444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Turkmenistan Oil and Gas Upstream Market stands as a vital sector within the nation’s economy, playing a pivotal role in shaping its growth and development. With abundant reserves and a strategic geographical location, Turkmenistan has emerged as a significant player in the global oil and gas industry. The market encompasses activities related to the exploration, drilling, and production of crude oil and natural gas resources. As an essential source of revenue and employment, the sector’s performance deeply impacts the country’s socio-economic landscape.

Meaning

The term “upstream” in the context of the oil and gas industry refers to the initial stages of the value chain, encompassing exploration and production activities. Turkmenistan’s upstream sector involves identifying potential reserves, drilling wells, extracting raw materials, and preparing them for further processing. This segment is crucial as it directly influences the availability of feedstock for downstream industries, energy security, and foreign exchange earnings.

Executive Summary

The Turkmenistan Oil and Gas Upstream Market demonstrates immense potential bolstered by its extensive hydrocarbon reserves and favorable investment climate. This report delves into the market’s key insights, drivers, restraints, and opportunities. It examines regional dynamics, competitive landscape, and emerging trends while considering the impact of the Covid-19 pandemic. Furthermore, the report outlines future industry projections and concludes with strategic suggestions for stakeholders.

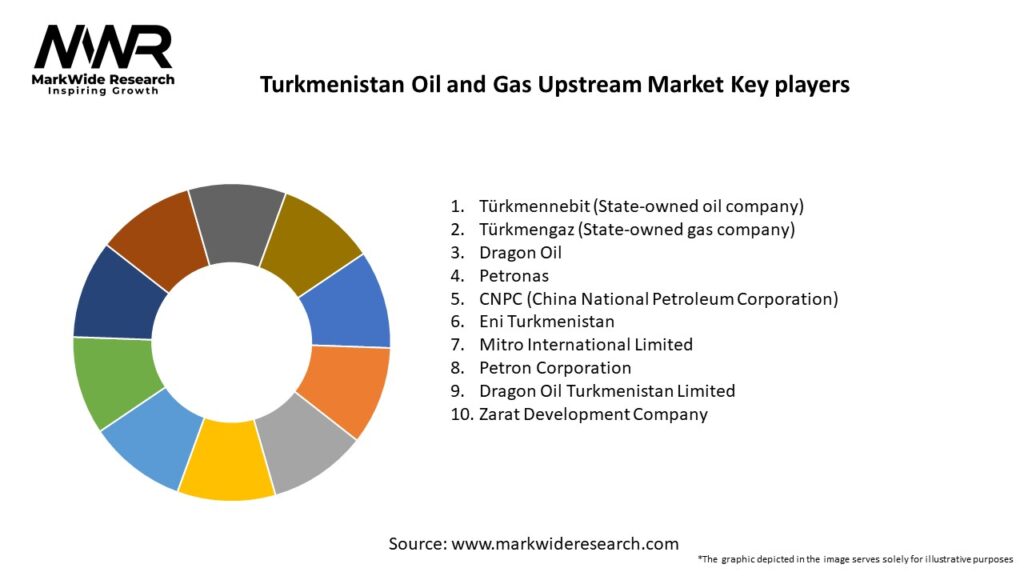

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the Turkmenistan Oil and Gas Upstream Market:

Market Restraints

The Turkmenistan Oil and Gas Upstream Market faces several challenges:

Market Opportunities

The Turkmenistan Oil and Gas Upstream Market offers several growth opportunities:

Market Dynamics

The Global Turkmenistan Oil and Gas Upstream Market is shaped by the following dynamics:

Regional Analysis

The Turkmenistan Oil and Gas Upstream Market is primarily influenced by the following regions:

Competitive Landscape

Leading Companies in the Turkmenistan Oil and Gas Upstream Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

