444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE architectural paints market represents a dynamic and rapidly evolving sector within the broader construction and building materials industry. Architectural paints in the UAE encompass a comprehensive range of coating solutions designed for both interior and exterior applications across residential, commercial, and industrial buildings. The market has experienced substantial growth driven by the country’s ambitious infrastructure development projects, increasing urbanization, and rising demand for premium decorative finishes.

Market dynamics indicate robust expansion with the sector benefiting from government initiatives supporting construction activities and smart city developments. The UAE’s strategic position as a regional hub for trade and tourism has further accelerated demand for high-quality architectural coatings. Growth projections suggest the market will continue expanding at a significant CAGR of 6.2% through the forecast period, supported by ongoing mega-projects and increasing consumer preference for sustainable coating solutions.

Regional distribution shows Dubai and Abu Dhabi commanding approximately 75% market share collectively, with emerging markets in Sharjah, Ajman, and other emirates contributing to overall growth. The market landscape features both international paint manufacturers and local players competing across various price segments and application categories.

The UAE architectural paints market refers to the comprehensive ecosystem of decorative and protective coating solutions specifically designed for building and construction applications within the United Arab Emirates. This market encompasses water-based paints, solvent-based coatings, specialty finishes, primers, and ancillary products used in residential, commercial, and institutional construction projects.

Architectural paints serve dual purposes of aesthetic enhancement and structural protection, providing weather resistance, durability, and visual appeal to building surfaces. The market includes various product categories such as interior wall paints, exterior facade coatings, wood finishes, metal protective coatings, and specialized solutions for harsh environmental conditions prevalent in the Gulf region.

Market participants include international paint manufacturers, regional distributors, specialty coating suppliers, and application service providers who collectively serve the diverse needs of contractors, architects, developers, and end consumers across the UAE’s construction sector.

Strategic analysis reveals the UAE architectural paints market as a high-growth sector characterized by increasing demand for premium coating solutions and sustainable paint technologies. The market benefits from strong construction activity, government infrastructure investments, and growing consumer awareness regarding indoor air quality and environmental sustainability.

Key market drivers include rapid urbanization, with urban population growth contributing to 85% of total demand, along with increasing disposable income and preference for luxury finishes. The commercial construction segment represents the largest application area, accounting for approximately 45% of market consumption, followed by residential applications at 35% and industrial uses at 20%.

Technology trends show increasing adoption of eco-friendly formulations, smart coatings with self-cleaning properties, and heat-reflective solutions designed for the region’s extreme climate conditions. Market consolidation continues with leading international brands strengthening their presence through strategic partnerships and local manufacturing capabilities.

Future prospects remain positive, supported by Vision 2071 initiatives, Expo 2020 legacy projects, and ongoing urban development programs across all emirates. The market is expected to witness continued innovation in product formulations and application technologies.

Market intelligence reveals several critical insights shaping the UAE architectural paints landscape. The following key insights provide strategic understanding of market dynamics:

Construction boom serves as the primary catalyst driving UAE architectural paints market expansion. The country’s ambitious infrastructure development programs, including smart city initiatives, transportation projects, and hospitality sector growth, create substantial demand for high-quality coating solutions. Government investments in mega-projects and urban development continue supporting market growth trajectories.

Economic diversification efforts have strengthened the construction sector’s contribution to GDP, with non-oil economic activities driving sustained demand for architectural paints. The UAE’s position as a regional business hub attracts international investments in commercial real estate, further boosting paint consumption across office buildings, retail centers, and mixed-use developments.

Climate considerations unique to the Gulf region drive demand for specialized coating solutions. Extreme temperatures, high humidity, and intense UV radiation necessitate advanced paint formulations with superior durability and performance characteristics. Energy efficiency requirements promote adoption of reflective coatings and thermal barrier solutions.

Consumer preferences increasingly favor premium decorative finishes and customized color solutions. Rising disposable income and lifestyle aspirations drive demand for luxury paint products and professional application services. Health consciousness promotes adoption of low-emission and antimicrobial coating solutions, particularly in residential and healthcare applications.

Raw material volatility presents significant challenges for architectural paint manufacturers operating in the UAE market. Fluctuating prices of key ingredients including titanium dioxide, resins, and solvents impact production costs and profit margins. Supply chain disruptions occasionally affect product availability and delivery schedules, particularly for specialized coating formulations.

