444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Type 2 diabetes drugs and devices market represents a critical segment of the global healthcare industry, addressing the growing epidemic of diabetes mellitus that affects millions worldwide. This comprehensive market encompasses pharmaceutical interventions, medical devices, and innovative technologies designed to manage blood glucose levels and improve quality of life for patients with Type 2 diabetes. Market dynamics indicate robust growth driven by increasing prevalence rates, aging populations, and advancing treatment methodologies.

Current market conditions reflect a landscape characterized by continuous innovation in drug development, device miniaturization, and digital health integration. The market experiences significant expansion with a projected CAGR of 6.8% over the forecast period, driven by rising diabetes incidence and improved healthcare access. Key market segments include insulin delivery systems, glucose monitoring devices, oral antidiabetic medications, and emerging therapeutic classes such as GLP-1 receptor agonists and SGLT-2 inhibitors.

Geographic distribution shows North America maintaining the largest market share at approximately 42%, followed by Europe and Asia-Pacific regions. The market benefits from substantial research and development investments, regulatory support for innovative treatments, and increasing awareness about diabetes management. Technological advancement continues to reshape treatment paradigms through continuous glucose monitoring systems, smart insulin pens, and artificial pancreas technologies.

The Type 2 diabetes drugs and devices market refers to the comprehensive ecosystem of pharmaceutical products, medical devices, and technological solutions specifically designed for the diagnosis, monitoring, and treatment of Type 2 diabetes mellitus. This market encompasses a wide range of therapeutic interventions including oral medications, injectable treatments, insulin delivery systems, blood glucose monitoring devices, and emerging digital health platforms that collectively address the complex needs of diabetes management.

Market scope extends beyond traditional pharmaceutical approaches to include innovative device technologies such as continuous glucose monitors, insulin pumps, smart injection systems, and integrated diabetes management platforms. The market serves healthcare providers, patients, caregivers, and healthcare systems by providing comprehensive solutions that enable effective glycemic control, reduce complications, and improve overall patient outcomes in Type 2 diabetes care.

Market performance demonstrates exceptional growth potential driven by the global diabetes epidemic and advancing treatment technologies. The Type 2 diabetes drugs and devices market exhibits strong fundamentals with increasing patient populations, expanding treatment options, and growing emphasis on personalized medicine approaches. Key growth drivers include rising obesity rates, sedentary lifestyles, aging demographics, and improved diagnostic capabilities leading to earlier disease detection.

Innovation trends focus on developing more effective therapeutic agents, user-friendly devices, and integrated care solutions that combine pharmaceutical and technological approaches. The market benefits from significant investment in research and development, with pharmaceutical companies and medical device manufacturers pursuing breakthrough therapies and next-generation monitoring systems. Regulatory environment remains supportive with expedited approval pathways for innovative diabetes treatments and devices.

Competitive landscape features established pharmaceutical giants, specialized diabetes care companies, and emerging technology firms developing digital health solutions. Market consolidation continues through strategic acquisitions and partnerships aimed at creating comprehensive diabetes care ecosystems. Future outlook indicates sustained growth with increasing focus on precision medicine, artificial intelligence integration, and value-based care models.

Strategic market insights reveal several critical factors shaping the Type 2 diabetes drugs and devices landscape:

Primary market drivers propelling growth in the Type 2 diabetes drugs and devices market stem from multiple interconnected factors. Demographic trends represent the most significant driver, with global aging populations and increasing life expectancy contributing to higher diabetes incidence rates. The prevalence of Type 2 diabetes correlates strongly with age, making demographic shifts a fundamental growth catalyst.

Lifestyle factors continue driving market expansion through rising obesity rates, sedentary behaviors, and dietary changes associated with urbanization and economic development. These factors contribute to insulin resistance and metabolic dysfunction, increasing the population requiring diabetes management solutions. Economic development in emerging markets improves healthcare access and affordability, expanding the addressable patient population.

Technological advancement serves as a crucial driver through continuous innovation in drug development, device miniaturization, and digital health integration. Advanced drug delivery systems, smart monitoring devices, and artificial intelligence applications enhance treatment effectiveness and patient compliance. Healthcare infrastructure improvements globally increase diagnosis rates and treatment accessibility, expanding market reach.

Regulatory support accelerates market growth through expedited approval processes for innovative diabetes treatments and devices. Government initiatives promoting diabetes awareness, prevention programs, and treatment access create favorable market conditions. Investment flows from pharmaceutical companies, medical device manufacturers, and venture capital firms fuel research and development activities, driving innovation and market expansion.

