444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The UAE agriculture market represents a dynamic and rapidly evolving sector that has undergone significant transformation in recent years. Despite challenging environmental conditions including limited water resources and arid climate, the United Arab Emirates has emerged as a regional leader in innovative agricultural practices and sustainable farming technologies. The market encompasses traditional farming methods alongside cutting-edge agricultural innovations such as vertical farming, hydroponics, and precision agriculture systems.

Market growth in the UAE agriculture sector has been particularly robust, driven by government initiatives aimed at achieving food security and reducing import dependency. The sector has experienced a compound annual growth rate of 8.2% over the past five years, reflecting strong investment in agricultural infrastructure and technology adoption. This growth trajectory positions the UAE as a significant player in the Middle East agricultural landscape.

Government support through various strategic initiatives has been instrumental in market expansion. The UAE’s National Food Security Strategy 2051 aims to position the country among the top 10 globally in food security by 2051, driving substantial investments in agricultural research, development, and implementation of advanced farming technologies.

The UAE agriculture market refers to the comprehensive ecosystem of agricultural activities, technologies, and services operating within the United Arab Emirates, encompassing crop production, livestock farming, aquaculture, and related agricultural support services designed to enhance food security and sustainable agricultural development.

Agricultural activities in the UAE span multiple sectors including traditional crop cultivation, modern greenhouse farming, livestock production, and emerging technologies such as cellular agriculture and alternative protein production. The market integrates both conventional farming practices adapted to local conditions and innovative agricultural technologies designed to overcome environmental challenges.

Technological integration has become a defining characteristic of the UAE agriculture market, with significant adoption of smart farming solutions, automated irrigation systems, and climate-controlled growing environments. These technologies enable efficient resource utilization while maximizing agricultural productivity in challenging environmental conditions.

Strategic positioning of the UAE agriculture market reflects the country’s commitment to achieving food security through technological innovation and sustainable farming practices. The market has demonstrated remarkable resilience and growth potential, attracting significant domestic and international investment in agricultural infrastructure and technology development.

Key market drivers include government policy support, increasing demand for locally produced food, and growing awareness of sustainable agricultural practices. The UAE’s strategic location as a regional hub for trade and logistics further enhances the market’s potential for expansion and regional influence.

Investment patterns show a strong focus on technology-driven agricultural solutions, with 72% of new agricultural investments directed toward innovative farming technologies and sustainable production methods. This trend reflects the market’s evolution toward high-tech, resource-efficient agricultural systems.

Market segmentation reveals diverse opportunities across crop production, livestock farming, aquaculture, and agricultural technology services. Each segment contributes to the overall market growth while addressing specific aspects of the UAE’s food security objectives and agricultural development goals.

Market dynamics in the UAE agriculture sector reveal several critical insights that shape the industry’s development trajectory and future prospects:

Government initiatives serve as the primary catalyst for UAE agriculture market growth, with comprehensive policy frameworks supporting agricultural development and food security objectives. The UAE government has implemented strategic programs that provide financial incentives, technical support, and infrastructure development for agricultural enterprises.

Food security concerns drive significant investment in local agricultural production capabilities. The UAE’s strategic goal of reducing food import dependency from current 85% to 50% by 2051 creates substantial market opportunities for domestic agricultural producers and technology providers.

Technological advancement in agricultural systems enables efficient production in challenging environmental conditions. The adoption of climate-controlled growing environments, automated farming systems, and precision agriculture technologies allows for year-round production and optimal resource utilization.

Population growth and urbanization trends increase demand for locally produced fresh food products. The UAE’s growing population, combined with increasing consumer preference for fresh, locally sourced food, creates expanding market opportunities for agricultural producers.

Investment climate favorable to agricultural innovation attracts both domestic and international capital. Government-backed investment funds, private equity interest, and venture capital funding support the development of agricultural technology companies and farming enterprises.

