444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Turkey residential real estate market represents one of the most dynamic and rapidly evolving property sectors in the Eastern Mediterranean region. Turkey’s residential market has experienced significant transformation over the past decade, driven by urbanization trends, foreign investment incentives, and government-backed housing initiatives. The market demonstrates robust growth potential with annual growth rates exceeding 8.5% in key metropolitan areas, making it an attractive destination for both domestic and international property investors.

Istanbul, Ankara, and Izmir continue to dominate the residential landscape, accounting for approximately 65% of total residential transactions nationwide. The market benefits from Turkey’s strategic geographical position, connecting Europe and Asia, which has attracted considerable foreign investment particularly from Middle Eastern and European buyers. Government incentives including citizenship-by-investment programs have further stimulated international demand, contributing to sustained market momentum.

Modern residential developments are increasingly focusing on mixed-use projects that combine residential units with commercial spaces, recreational facilities, and smart home technologies. The market shows strong preference for properties offering contemporary amenities and sustainable building practices, reflecting changing consumer preferences and lifestyle expectations.

The Turkey residential real estate market refers to the comprehensive ecosystem of residential property buying, selling, renting, and development activities across Turkish territories. This market encompasses various property types including apartments, villas, townhouses, and luxury residences, serving both domestic residents and international investors seeking property ownership in Turkey.

Residential real estate in Turkey includes primary residences, secondary homes, investment properties, and rental accommodations across urban, suburban, and coastal regions. The market operates through established channels including real estate agencies, property developers, online platforms, and direct transactions, all regulated by Turkish property laws and international investment frameworks.

Market participants include individual homebuyers, property investors, real estate developers, construction companies, financial institutions, and government entities that collectively shape market dynamics through supply, demand, and regulatory influences.

Turkey’s residential real estate sector demonstrates exceptional resilience and growth potential, supported by favorable demographics, strategic location advantages, and progressive government policies. The market has successfully attracted international attention through citizenship-by-investment programs, resulting in increased foreign property acquisitions and market diversification.

Key market drivers include rapid urbanization with urban population growth rates of 2.3% annually, rising disposable incomes, and expanding mortgage accessibility. The sector benefits from Turkey’s young demographic profile, with approximately 42% of the population under age 30, creating sustained demand for modern residential solutions.

Investment opportunities are particularly strong in emerging districts of major cities, coastal resort areas, and regions benefiting from infrastructure development projects. The market shows increasing sophistication with growing emphasis on sustainable construction practices, smart home integration, and community-oriented developments that cater to evolving lifestyle preferences.

Market challenges include economic volatility, currency fluctuations, and regulatory changes that can impact investor confidence. However, the fundamental demand drivers remain robust, supported by population growth, urbanization trends, and Turkey’s strategic importance as a regional hub for business and tourism.

Strategic market insights reveal several critical trends shaping Turkey’s residential real estate landscape:

Demographic transformation serves as the primary catalyst for Turkey’s residential real estate growth. The country’s young population structure creates sustained demand for housing, while increasing urbanization rates drive development in metropolitan areas. Internal migration patterns from rural to urban areas generate consistent demand for residential properties in major cities.

Government policy support significantly influences market dynamics through various initiatives. The citizenship-by-investment program has attracted substantial foreign capital, while social housing projects address affordable housing needs. Infrastructure investments including transportation networks, airports, and urban renewal projects enhance property values and accessibility.

Economic factors contribute to market momentum through rising disposable incomes, expanding middle class, and improved access to mortgage financing. The development of Turkey’s financial sector has made homeownership more accessible to domestic buyers, while favorable exchange rates attract international investors seeking value opportunities.

Tourism industry growth creates additional demand for residential properties, particularly in coastal and historic regions. The expansion of Turkey’s tourism sector generates rental income opportunities and drives development of vacation homes and investment properties catering to both domestic and international visitors.

Economic volatility presents significant challenges to market stability, with currency fluctuations affecting both domestic purchasing power and international investor confidence. Inflation pressures impact construction costs and property affordability, potentially limiting market accessibility for certain buyer segments.

Regulatory uncertainties can create market hesitation, particularly regarding foreign ownership rules, tax policies, and property transfer procedures. Changes in government policies or international relations may influence investor sentiment and cross-border property transactions.

Supply chain disruptions affect construction timelines and project costs, potentially delaying new residential developments and impacting market supply. Material cost increases and labor shortages in construction sectors can influence project feasibility and pricing strategies.

Regional geopolitical factors may impact investor confidence and international buyer interest, particularly during periods of regional instability. Market perception and international investment flows can be sensitive to broader geopolitical developments affecting the region.

Emerging district development presents substantial opportunities for investors and developers. Areas undergoing urban transformation or benefiting from new infrastructure projects offer potential for significant value appreciation and rental income generation.