Significant market restraints challenge growth in the Type 2 diabetes drugs and devices sector despite overall positive trends. Cost considerations represent the primary constraint, with high prices for innovative medications and advanced devices limiting patient access, particularly in developing regions and among uninsured populations. Healthcare systems face budget pressures that restrict coverage for newer, more expensive treatment options.

Regulatory complexities create barriers to market entry and expansion, with lengthy approval processes, stringent safety requirements, and varying international standards increasing development costs and time-to-market. Patent expirations for blockbuster diabetes medications expose manufacturers to generic competition, reducing revenue streams and limiting investment in new product development.

Side effect concerns associated with certain diabetes medications, including hypoglycemia risks, weight gain, and cardiovascular complications, create prescriber hesitancy and patient compliance challenges. Technology adoption barriers include patient resistance to complex devices, digital literacy limitations, and healthcare provider training requirements that slow market penetration.

Healthcare disparities limit market reach in underserved populations and rural areas where access to specialized diabetes care remains limited. Reimbursement challenges create uncertainty for patients and providers, with insurance coverage variations and prior authorization requirements affecting treatment decisions and market growth potential.

Emerging market opportunities in the Type 2 diabetes drugs and devices sector present substantial growth potential across multiple dimensions. Digital health integration offers unprecedented opportunities for developing comprehensive diabetes management platforms that combine medication management, glucose monitoring, lifestyle tracking, and healthcare provider communication in unified ecosystems.

Precision medicine represents a transformative opportunity through genetic testing, biomarker identification, and personalized treatment algorithms that optimize therapeutic outcomes while minimizing adverse effects. Artificial intelligence applications enable predictive analytics, automated insulin dosing, and personalized care recommendations that improve patient outcomes and reduce healthcare costs.

Emerging markets provide significant expansion opportunities as healthcare infrastructure develops, economic conditions improve, and diabetes awareness increases. Countries in Asia-Pacific, Latin America, and Africa show rapid market growth potential driven by rising diabetes prevalence and improving healthcare access. Biosimilar development creates opportunities for cost-effective treatment options that expand patient access while maintaining therapeutic efficacy.

Combination therapies offer opportunities for developing innovative treatment regimens that address multiple pathophysiological mechanisms simultaneously. Prevention technologies represent emerging opportunities through early detection systems, risk assessment tools, and lifestyle intervention platforms that address pre-diabetes populations and prevent disease progression.

Market dynamics in the Type 2 diabetes drugs and devices sector reflect complex interactions between technological innovation, regulatory evolution, competitive pressures, and changing patient needs. Innovation cycles drive continuous product development with pharmaceutical companies investing heavily in next-generation therapeutic agents and medical device manufacturers developing increasingly sophisticated monitoring and delivery systems.

Competitive intensity increases as traditional pharmaceutical companies face competition from specialized diabetes care firms, technology companies entering healthcare, and biosimilar manufacturers offering cost-effective alternatives. Market consolidation continues through mergers, acquisitions, and strategic partnerships aimed at creating comprehensive diabetes care portfolios and expanding global reach.

Regulatory evolution shapes market dynamics through changing approval requirements, safety standards, and reimbursement policies that influence product development strategies and market access. Patient empowerment trends drive demand for user-friendly devices, mobile health applications, and self-management tools that enable greater patient control over diabetes care.

Healthcare transformation toward value-based care models influences market dynamics by emphasizing outcomes-based pricing, risk-sharing arrangements, and integrated care delivery systems. Global health initiatives focused on non-communicable disease management create opportunities for market expansion while establishing quality and accessibility standards that shape competitive dynamics.

Comprehensive research methodology employed in analyzing the Type 2 diabetes drugs and devices market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability. Primary research includes extensive interviews with healthcare professionals, diabetes specialists, pharmaceutical executives, medical device manufacturers, and patient advocacy groups to gather firsthand insights on market trends, challenges, and opportunities.

Secondary research encompasses analysis of clinical trial databases, regulatory filings, patent applications, scientific literature, and industry reports to understand technological developments, competitive positioning, and market evolution. Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market growth, segment performance, and regional dynamics.

Market segmentation analysis examines product categories, therapeutic classes, device types, distribution channels, and end-user segments to identify growth opportunities and competitive dynamics. Competitive intelligence includes company profiling, product portfolio analysis, strategic initiative tracking, and market share assessment across key market participants.

Validation processes involve cross-referencing multiple data sources, expert review panels, and sensitivity analysis to ensure research findings accuracy and reliability. Continuous monitoring systems track market developments, regulatory changes, and competitive activities to maintain current and relevant market intelligence throughout the research period.