Regional trade positioning enhances the UAE’s role as an agricultural hub for the Middle East region. Strategic location, advanced logistics infrastructure, and trade relationships create opportunities for agricultural product distribution and technology transfer throughout the region.

Environmental challenges pose significant constraints on traditional agricultural development in the UAE. Limited freshwater resources, extreme temperatures, and sandy soil conditions require substantial technological intervention and investment to enable viable agricultural production.

High operational costs associated with advanced agricultural technologies and climate-controlled growing systems impact market profitability. The need for energy-intensive cooling systems, specialized equipment, and technical expertise increases production costs compared to traditional farming regions.

Skilled labor shortage in agricultural technology and modern farming practices limits market expansion potential. The UAE agriculture sector faces challenges in recruiting and retaining qualified personnel with expertise in advanced agricultural systems and sustainable farming practices.

Import competition from established agricultural regions with natural advantages creates pricing pressure on local producers. Competing with imported agricultural products from regions with favorable climate conditions and lower production costs remains a significant market challenge.

Water scarcity continues to be a fundamental constraint on agricultural expansion. Despite technological solutions for water conservation and efficiency, the limited availability of freshwater resources requires careful management and innovative approaches to sustainable water use.

Initial investment requirements for establishing modern agricultural operations can be prohibitive for smaller enterprises. The capital-intensive nature of advanced agricultural technologies and infrastructure development creates barriers to entry for some market participants.

Vertical farming expansion presents substantial growth opportunities in the UAE agriculture market. The development of multi-story growing facilities and controlled environment agriculture systems enables high-density crop production while minimizing land and water usage requirements.

Export market development offers significant potential for UAE agricultural producers. The country’s strategic location and advanced logistics infrastructure create opportunities for exporting high-quality agricultural products to regional and international markets.

Agri-tech innovation continues to drive market opportunities through the development and implementation of cutting-edge agricultural technologies. Areas such as artificial intelligence, robotics, and biotechnology offer potential for revolutionary improvements in agricultural productivity and efficiency.

Sustainable agriculture practices align with global trends toward environmental responsibility and resource conservation. The development of circular agriculture systems, renewable energy integration, and waste reduction technologies creates new market segments and competitive advantages.

Alternative protein production represents an emerging opportunity within the UAE agriculture market. Investment in cellular agriculture, insect farming, and plant-based protein production addresses growing demand for sustainable protein sources.

Regional partnerships and technology transfer initiatives expand market reach and influence. Collaboration with other Gulf Cooperation Council countries and regional agricultural development projects create opportunities for market expansion and knowledge sharing.

Supply chain evolution in the UAE agriculture market reflects the integration of advanced logistics and distribution systems. Modern cold chain infrastructure, automated processing facilities, and direct-to-consumer distribution channels enhance market efficiency and product quality maintenance.

Consumer behavior shifts toward locally produced and sustainably grown food products drive market demand patterns. Increasing consumer awareness of food provenance, environmental impact, and nutritional quality influences purchasing decisions and market opportunities.

Technology integration accelerates across all aspects of agricultural operations, from production and processing to distribution and marketing. The adoption of Internet of Things sensors, data analytics, and automation systems transforms traditional farming practices and operational efficiency.

Investment flows into the UAE agriculture sector demonstrate strong confidence in market potential and growth prospects. According to MarkWide Research analysis, agricultural technology investments have increased by 156% over the past three years, reflecting robust market dynamics and investor interest.

Regulatory framework development supports market growth while ensuring food safety and environmental protection. Updated agricultural regulations, certification programs, and quality standards create a structured environment for market development and consumer confidence.

International collaboration enhances market capabilities through knowledge transfer, technology sharing, and joint venture development. Partnerships with leading agricultural nations and technology providers accelerate market advancement and competitive positioning.

Comprehensive market analysis for the UAE agriculture market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes direct interviews with industry stakeholders, government officials, and agricultural technology providers to gather firsthand insights into market conditions and trends.