Sustainable housing initiatives create opportunities for developers focusing on environmentally friendly construction practices. Growing consumer awareness of sustainability drives demand for energy-efficient homes, green building certifications, and eco-friendly residential communities.

Technology integration offers differentiation opportunities through smart home features, digital property management systems, and innovative residential services. Properties incorporating advanced technology solutions attract premium pricing and appeal to tech-savvy buyers.

Tourism-related residential development provides opportunities in coastal regions and cultural destinations. The growth of Turkey’s tourism industry supports demand for vacation rentals, second homes, and hospitality-residential hybrid developments that cater to both investors and tourists.

Supply and demand equilibrium varies significantly across different regions and property segments. Major metropolitan areas experience strong demand pressure, while emerging markets show potential for supply expansion and development opportunities.

Price dynamics reflect regional variations, with coastal properties and prime urban locations commanding premium valuations. Market pricing responds to local economic conditions, infrastructure development, and international investment flows, creating diverse opportunities across different price segments.

Transaction patterns show seasonal variations, with peak activity during spring and summer months when both domestic and international buyers are most active. Market liquidity remains strong in established areas, while emerging markets may require longer transaction periods.

Investment flows demonstrate increasing sophistication, with institutional investors joining individual buyers in residential property acquisition. The market benefits from diverse funding sources including domestic banks, international lenders, and private investment funds supporting residential development projects.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Turkey’s residential real estate sector. Primary research includes extensive interviews with real estate professionals, property developers, government officials, and market participants across major Turkish cities.

Secondary research incorporates analysis of government statistics, property transaction records, construction permits, and economic indicators that influence residential market performance. MarkWide Research utilizes proprietary databases and industry reports to validate market trends and projections.

Data collection methods include property price surveys, transaction volume analysis, and demographic studies that provide insights into buyer behavior and market preferences. Regional analysis covers major metropolitan areas, emerging markets, and coastal regions to ensure comprehensive market coverage.

Market validation involves cross-referencing multiple data sources and conducting expert interviews to confirm research findings and market projections. The methodology ensures reliable insights for stakeholders making strategic decisions in Turkey’s residential real estate market.

Istanbul region dominates Turkey’s residential real estate landscape, accounting for approximately 35% of total residential transactions nationwide. The city’s status as Turkey’s economic and cultural center drives sustained demand from both domestic and international buyers. European and Asian sides of Istanbul offer distinct characteristics, with the European side commanding premium pricing while the Asian side provides value opportunities and rapid development.

Ankara metropolitan area represents the second-largest residential market, benefiting from its status as the capital city and government center. The region shows stable demand patterns supported by public sector employment and university presence, with steady annual growth rates of 6-7% in residential property values.

Izmir and Aegean coast demonstrate strong performance driven by lifestyle preferences and tourism appeal. The region attracts both domestic buyers seeking coastal living and international investors interested in vacation properties. Coastal properties in this region show consistent appreciation and strong rental yields.

Mediterranean coastal regions including Antalya and surrounding areas experience robust international demand, particularly from European buyers. These markets benefit from year-round tourism, favorable climate, and established expatriate communities that support property values and rental markets.

Emerging markets in Central Anatolia and other developing regions offer growth potential supported by infrastructure investments and industrial development. These areas provide opportunities for value-oriented investors and first-time homebuyers seeking affordable residential options.

