics, increasing environmental awareness, and ongoing product innovation. Sustainable segment expansion is expected to accelerate, with eco-friendly products potentially capturing 25% market share within the next five years as consumer preferences shift toward environmentally responsible options.

Technology integration will reshape market dynamics through smart diaper development, IoT connectivity, and mobile app integration that enhances user experience and provides valuable data insights. E-commerce growth is projected to reach 40% of total sales as digital adoption continues expanding among UAE consumers.

Premium segment consolidation will likely continue as consumers increasingly prioritize quality and advanced features over price considerations. MWR forecasts suggest that innovation cycles will accelerate, with new product launches becoming more frequent and feature-rich to maintain competitive advantages.

Regional market integration will strengthen as UAE-based distributors expand operations across GCC countries, leveraging established logistics networks and market expertise. Regulatory evolution may introduce new standards for environmental impact and product safety that will influence manufacturing processes and market dynamics.

The UAE baby diapers industry market demonstrates remarkable resilience and growth potential, supported by stable demographics, strong consumer purchasing power, and continuous product innovation. Market dynamics reflect a mature industry that successfully balances premium positioning with accessibility across diverse consumer segments.

Sustainability trends and digital transformation represent the most significant opportunities for market expansion and differentiation. Consumer preferences continue evolving toward environmentally responsible products and convenient purchasing experiences that align with modern lifestyle requirements.

Competitive landscape remains intense but stable, with established brands maintaining strong market positions while creating opportunities for innovation and niche market development. Future success will depend on companies’ ability to adapt to changing consumer expectations, regulatory requirements, and technological advancements while maintaining product quality and brand trust that define the UAE baby diapers market.

What is Baby Diapers?

Baby diapers are absorbent garments worn by infants and toddlers to contain waste. They are designed to keep the baby dry and comfortable while preventing leaks and skin irritation.

What are the key players in the UAE Baby Diapers Industry Market?

Key players in the UAE Baby Diapers Industry Market include Procter & Gamble, Kimberly-Clark, Unicharm, and Nestlé, among others. These companies are known for their innovative products and strong market presence.

What are the growth factors driving the UAE Baby Diapers Industry Market?

The growth of the UAE Baby Diapers Industry Market is driven by increasing birth rates, rising disposable incomes, and growing awareness of hygiene among parents. Additionally, the demand for eco-friendly and biodegradable diaper options is on the rise.

What challenges does the UAE Baby Diapers Industry Market face?

The UAE Baby Diapers Industry Market faces challenges such as high competition, fluctuating raw material prices, and environmental concerns regarding waste disposal. These factors can impact profitability and market growth.

What opportunities exist in the UAE Baby Diapers Industry Market?

Opportunities in the UAE Baby Diapers Industry Market include the introduction of premium and organic diaper products, expansion into online retail channels, and increasing demand for innovative features such as enhanced absorbency and skin-friendly materials.

What trends are shaping the UAE Baby Diapers Industry Market?

Trends in the UAE Baby Diapers Industry Market include a shift towards sustainable and biodegradable materials, the rise of subscription services for convenience, and the incorporation of smart technology in diaper design for better monitoring of the baby’s needs.

UAE Baby Diapers Industry Market

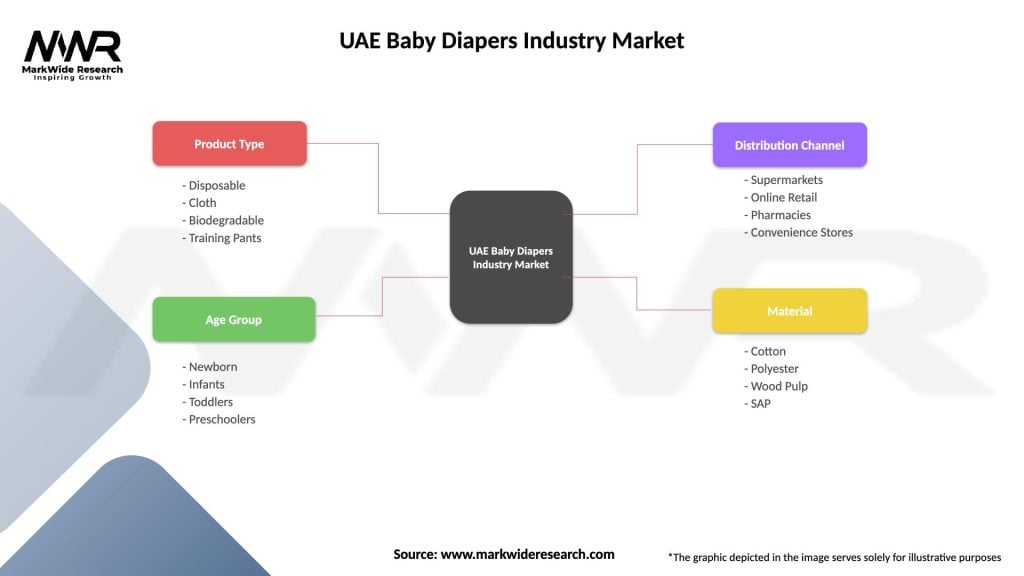

| Segmentation Details | Description |

|---|---|

| Product Type | Disposable, Cloth, Biodegradable, Training Pants |

| Age Group | Newborn, Infants, Toddlers, Preschoolers |

| Distribution Channel | Supermarkets, Online Retail, Pharmacies, Convenience Stores |

| Material | Cotton, Polyester, Wood Pulp, SAP |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Baby Diapers Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at