North American market dominates the global Type 2 diabetes drugs and devices landscape, accounting for approximately 42% of total market share, driven by high diabetes prevalence, advanced healthcare infrastructure, and strong reimbursement systems. The United States leads regional growth through robust research and development activities, early adoption of innovative technologies, and comprehensive insurance coverage for diabetes treatments and devices.

European market represents the second-largest regional segment with 28% market share, characterized by strong regulatory frameworks, universal healthcare systems, and increasing focus on diabetes prevention and management. Key markets include Germany, France, United Kingdom, and Italy, with growing emphasis on cost-effective treatment solutions and digital health integration.

Asia-Pacific region demonstrates the highest growth potential with market expansion rates exceeding 8.5% annually, driven by rising diabetes prevalence, improving healthcare access, and economic development. China and India represent major growth markets with large patient populations and expanding healthcare infrastructure. Japan maintains a mature market with focus on advanced device technologies and precision medicine approaches.

Latin American markets show increasing growth momentum with regional market share reaching 12%, led by Brazil, Mexico, and Argentina. Middle East and Africa represent emerging opportunities with growing diabetes awareness and healthcare infrastructure development, though market penetration remains limited by economic and access challenges.

Competitive landscape in the Type 2 diabetes drugs and devices market features a diverse ecosystem of established pharmaceutical companies, specialized diabetes care firms, medical device manufacturers, and emerging technology companies. Market leadership is distributed among several key players with distinct competitive advantages and strategic focus areas.

Market segmentation in the Type 2 diabetes drugs and devices sector encompasses multiple classification frameworks that provide detailed insights into market structure and growth opportunities. Product-based segmentation represents the primary classification approach, dividing the market into distinct categories based on therapeutic mechanisms and device functionalities.

By Drug Class:

By Device Type:

Pharmaceutical category dominates market revenue through high-value specialty medications and innovative therapeutic agents. Insulin products maintain significant market share despite biosimilar competition, with long-acting formulations and combination products driving growth. GLP-1 receptor agonists represent the fastest-growing drug category with adoption rates increasing 38% annually, driven by weight management benefits and cardiovascular protection.

Medical device category experiences rapid growth through technological advancement and increasing patient adoption of self-monitoring systems. Continuous glucose monitoring shows exceptional growth potential with market penetration expanding 45% annually among insulin-dependent patients. Smart insulin pens emerge as high-growth segment combining traditional delivery methods with digital connectivity and dose tracking capabilities.

Digital health category represents emerging high-growth segment through mobile applications, telemedicine platforms, and artificial intelligence-powered management systems. Integration solutions combining multiple diabetes management components show increasing market traction as healthcare systems seek comprehensive care platforms.

Biosimilar category impacts traditional insulin markets through cost-effective alternatives, with market share reaching 22% in established markets. Combination therapy category grows rapidly as clinical evidence supports multi-mechanism treatment approaches for optimal glycemic control and reduced pill burden.

Healthcare providers benefit from expanding treatment options that enable personalized care approaches, improved patient outcomes, and enhanced practice efficiency. Advanced monitoring technologies provide real-time patient data that supports clinical decision-making and enables proactive intervention strategies. Digital health platforms streamline patient management, reduce administrative burden, and facilitate remote care delivery.

Patients experience significant benefits through improved treatment effectiveness, reduced side effects, and enhanced quality of life. User-friendly devices simplify diabetes management routines while providing valuable insights into glucose patterns and treatment response. Continuous monitoring systems reduce fingerstick testing frequency and provide early warning of glucose excursions.

Pharmaceutical companies benefit from robust market demand, premium pricing for innovative products, and opportunities for market expansion through emerging therapeutic classes. Device manufacturers capitalize on growing demand for advanced monitoring and delivery systems with recurring revenue models through consumable products and service contracts.

Healthcare systems realize benefits through improved patient outcomes, reduced complications, and cost-effective care delivery models. Payers benefit from value-based pricing arrangements, reduced long-term complications costs, and improved member health outcomes that support sustainable healthcare economics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the Type 2 diabetes drugs and devices market through integration of mobile health applications, artificial intelligence, and connected device technologies. Smart insulin pens with dose tracking capabilities, continuous glucose monitoring with smartphone integration, and artificial pancreas systems demonstrate the convergence of pharmaceutical and technology solutions.

Personalized medicine emerges as a transformative trend through genetic testing, biomarker identification, and individualized treatment algorithms. Pharmacogenomic testing enables optimized medication selection while precision dosing algorithms improve therapeutic outcomes and reduce adverse effects. Lifestyle integration through wearable devices and activity tracking creates comprehensive diabetes management ecosystems.