Secondary research incorporates analysis of government publications, industry reports, academic studies, and statistical databases to provide comprehensive market context and historical perspective. This approach ensures thorough coverage of market dynamics and trend analysis.

Data collection methods include structured surveys of agricultural producers, technology providers, and market participants to quantify market trends and performance indicators. Statistical analysis of production data, investment flows, and market performance metrics provides quantitative foundation for market assessment.

Expert consultation with agricultural specialists, technology developers, and policy makers enhances research depth and accuracy. Industry expert interviews provide qualitative insights into market challenges, opportunities, and future development prospects.

Market validation processes ensure research findings accuracy through cross-referencing multiple data sources and stakeholder verification. This methodology provides reliable foundation for market analysis and strategic recommendations.

Dubai emirate leads the UAE agriculture market with 35% market share, driven by advanced infrastructure, strategic location, and significant investment in agricultural technology development. The emirate hosts major agricultural research facilities and serves as a regional hub for agricultural innovation and trade.

Abu Dhabi emirate represents 28% of market activity, with substantial government-backed agricultural projects and large-scale farming operations. The emirate’s focus on food security initiatives and sustainable agriculture development contributes significantly to overall market growth.

Sharjah and Northern Emirates account for 22% of agricultural production, with emphasis on traditional farming adapted to modern techniques. These regions benefit from relatively favorable agricultural conditions and proximity to regional markets.

Eastern regions contribute 15% to market development, focusing on specialized crops and niche agricultural products. The area’s unique geographic characteristics enable specific agricultural applications and export-oriented production.

Regional specialization patterns reflect optimal resource utilization and market positioning strategies. Each emirate develops agricultural capabilities aligned with local advantages, infrastructure availability, and market access opportunities.

Inter-emirate collaboration enhances overall market efficiency through resource sharing, knowledge transfer, and coordinated development initiatives. Integrated planning and joint projects maximize agricultural potential across the UAE.

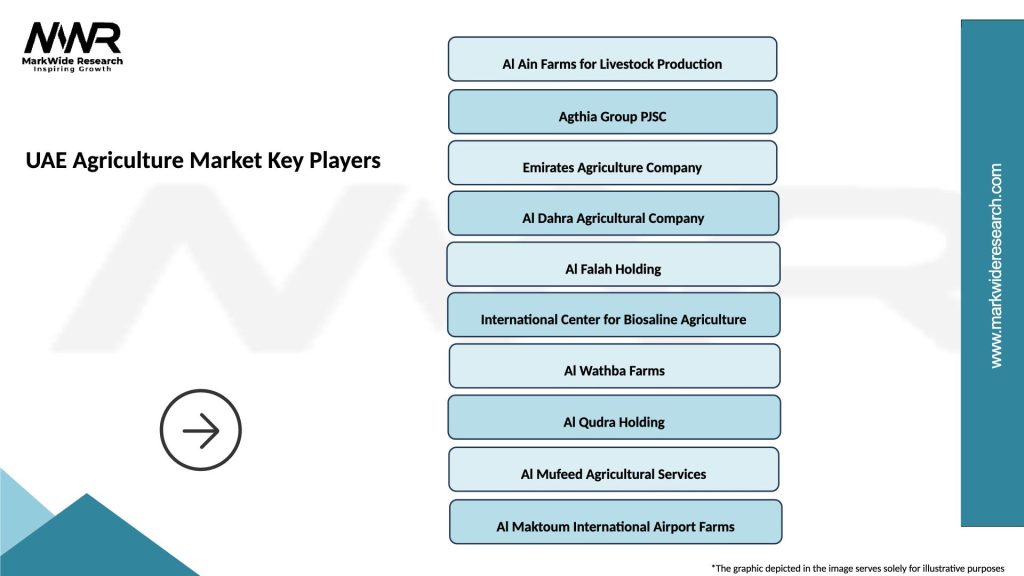

Market leadership in the UAE agriculture sector includes both established agricultural companies and innovative technology providers driving industry transformation:

Competitive strategies focus on technological innovation, operational efficiency, and market differentiation through sustainable practices and premium product positioning. Companies invest heavily in research and development to maintain competitive advantages.

