444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The medical device outsourcing market in the United Arab Emirates (UAE) and Israel has been experiencing significant growth in recent years. This market encompasses the outsourcing of various medical device manufacturing processes, including design, prototyping, manufacturing, assembly, packaging, and sterilization. The outsourcing of these processes allows medical device companies to focus on their core competencies while reducing costs and leveraging the expertise of outsourcing partners.

Meaning

Medical device outsourcing refers to the practice of delegating certain aspects of medical device manufacturing to external service providers. These service providers specialize in specific manufacturing processes, such as injection molding, machining, electronics assembly, or sterilization. By outsourcing these processes, medical device companies can streamline their operations, reduce time-to-market, and improve cost efficiency.

Executive Summary

The medical device outsourcing market in the UAE and Israel is witnessing steady growth due to several factors. The increasing demand for medical devices, advancements in technology, rising healthcare expenditures, and the need for cost-effective manufacturing solutions are driving the market forward. Both countries have robust healthcare systems and a favorable business environment, attracting local and international medical device manufacturers.

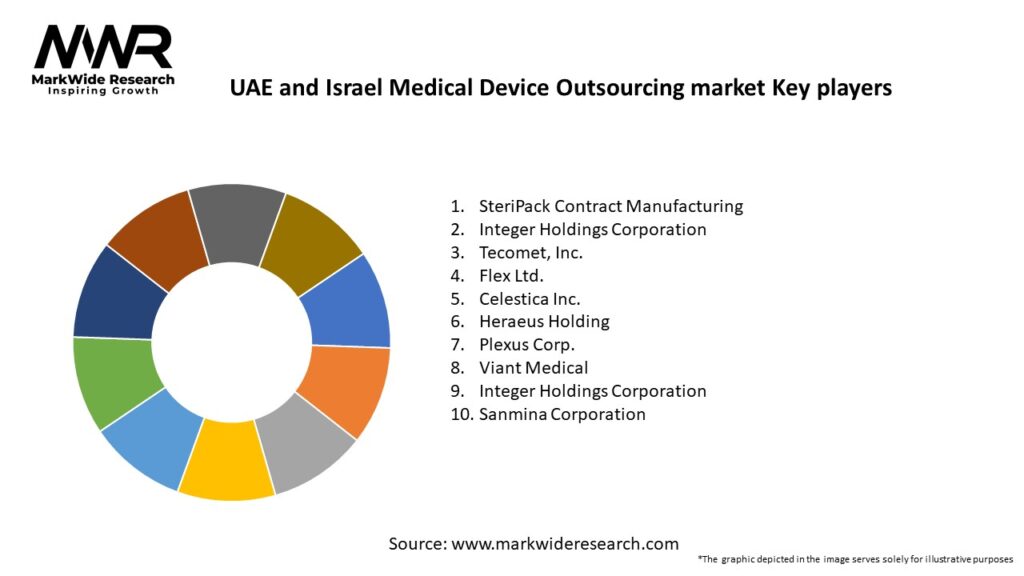

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The medical device outsourcing market in the UAE and Israel is characterized by intense competition and evolving market dynamics. The market players are continually focusing on improving their capabilities, expanding their service portfolios, and adopting advanced technologies to stay ahead in the competitive landscape.

Regional Analysis

The UAE and Israel are key players in the medical device outsourcing market in the Middle East region. The UAE has established itself as a regional hub for healthcare and medical tourism, attracting significant investments from both domestic and international medical device manufacturers. Israel, known for its technological advancements and innovation, has a thriving medical device industry and a strong ecosystem supporting research and development.

Competitive Landscape

Leading Companies in the UAE and Israel Medical Device Outsourcing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