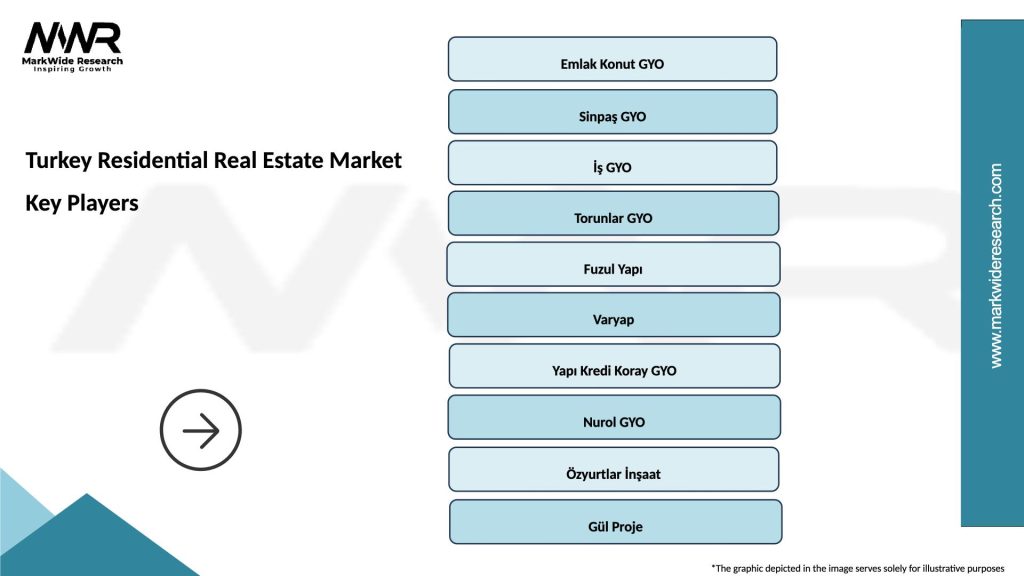

Major property developers shape Turkey’s residential real estate market through large-scale projects and innovative development approaches:

Market competition drives innovation in project design, financing options, and customer services. Developers increasingly focus on differentiation through architectural excellence, sustainable practices, and comprehensive community amenities that enhance resident experience and property values.

By Property Type:

By Buyer Category:

By Price Segment:

Apartment segment continues to dominate Turkey’s residential market due to urbanization trends and land scarcity in major cities. Modern apartment complexes increasingly feature comprehensive amenities including fitness centers, swimming pools, and security services that appeal to contemporary lifestyle preferences.

Villa developments show strong performance in coastal regions and suburban areas where land availability supports larger residential projects. These properties attract affluent buyers seeking privacy, space, and luxury amenities, often commanding significant premium pricing over apartment units.

New construction properties represent the majority of market transactions, reflecting buyer preferences for modern amenities, energy efficiency, and contemporary design standards. Pre-construction sales offer attractive pricing for buyers willing to commit to projects during development phases.

Resale market provides opportunities for buyers seeking established neighborhoods, mature landscaping, and immediate occupancy. Properties in well-established areas often offer stable value appreciation and proven rental income potential for investors.

Smart home integration becomes increasingly important across all property categories, with buyers expecting modern technology features including automated systems, security integration, and energy management capabilities that enhance living experience and property values.

Property developers benefit from strong market demand, diverse buyer segments, and government support for residential construction. The market offers opportunities for various development scales from affordable housing to luxury projects, enabling developers to diversify portfolios and optimize returns.

Real estate investors gain access to a dynamic market with multiple investment strategies including buy-to-let properties, capital appreciation opportunities, and portfolio diversification benefits. Rental yields remain attractive in prime locations, while long-term appreciation potential supports wealth building objectives.

Financial institutions benefit from expanding mortgage markets, property financing opportunities, and growing demand for real estate-related financial services. The sector supports bank lending growth and fee income generation through various property transaction services.

Construction companies experience sustained demand for residential construction services, supporting employment and business growth. The market provides opportunities for specialization in different construction types, from affordable housing to luxury developments.

Government entities benefit from increased tax revenues, urban development, and economic activity generated by residential real estate transactions. The sector supports broader economic objectives including employment creation and infrastructure development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable development practices are becoming increasingly important in Turkey’s residential market. Developers focus on energy-efficient construction, green building certifications, and environmentally responsible development practices that appeal to environmentally conscious buyers and reduce long-term operating costs.

Mixed-use development concepts gain popularity as buyers seek convenience and lifestyle integration. Projects combining residential units with retail, office, and recreational facilities create vibrant communities and enhance property values through comprehensive amenity offerings.

Digital transformation reshapes property marketing, sales processes, and property management services. Online platforms, virtual tours, and digital transaction processes improve market efficiency and accessibility for both domestic and international buyers.

Community-focused developments emphasize social spaces, recreational facilities, and shared amenities that foster resident interaction and enhance quality of life. These projects appeal to buyers seeking lifestyle enhancement beyond basic housing needs.

International design standards influence Turkish residential projects as developers seek to attract global buyers and compete in international markets. Architectural excellence and international quality standards become key differentiators in premium market segments.

Government policy initiatives continue to shape market dynamics through updated citizenship-by-investment requirements, tax incentives, and housing support programs. Recent policy adjustments aim to balance foreign investment attraction with domestic buyer protection and market stability.

Infrastructure investments including new transportation networks, airports, and urban renewal projects significantly impact regional property values and development opportunities. Major projects like Istanbul’s new airport and canal project influence surrounding residential markets.

Technology adoption accelerates across the industry with developers implementing smart building systems, digital marketing platforms, and automated property management solutions. MWR analysis indicates that technology integration becomes a key competitive factor in residential developments.

International partnerships between Turkish developers and foreign companies bring global expertise, financing, and market access to domestic residential projects. These collaborations enhance project quality and international market appeal.

Regulatory updates regarding foreign property ownership, construction standards, and environmental requirements continue to evolve, requiring market participants to adapt strategies and compliance procedures accordingly.