Value-based care models influence market dynamics through outcomes-based pricing, risk-sharing arrangements, and integrated care delivery systems. Telemedicine adoption accelerates diabetes care accessibility while remote patient monitoring enables proactive intervention strategies. Biosimilar expansion continues reshaping insulin markets through cost-effective alternatives that maintain therapeutic efficacy.

Combination therapy approaches gain prominence as clinical evidence supports multi-mechanism treatment strategies for optimal glycemic control. Fixed-dose combinations improve patient compliance while novel drug delivery systems enhance therapeutic effectiveness and patient convenience.

Recent industry developments demonstrate accelerating innovation and strategic positioning across the Type 2 diabetes drugs and devices market. Regulatory approvals for next-generation GLP-1 receptor agonists with enhanced efficacy profiles and reduced dosing frequency create new treatment paradigms. Continuous glucose monitoring technology advances include extended sensor wear time, improved accuracy, and integration with insulin delivery systems.

Strategic partnerships between pharmaceutical companies and technology firms accelerate digital health solution development and market penetration. Acquisition activities focus on expanding diabetes care portfolios, accessing innovative technologies, and strengthening competitive positioning. Clinical trial results for cardiovascular outcome studies influence prescribing patterns and market dynamics for SGLT-2 inhibitors and GLP-1 receptor agonists.

Manufacturing investments in biosimilar production capabilities expand access to cost-effective insulin products while maintaining quality standards. Digital health platform launches integrate multiple diabetes management components into comprehensive care ecosystems. Artificial intelligence applications in glucose prediction, insulin dosing, and lifestyle recommendations demonstrate technology’s transformative potential in diabetes care.

Regulatory initiatives supporting interoperability standards enable seamless data sharing between devices and healthcare systems. Reimbursement expansions for continuous glucose monitoring and digital health solutions improve patient access to advanced diabetes management technologies.

Strategic recommendations for market participants emphasize the importance of embracing digital transformation while maintaining focus on core therapeutic competencies. MarkWide Research analysis suggests that companies should prioritize integrated solution development that combines pharmaceutical products with digital health platforms to create comprehensive diabetes management ecosystems.

Investment priorities should focus on artificial intelligence capabilities, continuous glucose monitoring technologies, and personalized medicine approaches that differentiate products in competitive markets. Geographic expansion strategies should target emerging markets with growing diabetes prevalence and improving healthcare infrastructure, while maintaining strong positions in established markets through innovation and value demonstration.

Partnership strategies should emphasize collaborations between pharmaceutical companies, device manufacturers, and technology firms to accelerate innovation and market penetration. Regulatory engagement remains critical for navigating evolving approval requirements and ensuring market access for innovative products. Patient-centric approaches should guide product development decisions, emphasizing user experience, treatment adherence, and quality of life improvements.

Competitive positioning requires continuous innovation, strong clinical evidence generation, and effective market access strategies. Value demonstration through health economic studies and real-world evidence becomes increasingly important for reimbursement and adoption decisions.

Future market outlook for the Type 2 diabetes drugs and devices sector indicates sustained growth driven by demographic trends, technological advancement, and expanding treatment paradigms. Market expansion is projected to continue with growth rates maintaining 6.8% CAGR through the forecast period, supported by rising diabetes prevalence and improving healthcare access globally.

Innovation trajectories point toward increasingly sophisticated treatment solutions combining pharmaceutical interventions with advanced device technologies and artificial intelligence capabilities. Artificial pancreas systems represent the future of diabetes care through automated insulin delivery based on continuous glucose monitoring and predictive algorithms. Gene therapy and regenerative medicine approaches may transform treatment paradigms in the longer term.

Market dynamics will be shaped by continued emphasis on value-based care, personalized medicine, and integrated care delivery systems. Digital health integration will accelerate with connected device adoption reaching 75% of diabetes patients by 2030. Emerging markets will drive significant growth as healthcare infrastructure develops and diabetes awareness increases.

Regulatory evolution will continue supporting innovation while ensuring patient safety and treatment effectiveness. MWR projections indicate that combination therapies, biosimilar products, and digital health solutions will reshape competitive dynamics and market structure throughout the forecast period.

The Type 2 diabetes drugs and devices market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by increasing disease prevalence, technological innovation, and expanding treatment options. Market fundamentals remain strong with sustained demand from growing patient populations, supportive regulatory environments, and continuous investment in research and development activities.

Key success factors for market participants include embracing digital transformation, developing integrated care solutions, and maintaining focus on patient-centric innovation. Competitive advantages will increasingly depend on the ability to combine pharmaceutical expertise with technological capabilities to create comprehensive diabetes management ecosystems that improve patient outcomes while reducing healthcare costs.