Regulatory complexity surrounding environmental standards and building codes requires continuous adaptation of product formulations and manufacturing processes. Compliance with evolving VOC emission limits and safety regulations increases development costs and time-to-market for new products. Import dependencies for certain raw materials expose the market to currency fluctuations and trade policy changes.

Skilled labor shortage in professional painting and application services constrains market growth potential. The specialized nature of advanced coating systems requires trained applicators, creating bottlenecks in project execution. Seasonal variations in construction activity affect demand patterns, with extreme summer temperatures limiting outdoor painting activities.

Price sensitivity in certain market segments, particularly residential applications, limits adoption of premium coating solutions. Economic uncertainties and project delays occasionally impact large-scale construction activities, affecting paint consumption volumes. Competition intensity among market participants pressures pricing strategies and profit margins across various product categories.

Sustainable construction initiatives present substantial opportunities for eco-friendly paint manufacturers in the UAE market. Growing emphasis on green building certifications and environmental sustainability creates demand for low-impact coating solutions. Innovation potential in bio-based formulations and recycled content paints aligns with circular economy principles and regulatory trends.

Smart building integration opens new avenues for functional coatings with embedded technologies. Opportunities exist for developing paints with air purification properties, antimicrobial characteristics, and energy-saving capabilities. IoT connectivity potential in smart coatings enables monitoring of building conditions and predictive maintenance applications.

Regional expansion opportunities emerge as UAE-based manufacturers leverage their expertise to serve broader GCC markets. The country’s strategic location and established supply chains facilitate export activities to neighboring countries with similar climate conditions and construction requirements. Technology transfer partnerships with international players enhance local capabilities and market competitiveness.

Retrofit market potential grows as existing buildings require maintenance and upgrading to meet current standards. Heritage preservation projects create demand for specialized restoration coatings and traditional finish replication. The expanding hospitality and tourism sectors drive continuous renovation activities, supporting sustained paint demand.

Competitive landscape dynamics reflect intense rivalry among international paint manufacturers and regional players vying for market share across different segments. Brand positioning strategies emphasize quality, durability, and climate-specific performance to differentiate products in a crowded marketplace. Market leaders invest heavily in local manufacturing capabilities and distribution networks to enhance competitiveness.

Technology evolution drives continuous product innovation with manufacturers developing advanced formulations addressing specific regional challenges. Digitalization trends transform customer engagement through virtual color visualization, online ordering platforms, and mobile application tools. According to MarkWide Research analysis, digital adoption in the paint industry has increased by 40% over recent years.

Supply chain optimization becomes increasingly important as manufacturers balance cost efficiency with service quality. Local production facilities reduce dependency on imports while improving responsiveness to market demands. Partnership strategies with distributors, contractors, and architects strengthen market penetration and customer relationships.

Regulatory evolution continues shaping product development priorities with stricter environmental standards driving innovation in sustainable formulations. Market consolidation trends see larger players acquiring specialized manufacturers to expand product portfolios and technical capabilities. Price competition intensifies in commodity segments while premium categories maintain healthy margins through value-added features.

Comprehensive analysis of the UAE architectural paints market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves direct engagement with industry stakeholders including manufacturers, distributors, contractors, and end-users through structured interviews and surveys. This approach provides firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements. Market sizing methodologies combine top-down and bottom-up approaches to validate market estimates and growth projections. Data triangulation ensures consistency across different information sources and analytical frameworks.

Expert consultation with industry professionals, technical specialists, and market analysts provides qualitative insights complementing quantitative data analysis. Field research includes site visits to manufacturing facilities, distribution centers, and construction projects to understand operational dynamics and market realities.

Analytical frameworks incorporate statistical modeling, trend analysis, and scenario planning to develop robust market forecasts. Quality assurance processes include peer review, data validation, and cross-referencing to maintain research integrity and reliability. Regular methodology updates ensure alignment with evolving market conditions and analytical best practices.

Dubai emirate dominates the UAE architectural paints market, accounting for approximately 45% of total consumption driven by extensive commercial construction, tourism infrastructure, and luxury residential developments. The emirate’s status as a global business hub attracts international investments in real estate projects requiring premium coating solutions. Construction diversity across hospitality, retail, office, and residential segments creates balanced demand patterns.

Abu Dhabi represents the second-largest market with 30% market share, supported by government infrastructure projects, cultural developments, and energy sector investments. The capital’s focus on sustainable construction and smart city initiatives drives demand for advanced coating technologies. Institutional projects including healthcare facilities, educational institutions, and government buildings contribute significantly to paint consumption.