Market participants should focus on regional diversification to capitalize on varying growth opportunities across Turkey’s diverse residential markets. Strategic positioning in emerging districts and infrastructure development zones offers potential for superior returns and market positioning.

Developers should prioritize sustainable construction practices and smart home integration to meet evolving buyer expectations and regulatory requirements. Projects incorporating environmental sustainability and technology features command premium pricing and attract quality tenants.

Investors should consider portfolio diversification across property types, locations, and buyer segments to optimize risk-adjusted returns. Market timing strategies should account for seasonal variations, economic cycles, and policy changes that influence market conditions.

Financial institutions should expand mortgage products and property-related services to capture growing market opportunities. Innovative financing solutions and digital service delivery can enhance competitive positioning and market share.

International buyers should conduct thorough due diligence regarding legal requirements, market conditions, and long-term investment prospects. Professional advisory services and local market expertise are essential for successful property acquisition and management.

Long-term growth prospects for Turkey’s residential real estate market remain positive, supported by favorable demographics, urbanization trends, and strategic location advantages. MarkWide Research projects continued market expansion with annual growth rates of 7-9% over the next five years, driven by sustained domestic demand and selective international investment.

Technology integration will accelerate across all market segments, with smart home features becoming standard expectations rather than premium additions. Digital platforms will continue transforming property marketing, sales processes, and ongoing property management services.

Sustainability requirements will become increasingly important, with green building standards and energy efficiency becoming key factors in property valuation and buyer decision-making. Developers focusing on environmental responsibility will gain competitive advantages.

Regional development patterns will continue evolving, with emerging markets gaining prominence as infrastructure investments and economic development create new opportunities beyond traditional metropolitan centers. Coastal regions will maintain appeal for both domestic and international buyers.

Market sophistication will increase through improved regulatory frameworks, enhanced transparency, and professional service standards that support sustainable market growth and investor confidence in Turkey’s residential real estate sector.

Turkey’s residential real estate market presents compelling opportunities for diverse stakeholders, supported by strong fundamental drivers including favorable demographics, strategic location, and government policy support. The market demonstrates resilience and adaptability, successfully navigating economic challenges while maintaining growth momentum.

Key success factors include strategic location selection, quality development practices, and responsiveness to evolving buyer preferences for sustainability and technology integration. Market participants who embrace innovation and maintain high standards will be best positioned for long-term success.

Future market development will be shaped by continued urbanization, infrastructure investments, and evolving lifestyle preferences that favor modern, well-amenitized residential properties. The market’s ability to attract both domestic and international buyers provides stability and growth potential.

Strategic recommendations emphasize the importance of market diversification, quality focus, and adaptation to changing buyer expectations. Turkey’s residential real estate market offers substantial opportunities for stakeholders who approach the market with appropriate expertise, resources, and long-term commitment to excellence.

What is Turkey Residential Real Estate?

Turkey Residential Real Estate refers to the sector involving the buying, selling, and renting of residential properties such as houses, apartments, and villas within Turkey. This market is influenced by various factors including economic conditions, urbanization, and demographic trends.

What are the key players in the Turkey Residential Real Estate Market?

Key players in the Turkey Residential Real Estate Market include Emlak Konut, Torunlar REIC, and Sinpaş GYO, among others. These companies are involved in various aspects of residential development, property management, and real estate investment.

What are the growth factors driving the Turkey Residential Real Estate Market?

The Turkey Residential Real Estate Market is driven by factors such as increasing urbanization, a growing population, and favorable government policies promoting home ownership. Additionally, foreign investment and tourism also contribute to market growth.

What challenges does the Turkey Residential Real Estate Market face?

Challenges in the Turkey Residential Real Estate Market include economic fluctuations, regulatory hurdles, and the impact of inflation on property prices. Additionally, the market faces issues related to overbuilding in certain areas.

What opportunities exist in the Turkey Residential Real Estate Market?

Opportunities in the Turkey Residential Real Estate Market include the potential for growth in luxury housing and eco-friendly developments. The increasing interest from foreign buyers also presents avenues for expansion and investment.

What trends are shaping the Turkey Residential Real Estate Market?

Trends in the Turkey Residential Real Estate Market include a shift towards smart home technologies and sustainable building practices. Additionally, there is a growing demand for mixed-use developments that combine residential, commercial, and recreational spaces.

Turkey Residential Real Estate Market

| Segmentation Details | Description |

|---|---|

| Property Type | Apartments, Villas, Townhouses, Duplexes |

| Price Range | Low-Cost, Mid-Range, Luxury, Premium |

| Buyer Type | First-Time Buyers, Investors, Expats, Retirees |

| Location | Urban, Suburban, Coastal, Rural |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Turkey Residential Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at