Market consolidation trends show increasing collaboration between traditional agricultural companies and technology providers. Strategic partnerships and joint ventures enable comprehensive agricultural solutions and market expansion.

By Technology:

By Crop Type:

By Application:

Controlled Environment Agriculture represents the fastest-growing segment with annual growth rate of 12.5%, driven by technological advancement and optimal resource utilization. This category includes greenhouse operations, vertical farms, and indoor growing facilities that enable year-round production regardless of external weather conditions.

Leafy greens production dominates crop categories with 45% of total production volume, reflecting consumer demand and optimal growing conditions for these crops in controlled environments. High turnover rates and consistent market demand make leafy greens particularly attractive for UAE producers.

Hydroponic systems show strong adoption rates across commercial operations, offering water efficiency and precise nutrient management. These systems align with UAE sustainability goals while enabling high-density production in limited space.

Export-oriented agriculture emerges as a significant growth category, with producers targeting regional and international markets for premium agricultural products. Quality standards and advanced logistics capabilities support export market development.

Organic agriculture gains momentum as consumer awareness increases and premium pricing supports profitability. Certified organic production methods attract environmentally conscious consumers and export opportunities.

Agricultural technology services expand rapidly as farming operations require specialized expertise and support systems. This category includes consulting, maintenance, and technology integration services for modern agricultural operations.

Agricultural producers benefit from government support programs, advanced infrastructure, and access to cutting-edge agricultural technologies. Financial incentives, technical assistance, and market development support enhance profitability and growth potential for farming enterprises.

Technology providers gain access to a rapidly growing market with strong government backing and significant investment potential. The UAE serves as a testing ground for agricultural innovations and a gateway to regional markets throughout the Middle East.

Investors find attractive opportunities in a government-supported sector with clear growth trajectory and strategic importance. Agricultural investments align with national priorities while offering potential for strong returns and positive social impact.

Consumers benefit from increased availability of fresh, locally produced food with reduced environmental impact and enhanced food security. Local production reduces supply chain risks and provides access to premium quality agricultural products.

Government stakeholders achieve food security objectives while developing a strategic economic sector. Agricultural development supports national resilience, economic diversification, and regional leadership in sustainable agriculture.

Research institutions access funding opportunities and practical applications for agricultural research. Collaboration with industry participants enables technology transfer and innovation development in real-world agricultural settings.

Strengths:

Weaknesses:

Opportunities:

Threats:

Vertical farming adoption accelerates across the UAE agriculture market, with new facilities incorporating advanced LED lighting, automated systems, and AI-driven growing optimization. This trend enables high-density production while minimizing resource consumption and environmental impact.

Sustainable agriculture practices gain prominence as environmental consciousness increases among consumers and producers. Integration of renewable energy, water recycling, and organic growing methods becomes standard practice in modern agricultural operations.

Digital agriculture transformation revolutionizes farming operations through IoT sensors, data analytics, and automated decision-making systems. MWR data indicates that 68% of commercial farms now utilize some form of digital agriculture technology for operational optimization.

Alternative protein development emerges as a significant trend, with investments in cellular agriculture, insect farming, and plant-based protein production. This trend addresses growing protein demand while reducing environmental impact compared to traditional livestock farming.

Regional collaboration increases through joint agricultural projects, technology sharing, and coordinated food security initiatives. Gulf Cooperation Council countries develop integrated agricultural strategies and resource sharing agreements.

Consumer direct marketing expands as producers develop direct-to-consumer sales channels, farmers markets, and subscription-based delivery services. This trend enhances producer margins while providing consumers with fresh, traceable agricultural products.

Government investment in agricultural research and development reaches unprecedented levels, with new research facilities and innovation centers supporting technology development and knowledge transfer. These investments position the UAE as a regional leader in agricultural innovation.