Northern Emirates including Sharjah, Ajman, Ras Al Khaimah, and Fujairah collectively account for 25% of market demand. These regions experience rapid residential development and industrial expansion, creating opportunities for cost-effective coating solutions. Manufacturing activities in these emirates support local paint production and distribution capabilities.

Regional preferences vary based on climate conditions, architectural styles, and economic factors. Coastal areas emphasize corrosion-resistant formulations while inland regions prioritize heat-reflective properties. Market penetration strategies adapt to local requirements and distribution channels across different emirates.

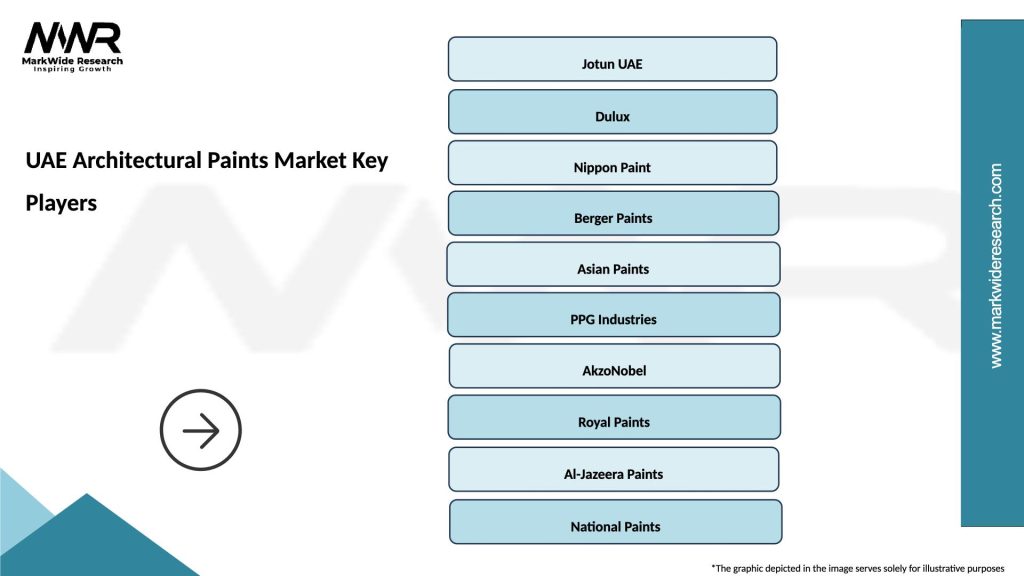

Market leadership in the UAE architectural paints sector features a mix of international giants and regional specialists competing across various segments and price points. The competitive environment emphasizes innovation, quality, and customer service as key differentiators.

Competitive strategies include local manufacturing investments, technical service enhancement, and digital platform development. Market positioning varies from premium quality leadership to cost-effective volume solutions targeting different customer segments.

Product segmentation reveals diverse categories serving specific application requirements and performance standards within the UAE architectural paints market. Each segment addresses unique customer needs and technical specifications.

By Product Type:

By Technology:

By Application:

Interior paint category demonstrates robust growth driven by residential construction and commercial space development. Premium emulsions with enhanced washability and stain resistance gain market share as consumers prioritize long-term value and maintenance convenience. Antimicrobial formulations experience increased adoption in healthcare and hospitality applications, particularly following heightened hygiene awareness.

Exterior coating segment emphasizes climate-specific performance with heat-reflective and UV-resistant formulations leading innovation efforts. Facade systems integrating thermal insulation and decorative finishes address energy efficiency requirements while providing aesthetic appeal. Elastomeric coatings gain popularity for their crack-bridging properties and long-term durability in harsh environmental conditions.

Specialty finishes represent high-growth opportunities with textured coatings, metallic effects, and decorative plasters commanding premium pricing. Customization capabilities through color matching and bespoke formulations enhance customer satisfaction and brand loyalty. Smart coatings with functional properties including air purification and self-cleaning characteristics emerge as future growth drivers.

Water-based technology continues gaining market share with adoption rates increasing by 12% annually, supported by environmental regulations and consumer preferences for low-emission products. Hybrid formulations combining water-based convenience with solvent-based performance characteristics address specific application requirements while maintaining environmental compliance.