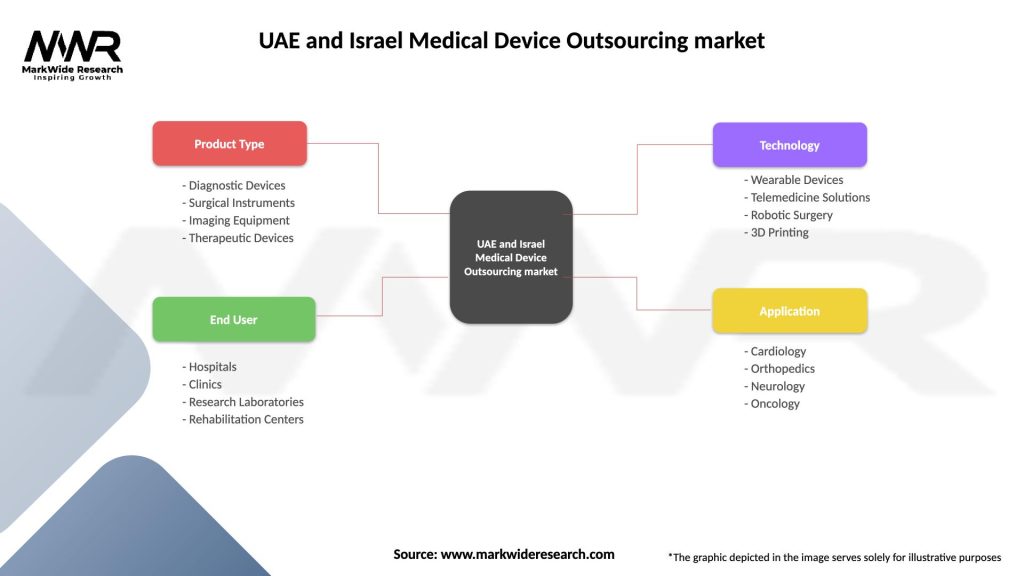

Segmentation

The medical device outsourcing market can be segmented based on the type of services offered, including design and engineering, prototyping, manufacturing, assembly and packaging, sterilization, and testing and validation. Companies may choose to outsource specific processes or opt for end-to-end solutions depending on their requirements and capabilities.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The medical device outsourcing market in the UAE and Israel offers several benefits for industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the medical device outsourcing market in the UAE and Israel. The increased demand for essential medical devices, such as ventilators, personal protective equipment (PPE), and diagnostic tests, placed a strain on the global supply chain. Medical device outsourcing companies played a crucial role in scaling up production and meeting the urgent market needs.

The pandemic also highlighted the importance of supply chain resilience and diversification. Many medical device companies realized the need to reduce their dependency on a single source or region for manufacturing. This realization is expected to drive increased outsourcing activities as companies seek to establish a more resilient and agile supply chain.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the medical device outsourcing market in the UAE and Israel appears promising. Factors such as the increasing demand for medical devices, technological advancements, favorable regulatory environment, and growing healthcare expenditures are expected to drive market growth.

The market is likely to witness continued expansion as medical device companies seek to optimize their operations, reduce costs, and leverage the expertise of outsourcing partners. Collaborative partnerships, advancements in automation and robotics, and a focus on sustainability are expected to shape the industry’s future landscape.

Conclusion

The medical device outsourcing market in the UAE and Israel presents significant opportunities for medical device companies looking to streamline their operations, reduce costs, and access specialized expertise. With a favorable business environment, strong regulatory frameworks, and technological advancements, both countries are attracting local and international players in the medical device industry.

Despite challenges such as intellectual property concerns, quality control issues, and geopolitical risks, the market is poised for growth. By embracing technological innovations, fostering collaborations, and focusing on compliance and quality, medical device outsourcing companies can navigate the evolving landscape and thrive in the years to come.

What is Medical Device Outsourcing?

Medical Device Outsourcing refers to the practice of contracting third-party companies to handle various aspects of medical device production, including design, manufacturing, and regulatory compliance. This approach allows companies to focus on core competencies while leveraging specialized expertise in the medical device sector.

What are the key players in the UAE and Israel Medical Device Outsourcing market?

Key players in the UAE and Israel Medical Device Outsourcing market include companies like Medtronic, Siemens Healthineers, and Teva Pharmaceutical Industries, which are known for their innovative medical technologies and outsourcing capabilities, among others.

What are the growth factors driving the UAE and Israel Medical Device Outsourcing market?

The growth of the UAE and Israel Medical Device Outsourcing market is driven by factors such as increasing demand for advanced medical technologies, rising healthcare expenditures, and the need for cost-effective manufacturing solutions. Additionally, the region’s strategic location enhances its appeal for global outsourcing.

What challenges does the UAE and Israel Medical Device Outsourcing market face?

Challenges in the UAE and Israel Medical Device Outsourcing market include stringent regulatory requirements, potential quality control issues, and the need for skilled labor. These factors can complicate the outsourcing process and impact overall efficiency.

What opportunities exist in the UAE and Israel Medical Device Outsourcing market?

Opportunities in the UAE and Israel Medical Device Outsourcing market include the potential for innovation in telemedicine devices, the growing demand for personalized medical solutions, and the expansion of digital health technologies. These trends are likely to attract more investment and partnerships.

What trends are shaping the UAE and Israel Medical Device Outsourcing market?

Trends shaping the UAE and Israel Medical Device Outsourcing market include the increasing adoption of automation in manufacturing processes, the rise of artificial intelligence in diagnostics, and a focus on sustainable practices in device production. These innovations are transforming the landscape of medical device outsourcing.

UAE and Israel Medical Device Outsourcing market

| Segmentation Details | Description |

|---|---|

| Product Type | Diagnostic Devices, Surgical Instruments, Imaging Equipment, Therapeutic Devices |

| End User | Hospitals, Clinics, Research Laboratories, Rehabilitation Centers |

| Technology | Wearable Devices, Telemedicine Solutions, Robotic Surgery, 3D Printing |

| Application | Cardiology, Orthopedics, Neurology, Oncology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the UAE and Israel Medical Device Outsourcing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at