International partnerships expand through agreements with leading agricultural nations and technology providers. Collaboration with Netherlands, Israel, and other agricultural innovation leaders brings advanced expertise and proven technologies to the UAE market.

Infrastructure development includes new agricultural zones, processing facilities, and distribution centers designed to support market growth. Strategic infrastructure investments enhance operational efficiency and market access for agricultural producers.

Regulatory framework updates establish comprehensive standards for organic agriculture, food safety, and environmental protection. New regulations support market development while ensuring consumer protection and environmental sustainability.

Technology commercialization accelerates as research institutions and startups bring innovative agricultural solutions to market. Successful technology transfer from research to commercial application demonstrates market maturity and innovation capability.

Export market expansion includes new trade agreements and market access initiatives for UAE agricultural products. Government support for export development creates opportunities for producers to access regional and international markets.

Investment prioritization should focus on water-efficient technologies and renewable energy integration to address fundamental resource constraints. Agricultural enterprises that successfully integrate these technologies will achieve competitive advantages and operational sustainability.

Market positioning strategies should emphasize quality, sustainability, and technological innovation rather than competing solely on price. Premium positioning aligned with consumer values and export market requirements offers better profitability potential.

Technology adoption requires careful evaluation of return on investment and operational integration. Producers should prioritize technologies that address specific operational challenges while providing measurable efficiency improvements and cost reductions.

Workforce development initiatives should address the skilled labor shortage through training programs, educational partnerships, and knowledge transfer initiatives. Investment in human capital development supports long-term market growth and operational excellence.

Regional collaboration opportunities should be pursued to leverage shared resources, knowledge, and market access. Strategic partnerships with regional agricultural stakeholders enhance market reach and operational capabilities.

Sustainability integration should be embedded in all agricultural operations to align with consumer expectations and regulatory requirements. Environmental responsibility becomes increasingly important for market access and brand positioning.

Market expansion prospects remain strong, supported by continued government investment, technological advancement, and growing demand for locally produced food. The UAE agriculture market is projected to maintain robust growth trajectory with annual growth rates exceeding 9% over the next five years.

Technology integration will accelerate with artificial intelligence, robotics, and biotechnology becoming standard components of agricultural operations. Advanced automation and data-driven decision making will enhance productivity while reducing operational costs and resource consumption.

Export market development offers significant growth potential as UAE producers establish quality reputation and market presence in regional and international markets. Premium positioning and advanced logistics capabilities support export expansion and revenue diversification.

Sustainability leadership positions the UAE as a model for sustainable agriculture in arid regions. Successful implementation of resource-efficient farming systems and renewable energy integration creates opportunities for technology export and knowledge transfer.

Regional hub development continues as the UAE strengthens its position as the Middle East center for agricultural innovation and technology. Strategic investments in research, education, and infrastructure support this regional leadership role.

Investment attraction will continue as the agricultural sector demonstrates strong growth potential and strategic importance. According to MarkWide Research projections, agricultural investment flows are expected to increase by 85% over the next three years, reflecting strong market confidence and growth prospects.

The UAE agriculture market represents a remarkable transformation story, evolving from traditional farming constraints to become a regional leader in agricultural innovation and sustainable production. Through strategic government support, technological advancement, and private sector investment, the market has achieved substantial growth while addressing fundamental challenges of water scarcity and environmental limitations.

Market dynamics demonstrate strong momentum across all segments, with controlled environment agriculture, precision farming, and sustainable production methods driving expansion. The integration of advanced technologies, from vertical farming systems to AI-driven optimization, positions the UAE agriculture market at the forefront of global agricultural innovation.

Future prospects remain exceptionally positive, supported by continued policy commitment, increasing investment flows, and growing market demand for locally produced, sustainable food products. The UAE’s strategic vision of achieving enhanced food security while developing a competitive agricultural sector creates substantial opportunities for all market participants and stakeholders in the years ahead.