Manufacturers benefit from expanding market opportunities driven by sustained construction activity and increasing demand for premium coating solutions. Local production capabilities reduce costs, improve supply chain efficiency, and enhance customer responsiveness. Innovation investments in sustainable formulations and advanced technologies create competitive advantages and market differentiation.

Distributors and retailers capitalize on growing market demand through expanded product portfolios and enhanced service offerings. Technical support capabilities including color consultation and application guidance strengthen customer relationships and increase transaction values. Digital platform integration improves operational efficiency and customer engagement.

Contractors and applicators benefit from advanced paint formulations offering improved workability, faster drying times, and superior finish quality. Training programs and technical support from manufacturers enhance professional capabilities and project outcomes. Specialized coating systems create opportunities for value-added services and higher profit margins.

End customers gain access to innovative coating solutions providing enhanced durability, aesthetic appeal, and functional benefits. Sustainability features including low emissions and environmental compliance support health and wellness objectives. Professional application services ensure optimal results and long-term satisfaction with coating investments.

Architects and specifiers benefit from comprehensive technical resources and performance data supporting informed material selection decisions. Collaboration opportunities with manufacturers enable custom solution development for specific project requirements. Sustainability credentials support green building certification objectives and environmental compliance.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability revolution transforms the UAE architectural paints market with increasing demand for environmentally responsible coating solutions. Low-VOC formulations and zero-emission paints gain market acceptance as health consciousness and environmental awareness drive consumer preferences. Manufacturers invest in bio-based raw materials and recycled content to meet sustainability objectives while maintaining performance standards.

Digital transformation reshapes customer engagement through virtual color visualization, augmented reality applications, and online ordering platforms. Color matching technology enables precise shade replication and customization, enhancing customer satisfaction and reducing waste. Mobile applications provide technical support, product information, and project management tools for professional users.

Functional coatings emerge as a significant trend with paints incorporating air purification, antimicrobial, and self-cleaning properties. Smart coating technologies enable monitoring of building conditions and predictive maintenance applications. Heat-reflective formulations gain prominence as energy efficiency becomes increasingly important in the region’s extreme climate.

Customization demand drives development of bespoke color solutions and specialized finishes tailored to specific project requirements. Texture innovation creates new aesthetic possibilities through advanced application techniques and material formulations. Premium decorative effects including metallic finishes and artistic textures command higher margins and customer loyalty.

Service integration sees manufacturers expanding beyond product supply to offer comprehensive solutions including technical consultation, application training, and project support. MWR data indicates that service-integrated offerings show 25% higher customer retention rates compared to product-only approaches.

Manufacturing expansion continues with international paint companies establishing local production facilities to serve the UAE and broader regional markets. Capacity investments reduce dependency on imports while improving cost competitiveness and supply chain reliability. Advanced manufacturing technologies enable flexible production and rapid response to market demands.

Strategic partnerships between paint manufacturers and construction companies strengthen market penetration and customer relationships. Collaboration agreements with architects and designers promote product specification and brand preference development. Joint ventures with local partners facilitate market entry and regulatory compliance for international players.

Product innovation accelerates with launches of climate-specific formulations addressing regional environmental challenges. Technology licensing agreements enable access to advanced coating technologies and manufacturing processes. Research and development investments focus on sustainable formulations and functional coating capabilities.

Digital platform development transforms customer engagement and operational efficiency through e-commerce capabilities and mobile applications. Supply chain digitization improves inventory management and distribution efficiency. Customer relationship management systems enhance service quality and market intelligence gathering.

Sustainability initiatives include carbon footprint reduction programs, waste minimization efforts, and circular economy implementations. Certification achievements in environmental management and product sustainability strengthen market positioning and regulatory compliance.

Market participants should prioritize sustainability initiatives and eco-friendly product development to align with evolving regulatory requirements and consumer preferences. Investment strategies should focus on local manufacturing capabilities to reduce costs and improve market responsiveness while building competitive advantages through supply chain optimization.

Innovation emphasis on climate-specific formulations and functional coatings will drive market differentiation and premium pricing opportunities. Digital transformation investments in customer engagement platforms and operational efficiency tools are essential for maintaining competitiveness in evolving market conditions.

Partnership development with key stakeholders including contractors, architects, and distributors strengthens market penetration and customer loyalty. Technical service capabilities should be enhanced to provide comprehensive solutions beyond product supply, creating additional value propositions and revenue streams.