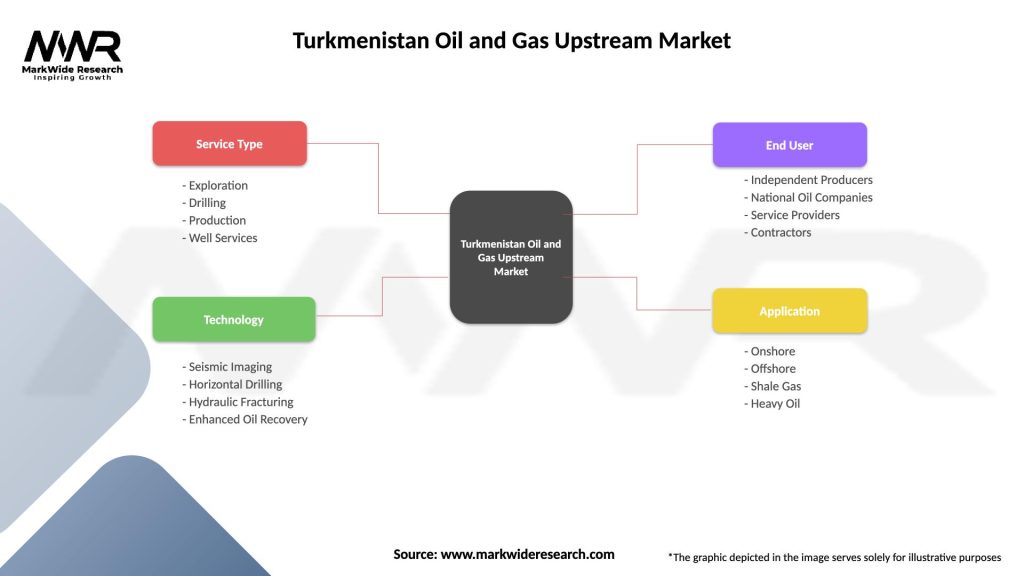

The Turkmenistan Oil and Gas Upstream Market can be segmented by the following factors:

Type of Resource

Field Type

End-User

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a notable impact on the Turkmenistan Oil and Gas Upstream Market. Disruptions in global supply chains and reduced energy demand led to fluctuating oil prices. However, the nation’s swift response and effective containment measures minimized the impact. The crisis underscored the importance of diversification and sustainable practices in the sector’s resilience.

Key Industry Developments

Recent industry developments include significant exploration and production projects, both independently and through international partnerships. Turkmenistan’s commitment to diversifying its export routes gained momentum, ensuring resilience in the face of market fluctuations. Technological integration and digitalization also marked key industry advancements, streamlining operations and increasing efficiency.

Analyst Suggestions

Considering the Turkmenistan Oil and Gas Upstream Market’s dynamic nature, analysts suggest a multi-faceted approach. Leveraging technological advancements for accurate reserve estimation and efficient production is essential. Diversification of export routes, combined with sustainable practices, can mitigate market volatility. Collaborative partnerships and continuous regulatory refinement also top the list of suggestions.

Future Outlook

The future of the Turkmenistan Oil and Gas Upstream Market appears promising. The sector’s strategic importance to the nation’s economy ensures continued government support and investment. Sustainable practices and technological integration will drive efficiency, while diversification of export routes minimizes risk. The industry’s adaptability and innovation will play a crucial role in shaping its trajectory.

Conclusion

The Turkmenistan Oil and Gas Upstream Market holds immense potential as a cornerstone of the nation’s economic growth. Abundant reserves, strategic positioning, and government initiatives to attract investments form a strong foundation. While challenges such as market volatility and infrastructural limitations persist, leveraging technological advancements and sustainable practices can pave the way for a resilient and prosperous future in the sector. As Turkmenistan navigates through these opportunities and challenges, strategic collaborations and innovation will be key drivers of success in the evolving global energy landscape.

What is Turkmenistan Oil and Gas Upstream?

Turkmenistan Oil and Gas Upstream refers to the exploration, extraction, and production of oil and natural gas resources in Turkmenistan. This sector plays a crucial role in the country’s economy and energy supply.

What are the key players in the Turkmenistan Oil and Gas Upstream Market?

Key players in the Turkmenistan Oil and Gas Upstream Market include Turkmennebit, Turkmen Gas, and international companies like Dragon Oil and Petronas, among others.

What are the growth factors driving the Turkmenistan Oil and Gas Upstream Market?

The growth of the Turkmenistan Oil and Gas Upstream Market is driven by the country’s rich hydrocarbon reserves, increasing global energy demand, and investments in infrastructure development.

What challenges does the Turkmenistan Oil and Gas Upstream Market face?

Challenges in the Turkmenistan Oil and Gas Upstream Market include geopolitical tensions, limited access to international markets, and the need for technological advancements in extraction methods.

What opportunities exist in the Turkmenistan Oil and Gas Upstream Market?

Opportunities in the Turkmenistan Oil and Gas Upstream Market include potential partnerships with foreign investors, the development of new oil fields, and the expansion of gas export routes to neighboring countries.

What trends are shaping the Turkmenistan Oil and Gas Upstream Market?

Trends in the Turkmenistan Oil and Gas Upstream Market include a focus on sustainable extraction practices, increased use of digital technologies for exploration, and a shift towards diversifying energy exports.

Turkmenistan Oil and Gas Upstream Market

| Segmentation Details | Description |

|---|---|

| Service Type | Exploration, Drilling, Production, Well Services |

| Technology | Seismic Imaging, Horizontal Drilling, Hydraulic Fracturing, Enhanced Oil Recovery |

| End User | Independent Producers, National Oil Companies, Service Providers, Contractors |

| Application | Onshore, Offshore, Shale Gas, Heavy Oil |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Turkmenistan Oil and Gas Upstream Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at