Future growth will be driven by emerging markets expansion, precision medicine adoption, and continued innovation in drug development and device technologies. The market’s evolution toward value-based care models, digital health integration, and personalized treatment approaches creates significant opportunities for companies that successfully navigate changing market dynamics while delivering meaningful value to patients, providers, and healthcare systems worldwide.

What is Type 2 Diabetes Drugs And Devices?

Type 2 Diabetes Drugs And Devices refer to the medications and tools used to manage and treat Type 2 diabetes, a chronic condition that affects the way the body processes blood sugar. This includes oral medications, insulin therapies, and devices like glucose monitors and insulin pumps.

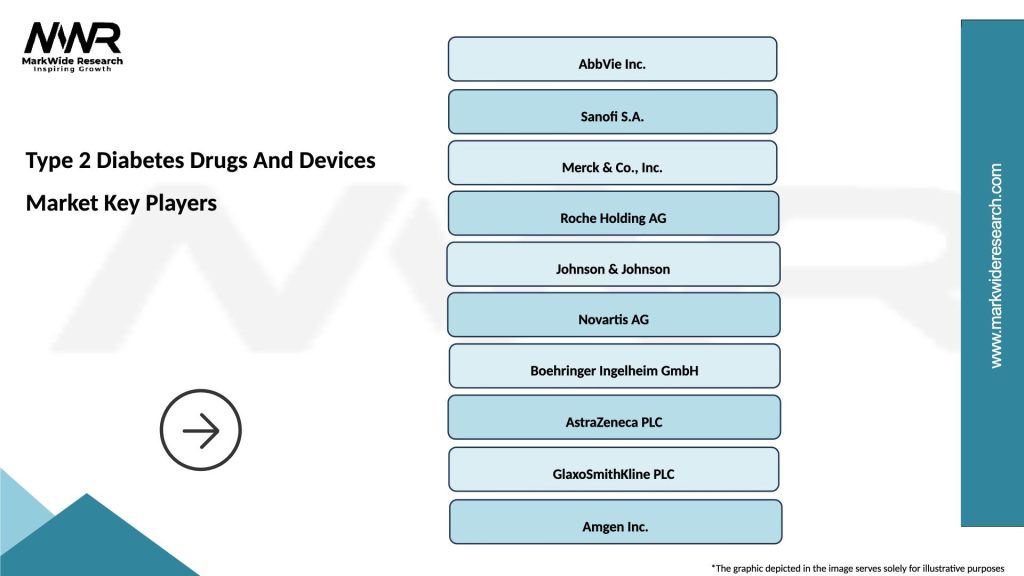

What are the key players in the Type 2 Diabetes Drugs And Devices Market?

Key players in the Type 2 Diabetes Drugs And Devices Market include companies such as Novo Nordisk, Sanofi, and Eli Lilly, which are known for their innovative diabetes treatments and devices. These companies focus on developing effective solutions to improve patient outcomes, among others.

What are the main drivers of growth in the Type 2 Diabetes Drugs And Devices Market?

The growth of the Type 2 Diabetes Drugs And Devices Market is driven by the increasing prevalence of Type 2 diabetes, advancements in drug formulations, and the rising adoption of technology-driven devices for diabetes management. Additionally, growing awareness about diabetes care contributes to market expansion.

What challenges does the Type 2 Diabetes Drugs And Devices Market face?

The Type 2 Diabetes Drugs And Devices Market faces challenges such as high treatment costs, regulatory hurdles, and the need for continuous innovation to meet patient needs. Additionally, competition from generic drugs can impact market dynamics.

What opportunities exist in the Type 2 Diabetes Drugs And Devices Market?

Opportunities in the Type 2 Diabetes Drugs And Devices Market include the development of personalized medicine, integration of digital health technologies, and expansion into emerging markets. These factors can enhance patient engagement and improve treatment adherence.

What are the current trends in the Type 2 Diabetes Drugs And Devices Market?

Current trends in the Type 2 Diabetes Drugs And Devices Market include the rise of continuous glucose monitoring systems, the use of artificial intelligence in diabetes management, and the increasing focus on patient-centric care. These innovations aim to improve the quality of life for individuals with diabetes.

Type 2 Diabetes Drugs And Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin, GLP-1 Agonists, DPP-4 Inhibitors, SGLT2 Inhibitors |

| Delivery Mode | Injectable, Oral, Continuous Glucose Monitoring, Insulin Pumps |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Technology | Smart Pens, Wearable Devices, Mobile Apps, Telehealth Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Type 2 Diabetes Drugs And Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at