Regional expansion strategies leveraging UAE-based capabilities can capture opportunities in broader Middle East and Africa markets. Market segmentation approaches should address specific customer needs across residential, commercial, and industrial applications with tailored product offerings and service models.

Quality assurance and performance validation remain critical for maintaining brand reputation and customer satisfaction in demanding climate conditions. Regulatory compliance proactivity ensures smooth operations and market access while supporting sustainability objectives and corporate responsibility initiatives.

Long-term prospects for the UAE architectural paints market remain highly positive, supported by sustained construction activity, government infrastructure investments, and evolving consumer preferences for premium coating solutions. Growth trajectory projections indicate continued expansion at robust CAGR levels through the forecast period, driven by diversified demand across residential, commercial, and institutional segments.

Technology evolution will accelerate with increasing adoption of smart coatings, sustainable formulations, and digitally-enabled customer experiences. Market maturation is expected to drive consolidation among smaller players while creating opportunities for specialized manufacturers and service providers. Innovation investments will focus on climate-specific solutions and functional coating capabilities.

Sustainability integration will become increasingly important with stricter environmental regulations and growing consumer awareness driving demand for eco-friendly products. Circular economy principles will influence product development and manufacturing processes, creating new business models and value propositions.

Regional integration opportunities will expand as UAE-based manufacturers leverage their capabilities to serve broader GCC and African markets. Export potential grows through established supply chains and technical expertise developed for regional climate conditions. According to MarkWide Research projections, regional market integration could increase by 30% over the next five years.

Digital transformation will continue reshaping industry operations through advanced analytics, IoT integration, and automated processes. Customer engagement evolution through virtual reality and augmented reality applications will enhance decision-making and satisfaction levels across all market segments.

The UAE architectural paints market represents a dynamic and rapidly evolving sector with substantial growth potential driven by sustained construction activity, government infrastructure investments, and increasing consumer sophistication. Market fundamentals remain strong with diversified demand across residential, commercial, and institutional applications supporting balanced growth trajectories.

Innovation leadership in climate-specific formulations, sustainable technologies, and functional coatings will determine competitive success in this demanding market environment. Digital transformation and service integration create new opportunities for market differentiation and customer value creation beyond traditional product offerings.

Strategic positioning requires balancing premium quality leadership with cost competitiveness while maintaining focus on sustainability and regulatory compliance. Regional expansion potential leveraging UAE-based capabilities offers additional growth avenues for established market participants.

Future success will depend on continuous adaptation to evolving market conditions, customer preferences, and technological possibilities while maintaining operational excellence and customer satisfaction standards. The UAE architectural paints market continues offering attractive opportunities for well-positioned industry participants committed to innovation and market leadership.

What is Architectural Paints?

Architectural paints are coatings used primarily for the protection and decoration of buildings and structures. They are designed for various surfaces, including walls, ceilings, and exteriors, and come in a variety of finishes and colors.

What are the key players in the UAE Architectural Paints Market?

Key players in the UAE Architectural Paints Market include companies like Jotun, National Paints, and Berger Paints, which are known for their innovative products and extensive distribution networks, among others.

What are the growth factors driving the UAE Architectural Paints Market?

The growth of the UAE Architectural Paints Market is driven by factors such as rapid urbanization, increasing construction activities, and a rising demand for eco-friendly and durable paint solutions in residential and commercial sectors.

What challenges does the UAE Architectural Paints Market face?

The UAE Architectural Paints Market faces challenges such as fluctuating raw material prices, stringent environmental regulations, and competition from low-cost alternatives, which can impact profit margins.

What opportunities exist in the UAE Architectural Paints Market?

Opportunities in the UAE Architectural Paints Market include the growing trend towards sustainable building practices, the introduction of smart coatings, and the increasing demand for customized paint solutions in the luxury segment.

What trends are shaping the UAE Architectural Paints Market?

Trends shaping the UAE Architectural Paints Market include the rise of digital color matching technologies, the popularity of anti-bacterial and anti-fungal paints, and a shift towards water-based formulations that are more environmentally friendly.

UAE Architectural Paints Market

| Segmentation Details | Description |

|---|---|

| Product Type | Emulsion, Enamel, Primer, Textured |

| Application | Interior, Exterior, Decorative, Protective |

| End User | Residential, Commercial, Industrial, Institutional |

| Distribution Channel | Retail, Wholesale, Online, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Architectural Paints Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at