What is Agriculture?

Agriculture refers to the practice of cultivating soil, growing crops, and raising animals for food, fiber, and other products. In the context of the UAE, it encompasses various methods including traditional farming, hydroponics, and aquaculture.

What are the key players in the UAE Agriculture Market?

Key players in the UAE Agriculture Market include Al Ain Farms, Emirates Agriculture Company, and Abu Dhabi Farmers’ Services Centre, among others. These companies are involved in various agricultural activities such as crop production, livestock farming, and food processing.

What are the main drivers of growth in the UAE Agriculture Market?

The main drivers of growth in the UAE Agriculture Market include increasing food security concerns, government initiatives to promote sustainable farming practices, and advancements in agricultural technology. These factors are encouraging investment in innovative farming solutions.

What challenges does the UAE Agriculture Market face?

The UAE Agriculture Market faces challenges such as limited arable land, water scarcity, and reliance on food imports. These issues necessitate the adoption of efficient agricultural practices and technologies to enhance productivity.

What opportunities exist in the UAE Agriculture Market?

Opportunities in the UAE Agriculture Market include the growth of organic farming, the adoption of smart agriculture technologies, and the potential for vertical farming. These trends are driven by consumer demand for fresh and sustainable food options.

What trends are shaping the UAE Agriculture Market?

Trends shaping the UAE Agriculture Market include the increasing use of precision agriculture, the rise of urban farming initiatives, and a focus on sustainable practices. These trends are transforming how food is produced and consumed in the region.

UAE Agriculture Market

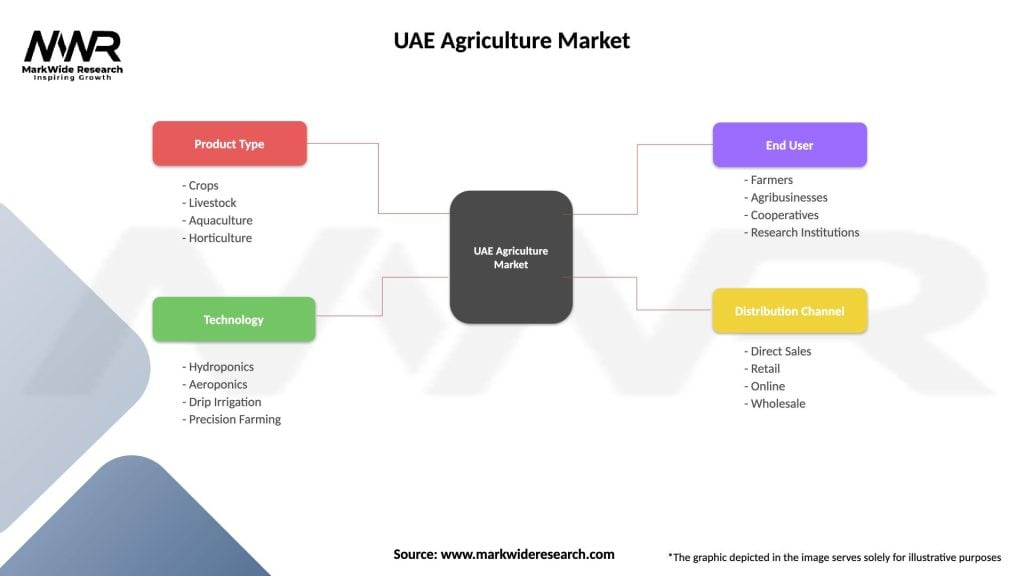

| Segmentation Details | Description |

|---|---|

| Product Type | Crops, Livestock, Aquaculture, Horticulture |

| Technology | Hydroponics, Aeroponics, Drip Irrigation, Precision Farming |

| End User | Farmers, Agribusinesses, Cooperatives, Research Institutions |

| Distribution Channel | Direct Sales, Retail, Online, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the UAE Agriculture Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at